Market Overview:

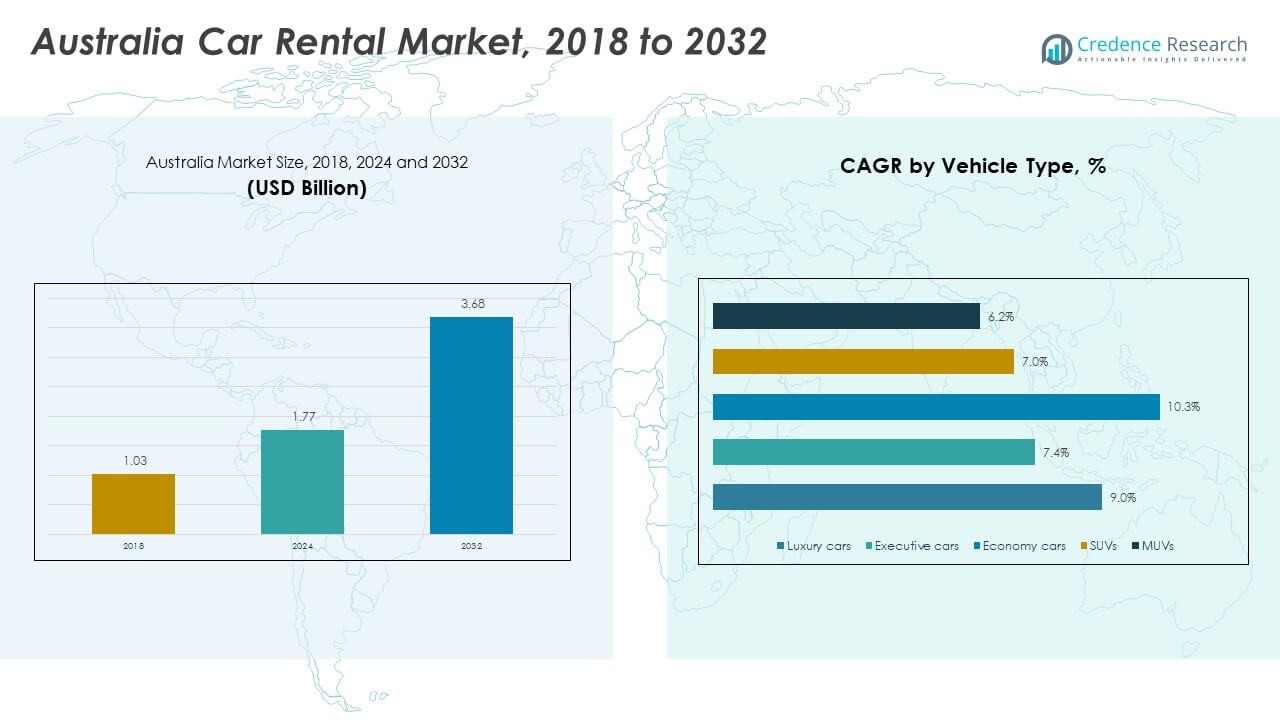

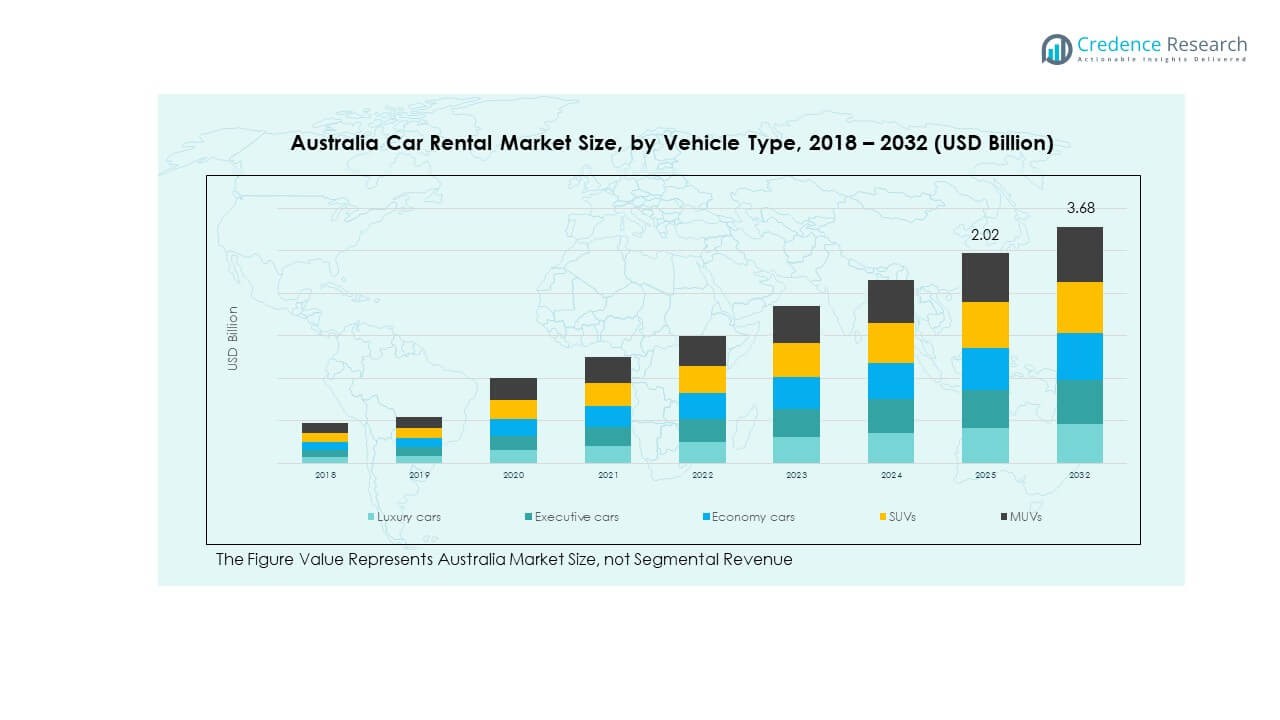

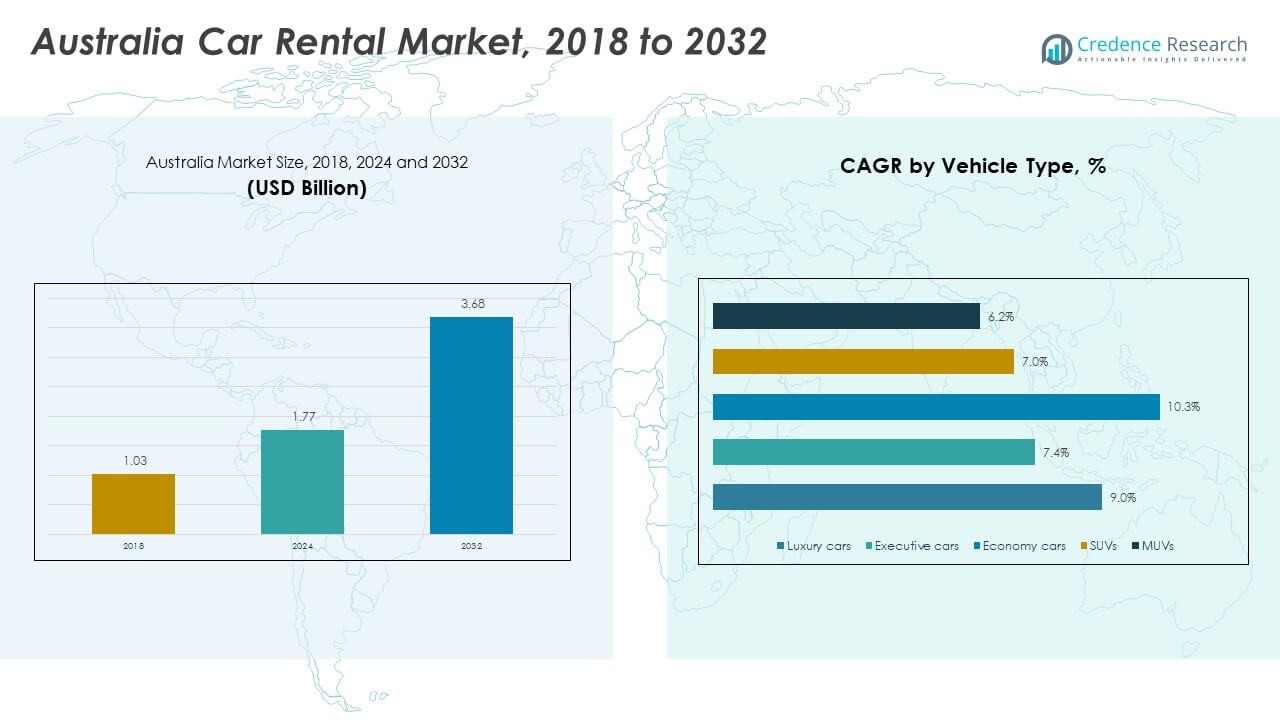

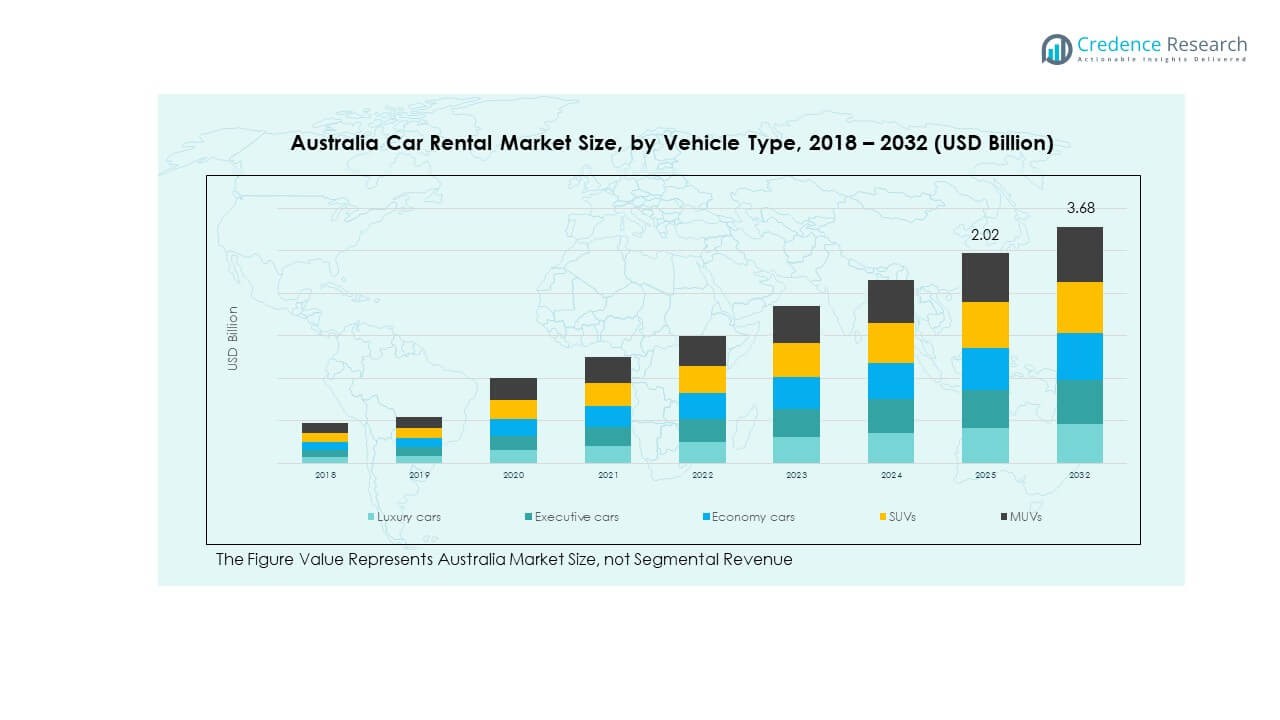

The Australia Car Rental Market size was valued at USD 1.03 Billion in 2018 to USD 1.77 Billion in 2024 and is anticipated to reach USD 3.68 Billion by 2032, at a CAGR of 8.92 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Car Rental Market Size 2024 |

USD 1.77 Billion |

| Australia Car Rental Market, CAGR |

8.92 % |

| Australia Car Rental Market Size 2032 |

USD 3.68 Billion |

Strong growth in tourism and domestic travel drives the market as consumers increasingly opt for rental cars over public transport. The expansion of ride‑sharing apps and digital booking platforms has simplified access to vehicles, boosting rental uptake. Business travel rebound and increasing consumer preference for flexible mobility have further stimulated demand. Rental companies are actively upgrading fleets with eco‑friendly vehicles and enhancing user experience through mobile apps and loyalty programmes.

Within the Australasian region, Australia leads car rental demand by virtue of its mature tourism industry and high vehicle ownership rates. Emerging economies in Southeast Asia show rising interest in rental services due to expanding middle classes and infrastructure improvement. Meanwhile, New Zealand supports growth via inbound tourism and short‑term rentals tied to outdoor recreation. The regional dynamics confirm Australia’s dominance and nearby markets’ emerging potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Car Rental Market size was valued at USD 1.03 billion in 2018, projected to reach USD 2.02 billion in 2024, and is expected to grow to USD 3.68 billion by 2032, at a CAGR of 8.92% during the forecast period.

- The East Coast region, including New South Wales, Victoria, and Queensland, holds the largest market share, accounting for approximately 45% due to high tourism and business activity in major cities like Sydney and Melbourne.

- Western Australia, contributing 15%, is the fastest-growing region, driven by the demand for rental cars in the mining sector and long-distance travel needs, particularly for SUVs and MUVs.

- In 2024, Economy Cars make up 45% of the market share, followed by SUVs at 30%, while Luxury and Executive Cars hold 15% and 10%, respectively, reflecting the cost-effective preferences of Australian renters.

- The SUV segment is expected to grow at a faster rate, driven by increased demand for versatile vehicles for both leisure and business travel, supported by the ongoing trend of outdoor activities.

Market Drivers:

Tourism and Travel Growth

The increasing influx of tourists in Australia has been a primary driver for the car rental market. Visitors often prefer rental cars for their flexibility and convenience, especially for exploring remote or scenic locations. This surge in tourism has enhanced demand, particularly during peak seasons. Both international tourists and domestic travelers seek the independence that comes with renting vehicles, leading to steady growth in the market. Car rental companies are responding by expanding their fleet sizes to meet seasonal demand spikes. The ability to rent cars with flexible terms has also played a crucial role in this growth. The tourism industry’s contribution remains significant, providing a solid foundation for market stability.

- For instance, in 2024, Hertz Global was focused on stabilizing its business and reducing its overall fleet by selling 30,000 electric vehicles (EVs) worldwide to cut costs and align with customer demand for traditional gasoline cars. Visitors generally prefer rental cars for their flexibility and convenience, particularly when exploring remote areas like Tasmania’s Cradle Mountain, a factor that influences the types of vehicles offered in specific regional fleets.

Digital Transformation and Online Platforms

The rapid adoption of digital technology has revolutionized the way consumers book car rentals in Australia. Online booking platforms and mobile apps have simplified the process, allowing users to easily compare prices and book cars at their convenience. These digital solutions have attracted tech-savvy consumers who value seamless experiences. Furthermore, car rental agencies have integrated advanced fleet management systems to optimize their operations. Digital channels have reduced dependency on traditional brick-and-mortar locations, allowing companies to serve a broader customer base. It has enhanced customer satisfaction by providing transparent pricing and quicker reservations. Digital solutions continue to drive growth in the Australian car rental market.

Increasing Preference for Flexible Mobility Solutions

Consumers in Australia increasingly seek flexible mobility solutions, and car rentals provide a compelling option. The preference for on-demand, short-term rentals is rising due to the ability to rent vehicles when needed, without long-term commitments. This trend is more prominent among urban residents who may not require car ownership due to access to public transportation. Car rentals offer convenience and cost-efficiency for those who only need a vehicle for specific occasions. The ability to rent cars for a few hours or days rather than weeks or months aligns with the growing desire for flexibility. It directly impacts the Australian car rental market, driving up demand for short-term rentals.

Business Travel Recovery

Business travel in Australia is gradually recovering, bolstering the car rental market. Professionals prefer renting cars during business trips for mobility and convenience, particularly in cities where public transport might be limited. Rental cars allow business travelers to stay productive, with vehicles providing the necessary space for meetings and travel between appointments. Additionally, companies are increasingly relying on rental services for their employees to ensure flexibility and cost control. Car rental services tailored for corporate clients have expanded, offering loyalty programs and fleet management options. This demand from business travelers plays a crucial role in sustaining market growth.

Market Trends:

Adoption of Eco-Friendly Vehicles

The Australian car rental market is witnessing a shift towards eco-friendly vehicles. Consumers are becoming more environmentally conscious, influencing rental companies to integrate electric and hybrid vehicles into their fleets. Many rental companies have introduced electric vehicle (EV) options as a part of their fleet renewal strategy. This trend aligns with the growing global demand for sustainable travel solutions. Car rental agencies are working towards reducing their carbon footprint by introducing energy-efficient vehicles. It also appeals to customers who are increasingly prioritizing sustainability when making purchasing decisions. The push for greener options is a defining trend shaping the future of the Australian car rental market.

- For instance, Europcar Australia also committed to integrating hybrid and electric vehicles into its fleet, offering consumers an alternative to traditional fuel-powered vehicles. The demand for greener vehicles is reshaping the market, with both companies and consumers increasingly prioritizing sustainability and reducing their carbon footprints.

Integration of AI and Automation in Fleet Management

Artificial Intelligence (AI) and automation are transforming fleet management in the Australian car rental industry. Rental agencies are using AI-powered systems to monitor vehicle health, optimize maintenance schedules, and manage bookings. This integration enhances operational efficiency by minimizing downtime and ensuring that vehicles are available when customers need them. Automated check-in and check-out processes are also becoming more common, improving customer experience and reducing wait times. Furthermore, AI systems help car rental companies predict demand more accurately, leading to better fleet allocation. Automation is driving significant improvements in service delivery and cost-efficiency in the Australian car rental market.

- For instance, a logistics company (referred to as MidWest Logistics in a case study) implemented AI-powered maintenance tracking, leading to a 73% reduction in unplanned downtime. These AI systems, using data from IoT sensors, monitor vehicle health in real-time and use machine learning to identify specific vibration patterns or other anomalies that precede equipment failure, optimizing maintenance schedules and ensuring cars are available when needed.

Growth of Ride-Sharing Integration

Ride-sharing platforms have started integrating with car rental services, creating a more seamless experience for consumers. In some cases, rental companies offer their vehicles through ride-sharing apps, enabling customers to use them for ride-sharing purposes. This collaboration provides more flexible transportation options, appealing to both short-term renters and those seeking a more comprehensive travel solution. This trend has gained momentum with the rise of flexible, on-demand mobility. The integration enhances accessibility and offers rental vehicles for various purposes, beyond traditional usage. It further increases the demand for car rental services, especially in urban areas.

Focus on Enhanced Customer Experiences

Car rental companies in Australia are focusing more on improving customer experiences. Enhanced services such as personalized rental packages, loyalty programs, and premium options are attracting more customers. Rental agencies are also introducing more user-friendly interfaces on their websites and apps. These changes cater to the rising demand for convenience and efficiency. Customers now have the option to pre-book vehicles, select their preferred models, and make changes to their reservations with ease. These trends highlight a shift towards consumer-centric service models, where satisfaction is a key priority. The Australian car rental market is adopting these trends to remain competitive.

Market Challenges Analysis:

High Operational Costs

The Australian car rental market faces significant challenges due to high operational costs. These costs are largely driven by vehicle maintenance, fleet insurance, and the rising cost of fuel. Companies must balance maintaining a fleet of diverse vehicles while keeping operational expenses manageable. The need to constantly update and replace vehicles to meet customer demand also adds to these costs. Furthermore, car rental businesses are under pressure to offer competitive pricing, which can limit their profitability. It is essential for rental companies to optimize their operations and find cost-effective solutions. Balancing cost efficiency with maintaining high-quality service is an ongoing challenge for the market.

Regulatory Compliance and Vehicle Standards

Meeting regulatory requirements and maintaining compliance with local laws poses a significant challenge for car rental companies in Australia. Rental businesses must ensure that their vehicles meet strict safety and environmental standards. Compliance with regulations such as emission norms and vehicle inspections requires constant attention and investment. Failure to adhere to these regulations could result in legal penalties or reputational damage. As the market moves toward electric vehicles, companies must also navigate the complexities of charging infrastructure and energy regulations. Regulatory compliance continues to be a critical hurdle for rental businesses to overcome in the competitive market.

Market Opportunities:

Expansion of Rental Services in Regional Areas

There is a notable opportunity for the Australian car rental market to expand into regional and rural areas. As more consumers look for ways to travel beyond major cities, the demand for rental cars in remote areas is rising. Rental services can cater to tourists visiting national parks, remote attractions, and smaller towns. By establishing more locations in these underserved areas, companies can tap into an emerging customer base. This expansion will not only support the tourism industry but also offer convenience to local residents who prefer renting rather than owning vehicles. It presents a promising growth area for the market.

Increase in Corporate and Fleet Rental Demand

The demand for corporate and fleet rental services is growing in Australia, driven by the expansion of businesses and changing workforce dynamics. Companies are increasingly adopting car rental services for employee travel and business needs. The growth of shared mobility and temporary employment trends contributes to this demand. By offering tailored fleet solutions and corporate packages, rental companies can tap into a lucrative segment. This demand, alongside the rise in temporary and gig-based employment, presents a clear opportunity for car rental businesses to expand their offerings. It plays a significant role in future market growth.

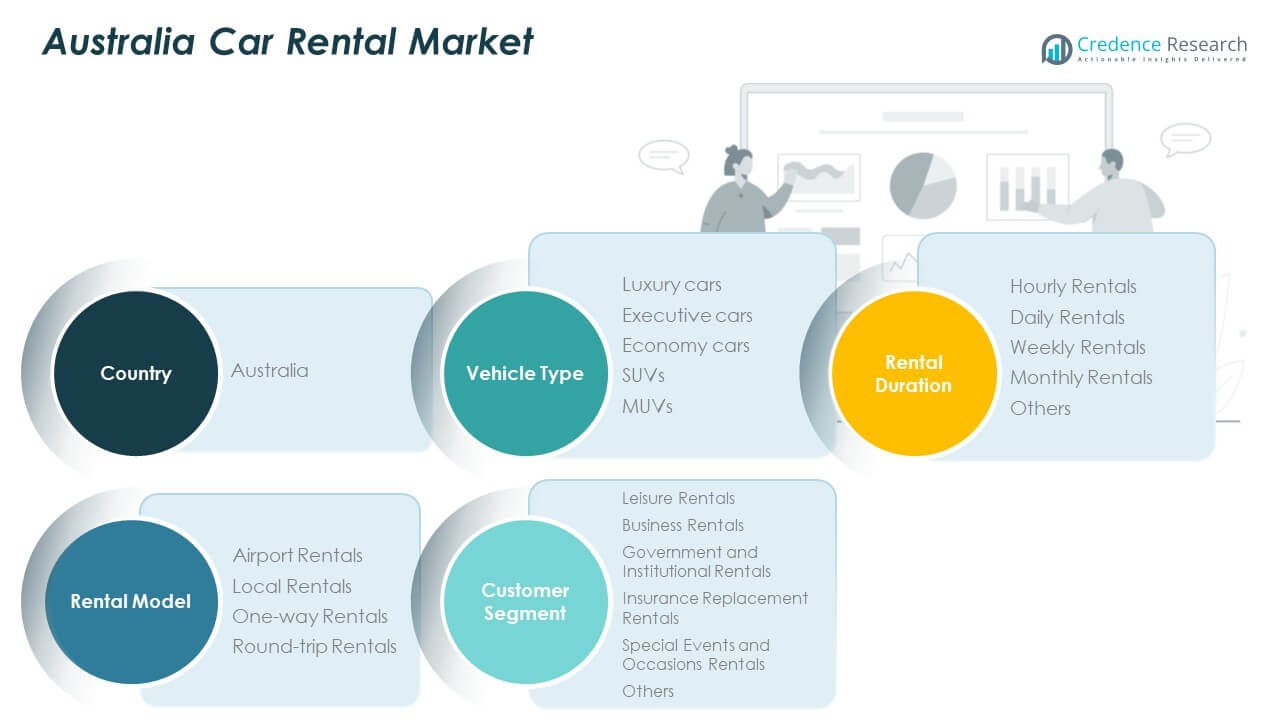

Market Segmentation Analysis:

By Vehicle Type

The Australia Car Rental Market is diversified by vehicle type, catering to varying customer needs. Luxury cars offer high-end options for affluent travellers seeking comfort and style. Executive cars are preferred by business travellers for their professionalism and convenience. Economy cars dominate for their affordability, meeting the needs of budget-conscious consumers. SUVs and MUVs attract those who require more space and versatility, especially for families or group travel. Each segment plays a crucial role in catering to different market demands.

- For instance, Europcar Australia, for instance, has expanded its luxury car fleet over the past two years to cater to the increasing demand from affluent travelers seeking comfort and style, particularly in Sydney and Melbourne. Executive cars are favored by business travelers for their professionalism and convenience.

By Rental Duration

The market also segments by rental duration, offering flexible options. Hourly rentals are ideal for short trips or specific needs, such as airport transfers. Daily rentals remain the most popular option, providing convenience for both tourists and business professionals. Weekly rentals cater to longer stays, offering cost savings for extended use. Monthly rentals cater to those who need a vehicle for an entire month, such as long-term travelers or expatriates. The “Others” segment includes various unique rental durations, fulfilling niche requirements.

By Rental Model

The Australia Car Rental Market offers several rental models, each catering to different preferences. Airport rentals are popular due to their convenience for arriving travelers. Local rentals offer vehicles for city travel, giving flexibility to customers. One-way rentals are gaining traction for their convenience, allowing customers to pick up and drop off vehicles at different locations. Round-trip rentals appeal to travelers who need to return to the starting point, providing predictable and convenient travel solutions.

By Customer Segment

The customer segmentation in the market is broad, addressing various needs. Leisure rentals cater to tourists and those traveling for personal reasons. Business rentals focus on corporate clients who require vehicles for work-related travel. Government and institutional rentals are geared towards public sector use, while insurance replacement rentals provide vehicles during claims processes. Special events and occasions rentals serve customers attending weddings, parties, or other events. The “Others” segment includes custom rental needs, further expanding market diversity.

Segmentation:

By Vehicle Type:

- Luxury Cars

- Executive Cars

- Economy Cars

- SUVs

- MUVs

By Rental Duration:

- Hourly Rentals

- Daily Rentals

- Weekly Rentals

- Monthly Rentals

- Others

By Rental Model:

- Airport Rentals

- Local Rentals

- One-way Rentals

- Round-trip Rentals

By Customer Segment:

- Leisure Rentals

- Business Rentals

- Government and Institutional Rentals

- Insurance Replacement Rentals

- Special Events and Occasions Rentals

- Others

Regional Analysis:

East Coast & Major Urban Centres

The Australia Car Rental Market derives approximately 45 % of its revenue from the east‑coast states of New South Wales and Victoria, driven by high tourist volumes and dense corporate travel. Sydney and Melbourne’s major airports and business districts support robust rental fleets and repeat bookings. Queensland captures about 20 % share benefited by leisure traffic to the Gold Coast and Brisbane. Strong airport throughput and urban infrastructure enable operators to optimise turnover and utilisation. Competition remains intense, and fleet refresh cycles accelerate to match consumer expectations. High‑income consumers and inbound tourists favour premium vehicle types, raising average daily rates. Firms with city‑and‑airport network synergy retain advantage in this region.

Western Australia & Regional Areas

Western Australia accounts for roughly 15 % of the market driven by mining‑sector mobility and long‑distance travel needs across remote zones. Operators in WA focus on SUVs, 4x4s and multi‑purpose vehicles suited for regional road‑trips and leisure. Fleet utilisation remains favourable given limited public transport in remote areas and high rental‑demand peaks. Long‑term rentals and one‑way trips between mining sites or regional airports boost revenue. However, slower population growth compared with east‑coast cities limits upside. Service coverage also presents logistical challenges for maintenance and vehicle turn‑around outside urban centres.

Other States & Territories

The remaining ~20 % of the market covers South Australia, Tasmania, the ACT and the Northern Territory, where it supports niche tourism, government‑mobilisation and event rentals. Operators in these regions focus on economy and SUVs for tourists exploring remote landscapes and national parks. Tasmania and NT deliver unique seasonality; rental demand spikes during holiday seasons and declines in off‑peak periods. Smaller market size encourages regional fleet optimisation and partnerships with travel‑agencies. Growth potential remains moderate given smaller population bases, though local government incentives for mobility can stimulate future demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hertz Australia

- Avis Australia

- Budget Australia

- Enterprise Australia

- Thrifty Australia

- Europcar Australia

- Redspot Car Rentals

- East Coast Car Rentals

- Apex Car Rentals

- Go Rentals

Competitive Analysis:

The Australia Car Rental Market is highly competitive, with numerous players vying for market share. Major international players like Hertz, Avis, and Europcar dominate, maintaining significant market share due to their extensive fleets and established brand recognition. Local players such as Redspot Car Rentals and East Coast Car Rentals also compete by offering tailored services and more flexible rental options. Price sensitivity remains a major competitive factor, with companies constantly refining their pricing models to attract cost-conscious consumers. Technology adoption, including mobile apps for seamless bookings and fleet management systems, is a key differentiator. Strategic partnerships, such as collaborations with travel agencies and airports, further enhance companies’ market position. Competitive pressure is heightened by new entrants focused on niche market segments like electric vehicle rentals, which could disrupt traditional car rental models.

Recent Developments:

- In November 2025, Hertz expanded its Asia-Pacific presence through a new franchise partnership with Ace Drive Pte Ltd in Singapore. From November 1, 2025, Ace Drive began operating both the Hertz and Thrifty brands in Singapore, offering self-drive rentals, long-term leasing, and chauffeur services for corporate and leisure customers.

- In October 2025, Hertz launched a fully online car-buying marketplace through HertzCarSales.com, allowing shoppers nationwide to browse, finance, and purchase vehicles entirely online. This digital platform provides greater confidence, transparency, and convenience through an enhanced digital experience, as the company leans on demand for used vehicles.

- In August 2025, Hertz announced a strategic partnership with Amazon Autos, becoming the e-commerce giant’s first fleet partner for certified used vehicle sales. The collaboration enables customers in Dallas, Houston, Los Angeles, and Seattle to browse, finance, and purchase Hertz vehicles directly on Amazon, with plans to expand the program to all 45 Hertz Car Sales locations across the United States in subsequent months. This partnership represents a significant move to grow Hertz’s digital retail footprint and reimagine the car-buying experience for customers.

- In July 2025, Avis Budget Group announced a multi-year strategic partnership with Waymo to launch fully autonomous ride-hailing operations in Dallas, Texas. Under this agreement, Avis Budget Group serves as Waymo’s fleet operations partner, delivering end-to-end services including infrastructure, vehicle readiness, maintenance, and depot management. Preliminary testing began in Dallas with a public rollout anticipated for 2026.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle Type, Rental Duration, Rental Model, and Customer Segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased demand for electric vehicles (EVs) will drive the growth of the Australia Car Rental Market.

- Technology adoption will further enhance fleet management, providing more efficient and customer-friendly services.

- Car-sharing and subscription-based models will emerge as competitive alternatives to traditional rentals.

- Rising tourism and business travel will continue to support rental demand, especially in urban centers.

- Environmental regulations will lead to more sustainable vehicle options in the rental fleets.

- The increasing popularity of ride-sharing will shift demand toward short-term rentals and flexible rental models.

- Digital and mobile platform usage will grow, enhancing customer experience and streamlining booking processes.

- Regional markets, particularly in Queensland and Western Australia, will see increased rental demand.

- The market will experience consolidation as companies merge and acquire smaller regional players.

- Government policies and infrastructure investments will influence the market, particularly in the electric vehicle segment.