Market Overview:

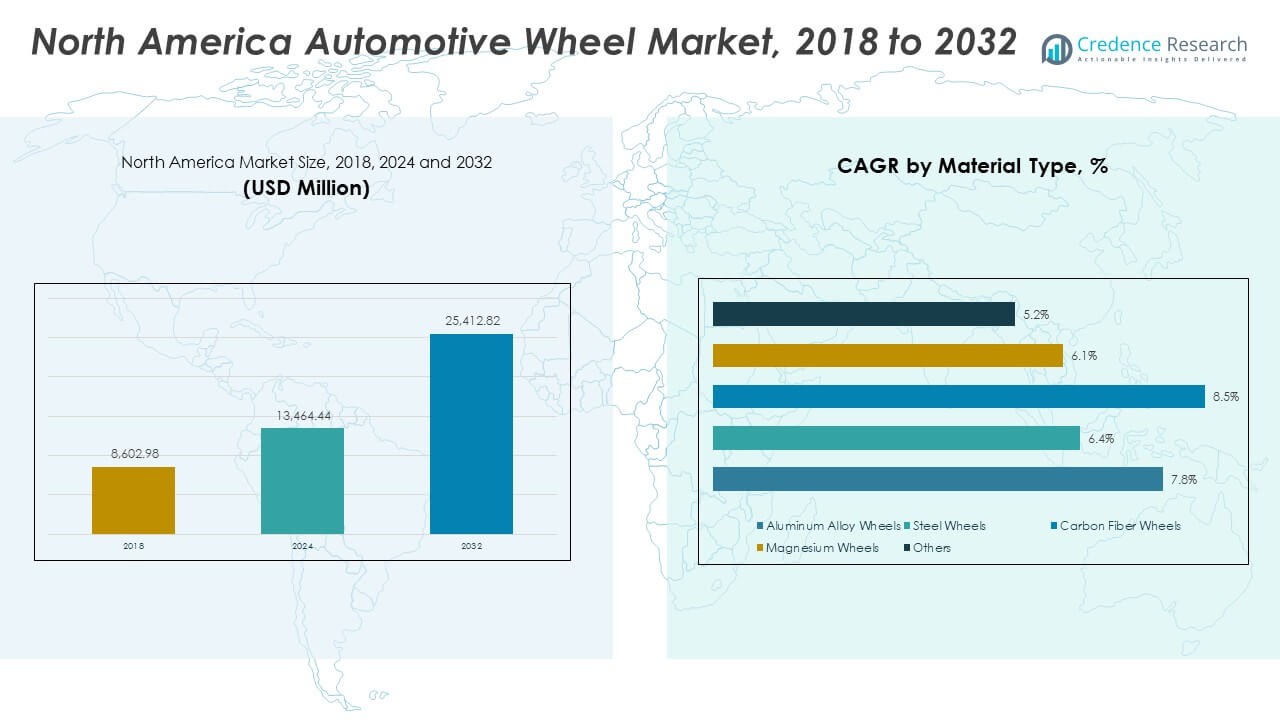

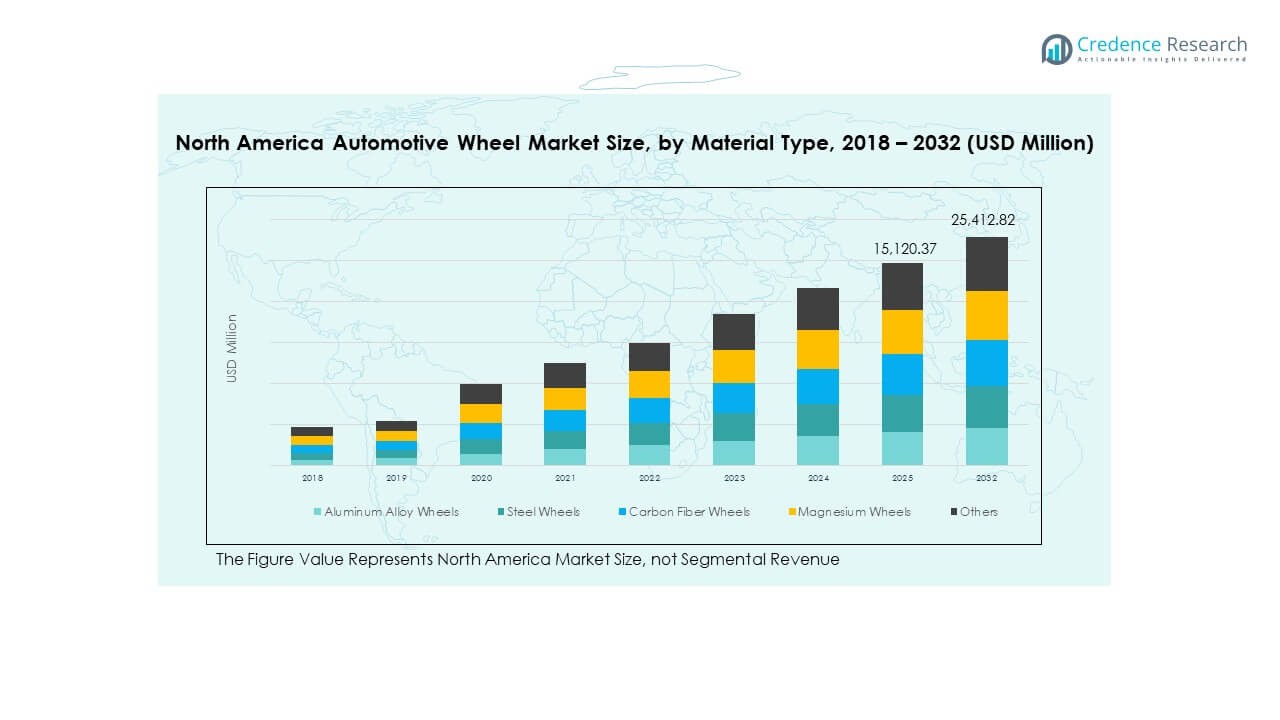

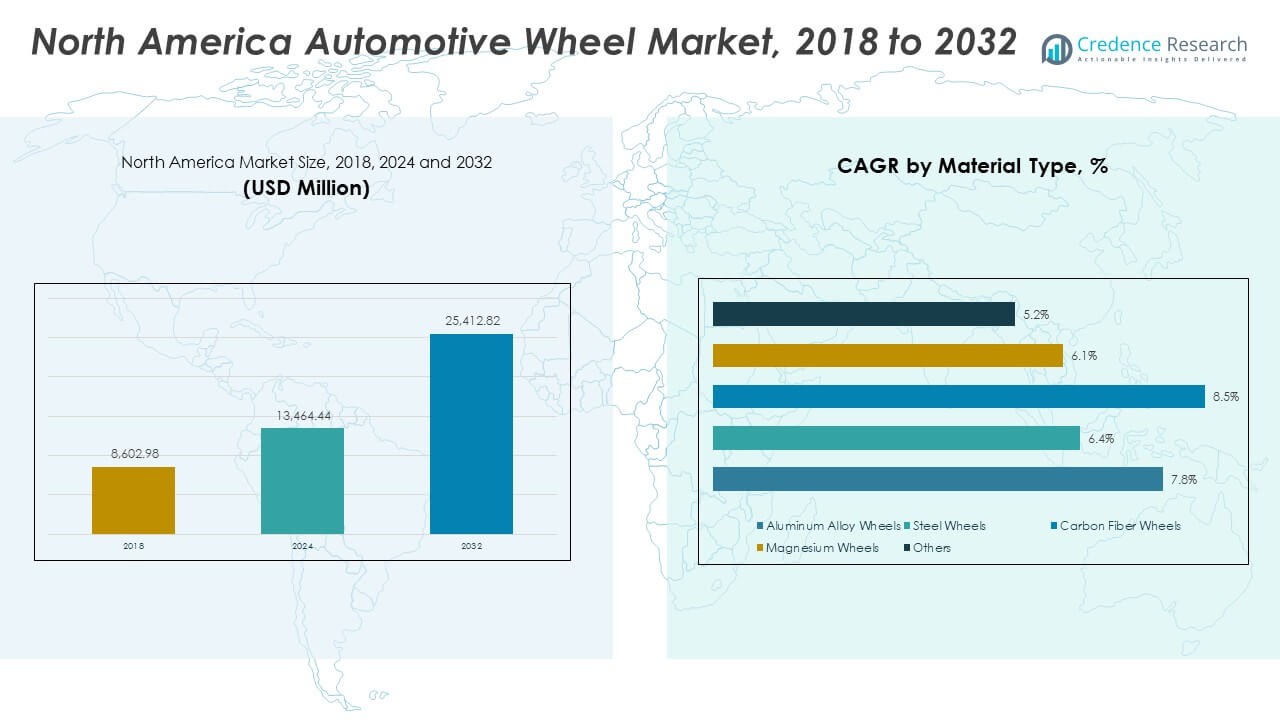

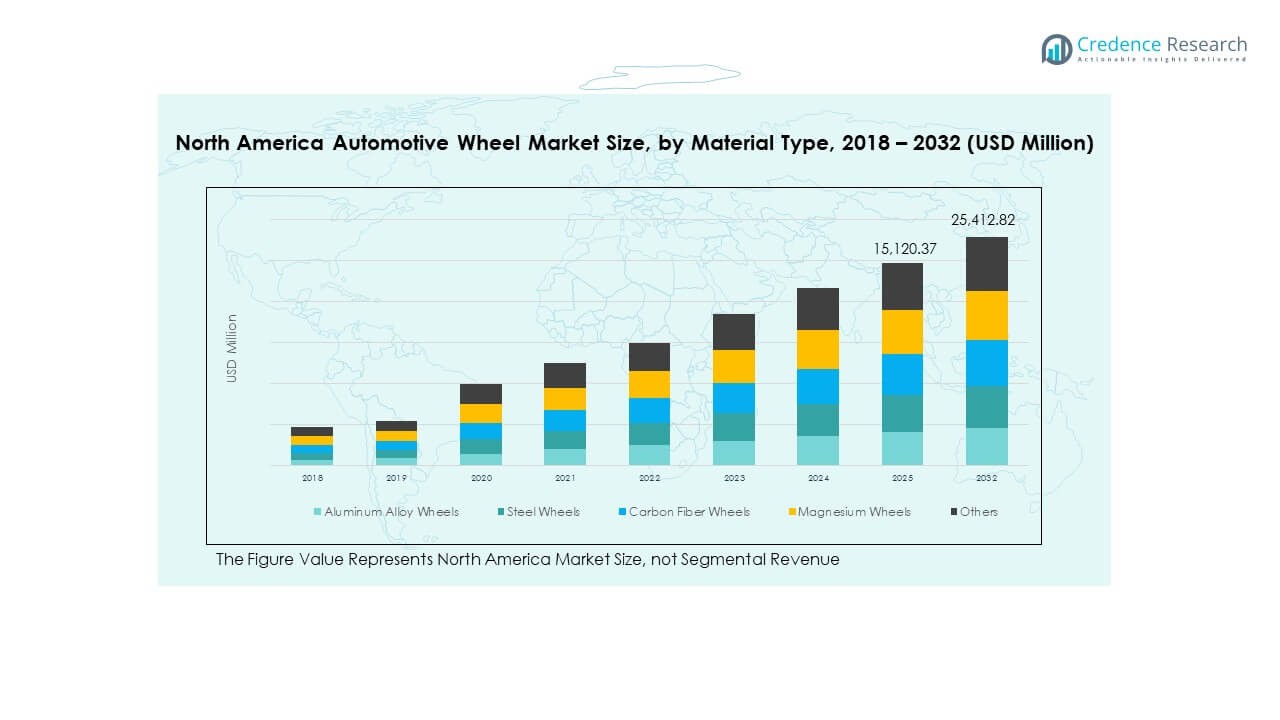

The North America Automotive Wheel Market size was valued at USD 8,602.98 million in 2018 to USD 13,464.44 million in 2024 and is anticipated to reach USD 25,412.82 million by 2032, at a CAGR of 7.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Automotive Wheel Market Size 2024 |

USD 13,464.44 Million |

| North America Automotive Wheel Market, CAGR |

7.70% |

| North America Automotive Wheel Market Size 2032 |

USD 25,412.82 Million |

The market growth is strongly influenced by rising adoption of electric and hybrid vehicles, prompting the need for energy-efficient and durable wheels. Manufacturers focus on weight reduction and improved aerodynamics to enhance vehicle efficiency. Expanding customization trends and advanced surface coating technologies, ensuring durability and corrosion resistance, also propel market demand. Additionally, the aftermarket segment experiences notable traction as consumers upgrade wheels for aesthetics and performance improvements.

Geographically, the United States dominates the North America automotive wheel market due to its high vehicle ownership rate, robust manufacturing infrastructure, and strong aftermarket industry. Canada shows steady growth with rising adoption of electric and luxury vehicles, supported by favorable government initiatives. Meanwhile, Mexico emerges as a key manufacturing hub due to cost advantages and increasing foreign investments from global automakers, strengthening its position within the regional supply chain.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Automotive Wheel Market was valued at USD 8,602.98 million in 2018, reached USD 13,464.44 million in 2024, and is projected to hit USD 25,412.82 million by 2032, expanding at a CAGR of 7.7% during the forecast period.

- The United States leads with a 68% share, supported by a strong OEM base, aftermarket strength, and advanced manufacturing capabilities. Canada follows with 19%, driven by electric vehicle growth and sustainability initiatives, while Mexico holds 13%, benefiting from low-cost manufacturing and export-driven operations.

- The fastest-growing region is Mexico, supported by industrial expansion, foreign investments, and integration into North American supply chains that favor cost-efficient wheel production.

- Aluminum alloy wheels dominate the segment, accounting for over 45% of the total market, due to lightweight design and corrosion resistance preferred in passenger and electric vehicles.

- Steel wheels hold nearly 30% share, maintaining importance across commercial and off-highway vehicles where strength and cost efficiency remain key priorities.

Market Drivers:

Rising Demand for Lightweight and Fuel-Efficient Wheels Across Passenger and Commercial Vehicles

The growing shift toward vehicle efficiency drives manufacturers to adopt lightweight wheel materials such as aluminum and carbon fiber. These materials reduce overall vehicle weight and enhance fuel economy while maintaining strength and durability. OEMs invest in advanced forging and casting processes to meet the rising need for efficiency-focused designs. The North America Automotive Wheel Market benefits from regulatory emphasis on emissions reduction and performance optimization. Automakers integrate lightweight wheels in both passenger and commercial vehicles to improve handling and safety. The market observes strong replacement demand from fleet operators seeking operational cost benefits. Consumers also favor fuel-efficient designs aligned with sustainability goals. This push toward efficiency continues to shape product innovation across the region.

- For instance, Alcoa Wheels developed its Ultra ONE forged aluminum wheel that weighed significantly less than comparable steel wheels—helping fleets shed up to 1,400 lb per rig.

Increasing Vehicle Production and Expanding Aftermarket Demand for Customized Wheels

Automotive production recovery in the United States and Mexico strengthens wheel demand across manufacturing and replacement segments. The region’s strong aftermarket industry fuels growth through demand for personalized, aesthetic, and high-performance wheels. It benefits from consumer preferences for visual enhancement and brand-specific customization. Companies focus on introducing wheels with diverse finishes, patterns, and colors that complement vehicle design. The aftermarket’s influence extends to both luxury and mid-range segments, driven by online retail expansion. Rapid availability of forged and multi-piece wheel options increases market competitiveness. Retailers offer broader access through digital channels, improving product reach. This combination of OEM growth and aftermarket expansion supports continuous market advancement.

- For instance, Wheel Craft offers a PVD chrome finish reported to provide enhanced corrosion resistance and is backed by a five-year warranty.

Technological Advancements in Manufacturing Processes and Smart Wheel Integration

Automation and precision machining play major roles in enhancing wheel quality and consistency. Manufacturers employ advanced casting, flow forming, and CNC machining to improve structural integrity. The North America Automotive Wheel Market benefits from technology adoption that enhances wheel safety, alignment, and performance monitoring. Integration of sensors for tire pressure, heat, and vibration analysis strengthens reliability and consumer appeal. Companies introduce IoT-enabled wheels for connected vehicle systems, improving maintenance accuracy. These innovations help reduce defects and extend wheel lifespan. R&D investments also focus on integrating recyclable alloys to align with sustainability targets. The use of digital twin technology streamlines production, reducing material waste and downtime.

Government Regulations and Safety Standards Supporting Market Growth

Stringent vehicle safety norms and environmental regulations drive automakers to adopt compliant wheel technologies. Governments emphasize improved braking performance and vehicle stability under changing road conditions. It accelerates development of stronger alloys and corrosion-resistant coatings for long-term reliability. Safety-focused testing standards by regulatory agencies promote consistent quality across regional production lines. Automakers implement advanced quality control systems to meet durability and crash-resistance criteria. New wheel inspection technologies ensure structural integrity and compliance with federal standards. The growing emphasis on carbon footprint reduction also motivates wheel manufacturers to innovate sustainable materials. These combined regulatory measures enhance trust among consumers and improve product acceptance across markets.

Market Trends:

Growing Adoption of Electric Vehicles Driving Demand for Specialized Wheel Designs

The transition toward electric mobility creates opportunities for advanced wheel engineering and aerodynamics. Manufacturers develop wheels that reduce drag, improve cooling, and manage higher torque output. The North America Automotive Wheel Market adapts to EV requirements with lightweight yet durable materials. Companies introduce aerodynamic wheel covers and alloys that optimize battery range. The EV boom in the U.S. strengthens investments in sustainable and recyclable wheel technologies. These designs help lower rolling resistance, supporting energy efficiency. Wheel suppliers partner with automakers to co-develop EV-specific wheel systems. The integration of smart materials ensures durability and aesthetics across electric fleets.

- For instance, tests of aerodynamic wheel covers by RealWheels Corp. demonstrated fuel (or energy) savings of 1%–2% on heavy-duty trucks equipped with their aero covers.

Shift Toward Luxury and Premium Segment Wheels with Enhanced Finishing Technologies

Consumer preference for luxury vehicles encourages adoption of premium wheel types with superior finishes. Demand rises for multi-piece, chrome-coated, and diamond-cut wheels that enhance aesthetics. It supports strong competition among manufacturers offering personalized customization. The North America Automotive Wheel Market witnesses luxury automakers focusing on brand-specific wheel lines to enhance identity. Advanced coating techniques improve surface durability against corrosion and damage. 3D printing aids in prototyping and complex design implementation for high-end vehicles. The surge in luxury SUV and crossover demand expands the premium wheel market base. This shift reflects rising disposable income and lifestyle-oriented automotive choices across the region.

- For example, companies now incorporate additive manufacturing or 3D-printing techniques to prototype complex high-end wheel designs. Advanced coating techniques improve surface durability against corrosion and damage.

Rising Focus on Sustainable and Recyclable Wheel Materials

Sustainability dominates wheel manufacturing as industries aim to reduce emissions and raw material waste. Recycled aluminum and low-emission manufacturing techniques gain traction in production. The North America Automotive Wheel Market experiences strong pressure to align with corporate sustainability goals. Firms invest in closed-loop recycling systems to recover scrap and minimize environmental impact. Eco-friendly coatings replace traditional chemical-based finishes for better compliance. Manufacturers explore hybrid material combinations that balance strength and recyclability. Growing awareness among consumers influences brand perception and purchase choices. Sustainability certification becomes an essential marketing factor for regional producers.

Digital Transformation and Integration of Smart Manufacturing Systems

Automation, AI, and data analytics reshape the regional wheel production landscape. Smart factories use predictive maintenance to improve uptime and minimize errors. It enhances efficiency and reduces production costs through real-time monitoring systems. The North America Automotive Wheel Market embraces robotics for precision forming and defect inspection. Advanced software integration allows manufacturers to design lightweight prototypes faster. Digital twins and simulation tools help refine product geometry and performance before manufacturing. Connectivity between machines ensures quality consistency across production sites. These innovations improve scalability and accelerate product delivery timelines.

Market Challenges Analysis:

Volatility in Raw Material Prices and Rising Production Costs Impacting Profit Margins

Fluctuating costs of aluminum, magnesium, and carbon fiber create significant challenges for wheel manufacturers. It affects pricing stability and supply predictability across regional markets. The North America Automotive Wheel Market faces high operational expenses due to energy and labor costs. Manufacturers struggle to balance premium design with affordability for mass consumers. Currency fluctuations also influence import costs of raw materials and components. High material dependency increases exposure to market volatility. Companies adopt hedging strategies and long-term contracts to manage risks. However, inconsistent availability of raw materials limits scalability for smaller players. Rising costs may reduce margins, affecting R&D investments and innovation pace.

Supply Chain Disruptions and Environmental Regulations Limiting Manufacturing Flexibility

Logistical constraints and trade tensions disrupt the steady supply of components from global partners. Pandemic-induced delays and transportation shortages continue to affect inventory management. The North America Automotive Wheel Market encounters difficulty in maintaining on-time deliveries for OEM and aftermarket demands. Stricter emission and waste disposal norms add operational complexity for manufacturers. Regulatory compliance increases production time and certification costs. Environmental standards push firms to upgrade equipment and adopt cleaner processes, requiring capital investment. Dependence on imported alloys creates vulnerability to policy shifts. Delayed shipments and regulatory hurdles hinder smooth market operations and supply chain resilience.

Market Opportunities:

Rising Investments in Smart Mobility and Next-Generation Wheel Technologies

The expansion of smart mobility and autonomous vehicle projects creates major growth prospects. The North America Automotive Wheel Market gains momentum through demand for intelligent wheel solutions with embedded sensors. These wheels assist in real-time diagnostics and stability monitoring for advanced driving systems. Manufacturers leverage AI and data analytics to design adaptive wheels capable of optimizing performance. New opportunities emerge from collaborations with EV makers for lightweight and aerodynamic wheel systems. Integration with digital platforms enhances predictive maintenance. This alignment with connected mobility trends attracts strong investor interest and innovation funding.

Growing Demand for Customization and Aftermarket Expansion

Consumer preference for personalization stimulates the aftermarket wheel segment’s expansion across the region. It benefits from e-commerce platforms enabling direct access to high-end designs and fitment options. The North America Automotive Wheel Market experiences steady demand for unique color finishes, patterns, and material combinations. Aftermarket players introduce quick-installation and performance-enhancing models for diverse vehicles. Retail networks strengthen partnerships with auto service centers to ensure broad reach. Manufacturers focusing on modular designs attract loyal customers seeking flexibility. This expanding aftermarket opens sustainable revenue channels for regional producers.

Market Segmentation Analysis:

By Material Type

The North America Automotive Wheel Market features diverse materials catering to performance, cost, and durability needs. Aluminum alloy wheels dominate due to their lightweight structure, corrosion resistance, and fuel efficiency benefits. Steel wheels maintain strong demand in commercial and heavy-duty applications for their affordability and robustness. Carbon fiber wheels gain momentum in premium and sports vehicles because of superior strength-to-weight ratios. Magnesium wheels attract attention for high-performance applications where reduced rotational mass enhances handling. Other materials, including hybrid composites, support innovation for customized and sustainable wheel solutions.

- For instance, ALCOA® Wheels claim weight savings up to 51% when substituting steel wheels, with some models achieving up to 213 kg less weight compared to steel equivalents.

By Vehicle Type

Passenger vehicles represent the largest segment, supported by high production volumes and consumer focus on comfort and aesthetics. Commercial vehicles show steady growth with the expansion of logistics and freight networks, emphasizing strength and longevity in wheel design. Off-highway vehicles account for a niche segment, relying on reinforced materials and structural durability to withstand rough terrains. The North America Automotive Wheel Market benefits from this varied application range, reflecting the region’s manufacturing diversity and vehicle modernization trends.

- For instance, ALCOA®’s forged aluminium wheels for trucks are forged with 8,000-ton presses from single blocks and deliver high mechanical strength with heat treatment.

By End-User

OEMs lead the market due to strong collaborations with automotive manufacturers and adoption of advanced wheel technologies. It experiences growth from factory-fitted wheels that comply with performance and emission standards. The aftermarket segment grows rapidly with customization demand and online sales expansion. Consumers seek aesthetic upgrades, improved performance, and specialized designs, enhancing product turnover. This dual demand from OEM and aftermarket channels sustains long-term market profitability across the region.

Segmentation:

By Material Type:

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Off-Highway Vehicles

By End-User:

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Region:

Regional Analysis:

United States – Market Leader with Strong Manufacturing and Aftermarket Ecosystem

The United States dominates the North America Automotive Wheel Market with over 68% market share in 2024. It benefits from advanced manufacturing infrastructure, technological innovation, and a robust automotive aftermarket network. Automakers emphasize lightweight and high-performance wheels to meet efficiency and emission goals. The country’s premium vehicle segment supports demand for aluminum and carbon fiber wheels. High consumer preference for customization strengthens the aftermarket sector. It also gains from increased electric vehicle adoption, encouraging innovation in wheel materials and aerodynamics. Continuous investment in production facilities and R&D reinforces its leadership in the region.

Canada – Emerging Market with Emphasis on Electric Mobility and Sustainability

Canada accounts for 19% of the regional share, driven by rising electric vehicle sales and supportive government policies. It emphasizes sustainable mobility solutions and local manufacturing efficiency. The market benefits from favorable trade relations and the presence of global automotive suppliers. Canadian wheel manufacturers invest in lightweight materials to enhance fuel economy and durability under diverse weather conditions. Demand for aluminum alloy wheels increases across passenger and commercial vehicles. The North America Automotive Wheel Market in Canada also reflects consumer interest in eco-friendly and corrosion-resistant wheel options. Strategic partnerships between OEMs and local suppliers accelerate market growth.

Mexico – Expanding Production Hub and Export-Oriented Market

Mexico holds around 13% of the regional share, emerging as a major manufacturing and export hub for global automakers. The country’s cost-effective labor and favorable trade agreements attract multinational wheel producers. Mexico’s growing vehicle assembly operations boost OEM demand for steel and aluminum wheels. It benefits from strong integration within North American supply chains, supporting exports to the U.S. and Canada. The aftermarket segment expands with urbanization and rising vehicle ownership. Local producers adopt automation and quality control technologies to meet international standards. The region’s industrial growth positions Mexico as a critical link in the regional automotive wheel value chain.

Key Player Analysis:

- Maxion Wheels

- Accuride Corporation

- Superior Industries International, Inc.

- American Eagle Wheels

- Alcoa Wheels

- MHT Luxury Wheels

- Wheel Pros

- Brixton Forged

- RTX Wheels

- Enkei

Competitive Analysis:

The North America Automotive Wheel Market features a competitive landscape driven by technological innovation, brand reputation, and strategic alliances. Key players such as Maxion Wheels, Accuride Corporation, and Superior Industries International dominate through extensive OEM partnerships and advanced manufacturing capabilities. It emphasizes lightweight materials, corrosion resistance, and design precision to meet evolving consumer and regulatory demands. Companies like Alcoa Wheels and Wheel Pros lead in premium and custom wheel categories, catering to both OEM and aftermarket clients. Continuous investments in R&D, digital distribution, and sustainable manufacturing strengthen competitive positioning. Strategic acquisitions and capacity expansion remain central to maintaining market leadership across the region.

Recent Developments:

- In September 2025, Maxion Wheels launched Maxion FUSION, an innovative hybrid wheel concept developed in collaboration with two original equipment manufacturers (OEMs). The new light vehicle wheel was unveiled at IAA Mobility 2025 and addresses the growing demand from OEMs for affordable, stylish, and sustainable wheel solutions. Additionally, in November 2025, Iochpe-Maxion announced a strategic expansion initiative in South America through a partnership with Polimetal, a leading aluminum wheel manufacturer in Argentina. Through this partnership, Maxion Wheels acquired a 50.1% share in Polimetal, which will enhance service capabilities and increase high-quality aluminum wheel output for customers’ short-term and long-term needs by leveraging global operations and redeploying existing assets.

- In September 2025, Superior Industries shareholders approved the company’s acquisition by a group of term loan investors led by Oaktree Capital Management. The company received shareholder approval on September 15, 2025, and confirmed that all required regulatory approvals for the transaction had been obtained. Superior Industries expected the acquisition to close on or before September 30, 2025. This strategic acquisition represented a significant development for the automotive wheel manufacturer that produces aluminum wheels for the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on material type, vehicle type, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing electric vehicle production will fuel demand for lightweight alloy and carbon fiber wheels.

- OEM partnerships will expand to integrate advanced wheel sensors and digital monitoring systems.

- Sustainable manufacturing using recycled aluminum will gain wider adoption among producers.

- Aftermarket customization will remain a strong revenue stream due to design personalization.

- Technological upgrades in forging and flow-forming will improve wheel strength and efficiency.

- Regional supply chains will localize further to mitigate global material cost fluctuations.

- Increasing investment in R&D will drive innovations in aerodynamics and corrosion resistance.

- Smart connectivity features will emerge as standard in high-end wheel segments.

- Mexico will evolve into a major export base due to manufacturing incentives and cost advantages.

- Competitive intensity will rise as global and regional brands expand their product portfolios.