Market Overview

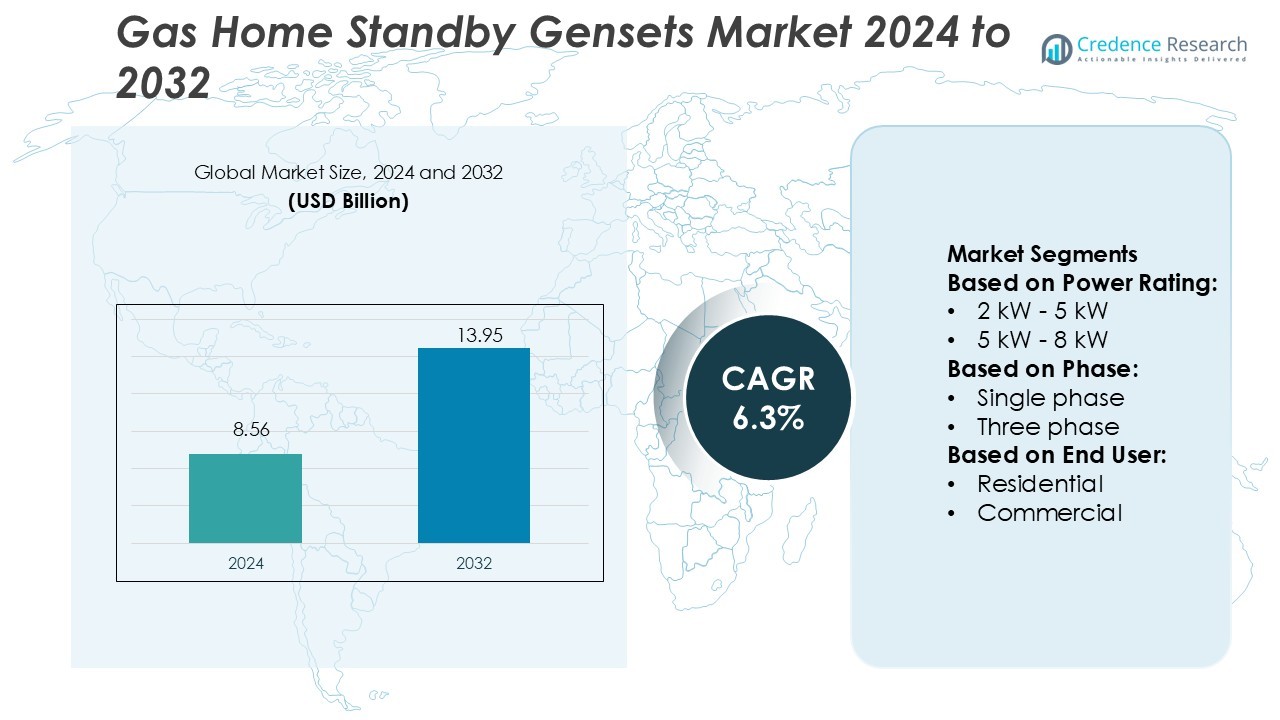

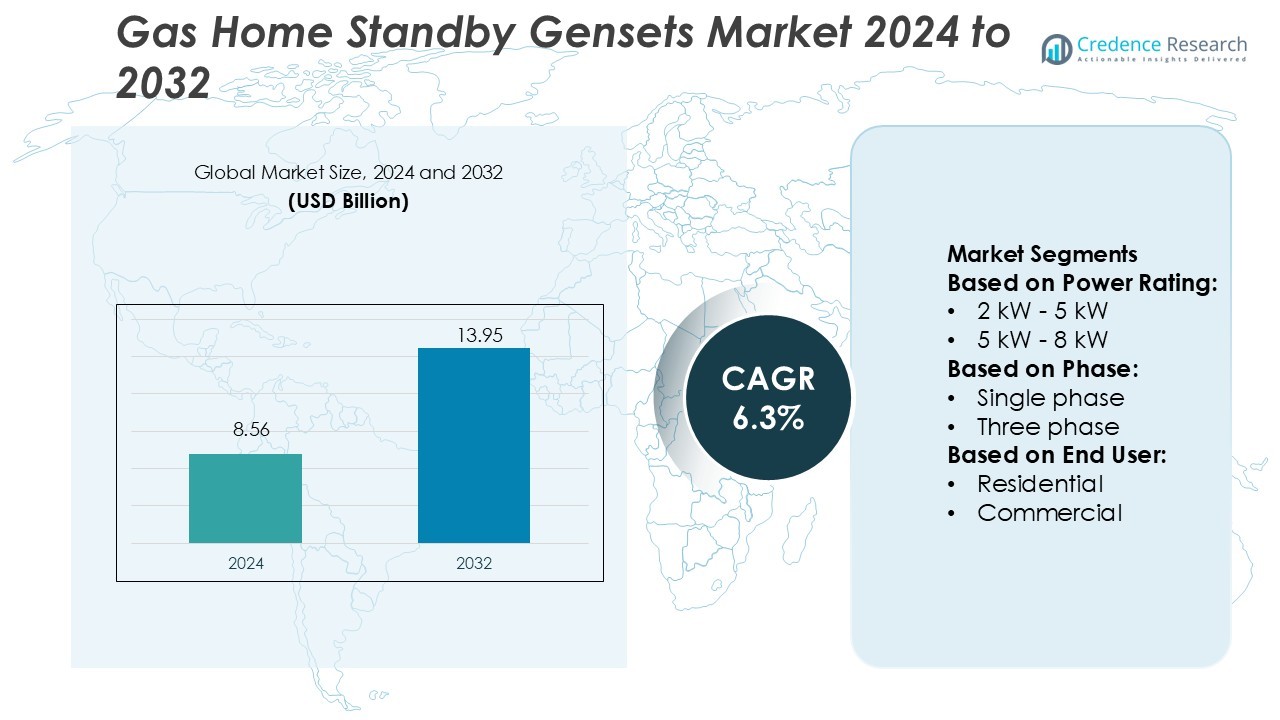

Gas Home Standby Gensets Market size was valued USD 8.56 billion in 2024 and is anticipated to reach USD 13.95 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Home Standby Gensets Market Size 2024 |

USD 8.56 Billion |

| Gas Home Standby Gensets Market, CAGR |

6.3% |

| Gas Home Standby Gensets Market Size 2032 |

USD 13.95 Billion |

The Gas Home Standby Gensets Market is led by prominent players such as Generac Power Systems, Inc., Cummins Inc., Kohler Co. Inc., and Caterpillar Inc., which dominate the global landscape with a wide range of high-quality, reliable products. These companies focus on innovation, offering advanced features such as smart connectivity and energy-efficient solutions. North America remains the leading region, accounting for approximately 40-45% of the market share. The demand in this region is driven by frequent power outages, strong consumer awareness of energy security, and a preference for eco-friendly backup power solutions. Additionally, companies are investing in expanding their product portfolios and exploring new technologies to maintain their market leadership. Europe follows as a significant market, with growing demand for cleaner energy solutions, while Asia-Pacific shows the fastest growth potential, driven by urbanization and increasing disposable incomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gas Home Standby Gensets Market size was valued at USD 8.56 billion in 2024 and is anticipated to reach USD 13.95 billion by 2032, at a CAGR of 6.3% during the forecast period.

- The market is driven by increasing power outages, consumer demand for reliable backup power, and the growing shift towards eco-friendly gas-powered gensets.

- Key trends include the integration of smart connectivity features, energy efficiency, and advancements in product design, making gensets more user-friendly and sustainable.

- The competitive landscape is led by Generac Power Systems, Inc., Cummins Inc., Kohler Co. Inc., and Caterpillar Inc., who are innovating to meet the evolving market demands for reliable, energy-efficient solutions.

- North America holds the largest market share, approximately 40-45%, driven by high demand for backup power solutions. Europe follows with strong growth, while Asia-Pacific is witnessing the fastest growth due to urbanization and rising disposable incomes.

Market Segmentation Analysis:

By Power Rating

In the gas home standby gensets market, the segment covering > 8 kW to 15 kW emerges as the dominant sub‑segment, capturing the largest share owing to its suitability for whole‑house backup power in modern homes. This rating range balances cost with performance, delivering sufficient capacity for HVAC, lighting, and appliance loads without the premium cost of higher‑rated units. Drivers include rising residential electrification, electric‑vehicle charging readiness, and the shift toward all‑electric homes, all of which boost adoption of gensets in this power‑rating band.

- For instance, KOHLER’s model 12RESV‑QS8 delivers 12 000 watts rated output (11 000 watts on natural gas) and maintains voltage regulation within ±1 %, while total harmonic distortion remains below 5 % of full load.

By Phase

Within the phase segmentation, single‑phase gensets lead the market by accounting for more than half of installations. These units align with typical residential wiring setups, offering simpler installation and lower cost compared to three‑phase systems. Growth is powered by increased smart‑home deployments, remote monitoring capabilities, and residential construction boom in suburban and semi‑urban markets where utility outages and grid stability concerns push homeowners toward reliable backup solutions.

- For instance, Mitsubishi Heavy Industries, Ltd’s DGICS Mark‑II control module integrates automatic/manual synchronization and load‑sharing functionality, supporting Ethernet and RS‑422 communications to manage genset systems of any phase seamlessly.

By End User

The residential end‑user sector dominates the gas home standby genset market, taking the largest share thanks to broad household demand. Homeowners increasingly invest in standby power systems due to more frequent grid outages, rising value of home‑office and home‑entertainment equipment, and growing interest in energy independence. Commercial and construction segments are expanding, but the scale and penetration in housing make residential the primary growth driver in this market space.

Key Growth Drivers

Increasing Power Outages

The rise in power outages driven by extreme weather events, natural disasters, and aging infrastructure is a significant driver for the Gas Home Standby Gensets market. Consumers are increasingly relying on backup power solutions to ensure the continuity of essential services in residential buildings. This surge in demand for reliable energy backup systems contributes to the growth of the genset market. Increased awareness of the importance of uninterrupted power supply further accelerates market expansion.

- For instance, General Electric’s 12 kW and 15 kW generators support full‑house backup with 12,000 watts (LP) and 11,000 watts (natural gas) output, include a 200 A whole‑house Symphony™ II transfer switch, and fuel consumption as low as 41 ft³/hr on LPG at half‑load.

Technological Advancements

Advancements in genset technology have led to more efficient and eco-friendly solutions, making gas home standby gensets more attractive to consumers. Innovations such as quieter operations, improved fuel efficiency, and reduced emissions contribute to their rising popularity. Additionally, the integration of smart technologies, including remote monitoring and control, enhances user convenience and operational efficiency, fostering growth in the market.

- For instance, Guardian 22 kW model (G0070420) offers a rated maximum continuous power capacity of 19.5 kW when running on natural gas, and records natural-gas consumption of 9.26 m³/hr at full load.

Cost-Effectiveness of Natural Gas

The cost-effectiveness and availability of natural gas compared to other fuels have made gas home standby gensets an attractive option for residential use. Natural gas is abundant, often cheaper, and cleaner, providing an environmentally friendly alternative to diesel-powered backup systems. The growing shift towards cleaner energy sources is driving the adoption of gas-powered gensets, making them a preferred choice for homeowners looking for cost-effective and sustainable solutions.

Key Trends & Opportunities

Shift Towards Clean Energy

As global environmental concerns rise, there is a notable shift towards clean energy solutions. Gas home standby gensets, which run on natural gas, are considered a cleaner alternative to traditional diesel-powered generators. With governments and consumers prioritizing sustainability, the demand for environmentally friendly backup power solutions is growing. This trend offers significant opportunities for manufacturers to capitalize on the shift towards eco-friendly and energy-efficient products.

- For instance, MTU Onsite Energy achieved a significant technical milestone with its upgraded mtu Series 1600 generator sets, which deliver electrical outputs ranging from 590 kVA to 996 kVA in the 50 Hz market—representing up to a 40 percent increase in power compared to the previous model.

Integration of Smart Features

The integration of smart technology into gas home standby gensets is a growing trend. Features like automated diagnostics, remote monitoring, and IoT connectivity are becoming more common, allowing users to manage their gensets more efficiently. These advancements not only improve convenience but also enable early detection of maintenance needs, reducing downtime. The trend towards smart homes offers a unique opportunity for manufacturers to offer integrated backup power solutions.

- For instance, EG‑i Series inverter generators include models such as the eG100i‑6CR and eG140i‑6CR, delivering rated standby outputs of 7.5 kW and 11.0 kW respectively, with fuel consumption at full load listed as 3.0 L/hr and 4.3 L/hr.

Expansion in Emerging Markets

The increasing demand for reliable power supply in emerging markets, particularly in regions like Asia-Pacific and Latin America, presents a significant growth opportunity for gas home standby genset manufacturers. As urbanization and industrialization continue in these regions, the need for efficient backup power solutions is rising. Manufacturers can capitalize on these growth areas by offering tailored solutions that meet the local energy needs and preferences.

Key Challenges

High Initial Investment

One of the major challenges in the gas home standby genset market is the high initial investment required for purchasing and installing these systems. The upfront costs, including equipment, installation, and maintenance, can be a barrier for many consumers, especially in price-sensitive markets. Although long-term savings from lower operating costs can offset the initial investment, the high price point remains a significant hurdle to widespread adoption.

Regulatory and Environmental Challenges

The gas home standby gensets market faces regulatory and environmental challenges related to emissions and fuel usage. Stringent regulations aimed at reducing carbon footprints and air pollution can limit the growth of traditional backup power solutions. Manufacturers must comply with evolving emission standards and invest in technologies that ensure compliance with government policies. Navigating these regulatory hurdles can be complex, especially in regions with varying laws on fuel usage and emissions.

Regional Analysis

North America

North America holds the largest market share in the gas home standby gensets market, accounting for 40-45%. The region’s market is driven by frequent power outages, especially due to severe weather conditions like storms, hurricanes, and snowstorms. Strong demand for reliable backup power solutions, along with high awareness of energy security, continues to fuel growth. Technological advancements in genset efficiency and integration with smart homes also contribute to market expansion. The North American market is expected to remain dominant, supported by a robust infrastructure and a preference for eco-friendly, cost-effective energy solutions.

Europe

Europe holds a significant market share of 25-30% in the gas home standby gensets market. The demand for backup power solutions is growing, driven by frequent power outages and an increasing preference for cleaner, more sustainable energy sources. Gas-powered gensets are seen as a more environmentally friendly option compared to diesel generators. As urbanization increases and consumers adopt smart home technologies, the market in Europe is set for steady growth. Government regulations encouraging energy efficiency and reduced emissions further boost the adoption of gas home standby gensets in the region.

Asia-Pacific

The Asia-Pacific region accounts for 20-25% of the global gas home standby gensets market. The market is expanding rapidly, fueled by rapid urbanization, increased disposable incomes, and growing demand for reliable backup power in both residential and commercial sectors. Power outages in developing countries, particularly in India and China, are a significant driver for the adoption of gensets. Although the market share in this region is smaller compared to North America and Europe, the strong economic growth and increasing awareness of backup power solutions make it one of the fastest-growing regions.

Latin America

Latin America holds a smaller share of 5-10% in the gas home standby gensets market. Frequent power outages in regions with unreliable infrastructure and a growing need for residential backup power contribute to market demand. However, the market is still developing due to lower disposable incomes and price sensitivity. Despite these challenges, rising urbanization and growing awareness of energy security are expected to drive steady growth in the coming years. As economies in Latin American countries continue to grow, the market for gas home standby gensets is set to expand, albeit at a slower pace than in other regions.

Middle East & Africa

The Middle East and Africa region represents 5-10% of the global gas home standby gensets market. The market is emerging, with growing demand driven by frequent power disruptions in parts of Africa and the Middle East. Governments in the region are investing in infrastructure improvements and energy diversification, which is creating opportunities for backup power solutions. Gas-powered gensets, being more affordable and environmentally friendly, are gaining popularity. Although the market share is smaller compared to other regions, the growing need for reliable electricity and improved energy access presents significant opportunities for market growth.

Market Segmentations:

By Power Rating:

By Phase:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gas Home Standby Gensets Market is highly competitive, with key players such as Kohler Co. Inc., Mitsubishi Heavy Industries, Ltd, General Electric, Generac Power Systems, Inc., Mahindra Powerol, MTU Onsite Energy, Yanmar Co., Ltd, Cooper Corp., Cummins Inc., and Caterpillar Inc. The Gas Home Standby Gensets Market is characterized by strong competition, driven by technological advancements and a growing demand for reliable backup power solutions. Key players in the market continually innovate to enhance the efficiency, performance, and eco-friendliness of their products. The integration of smart technologies, such as remote monitoring and automated diagnostics, is becoming a key differentiator. Additionally, the growing trend toward sustainability has led to a preference for gas-powered gensets over diesel alternatives, due to their lower emissions and greater fuel efficiency. As demand for home backup power systems rises, companies are focusing on expanding their product offerings and enhancing customer experience. Regional and local players are also gaining ground, offering cost-effective solutions tailored to specific market needs. The competitive landscape is evolving rapidly, with players constantly striving to maintain market share through innovation, strategic partnerships, and regional expansions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kohler Co. Inc.

- Mitsubishi Heavy Industries, Ltd

- General Electric

- Generac Power Systems, Inc.

- Mahindra Powerol

- MTU Onsite Energy

- Yanmar Co., Ltd

- Cooper Corp.

- Cummins Inc.

- Caterpillar Inc.

Recent Developments

- In October, 2024, HIMOINSA launched its HGY Series of natural gas generators in Madrid, Spain, showcasing a new power solution for critical applications. Developed in collaboration with Yanmar Power Technology, these generators range from 1250kVA to 3500kVA and are designed for efficiency and low emissions.

- In September 2024, Kohler’s assembly plant in Hattiesburg, Mississippi, was noted as a key facility for producing reliable standby generators used to power homes and small businesses during outages. The plant specializes in producing both air-cooled and water-cooled units which are designed to operate on natural gas or liquid propane.

- In May 2024, Briggs & Stratton has launched the 26 kW Power Protect Home Standby Generator which integrates sophisticated motor starting capabilities and comes with an industry leading warranty. Additionally, the generator boasts dual fuel capability of natural gas and liquid propane.

- In March 2024, Cummins and Sudhir Power have successfully participated in a major roadshow in Rajasthan where the CPCB IV compliant technology of their gensets was on display. The campaign sought to foster a new brand for the products’ generators which included enhanced operational efficiency, reliability, and compliance with emission regulations.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Phase, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for gas home standby gensets will continue to grow as power outages become more frequent due to climate change and aging infrastructure.

- Technological advancements, including smart connectivity and remote monitoring, will make gensets more efficient and user-friendly, enhancing their appeal.

- Rising consumer preference for eco-friendly power solutions will drive the shift from diesel to gas-powered gensets, supporting market growth.

- Increasing awareness of energy security will prompt more homeowners to invest in reliable backup power systems, boosting market demand.

- The market will see significant growth in emerging economies, driven by rising disposable incomes and the expansion of residential infrastructure.

- Manufacturers will focus on improving fuel efficiency and reducing emissions to comply with stricter environmental regulations and meet consumer expectations.

- Cost-effective solutions will become more prevalent as competition intensifies, offering consumers affordable options without compromising quality.

- Integration of energy storage systems with gensets will become more common, providing more sustainable and reliable power solutions for homeowners.

- Regional players will gain market share by offering products tailored to local needs and preferences, especially in developing markets.

- Strategic partnerships and collaborations between companies will lead to innovation and better distribution channels, accelerating market penetration.