Market Overview:

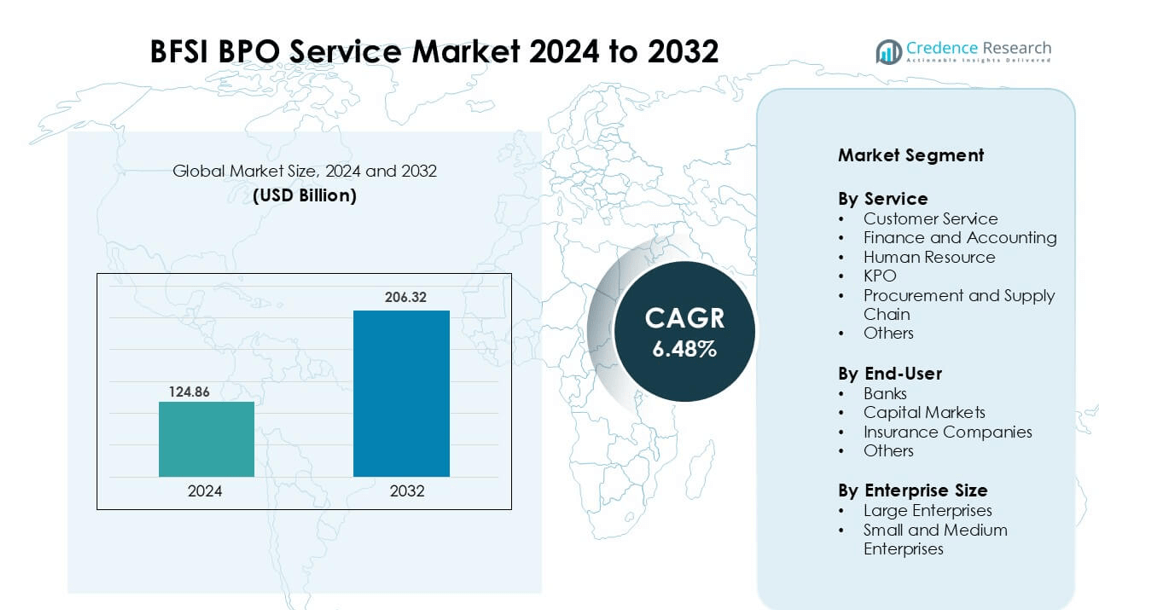

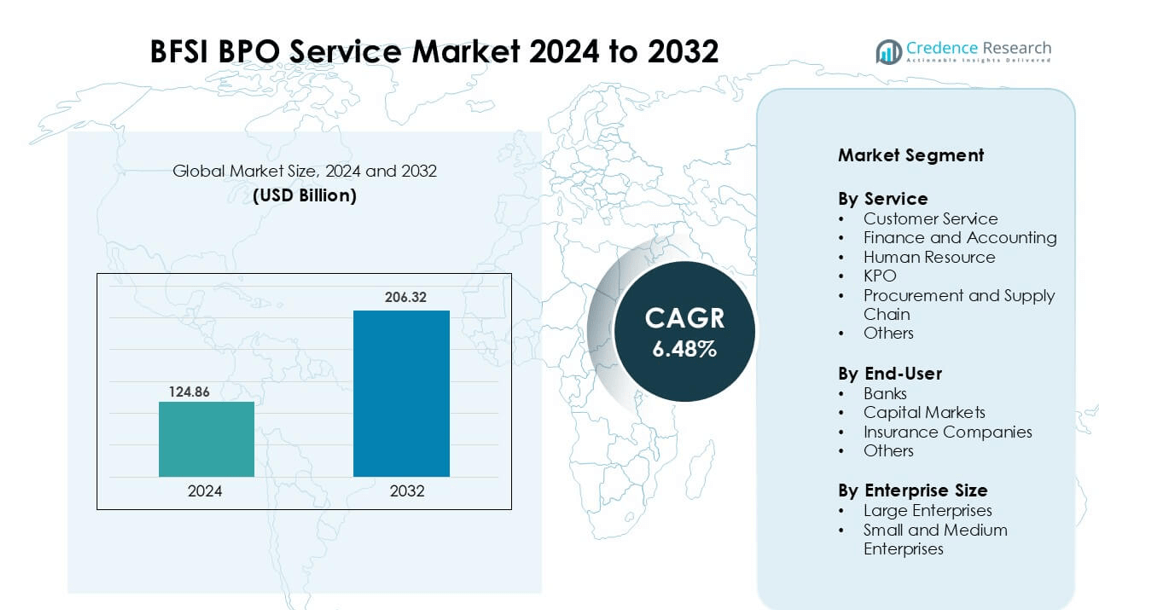

BFSI BPO Service Market was valued at USD 124.86 billion in 2024 and is anticipated to reach USD 206.32 billion by 2032, growing at a CAGR of 6.48 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| BFSI BPO Service Market Size 2024 |

USD 124.86 billion |

| BFSI BPO Service Market, CAGR |

6.48% |

| BFSI BPO Service Market Size 2032 |

USD 206.32 billion |

The BFSI BPO service market includes major players such as Capita plc, Infosys Limited, Amdocs, Concentrix Corporation, CBRE, Accenture, Atos SE, Cognizant, HCL Technologies Limited, and Capgemini. These companies provide large delivery networks, multilingual customer support, compliance management, automated KYC, loan processing, and analytics-driven fraud control. Vendors invest in AI chatbots, robotic automation, cloud platforms, and secured data environments to improve accuracy and meet regulatory standards. North America leads the market with a 35% share, driven by high outsourcing adoption among banks, insurers, and wealth managers seeking cost efficiency, scalable workflows, and 24×7 support models.

Market Insights

- The BFSI BPO service market reached USD 124.86 billion in 2024 and grows at a CAGR of 6.48 % through 2032, supported by rising outsourcing demand in banking, insurance, and capital markets.

- Cost optimization remains a key driver, as financial institutions outsource customer service, KYC checks, loan processing, and compliance tasks to reduce operational cost and improve turnaround speed.

- Automation, AI chatbots, and cloud delivery models shape market trends, with vendors using digital workflows for faster onboarding, secure document handling, and real-time fraud monitoring.

- The market is moderately consolidated, with large players offering global delivery centers, multilingual support, and secure data infrastructure; however, data privacy regulations and cybersecurity risks restrain adoption for sensitive processes.

- North America leads with 35% share, while Asia-Pacific holds 28% due to strong offshore capabilities; on the service side, customer service is the dominant segment with the highest share driven by high transaction volume in retail banking and insurance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

Customer service leads this category with the largest market share. Banks, insurers, and fintech firms outsource call centers, omnichannel support, KYC verification, and complaint handling to improve response time and lower operating cost. Digital channels like chatbots, voice bots, and CRM-integrated support make outsourcing more efficient. Finance and accounting services also grow due to rising demand for billing, reconciliation, and regulatory reporting. KPO services gain traction in analytics, fraud detection, and credit risk modeling. Human resource and procurement outsourcing remain smaller but expand as firms adopt automation and cloud management tools.

- For instance, LimeChat claims that its generative-AI agents can handle as much as 70% of customer complaints for its clients, with an aim to make many customer service roles obsolete across India’s call centre industry.

By End-User

Banks dominate the end-user segment with the highest share. Large banks outsource back-office work, collections, loan processing, and customer onboarding to boost productivity and reduce manual errors. BPO vendors also help banks manage compliance, AML screening, and data security standards. Insurance companies increase outsourcing for policy administration, claims processing, and telesales. Capital market firms outsource trade settlement, reconciliation, and investment research, driven by strict regulatory deadlines and cost pressure. Other financial institutions such as NBFCs and digital lending platforms adopt outsourced CRM and analytics to handle rising customer volume.

- For instance, Infosys supported a European investment firm with its Finacle Treasury Platform, processing more than 25,000 daily trades across asset classes with real-time compliance reports.

By Enterprise Size

Large enterprises hold the dominant share because they operate high-volume transactions and need scalable outsourcing models. Global banks and insurers rely on multi-country BPO hubs to standardize processes, deploy automation, and cut support costs. Many large firms shift from captive centers to outsourced partners to improve flexibility and speed of service. Small and medium enterprises adopt BPO services at a faster rate for customer support, telemarketing, payroll, and accounting. Cloud platforms and pay-as-you-go pricing models drive SME adoption, as companies avoid heavy investment in infrastructure and full-time staff.

Key Growth Drivers

Cost Optimization and Focus on Core Banking

Banks and insurers outsource non-core work to lower operational costs and improve efficiency. BPO partners handle back-office tasks, customer support, KYC checks, compliance filing, and loan processing. Outsourcing reduces staffing pressure and IT investment for large workloads. Global BFSI firms also shift processes to shared service centers across India, the Philippines, and Eastern Europe to gain labor and infrastructure advantages. Cloud-based automation helps BPO vendors deliver faster turnaround, fewer errors, and stronger customer experience. As competition rises in retail banking, wealth management, and insurance sales, management teams prefer outsourcing to stay focused on product innovation, digital channels, and revenue growth.

- For instance, State Street Bank implemented an automation programme that delivered 1.5 million hours back to the business over four years and reduced the onboarding-to-trading time for new accounts by 49%. SS&C Blue Prism.

Rising Demand for Automation and Digital Workflows

Banks and insurers adopt robotic process automation, AI chatbots, OCR, and advanced analytics for repetitive tasks. BPO vendors use automation for customer onboarding, claims processing, KYC verification, and fraud alerts. Digital workflows shorten approval time and improve accuracy. Automated KYC reduces manual errors and supports real-time authentication. Voice bots and multilingual chatbots handle high call volumes without adding support staff. Machine learning analytics help banks identify risky transactions and improve compliance quality. These improvements make outsourcing more attractive for BFSI firms, as digital service reduces cost per transaction and boosts customer satisfaction across mobile and web channels.

- For instance, ICICI Bank has expanded its RPA initiative to more than 750 software robots, which were handling approximately 2 million transactions daily.

Regulatory Compliance and Data Security Requirements

Strict rules on AML, KYC, data privacy, and financial reporting drive outsourcing to expert providers. BPO vendors maintain strong audit systems, rule-based workflows, and secure cloud infrastructure to support compliance-heavy processes. Banks use third-party partners for risk scoring, sanction screening, and documentation checks. Insurance companies outsource claims verification, policy audits, and fraud detection to meet industry guidelines. Vendors that follow ISO certifications and data protection frameworks attract global BFSI clients. As new consumer protection laws and cybersecurity norms evolve, financial institutions depend more on outsourcing partners to maintain accuracy and avoid penalties.

Key Trends & Opportunities

Growing Integration of Analytics and AI Platforms

BPO providers add predictive analytics to analyze customer behavior, credit performance, and fraud patterns. AI-driven dashboards help banks improve credit scoring and loan approvals. Insurance firms use data models for claim prediction and customer retention. Automated workflows allow real-time monitoring of transactions and suspicious activity. Advanced analytics add value beyond cost savings, turning BPO into a strategic partner. This shift creates strong opportunities for vendors offering high-tech digital operations, cloud-based solutions, multilingual bots, and intelligent CRM frameworks for global BFSI clients.

- For instance, Accenture has published reports on AI in banking and has invested in companies that combat AI-generated fraud. They have also worked with financial services institutions on ethical AI use.

Expansion of Cloud-Based and Remote Delivery Models

BFSI companies now prefer cloud-first outsourcing with virtual desktops, secure VPNs, and encrypted workspaces. Remote delivery reduces office cost and allows flexible staffing across time zones. Vendors hire global teams to handle 24×7 support. Cloud tools make document sharing, digital KYC, and workflow tracking easier. Many banks that shifted to remote support during global disruptions continue using hybrid outsourcing models. This trend expands market opportunity for cloud-based BPO platforms and managed service providers that offer compliance-ready digital environments.

- For instance, HCL Technologies deployed its Cloud Desktop-as-a-Service platform for a global financial client, supporting more than 20,000 remote agents with secure VDI access and multi-factor authentication.

Key Challenges

Data Privacy and Cybersecurity Risks

BFSI processes involve sensitive customer details, financial records, and identity documents. Breaches or unauthorized access can lead to lawsuits, penalties, and reputation loss. Vendors must invest in encryption, secure networks, multi-factor authentication, and continuous monitoring. Any security gap weakens trust between financial institutions and outsourcing partners. Compliance with global data laws like GDPR, PCI-DSS, and local banking regulations increases cost and operational burden for vendors.

Talent Shortage and High Skill Requirements

BPO services now demand trained staff for analytics, automation management, AML checks, investment research, and regulatory reporting. Finding and retaining skilled employees increases hiring cost. BFSI firms expect domain experts, multilingual agents, and compliance-trained staff. High employee turnover in BPO centers also affects service continuity and quality. Vendors need training programs, knowledge platforms, and incentives to maintain workforce stability.

Regional Analysis

North America

North America holds 35% share of the BFSI BPO service market, driven by high outsourcing adoption among banks, insurers, and wealth managers. Financial institutions outsource customer support, loan servicing, underwriting assistance, and regulatory documentation to reduce operating cost and improve response time. The U.S. leads cloud-based outsourcing, automated KYC validation, and AI-enabled chat support. Strict compliance standards such as PCI-DSS and data privacy regulations increase demand for secure delivery models. Nearshore and offshore partnerships remain strong, supporting 24×7 multilingual operations for retail banking and insurance clients across the region.

Europe

Europe accounts for 25% share, supported by large banking groups, insurance firms, and strong fintech presence. BFSI organizations outsource document processing, claims management, and onboarding workflows to meet GDPR, AML rules, and audit requirements. Eastern Europe remains a major delivery base due to multilingual talent and advanced IT skills. The rise of open banking, digital payments, and online insurance strengthens outsourcing needs. Hybrid models combining onshore compliance teams and offshore processing centers help reduce overall cost while maintaining regulatory accuracy and secure data handling.

Asia-Pacific

Asia-Pacific holds 28% share and acts as the global outsourcing engine for BFSI operations. India and the Philippines lead with large workforce capacity, analytics capabilities, and competitive pricing. Global banks and insurers run shared service hubs for customer service, back-office processing, transaction support, and regulatory workflow management. Domestic BFSI firms in China, India, and Southeast Asia also increase outsourcing due to rapid digital banking adoption. Automation, cloud platforms, and multilingual support strengthen scalability, while Malaysia and Indonesia emerge as secondary delivery hubs.

Latin America

Latin America captures 7% share, supported by nearshore advantages for North American and European BFSI clients. Vendors in Mexico, Colombia, and Brazil provide Spanish and Portuguese support for customer service, loan processing, and collections. Domestic banks and fintech lenders also outsource credit verification, tele-sales, and fraud monitoring. Proximity to U.S. time zones and expanding IT talent pools improve service quality. Investments in digital payments, mobile banking, and cybersecurity compliance create new outsourcing demand across regional markets.

Middle East & Africa

The Middle East & Africa region holds 5% share but posts steady expansion. Banks, insurers, and digital lenders outsource call center operations, account servicing, and onboarding support to improve efficiency. GCC countries adopt outsourced KYC validation, sanctions screening, and fraud analytics. South Africa and Kenya emerge as skilled English-speaking delivery hubs with growing fintech ecosystems. Government focus on digital banking and financial inclusion supports adoption. Investments in cloud infrastructure and secure process management continue to drive outsourcing momentum across MEA markets.

Market Segmentations:

By Service

- Customer Service

- Finance and Accounting

- Human Resource

- KPO

- Procurement and Supply Chain

- Others

By End-User

- Banks

- Capital Markets

- Insurance Companies

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the BFSI BPO service market includes global outsourcing leaders and specialized providers delivering high-volume transaction support, compliance management, and digital process automation. Companies such as Accenture, Infosys Limited, Capita plc, HCL Technologies Limited, Amdocs, Capgemini, Concentrix Corporation, Cognizant, Atos SE, and CBRE offer large delivery networks, multilingual customer support, and advanced IT infrastructure. Vendors invest in robotics, AI chatbots, OCR, fraud analytics, and cloud-based workflow solutions to improve service speed and accuracy. Partnerships with banks and insurers focus on automated KYC, regulatory reporting, loan processing, and digital onboarding. Many providers expand hybrid onshore–offshore delivery centers to manage real-time customer interaction and secure data handling. As financial institutions accelerate digital transformation, service providers compete on automation capability, cybersecurity readiness, domain expertise, and scalable pricing models. Continuous upgrades in workforce training, risk controls, and remote service platforms strengthen long-term outsourcing partnerships across the BFSI sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Amdocs (specifically, its Amdocs Studios division) was indeed named the Best Technology Solution Provider to Digital Banks at the Global Bank Tech Awards 2025, hosted by The Digital Banker.

- In June 2025, Infosys Opened a GIFT City development center for global BFSI clients.

Report Coverage

The research report offers an in-depth analysis based on Service, End-User, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Banks and insurers will increase outsourcing to focus on core digital products and faster customer service delivery.

- Automation and AI-driven workflows will reduce manual processing time in KYC, underwriting, and claims.

- Cloud-based BPO platforms will expand due to secure remote access and scalable delivery models.

- Voice bots and multilingual chatbots will handle larger call volumes without increasing support staff.

- Advanced analytics will improve fraud detection, credit decisions, and regulatory reporting accuracy.

- More firms will adopt hybrid onshore–offshore service models to balance cost and compliance.

- Cybersecurity and data privacy investments will grow as financial institutions tighten security standards.

- SMEs will adopt outsourced services for accounting, customer support, and payroll to avoid infrastructure costs.

- Vendor partnerships with fintech platforms will increase for digital onboarding and payment processing.

- Talent development in compliance, analytics, and automation roles will become a priority for BPO providers.