Market Overview:

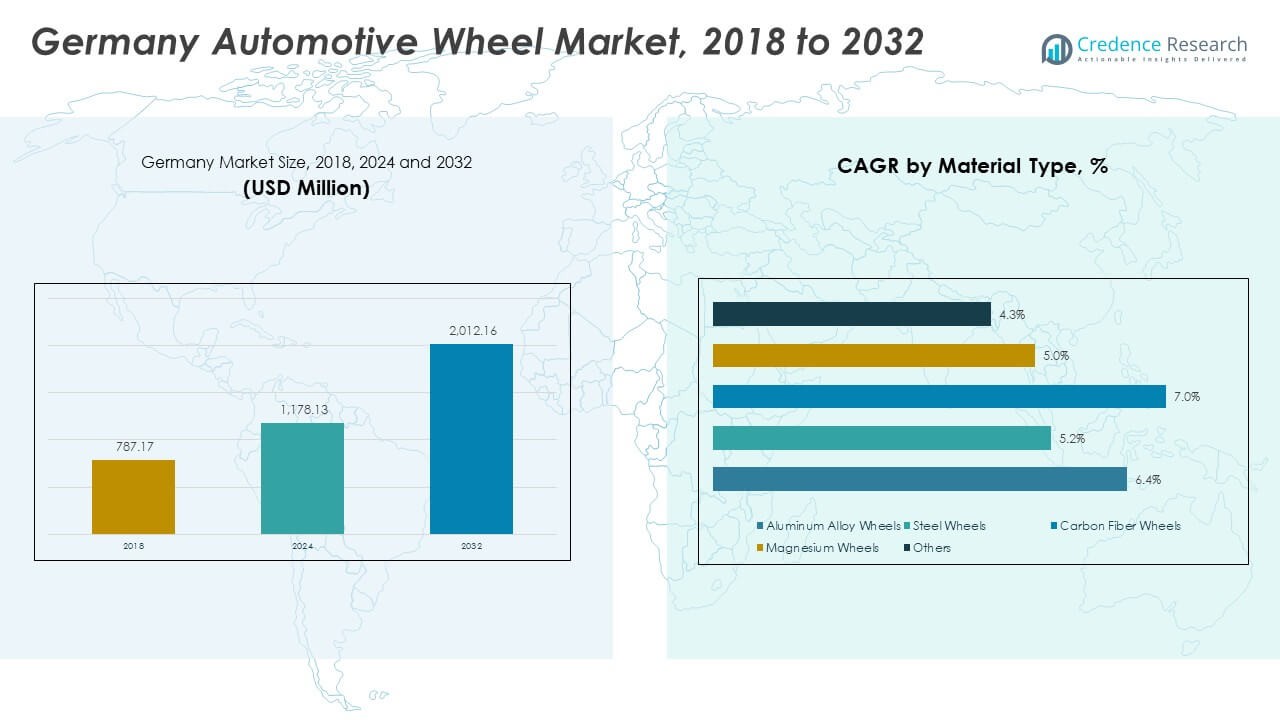

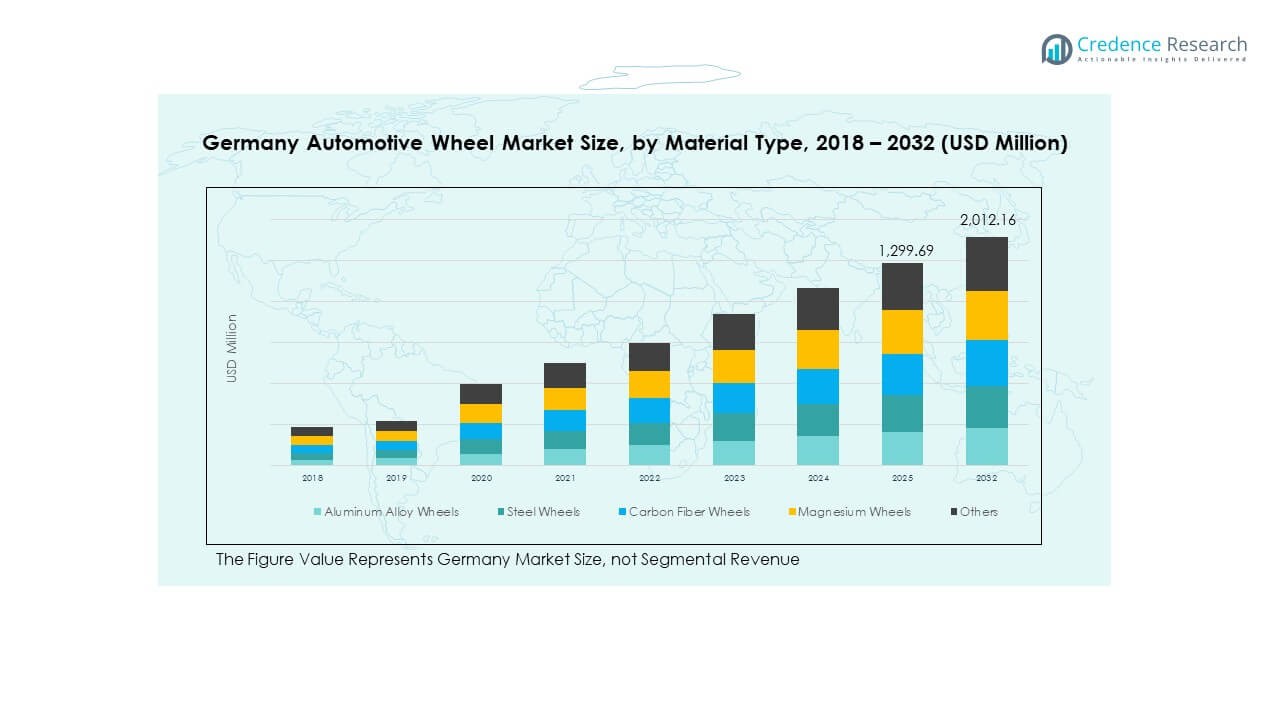

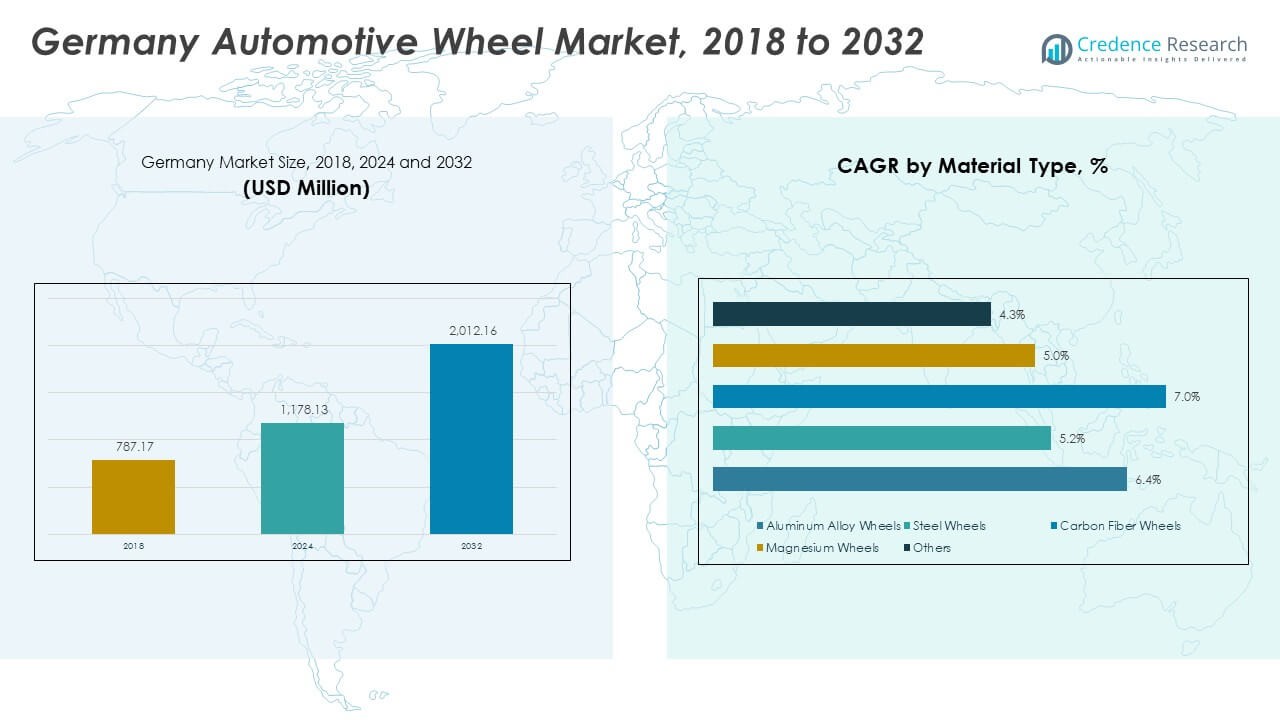

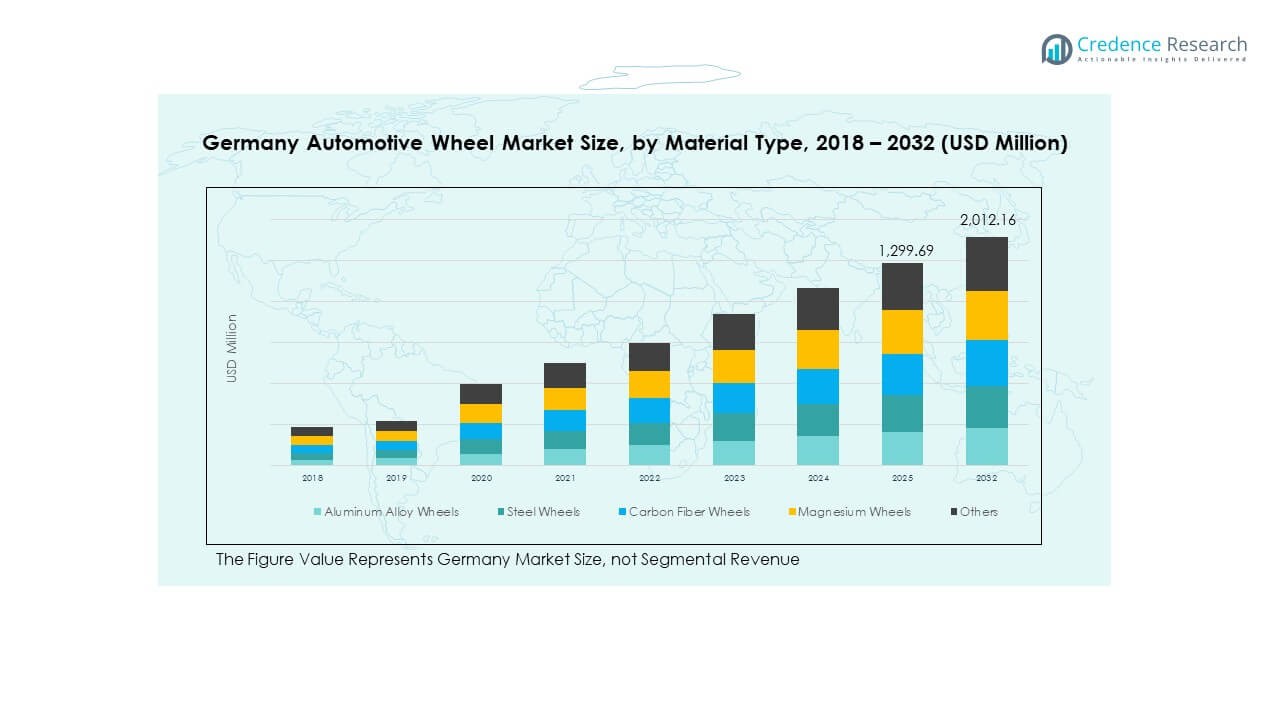

The Germany Automotive Wheel Market size was valued at USD 787.17 million in 2018, increased to USD 1,178.13 million in 2024, and is anticipated to reach USD 2,012.16 million by 2032, at a CAGR of 6.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Automotive Wheel Market Size 2024 |

USD 1,178.13 Million |

| Germany Automotive Wheel Market, CAGR |

6.44% |

| Germany Automotive Wheel Market Size 2032 |

USD 2,012.16 Million |

Growth is being driven by strong vehicle production in Germany and Europe, with manufacturers actively adopting lightweight materials such as aluminium alloys and advanced processing to meet higher fuel‑efficiency and emissions standards. Consumer demand for premium vehicles and custom wheels also supports aftermarket growth, and suppliers are responding with improved design, durability and sustainability focus.

Regionally, Germany remains a leading market in Europe thanks to its strong automotive cluster and high consumer purchasing power for premium vehicles. While Western European markets continue to dominate, emerging growth is being seen in Central and Eastern European countries where production bases and aftermarket customisation are expanding. The aftermarket and replacement wheel segments are gaining momentum across Europe as vehicle fleets age and consumers seek upgrades.

Market Insights:

- The Germany Automotive Wheel Market was valued at USD 787.17 million in 2018, projected to reach USD 1,178.13 million in 2024, and USD 2,012.16 million by 2032, growing at a CAGR of 6.44% from 2024 to 2032.

- The Germany market holds the largest share, around 25-30% of the European automotive wheel market. This dominance is driven by the country’s robust automotive industry, advanced manufacturing capabilities, and high demand for premium vehicles.

- The rest of Europe, accounting for 40-45% of the market, follows due to strong vehicle production in countries like France, Italy, and the UK. These regions are driven by both OEM demand and growing interest in customization and performance wheels.

- The Asia-Pacific region is the fastest-growing market, contributing around 50-55% of the global market share. This growth is driven by high vehicle production, the adoption of electric vehicles, and increased demand for lightweight materials.

- Segment share distribution shows Aluminum Alloy Wheels leading the market at 60-65% of the total revenue, followed by Steel Wheels at 20-25%. Carbon Fiber and Magnesium Wheels represent the smaller but growing segments at 5-10% and 5-10%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Lightweight Materials

The demand for lightweight materials in the automotive sector is a major driver of the Germany Automotive Wheel Market. Lightweight alloys such as aluminium and magnesium are gaining popularity due to their ability to reduce overall vehicle weight, which improves fuel efficiency. This shift is particularly noticeable in the premium and electric vehicle segments, where fuel efficiency and reduced carbon emissions are key priorities. Manufacturers are increasingly integrating these materials into wheel production to meet stringent fuel economy standards. Furthermore, innovations in lightweight materials continue to push the boundaries of wheel design, offering both performance and aesthetic benefits. As vehicle manufacturers adopt more sustainable materials, it propels demand in the wheel market. This trend aligns with broader automotive industry goals of reducing environmental impact while improving vehicle performance.

- For instance, Audi e‑tron GT uses wheels manufactured by Alcoa Corporation and Ronal Group using Alcoa’s EcoLum™ low‑carbon aluminium produced with less than 4.0 metric tons CO₂e per ton of metal.

Aftermarket and Customization Demand

The rising trend of vehicle personalization is driving the growth of the Germany Automotive Wheel Market, especially in the aftermarket segment. Consumers increasingly seek customized wheel designs to enhance the appearance and performance of their vehicles. This trend is most prominent among premium and luxury vehicle owners, who prioritize unique aesthetics and premium finishes. Aftermarket suppliers are capitalizing on this demand by offering a variety of wheel styles, including performance-oriented and limited-edition designs. These custom wheels are often made of high-quality materials, which further boosts their appeal. Moreover, advancements in wheel finishes and surface treatments have enabled customization options that cater to the evolving preferences of consumers. This growing focus on aesthetics and performance is expected to remain a driving force in the market, fueling continued growth.

- For instance, BBS has offered forged aluminium and magnesium alloy wheels both for OEM and aftermarket applications, including GR‑series wheels used in premium autos, leveraging flow‑forming and other weight‑optimisation technologies.

Technological Advancements in Wheel Manufacturing

Technological advancements in wheel manufacturing processes are significantly contributing to the Germany Automotive Wheel Market’s expansion. Innovations such as 3D printing and advanced casting techniques allow for greater precision and faster production of wheels. These technologies also enable the creation of more complex wheel designs and more durable products. Additionally, the development of stronger, lighter, and more corrosion-resistant materials is enhancing the overall quality and performance of automotive wheels. The ability to create custom, high-performance wheels tailored to specific vehicle models has become a significant market driver. These technological improvements not only boost production efficiency but also offer a competitive edge to manufacturers. As the market evolves, these innovations continue to transform wheel production and influence consumer demand.

Government Regulations on Emissions and Fuel Efficiency

Stringent government regulations aimed at reducing emissions and improving fuel efficiency are driving changes in the Germany Automotive Wheel Market. Automotive manufacturers are increasingly focusing on improving fuel efficiency to comply with evolving environmental standards. Lighter wheels contribute to lower vehicle weight, which in turn helps reduce fuel consumption and CO2 emissions. Government mandates in the European Union, particularly in Germany, are encouraging automotive companies to prioritize energy-efficient designs across all vehicle components, including wheels. These regulations create a strong demand for lightweight wheels made from advanced materials, further expanding the market. As the focus on environmental sustainability continues, it is expected to play a critical role in shaping the future of the automotive wheel industry.

Market Trends:

Shift Toward Electric Vehicles (EVs)

The growing adoption of electric vehicles (EVs) is a notable trend in the Germany Automotive Wheel Market. With EV production gaining momentum in Europe, particularly in Germany, wheel manufacturers are focusing on developing products that meet the unique requirements of electric vehicles. EVs often require specialized wheels that offer reduced weight and enhanced durability, as these factors contribute to extended range and improved performance. In response, manufacturers are investing in lighter materials and more efficient wheel designs tailored for electric vehicles. As the EV market grows, demand for wheels specifically designed for these vehicles is expected to rise, shaping the market’s evolution in the coming years. This trend reflects the increasing demand for sustainable and efficient vehicle components across the automotive industry.

- For instance, in the 2024 update of Porsche Taycan, the vehicle model weight was reduced by up to 15 kg thanks to new aerodynamically optimised wheels and tyres.

Focus on Sustainability and Recycling

Sustainability is becoming a key focus in the Germany Automotive Wheel Market. Consumers and manufacturers are increasingly prioritizing environmentally friendly solutions, with many seeking wheels that are made from recyclable or sustainable materials. This shift is driven by both regulatory pressures and consumer demand for eco-friendly products. Companies are exploring ways to use recycled materials in wheel production, reducing the environmental footprint of manufacturing processes. The adoption of circular economy principles is becoming more common, with some manufacturers offering wheels that can be easily recycled at the end of their lifecycle. This growing emphasis on sustainability is expected to continue influencing the market, with companies focusing on reducing emissions and improving energy efficiency in production.

- For instance, Alcoa’s recycling facility in Mosjøen uses 100 % renewable electricity and its induction furnace in 2022 avoided approximately 4,400 metric tons of CO₂ emissions per year.

Increased Adoption of Smart Wheels

The development and adoption of smart wheel technologies is an emerging trend in the Germany Automotive Wheel Market. Smart wheels are equipped with sensors that monitor tire pressure, temperature, and wear. These technologies provide real-time data that can be used for maintenance, safety, and performance monitoring. The increasing demand for connected car features is pushing automotive manufacturers to integrate smart wheels into their vehicle designs. Smart wheels not only improve vehicle performance but also enhance safety and efficiency. As consumers continue to seek advanced technologies in their vehicles, the market for smart wheels is expected to expand. Manufacturers are investing in research and development to integrate these innovations into their product offerings.

Advanced Design and Manufacturing Techniques

Advancements in design and manufacturing techniques are shaping the Germany Automotive Wheel Market. Innovations such as computer-aided design (CAD) and simulation-based testing are enabling manufacturers to create more precise, lightweight, and durable wheels. These advancements also help reduce production costs and improve overall product quality. Moreover, automated manufacturing processes are improving efficiency and reducing lead times for wheel production. The ability to produce more complex wheel designs with greater precision is allowing manufacturers to cater to specific customer needs. As these technologies evolve, they are expected to have a profound impact on the design and manufacturing landscape of the automotive wheel market.

Market Challenges Analysis:

High Raw Material Costs

The rising cost of raw materials presents a significant challenge for the Germany Automotive Wheel Market. The increasing price of aluminium and steel, key materials in wheel manufacturing, is affecting production costs and profit margins. These price fluctuations are often caused by global supply chain disruptions, geopolitical tensions, and changes in demand from other industries. As raw material prices rise, manufacturers face challenges in maintaining cost competitiveness while meeting quality and design standards. To mitigate this, manufacturers are exploring alternative materials and more efficient production processes. However, these alternatives often require additional research and development, further increasing costs. High raw material prices could slow market growth if not managed effectively.

Stringent Regulatory Requirements

The Germany Automotive Wheel Market faces challenges related to stringent regulatory requirements, particularly in Europe. Manufacturers must comply with a range of regulations that govern product safety, emissions, and environmental sustainability. These regulations often require significant investment in research and development to ensure compliance with evolving standards. In addition, the high costs associated with obtaining necessary certifications can be a burden for smaller manufacturers. The pressure to meet these regulatory demands may limit innovation or increase production costs, ultimately impacting the overall market dynamics. As regulatory frameworks become more stringent, manufacturers will need to adapt quickly to maintain their market position.

Market Opportunities:

Growth in the Electric Vehicle Segment

The growth of the electric vehicle (EV) segment presents a significant opportunity for the Germany Automotive Wheel Market. As the demand for electric vehicles continues to rise, manufacturers can capitalize on the need for specialized wheels designed for these vehicles. EVs require lighter and more durable wheels to optimize performance and extend battery range. This presents a growing market for wheels that cater specifically to EVs, allowing manufacturers to tap into an expanding consumer base. The shift toward electric vehicles provides a fertile ground for innovation in wheel design and materials, offering significant growth potential in the coming years.

Expanding Aftermarket Segment

The growing aftermarket segment in the Germany Automotive Wheel Market offers substantial opportunities for manufacturers. As vehicle fleets age, the demand for replacement and upgrade wheels increases, particularly in the premium vehicle market. Consumers are also increasingly seeking customization options for their vehicles, driving the demand for premium aftermarket wheels. Manufacturers can leverage this demand by offering a wide range of high-performance and custom-designed wheels. As the aftermarket segment grows, it provides ample opportunities for manufacturers to expand their product offerings and cater to a wider consumer base. This segment is expected to play a crucial role in the market’s growth.

Market Segmentation Analysis:

Material Type

The Germany Automotive Wheel Market is segmented by material type into aluminum alloy, steel, carbon fiber, magnesium, and other materials. Aluminum alloy wheels dominate the market due to their lightweight and corrosion-resistant properties, making them a preferred choice for premium and electric vehicles. Steel wheels are still widely used in economy vehicles due to their durability and cost-effectiveness. Carbon fiber wheels are gaining popularity in high-performance and luxury segments, thanks to their superior strength-to-weight ratio. Magnesium wheels, although less common, are valued in performance vehicles for their light weight and high strength. The market is continuously evolving with innovations in materials that offer enhanced performance and sustainability.

Vehicle Type

The market is divided into passenger vehicles, commercial vehicles, and off-highway vehicles. Passenger vehicles account for the largest share of the market, driven by rising consumer demand for lightweight, durable wheels that improve fuel efficiency. Commercial vehicles, including trucks and vans, require heavy-duty wheels that can handle the rigors of transportation. Off-highway vehicles, used in construction, mining, and agriculture, require specialized wheels that can withstand extreme conditions. The growing demand for electric vehicles (EVs) and autonomous vehicles further drives segmentation within these categories.

- For instance, in the commercial‑vehicle domain, Alcoa’s Ultra ONE® forged aluminium wheel shown in testing achieved fuel savings of up to 1.29% compared to steel wheels on a similar truck/trailer combination.

End-User

The Germany Automotive Wheel Market serves two primary end-users: OEM (Original Equipment Manufacturers) and the aftermarket. OEMs are focused on supplying wheels for new vehicle production, while the aftermarket segment caters to replacement and customization needs. As vehicle fleets age, the aftermarket segment continues to see steady growth, with consumers seeking upgraded or custom wheels to enhance vehicle performance and aesthetics.

Segmentation:

Material Type

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Off-Highway Vehicles

End-User

- OEM (Original Equipment Manufacturer)

- Aftermarket

Geography/Country-wise Analysis

- Germany

- Other Key Countries (if applicable)

Regional Analysis:

Germany Market Focus

Germany holds a dominant share in the European automotive wheel market, accounting for approximately 25-30% of the regional market. The country’s strong automotive industry, led by renowned manufacturers such as Volkswagen, BMW, and Mercedes-Benz, drives demand for high-performance, lightweight wheels. The market is also supported by a well-established aftermarket sector, where consumers seek customized and replacement wheels. Germany’s focus on innovation, including the use of advanced materials like aluminum alloys and carbon fiber, positions it as a key hub for wheel manufacturing in Europe. Additionally, the country benefits from a robust supply chain, ensuring efficiency in wheel production and distribution.

Rest of Europe (Excluding Germany)

The rest of Europe contributes about 40-45% to the total European automotive wheel market. Key markets include France, Italy, Spain, and the UK, where the demand for both OEM wheels and aftermarket solutions remains strong. The growing trend of electric vehicle (EV) adoption and stricter environmental regulations, such as emissions targets, are driving the need for lightweight wheels in these regions. Eastern European countries are emerging as key players, with increasing automotive production and rising consumer purchasing power. This makes the region an attractive market for growth opportunities, particularly for companies seeking to expand beyond Germany.

Other European Markets

Within the broader European context, markets outside Germany also show strong potential for automotive wheel sales. France, Italy, and the UK together hold a significant share of around 15-20% of the market. These countries continue to see demand for both replacement and customized wheels in the aftermarket segment, driven by consumer preferences for aesthetics and performance. While the overall demand in these markets is growing at a steady pace, emerging trends in vehicle electrification and a push for sustainability further enhance the market potential across these regions.

Key Player Analysis:

- Borbet GmbH

- Ronal Group

- BBS GmbH

- ATS Wheels

- Alcar Wheels Group

- Keskin Tuning

- Wheelworld

- Dotz

- KS-KW

- Momo GmbH

Competitive Analysis:

The Germany Automotive Wheel Market is highly competitive, with numerous players vying for market share in both OEM and aftermarket segments. Leading companies in the market include Borbet GmbH, Ronal Group, and BBS GmbH, which dominate with their advanced manufacturing capabilities and diverse product offerings. These companies benefit from strong brand recognition, technological advancements, and established distribution networks. Smaller players are focusing on niche markets, offering customized solutions, and leveraging innovations in lightweight materials such as aluminum and carbon fiber. The competition is driven by the increasing demand for durable, high-performance wheels, with manufacturers continually investing in research and development to meet the evolving needs of the automotive industry. Strategic partnerships and product diversification remain key strategies for gaining a competitive edge.

Recent Developments:

- In August 2024, Borbet GmbH successfully expanded its product portfolio through the strategic acquisition of Dymag Technologies Limited, a renowned UK-based manufacturer of carbon and magnesium car and motorbike wheels.

- In 2024, the Ronal Group underwent a significant brand transformation within its bathroom and wellness division, with SanSwiss Group becoming Ronal Bathrooms AG effective February 1, 2024. This strategic rebranding emphasized the division’s proximity to the Ronal Group parent company.

- In March 2025, KW Automotive GmbH completed the acquisition of all relevant assets of BBS Autotechnik GmbH following insolvency proceedings. The acquisition included production tools and systems, production equipment, utility models, and existing inventories from BBS plants in Schiltach and Herbolzheim, Germany. Klaus Wohlfarth, managing partner of KW Automotive GmbH, stated that after the tough cuts of recent months, the company is creating the conditions for a fresh start.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on material type, vehicle type, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue to grow with a focus on lightweight and high-performance materials.

- Demand for electric vehicles will drive the development of specialized wheels.

- Innovations in wheel design and manufacturing processes will increase production efficiency.

- Growing customization demand in the aftermarket segment will enhance market dynamics.

- Environmental regulations will push for sustainable, recyclable wheel solutions.

- Increased adoption of smart wheels with embedded sensors for real-time monitoring.

- The shift towards more durable and cost-effective materials will continue.

- Premium and luxury vehicle demand will support high-end wheel production.

- Expansion in Eastern Europe will provide growth opportunities.

- The shift to digital tools for manufacturing and distribution will optimize operations.