Market Overview

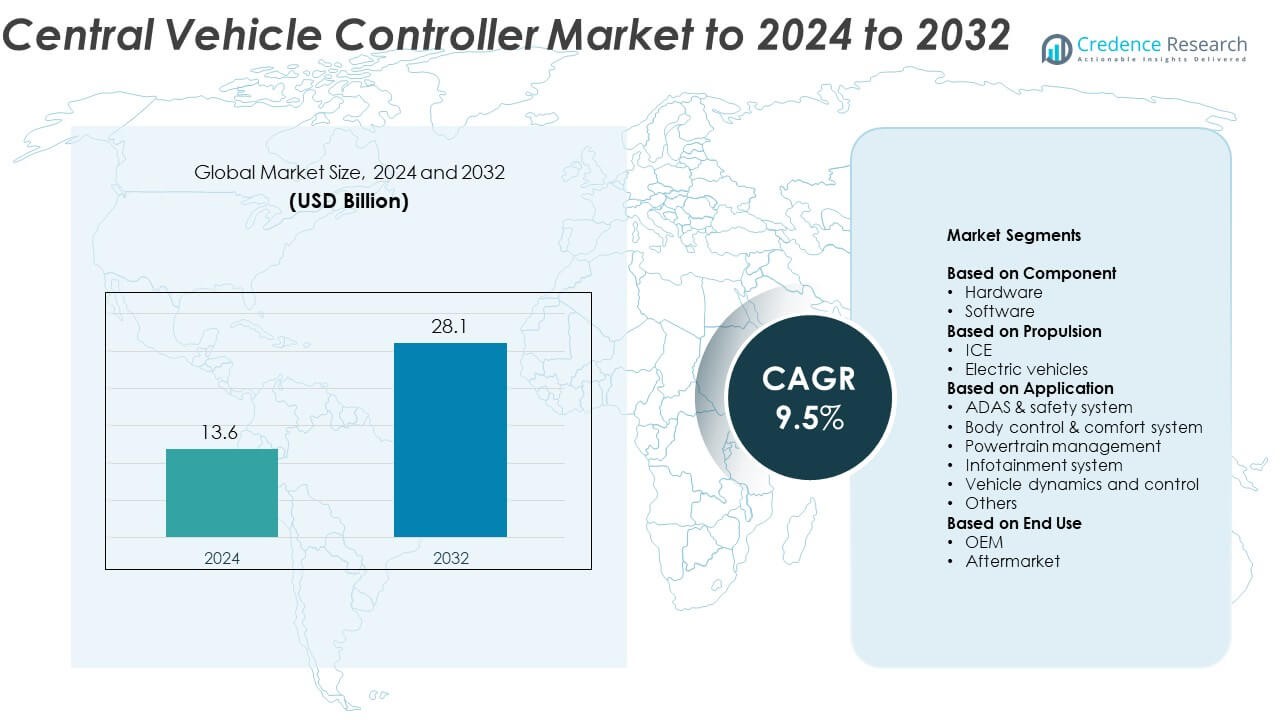

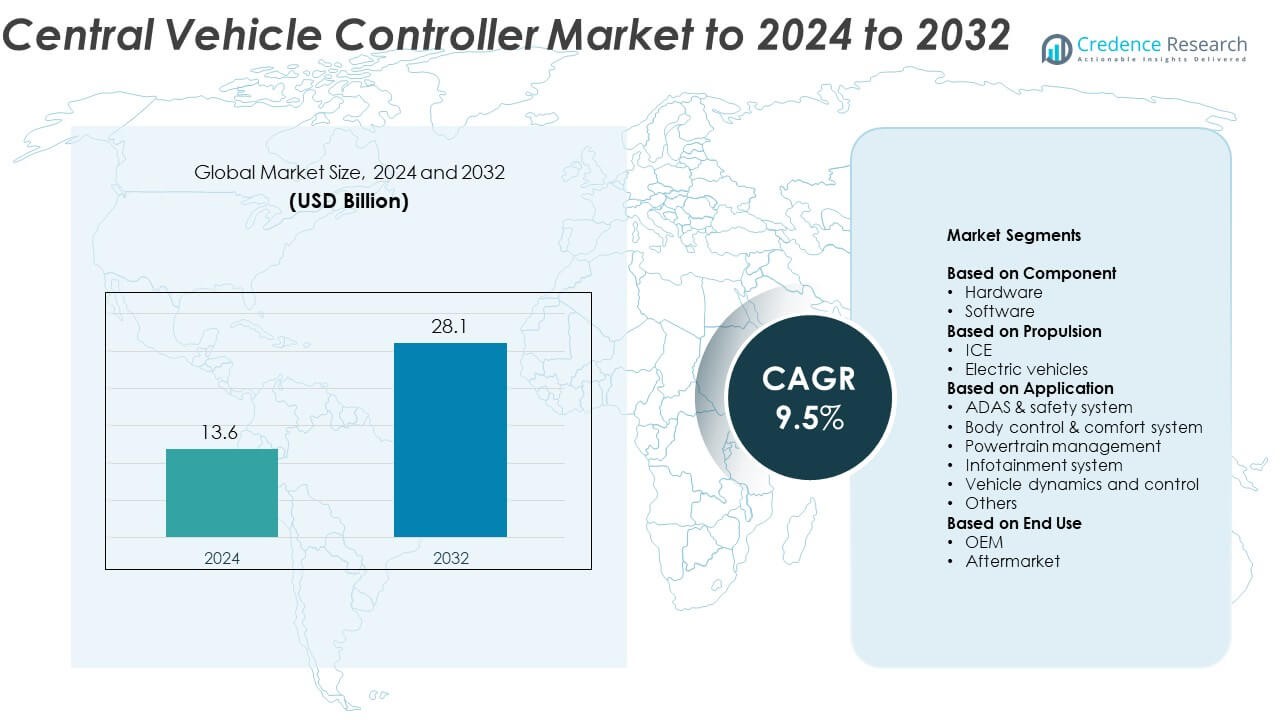

Central Vehicle Controller Market size was valued at USD 13.6 Billion in 2024 and is anticipated to reach USD 28.1 Billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Central Vehicle Controller Market Size 2024 |

USD 13.6 Billion |

| Central Vehicle Controller Market, CAGR |

9.5% |

| Central Vehicle Controller Market Size 2032 |

USD 28.1 Billion |

The central vehicle controller market is led by major players including Continental, Aptiv, ZF Friedrichshafen, Bosch, Magna International, Denso, Infineon Technologies, NXP Semiconductors, NVIDIA, and STMicroelectronics. These companies dominate through innovations in software-defined architectures, AI integration, and advanced semiconductor solutions that enhance vehicle efficiency and connectivity. North America holds the largest regional share of 37.2% in 2024, driven by strong technological adoption and the presence of key automotive OEMs. Europe follows with 31.6% share, supported by rapid electrification and stringent emission norms, while Asia Pacific accounts for 24.8%, emerging as the fastest-growing market due to expanding EV production and local manufacturing initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The central vehicle controller market was valued at USD 13.6 Billion in 2024 and is projected to reach USD 28.1 Billion by 2032, growing at a CAGR of 9.5%.

- Rising adoption of electric vehicles and advanced driver assistance systems is a key growth driver, as centralized control enables improved efficiency and safety across vehicle systems.

- Increasing integration of AI, machine learning, and zonal architectures is shaping market trends, enhancing real-time communication and reducing wiring complexity.

- The market is moderately consolidated, with major players focusing on partnerships and product innovation to expand their global footprint and strengthen competitive advantage.

- North America leads with 37.2% share, followed by Europe at 31.6% and Asia Pacific at 24.8%, while the hardware component segment dominates with nearly 58.3% share due to strong demand for high-performance processors and control units.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Component

The hardware segment dominates the central vehicle controller market, accounting for nearly 58.3% share in 2024. This dominance is due to the rising integration of high-performance processors, sensors, and control modules that enable real-time vehicle communication. The growing demand for domain and zonal controllers in advanced architectures supports this trend. Hardware components ensure seamless coordination across multiple vehicle functions, improving safety and energy efficiency. Increasing adoption of 32-bit and 64-bit microcontrollers by OEMs also enhances processing power and system reliability.

- For instance, NXP’s S32N55 integrates 16 Arm Cortex-R52 cores at up to 1.2 GHz and 48 MB SRAM for central controllers.

By Propulsion

The electric vehicles segment leads the market with around 64.7% share in 2024. Growing EV adoption drives the need for centralized control to optimize battery performance, regenerative braking, and energy distribution. Automakers are focusing on software-defined architectures that integrate propulsion, safety, and infotainment systems under a unified control unit. This shift enables enhanced vehicle intelligence and reduces wiring complexity. Supportive government policies and advances in battery management systems further accelerate the deployment of central controllers in electric vehicles.

- For instance, Analog Devices’ wireless BMS, debuting with GM, cuts battery wiring by up to 90% in production EVs.

By Application

The ADAS and safety system segment holds the largest share of about 33.9% in 2024. Rising demand for adaptive cruise control, lane-keeping assist, and automated emergency braking boosts adoption. Central vehicle controllers enable faster sensor fusion and decision-making in real time, ensuring occupant safety. Automakers use integrated control platforms to handle data from radar, LiDAR, and cameras more efficiently. Increasing regulatory mandates for advanced driver assistance features continue to drive this segment’s growth globally.

Key Growth Drivers

Rising Adoption of EV and ADAS Technologies

The rapid expansion of electric vehicles and advanced driver assistance systems is a major growth catalyst. Central vehicle controllers enable efficient power management, real-time decision-making, and coordination across multiple systems in EVs and ADAS platforms. Automakers increasingly rely on centralized architectures to handle complex control tasks, reducing wiring and improving safety. Growing government support for clean mobility and stricter safety norms further stimulate demand for intelligent vehicle control systems across both passenger and commercial vehicles.

- For instance, Volvo’s ES90 uses dual NVIDIA Orin computing, rated at 508 TOPS combined for active safety and energy management.

Shift Toward Software-Defined Vehicle Architectures

Automotive manufacturers are transitioning from traditional distributed control systems to software-defined architectures. This shift drives the adoption of central vehicle controllers that consolidate vehicle functions onto a unified computing platform. Such architectures simplify updates through over-the-air software integration, improving flexibility and cost efficiency. The rising use of advanced processors, AI-driven decision systems, and domain controllers enhances the scalability of vehicle platforms. This evolution supports rapid feature deployment and accelerates the digital transformation of the automotive industry.

- For instance, Qualcomm’s Snapdragon Ride Flex scales from about 50 TOPS and runs cockpit plus ADAS on one SoC for SDV stacks.

Growing Demand for Enhanced Vehicle Efficiency and Connectivity

Consumers expect smarter, more connected vehicles that optimize performance and efficiency. Central vehicle controllers play a key role by managing communication among subsystems such as powertrain, body control, and infotainment. Real-time data analysis helps improve fuel efficiency, diagnostics, and predictive maintenance. Increasing adoption of IoT and 5G-enabled vehicles further amplifies demand for centralized computing frameworks. Automakers integrate these controllers to meet user expectations for seamless connectivity and advanced telematics.

Key Trends & Opportunities

Integration of AI and Machine Learning in Control Systems

Automakers are incorporating AI and machine learning to enhance predictive control and adaptive responses. These technologies enable controllers to analyze vast sensor data and make real-time adjustments for performance optimization. Machine learning algorithms support predictive maintenance and autonomous decision-making. The trend toward intelligent and self-learning vehicle systems opens opportunities for advanced control software development and improved safety analytics.

- For instance, NVIDIA DRIVE Orin delivers up to 254 TOPS on a single SoC for centralized ADAS/AD compute.

Expansion of Zonal Control Architectures

The industry is witnessing a transition from domain-based to zonal architectures to reduce wiring and improve modularity. Zonal controllers centralize control for multiple vehicle zones, lowering weight and manufacturing complexity. This evolution aligns with the growing focus on electric and connected vehicles. Leading manufacturers are investing in zonal designs to simplify software integration and future-proof vehicle platforms, creating new opportunities for scalable and flexible system designs.

- For instance, Tesla’s Model 3 wiring was reduced by about 50% with a zonal layout, improving build efficiency.

Rising Collaboration Between Automakers and Tech Firms

Collaborations between automotive OEMs and semiconductor or software companies are shaping the future of vehicle control. These partnerships enable the development of high-performance computing platforms and standardized software ecosystems. Such alliances accelerate innovation in real-time control, cybersecurity, and system efficiency, strengthening competitiveness across the market.

Key Challenges

High Development and Integration Costs

Developing centralized vehicle control systems requires significant investment in hardware, software, and validation processes. The complexity of integrating multiple vehicle functions into a single platform increases costs for OEMs and suppliers. Small and mid-sized automakers face barriers due to high R&D expenses and long development cycles. Managing software updates and ensuring interoperability among diverse vehicle models add further cost pressures.

Cybersecurity and Data Management Risks

Centralized control increases exposure to cybersecurity vulnerabilities, as multiple vehicle systems connect through a single computing hub. Ensuring data integrity and protection from hacking attempts has become a critical challenge. Manufacturers must adopt advanced encryption, intrusion detection, and real-time monitoring systems to mitigate risks. Rising data privacy regulations further complicate compliance, pushing automakers to invest in secure architectures that safeguard vehicle communication networks.

Regional Analysis

North America

North America dominates the central vehicle controller market with nearly 37.2% share in 2024. The region’s leadership stems from strong adoption of advanced driver assistance systems, connected vehicles, and electric mobility platforms. The United States plays a major role, driven by high investments in automotive electronics and growing demand for safety and automation features. Leading automakers and technology firms are developing zonal and software-defined architectures to enhance efficiency. The presence of key OEMs and Tier 1 suppliers continues to support innovation, positioning North America as a frontrunner in vehicle intelligence integration.

Europe

Europe accounts for about 31.6% share of the global market in 2024. The region’s growth is supported by strict emission norms, digitalization of vehicles, and the rapid transition toward electrification. Germany, France, and the United Kingdom are leading contributors, focusing on the development of modular and scalable control architectures. Increasing collaboration between automakers and semiconductor companies accelerates adoption. Government initiatives promoting autonomous mobility and sustainability further enhance the regional outlook, driving investments in centralized computing systems across premium and mid-range vehicle segments.

Asia Pacific

Asia Pacific holds nearly 24.8% share of the market in 2024 and is the fastest-growing region. China, Japan, and South Korea are key hubs for vehicle electronics manufacturing and innovation. Rapid urbanization, rising disposable incomes, and expanding EV adoption are major factors propelling market growth. Regional manufacturers are implementing centralized vehicle control to improve efficiency and reduce system complexity. Increasing focus on affordable software-defined vehicles and strong government incentives for EV production further strengthen market expansion across emerging economies in Southeast Asia and India.

Latin America

Latin America represents around 4.1% share of the central vehicle controller market in 2024. Growth in the region is supported by gradual electrification, expanding automotive production, and increasing preference for connected mobility. Brazil and Mexico are the key markets, with OEMs introducing centralized control systems in mid-range vehicles. Government support for emission reduction and technology modernization enhances adoption. However, limited infrastructure for advanced EVs and high integration costs remain challenges. The region is expected to see steady growth as manufacturers localize production and adopt cost-efficient control solutions.

Middle East and Africa

The Middle East and Africa capture approximately 2.3% share in 2024. The market is gradually expanding due to rising interest in electric and connected vehicles, particularly in the Gulf Cooperation Council countries. Governments are promoting smart mobility initiatives, encouraging automotive digitalization and innovation. Growing imports of advanced vehicles equipped with centralized controllers are improving regional awareness. However, limited production capacity and dependency on foreign technology hinder faster adoption. Continued investment in infrastructure and sustainable transport programs will likely enhance future opportunities in this developing market.

Market Segmentations:

By Component

By Propulsion

By Application

- ADAS & safety system

- Body control & comfort system

- Powertrain management

- Infotainment system

- Vehicle dynamics and control

- Others

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The central vehicle controller market features strong competition among leading players such as Continental, Aptiv, ZF Friedrichshafen, Bosch, Magna International, Denso, Infineon Technologies, NXP Semiconductors, NVIDIA, and STMicroelectronics. These companies are focusing on developing high-performance computing platforms that support software-defined and zonal vehicle architectures. Strategic collaborations with automotive OEMs and technology providers are enhancing their capabilities in system integration, AI-based control, and real-time data processing. Continuous investment in semiconductor innovation, cybersecurity solutions, and modular hardware design strengthens their competitive position. Market participants are also expanding production capacity and adopting cloud-based development environments to streamline software updates and improve scalability. Growing emphasis on sustainability and electrification further encourages development of energy-efficient controllers that optimize power distribution across multiple vehicle domains. The competitive environment remains dynamic, characterized by mergers, product upgrades, and regional expansion strategies aimed at capturing emerging opportunities in connected and autonomous mobility ecosystems.

Key Player Analysis

- Continental

- Aptiv

- ZF Friedrichshafen

- Bosch

- Magna International

- Denso

- Infineon Technologies

- NXP Semiconductors

- NVIDIA

- STMicroelectronics

Recent Developments

- In 2025, NEXTY Electronics began offering Denso Ten’s Vehicle Control Unit (VCU), which integrates control of multiple vehicle functions, designed as a core controller for compact mobility and industrial equipment, facilitating system-level integration and reducing development lead times. This offering is expanding in Japan and internationally.

- In 2024, Continental announced a new generation of high-performance computing units for in-vehicle applications focusing on AI and sensor fusion for ADAS.

- In 2024, NVIDIA announced DRIVE Thor centralized car computer platform based on their Blackwell GPU architecture targeting next-generation AI-enabled consumer and commercial vehicles.

- In 2023, Bosch unveiled a comprehensive software platform to accelerate intelligent vehicle function development and deployment on their Central Vehicle Controller hardware.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Propulsion, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of software-defined vehicles will drive demand for centralized control architectures.

- Electric vehicle expansion will accelerate integration of advanced central controllers for energy optimization.

- Automakers will focus on zonal architecture to reduce wiring complexity and improve system efficiency.

- Growing implementation of AI and machine learning will enhance predictive control and safety analytics.

- Rising connectivity and 5G networks will strengthen real-time vehicle-to-everything communication capabilities.

- Partnerships between automakers and semiconductor firms will expand innovation in control modules.

- Regulatory mandates for safety and emission compliance will encourage wider adoption of integrated controllers.

- Increasing demand for over-the-air updates will boost development of flexible software control platforms.

- Emerging markets in Asia Pacific and Latin America will see rapid deployment of cost-effective controllers.

- Cybersecurity advancements will become essential to safeguard centralized vehicle control systems from data threats.

Market Segmentation Analysis:

Market Segmentation Analysis: