Market Overview:

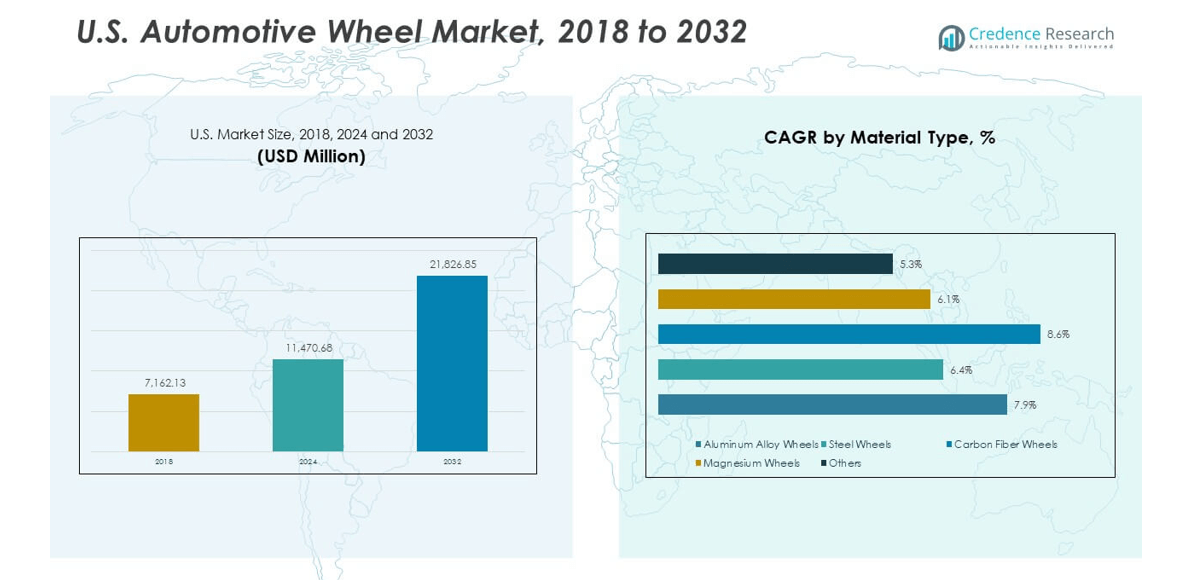

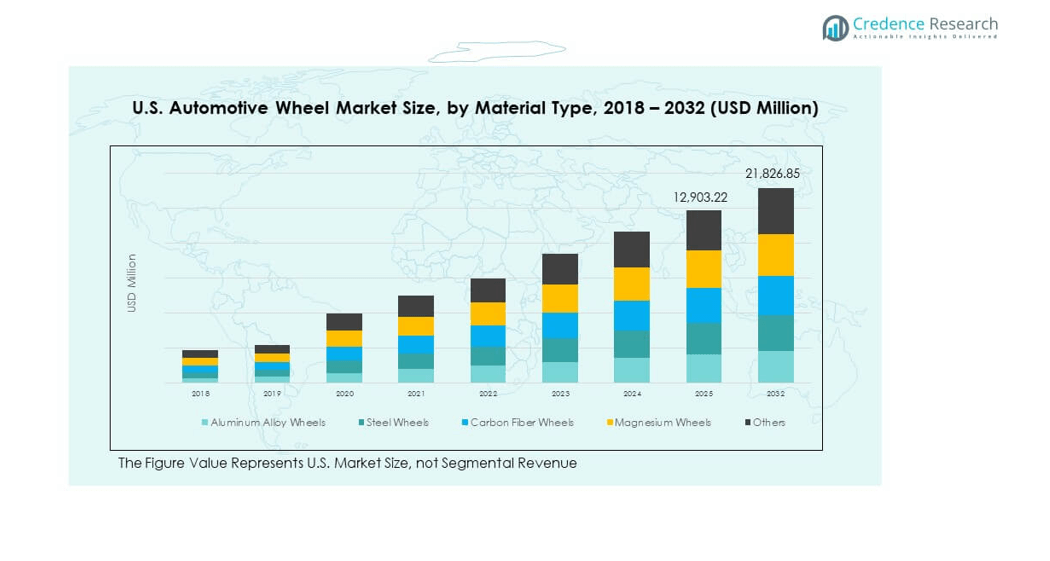

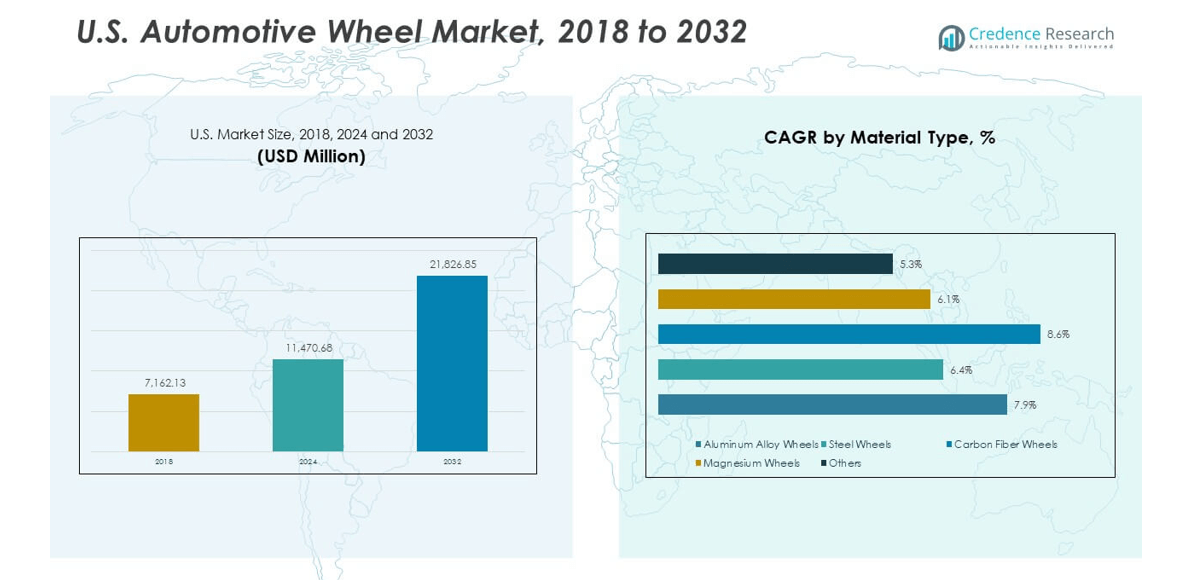

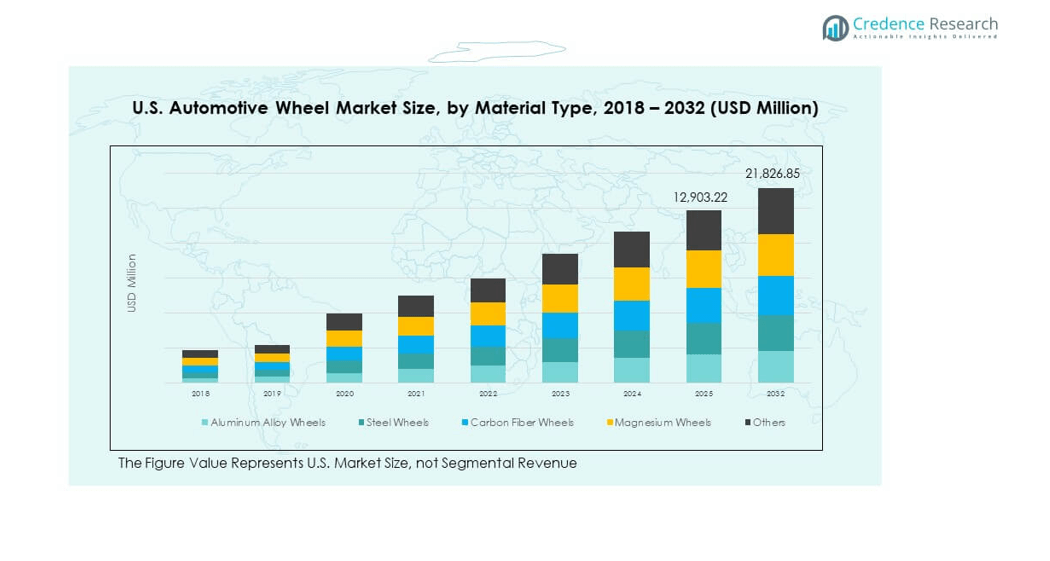

The U.S. Automotive Wheel Market size was valued at USD 7,162.13 million in 2018, grew to USD 11,470.68 million in 2024, and is anticipated to reach USD 21,826.85 million by 2032, at a CAGR of 7.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Automotive Wheel Market Size 2024 |

USD 11,470.68 million |

| U.S. Automotive Wheel Market, CAGR |

7.80% |

| U.S. Automotive Wheel Market Size 2032 |

USD 21,826.85 million |

Market drivers include rising vehicle production in the U.S. and growing demand for aftermarket wheel upgrades, both of which increase wheel unit consumption. Manufacturers actively innovate with lightweight alloys and improved surface treatments to boost vehicle efficiency and aesthetics. Meanwhile, stricter regulatory standards around fuel economy and emissions push automakers to adopt advanced wheel technologies, further accelerating the market.

Regionally, the U.S. market leads North America due to its mature automotive ecosystem and high aftermarket penetration. Emerging regions such as Mexico and parts of Central America offer growth potential as vehicle ownership rises and infrastructure modernises. At the same time, established markets in Western Europe and Asia Pacific hold steady, though U.S.‐based production and consumption remain central to the regional dynamics.

Market Insights:

- The U.S. Automotive Wheel Market was valued at USD 7,162.13 million in 2018, is expected to reach USD 11,470.68 million by 2024, and is projected to grow to USD 21,826.85 million by 2032, with a CAGR of 7.80% during the forecast period.

- North America, particularly the U.S., holds the largest share of the market, driven by its strong automotive manufacturing base and high demand for both OEM and aftermarket wheels. Europe and Asia-Pacific follow, benefiting from significant vehicle production and technological advancements.

- Asia-Pacific is the fastest-growing region, holding a substantial share due to rising vehicle production, increasing consumer demand for premium wheels, and the growing adoption of electric vehicles (EVs) in emerging markets.

- Aluminum alloy wheels dominate the U.S. Automotive Wheel Market, contributing the largest share, followed by steel wheels. These materials are preferred due to their lightweight, durability, and cost-effectiveness, especially in passenger vehicles.

- In terms of revenue, the market is heavily driven by the OEM segment, with aftermarket sales contributing significantly to market growth as consumers seek customization and replacement solutions for wheels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increase in Vehicle Production

The U.S. Automotive Wheel Market is strongly driven by the growing vehicle production in the country. Rising demand for both passenger and commercial vehicles leads to higher wheel consumption. This surge in production has resulted in a steady growth in the market for automotive wheels, as manufacturers seek durable and efficient solutions. Automakers in the U.S. are constantly innovating to meet consumer preferences for safety, performance, and style. As more vehicles are built, the demand for high-quality wheels to meet stringent safety standards rises, boosting the market further.

- For instance, Accuride Corporation’s Henderson, Kentucky facility manufactures over 10,000 heavy‑truck wheels daily, directly linking higher vehicle build rates to increased wheel demand. Rising demand for both passenger and commercial vehicles leads to higher wheel consumption.

Technological Advancements in Wheel Manufacturing

Technological progress in wheel manufacturing has significantly contributed to the U.S. Automotive Wheel Market’s growth. The industry has shifted toward the use of lightweight alloys such as aluminum, reducing vehicle weight and enhancing fuel efficiency. Improved surface treatments like chrome plating and powder coating are becoming more common, offering enhanced durability and aesthetic appeal. These advancements not only improve wheel performance but also reduce overall maintenance costs, making them a preferred choice for manufacturers and consumers alike.

- For example, Maxion Wheels lowered the weight of its commercial‑vehicle steel wheels from 41 kg to 34 kg through its lightweighting programme, showing concrete weight savings. The industry has shifted toward use of lightweight alloys such as aluminum, reducing vehicle weight and enhancing fuel efficiency.

Rising Demand for Aftermarket Wheels

The increasing demand for aftermarket automotive parts and upgrades is another key driver for the U.S. Automotive Wheel Market. Consumers are now more focused on personalizing their vehicles, and wheels are a major component in enhancing the aesthetic value of a car. Aftermarket wheels allow customers to customize their vehicles to their liking, improving vehicle performance and style. This trend is particularly evident in the growing market for luxury vehicles, where aesthetics play a crucial role in the consumer purchasing decision.

Government Regulations and Environmental Impact

Stricter government regulations on fuel economy and emissions are also driving the U.S. Automotive Wheel Market. Automakers must adhere to fuel efficiency standards set by the U.S. Environmental Protection Agency (EPA), leading to an increased demand for lighter, more fuel-efficient wheels. The push toward reducing the carbon footprint of vehicles has led to innovations in wheel design, focusing on materials that contribute to reduced weight and improved aerodynamics. These factors are expected to continue driving the demand for advanced wheels in the automotive sector.

Market Trends:

Shift Toward Lightweight Wheels

One of the prominent trends in the U.S. Automotive Wheel Market is the increasing shift toward lightweight wheels. The need for fuel-efficient vehicles has made lightweight materials, such as aluminum and magnesium, more popular. These materials help reduce the overall vehicle weight, which in turn improves fuel efficiency and reduces emissions. This trend is further bolstered by consumer preference for sleek and stylish designs, as lightweight wheels are also seen as more attractive. Automotive manufacturers are focusing on innovative designs that combine functionality with aesthetics to appeal to a wide range of consumers.

- For instance, Maxion Wheels’ “Reduced Rim Technology” (RRT) uses rim thickness of only 2.15 mm on aluminum wheels, enabling significant weight reduction without sacrificing performance. The need for fuel‑efficient vehicles has made lightweight materials, such as aluminum and magnesium, more popular.

Customization and Personalization

Customization of vehicles, particularly wheels, has become a growing trend in the U.S. Automotive Wheel Market. Consumers are seeking wheels that offer both performance and a unique design, creating opportunities for manufacturers to cater to this demand. Wheel manufacturers are responding with a variety of styles, finishes, and sizes, allowing consumers to create a more personalized driving experience. This trend is especially prevalent among younger, style-conscious buyers who value individuality and customization in their vehicles.

Emerging Interest in Smart Wheels

A new and emerging trend in the U.S. Automotive Wheel Market is the development of smart wheels. These wheels incorporate sensors and embedded technology that can monitor tire pressure, temperature, and overall vehicle performance. The introduction of these advanced wheels reflects the growing interest in connected automotive technologies. The integration of smart wheels with automotive systems offers a more seamless driving experience and opens the door for new innovations in vehicle maintenance and safety.

Advancement in Eco-Friendly Wheels

The trend toward eco-friendly materials in the U.S. Automotive Wheel Market has gained significant traction. Consumers and manufacturers alike are becoming more concerned with sustainability, prompting the development of wheels made from recyclable and environmentally friendly materials. The use of sustainable materials not only helps meet regulatory standards but also appeals to the growing number of eco-conscious consumers. This trend is likely to influence the market for years to come, as the demand for greener vehicles continues to rise.

Market Challenges Analysis:

Rising Raw Material Costs

One of the primary challenges faced by the U.S. Automotive Wheel Market is the increasing cost of raw materials, especially aluminum and steel. The volatility in global commodity prices directly impacts the production cost of wheels, affecting manufacturers’ profit margins. Manufacturers are under pressure to balance cost efficiency with quality, as any increase in raw material costs is often passed on to the consumer. This has made it challenging for manufacturers to maintain competitive pricing in an already price-sensitive market. The need for cost-effective solutions remains a key challenge for market players.

Technological and Production Constraints

Another significant challenge for the U.S. Automotive Wheel Market lies in the limitations of current manufacturing processes. The demand for innovative wheel designs and lightweight materials has pushed manufacturers to invest in advanced production techniques. However, not all manufacturers have access to the necessary technology, which can lead to inefficiencies in production and increased costs. These technological and production constraints could limit the scalability of new product offerings, slowing down the adoption of next-generation wheels in the market.

Market Opportunities:

Expansion in Emerging Markets

The U.S. Automotive Wheel Market presents opportunities for growth through expansion into emerging markets. As global vehicle production continues to rise, manufacturers are looking beyond North America to target regions such as Latin America and Asia-Pacific. These regions are seeing an increase in vehicle sales, especially in countries with growing middle-class populations and improving infrastructure. By expanding their reach into these markets, U.S.-based manufacturers can tap into new customer bases and increase their global footprint, contributing to overall market growth.

Investment in Advanced Wheel Technologies

Investment in advanced wheel technologies also represents a significant opportunity for the U.S. Automotive Wheel Market. With the rising demand for electric vehicles (EVs), automakers are focusing on the development of wheels that can support the unique requirements of electric drivetrains. This includes wheels designed for higher torque, durability, and lightweight construction. Manufacturers that invest in developing these specialized wheels for EVs are well-positioned to capitalize on the growing EV market, which is expected to continue its rapid growth over the coming years.

Market Segmentation Analysis:

By Material Type:

The U.S. Automotive Wheel Market is segmented by material type into aluminum alloy wheels, steel wheels, carbon fiber wheels, magnesium wheels, and others. Aluminum alloy wheels dominate the market due to their lightweight properties, improving fuel efficiency. Steel wheels, on the other hand, are favored for their durability and cost-effectiveness, particularly in commercial vehicle applications. Carbon fiber wheels are gaining traction in the luxury vehicle segment due to their strength and weight reduction capabilities. Magnesium wheels, though niche, are preferred for their ultra-lightweight properties, primarily in high-performance vehicles. Other materials include composite and hybrid wheels, which offer specific advantages in weight, cost, and performance.

- For instance, Maxion’s Reduced Rim Technology lowers rim thickness to 2.15 mm, enabling more efficient aluminum wheels. Carbon fiber wheels are gaining traction in the luxury vehicle segment; for instance Carbon Revolution has sold over 100,000 carbon fiber wheels into OEM programs for brands such as Ferrari and Lamborghini.

By Vehicle Type:

The market is further segmented by vehicle type into passenger vehicles, commercial vehicles, and off-highway vehicles. Passenger vehicles hold the largest share, driven by high demand for both economy and luxury vehicles. Commercial vehicles are a growing segment, as fleet operators seek cost-effective, durable wheel solutions. Off-highway vehicles, including construction and mining vehicles, require specialized wheels designed for tough conditions and heavy loads, fueling demand in this segment.

- For instance, major automakers integrate advanced aluminum wheels early in passenger car platforms to reduce unsprung mass. Off‑highway vehicles—including construction and mining equipment—require specialized wheels designed for heavy loads and tough conditions; for instance, alloy and steel wheel producers develop reinforced rims rated for loads exceeding 10 tons.

By End-User:

The U.S. Automotive Wheel Market is also segmented by end-user, including OEM (Original Equipment Manufacturer) and aftermarket. OEMs dominate, as wheels are a critical component of vehicle manufacturing. The aftermarket segment is growing due to increased consumer interest in vehicle customization and wheel upgrades.

By Distribution Channel:

The distribution channels include online stores, specialty stores, and others. Online stores are increasingly popular, offering convenience and a wide selection. Specialty stores continue to play a significant role in the aftermarket segment, providing tailored solutions for consumers. Other channels include direct sales to large fleet operators and dealerships.

Segmentation:

By Material Type:

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Off‑Highway Vehicles

By End‑User:

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Distribution Channel:

- Online Stores

- Specialty Stores

- Others

Regional Analysis:

U.S. Market Overview

The U.S. Automotive Wheel Market holds a dominant position within North America, contributing significantly to the region’s market share. As the largest consumer of automotive wheels in the region, the U.S. market benefits from a strong vehicle production base and a well-developed aftermarket sector. The demand for high-quality, lightweight wheels, driven by regulatory pressures on fuel efficiency and consumer preferences for design and performance, continues to fuel market growth. The OEM sector is particularly influential, with significant investments in aluminum and alloy wheels. The U.S. also stands out for its innovation in wheel manufacturing, supporting both performance and aesthetic demands.

Regional Trends in the U.S.

The demand for automotive wheels in the U.S. is primarily driven by the increasing production of both passenger and commercial vehicles. This growth is further supported by a shift toward SUVs and electric vehicles (EVs), which require specialized wheel designs. As consumers seek both functional and customizable wheel options, the aftermarket sector has seen significant expansion. U.S. manufacturers are focusing on lightweight materials like aluminum and magnesium, which contribute to improved vehicle efficiency and reduced emissions. These trends are expected to continue as the demand for eco-friendly vehicles rises, driving the need for advanced wheel technologies.

Regional Challenges and Opportunities

The U.S. automotive wheel market faces challenges, including rising raw material costs and supply chain disruptions. Steel and aluminum prices fluctuate, impacting production costs and profit margins. However, opportunities exist in the growing demand for premium wheels, particularly in the luxury vehicle segment. The increasing popularity of electric vehicles (EVs) presents a key growth area, as these vehicles require specialized wheels for better performance. Additionally, the U.S. market’s focus on innovation and adoption of advanced manufacturing processes positions it to benefit from future growth, especially in the premium and electric vehicle wheel segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Automotive Wheel Market is highly competitive, with key players focusing on innovation and strategic partnerships to enhance market share. Major manufacturers such as Accuride Corporation, Superior Industries International, and Maxion Wheels lead the market by offering a wide range of high-quality, durable wheels for various vehicle types. These companies are investing heavily in research and development to meet consumer demands for lightweight, fuel-efficient wheels that comply with stringent environmental regulations. Their focus on innovation, coupled with efforts to expand production capabilities, strengthens their position in the U.S. automotive wheel industry. With increased demand for premium and custom wheels, competition is also intensifying in the aftermarket segment, with new entrants targeting niche customer bases. These competitive dynamics continue to drive technological advancements, cost optimization, and growth within the market.

Recent Developments:

- In November 2025, Iochpe-Maxion announced strategic actions through its wheels business, Maxion Wheels, to address the growing demand for light vehicle aluminum wheels in South America. On November 3, 2025, Iochpe-Maxion’s subsidiary, IOCHPE-MAXION AUSTRIA GMBH, acquired a 50.1% shareholding in Polimetal S.A., a leading aluminum wheel manufacturer based in Argentina, for a total price of $13.5 million. The acquisition aims to drive the expansion of Polimetal’s operations in Argentina, strengthening the company’s ability to meet growing demand for local content. The payment will be made in installments: $3 million upon closing, $3 million by November 2026, and the remaining $7.5 million in subsequent installments. This partnership, combined with the utilization of Maxion’s global operations and the redeployment of existing assets to Brazilian facilities in Santo Andre and Limeira, represents a comprehensive strategy to enhance service levels and high-quality aluminum wheel output for both short-term and long-term customer demands in the Mercosur region.

- In July 2025, Superior Industries International announced that it had entered into definitive agreements to be acquired by a group of its term loan investors, including Oaktree Capital Management. This pivotal transaction involved converting approximately $550 million of term loan claims into 96.5% of the common equity of a new parent company, reducing Superior’s funded debt by nearly 90%—from approximately $982 million to around $125 million. The acquisition received affirmative shareholder approval on September 15, 2025, and all requisite regulatory approvals were obtained. The transaction was expected to close on or before September 30, 2025, after which the company would become privately held. This strategic move aimed to address Superior’s over-leveraged balance sheet and provide a necessary financial foundation to support the company’s long-term success in the global wheel industry.

- In March 2025, Accuride Corporation successfully emerged from its Chapter 11 restructuring process, marking a significant transformation for the company. Through this restructuring, Accuride equitized over $400 million of funded debt and restructured approximately $170 million of additional obligations. The company received substantial new investment from its existing investors, including a $70 million asset-based lending facility and a $95+ million exit facility, designed to strengthen liquidity and support long-term growth. As part of this restructuring, the company’s lenders—including KKR, Caspian, and accounts managed by Guggenheim Partners Investment Management and its affiliates—became Accuride’s new owners. With this successful emergence, Geoff Bruce was appointed as Interim CEO, succeeding Robin Kendrick, who transitioned to a director role on Accuride’s reconstituted Board. The company is now positioned for long-term growth with a focused strategy on its core North American wheels segment, leveraging its strong market position and innovation capabilities.

Report Coverage:

The research report offers an in-depth analysis based on material type, vehicle type, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for lightweight wheels will increase as automakers focus on fuel efficiency.

- Innovations in wheel material technologies will drive product differentiation.

- The expansion of electric vehicle production will lead to new wheel requirements.

- The aftermarket segment will grow with rising vehicle customization trends.

- Advancements in smart wheel technologies will become more prevalent.

- Environmental regulations will continue to impact the materials used in wheel manufacturing.

- The market will see stronger growth in premium wheels for luxury and performance vehicles.

- Automation in wheel manufacturing will improve production efficiency and reduce costs.

- Increasing consumer awareness of sustainability will push demand for eco-friendly wheels.

- Strategic mergers and acquisitions will intensify as companies seek to expand their capabilities and market reach.