Market Overview

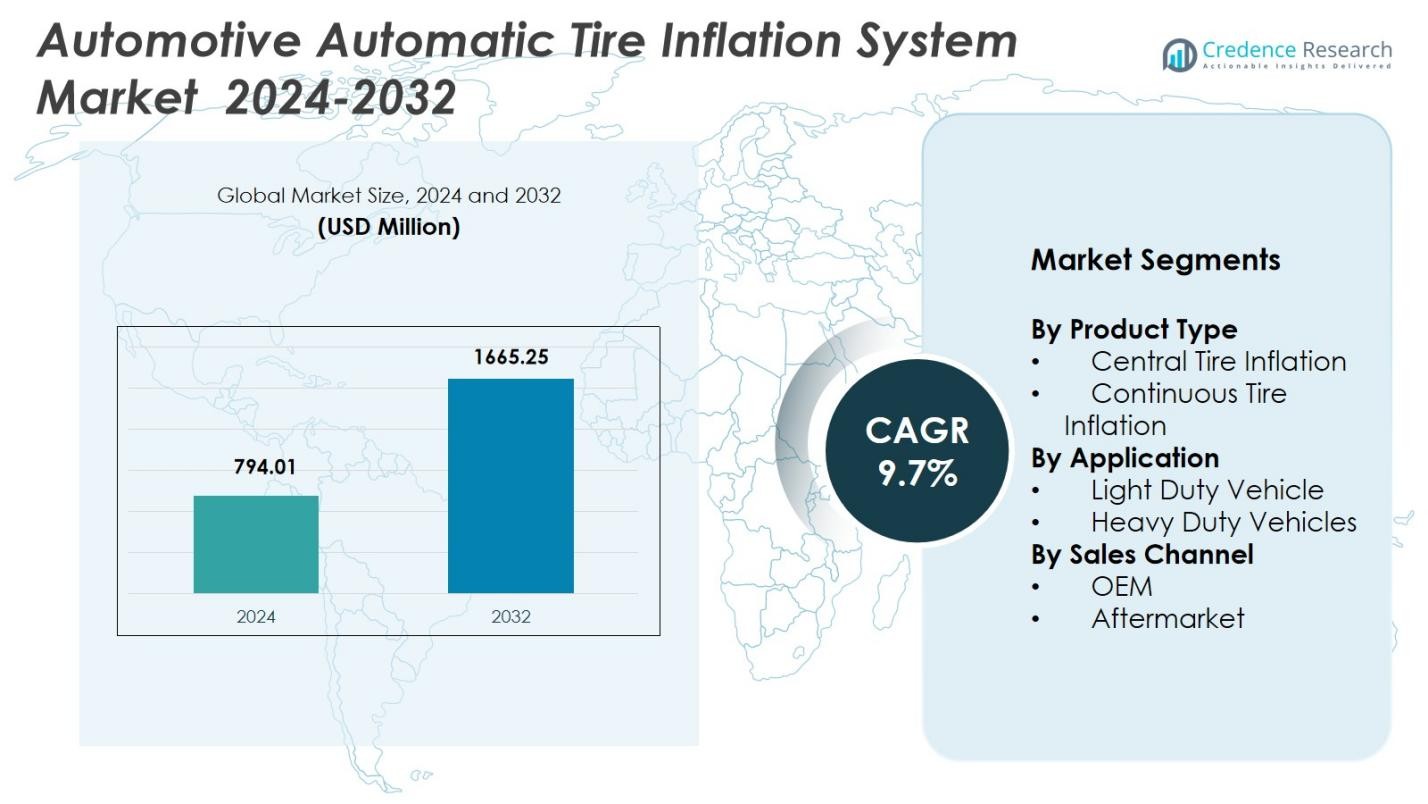

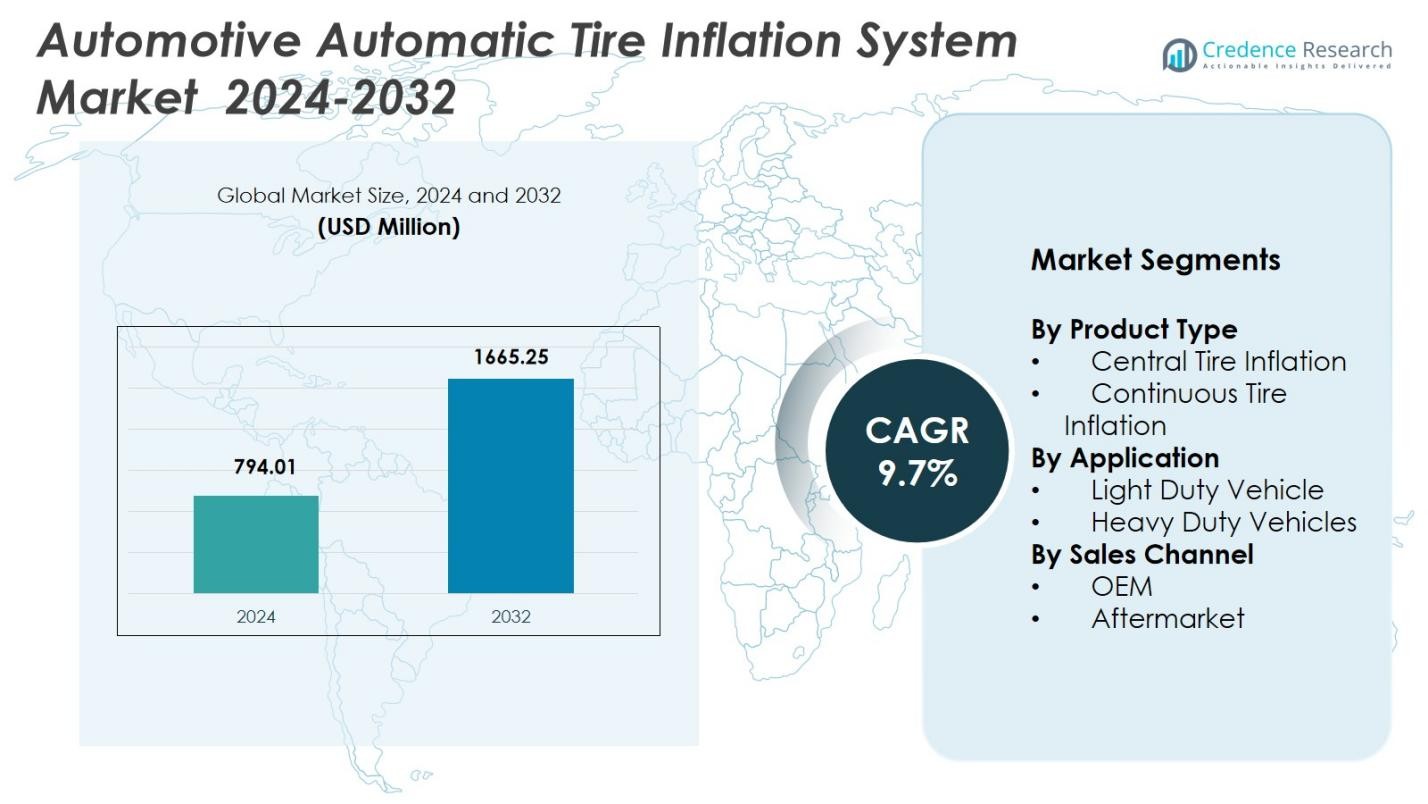

Automotive Automatic Tire Inflation System Market size was valued at USD 794.01 Million in 2024 and is anticipated to reach USD 1665.25 Million by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Automatic Tire Inflation System Market Size 2024 |

USD 794.01 Million |

| Automotive Automatic Tire Inflation System Market, CAGR |

9.7% |

| Automotive Automatic Tire Inflation System Market Size 2032 |

USD 1665.25 Million |

Automotive Automatic Tire Inflation System Market is shaped by prominent players such as Cummins Inc., MICHELIN, Goodyear Tire & Rubber Company, Continental AG, Bridgestone Corporation, Pirelli & C. S.p.A., Schrader TPMS Solutions, Bendix Commercial Vehicle Systems LLC, Wabco Holdings Inc., and Ravaglioli S.p.A., all contributing to technology innovation and system reliability. These companies focus on expanding ATIS integration across commercial trucks, off-road vehicles, trailers, and heavy-duty equipment through advanced pneumatic controls, sensor-driven solutions, and OEM partnerships. North America leads the global market with a 38% share in 2024, driven by strong fleet adoption, stringent safety regulations, and high penetration of connected vehicle technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Automotive Automatic Tire Inflation System Market reached USD 794.01 Million in 2024 and will grow at a CAGR of 9.7% through 2032.

- Market growth is driven by rising demand for fuel efficiency, tire longevity, and reduced downtime, with Central Tire Inflation holding a 62% share as the leading product segment.

- Increasing adoption of smart, connected tire technologies and integration of ATIS in electric and next-generation commercial vehicles shapes major market trends.

- Key players such as Cummins, MICHELIN, Goodyear, Continental, Bridgestone, Pirelli, Bendix, Wabco, Schrader, and Ravaglioli strengthen their positions through product innovation and OEM collaborations.

- North America leads the global landscape with a 38% share, followed by Europe at 29% and Asia Pacific at 24%, while Heavy Duty Vehicles remain the dominant application segment with a 71% share in 2024.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Automotive Automatic Tire Inflation System Market is primarily led by the Central Tire Inflation segment, accounting for 62% share in 2024, supported by its widespread adoption in commercial fleets, agricultural equipment, and off-road vehicles requiring dynamic pressure adjustments. Its ability to enhance traction, reduce tire wear, and improve vehicle stability drives strong demand across construction and mining sectors. The Continuous Tire Inflation segment, holding 38% share, grows steadily due to rising penetration in long-haul trucks and trailers focused on fuel efficiency and consistent tire pressure maintenance.

- For instance, Spicer Central Tire Inflation System (CTIS™) enables drivers to adjust tire pressure based on vehicle load and terrain, featuring an automatic emergency mode that handles leaks while improving traction, tire life, and fuel consumption in off-road conditions.

By Application

The Heavy Duty Vehicles segment dominates the Automotive Automatic Tire Inflation System Market with a 71% share in 2024, driven by intensive usage in logistics fleets, military vehicles, construction machinery, and off-highway equipment that rely on optimized tire pressure for safety and operational efficiency. Fleet operators increasingly adopt ATIS to reduce downtime, improve tire life, and enhance fuel economy across larger vehicle platforms. The Light Duty Vehicle segment, holding 29% share, is expanding gradually as OEMs integrate ATIS solutions into SUVs, pickups, and utility vehicles targeting enhanced driving stability and reduced maintenance needs.

- For instance, Tata Motors’ LPT 1916 truck features low-rolling-resistance tires alongside advanced controls like cruise control and a dual-mode fuel economy switch, supporting real-time tracking to enhance fleet uptime and efficiency.

By Sales Channel

The OEM segment leads the market with a 58% share in 2024, driven by growing manufacturer integration of tire inflation systems in commercial trucks, off-road vehicles, and high-performance applications to meet safety standards and efficiency targets. OEM-installed systems offer higher reliability, seamless vehicle compatibility, and lifecycle performance benefits. The Aftermarket segment, with a 42% share, continues to expand due to increasing retrofitting of ATIS in aging fleet vehicles, rising cost-saving priorities, and demand for improved tire longevity and fuel efficiency among fleet operators seeking quicker upgrades.

Key Growth Drivers

Rising Demand for Fuel Efficiency and Reduced Tire Wear

The Automotive Automatic Tire Inflation System Market experiences strong growth as fleet operators and OEMs prioritize technologies that reduce operating costs and enhance vehicle efficiency. Maintaining optimal tire pressure minimizes rolling resistance, improves fuel economy, and extends tire life, making ATIS an attractive investment for logistics, agriculture, and construction sectors. Increasing fuel prices, tightening carbon-emission regulations, and the need for sustainable fleet operations encourage the adoption of intelligent tire pressure systems across both heavy-duty and light-duty vehicles.

- For instance, Goodyear Tire & Rubber Company offers integrated ATIS solutions that minimize fleet downtime and improve safety through advanced tire management. These systems help maintain consistent pressure, supporting fuel efficiency in commercial operations.

Expansion of Commercial Fleet Operations and Long-Haul Transportation

Growth in e-commerce, logistics, and long-distance freight transport significantly boosts demand for automated tire inflation solutions. Heavy-duty trucks and trailers require reliable tire performance to operate safely and efficiently under continuous load conditions. ATIS supports fleet uptime by preventing blowouts, improving load distribution, and reducing maintenance frequency. As fleet sizes expand globally, operators increasingly adopt advanced tire inflation technologies to reduce downtime, ensure consistent performance, and comply with stringent safety standards governing commercial vehicle operations.

- For instance, Pressure Systems International (PSI) provides ATIS that integrates with telematics for real-time tire pressure monitoring in long-haul trucking, helping fleets minimize roadside breakdowns during extended freight operations.

Technological Advancements in Tire Management and Vehicle Electronics

Integration of smart sensors, telematics, and connected vehicle platforms accelerates ATIS adoption across automotive applications. Modern systems utilize real-time pressure monitoring, automated adjustments, and predictive analytics to enhance vehicle control and safety. Advances in electronic control units, pneumatic components, and data-driven diagnostics improve system reliability and user convenience. Growing interest in autonomous and semi-autonomous mobility further promotes demand for automated tire management solutions, strengthening the role of ATIS in next-generation vehicle architectures.

Key Trends & Opportunities

Growing Integration of ATIS in Electric and Next-Generation Vehicles

Electrification trends create new opportunities for ATIS adoption as EV efficiency heavily depends on optimized tire performance. Tire pressure variations significantly impact driving range, battery load, and overall energy consumption. Manufacturers increasingly integrate ATIS into electric trucks, delivery vans, and utility vehicles to improve range reliability and safety. The shift toward intelligent, connected vehicle systems also enables seamless integration of ATIS with onboard diagnostics, offering opportunities for innovation in predictive maintenance and energy-efficient mobility solutions.

- For instance, Michelin launched the ZEN@TERRA CTIS in 2019 for farm tractors, allowing operators to adjust tire pressure from the cab low for fields and high for roads. Though focused on agriculture, this demonstrates ATIS integration in utility vehicles to optimize performance and efficiency.

Increasing Adoption of Smart and Connected Tire Technologies

A major industry trend involves the transition to smart tire ecosystems equipped with IoT-enabled sensors, cloud connectivity, and AI-based monitoring tools. These technologies enhance real-time visibility of tire conditions, reduce operational risks, and support automated decision-making for pressure optimization. Manufacturers are developing integrated platforms where ATIS operates alongside TPMS and predictive maintenance software, creating new value for fleet operators. This trend opens opportunities for subscription-based services, data analytics solutions, and cross-platform integration with fleet management systems.

- For instance, Goodyear’s SightLine technology embeds sensors in tires to monitor pressure, temperature, tread wear, and road conditions in real time. This data streams to AI management systems for predictive maintenance, enabling faster responses to potential issues and integration with fleet operations.

Key Challenges

High Initial Costs and Complex System Integration

Despite clear operational benefits, high upfront installation costs remain a major barrier to broader ATIS adoption, especially among small and mid-sized fleet operators. Integration complexity involving air compressors, hoses, rotary unions, and vehicle electronics increases installation time and requires skilled technicians. OEMs must balance performance enhancements with cost constraints to make ATIS more accessible. Additionally, retrofitting older vehicles presents challenges related to compatibility, structural modifications, and added maintenance requirements.

Reliability Issues in Harsh Operating Environments

ATIS components are exposed to demanding environmental conditions, including dust, moisture, extreme temperatures, and road debris. Such exposure can lead to hose wear, valve failures, air leaks, and reduced system responsiveness. In off-road, mining, and agricultural applications, durability becomes a critical concern, affecting long-term performance and maintenance costs. Ensuring system reliability, enhancing component robustness, and minimizing downtime remain key challenges for manufacturers seeking to expand adoption across harsher operational settings.

Regional Analysis

North America

North America holds a leading position in the Automotive Automatic Tire Inflation System Market with a 38% share in 2024, driven by strong adoption across commercial fleets, off-highway equipment, and long-haul trucking operations. The region benefits from stringent vehicle safety regulations, high fuel costs, and rapid integration of advanced tire management technologies. Increasing investments in connected fleet solutions, rising demand for preventive maintenance, and strong OEM penetration across the U.S. and Canada support market expansion. Growth in e-commerce logistics and cross-border freight movement further reinforces ATIS adoption in heavy-duty trucks and trailers.

Europe

Europe accounts for a 29% share in 2024, supported by stringent emission standards, EU-wide sustainability initiatives, and rapid deployment of smart vehicle technologies. High emphasis on road safety, efficient fleet management, and adoption of intelligent mobility solutions accelerates demand for ATIS across commercial fleets. Key markets such as Germany, France, and the UK lead in OEM integration due to advanced automotive manufacturing capabilities. Increasing popularity of electric delivery vans, construction equipment modernization, and regulatory pressure to reduce fuel consumption strengthen ATIS adoption across regional vehicle categories.

Asia Pacific

Asia Pacific commands a 24% share in 2024, driven by expanding commercial transportation networks, rapid industrialization, and strong growth in logistics, agriculture, and mining sectors. China and India exhibit rising demand for ATIS as fleet operators focus on reducing tire-related downtime, improving load efficiency, and enhancing fuel savings. Increasing commercial vehicle production, infrastructure development, and government support for vehicle safety improvements further accelerate market growth. Adoption also rises across off-road vehicles as construction and mining activities expand in Southeast Asia, creating significant long-term opportunities for ATIS manufacturers.

Latin America

Latin America holds a 5% share in 2024, supported by steady adoption across commercial fleets, agricultural vehicles, and mining trucks in Brazil, Mexico, and Chile. Growing demand for improved fleet efficiency, rising tire replacement costs, and expansion of cross-border logistics drive ATIS implementation. Although cost sensitivity remains a challenge, aftermarket retrofitting gains momentum as operators seek solutions to reduce fuel consumption and enhance vehicle uptime. Investments in infrastructure development and increasing use of heavy-duty vehicles in mining corridors contribute to gradual market growth across the region.

Middle East & Africa

The Middle East & Africa region captures a 4% share in 2024, driven by increasing utilization of heavy-duty trucks, construction machinery, and off-road vehicles across mining, oil & gas, and infrastructure projects. Harsh operating environments and high tire wear rates encourage adoption of ATIS to improve durability, reduce maintenance costs, and enhance safety. GCC countries show rising demand for advanced fleet management systems, while Africa experiences gradual uptake supported by expanding logistics networks. Growing modernization of industrial fleets and interest in reliability-oriented vehicle technologies support long-term market potential.

Market Segmentations:

By Product Type

- Central Tire Inflation

- Continuous Tire Inflation

By Application

- Light Duty Vehicle

- Heavy Duty Vehicles

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Automotive Automatic Tire Inflation System Market is shaped by leading players including Cummins Inc., MICHELIN, Goodyear Tire & Rubber Company, Continental AG, Bridgestone Corporation, Pirelli & C. S.p.A., Schrader TPMS Solutions, Bendix Commercial Vehicle Systems LLC, Wabco Holdings Inc., and Ravaglioli S.p.A. These companies focus on expanding their ATIS portfolios through advanced pneumatic technologies, integrated electronic controls, and sensor-driven pressure management solutions. Major manufacturers strengthen their market position by collaborating with OEMs, enhancing product reliability, and developing solutions tailored for heavy-duty trucks, off-road vehicles, and military platforms. Growing emphasis on fuel efficiency, predictive maintenance, and connected mobility drives companies to invest in R&D for intelligent, telematics-enabled tire inflation systems. Additionally, aftermarket expansion, diversification into EV-compatible ATIS solutions, and strategic acquisitions support competitive intensity across global markets.

Key Player Analysis

Recent Developments

- In March 2025, Aperia Technologies announced an exclusive partnership with The Goodyear Tire & Rubber Company to integrate its Halo Connect i3 automatic tire inflation system into Goodyear’s global “Tires-as-a-Service” (TaaS) solution.

- In June 2023, Trail Tech introduced a feature-rich cordless tire inflator designed for adventurers. The portable air compressor is equipped with advanced features, providing powerful and convenient inflation capabilities. It caters to the needs of on-the-go outdoor enthusiasts and travelers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of ATIS will rise as fleet operators prioritize fuel efficiency, tire longevity, and reduced operating costs.

- OEM integration will increase as manufacturers embed ATIS into next-generation commercial and off-road vehicles.

- Electrification trends will drive demand for energy-efficient tire management systems in electric trucks and delivery fleets.

- Smart, connected ATIS solutions will expand with greater use of IoT sensors, telematics, and predictive analytics.

- Aftermarket installations will grow as aging fleets retrofit ATIS to enhance safety and vehicle uptime.

- Regulatory pressure on emissions and road safety will accelerate adoption across heavy-duty transportation sectors.

- Autonomous and semi-autonomous vehicle development will increase reliance on automated tire pressure optimization systems.

- Harsh-environment applications such as mining, construction, and agriculture will drive demand for more durable ATIS designs.

- Partnerships between ATIS manufacturers and fleet management platforms will expand data-driven tire monitoring ecosystems.

- Continuous R&D investments will lead to lightweight, low-maintenance, and more cost-effective ATIS solutions.

Market Segmentation Analysis:

Market Segmentation Analysis: