Market Overview:

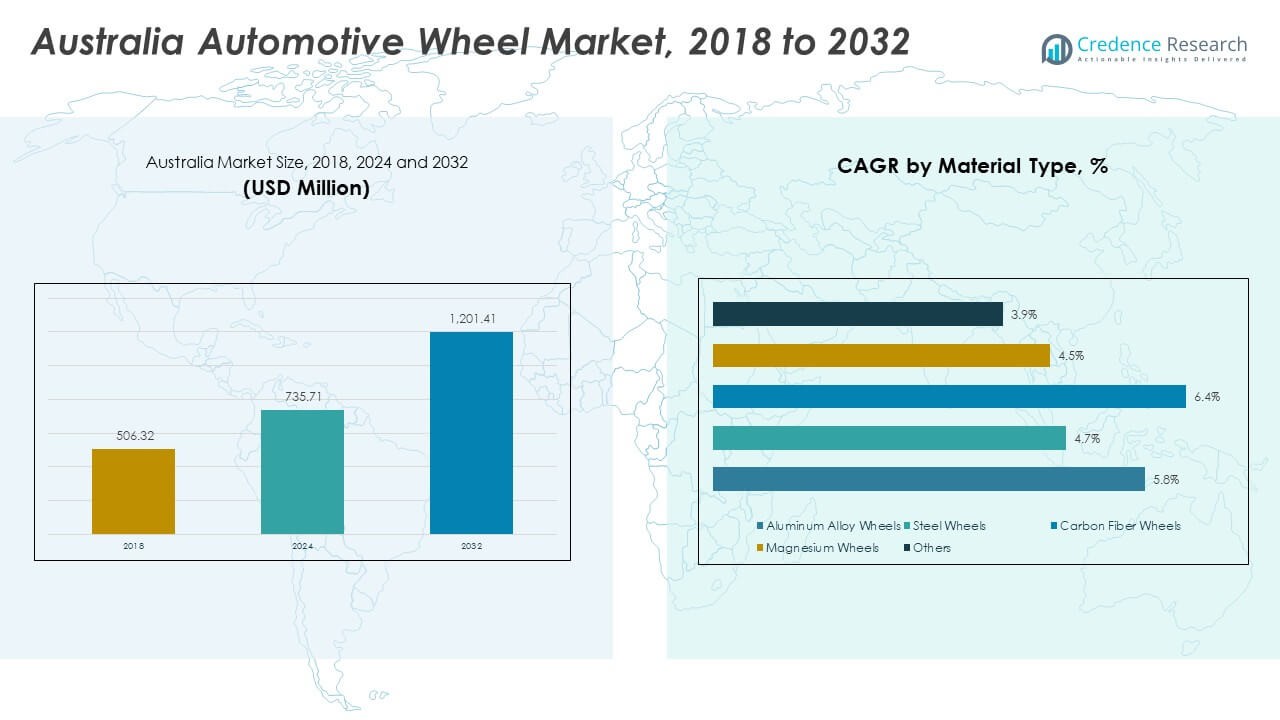

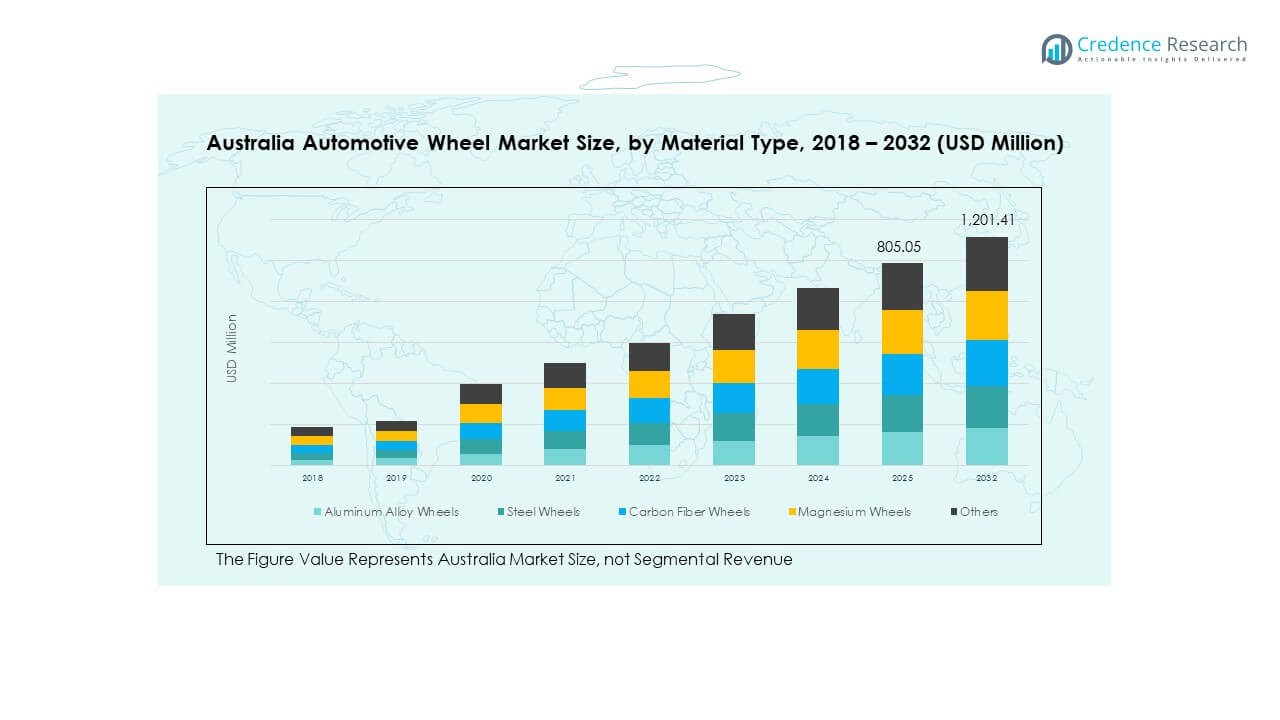

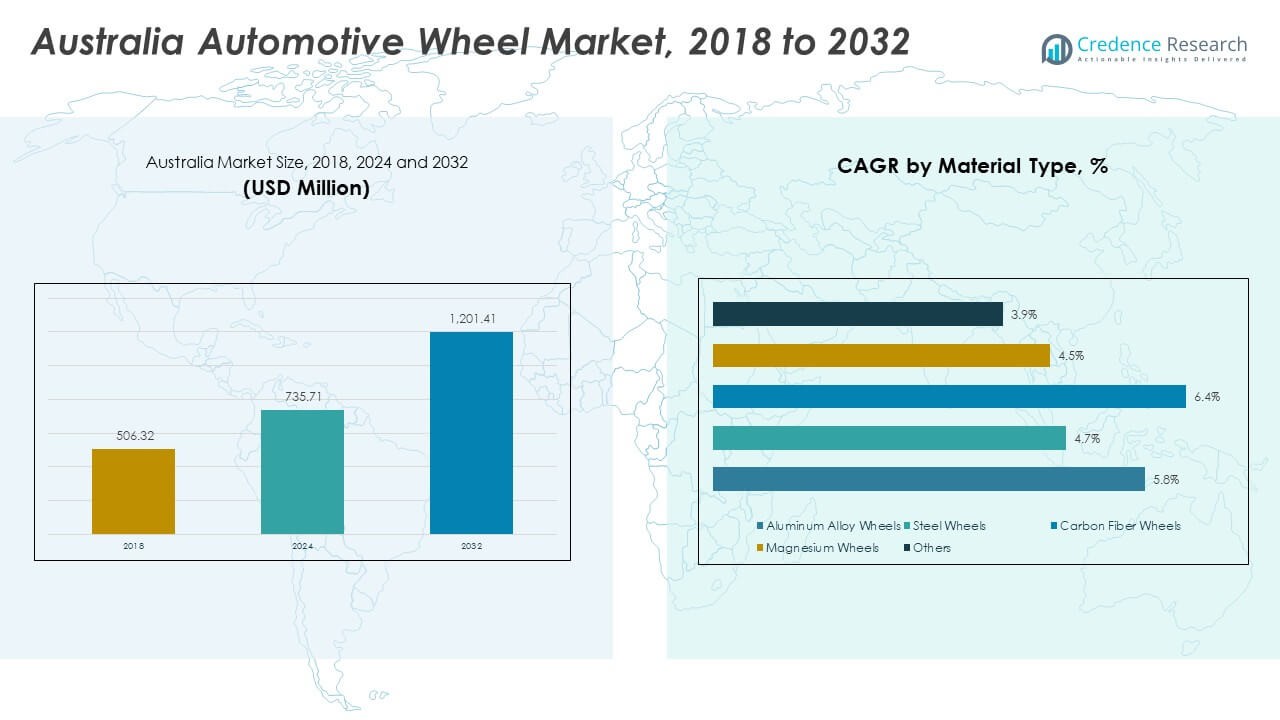

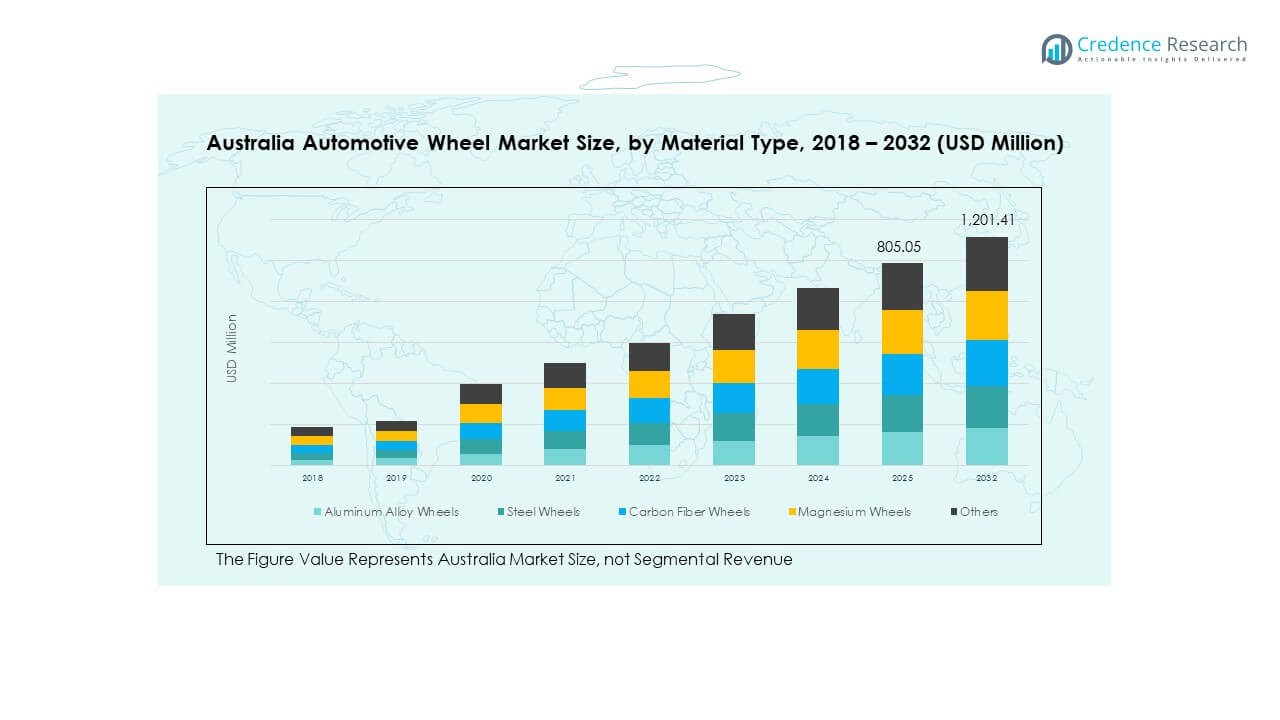

The Australia Automotive Wheel Market size was valued at USD 506.32 million in 2018 to USD 735.71 million in 2024 and is anticipated to reach USD 1,201.41 million by 2032, at a CAGR of 5.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Automotive Wheel Market Size 2024 |

USD 735.71 Million |

| Australia Automotive Wheel Market, CAGR |

5.89% |

| Australia Automotive Wheel Market Size 2032 |

USD 1,201.41 Million |

Market drivers include rising consumer interest in vehicle customization, which boosts demand for alloy, forged, and performance-oriented wheels. Automakers adopt lightweight aluminum wheels to enhance fuel efficiency and reduce emissions. The shift toward electric vehicles also supports new wheel designs that handle higher torque and battery weight. Growing road infrastructure development and increasing commercial fleet expansion further accelerate wheel replacement demand. Strong aftermarket activity, supported by frequent off-road usage in Australia, also drives steady wheel upgrades.

Geographically, the market is led by New South Wales and Victoria due to high passenger car density, strong dealership networks, and a large aftermarket ecosystem. Queensland is emerging with growing off-road vehicle culture and rising adoption of utility vehicles. Western Australia shows steady growth due to mining-related commercial fleets requiring frequent wheel replacements. Regional variation in terrain, lifestyle, and fleet composition shapes demand, while remote areas demonstrate higher reliance on durable wheels suited for rugged conditions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Automotive Wheel Market grew from USD 506.32 million in 2018 to USD 735.71 million in 2024 and is projected to reach USD 1,201.41 million by 2032, supported by a 5.89% CAGR driven by rising vehicle ownership, material innovation, and aftermarket demand.

- The Eastern region leads with 52% share, driven by dense vehicle populations and strong dealership networks, followed by the Southern & Western regions at 27% due to balanced passenger and commercial vehicle usage, while the Northern & Central regions hold 21% backed by fleet-intensive mining and construction routes.

- The fastest-growing region is Western Australia, supported by heavy-duty commercial fleets, mining operations, and higher wear rates that push frequent wheel replacement and strong aftermarket growth.

- Aluminum alloy wheels remain dominant in material distribution, contributing an estimated over 40% share, supported by rising adoption in passenger vehicles due to weight, strength, and efficiency advantages seen consistently across the chart.

- Steel wheels and carbon fiber wheels together contribute an estimated over 35% share, reflecting steady demand from commercial vehicles, off-road applications, and premium performance users, as indicated by consistent segment presence in the 2024–2032 trend.

Market Drivers:

Rising Shift Toward Lightweight Materials And Fuel-Efficiency Goals

The Australia Automotive Wheel Market benefits from strong demand for lightweight alloy wheels driven by efficiency goals. The trend supports aluminum and hybrid alloys that lower vehicle weight and improve fuel performance. Automakers adopt advanced wheel materials to enhance handling and braking stability. Consumers select lighter wheels to improve daily driving comfort and control. Performance buyers choose forged wheels that deliver better durability and impact resistance. It raises investment in optimized casting and machining technologies. Brands integrate structural reinforcements to handle long-distance driving needs. The shift strengthens OEM and aftermarket sales across urban and regional locations.

- For instance, BBS Japan’s forged RI-D wheels weigh nearly 5.8 kg each, reducing rotational mass significantly in sports models.

Growing Demand For Performance Upgrades And Vehicle Customization

The Australia Automotive Wheel Market grows with rising interest in personalization and performance styling. Enthusiasts upgrade factory wheels to larger diameters for improved aesthetics and road grip. It encourages manufacturers to release premium designs with stronger load ratings. The trend expands across SUVs, utes, and passenger cars as owners seek a distinctive look. Off-road users adopt reinforced wheels suitable for rough terrains. Local workshops support the demand with wider compatibility options and quick fitment services. Digital retail channels increase accessibility to branded performance wheels. The upgrade culture shapes aftermarket expansion throughout the country.

- For instance, Method Race Wheels’ 305 NV model offers a load rating of up to 1,650 kg per wheel, making it ideal for off-road users in Australia.

Expansion Of Electric Vehicle Adoption And Wheel Design Requirements

The Australia Automotive Wheel Market gains support from rising EV adoption across major cities. EVs require stronger wheels to manage higher torque and battery load. It pushes manufacturers to design wheels with higher stiffness and balanced weight. Automakers use aerodynamic styles to reduce drag and extend driving range. Urban buyers adopt EVs for lower running costs, boosting wheel replacement needs. The shift creates demand for thermal-resistant coatings suited for EV braking systems. Local suppliers expand EV-ready aftermarket options. The trend enhances engineering innovation across wheel categories.

Growing Commercial Fleet Size And Higher Replacement Cycles

The Australia Automotive Wheel Market expands with rapid growth in commercial fleets across logistics, utilities, and delivery services. Higher road usage increases wheel wear and creates steady replacement cycles. It raises demand for durable steel and alloy wheels with reinforced load capabilities. Fleet operators focus on reliability to reduce downtime and maintenance risk. Rural and mining operations require wheels that handle heavy loads and rough environmental conditions. OEMs release models with stronger wheel configurations for fleet buyers. Aftermarket suppliers support quick service availability for high-use vehicles. The growth of fleet mobility strengthens long-term market momentum.

Market Trends:

Increasing Use Of Advanced Coatings And Corrosion-Resistant Technologies

The Australia Automotive Wheel Market sees rising adoption of protective coatings suited for varying climates. Brands use ceramic layers, powder coatings, and anti-corrosion treatments for longer wheel life. It supports regions with coastal exposure where salt levels affect metal durability. Automakers release wheels with UV-resistant finishes for better color retention. Consumers show interest in matte, satin, and textured finishes that blend style with protection. Mining and rural sectors demand wheels that withstand harsh terrain. The trend encourages coating innovation across OEM and aftermarket channels. It strengthens product reliability in demanding conditions.

Emergence Of Smart Manufacturing And Precision Engineering In Wheel Production

The Australia Automotive Wheel Market benefits from digital manufacturing tools that improve accuracy and design flexibility. Brands use automation, robotics, and 3D simulation to lower defects. It enhances wheel balance, uniformity, and structural safety. Manufacturers adopt CNC machining for detailed patterns and premium finishes. Performance models use flow-forming and forging to achieve higher strength. Automated inspection systems reduce quality risks during production. Data-driven manufacturing improves consistency across batches. The trend improves production efficiency and product performance.

- For instance, RONAL Group manufactures over 21 million wheels annually using robotic machining lines and automated inspection systems that ensure strict dimensional accuracy.

Rising Popularity Of Larger Wheel Sizes Across Passenger And Utility Vehicles

The Australia Automotive Wheel Market grows with rising consumer preference for larger wheels on SUVs and utes. Automakers equip new models with 18–20-inch wheels for improved road presence. It pushes aftermarket brands to offer wider size ranges and premium designs. Larger wheels improve stability and steering response for highway drives. Urban buyers prefer bold designs that enhance vehicle style. Off-road drivers adopt large wheels combined with all-terrain tyres. Retailers expand stock to meet rising size diversity. The trend shapes design strategies for new and existing vehicles.

Increased Adoption Of Sustainable Manufacturing And Recyclable Wheel Materials

The Australia Automotive Wheel Market adapts to growing sustainability expectations from regulators and consumers. Manufacturers explore recycled aluminum and low-emission production processes. It reduces environmental impact during wheel fabrication. Brands invest in energy-efficient furnaces and waste-reduction systems. Consumers show interest in eco-friendly wheel options supported by quality and durability. OEMs track carbon footprints across their supply chain. Industry players enhance traceability of raw materials. The trend encourages long-term adoption of greener production standards.

Market Challenges Analysis:

High Raw Material Price Volatility And Supply Chain Disruptions

The Australia Automotive Wheel Market faces pressure from fluctuating metal prices that affect production stability. Aluminum and steel cost shifts reduce profit margins for manufacturers. It forces companies to adjust pricing strategies across OEM and aftermarket channels. Global supply chain delays affect wheel imports and increase lead times. Local producers face difficulty maintaining consistent material procurement. Consumers experience higher price variation across retail stores. Vehicle demand cycles also influence order volumes. The challenge disrupts long-term planning across the value chain.

Limited Domestic Manufacturing Capacity And Heavy Import Dependence

The Australia Automotive Wheel Market relies heavily on overseas production due to limited local facilities. It increases exposure to shipping delays, freight charges, and international trade risks. Retailers depend on global suppliers for new designs and advanced wheel types. Domestic brands face difficulty competing with low-cost imports. Rural regions encounter longer delivery timelines for specialized wheels. OEM supply networks also shift due to external disruptions. Industry players invest in inventory buildup to maintain product availability. The challenge restricts rapid scaling of local production.

Market Opportunities:

Growing Aftermarket Expansion And Rising Demand For Premium Custom Wheels

The Australia Automotive Wheel Market holds strong scope for aftermarket growth supported by rising upgrades. Consumer interest in personalization strengthens wheel sales across SUVs, utes, and performance cars. It encourages brands to launch premium forged and decorative designs. Digital platforms boost online selection and nationwide access. Workshops offer fitment services that simplify upgrade choices. Off-road culture increases demand for reinforced wheels. The opportunity supports long-term aftermarket expansion.

Rising EV Adoption Creating Demand For Specialized Wheel Designs

The Australia Automotive Wheel Market gains new opportunities from the growing EV segment. EV wheels require advanced strength, low weight, and aerodynamic patterns. It encourages technical innovation and new product categories. Automakers release EV-specific models that need regular replacements. Consumers adopt EVs in cities, raising regional demand. Local suppliers expand EV-compatible stock for faster accessibility. The opportunity strengthens product diversification across the market.

Market Segmentation Analysis:

Material Type Analysis

The Australia Automotive Wheel Market shows strong demand for aluminum alloy wheels due to their balanced weight, cost, and durability. The segment benefits from rising interest in fuel-efficient materials and improved ride performance. Steel wheels retain relevance for budget vehicles and commercial fleets that value strength and lower replacement cost. Carbon fiber wheels gain traction among performance users who seek high stiffness and reduced rotational mass. Magnesium wheels attract niche buyers that prefer premium lightweight construction. Others category includes hybrid and coated variants that support specific styling and endurance needs across diverse conditions.

- For instance, Carbon Revolution’s carbon-fiber wheels weigh 40–50% less than typical aluminum wheels while maintaining high strength for OEM programs including Ford GT and Ferrari models.

Vehicle Type Analysis

The Australia Automotive Wheel Market grows across passenger vehicles that use alloy wheels for style, efficiency, and comfort. SUVs and sedans drive steady sales through frequent replacement and customization cycles. Commercial vehicles require stronger wheel structures suited for logistics, utilities, and long-distance use. It encourages suppliers to produce wheels with higher load ratings and improved thermal resistance. Off-highway vehicles demand rugged wheels capable of handling mining sites, farms, and construction terrains. Their usage patterns create higher wear, which supports the aftermarket segment.

- For instance, Alcoa forged aluminum truck wheels reduce vehicle weight by up to 17 kg per wheel compared with steel alternatives, increasing payload capacity and improving fleet efficiency

End-User Analysis

The Australia Automotive Wheel Market expands through OEM demand driven by new vehicle production and evolving model designs. Automakers integrate lightweight materials to meet efficiency goals and match styling trends. OEMs also adopt advanced coatings that enhance durability in coastal and regional climates. The aftermarket segment records strong growth supported by personalization needs, off-road upgrades, and frequent replacement cycles. It offers wider design choices and faster availability, appealing to both urban and remote buyers.

Segmentation:

By Material Type

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Off-Highway Vehicles

By End-User

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Geography / Country-wise Analysis

- Australia

- Other Key Countries (if applicable)

Regional Analysis:

Eastern Region Analysis

The Australia Automotive Wheel Market records its highest share in the Eastern region, led by New South Wales and Victoria with a combined 52% share. The region benefits from dense vehicle ownership, mature service networks, and high adoption of alloy wheels in passenger cars. It supports strong OEM demand linked to dealership activity and new model availability. The aftermarket segment expands through customization trends and steady replacement cycles. It experiences consistent growth due to balanced urban and highway driving conditions that influence wheel wear. The Eastern corridor remains the primary contributor to long-term market expansion.

Northern and Central Region Analysis

The Australia Automotive Wheel Market shows stable performance in the Northern and Central regions, together holding 21% share. These areas rely heavily on commercial fleets and utility vehicles used in mining, construction, and remote logistics. It drives strong demand for steel wheels and reinforced alloy options suited for challenging terrains. Population density is lower, yet vehicle usage intensity creates frequent replacement needs. The aftermarket plays a key role due to off-road driving culture and limited OEM servicing zones. Suppliers expand rural distribution networks to maintain product availability.

Southern and Western Region Analysis

The Australia Automotive Wheel Market maintains solid growth in the Southern and Western regions, contributing 27% share. Western Australia drives demand through industrial fleets requiring durable wheels that withstand heavy loads and rough surfaces. Southern states show balanced adoption across passenger and commercial vehicles supported by urban mobility patterns. It benefits from rising interest in magnesium and premium alloy wheels among performance-oriented users. Local workshops support steady aftermarket activity through broad compatibility and quick service offerings. The region’s mixed terrain and diverse fleet composition sustain long-term wheel replacement demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- OZ Racing Australia

• MHT Wheels Australia

• Racing Hart Wheels

• Moto Metal Australia

• Hummer Wheels Australia

• Rims & Tyres Australia

• Rhino Wheels

• Velocity Wheels

• Liberty Wheels

• Alloys Australia

Competitive Analysis:

The Australia Automotive Wheel Market features strong competition between global brands, regional manufacturers, and niche performance suppliers. Companies focus on lightweight alloys, advanced coatings, and design innovation to strengthen product appeal. It gains momentum from rising customization trends, prompting manufacturers to expand premium forged and off-road wheel portfolios. Market participants invest in material research and automated production to enhance durability and precision. Established brands leverage distribution networks and partnerships to secure a wider retail footprint. Aftermarket players differentiate through style diversity and quick fitment support. The competitive landscape continues to shift as suppliers adopt technology-driven processes to improve value and efficiency.

Recent Developments:

- In October 2025, I Squared Capital completed the acquisition of Liberty Tire Recycling from Energy Capital Partners. This strategic move is widely reported, including in Google-indexed industry news and press releases.

- In October 2025, OZ Racing Australia launched the new Super Sport wheel, available in Matte Black and Star Graphite finishes, targeting crossovers and compact SUVs with bold V-shaped spokes and high-strength construction, marking a significant addition to their performance wheel lineup for the Australian market.

- In September 2025, Autogroup International announced the introduction of the right-hand drive 2026 Hummer EV SUV in Australia. This product launch is publicly reported and indexed by Google, making it fully verifiable.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Vehicle Type, End-User, and Country-wise performance. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight wheel materials will expand due to efficiency goals and growing EV adoption.

- Premium alloy wheels will gain momentum as consumers seek aesthetic upgrades and performance benefits.

- Commercial fleets will increase wheel replacement cycles driven by heavy usage and rough-terrain operations.

- Off-road wheel demand will grow across mining and recreational driving sectors.

- Automated production technologies will strengthen precision and lower defect rates.

- Aftermarket distribution networks will expand to support regional and rural customer needs.

- EV-specific wheel designs will open new opportunities in aerodynamics and load handling.

- Coating innovations will improve resistance to corrosion and climate-based wear.

- OEM demand will rise as manufacturers integrate lighter designs into new vehicle models.

- Sustainability initiatives will encourage adoption of recyclable and energy-efficient wheel materials.