Market Overview:

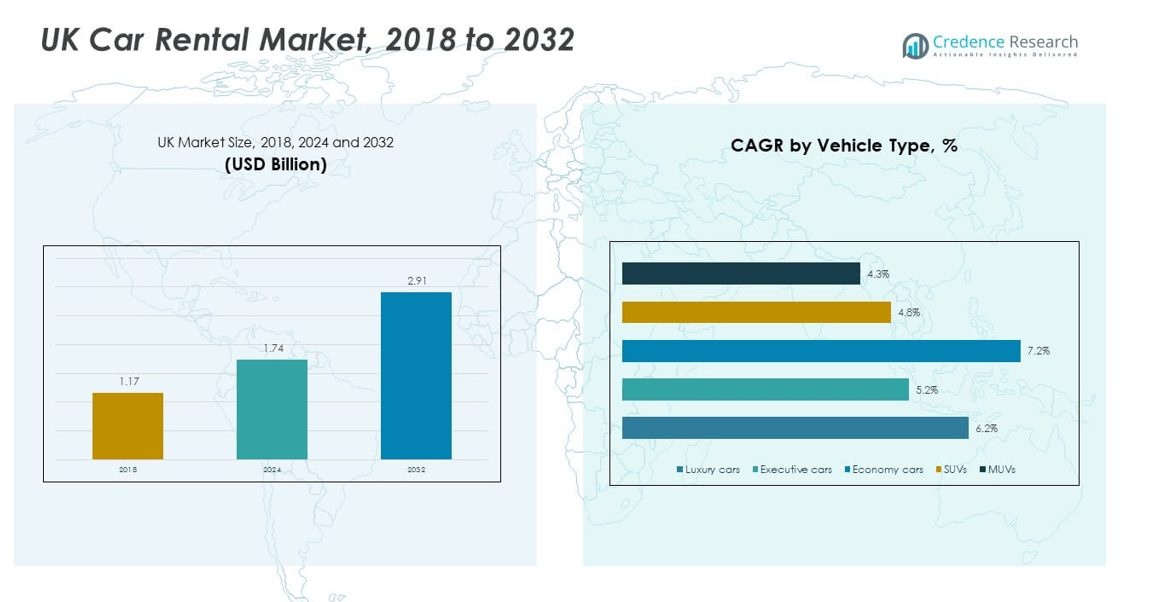

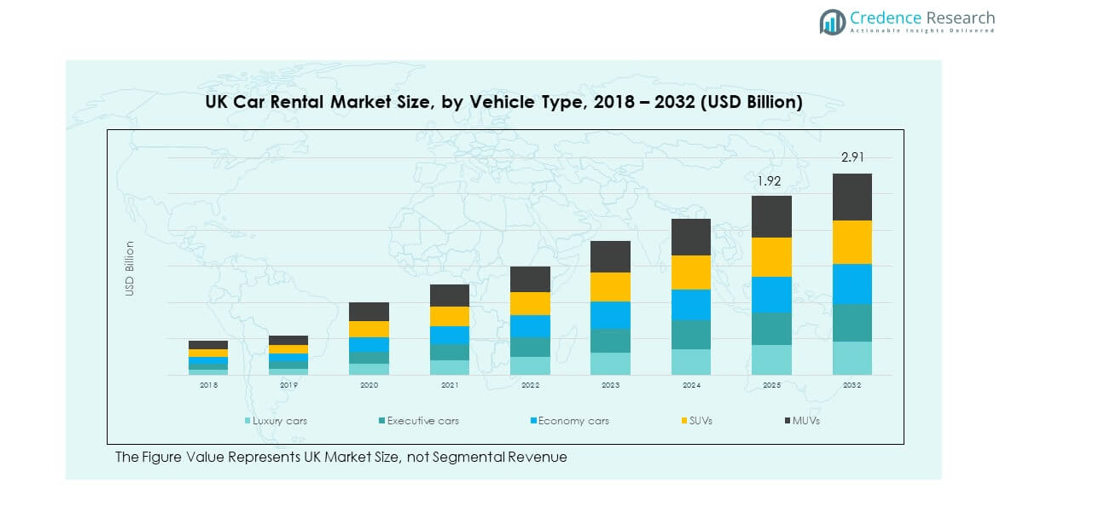

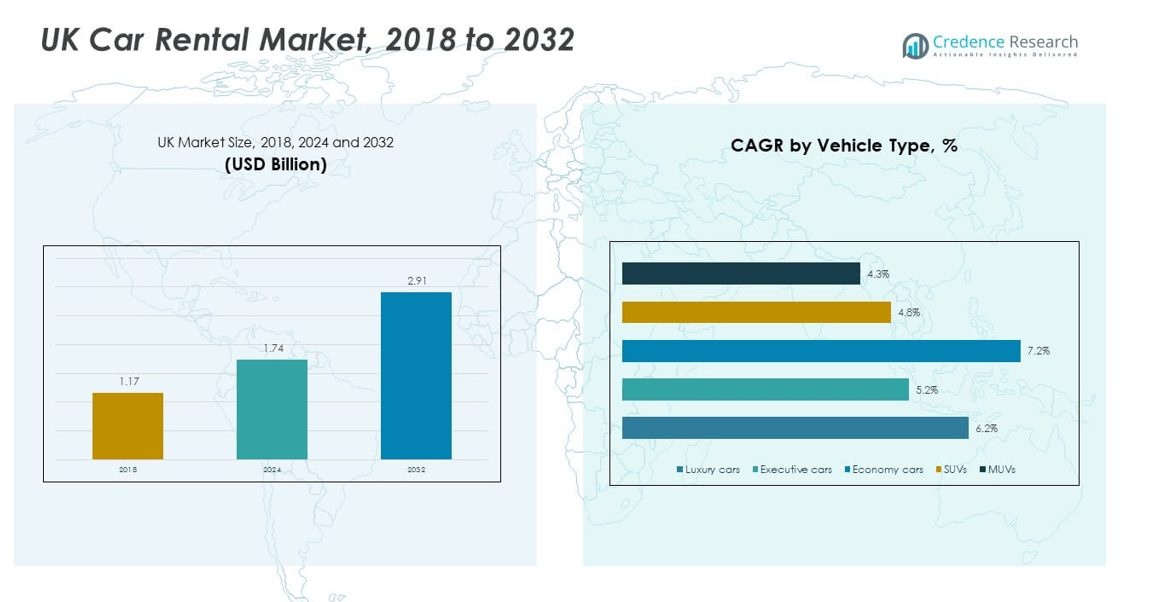

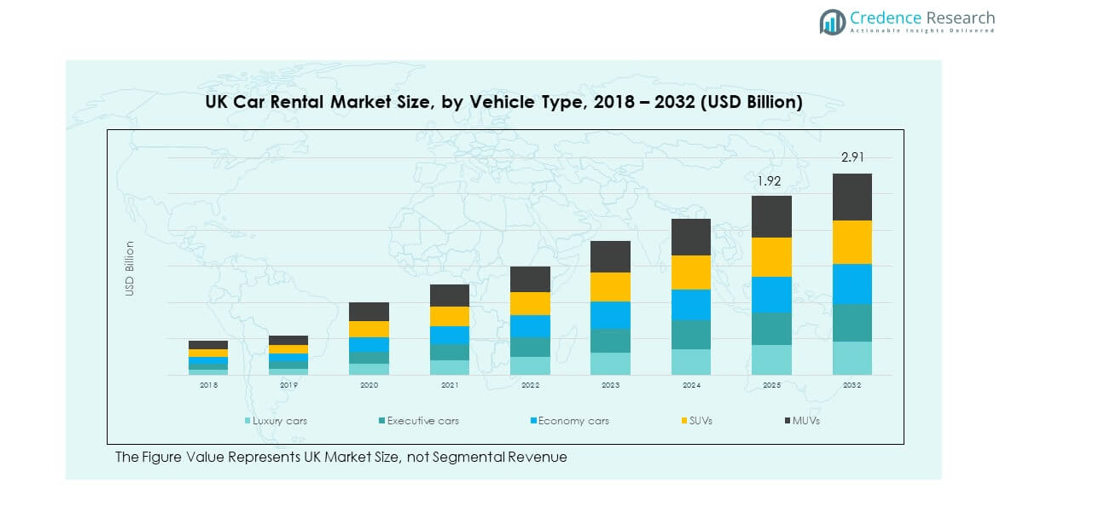

The UK Car Rental Market size was valued at USD 1.17 billion in 2018, grew to USD 1.74 billion in 2024, and is anticipated to reach USD 2.91 billion by 2032, at a CAGR of 6.15 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Car Rental Market Size 2024 |

USD 1.74 billion |

| UK Car Rental Market, CAGR |

6.15% |

| UK Car Rental Market Size 2032 |

USD 2.91 billion |

Growth is being driven by increasing tourism, rising demand for flexible mobility solutions and the shift away from vehicle ownership. Rental firms actively adapt by expanding short‑term offerings and embracing digital bookings to capture younger, tech‑savvy customers. Environmental factors also push expansion as fleets incorporate hybrids and EVs to meet sustainability goals and appeal to eco‑conscious renters.

Regionally, England remains the dominant market within the UK thanks to high tourism volumes in London and major airports such as Heathrow and Gatwick. Scotland and Wales are emerging as growth areas due to increasing domestic travel and rural rental demand. Northern Ireland, while smaller, is gaining traction as improved connectivity and rental services expand beyond major urban centres.

Market Insights:

- The UK Car Rental Market size was valued at USD 1.17 billion in 2018, expected to reach USD 1.92 billion by 2024, and projected to grow to USD 2.91 billion by 2032, with a CAGR of 6.15%.

- England holds the largest market share at around 70%, followed by Scotland and Wales at 20%, and Northern Ireland at 10%, with England dominating due to its major urban centers and tourism traffic.

- The fastest-growing region is Scotland and Wales, with a 20% market share, driven by growing domestic travel, scenic tourism, and rising rental demands in rural and regional areas.

- The Economy Cars segment held the largest share in 2024, contributing significantly to the UK Car Rental Market, followed by SUVs and Executive Cars.

- By 2032, MUVs and SUVs are expected to show the highest growth, supported by increasing demand for versatile, space-efficient vehicles for both leisure and business travel.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Tourism and Business Travel

The growth of the UK Car Rental Market is driven by the increasing influx of international and domestic tourists. Popular tourist destinations like London, Edinburgh, and Manchester contribute to this demand. The rise in business travel further supports this trend, as companies prefer car rentals for greater flexibility and convenience. Rental services offer a seamless option for business professionals attending meetings, conferences, and corporate events. The availability of rental vehicles enables tourists and professionals alike to navigate the country efficiently, further boosting the market’s potential.

- For instance, car rental companies in the UK, including major players like Hertz, experienced increased demand during major events like the London 2012 Olympics, which attracted millions of visitors. News reports from the time advised visitors to book their car hire early to avoid disappointment, indicating a significant surge in demand.

Shift Toward Flexible Mobility Solutions

There is a noticeable shift from vehicle ownership to flexible mobility options. Consumers are increasingly preferring rental vehicles over long-term commitments such as purchasing or leasing a car. This trend is driven by the convenience of renting a car for specific needs like travel, leisure, or business trips, without the burden of maintenance and ownership costs. The growth of shared mobility solutions such as car-sharing services is also playing a role in changing mobility preferences. This shift is expected to support sustained demand for car rental services.

- For instance, Sixt SE has capitalized on this trend by offering its car-sharing service, Sixt Share, which allows customers to rent cars by the hour, offering a flexible solution for those who need a vehicle for short-term use.

Environmental Awareness and Sustainability Initiatives

The rise in environmental awareness has encouraged rental companies to offer more eco-friendly options, such as hybrid and electric vehicles (EVs). The UK government’s push for greener transport options aligns with this trend, with policies supporting sustainability and carbon reduction. This trend also aligns with the increasing consumer demand for green alternatives in transportation. As car rental companies adopt more sustainable practices, it strengthens the market’s appeal among environmentally conscious customers.

Technological Advancements in Rental Processes

Advancements in technology are enhancing the rental experience and fueling market growth. The proliferation of mobile apps, online booking platforms, and digital payment methods has made renting cars more convenient and efficient. Customers can now book vehicles on-the-go, select their preferred car models, and complete payments seamlessly. These innovations are improving the customer experience, driving greater demand for car rentals in the UK market.

Market Trends:

Rise in Electric Vehicle (EV) Rentals

The UK Car Rental Market is witnessing a significant trend toward electric vehicle (EV) rentals. The increasing focus on reducing carbon emissions is driving rental companies to expand their EV fleets. Customers are more inclined to opt for EVs, as they align with their eco-conscious preferences. In response, car rental companies are introducing a broader range of EV models to meet this demand. This trend not only supports environmental goals but also caters to the growing consumer interest in electric mobility, paving the way for EVs to become a mainstream choice in the rental sector.

- For instance, Enterprise Rent-A-Car UK added over 300 electric vehicles to its fleet in 2023, responding to the growing demand for eco-friendly travel options. Customers are more inclined to opt for EVs, as they align with their eco-conscious preferences. In response, car rental companies like Hertz UK and Sixt SE are introducing a broader range of EV models, such as the Tesla Model 3 and Nissan Leaf, to meet this demand.

Integration of Artificial Intelligence (AI) in Rental Operations

AI and machine learning are becoming integral to the operations of car rental companies. AI is being used for predictive maintenance, route optimization, and fleet management, enabling rental companies to enhance operational efficiency. Additionally, AI-powered chatbots and virtual assistants are being incorporated into customer service to provide real-time assistance and streamline the booking process. The use of AI helps rental firms provide better services while reducing operational costs, making the UK Car Rental Market more competitive.

- For instance, Avis UK has integrated AI-based algorithms to manage its fleet in real-time, allowing it to predict demand surges and adjust pricing accordingly. Additionally, AI-powered chatbots and virtual assistants are being incorporated into customer service to provide real-time assistance and streamline the booking process.

Expansion of Car-Sharing Services

Car-sharing services are rapidly expanding across the UK, offering customers a more flexible and cost-effective alternative to traditional rentals. With the rise of apps like Zipcar and Enterprise CarShare, individuals can rent cars by the hour or day without the long-term commitment of ownership. This model caters to younger consumers and urban dwellers who prefer short-term access to vehicles. As more consumers embrace car-sharing services, the demand for such services is expected to increase, contributing to the growth of the UK Car Rental Market.

Partnerships and Collaborations for Fleet Expansion

Car rental companies are increasingly forming partnerships with automotive manufacturers, ride-sharing platforms, and technology providers to expand their fleets and improve service offerings. These collaborations allow rental firms to diversify their fleet by introducing more electric vehicles, luxury models, and specialized vehicles. By collaborating with ride-sharing companies, car rental firms are also tapping into a new market segment, where customers can use their rental cars for both personal and business purposes. These partnerships are expected to boost market growth by expanding rental options and improving accessibility.

Market Challenges:

Intense Competition and Price Sensitivity

The UK Car Rental Market faces intense competition from both traditional rental companies and new entrants offering alternative mobility solutions. The increasing availability of car-sharing services, along with the introduction of ride-hailing apps like Uber and Lyft, is putting pressure on traditional rental services. Rental companies must continuously innovate to stay competitive by offering better pricing, more convenient services, and an extensive fleet. Price sensitivity among customers also adds to the challenge, as consumers seek value for money, which limits the profitability of rental firms.

Regulatory and Compliance Issues

The UK Car Rental Market is subject to numerous regulatory and compliance requirements, including safety standards, environmental regulations, and insurance laws. Rental companies must navigate these complex regulations, which can lead to increased operational costs. Stricter emissions regulations are also pushing companies to transition to cleaner vehicles, requiring significant investment in new fleets. Adapting to these regulatory demands can be challenging for rental companies, especially smaller firms that may not have the financial resources to keep up with these changes.

Market Opportunities:

Growing Demand for Short-Term Rentals

The increasing demand for short-term rentals presents a significant opportunity for the UK Car Rental Market. As consumers continue to move away from long-term car ownership, the preference for short-term rental solutions is expected to rise. Business professionals, tourists, and local customers are all seeking flexible rental options that allow them to access vehicles as needed, without the commitment of owning a car. Rental companies can capitalize on this opportunity by expanding their short-term rental offerings, thus capturing a larger share of the market.

Expansion of Digital and Contactless Services

The growth of digital and contactless services offers substantial opportunities for the UK Car Rental Market. Customers are increasingly expecting seamless and contactless rental experiences, from booking and payment to vehicle pickup and drop-off. By investing in digital platforms and contactless check-ins, rental companies can enhance customer satisfaction and streamline their operations. This trend also caters to health and safety concerns, which have been particularly relevant post-pandemic. Car rental companies can leverage digital services to improve efficiency and attract a tech-savvy customer base.

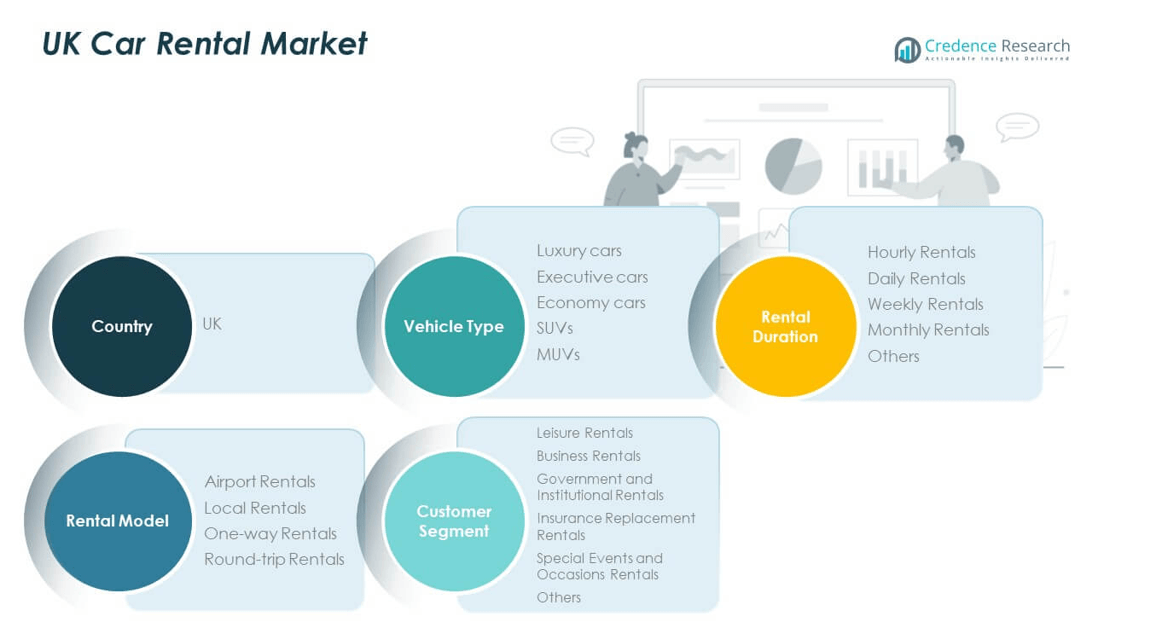

Market Segmentation Analysis:

Vehicle Type Segment:

The UK Car Rental Market offers a diverse range of vehicle types to cater to varying customer needs. Luxury cars are preferred for high-end business travel and leisure, offering premium comfort and performance. Executive cars are popular for corporate rentals, combining style and practicality. Economy cars dominate the market due to their affordability and fuel efficiency, making them ideal for budget-conscious consumers. SUVs and MUVs are gaining popularity, particularly for families and travelers seeking more space and versatility for longer trips.

- For example, Sixt SE’s luxury fleet includes top-tier brands like Mercedes-Benz and BMW, designed for corporate clients and premium leisure travelers. Executive cars are popular for corporate rentals, combining style and practicality. Enterprise Rent-A-Car UK has seen growing demand for these vehicles, especially among business professionals.

Rental Duration Segment:

The demand for hourly rentals is growing, driven by customers who need flexibility for short trips. Daily rentals remain the most popular option for tourists and business professionals seeking a car for a few days. Weekly rentals are often favored by customers needing a vehicle for extended trips or vacations. Monthly rentals cater to business professionals or long-term visitors who require a vehicle for extended periods. Other rental durations, such as long-term and subscription-based models, are also emerging in the UK market.

- For instance, Sixt SE introduced its “Sixt Share” car-sharing service, allowing customers to rent vehicles by the minute, hour, or day in specific markets, such as Germany (cities like Berlin, Hamburg, and Munich) and the Netherlands (cities like Amsterdam, Rotterdam, The Hague, and Utrecht). While Sixt is expanding its general car rental network in the UK, its primary UK operations focus on traditional daily, weekly, and monthly rentals of cars and vans.

Rental Model Segment:

Airport rentals are a key segment in the UK Car Rental Market, as airports remain major hubs for both tourists and business travelers. Local rentals cater to customers needing a vehicle within city limits for short-term purposes. One-way rentals are increasingly sought after for road trips and travel flexibility. Round-trip rentals are ideal for customers looking to explore a region and return to the starting point.

Customer Segment:

Leisure rentals dominate as tourists and individuals seek vehicles for personal trips. Business rentals cater to corporate clients who require vehicles for professional purposes. Government and institutional rentals support public sector organizations. Insurance replacement rentals are necessary for customers whose vehicles are being repaired or replaced. Special events and occasions rentals cater to weddings, parties, and other significant events. Other customer segments include long-term and fleet rentals.

Segmentation:

By Vehicle Type Segment:

- Luxury Cars

- Executive Cars

- Economy Cars

- SUVs

- MUVs

By Rental Duration Segment:

- Hourly Rentals

- Daily Rentals

- Weekly Rentals

- Monthly Rentals

- Others

By Rental Model Segment:

- Airport Rentals

- Local Rentals

- One-way Rentals

- Round-trip Rentals

By Customer Segment:

- Leisure Rentals

- Business Rentals

- Government and Institutional Rentals

- Insurance Replacement Rentals

- Special Events and Occasions Rentals

- Others

By Country Segment:

- UK Car Rental Market (volume and revenue share by country, vehicle type, rental duration, rental model, customer segment)

Regional Analysis:

England Region

The UK Car Rental Market in England holds the largest regional share, estimated at around 70 % of national revenue. It generates strong demand through major airports, metropolitan travel hubs and high tourist footfall. Business travel and corporate leasing remain concentrated in London and the South East, supporting premium segment rentals. Urban commuters and regional holidaymakers also contribute significantly. Rental operators in this region optimise fleets and services for high utilisation and dynamic pricing. Competitive pressure remains intense, driving innovation in digital booking and loyalty programmes.

Scotland and Wales Region

Scotland and Wales collectively account for approximately 20 % of the UK rental market share. These regions attract more leisure and domestic travel bookings, driven by scenic routes and holiday destinations. Operators focus on economy and SUV segments to suit local preferences and longer rental durations. Seasonality affects demand more in these regions than in England, prompting flexible pricing. Rental firms invest in branch network expansion and partnerships with regional tourism boards. Growth potential remains strong due to rising stay‑cation trends and mobility of remote workers.

Northern Ireland Region

Northern Ireland contributes roughly 10 % of the total market share in the UK car rental business. Market activity centres on airport pickups and regional road trips, with fewer corporate accounts than in mainland UK. Fleet composition tends toward economy and one‑way rentals, driven by inter‑island travel needs and tourism. Infrastructure limitations and fewer large‑scale airports restrict scale but also offer niche opportunities. Rental providers in Northern Ireland emphasise local customer service and partnerships with travel agencies. Emerging mobility models may further stimulate growth in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK Car Rental Market is highly competitive, with key players offering diverse services to meet evolving customer needs. Leading companies like Enterprise Rent-A-Car, Hertz UK, and Europcar UK dominate, focusing on a broad fleet range that includes luxury, economy, and electric vehicles. New entrants and local players are leveraging niche offerings, such as eco-friendly car rentals and tech-enabled services. Strategic alliances and technology adoption are reshaping the competitive landscape. Companies are enhancing customer experience through digital platforms, loyalty programs, and improved service offerings. Operational efficiency remains key for market leaders, particularly in managing fleet size and pricing flexibility to meet demand.

Recent Developments:

- In June 2025, Enterprise Rent-A-Car UK secured a significant partnership with the National League, becoming its title sponsor. The agreement, which commenced in June 2025, granted Enterprise naming rights to the National League and its three divisions – the Enterprise National League, Enterprise National League North, and Enterprise National League South.

- In August 2025, Hertz Global announced a strategic partnership with Amazon, marking a significant expansion of its retail operations. On August 20, 2025, Hertz Car Sales launched on Amazon Autos, allowing shoppers to browse, finance, and purchase from thousands of high-quality pre-owned vehicles through Amazon’s marketplace.

Report Coverage:

The research report offers an in-depth analysis based on vehicle types, rental models, customer segments, and regional dynamics. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Car Rental Market will see increasing adoption of electric and hybrid vehicles.

- Rental companies will continue focusing on providing flexible, short-term rentals to meet changing consumer preferences.

- Car-sharing services will rise as a competitive alternative to traditional rentals.

- Digital platforms and mobile apps will enhance customer experience, enabling easier bookings and payments.

- Growing demand for luxury and executive car rentals will cater to business professionals.

- Partnerships between car rental firms and ride-sharing companies will expand.

- Government policies supporting green transport will accelerate the fleet transition to EVs.

- Sustainable business practices will be a key differentiator for market players.

- Increasing tourism will continue to drive demand for car rentals, especially in major cities.

- Regulatory challenges around emissions will influence rental fleets and business operations.