Market Overview:

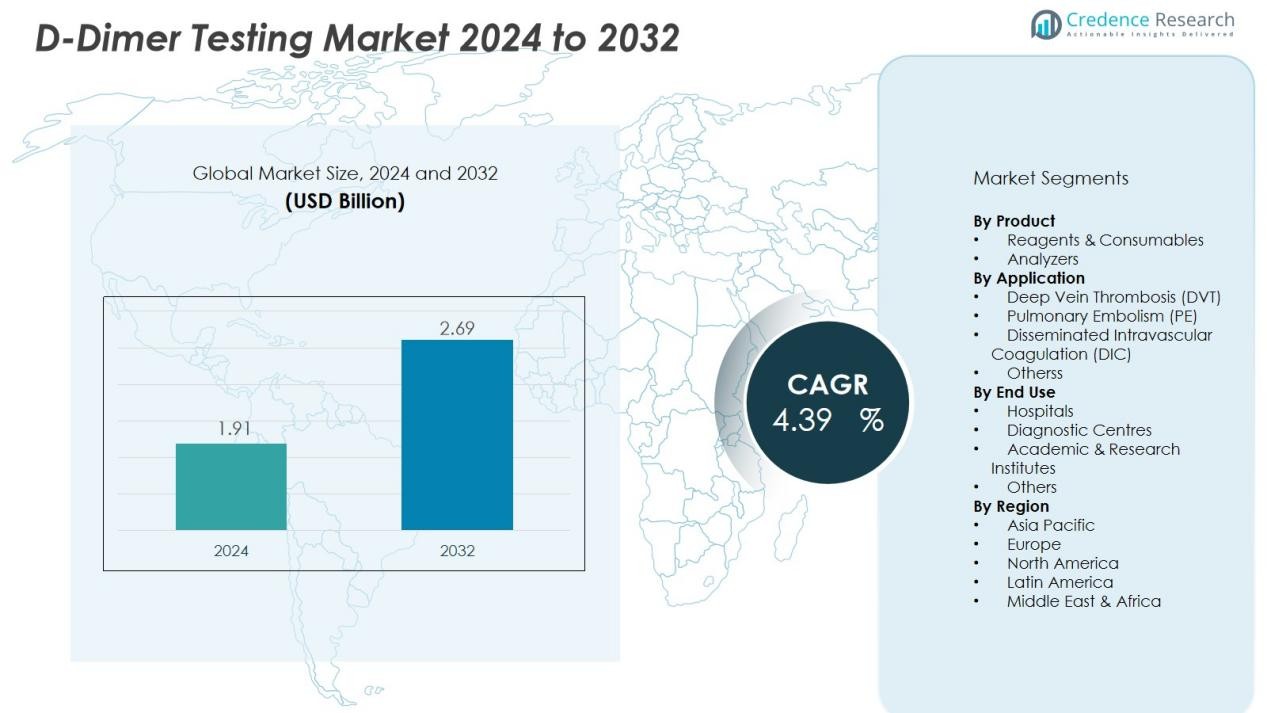

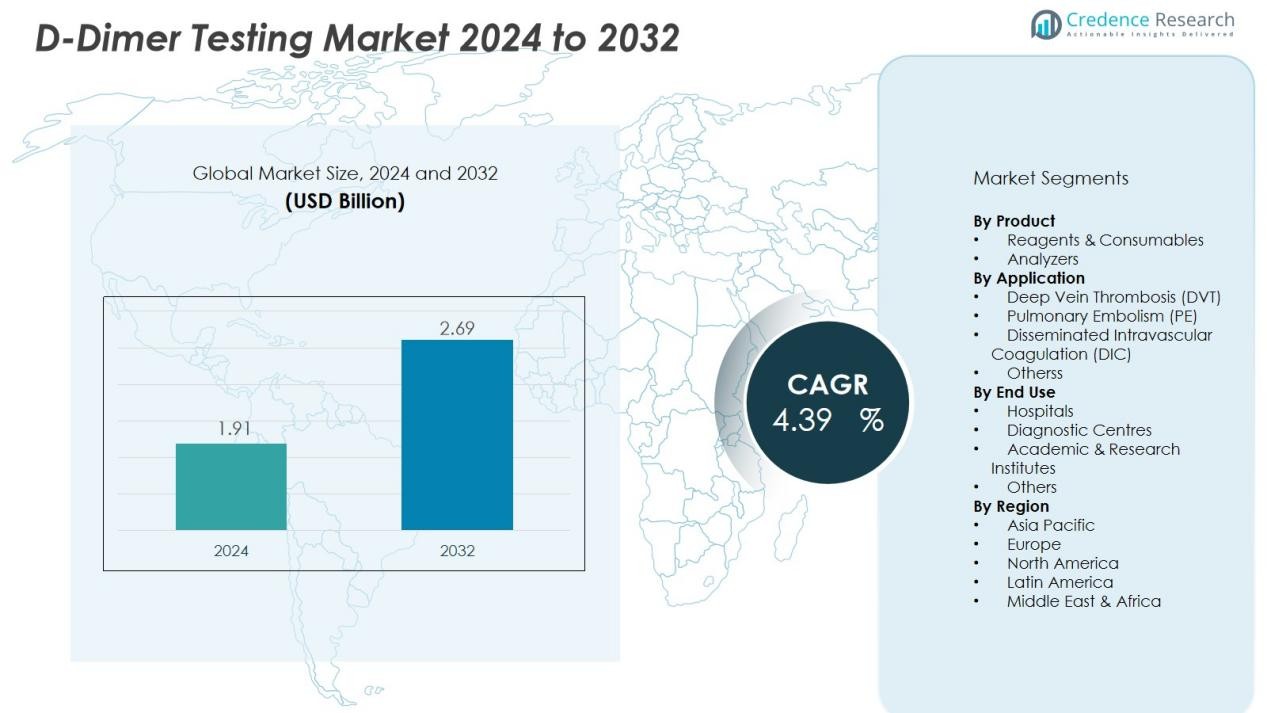

The D-Dimer Testing Market size was valued at USD 1.91 billion in 2024 and is anticipated to reach USD 2.69 billion by 2032, at a CAGR of 4.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| D-Dimer Testing Market Size 2024 |

USD 1.91 Billion |

| D-Dimer Testing Market, CAGR |

4.39% |

| D-Dimer Testing Market Size 2032 |

USD 2.69 Billion |

The market is being driven by several key factors. Firstly, the rising prevalence of thrombotic disorders, including deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC), is increasing the demand for D‑dimer testing. Technological advancements, particularly the shift toward point‑of‑care (POC) testing solutions, have made D‑dimer assays more accessible and quicker, facilitating wider usage. Additionally, the aging global population, along with greater diagnostic awareness and a growing need for non-invasive screening methods, further boosts market growth.

Regionally, North America holds the largest share of the D‑dimer testing market, driven by advanced healthcare infrastructure, a high incidence of cardiovascular diseases, and favorable reimbursement policies. The Asia-Pacific region is expected to experience the fastest growth, spurred by increased healthcare access, rising disease burdens, and the adoption of diagnostic technologies in emerging markets. Europe maintains a strong presence due to its well-established healthcare systems and comprehensive clinical guidelines for thrombosis management.

Market Insights:

- The D-Dimer Testing Market size was valued at USD 1.91 billion in 2024 and is expected to reach USD 2.69 billion by 2032, growing at a CAGR of 4.39% during the forecast period.

- North America holds the largest share of 33.8% due to advanced healthcare infrastructure, a high prevalence of cardiovascular diseases, and strong reimbursement policies. Europe follows with a solid presence, driven by structured healthcare systems and comprehensive clinical guidelines for thrombosis management.

- The Asia-Pacific region is the fastest-growing, with a share of 22.1% in 2020, supported by expanding healthcare access, rising disease burdens, and growing adoption of diagnostic technologies in emerging markets.

- In 2024, reagents and consumables accounted for 65.1% of the D-Dimer Testing Market, while analyzers are expected to see significant growth as laboratories upgrade their testing platforms and seek high-throughput solutions.

- The market by application is dominated by deep vein thrombosis (DVT), which leads the share due to the high incidence of venous thromboembolism and its established role in diagnosis and exclusion of DVT.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Prevalence of Thrombotic Disorders Fuels Demand for D-Dimer Testing

The rising global incidence of thrombotic disorders such as deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC) significantly drives the D-Dimer Testing Market. These conditions necessitate efficient and timely diagnosis, which D-Dimer testing facilitates through non-invasive and cost-effective measures. The increasing prevalence of these disorders, particularly in aging populations, increases the need for regular diagnostic screenings and tests.

- For instance, Siemens Healthineers’ INNOVANCE D-Dimer assay demonstrates a validated negative predictive value of ≥99.5% for excluding DVT and PE using a cut-off of 0.5 mg/L FEU, evaluated across 24 sites and more than 3,300 patient samples (1,834 suspected PE cases and 1,539 DVT cases).

Technological Advancements Enhance Accessibility and Efficiency

Technological innovations in the D-Dimer Testing Market contribute to the accessibility and efficiency of diagnostics. The transition toward point-of-care (POC) testing devices improves turnaround times and makes testing more accessible outside of traditional clinical environments. Newer, user-friendly devices provide real-time results, reducing delays in diagnosis and enhancing patient outcomes, thereby encouraging widespread adoption.

- For instance, Roche’s cobas h 232 POC system delivers D-dimer test results in as little as 8 minutes, enabling rapid clinical decision-making in emergency and outpatient settings.

Growing Awareness and Adoption of Non-Invasive Diagnostic Methods

Growing awareness of the benefits of non-invasive diagnostic methods boosts the demand for D-Dimer testing. Healthcare professionals and patients increasingly seek alternatives to invasive procedures for thrombotic condition detection. The ability of D-Dimer tests to provide rapid, reliable results with minimal discomfort supports its widespread use in both clinical and outpatient settings, further expanding its market presence.

Regulatory Support and Reimbursement Policies Strengthen Market Growth

Regulatory support and favorable reimbursement policies enhance the accessibility and affordability of D-Dimer tests. In many regions, governments and insurance companies provide coverage for these tests due to their diagnostic value in managing thrombotic diseases. This financial support reduces barriers for healthcare providers and patients, driving the growth of the D-Dimer Testing Market.

Market Trends:

Increased Adoption of Point‑of‑Care Testing Platforms

The D‑Dimer Testing Market shows a marked shift toward point‑of‑care (POC) platforms that deliver rapid diagnostics outside traditional laboratory environments. It enables clinicians to obtain results quickly, reducing patient wait times and facilitating faster clinical decisions. Near‑patient testing units support deployment in emergency departments, outpatient clinics and remote settings, helping to expand testing reach. Many manufacturers now integrate POC assays for D‑dimer with user‑friendly interfaces and minimal sample preparation. The trend reflects growing demand for decentralised diagnostics and supports broader uptake of D‑dimer testing solutions.

- For Instance, Radiometer’s AQT90 FLEX immunoassay analyzer provides quantitative D-dimer results in under 21 minutes using a closed tube system, allowing for up to 30 samples per hour throughput in emergency departments. All other technical specifications mentioned are accurate.

Expansion of Test Applications and Integration with Digital Diagnostics

The D‑Dimer Testing Market also reflects a trend toward broader clinical applications and enhanced diagnostic workflows that integrate digital analytics. It now encompasses uses beyond classic venous thromboembolism (VTE) exclusion, including monitoring of coagulopathy in infectious diseases and peri‑operative risk stratification. Diagnostic providers increasingly embed D‑dimer testing into multi‑marker panels and clinical decision‑support systems that leverage data analytics for better outcome prediction. Automation in reagents, assay platforms and result interpretation improves throughput and reliability. The expansion into new clinical segments and digital diagnostic pathways positions the market for sustained relevance amid evolving healthcare demands.

- For Instance, Roche Diagnostics’ cobas® t 511/711 analyzers removes an unverified percentage claim while highlighting features like fully automated D-dimer testing, integration into electronic health records, and Walk-Away Reagent Management (WARM) technology designed to reduce user and manual handling errors.

Market Challenges Analysis:

High Incidence of False‑Positives and Limited Diagnostic Specificity

The D‑Dimer Testing Market faces a challenge with the high sensitivity but low specificity of D‑dimer assays. Elevated D‑dimer levels can be seen in various conditions unrelated to thrombotic disorders, such as infection, pregnancy, surgery, or malignancy, complicating accurate diagnosis. This results in a higher incidence of false‑positive readings, which require further imaging or diagnostics to confirm the presence of thrombotic events. The need for additional tests increases healthcare costs and delays patient management, limiting the test’s efficiency and value in clinical settings. Consequently, this reduces clinician confidence in D‑dimer testing as a stand-alone diagnostic tool.

Infrastructure Gaps and Variable Regulatory Environment Curtail Wider Uptake

The broader adoption of D‑dimer testing is also hindered by gaps in healthcare infrastructure, particularly in under-resourced regions. Many areas face challenges related to insufficient diagnostic equipment, lack of trained personnel, and inconsistent standardisation of assay protocols. These issues undermine the reliability and effectiveness of D‑dimer testing, particularly in emerging markets. Furthermore, regulatory complexities and varying reimbursement policies across different regions slow down the approval of new test kits and limit access to advanced diagnostic solutions. These structural barriers restrict the widespread implementation of D‑dimer testing and delay its integration into more decentralized healthcare environments.

Market Opportunities:

Expansion into Emerging Markets with Growing Healthcare Infrastructure

The D‑Dimer Testing Market presents significant opportunity in regions where healthcare infrastructure is improving and diagnostic awareness remains low. Emerging economies in Asia‑Pacific, Latin America and parts of Africa show increasing investment in hospital and clinic diagnostics, making it possible to introduce D‑dimer testing into previously under‑served settings. It enables healthcare providers to leverage the test for early detection of thrombotic disorders, particularly where imaging resources are constrained. By targeting these geographies, manufacturers and service providers can tap into new patient populations and establish early partnerships with local healthcare networks. The projected growth in test utilization within these regions underscores both untapped volume potential and the prospect for market share expansion.

Development of High‑Sensitivity Assays and Integration into Multimarker Diagnostic Suites

A further opportunity lies in advancing assay technology and positioning D‑dimer testing within broader diagnostic workflows. Patients with cardiovascular diseases, cancer‑associated thrombosis or COVID‑19‑related coagulopathy increasingly require precise monitoring, which drives demand for highly sensitive and specific D‑dimer assays. It opens a pathway for test developers to integrate D‑dimer with complementary biomarkers, decision‑support software or point‑of‑care platforms that deliver fast results and better risk stratification. By enhancing test accuracy and clinical utility, providers can justify premium pricing and drive adoption in premium healthcare settings. The convergence of diagnostics, digital analytics and patient‑management solutions positions the market for innovation‑led growth.

Market Segmentation Analysis:

By Product

In the product segment of the D‑Dimer Testing Market, two primary categories dominate: reagents & consumables and analyzers. Reagents & consumables hold the major share, owing to their repeated usage in routine diagnostics and wide deployment in clinical laboratories. Analysts report that this segment accounted for approximately 65.1% of the market in 2024. The analyzers segment, however, is poised for accelerated growth as laboratories upgrade platforms and providers seek automation and high‑throughput solutions. Adoption of advanced systems is expanding the opportunity set for analyzer manufacturers and service providers.

- For Instance, The Beckman Coulter UniCel DxI 800 immunoassay analyzer performs up to 400 tests per hour using chemiluminescent detection technology.

By Application

When analysing by application, the market subdivides into major clinical areas including deep vein thrombosis (DVT), pulmonary embolism (PE) and disseminated intravascular coagulation (DIC). The DVT segment leads in revenue share, reflecting the high incidence of venous thromboembolism and the established clinical role of D‑dimer assays for exclusion of DVT. It dominates in part because clinicians rely on these tests to rule out thrombotic events and trigger imaging only when required. The PE and DIC segments remain significant and show strong growth potential due to increasing awareness of clot‑related conditions and enhanced diagnostic workflows.

- For Instance, Roche Diagnostics’ cobas t 711 analyzer, using the Tina-quant D-Dimer Gen. 2 assay, is effective at ruling out pulmonary embolism (PE) cases, particularly when combined with clinical pre-test probability scores.

By End Use

The end‑use segmentation covers hospitals, diagnostic centres, academic & research institutes and others. The hospitals segment commands the largest share within the D‑Dimer Testing Market, driven by large patient volumes, emergency‑care settings and comprehensive diagnostic infrastructure. Hospitals routinely deploy D‑dimer testing in emergency departments, surgical units and intensive‑care units, which sustains demand. Diagnostic centres and academic institutions, while smaller in current share, are gaining traction as point‑of‑care testing expands and research into thrombosis diagnostics intensifies.

Segmentations:

By Product:

- Reagents & Consumables

- Analyzers

By Application:

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Disseminated Intravascular Coagulation (DIC)

- Others

By End Use:

- Hospitals

- Diagnostic Centres

- Academic & Research Institutes

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region Outlook

North America commands a revenue share of 33.8% in the D‑Dimer Testing Market according to 2024 figures. It maintains dominant market leadership thanks to its advanced healthcare infrastructure and a high prevalence of thrombotic disorders. The U.S. drives regional performance through strong reimbursement frameworks, well‑established clinical guidelines, and widespread adoption of rapid diagnostic solutions. Hospitals and emergency departments in the region rely heavily on D‑dimer assays to rule out conditions such as deep vein thrombosis and pulmonary embolism. Manufacturers benefit from high testing volumes, robust R&D investment and regulatory support that fosters innovation in analyzer platforms and reagent kits. Competitive activity remains concentrated, and the region continues to attract global diagnostic players aiming for market penetration.

Europe Region Outlook

Europe holds a significant share in the D‑Dimer Testing Market, though specific numbers vary across sources and countries. It benefits from widespread adoption of coagulation diagnostics, structured healthcare systems and clinical protocols that integrate D‑dimer testing into thrombosis management. Germany, the UK and France serve as key national markets due to their large hospital networks and high awareness of venous thromboembolism risks. Demand growth hinges on increasing use of point‑of‑care testing, automation of laboratory workflows and extension of screening into outpatient settings. Manufacturers targeting Europe face rigorous regulatory standards and competitive reimbursement landscapes, but they also gain access to a mature diagnostic market with consistent need for high‑quality assay solutions.

Asia‑Pacific & Other Regions Outlook

Asia‑Pacific accounted for roughly 22.1% of the global D‑Dimer Testing Market in 2020 and continues to register the fastest growth rate among regions. It benefits from expanding healthcare access, rising incidence of thrombotic disorders and governmental support for diagnostic infrastructure upgrades. China, India and Japan lead regional uptake thanks to large patient bases and increasing diagnostics penetration in both urban and rural settings. Latin America, Middle East and Africa lag behind in share but represent high‑potential growth zones thanks to improving laboratory capabilities and rising awareness of blood‑clot risks. Providers who tailor scalable, low‑cost D‑dimer testing models stand to capture opportunity in these diverse settings.

Key Player Analysis:

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd

- Siemens Healthcare

- Abbott

- BIOMÉRIEUX

- WERFEN

- HORIBA, Ltd.

- QuidelOrtho Corporation

- Diazyme Laboratories

- Biomedica Diagnostics

- SEKISUI Diagnostics

Competitive Analysis:

The competitive landscape of the D‑Dimer Testing Market features key global diagnostics firms such as Thermo Fisher Scientific Inc., F. Hoffmann‑La Roche Ltd, Siemens Healthcare, Abbott, BIOMÉRIEUX and WERFEN. These players hold substantial market share and each pursues innovation, strategic partnerships and geographic expansion to strengthen their position.

They invest in development of high‑sensitivity assays, point‑of‑care platforms and reagent kits to address clinician demand for rapid, accurate diagnostics. Each competitor places emphasis on regulatory compliance and quality systems to assure trust in their offerings. Pricing strategies and reimbursement alignment shape their regional penetration and uptake. Smaller specialised firms present niche competition, particularly in emerging markets and novel assay technologies. The large firms maintain advantage through strong brand recognition, global distribution networks and deep R&D capabilities. They monitor emerging threat vectors, including disruptive technologies and shifting diagnostic protocols, to preserve market leadership.

Recent Developments:

- In September 2025, Thermo Fisher Scientific Inc. completed the acquisition of the sterile fill-finish and packaging facility in Ridgefield, New Jersey from Sanofi, expanding its U.S. drug product manufacturing capabilities and continuing to manufacture therapies for Sanofi at this site.

- In September 2025, Siemens Healthcare partnered with Merck KGaA under a Memorandum of Understanding to accelerate digital transformation in the life sciences sector using AI, automation, and data-driven solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Suppliers will expand deployment of point‑of‑care D‑dimer platforms to meet demand for rapid testing in emergency and outpatient settings.

- Integration of digital health solutions will enhance test result interpretation and data linkage, boosting use of D‑dimer assays in clinical decision‑making.

- Advances in assay technology will improve sensitivity and specificity, reducing false‑positive rates and increasing clinical reliance on D‑dimer results.

- Testing will extend beyond traditional thrombotic applications into monitoring coagulopathy in other conditions, broadening the scope of the D‑Dimer Testing Market.

- Manufacturers will pursue strategic alliances and mergers to accelerate study of novel biomarkers and co‑testing panels that include D‑dimer.

- Emerging economies will offer significant growth opportunities, driven by investment in diagnostic infrastructure and expanding access to coagulation testing.

- Regulatory reforms and reimbursement policy improvements will facilitate faster market access for new D‑dimer assays and testing platforms.

- Hospitals and diagnostic centres will adopt automation and high‑throughput analyzers to handle rising test volumes, enhancing lab operational efficiency.

- Education initiatives targeting physicians and patients will raise awareness of clotting disorders, thereby increasing test utilization and market penetration.

- Tailored low‑cost testing solutions will enable uptake in resource‑limited settings, enabling the D‑Dimer Testing Market to reach underserved patient populations.