Market Overview

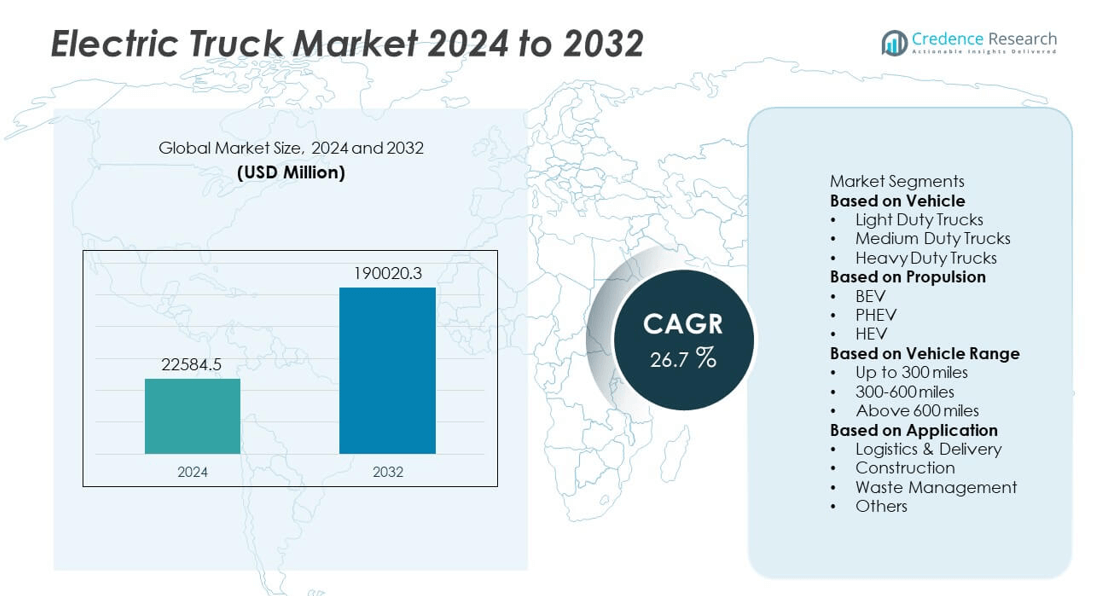

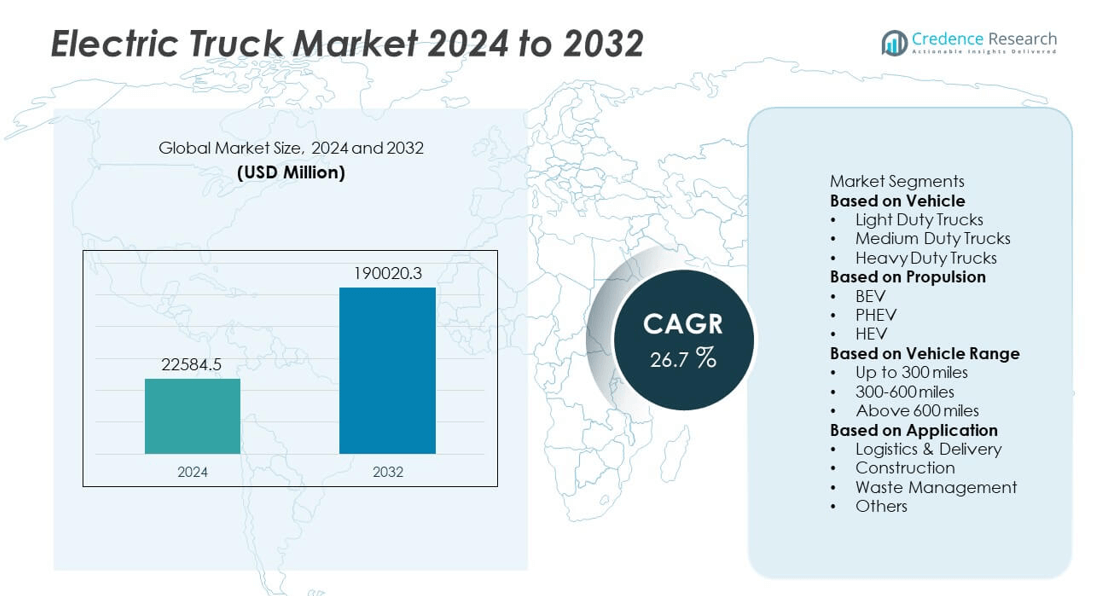

The global Electric Truck Market was valued at USD 22,584.5 million in 2024 and is projected to reach USD 190,020.3 million by 2032, growing at a CAGR of 26.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Truck Market Size 2024 |

USD 22,584.5 million |

| Electric Truck Market, CAGR |

26.7% |

| Electric Truck Market Size 2032 |

USD 190,020.3 million |

The Electric Truck Market is led by major players such as PACCAR Inc., Foton International, Scania, Dongfeng Motor Company, Daimler Truck AG, ISUZU MOTORS LIMITED, FAW Group Co., Ltd., Navistar Inc., BYD Company Ltd., and AB Volvo. These companies are advancing product portfolios through battery innovations, digital fleet technologies, and sustainable manufacturing. Strategic partnerships with energy and logistics firms are expanding their market presence. Asia-Pacific emerged as the leading region, holding a 35% market share in 2024, driven by large-scale production and strong government incentives. North America and Europe, holding 33% and 29% shares respectively, follow due to rapid fleet electrification, regulatory support, and infrastructure growth across logistics and long-haul transport sectors.

Market Insights

- The Electric Truck Market was valued at USD 22,584.5 million in 2024 and is projected to reach USD 190,020.3 million by 2032, growing at a CAGR of 26.7% during the forecast period.

- Key growth drivers include stricter emission regulations, government incentives, and rapid adoption of zero-emission fleets by logistics and delivery companies.

- Market trends highlight advancements in battery technology, integration of connected systems, and increasing investment in fast-charging infrastructure to support long-range trucks.

- The competitive landscape features leading players such as PACCAR Inc., AB Volvo, Daimler Truck AG, BYD, Dongfeng Motor Company, and Scania, focusing on R&D, fleet solutions, and cross-sector collaborations.

- Asia-Pacific leads the market with 35% share, followed by North America at 33% and Europe at 29%, while light-duty trucks dominate the vehicle segment with a 47% share due to their strong demand in urban logistics and delivery services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

Light-duty trucks dominated the Electric Truck Market in 2024, accounting for nearly 47% of the total share. Their dominance is supported by strong adoption in urban logistics, last-mile delivery, and municipal fleet operations. Companies are choosing light-duty models due to their lower initial cost, shorter charging time, and ease of deployment in dense city networks. E-commerce growth and fleet electrification initiatives by players such as Rivian and Ford are driving this segment. The medium and heavy-duty segments are expanding as governments introduce stricter emission targets for long-haul and industrial transport.

- For instance, BYD launched its 8TT battery-electric heavy-duty truck powered by a lithium-iron-phosphate battery and a 483 hp electric motor. The truck is available with either a 422 kWh or an extended-range 563 kWh battery pack.

By Propulsion

Battery Electric Vehicles (BEVs) led the market with about 63% share in 2024. The growth stems from advancements in high-energy-density lithium-ion batteries and falling per-kWh costs. BEVs eliminate tailpipe emissions and align with zero-emission targets across major economies. Fleet operators are adopting BEVs for their lower operational and maintenance costs. Increasing investment by manufacturers like Volvo and Daimler in long-range battery systems strengthens this dominance. Plug-in hybrid and hybrid trucks maintain niche adoption in regions with limited charging infrastructure but are expected to decline as battery technology improves.

- For instance, Volvo Trucks introduced its FH Electric long-haul truck equipped with a 540 kWh battery pack delivering 490 kW continuous power and a driving range of 300 km per charge under full load. The vehicle supports fast charging up to 250 kW, enabling 80% recharge in 90 minutes, and features an integrated thermal management system for optimal battery efficiency during long-haul transport.

By Vehicle Range

Trucks with a range of up to 300 miles captured roughly 52% market share in 2024. This segment benefits from cost-effective battery configurations suitable for regional and urban deliveries. Light-duty and medium-duty fleets prioritize short-range vehicles for predictable daily routes and quick recharging cycles. Manufacturers such as BYD and Tesla focus on improving efficiency in this range class to optimize fleet economics. The 300–600-mile segment is growing with the introduction of next-generation heavy trucks designed for intercity and logistics operations requiring extended travel distances.

Key Growth Drivers

Government Incentives and Emission Regulations

Strict emission laws and sustainability goals are accelerating electric truck adoption worldwide. Governments offer tax rebates, purchase incentives, and infrastructure funding to promote zero-emission transport. These policies reduce the cost gap between diesel and electric trucks and encourage fleet operators to transition faster. Regulatory initiatives such as clean vehicle mandates in North America and Europe further push automakers toward electrification. As compliance requirements tighten, manufacturers and logistics firms increasingly view electric trucks as essential to long-term business strategy.

- For instance, Daimler Truck AG’s Mercedes-Benz eActros 600 received approval under Germany’s Federal Electromobility Subsidy Program, providing up to €24,000 per vehicle in purchase incentives. The model features a 621 kWh battery capacity and 500 kW charging capability, aligning with the EU’s CO₂ reduction framework and enabling operators to meet stringent emission compliance in long-haul operations.

Advancements in Battery Technology

Continuous improvements in battery chemistry and performance are driving the market’s expansion. Modern lithium-ion and solid-state batteries offer higher efficiency, longer range, and shorter charging times. These innovations help reduce operational costs and enhance vehicle reliability in commercial use. Manufacturers are focusing on advanced thermal management and lightweight materials to improve battery lifespan and energy output. As technology evolves, electric trucks are becoming more practical for both regional and long-haul applications, supporting sustained market growth.

- For instance, Scania developed its next-generation electric truck platform with a 624 kWh lithium-ion battery system capable of delivering 610 hp (450 kW) and a range of 350 km per charge under full load. The system employs an advanced liquid cooling module that maintains battery temperatures within 25–35°C, extending lifecycle performance beyond 4,000 charge cycles in heavy-duty operations.

Rising Fleet Electrification in Logistics

Major logistics and delivery companies are transitioning to electric fleets to meet sustainability goals. The shift reduces fuel costs, minimizes emissions, and improves operational efficiency. Fleet operators value the quiet operation and lower maintenance needs of electric trucks in urban delivery settings. Corporate sustainability commitments and e-commerce growth are further boosting adoption. As major fleet owners set clear decarbonization targets, demand for efficient and reliable electric trucks continues to expand across global logistics networks.

Key Trends & Opportunities

Expansion of Charging Infrastructure

Development of public and private charging networks is transforming electric truck operations. Fast-charging hubs and depot-based systems are improving route flexibility and uptime for fleets. Manufacturers and energy providers are partnering to deploy high-capacity chargers along logistics corridors. The growing use of renewable-powered charging and grid-integrated solutions presents opportunities for energy management companies. Enhanced accessibility to reliable charging networks will be crucial for enabling long-distance electric freight movement in the coming years.

- For instance, the Volvo Group and Pilot Company formed a partnership to develop a high-performance, public charging network for medium- and heavy-duty electric trucks in North America. The chargers, which will be open to all Class 8 truck brands, will be strategically installed at select Pilot and Flying J travel centers along major transportation corridors.

Integration of Connected and Autonomous Technologies

Electric trucks are increasingly integrated with digital and autonomous systems for smarter fleet management. Telematics solutions help monitor vehicle performance, optimize routes, and predict maintenance needs. Automation and driver-assistance technologies enhance safety and reduce fatigue, especially in logistics operations. The convergence of electrification and connectivity is creating new service opportunities for software developers and fleet operators. These technologies collectively support efficient, data-driven, and sustainable transport ecosystems across major logistics networks.

- For instance, PACCAR Inc. equips its Kenworth T680E with the PACCAR Connect telematics system, which provides real-time vehicle health monitoring and analytics through cloud integration. The all-electric truck’s system tracks battery performance and other diagnostics.

Key Challenges

High Upfront Cost and Limited Profitability

The cost of purchasing electric trucks remains high compared to diesel alternatives. Batteries and charging systems represent a significant portion of total vehicle expense. Although electric trucks offer lower operating and maintenance costs, long payback periods deter smaller fleet owners. Limited financing options and uncertain residual values also slow adoption. Reducing manufacturing costs and introducing supportive leasing or financing models will be vital to improving market accessibility for commercial operators.

Insufficient Charging Infrastructure and Power Constraints

Inadequate charging infrastructure continues to restrict widespread deployment of electric trucks. Existing networks are often designed for passenger vehicles and lack the capacity for heavy-duty operations. Fleet operators face challenges with charging availability, grid capacity, and standardization. These issues increase downtime and complicate long-distance logistics planning. Coordinated investment in fast-charging corridors, grid upgrades, and standardized interfaces is essential to support the operational efficiency and scalability of electric truck fleets.

Regional Analysis

North America

North America held a market share of 33% in 2024, driven by strong government incentives and early adoption of zero-emission freight vehicles. The U.S. and Canada are leading investments in charging infrastructure and fleet electrification across logistics and municipal sectors. Supportive policies, such as the Inflation Reduction Act, have accelerated manufacturing and deployment of electric trucks. Major players like Tesla, Rivian, and Freightliner are expanding regional production capacity. Growing adoption in last-mile delivery and long-haul applications strengthens North America’s position as a key hub for commercial electric vehicle innovation.

Europe

Europe captured a 29% market share in 2024, supported by strict emission regulations and sustainability mandates. The European Union’s carbon neutrality goals are encouraging fleet electrification and replacement of diesel trucks. Countries such as Germany, the Netherlands, and the United Kingdom are leading adoption through strong infrastructure investments and corporate fleet transitions. Manufacturers including Volvo, Daimler, and Renault are developing advanced electric truck platforms tailored for regional logistics. Expansion of cross-border charging corridors and zero-emission zones continues to enhance the region’s long-term growth outlook in electric commercial mobility.

Asia-Pacific

Asia-Pacific accounted for the largest market share of 35% in 2024, driven by rapid industrialization, government incentives, and strong domestic manufacturing. China dominates regional demand with large-scale electric truck production from BYD, FAW, and Dongfeng. India, Japan, and South Korea are also increasing investments in battery manufacturing and fleet electrification programs. Expanding logistics and e-commerce sectors further accelerate adoption across short- and medium-haul transport. Favorable policy frameworks and local supply chain integration make Asia-Pacific a critical production and consumption center for global electric truck deployment.

Latin America

Latin America represented a 2% market share in 2024, with growth led by Brazil, Mexico, and Chile. Rising fuel costs and growing awareness of clean transport are driving regional demand. Fleet operators are adopting electric trucks for urban logistics, supported by limited but expanding charging networks. Partnerships between global manufacturers and local distributors are helping lower import costs and encourage early adoption. Government pilot programs and private investments in sustainable mobility are expected to improve accessibility. The region remains in an early adoption phase but shows strong long-term growth potential.

Middle East & Africa

The Middle East and Africa held a 1% market share in 2024, reflecting emerging adoption trends across key urban centers. Countries such as the UAE, Saudi Arabia, and South Africa are investing in electric vehicle infrastructure and clean transport initiatives. Government-backed sustainability goals, particularly under programs like Saudi Vision 2030, support future expansion. Logistics and mining sectors are exploring electric trucks for cost and emission reduction. Although infrastructure remains limited, rising interest from international manufacturers indicates gradual progress toward regional electrification of commercial transport.

Market Segmentations:

By Vehicle

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

By Propulsion

By Vehicle Range

- Up to 300 miles

- 300-600 miles

- Above 600 miles

By Application

- Logistics & Delivery

- Construction

- Waste Management

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Truck Market features leading manufacturers such as PACCAR Inc., Foton International, Scania, Dongfeng Motor Company, Daimler Truck AG, ISUZU MOTORS LIMITED, FAW Group Co., Ltd., Navistar Inc., BYD Company Ltd., and AB Volvo. These companies are focusing on expanding production capacity, improving battery performance, and launching long-range electric models. Strategic collaborations with battery suppliers and charging infrastructure providers are strengthening their market reach. Manufacturers are also investing in digital fleet management, telematics, and autonomous driving technologies to enhance efficiency and safety. Regional players in Asia-Pacific are focusing on cost-effective electric models, while European and North American manufacturers emphasize performance, sustainability, and compliance with emission standards. Continuous R&D efforts and growing competition are driving rapid innovation, lowering costs, and expanding global adoption of electric trucks across commercial fleets and logistics applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PACCAR Inc.

- Foton International

- Scania

- Dongfeng Motor Company

- Daimler Truck AG

- ISUZU MOTORS LIMITED

- FAW Group Co., Ltd.

- Navistar, Inc

- BYD Company Ltd.

- AB Volvo

Recent Developments

- In September 2025, DAF (a PACCAR division) commenced series production of the XD and XF Electric models, featuring modular powertrains with PACCAR electric motors rated between 170 and 350 kW and battery packs supporting ranges from 200 to over 500 km.

- In August 2025, Scania launched a Europe-wide electric truck roadshow to showcase its electric truck models and promote sustainable transport solutions.

- In June 2025, Daimler Truck AG (via Mercedes-Benz eActros) signed a deal to rent 30 eActros 600 electric trucks to DHL for parcel transport, with deliveries scheduled by the end of Q2 2026.

- In April 2025, PACCAR Inc. unveiled its new T680E and T880E electric trucks built on the PACCAR ePowertrain platform for Class 8 applications.

- In April 2025, BYD reported that its commercial vehicle sales, including electric trucks, jumped from 1,055 units in June 2024 to 4,568 units in June 2025.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, Vehicle Range, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric truck market will continue expanding as nations push for zero-emission freight transport.

- Battery efficiency and charging speed improvements will make long-haul operations more practical.

- Manufacturers will invest heavily in lightweight materials to enhance vehicle performance and range.

- Fleet electrification programs by logistics and retail companies will accelerate large-scale adoption.

- Public and private investments will strengthen high-capacity charging infrastructure across major transport routes.

- Partnerships between automakers and energy firms will support integrated charging and battery-swapping networks.

- Government incentives and carbon reduction targets will remain key drivers of market growth.

- Emerging economies will witness faster adoption due to falling battery costs and local production initiatives.

- Autonomous and connected electric trucks will improve operational efficiency and reduce logistics downtime.

- Sustainability goals and digital innovation will continue to reshape global commercial transport strategies.