Market Overview

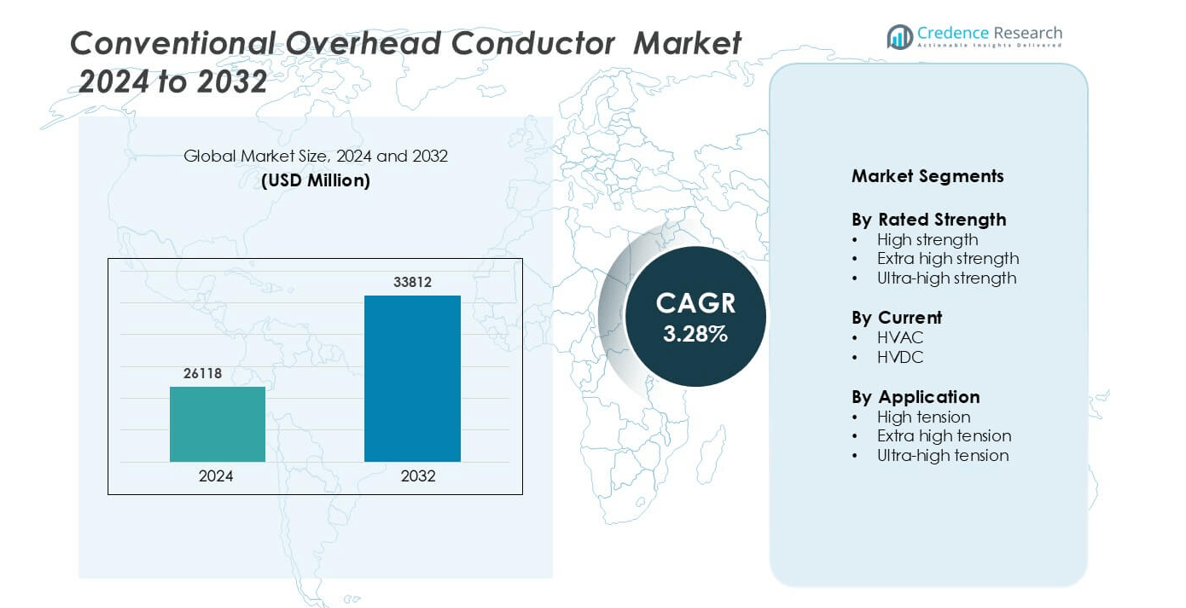

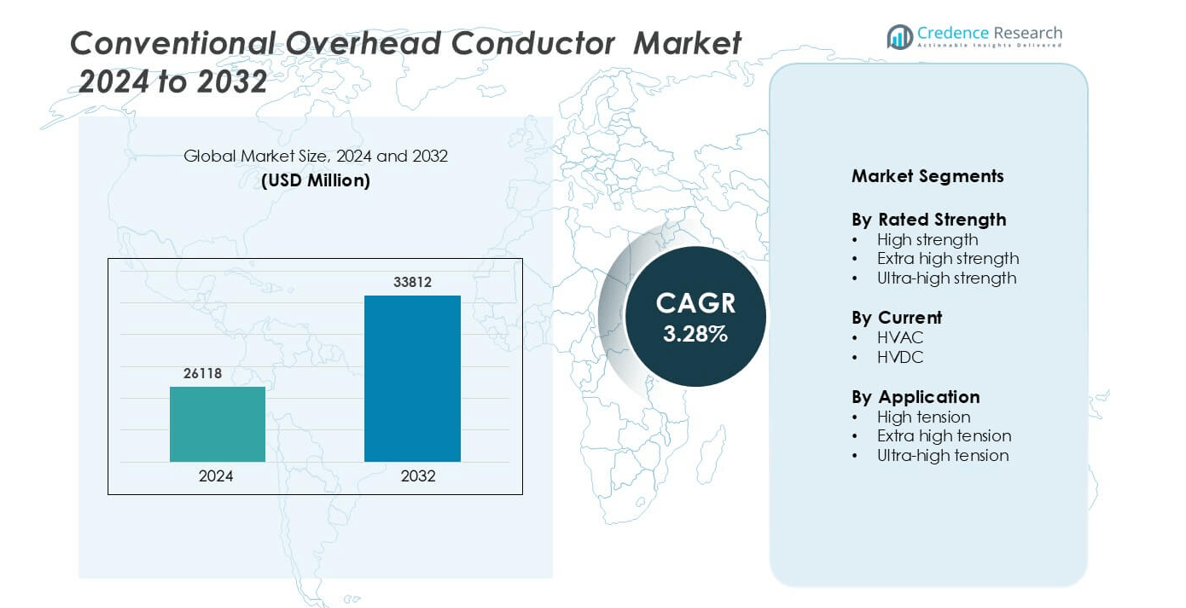

Conventional Overhead Conductor Market was valued at USD 26118 million in 2024 and is anticipated to reach USD 33812 million by 2032, growing at a CAGR of 3.28 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conventional Overhead Conductor Market Size 2024 |

USD 26118 million |

| Conventional Overhead Conductor Market, CAGR |

3.28% |

| Conventional Overhead Conductor Market Size 2032 |

USD 33812 million |

The Conventional Overhead Conductor Market is led by key players such as Hindustan Urban Infrastructure Limited, Lamifil, CTC Global Corporation, Bekaert, Gupta Power, APAR, Elsewedy Electric, Alcon Marepha, KEI Industries Limited, and CMI Limited. These companies maintain strong market positions through continuous innovation, advanced conductor designs, and extensive project portfolios across transmission and distribution sectors. Strategic collaborations with utilities and large-scale infrastructure developers further strengthen their presence. Asia-Pacific emerged as the leading region in 2024, accounting for 38% of the global market share, driven by rapid grid expansion, urban electrification, and renewable energy integration initiatives across China, India, and Japan.

Market Insights

- The Conventional Overhead Conductor Market was valued at USD 26118 million in 2024 and is projected to grow at a CAGR of 3.28% during 2025–2032.

- Market growth is driven by rising investments in grid modernization, renewable energy integration, and transmission infrastructure upgrades to meet increasing electricity demand.

- Advancements in aluminum alloy and carbon-core conductor technologies are enhancing performance efficiency and durability, supporting the shift toward high-capacity transmission systems.

- Key players such as Hindustan Urban Infrastructure Limited, Lamifil, CTC Global Corporation, and APAR lead through innovation, strategic partnerships, and capacity expansion in global projects.

- Asia-Pacific dominates with a 38% share, followed by North America at 34%, while the ultra-high strength segment leads the market with 42% share due to its superior tensile capacity and adoption in high-voltage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Rated Strength

The ultra-high strength segment dominated the Conventional Overhead Conductor Market with a 42% share in 2024. Its superior tensile capacity and low sag characteristics make it ideal for long-span and high-voltage transmission lines. Utilities increasingly favor these conductors to enhance grid reliability and reduce transmission losses. Advancements in composite core and aluminum alloy designs have further boosted their efficiency and lifespan. The rising demand for upgrading old transmission infrastructure and integrating renewable power sources continues to drive this segment’s strong market position globally.

- For instance, CTC Global’s ACCC®-AZR conductor features a composite core rated at 310 ksi (2 137 MPa) and an overall conductor ultimate tensile strength of 195 kN

By Current

The HVAC segment held the largest market share of 63% in 2024, driven by widespread use in traditional grid infrastructure. Alternating current systems remain dominant due to easier voltage transformation, low conversion losses, and established transmission networks. HVAC conductors are extensively used in inter-regional and intra-regional power distribution. Investments in grid modernization and smart grid technologies have further strengthened their adoption. Although HVDC applications are growing for long-distance transmission, HVAC conductors continue to lead due to cost-effectiveness and simpler maintenance requirements.

- For instance, Bekaert’s ACSS conductor, used widely by utilities, performs reliably at continuous temperatures up to 250 °C, enabling higher loads in AC transmission applications.

By Application

The high-tension segment accounted for the largest share of 46% in 2024, supported by its broad use in urban and industrial power transmission. These systems efficiently deliver electricity over medium distances while maintaining voltage stability. High-tension conductors are preferred for their cost-efficiency and compatibility with existing power infrastructure. Increasing urbanization, rapid industrial development, and infrastructure expansion projects have significantly contributed to the segment’s growth. Furthermore, ongoing utility upgrades and renewable energy integration continue to support demand for high-tension applications across developing and developed regions.

Key Growth Drivers

Rising Power Transmission Infrastructure Development

The rapid expansion of power transmission infrastructure is a major growth driver for the Conventional Overhead Conductor Market. Global electricity demand continues to increase due to urbanization, industrial growth, and the electrification of transport and heating systems. Utilities and governments are investing heavily in new transmission lines and upgrading aging grids to improve capacity and reliability. For instance, large-scale projects in Asia-Pacific and North America focus on strengthening cross-border power transfer networks. The integration of renewable energy sources such as solar and wind further increases the need for robust overhead conductors capable of handling variable loads and long-distance transmission efficiently.

- For instance, CTC Global Corporation has documented installation of over 180 000 km of its ACCC® conductors across more than 500 projects worldwide, demonstrating the scale of deployment efforts.

Integration of Renewable Energy Projects

The increasing deployment of renewable energy systems has significantly boosted the adoption of conventional overhead conductors. These conductors play a critical role in connecting renewable power plants—such as solar farms and wind parks—to regional and national grids. As countries aim to meet carbon neutrality targets, the need for efficient high-voltage lines grows. For example, China and India are investing in extensive renewable corridors that depend on high-tension conductor networks. Additionally, Europe’s offshore wind projects rely on reliable conductors to transmit electricity from remote generation sites to urban centers. This renewable integration trend is expected to sustain strong market demand in the coming decade.

- For instance, CTC Global has deployed its ACCC® conductors across over 200,000 km of lines in 67 countries, enabling transmission corridors tied to wind and solar generation.

Modernization and Replacement of Aging Power Lines

Aging transmission networks across developed economies have increased the need for conductor replacement and grid modernization. Conventional overhead conductors are being upgraded with stronger, corrosion-resistant materials that improve efficiency and durability. For instance, the U.S. Department of Energy has initiated large-scale transmission upgrades under its Grid Resilience program. Similar initiatives in Europe and Japan aim to enhance grid stability and reduce transmission losses. These modernization projects support consistent demand for conductors that can handle higher current loads, operate in extreme weather, and reduce long-term maintenance costs, ensuring reliable energy delivery across expanding power grids.

Key Trend and Opportunities

Transition Toward Advanced Aluminum Alloy Conductors

Manufacturers are increasingly focusing on advanced aluminum alloy conductors that offer higher strength-to-weight ratios and better thermal performance. These innovations address the growing need for efficient and durable transmission solutions. For instance, aluminum-zirconium alloys and carbon-core variants have demonstrated superior resistance to sag and corrosion in high-temperature environments. This trend aligns with global sustainability goals by enhancing power line efficiency while reducing material consumption. The ongoing shift toward these next-generation materials is creating opportunities for technology-driven companies in the conductor manufacturing space.

- For instance, Aluminum-zirconium alloys are widely used for overhead electrical conductors due to their high strength and thermal resistance (e.g., operating temperatures up to 150°C or higher).

Grid Expansion in Emerging Economies

Rapid industrialization in emerging economies such as India, Indonesia, and Brazil is driving new grid expansion projects. Governments are prioritizing rural electrification and inter-regional connectivity to meet increasing power demands. This creates lucrative opportunities for conventional overhead conductor suppliers, especially those offering cost-effective and high-strength solutions. The expansion of renewable energy zones in these regions also necessitates new transmission corridors. As a result, manufacturers are securing long-term contracts and partnerships with utilities to support infrastructure buildouts, enhancing their global market footprint.

- For instance, APAR Industries Limited has supplied more than 500,000 km of conductors to power grid and STU transmission networks across India. Governments prioritise rural electrification and inter-regional connectivity to meet rising power demand.

Key Challenges

Fluctuating Raw Material Prices

Volatility in the prices of key raw materials, including aluminum and steel, poses a significant challenge to market stability. Frequent cost fluctuations impact profit margins and complicate long-term project planning for both manufacturers and utilities. Supply chain disruptions and trade restrictions further intensify these risks. Producers are adopting hedging strategies and sourcing diversification to mitigate cost pressure. However, sustained instability in material markets can delay grid projects and reduce investment confidence, directly affecting the growth momentum of the conventional overhead conductor industry.

Environmental and Regulatory Constraints

Environmental restrictions and land-use regulations present another key challenge for the Conventional Overhead Conductor Market. Construction of transmission lines often faces delays due to concerns about deforestation, wildlife disruption, and public opposition. Stringent government approval processes, particularly in developed regions, can extend project timelines and increase costs. Manufacturers must comply with multiple safety and environmental standards during production and installation. To address these challenges, utilities are exploring compact line designs and innovative tower structures that minimize environmental impact while ensuring grid reliability and compliance with sustainability regulations.

Regional Analysis

North America

North America led the Conventional Overhead Conductor Market with a 34% share in 2024. The region’s growth is driven by extensive grid modernization projects and renewable energy integration. The United States and Canada are upgrading existing transmission infrastructure to handle higher voltage levels and improve grid reliability. Investments in cross-border interconnections and smart grid technologies further enhance market expansion. Additionally, the adoption of advanced aluminum and composite conductors to replace aging lines strengthens the region’s position. Ongoing efforts to reduce energy loss and support clean energy transition sustain steady demand for high-performance conductors.

Europe

Europe accounted for a 27% share of the Conventional Overhead Conductor Market in 2024, supported by the EU’s focus on decarbonization and renewable integration. Countries such as Germany, France, and the U.K. are heavily investing in transmission upgrades and cross-border power links. Initiatives under the European Green Deal are promoting energy efficiency and grid digitalization. The region’s emphasis on undergrounding and compact transmission designs also drives conductor innovation. Continuous expansion of offshore wind and inter-regional transmission systems ensures consistent demand for high-strength and corrosion-resistant conductors across European power networks.

Asia-Pacific

Asia-Pacific dominated the global market with a 38% share in 2024, driven by rapid industrialization and expanding power infrastructure. China, India, and Japan are leading major grid expansion and rural electrification projects. Rising electricity consumption and renewable energy deployment further accelerate demand for overhead conductors. Government initiatives promoting smart grids and cross-country transmission corridors are supporting large-scale deployments. The region’s strong manufacturing base and cost-efficient production also enhance competitiveness. Continuous investment in high-voltage networks and the integration of renewable energy zones consolidate Asia-Pacific’s leadership in the global conductor market.

Latin America

Latin America captured an 8% share of the Conventional Overhead Conductor Market in 2024, driven by growing electrification in Brazil, Mexico, and Chile. Governments are investing in new power transmission lines to enhance regional connectivity and support renewable energy projects. Expanding wind and solar installations across the region demand reliable conductor networks for long-distance transmission. Infrastructure modernization programs and rural grid extensions also contribute to market growth. However, limited funding and regulatory challenges slightly constrain large-scale deployment. Still, rising private-sector participation continues to strengthen Latin America’s transmission capacity and reliability.

Middle East & Africa

The Middle East & Africa held a 6% share in the Conventional Overhead Conductor Market in 2024. Growth is supported by expanding energy infrastructure and grid interconnection projects across Saudi Arabia, the UAE, and South Africa. Increasing electricity consumption from industrial and urban development drives the adoption of high-strength conductors. Investments in renewable power generation, particularly solar, are creating new transmission demands. Ongoing regional initiatives such as cross-border grid connectivity in Africa are further enhancing market potential. The gradual shift toward resilient and cost-efficient conductor technologies supports long-term regional growth.

Market Segmentations:

By Rated Strength

- High strength

- Extra high strength

- Ultra-high strength

By Current

By Application

- High tension

- Extra high tension

- Ultra-high tension

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Conventional Overhead Conductor Market is characterized by the presence of several global and regional manufacturers focusing on innovation, capacity expansion, and strategic partnerships. Key players such as Hindustan Urban Infrastructure Limited, Lamifil, CTC Global Corporation, Bekaert, Gupta Power, APAR, Elsewedy Electric, Alcon Marepha, KEI Industries Limited, and CMI Limited dominate the market through diversified product portfolios and strong distribution networks. Companies are increasingly investing in advanced materials like aluminum-zirconium alloys and carbon-core conductors to enhance performance and reduce line losses. Strategic collaborations with utilities and government agencies are also supporting long-term contracts for grid expansion projects. Many manufacturers are prioritizing sustainability by adopting eco-efficient production processes and recyclable materials. Furthermore, ongoing investments in R&D, coupled with modernization of transmission networks worldwide, are enabling these firms to strengthen their market positioning and cater to rising global demand for efficient, high-capacity transmission conductors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, APAR Industries Limited allocated USD 34.4 million for its conductor business which includes manufacturing rods for cables. This assigned amount would enhance APAR’s conductor capacity by 25,000 tonnes and lead to growth of the company across various regions including India.

- In November 2024, Southwire company LLC in collaboration with Georgia power has led to a federal funding grant of USD 160 million to enhance the electrical grid throughout the state of Georgia including the installation of Southwire’s C7 overhead conductor. This will serve 2.7 million customers across the state.

Report Coverage

The research report offers an in-depth analysis based on Rated Strength, Current, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising electricity demand and transmission expansion.

- Integration of renewable energy sources will increase the need for high-capacity conductors.

- Advancements in aluminum alloy and composite materials will enhance efficiency and durability.

- Grid modernization projects will create consistent demand across developed and emerging economies.

- Asia-Pacific will continue to dominate due to rapid industrialization and rural electrification.

- Manufacturers will focus on lightweight, corrosion-resistant designs for improved performance.

- Strategic collaborations with utilities will strengthen long-term project pipelines.

- Investments in smart grid and digital monitoring systems will optimize conductor operations.

- Replacement of aging infrastructure will remain a key market driver globally.

- Sustainability initiatives and eco-efficient production methods will shape future manufacturing trends.