Market Overview:

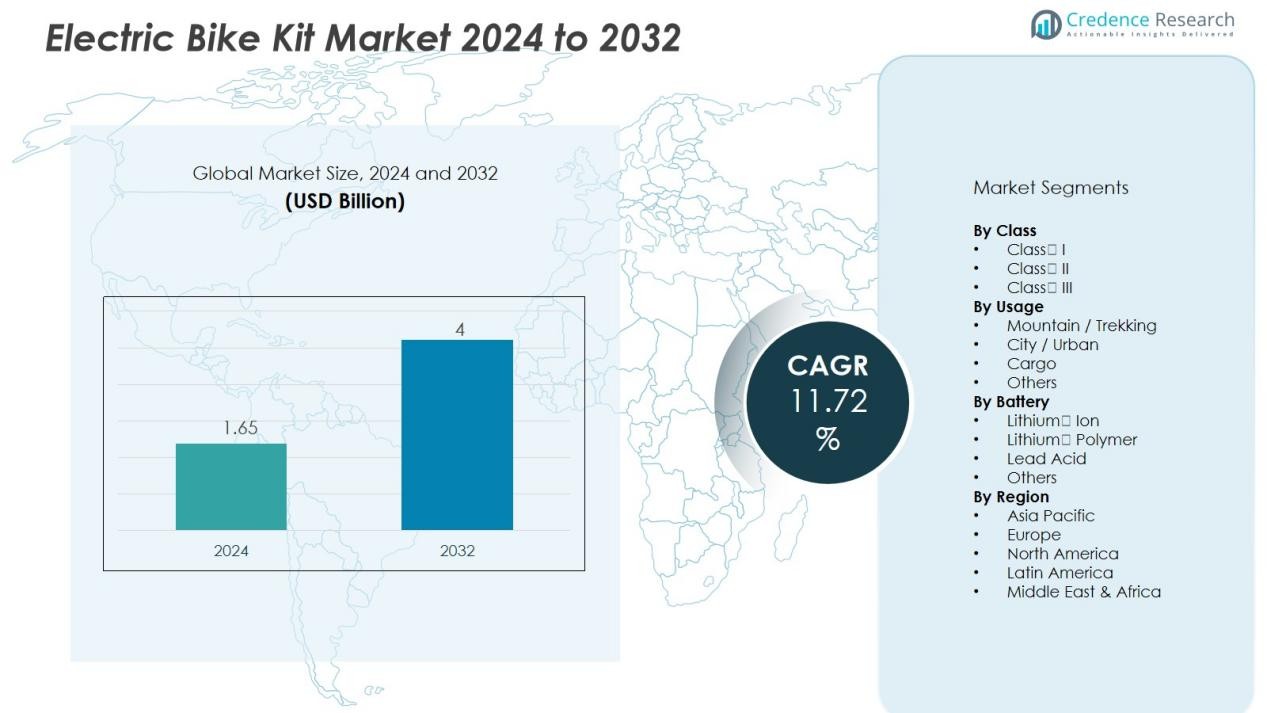

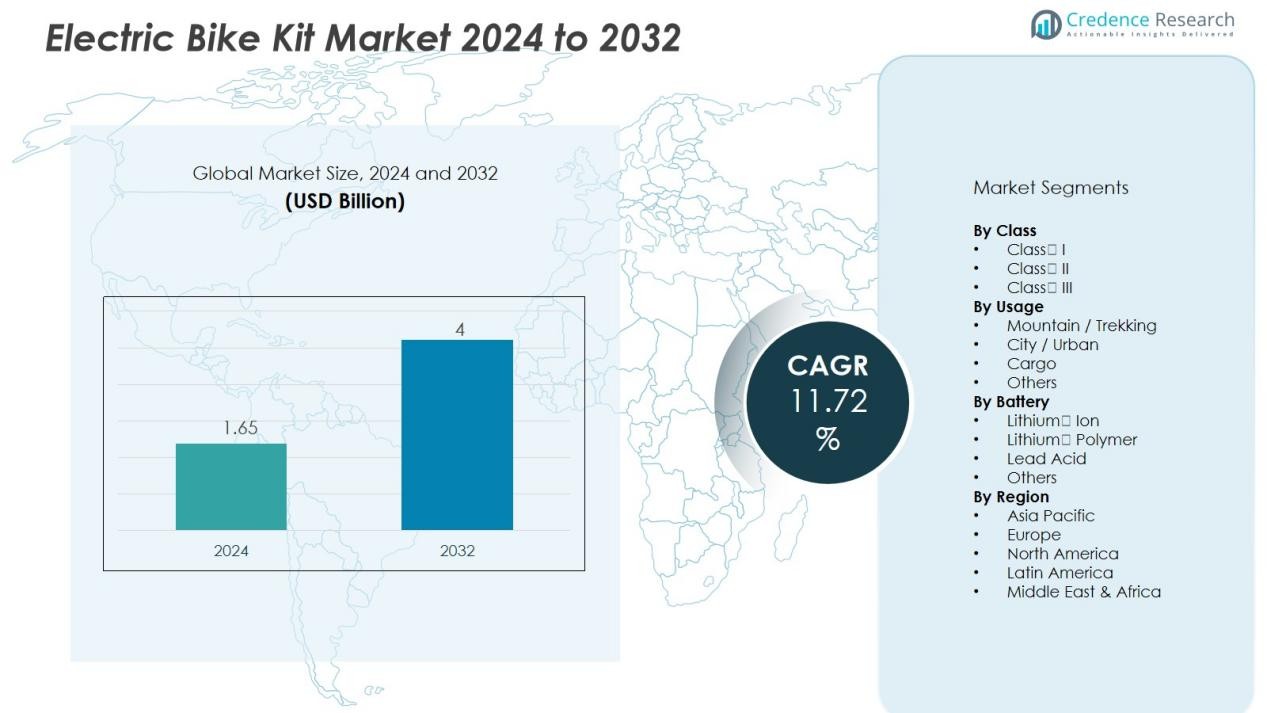

The Electric Bike Kit Market size was valued at USD 1.65 billion in 2024 and is anticipated to reach USD 4 billion by 2032, at a CAGR of 11.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Bike Kit Market Size 2024 |

USD 1.65 Billion |

| Electric Bike Kit Market, CAGR |

11.72% |

| Electric Bike Kit Market Size 2032 |

USD 4 Billion |

Several factors are driving this market’s growth. Increasing environmental awareness and the need for sustainable transportation options are encouraging more consumers to opt for e-mobility solutions. Government incentives and favorable regulations also play a significant role in boosting the adoption of electric bike kits. Additionally, the growing urbanization and traffic congestion in cities are fueling demand for compact and cost-effective micro-mobility solutions. The ability to retrofit existing bicycles with electric kits further appeals to cost-conscious consumers, expanding the market’s reach.

Regionally, the Asia-Pacific market is expected to lead in both market share and growth rate, driven by rapid urbanization and the increasing popularity of e-mobility. North America and Europe are also significant markets, benefiting from strong infrastructure, consumer awareness, and regulatory support. Emerging markets in Latin America, the Middle East, and Africa are beginning to show growth potential, presenting additional opportunities for market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electric Bike Kit Market size was valued at USD 1.65 billion in 2024 and is projected to reach USD 4 billion by 2032, growing at a CAGR of 11.72% during the forecast period.

- The Asia-Pacific region dominates the market with a 74.7% share in 2023, driven by rapid urbanization, a strong manufacturing base, and growing e-mobility adoption. North America follows with a significant share, benefiting from infrastructure support, consumer awareness, and increasing demand for sustainable mobility. Europe ranks second, leveraging its established cycling culture, supportive policies, and high retrofit activity.

- The fastest-growing region is North America, with a steady increase in market share due to rising environmental awareness, micro-mobility adoption, and strong aftermarket networks for bike retrofitting.

- By class, the Electric Bike Kit Market is primarily driven by Class III kits, which cater to higher-speed requirements, accounting for a substantial portion of the segment. The Class I segment remains strong due to its simplicity and safety, appealing to casual riders.

- In the battery segment, Lithium-Ion batteries dominate with a significant share due to their favorable energy density, light weight, and long cycle life, followed by Lithium-Polymer and Lead-Acid batteries.

Market Drivers:

Market Drivers:

Rising Demand for Sustainable Transportation Solutions

The shift toward eco-friendly transportation is one of the key drivers of the Electric Bike Kit Market. Increasing concerns over climate change and air pollution have led consumers to seek alternative, greener transportation options. Electric bike kits provide an affordable and effective way to reduce carbon footprints while still enjoying the benefits of cycling. With governments around the world pushing for sustainability, the adoption of electric mobility is becoming a key priority for many cities and regions.

- For instance, Bosch closely integrated its eBike drive system with a 100 Nm mid-drive motor and a 750 Wh (0.75 kWh) modular battery pack, enabling a measured range of up to 140 kilometers on a single charge under optimal riding conditions.

Government Incentives and Regulations Supporting E-Mobility

Government policies and incentives aimed at reducing emissions and promoting clean energy solutions are significantly boosting the Electric Bike Kit Market. Subsidies, tax rebates, and other financial incentives make it more affordable for consumers to retrofit their bikes with electric kits. In many regions, local authorities are also implementing regulations that favor the adoption of electric vehicles, including electric bikes, which further encourages market growth and the transition to greener mobility solutions.

- For instance, in the United States, California’s statewide program, administered by the California Air Resources Board (CARB), offers point-of-sale incentive vouchers of $1,750, with an additional $250 available for priority applicants, for a maximum total of $2,000 for e-bike purchases.

Cost-Effectiveness of Retrofitting Existing Bikes

The affordability of retrofitting traditional bicycles with electric kits drives the Electric Bike Kit Market’s growth. Consumers prefer converting their existing bicycles, as this is a less expensive option compared to purchasing a brand-new electric bike. This cost-effective alternative appeals to a wide range of customers, particularly those who already own high-quality bicycles but want to transition to electric mobility without the high upfront costs of an e-bike.

Urbanization and Traffic Congestion

Urbanization is another major factor contributing to the growth of the Electric Bike Kit Market. As cities become more densely populated, traffic congestion and limited parking spaces are pushing commuters toward more efficient transportation options. Electric bikes equipped with conversion kits offer a practical solution for short-distance commutes, providing a faster and more convenient way to navigate congested urban areas while avoiding the challenges posed by traditional transportation methods.

Market Trends:

Growing Focus on Smart Features and Connectivity

The Electric Bike Kit Market is witnessing a rising trend towards the integration of smart features, offering enhanced user experience and performance management. Consumers increasingly demand features like GPS tracking, real-time data analytics, and smartphone connectivity for bike performance monitoring, ride history, and theft protection. Manufacturers are developing conversion kits with integrated Bluetooth, apps for performance tracking, and smart battery management systems. This shift towards smart technology not only appeals to tech-savvy users but also supports the growing trend of connected mobility. It allows users to customize their e-bike experience while ensuring greater safety and efficiency in daily commutes.

- For instance, Ecobike’s GPS tracker redeploys precise location data with a built-in 6-month independent power supply, enabling remote lock and fleet management capabilities.

Expansion of E-mobility Solutions and Urban Integration

The Electric Bike Kit Market is also benefiting from the expanding role of e-mobility solutions, particularly in urban settings. With rising traffic congestion and increasing environmental awareness, city planners and transport authorities are encouraging the use of compact and sustainable transportation options like electric bikes. Retrofitting existing bicycles with electric kits is an affordable solution to urban mobility challenges, offering commuters a practical alternative to traditional vehicles. The demand for retrofitting solutions is rising, as e-bike kits allow consumers to continue using their existing bicycles while upgrading to electric assistance. This trend is particularly strong in densely populated cities where the need for efficient and eco-friendly transportation is paramount.

- For Instance, Brose manufactures compact mid-drive motors such as the Drive T, which provides 70 Nm of torque, and high-performance models like the Drive S Mag, which can deliver a peak of 90 Nm.

Market Challenges Analysis:

Lack of Standardisation and Component Compatibility

One of the primary challenges for the Electric Bike Kit Market lies in the absence of uniform standards and widespread component compatibility. Manufacturers often use different motor mounts, controller protocols and battery interfaces, which creates confusion for consumers trying to retrofit conventional bicycles. It complicates installation, increases return rates and deters less‑experienced users from converting their bikes. Retailers and installers face extra support burdens when they must decipher kit‑frame compatibility issues. The resulting fragmentation slows adoption and raises total cost of ownership for users seeking plug‑and‑play conversion solutions.

Technical Expertise, Regulatory Complexity and Competitive Pressure

A further set of hurdles impacts the Electric Bike Kit Market through technical demands, regulatory variation and substitution from factory‑built e‑bikes. Some kits require mechanical knowledge, special tools or wiring skill, which limits the addressable audience and raises warranty claim risk. Regulations vary by country and region—power output, speed limits and classification differ—which makes global kit distribution and marketing more complex. Consumers may question the durability or reliability of retrofitted systems compared to purpose‑built e‑bikes. Meanwhile, declines in new e‑bike prices put pressure on kit makers to differentiate through quality and service rather than cost alone.

Market Opportunities:

Expansion of After‑market and Retrofitting Channels

Growing consumer interest in converting existing bicycles presents a strong opportunity for the Electric Bike Kit Market. Many cyclists already own quality frames and components, so they favour kits that allow them to electrify their bikes rather than purchase a new electric model. It opens up a large, cost‑sensitive audience and encourages manufacturers to develop easy‑to‑install solutions with minimal specialized tools. Retailers and service providers can capture this demand by offering conversion workshops, kit‑bundles and value‑added services such as installation and tuning. This retrofit pathway helps extend the lifecycle of standard bicycles and supports sustainability‑oriented buyers.

Integration of Smart Features and New Mobility Models

Advances in electronics and connectivity deliver another avenue for growth in the Electric Bike Kit Market. It becomes feasible to incorporate smartphone integration, GPS tracking, ride analytics and smart battery management into conversion kits, which raises the appeal for tech‑savvy users. Fleet operations, bike‑sharing platforms and urban micro‑mobility schemes provide potential new sales channels where modular kit systems can be installed and maintained at scale. Manufacturers that partner with mobility service providers or develop subscription‑based models for kits and battery services can gain competitive advantage. This shift toward connected, service‑oriented offerings supports deeper market penetration and recurring revenue streams for kit suppliers.

Market Segmentation Analysis:

By Class

The class‑based segmentation sorts kits into categories such as Class I (pedal‑assist up to 20 mph), Class II (throttle‑assist up to 20 mph) and Class III (pedal‑assist up to 28 mph). The Class III segment holds substantial share because users demand higher speed and performance for commuting and multi‑use applications. Growth in the Class I segment remains strong given its regulatory simplicity and appeal to casual riders seeking ease of use and safety. Kit manufacturers address both premium performance and entry‑level value by offering products aligned with these classes.

- For instance, Bosch eBike Systems highlighted that its Performance Line CX motor enables up to 85 Nm of torque at peak engagement on Class III setups (which power riders to sustained higher speeds in urban routes, up to 28 mph), with some smart system versions able to be upgraded to 100 Nm via a software update.

By Usage

Usage‑based segmentation groups kits into Mountain/Trekking, City/Urban, Cargo and Others. Mountain/Trekking currently dominates because enthusiasts retrofit bikes for off‑road and recreation applications. The City/Urban segment experiences rapid expansion driven by urban commuters who seek compact mobility solutions in congested areas. Cargo applications represent a growing niche as last‑mile and delivery operators convert standard bikes for heavier loads and commercial use. Market participants invest in usage‑specific features such as higher‑torque motors for cargo or lightweight frames for urban kits.

- For Instance, Shimano’s DEORE XT crankset features a rigid and lightweight Hollowtech II design for efficient power transfer and enhanced durability for demanding mountain terrains.

By Battery Type

Battery‑type segmentation includes Lithium‑Ion, Lithium‑Polymer, Lead‑Acid and Others. The Lithium‑Ion category leads thanks to its favourable energy density, weight and cycle life. Lithium‑Polymer holds growth potential due to its flexible form‑factor and design versatility. Lead‑Acid remains a minor share owing to weight and limited performance, but it retains relevance in budget kits and developing regions. Kit suppliers enhance compatibility by offering swappable or modular battery options to meet different user requirements and regional constraints.

Segmentations:

By Class

- Class‑I

- Class‑II

- Class‑III

By Usage

- Mountain / Trekking

- City / Urban

- Cargo

- Others

By Battery

- Lithium‑Ion

- Lithium‑Polymer

- Lead Acid

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia‑Pacific Region

The Asia‑Pacific region held around 74.7 % market share in the Electric Bike Kit Market during 2023. It benefits from concentrated manufacturing presence in countries such as China and India, strong government policies that encourage electric mobility, and rapid urbanisation driving micro‑mobility adoption. It supports a wide range of conversion kit suppliers who offer cost‑effective solutions tailored for high‑density cities. It also sees elevated demand for retrofit kits due to large existing bicycle fleets and growing consumer interest in electrification. It faces competition among local and international brands, driving innovation and pricing pressure. It must address infrastructure gaps and regulatory divergence across sub‑regions to fully capitalise on growth.

Europe Region

Europe captured a significant portion of the market share in the Electric Bike Kit Market in 2023, ranking second globally. It leverages extensive cycling culture, supportive national incentives for e‑mobility, and established distribution channels. It sees rising retrofit activity driven by urban commutes, cargo bike conversions and shared‑mobility models. It also emphasises standardisation and regulatory alignment—factors that reduce consumer risk and streamline supplier operations. It faces challenges from cost competition and the need to comply with stringent safety and performance standards. It presents opportunity for premium kit providers that combine higher performance with regulatory certification.

North America and Rest of World

North America held a relevant share of the Electric Bike Kit Market in 2023 with steady growth prospects driven by environmental awareness and micro‑mobility adoption. It features strong aftermarket installation networks and growing retrofit enthusiasm among existing bicycle owners. It encounters higher labour and logistics costs compared to other regions which can raise consumer‑facing prices. The Rest of World segment—covering Latin America, Middle East & Africa—holds a smaller share but demonstrates emerging potential through infrastructure investment, rising urban traffic congestion, and supportive policy frameworks. It requires tailored strategies due to varying regulatory environments and lower per‑capita spend levels.

Key Player Analysis:

- Bafang (China)

- Swytch (U.K.)

- E-BikeKit (U.S.)

- Bosch (Germany)

- Shimano (Japan)

- Tongsheng (China)

- Rubbee X (Lithuania)

- eBikeling (U.S.)

- L-faster (China)

- VEVOR (U.S.)

Competitive Analysis:

Here is a competitive analysis of the Electric Bike Kit Market, featuring key players such as Bafang Electric (Suzhou) Co., Ltd. (China), Swytch Technology Ltd. (U.K.), E‑BikeKit (USA) (U.S.), Robert Bosch GmbH (Germany) and Shimano, Inc. (Japan).

Bafang holds a strong global position in manufacturing motors and batteries for bicycle conversions, leveraging large scale, wide distribution and a broad product range covering both hub‑drive and mid‑drive kits. Swytch differentiates itself through lightweight, easy‑install retrofit kits designed for urban commuters and emphasises compatibility across many bicycle frames. E‑BikeKit focuses on the U.S. aftermarket and offers bundled kits with motor, battery and controls tailored for North American standards and users. Bosch brings premium engineering, brand reputation and OEM partnerships to the kit segment, catering to higher‑end conversions and trusted performance. Shimano leverages its legacy in bicycle drivetrain systems and integrates conversion kits with its established network, aiming at users who prioritise reliability and ease of integration.

Competition remains intense and it centres on price, performance, installation simplicity and brand trust. Each player must keep innovating motor torque, battery capacity, connectivity features and compatibility to maintain or grow their share in the market.

Recent Developments:

- In September 2024, Bafang’s electric motorcycle division was acquired and spun off by Sunny He into Gallop Electric, focusing on the electric motorcycle market.

- In October 2025, VEVOR launched its Hybrid Heat Press, a patented innovation designed for home creators, hobbyists, and small business owners, marking a significant expansion in their home equipment lineup.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Class, Usage, Battery and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Electric Bike Kit Market will benefit from falling battery costs, which will make conversion kits more affordable and increase access for a broader consumer base.

- It will gain momentum through urban micro‑mobility initiatives; many city planners and transport authorities will include bike‑retrofit programs in their mobility strategies.

- The market will expand its application scope beyond urban commuting into niches such as cargo bikes and last‑mile logistics, creating new revenue streams and partnerships.

- It will see growth in smart connectivity features, enabling integration with apps for performance tracking, theft protection and shared mobility operations.

- The retrofit segment will grow faster than new electric‑bike sales because it allows owners to upgrade existing bikes with minimal investment and disruption.

- It will face opportunity in regions with emerging e‑mobility frameworks, where conversion kits offer a lower‑cost entry into electric mobility compared with full e‑bikes.

- Manufacturers will shift toward modular kit architectures, giving consumers choice over motor type, battery size and control system and supporting aftermarket flexibility.

- It will align more closely with sustainability goals, as retrofitting existing bicycles reduces resource consumption compared to manufacturing entirely new electric bikes.

- Distribution models will diversify, with conversion kits being sold through bike‑shops, online channels and mobility‑service firms, improving reach and speed to market.

- It will experience increased collaboration between kit‑manufacturers, mobility platforms and cities, driving co‑development of solutions and offering service models such as battery‑as‑a‑service or subscription retrofit packages.

Market Drivers:

Market Drivers: