Market Overview

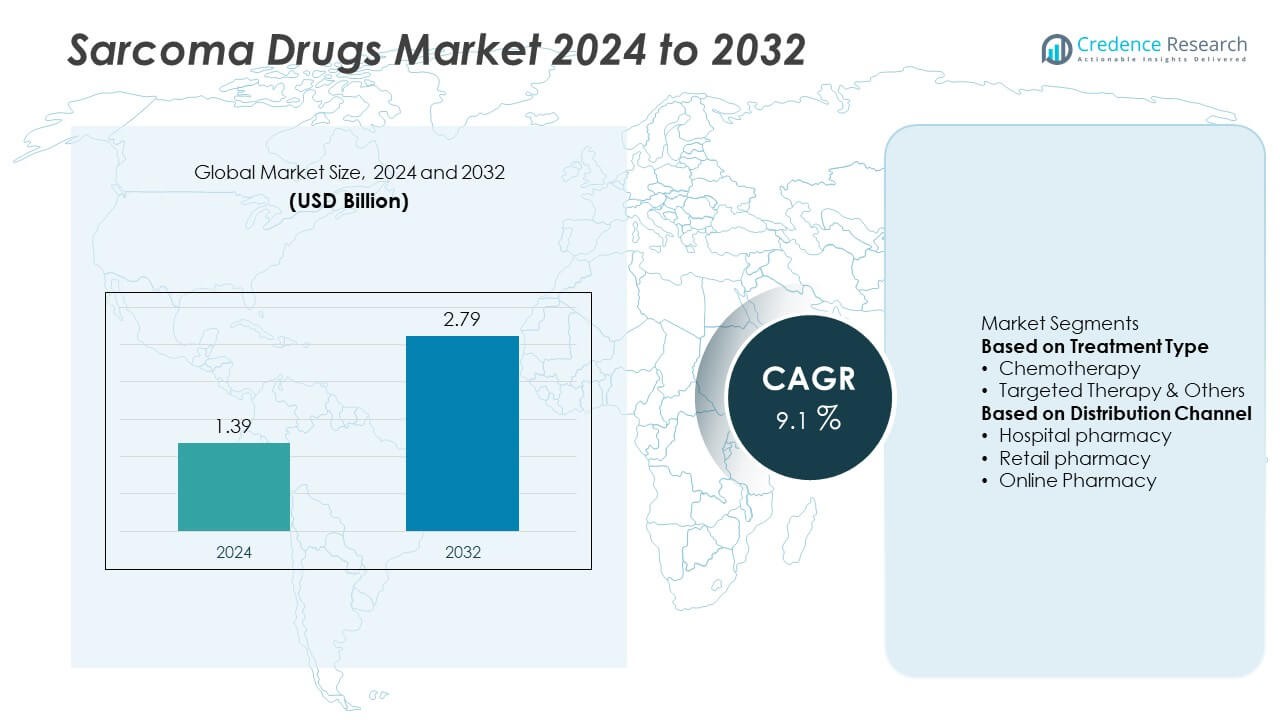

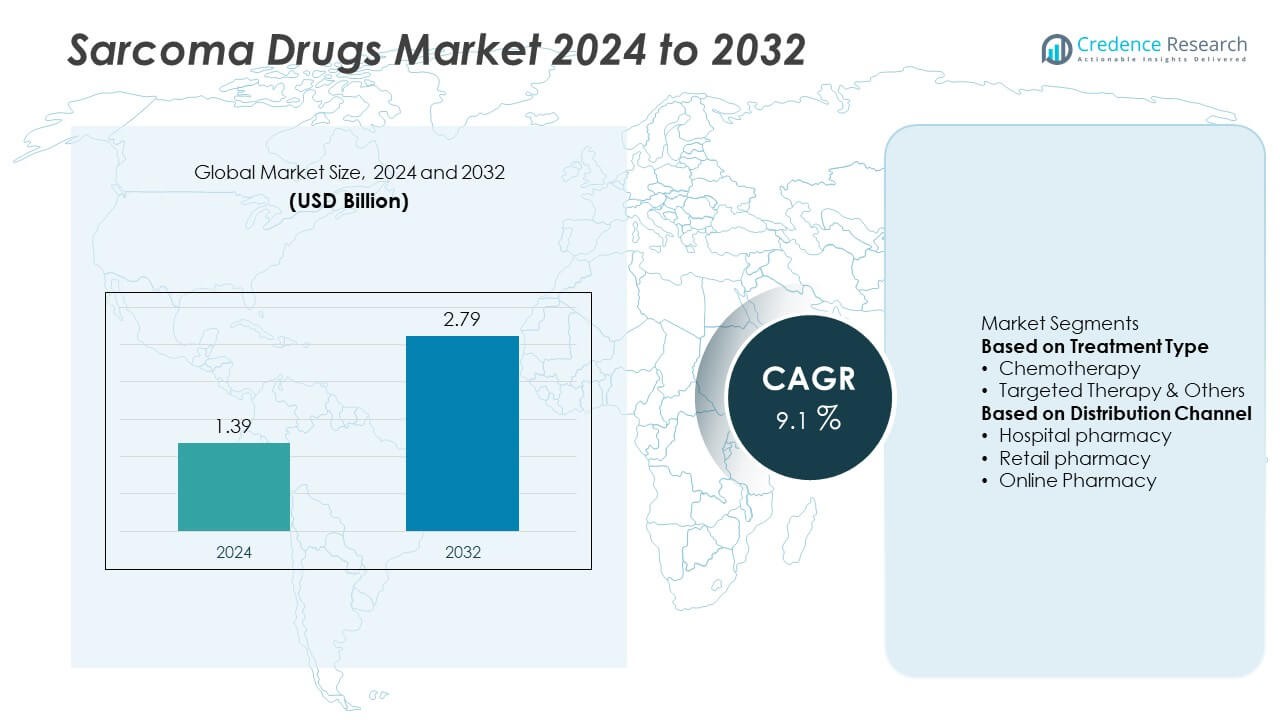

The Sarcoma Drugs Market was valued at USD 1.39 billion in 2024 and is projected to reach USD 2.79 billion by 2032, growing at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sarcoma Drugs Market Size 2024 |

USD 1.39 Billion |

| Sarcoma Drugs Market, CAGR |

9.1% |

| Sarcoma Drugs Market Size 2032 |

USD 2.79 Billion |

The Sarcoma Drugs Market is led by key players including Bayer AG, Daiichi Sankyo Company Limited, Novartis AG, Eisai Co. Ltd., Pfizer Inc., Johnson & Johnson, Eli Lilly and Company, Merck & Co. Inc., Takeda Pharmaceutical Company Limited, and GSK plc. These companies dominate through innovative oncology portfolios, strong R&D pipelines, and strategic collaborations focused on targeted and immuno-oncology therapies. North America held the largest market share of 42.6% in 2024, driven by advanced healthcare infrastructure and high treatment adoption. Europe followed with 29.3%, supported by strong clinical research and regulatory incentives, while Asia-Pacific accounted for 19.8%, fueled by rising cancer prevalence and expanding access to advanced therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sarcoma Drugs Market was valued at USD 1.39 billion in 2024 and is projected to reach USD 2.79 billion by 2032, growing at a CAGR of 9.1% during the forecast period.

- Rising incidence of sarcoma cases and increased adoption of targeted and immunotherapy treatments are driving market growth, with the chemotherapy segment holding a 62.4% share in 2024 due to its continued clinical relevance.

- Key market trends include growing investment in precision oncology, expansion of orphan drug designations, and increased focus on combination therapies for improved survival outcomes.

- Leading players such as Bayer AG, Novartis AG, Pfizer Inc., and Eli Lilly and Company are strengthening their pipelines through collaborations and R&D in rare cancer therapeutics.

- North America led the market with a 42.6% share, followed by Europe (29.3%) and Asia-Pacific (19.8%), driven by growing healthcare investments, clinical research, and expanding access to cancer care.

Market Segmentation Analysis:

By Treatment Type

The chemotherapy segment dominated the sarcoma drugs market in 2024 with a 62.4% share, driven by its continued use as the standard treatment for both soft tissue and bone sarcomas. Chemotherapy remains widely adopted due to its broad efficacy across multiple sarcoma subtypes and use in combination therapies for advanced stages. The availability of established drug regimens, such as doxorubicin and ifosfamide, supports market stability. Meanwhile, targeted therapy and other advanced treatments are expanding rapidly, fueled by personalized medicine approaches and rising demand for improved survival outcomes with fewer side effects.

- For instance, the pegylated liposomal formulation of doxorubicin (Doxil® or Caelyx®) was developed to reduce cardiotoxicity compared to conventional doxorubicin, thereby allowing for higher cumulative doses and improving the safety profile for patients with cancers such as ovarian cancer, AIDS-related Kaposi’s sarcoma, and multiple myeloma.

By Distribution Channel

The hospital pharmacy segment led the sarcoma drugs market in 2024 with a 58.6% share, supported by the dominance of hospital-based oncology treatments and clinical drug administration. Hospitals remain key distribution centers for chemotherapy and targeted therapies requiring supervision and infusion-based delivery. Retail and online pharmacies are showing steady growth, aided by increased patient access to oral anticancer medications and post-treatment prescriptions. Expanding digital health infrastructure and tele-oncology platforms are further encouraging online pharmacy sales, improving patient convenience and medication adherence in long-term cancer management.

- For instance, the adoption of digital health tools, such as mobile apps and reminder systems, in various oncology settings has been shown to improve medication adherence rates and enhance the quality of life for cancer patients.

Key Growth Drivers

Rising Incidence of Sarcoma Cases

The global increase in sarcoma cases, particularly soft tissue and bone sarcomas, drives demand for effective treatments. Advancements in diagnostic imaging and genetic profiling are improving early detection rates, expanding the patient base for drug therapy. The growing prevalence of risk factors such as radiation exposure and genetic mutations also contributes to higher treatment needs. This rising burden has encouraged pharmaceutical companies to invest in new drug formulations and clinical trials aimed at improving survival outcomes and reducing treatment-related toxicity.

- For instance, Eli Lilly and Company conducted an open-label, randomized phase 2 multicenter study on olaratumab, involving 133 patients with advanced soft tissue sarcoma, where combination therapy with doxorubicin demonstrated a median overall survival improvement of 11.8 months compared to doxorubicin alone, leading to accelerated regulatory approval.

Advancements in Targeted and Immunotherapies

Continuous progress in molecular biology and immuno-oncology is transforming sarcoma treatment. Targeted therapies, including tyrosine kinase inhibitors and monoclonal antibodies, are gaining prominence due to higher efficacy and fewer side effects than conventional chemotherapy. Immunotherapies such as checkpoint inhibitors are expanding treatment options for resistant sarcoma types. Pharmaceutical companies are actively conducting clinical studies to combine targeted and immune-based therapies, driving long-term market growth and enhancing personalized treatment outcomes for patients.

- For instance, Merck & Co., Inc. reported results from a Phase 2 SARC028 trial using pembrolizumab in specific subtypes of soft tissue sarcoma, which demonstrated durable tumor responses in some patients with undifferentiated pleomorphic sarcoma and dedifferentiated liposarcoma.

Increasing R&D Investments by Pharmaceutical Companies

Pharmaceutical firms are significantly increasing research and development spending to address the unmet needs in sarcoma management. With limited approved drugs available, there is strong emphasis on developing novel molecules, orphan drugs, and precision therapies. Collaborative research between biotech startups and cancer research institutes is accelerating innovation. Government incentives for rare cancer drug development, including fast-track designations and extended exclusivity periods, further stimulate market expansion. These initiatives are expected to deliver new treatment options and sustain growth momentum over the coming years.

Key Trends & Opportunities

Shift Toward Personalized and Genomic Medicine

The sarcoma drugs market is witnessing a growing shift toward personalized medicine, driven by advancements in genetic sequencing and biomarker analysis. Tailored therapies designed to target specific gene mutations, such as PDGFR and KIT, are improving treatment efficacy and reducing adverse effects. Pharmaceutical developers are focusing on precision oncology approaches to optimize patient outcomes. This trend supports the integration of molecular diagnostics with targeted drug development, creating significant opportunities for customized and adaptive treatment strategies.

- For instance, Novartis AG developed imatinib mesylate (Gleevec) specifically targeting KIT and PDGFRα gene mutations, achieving durable responses in over 80% of GIST patients carrying exon 11 mutations and demonstrating median progression-free survival exceeding 50 months in long-term clinical follow-ups.

Expansion of Clinical Trials and Drug Approvals

A surge in global clinical trials focused on rare sarcoma subtypes is accelerating drug innovation. Companies are leveraging next-generation research tools and global partnerships to fast-track development timelines. Regulatory bodies like the FDA and EMA are granting orphan drug designations and priority review status for promising sarcoma treatments, enhancing approval rates. This expansion of trial activity and favorable regulatory pathways is expected to introduce novel therapies and strengthen the overall drug pipeline in the coming years.

- For instance, Daiichi Sankyo Company, Limited initiated a Phase 1 first-in-human trial of its antibody–drug conjugate DS-6157 targeting GPR20 in gastrointestinal stromal tumor (GIST), enrolling 34 patients with advanced GIST to evaluate dose escalation and safety.

Key Challenges

High Treatment Costs and Limited Accessibility

The high cost of advanced therapies, including targeted and immuno-oncology drugs, limits accessibility in developing regions. Many sarcoma patients face financial challenges due to prolonged treatment cycles and combination therapies. Limited insurance coverage and reimbursement barriers further constrain adoption rates. Healthcare providers and policymakers are under pressure to establish cost-effective pricing models and improve access to life-saving treatments, especially in low- and middle-income countries.

Limited Awareness and Delayed Diagnosis

Low awareness among patients and general practitioners often leads to delayed sarcoma diagnosis, reducing the effectiveness of treatment. Sarcomas account for a small percentage of total cancer cases, making early recognition difficult. Delayed referrals and misdiagnoses result in advanced disease stages at presentation, requiring aggressive and costly interventions. Improving diagnostic infrastructure, clinician training, and public awareness campaigns are essential to enhance early detection and improve survival outcomes.

Regional Analysis

North America

North America dominated the sarcoma drugs market in 2024 with a 42.6% share, supported by advanced healthcare infrastructure, strong oncology research funding, and high treatment adoption rates. The United States leads the region due to its robust clinical trial activity and availability of FDA-approved targeted therapies. The presence of key pharmaceutical players and strong insurance coverage further support market growth. Rising awareness of rare cancers and growing demand for innovative treatments contribute to the region’s continued leadership in sarcoma drug development and commercialization.

Europe

Europe accounted for a 29.3% share of the sarcoma drugs market in 2024, driven by established cancer treatment networks and expanding access to precision therapies. Countries such as Germany, France, and the United Kingdom lead due to well-funded healthcare systems and ongoing research collaborations. The European Medicines Agency’s support for orphan drug designations encourages innovation and faster approval of rare cancer drugs. Increasing investment in clinical studies and growing patient awareness campaigns continue to strengthen Europe’s position in the global sarcoma drug market.

Asia-Pacific

Asia-Pacific held a 19.8% share of the sarcoma drugs market in 2024, supported by rising cancer prevalence, improving healthcare infrastructure, and growing access to advanced oncology treatments. Japan and China are leading contributors, benefiting from expanding clinical research and increased adoption of targeted therapies. Government programs promoting early cancer detection and greater investment by multinational pharmaceutical companies are accelerating regional market growth. Expanding diagnostic capabilities and improving affordability of cancer medications are expected to further enhance treatment accessibility in the coming years.

Latin America

Latin America captured a 5.1% share of the sarcoma drugs market in 2024, driven by gradual improvements in healthcare systems and access to oncology care. Brazil and Mexico are key contributors, supported by public health initiatives aimed at expanding cancer diagnosis and treatment coverage. The growing availability of branded and generic chemotherapy drugs enhances market presence in the region. However, high treatment costs and limited awareness continue to challenge growth. Ongoing government efforts to strengthen cancer care infrastructure are expected to improve market penetration.

Middle East & Africa

The Middle East & Africa region accounted for a 3.2% share of the sarcoma drugs market in 2024. Market growth is driven by increasing healthcare expenditure, expanding oncology centers, and adoption of advanced cancer therapies in countries such as Saudi Arabia, the UAE, and South Africa. Government initiatives to improve rare disease awareness and access to specialty drugs are supporting steady progress. However, limited diagnostic capabilities and high drug costs hinder large-scale adoption. Collaborations with global pharmaceutical companies and regional cancer programs are expected to boost long-term growth.

Market Segmentations:

By Treatment Type

- Chemotherapy

- Targeted Therapy & Others

By Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sarcoma Drugs Market is shaped by major players such as Bayer AG, Daiichi Sankyo Company Limited, Novartis AG, Eisai Co. Ltd., Pfizer Inc., Johnson & Johnson, Eli Lilly and Company, Merck & Co. Inc., Takeda Pharmaceutical Company Limited, and GSK plc. These companies focus on expanding their oncology portfolios through research collaborations, clinical trials, and product launches targeting rare sarcoma subtypes. Strategic initiatives such as partnerships with cancer research institutes and acquisitions of biotech firms are strengthening their pipelines. Market leaders emphasize innovation in targeted therapies, immuno-oncology, and personalized treatment approaches to improve patient outcomes. Growing investment in orphan drug development and regulatory fast-track approvals is enabling faster market access. Companies are also prioritizing global expansion, particularly in Asia-Pacific and Europe, where increasing cancer prevalence and healthcare advancements are creating strong growth opportunities in the sarcoma treatment landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer AG

- Daiichi Sankyo Company, Limited

- Novartis AG

- Eisai Co., Ltd

- Pfizer Inc.

- Johnson & Johnson

- Eli Lilly and Company

- Merck & Co., Inc.

- Takeda Pharmaceutical Company Limited

- GSK plc

Recent Developments

- In January 2025, Pfizer disclosed that its investigational approach for Ewing sarcoma with Ibrance (palbociclib) is under Phase II development, reinforcing commitment to sarcoma subtypes beyond the more common STS (soft-tissue sarcoma).

- In December 2024, Bayer AG included a portfolio project targeting GIST (gastrointestinal stromal tumour) — the most common sarcoma subtype — where more than 80 % of tumours harbour KIT mutations, reinforcing the focus on molecular-targeted therapies in sarcoma.

- In November 2024, Merck & Co., Inc. (MSD) and a research consortium announced the Sarcoma Alliance for Research through Collaboration (SARC)-led trial of pembrolizumab which showed disease-free survival of 67 % at two years in 127 adults with locally advanced soft tissue sarcoma of the extremity treated with immunotherapy plus standard care, versus 52 % in the control arm.

- In August 2024, Adaptimmune plc (partnered with GSK plc) reported that its T cell therapy afamitresgene autoleucel achieved an overall response rate of 43.2 % in a Phase 2 trial involving 44 adults with unresectable or metastatic synovial sarcoma who had received prior chemotherapy.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing awareness and early diagnosis of rare cancers.

- Targeted therapies and immuno-oncology drugs will drive next-generation treatment developments.

- Pharmaceutical companies will increase R&D spending on precision and combination therapies.

- Personalized medicine approaches will enhance treatment outcomes and patient survival rates.

- Orphan drug designations will encourage innovation and faster regulatory approvals.

- North America will maintain leadership due to strong research infrastructure and advanced healthcare systems.

- Europe will grow with expanding clinical trials and support for rare cancer initiatives.

- Asia-Pacific will emerge as a high-growth region with improving cancer care access.

- High treatment costs and reimbursement challenges will influence global market strategies.

- Collaborations between pharma firms and research institutions will accelerate novel drug discoveries