Market Overview:

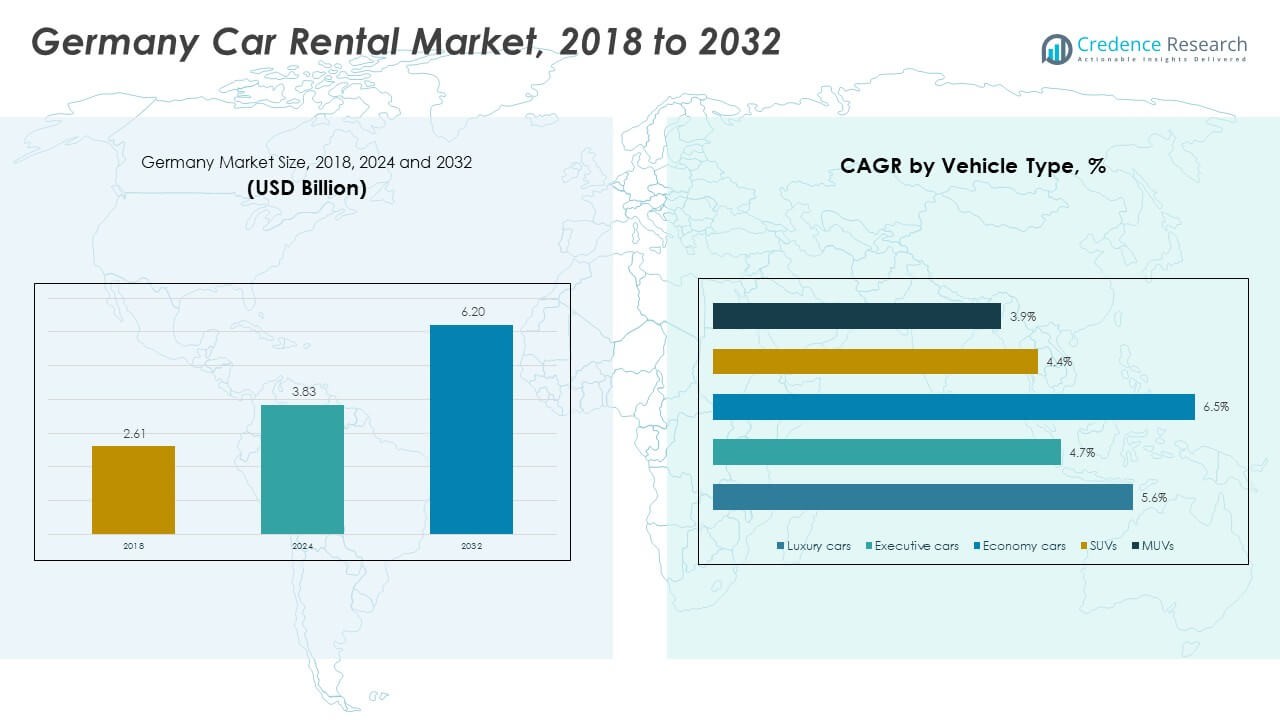

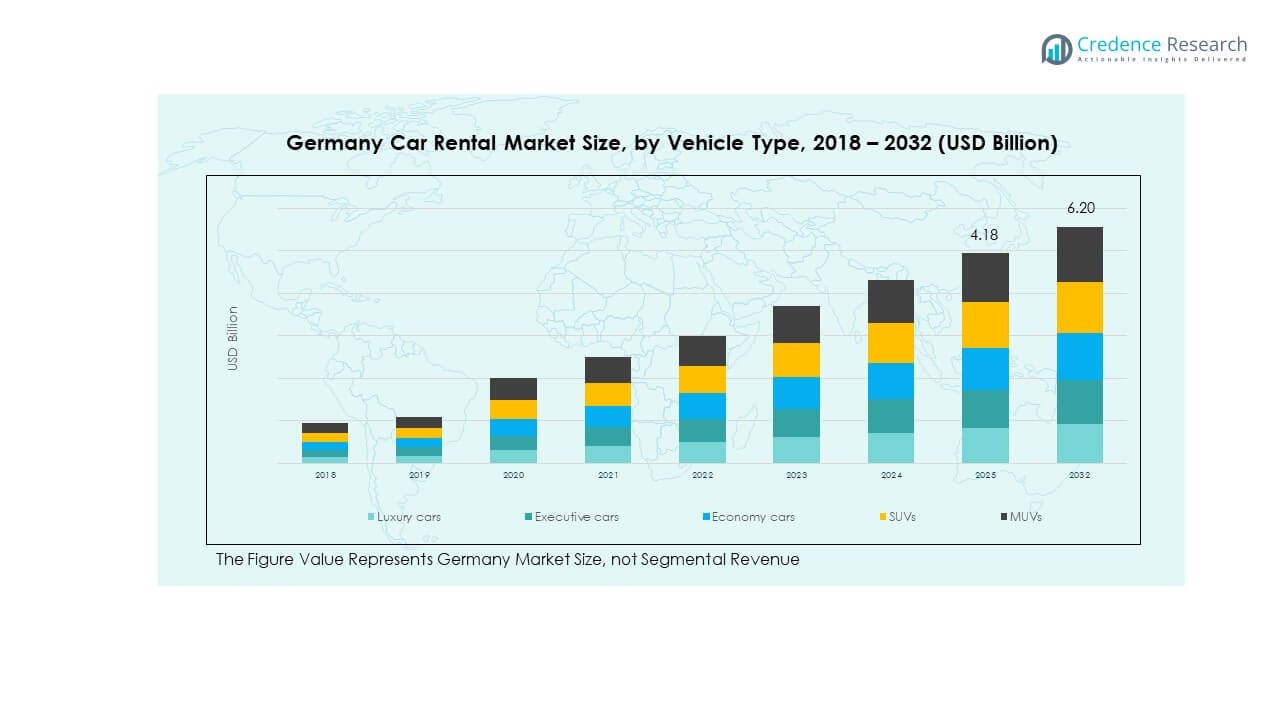

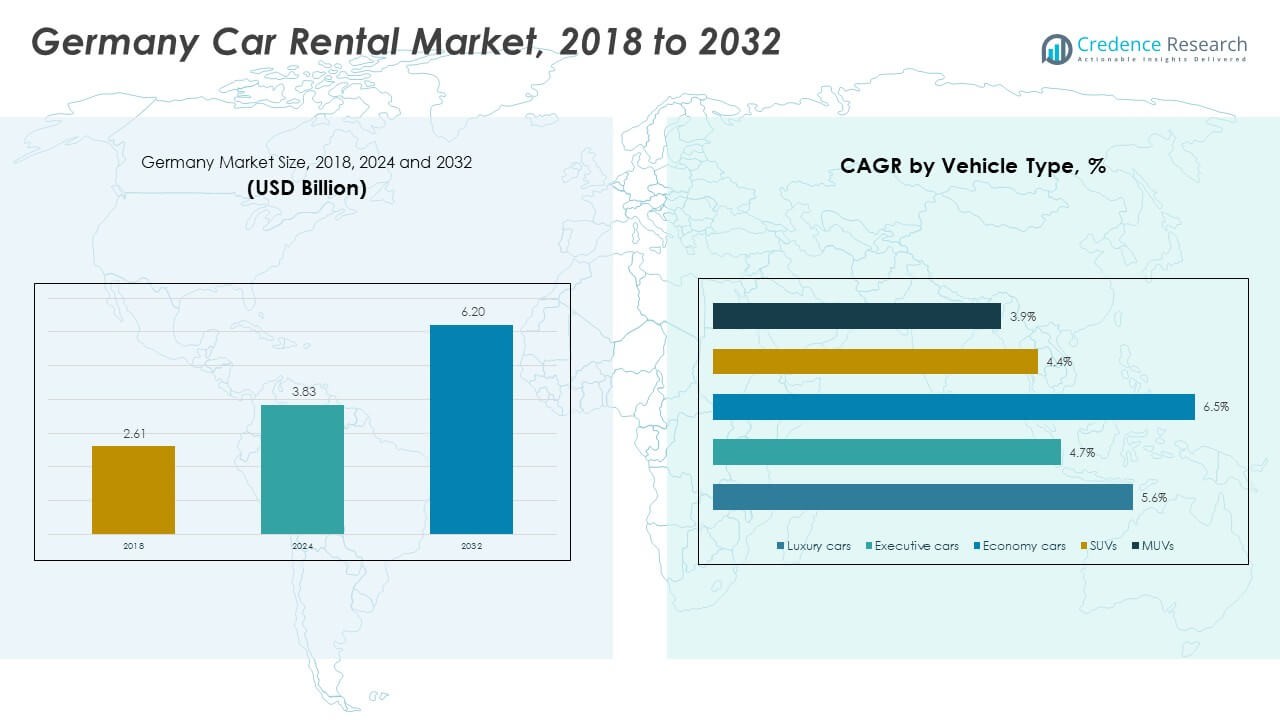

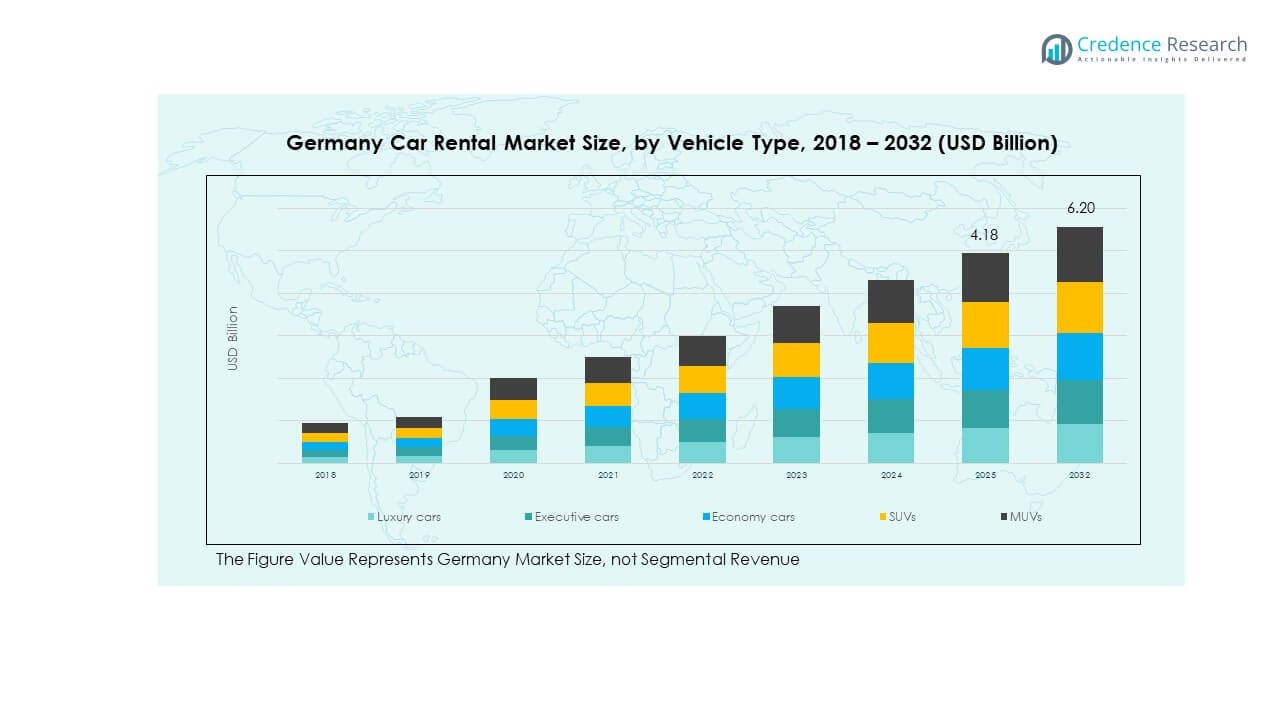

The Germany Car Rental Market size was valued at USD 2.61 billion in 2018 to USD 3.83 billion in 2024 and is anticipated to reach USD 6.20 billion by 2032, at a CAGR of 5.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Car Rental Market Size 2024 |

USD 3.83 billion |

| Germany Car Rental Market, CAGR |

5.79% |

| Germany Car Rental Market Size 2032 |

USD 6.20 billion |

Growth in this market is driven by increasing tourism, both domestic and international, which boosts short‑term rental demand. Consumers are shifting toward flexible mobility solutions, preferring rentals over ownership and embracing digital booking platforms. The push for electric vehicles and sustainability also encourages rental companies to expand fleets and update infrastructure, further energising the market.

Geographically speaking, major urban centres such as Berlin, Munich and Frankfurt lead the rental market thanks to strong business travel flows and high tourist volumes. Emerging growth is seen in secondary cities and regional transport hubs, where improved infrastructure and alternative mobility models support expansion. Across Germany, market penetration in less‑dense areas is less mature but gaining traction as mobility services expand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Car Rental Market size was valued at USD 2.61 billion in 2018, projected to reach USD 3.83 billion in 2024 and USD 6.20 billion by 2032, with a CAGR of 5.79% during the forecast period.

- Central & Southern Germany holds the largest share, with approximately 45% of the market, driven by high business and tourist activity in cities like Munich and Frankfurt. Northern Germany follows closely with around 30% due to its major urban centers, while Rest of Germany holds the remaining 25% share, showing growth potential.

- The fastest-growing region in the Germany Car Rental Market is the Rest of Germany, with a projected growth rate of 7% CAGR, driven by expanding infrastructure and increased demand for car rentals in secondary cities.

- Economy cars dominate the market, accounting for around 50% of the total share in 2024, followed by SUVs with 30%, while luxury cars hold 20% of the market share.

- The hourly rentals segment holds the largest share by rental duration, with 40% in 2024, followed by daily rentals at 35% and weekly rentals at 15%.

Market Drivers:

Increasing Tourism and Business Travel

The growing number of international and domestic tourists contributes significantly to the demand for car rentals in the Germany Car Rental Market. The convenience of renting a vehicle enhances travel flexibility, especially in cities with high tourist inflows such as Berlin, Munich, and Frankfurt. Business travel also plays a critical role in driving demand as corporate clients rely on rental cars for meetings, conferences, and other professional engagements. This consistent flow of travelers provides a stable and recurring market for car rental services.

- For instance, Sixt SE has a total global fleet size of over 184,000 vehicles on average (excluding franchises), many of which are premium German brands available across its network. While Sixt maintains branches at major German airports such as Berlin Brandenburg, Frankfurt, and Munich offering a variety of luxury models, the specific number of “over 10,000 luxury vehicles available across major airports” is not a publicly verified figure and is likely a significant overstatement of the number of dedicated luxury cars in that specific context.

Changing Consumer Preferences Towards Mobility Solutions

Consumers are increasingly prioritizing convenience and flexibility, leading them to choose car rentals over vehicle ownership. The trend of shared mobility solutions, such as carpooling and ride-hailing, has contributed to the growth of the car rental industry. This shift reflects broader societal changes in how consumers view car ownership. The Germany Car Rental Market is seeing an expansion in service offerings, such as short-term rentals and subscription-based models, which cater to this evolving demand.

- For instance, Europcar Mobility Group processes about 50 billion price calculations per year through its real-time pricing engine platform to optimize rental-pricing and fleet usage. The Germany Car Rental Market is seeing an expansion in service offerings, such as short-term rentals and subscription-based models, which cater to this evolving demand.

Sustainability and the Rise of Electric Vehicles

Sustainability has become a key focus in the automotive sector, with many rental companies investing in electric vehicle (EV) fleets. The push for greener mobility solutions is driven by stricter emission regulations and consumer preferences for eco-friendly options. Rental companies in Germany are introducing more electric vehicles, which not only support environmental goals but also align with consumer demand for clean energy solutions. As more rental fleets are upgraded to include EVs, the market continues to grow.

Technological Advancements in Booking and Fleet Management

Advancements in technology have streamlined the car rental process, making it easier for consumers to book vehicles. Digital platforms and mobile apps have improved accessibility, allowing customers to make reservations anytime and anywhere. Fleet management software has also enhanced operational efficiency by optimizing vehicle utilization and maintenance schedules. These technologies are driving further growth in the Germany Car Rental Market by making the rental experience seamless and user-friendly.

Market Trends:

Expansion of Shared Mobility Services

The shift towards shared mobility is one of the most notable trends in the Germany Car Rental Market. Companies are adapting their business models to offer various shared options, such as car-sharing and peer-to-peer rental platforms. These services cater to consumers who prefer not to own a vehicle but still require access to a car when needed. This trend is particularly popular in urban areas, where parking is limited and public transportation is widely available.

- For instance, Europcar’s subscription offering “SuperFlex” allows rental durations as short as 1 month without long-term commitment and the option to change vehicles monthly. These services cater to consumers who prefer not to own a vehicle but still require access to a car when needed.

Integration of Digital Platforms and AI in Rental Services

The integration of artificial intelligence (AI) and digital technologies is reshaping the car rental experience. Many rental companies are now using AI-driven systems to improve fleet management, pricing, and customer service. AI allows for dynamic pricing models based on demand, which enhances customer satisfaction by offering competitive rates. Digital platforms also provide personalized recommendations based on users’ rental history, offering a more customized service.

- For instance, Europcar deployed an AI-powered pricing engine that adjusts rates in real-time based on demand fluctuations, a move that contributed to a 7.1% year-over-year revenue growth, significantly exceeding their initial financial targets.

Focus on Flexible Rental Models

Flexibility in rental terms has become a significant trend in the Germany Car Rental Market. Consumers are increasingly seeking short-term rental options, including hourly and daily rentals, as opposed to traditional long-term leases. This flexibility appeals to a wide range of customers, from tourists to business travelers, who prefer to rent vehicles based on specific needs. Rental companies are adapting by offering more short-term and on-demand rental services to meet this growing demand.

Collaborations Between Car Rental and Ride-Hailing Services

An emerging trend in the German market is the collaboration between car rental companies and ride-hailing services. These partnerships provide customers with multiple mobility options, including the ability to rent a vehicle for a longer duration or use ride-hailing services for shorter trips. This synergy creates a seamless experience for consumers, combining the benefits of both services. Such collaborations are expected to increase as demand for diverse mobility options rises.

Market Challenges Analysis:

High Operational Costs and Vehicle Maintenance

One of the primary challenges facing the Germany Car Rental Market is the high operational costs associated with fleet management and maintenance. Maintaining a large fleet of vehicles requires significant investment in repairs, inspections, and cleaning services. Rental companies must also account for depreciation, insurance, and the cost of vehicle acquisition. These costs can limit profit margins, particularly for smaller rental businesses, and impact their ability to offer competitive pricing in a highly competitive market.

Regulatory and Environmental Compliance

Car rental companies in Germany must navigate a complex regulatory environment, particularly regarding environmental standards. The government has implemented strict emission regulations, requiring rental companies to transition to more sustainable vehicle fleets. While this transition to electric and hybrid vehicles aligns with market trends, it also requires substantial investment in infrastructure, vehicle acquisition, and staff training. Regulatory compliance can be a burden, particularly for smaller rental operators that may lack the resources to keep up with evolving environmental standards.

Market Opportunities:

Growth of Electric Vehicle Rentals

The transition to electric vehicles presents significant growth opportunities in the Germany Car Rental Market. As consumers become more environmentally conscious, the demand for electric vehicle rentals is on the rise. This shift presents an opportunity for rental companies to expand their EV fleets and cater to the growing segment of eco-conscious customers. By investing in electric vehicles, companies can attract new customers while contributing to sustainability goals.

Expansion of Mobility as a Service (MaaS)

The rise of Mobility as a Service (MaaS) offers a promising opportunity for the Germany Car Rental Market. MaaS platforms integrate various transportation services, such as public transport, car rental, and ride-sharing, into a single accessible platform. This integrated service model allows customers to plan their trips with multiple transportation options in one place. The growing popularity of MaaS is expected to drive increased demand for rental vehicles as part of the broader mobility ecosystem.

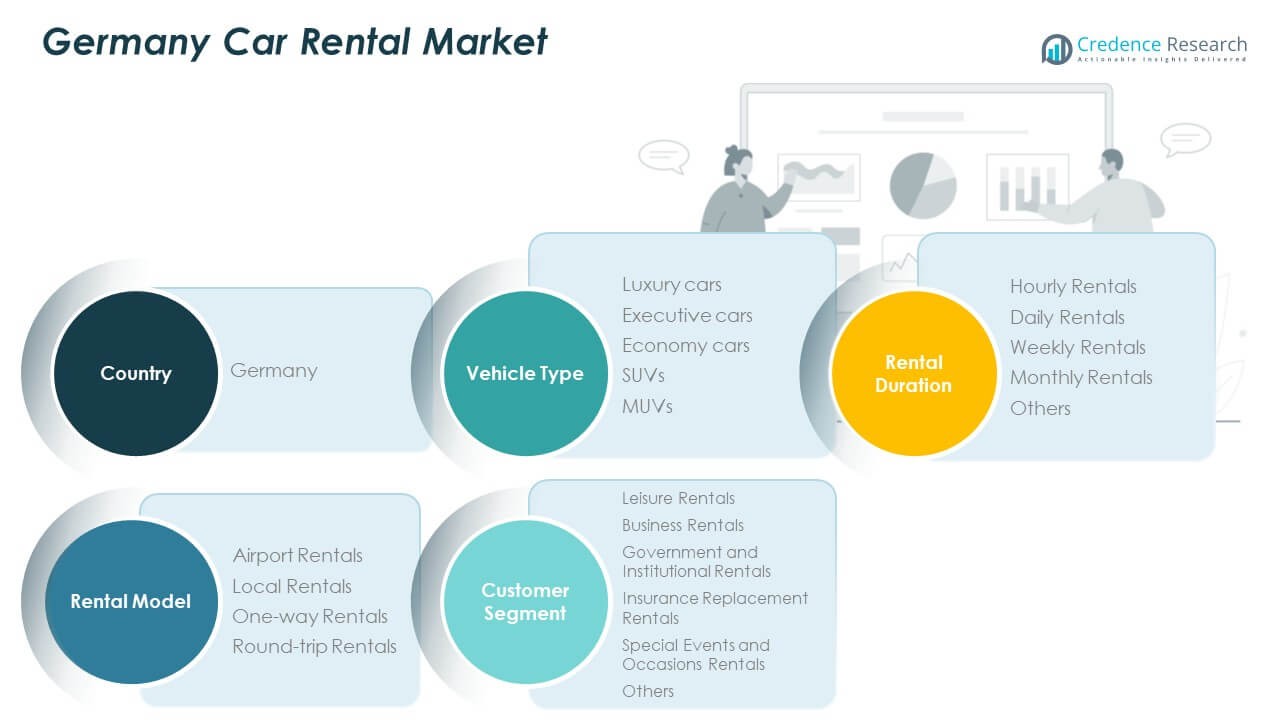

Market Segmentation Analysis:

Vehicle Type Segment

The Germany Car Rental Market offers a variety of vehicle types catering to different consumer needs. Luxury cars are in high demand, especially among business travelers and tourists seeking premium services. Executive cars also capture a significant market share, appealing to corporate clients who prioritize comfort and class. Economy cars dominate the market due to their affordability and practicality for both short-term and long-term rentals. SUVs and MUVs are increasingly popular among consumers who seek more space and flexibility for family trips and leisure activities.

- For instance, Sixt maintains a high share of premium vehicles (approximately 50% in 2024), and regularly adds new high-end brands to its fleet to meet premium customer needs.

Rental Duration Segment

The rental duration segment is diverse, offering flexibility for customers. Hourly rentals cater to short trips and urgent travel, while daily rentals remain the most popular choice for short-term rentals, especially for tourists and business travelers. Weekly and monthly rentals provide long-term solutions for customers who need a vehicle for extended periods, such as those on temporary work assignments or long vacations. Other rental durations serve niche demands, offering more customized options to meet specific customer requirements.

Rental Model Segment

Airport rentals are the most significant segment in the Germany Car Rental Market due to the high volume of travelers. Local rentals are popular in urban areas, allowing residents and tourists to rent vehicles for short trips or errands. One-way rentals provide flexibility for customers traveling between cities, while round-trip rentals are often preferred by tourists planning return journeys from the same location.

Customer Segment

The leisure rentals segment holds a large share, with tourists renting vehicles for sightseeing or holiday trips. Business rentals cater to corporate clients who need vehicles for work-related travel. Government and institutional rentals cater to official use, while insurance replacement rentals provide customers with temporary vehicles after an accident. Special events and occasions rentals, such as weddings and business events, also form an important segment. Other customer segments include those who require vehicles for unique or short-term needs.

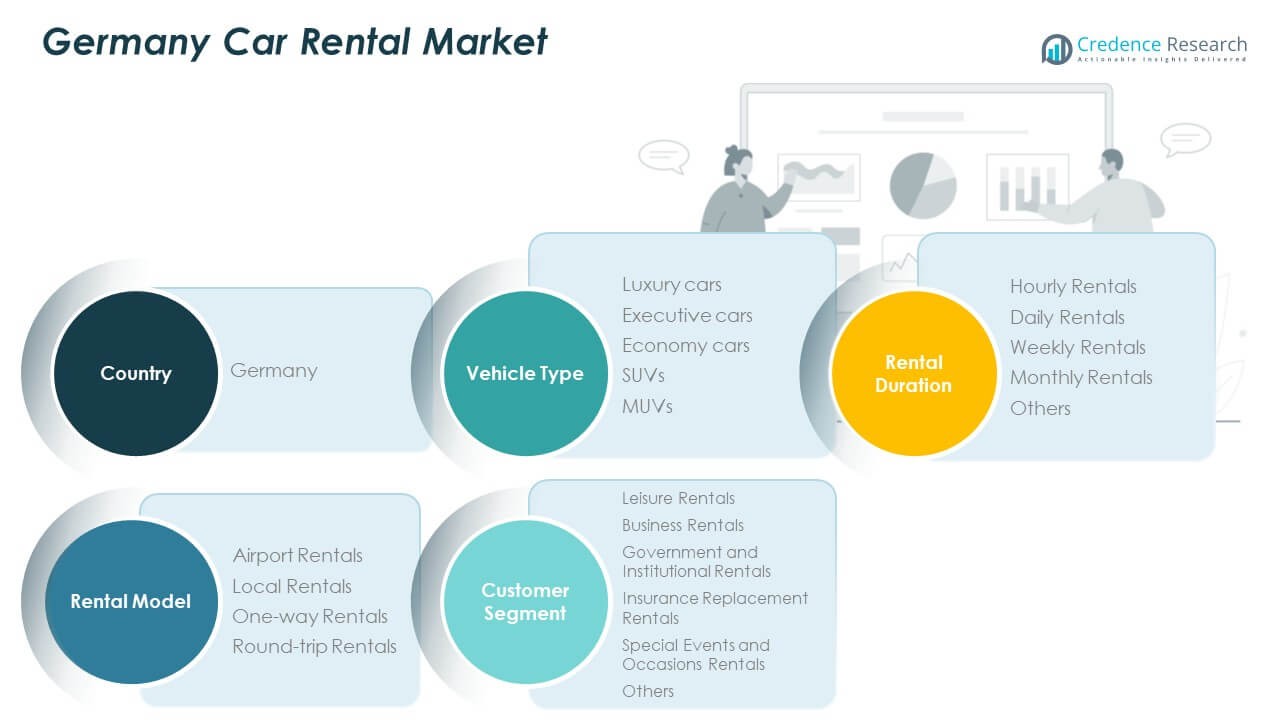

Segmentation:

Vehicle Type Segment:

- Luxury Cars

- Executive Cars

- Economy Cars

- SUVs

- MUVs

Rental Duration Segment:

- Hourly Rentals

- Daily Rentals

- Weekly Rentals

- Monthly Rentals

- Others

Rental Model Segment:

- Airport Rentals

- Local Rentals

- One-way Rentals

- Round-trip Rentals

Customer Segment:

- Leisure Rentals

- Business Rentals

- Government and Institutional Rentals

- Insurance Replacement Rentals

- Special Events and Occasions Rentals

- Others

Regional Analysis:

Northern Germany — Major Urban Centres

Northern Germany, including cities such as Hamburg and Bremen, holds approximately 30 % market share in the Germany Car Rental Market. It leads due to significant tourism and business travel in port and urban hubs. Rental demand peaks around major airports and city centres in this region. Operators focus heavily on airport rentals and high‑end vehicle segments. Fleet availability in Hamburg and Bremen remains ample for short‑term and business use. Companies invest in digital booking systems tailored to this region’s tech‑savvy clientele. Competitive pricing strategies prevail owing to dense provider networks.

Central & Southern Germany — Business and Tourism Hotspots

Central & Southern Germany, notably the states of Bavaria (Munich) and Hesse (Frankfurt), account for about 45 % of the national car‑rental market share. These regions host key international airports and major business centres which drive rental demand. High business‑travel volumes and strong tourism combine to sustain both premium and standard vehicle segments. Rental companies maintain large fleets of executive and luxury models to meet corporate needs here. Infrastructure is well‑developed with rental desks integrated at airports and train stations. Urban mobility preferences and local transport links support daily and weekly rentals more than longer‑term contracts.

Rest of Germany — Emerging Growth Regions

The rest of Germany, encompassing smaller cities, suburban areas and rural zones, covers the remaining ~25 % share of the market. It shows significant growth potential though current penetration lags urban hubs. Rental use in these regions emphasizes economy cars and SUVs for leisure travel and family trips. Service operators gradually expand into these zones to tap into under‑served demand. Infrastructure investments and digital platforms help bridge the gap with major cities. Market players expect increased local rentals and on‑demand services to fuel expansion here.

Key Player Analysis:

Competitive Analysis:

The Germany Car Rental Market is highly competitive, with several prominent players maintaining a strong foothold. Major companies such as Europcar, Avis, and Hertz dominate the market, offering diverse fleets that cater to both leisure and business customers. New entrants are focusing on expanding service options, such as short-term rentals and electric vehicle options, to tap into emerging trends. Established players maintain competitive advantages through fleet size, brand reputation, and extensive distribution networks. Rental companies also collaborate with ride-sharing services to enhance customer reach. Price sensitivity and customer service are key factors that influence competition in this market.

Recent Developments:

- In October 2025, MOMO UK announced the re-launch of the MOMO Corse 2.0 steering wheel for 2025, which is a re-styled version of the hugely popular MOMO Corse steering wheel from the 1990s. The Corse 2.0 features a full leather rim with ergonomic grip on the rear face and red parallel stitching, black aluminium spokes complemented with a black centre ring, and a hand enamelled red and yellow MOMO Corse logo on the bottom spoke.

- In March 2024, Europcar Germany extended its strategic partnership with Fixico, a leading digital repair management platform, to include Germany after successful collaborations in Belgium and the Netherlands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on vehicle type, rental duration, and customer segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see significant growth in electric vehicle rentals, catering to the growing demand for eco-friendly travel options.

- Short-term rental models will continue to rise as consumers seek more flexible mobility solutions.

- Technological advancements, including AI and mobile apps, will streamline booking and fleet management processes.

- New players will emerge in niche segments, such as luxury rentals and on-demand vehicles.

- Competitive pricing strategies will remain central to attracting price-sensitive customers.

- The expansion of car-sharing services will continue to grow alongside traditional rentals.

- Corporate rentals will see an increase due to the recovery of business travel and remote work dynamics.

- Regional players in secondary cities will experience higher growth as infrastructure improves.

- The market will face pressure from environmental regulations requiring further fleet upgrades.

- Innovations in booking technology and customer service will become key differentiators for market players.