Market Overview

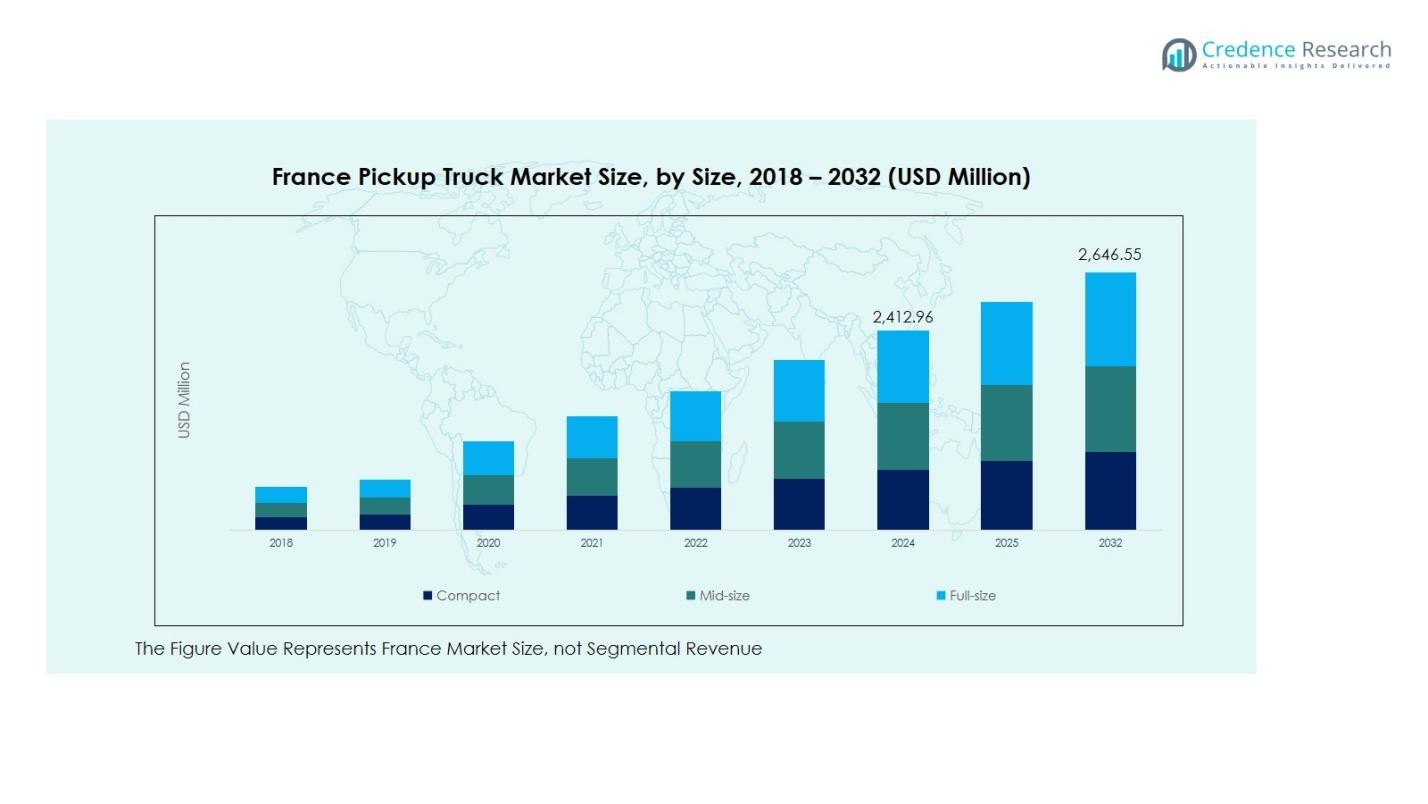

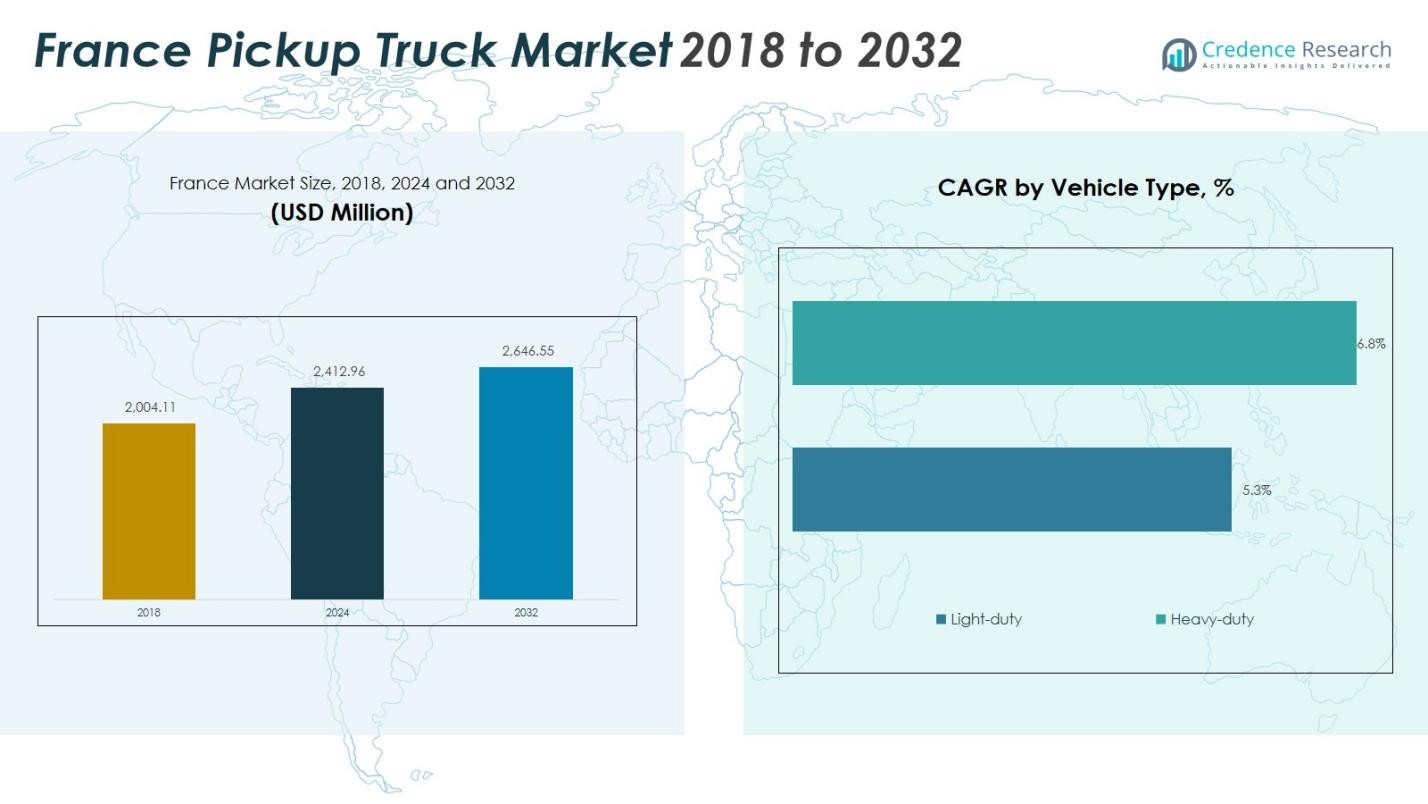

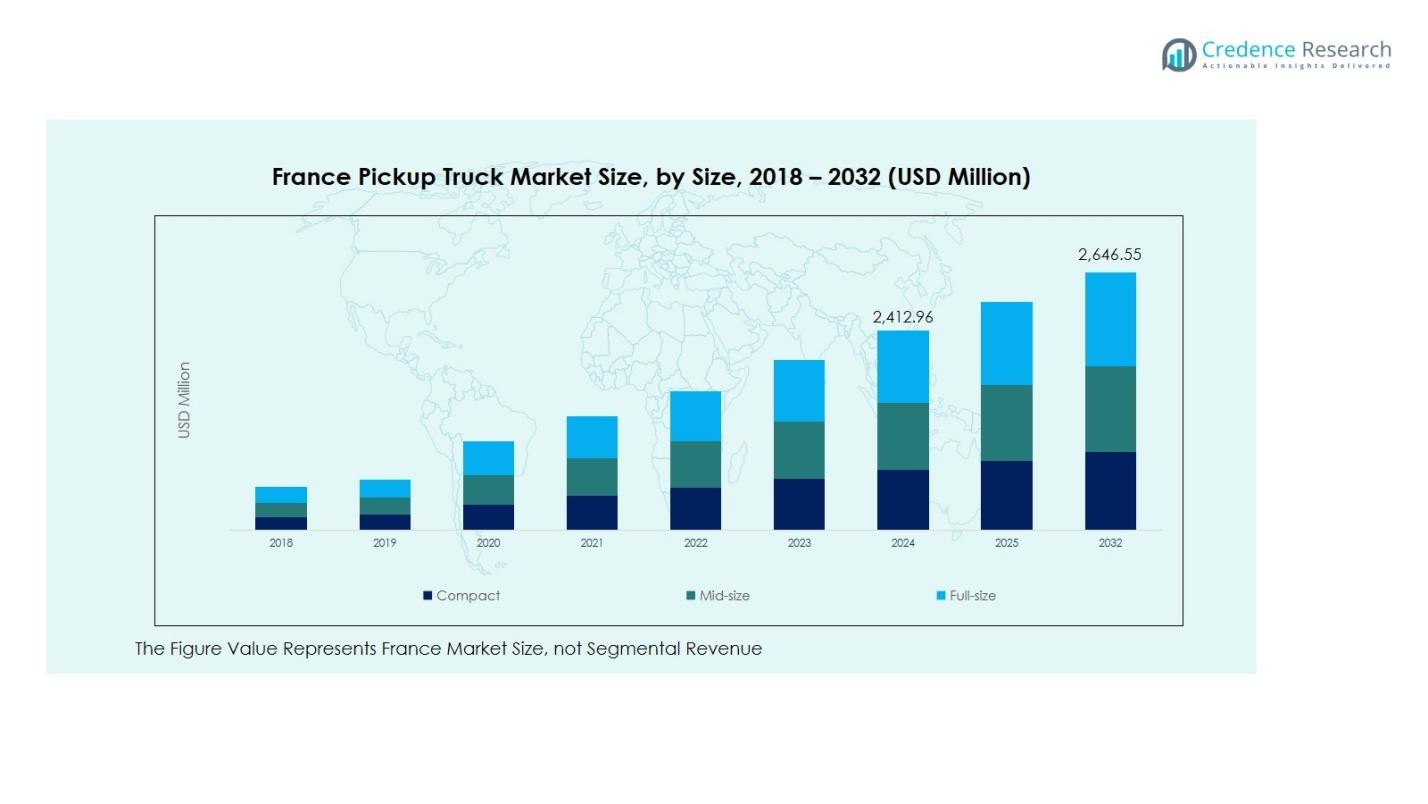

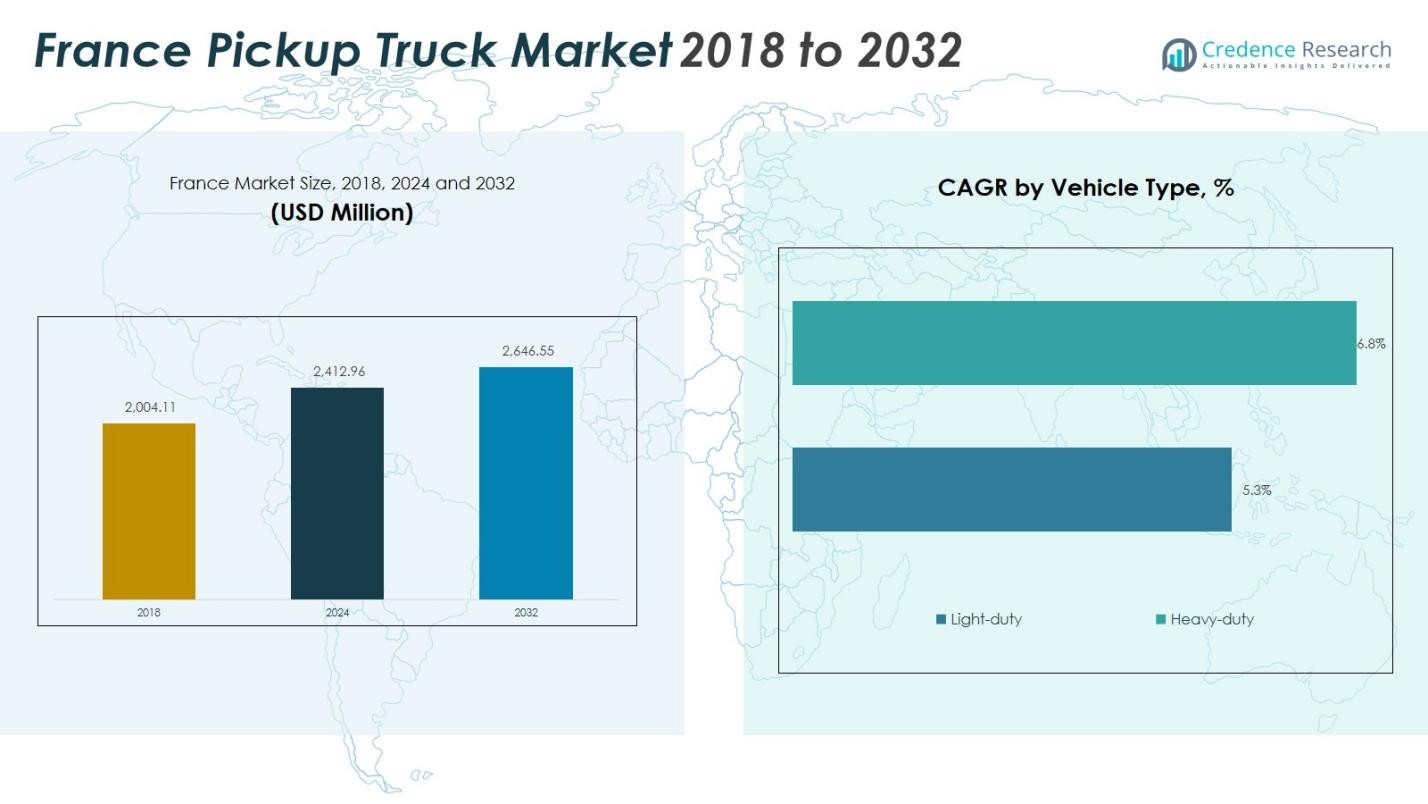

France Pickup Truck Market size was valued at USD 2,004.11 million in 2018, increased to USD 2,412.96 million in 2024, and is anticipated to reach USD 2,646.55 million by 2032, at a CAGR of 1.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electroencephalography Systems Market Size 2024 |

USD 2,412.96 Million |

| Electroencephalography Systems Market, CAGR |

1.16% |

| Electroencephalography Systems Market Size 2032 |

USD 2,646.55 Million |

France Pickup Truck Market is shaped by key players such as Ford Motor Company, Toyota Motor Corporation, Nissan Motor Co., Ltd., Volkswagen AG, Isuzu Motors Ltd., and Mitsubishi Motors Corporation, all offering diversified models to meet evolving commercial and personal transportation needs. These brands focus on fuel efficiency, performance, and electrification to cater to growing sustainability trends. Northern France leads the market with 28% share, driven by its strong industrial and logistics infrastructure, extensive cross-border trade, and high adoption of light-duty pickups for fleet and utility operations across manufacturing, agriculture, and construction sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Pickup Truck Market was valued at USD 2,412.96 million in 2024 and is projected to grow at a CAGR of 1.16% through 2032.

- Market growth is driven by rising adoption among SMEs and commercial fleets, with the light-duty vehicle segment holding 63% share due to its operational flexibility and fuel efficiency.

- Electrification and advanced safety features are emerging as key trends, with electric pickup models steadily gaining acceptance amid tightening emissions regulations and growing charging infrastructure.

- The market is dominated by leading players such as Ford, Toyota, Nissan, Volkswagen, Isuzu, and Mitsubishi Motors, who are focusing on expanding their regional footprint and introducing hybrid and electric models.

- Northern France leads regionally with 28% share, followed by Southern France and Western France, while commercial applications hold the largest segment share at 48%, driven by last-mile delivery, logistics, and industrial operations across key economic zones.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Vehicle Type:

The France Pickup Truck Market is segmented into light-duty and heavy-duty pickup trucks. Light-duty pickup trucks dominate the market, holding 63% share in 2024 due to growing demand from small businesses, utility services, and personal users requiring flexible cargo solutions. This segment benefits from lower operational costs, improved fuel efficiency, and rising adoption in urban and suburban areas. Heavy-duty vehicles account for the remaining share, driven by their use in construction and industrial sectors requiring higher towing and payload capabilities, though their adoption remains limited by higher upfront and maintenance costs.

- For instance, in 2024, Volvo Trucks registered 1,970 electric trucks over 16 tonnes in Europe (EU, UK, Norway, and Switzerland), achieving a 47% market share in this segment and positioning the company as a leader in heavy-duty electrification.

By Application:

The market is divided into commercial, industrial, personal, and others, with the commercial segment leading with 48% share in 2024. This dominance is driven by increasing fleet modernization, logistics support, and growing e-commerce activities across France, where versatile commercial pickups support last-mile delivery and light transport. The industrial sector follows, supported by use in manufacturing and construction projects. The personal segment is gradually rising due to lifestyle changes and recreational use, while the “others” category encompasses municipal and utility-driven purchases, contributing moderately to overall demand.

- For instance, Renault Pro+ reported a rise in demand for its Trafic and Master models in 2023, supported by fleet upgrades in logistics and parcel services.

By Fuel Type:

Diesel-powered pickup trucks hold the largest share in the France Pickup Truck Market, commanding 68% share in 2024. This segment’s dominance stems from diesel’s high torque output and fuel economy, making it the preferred choice for long-distance and heavy-load applications. However, the petrol segment maintains a significant foothold among urban users valuing lower initial costs and smoother driving performance. Electric pickup trucks, though currently limited to about 7% share, are rapidly gaining momentum due to supportive emission regulations, rising EV infrastructure, and increasing model availability.

Key Growth Drivers

Rising Demand from the Commercial and SME Sector

The France Pickup Truck Market is experiencing strong growth due to increased adoption by small and medium-sized enterprises (SMEs) and commercial operations. Pickup trucks are being used more frequently for last-mile deliveries, cargo transport, and mobile businesses, creating demand for versatile, fuel-efficient vehicles. Businesses in sectors like construction, agriculture, and mobile services are opting for dual-purpose trucks that offer utility and cost-effectiveness. The flexibility to operate both in urban and rural settings further strengthens this trend, driving steady market expansion across diverse business segments.

- For instance, Schenker France has expanded its fleet to include 135 electric trucks alongside 410 trucks running on hydrotreated vegetable oil (HVO), underscoring the demand for versatile and eco-friendly commercial vehicles suited for last-mile deliveries and urban logistics.

Government Incentives and Emission Regulations

Environmental policies in France are encouraging the shift toward cleaner vehicle technologies, including the adoption of electric and low-emission pickup trucks. Government incentives such as tax reductions and subsidies for electric vehicles (EVs) have boosted interest in EV pickups, especially among fleet operators seeking compliance with emission standards. As urban pollution regulations tighten, more businesses and individuals are embracing environmentally friendly alternatives. This regulatory push is not only reducing emissions but also stimulating innovation among manufacturers to introduce cleaner, compliant models, fueling long-term market growth.

- For instance, Renault Trucks has received the first French road approval for an electric retrofitted truck, supported by the French Environment and Energy Management Agency (Ademe), showcasing innovation driven by regulatory and subsidy frameworks.

Growing Lifestyle and Recreational Usage

Pickup trucks are increasingly becoming popular among private buyers in France, driven by their appeal as lifestyle and recreational vehicles. Models that combine off-road capabilities with comfort and advanced features are attracting consumers interested in adventure travel, outdoor recreation, and towing recreational equipment. This trend has led manufacturers to introduce more stylish, feature-rich trucks with improved interiors and advanced technology packages. As consumer preferences evolve, the crossover of pickups into personal mobility and lifestyle segments is expanding the customer base beyond traditional commercial users.

Key Trends & Opportunities

Electrification and Sustainable Vehicle Development

One of the most prominent trends in the France Pickup Truck Market is the growing shift toward electric and hybrid pickup models. As environmental concerns rise, consumers and businesses are increasingly seeking sustainable alternatives to diesel-powered vehicles. Major manufacturers are responding by introducing electric pickup prototypes and working on battery advancements to improve range and towing capacity. This shift presents a significant opportunity, particularly for early adopters and market leaders, as the demand for eco-friendly utility vehicles increases in alignment with national carbon neutrality targets.

- For instance, Mercedes-Benz Trucks launched the battery-electric eActros 600 long-haul truck, featuring integrated electric axles and lithium iron phosphate batteries, operating successfully in over 15 European countries, including France.

Advanced Safety and Connectivity Features

Modern pickup trucks in France are evolving with integrated advanced driver-assistance systems (ADAS), connected interfaces, and smart telematics. Features such as lane assist, adaptive cruise control, 360-degree cameras, and cloud-based fleet management tools are gaining traction, especially in commercial fleets aimed at improving safety and operational efficiency. Connectivity enhancements allow fleet managers to monitor vehicle health, optimize routes, and reduce downtime. This trend not only elevates user experience but also helps manufacturers differentiate products, opening avenues for premium pickup variants with advanced digital capabilities.

- For instance, fleet telematics providers like Munic offer AI-powered solutions tailored for trucks and light commercial vehicles, enabling real-time monitoring of vehicle health, fuel usage, and driver behavior. These systems allow fleet managers to optimize routes and reduce downtime effectively.

Key Challenges

High Ownership and Maintenance Costs

Despite their utility, pickup trucks often come with high upfront prices, insurance premiums, and maintenance costs, which limit adoption for smaller businesses and private users. The total cost of ownership, especially for heavy-duty and electric models, can be prohibitive compared to compact vans or passenger vehicles. These costs include regular maintenance, tire replacements, fuel or charging expenses, and compliance with emission standards. The financial burden poses a challenge for widespread market penetration, especially in cost-sensitive segments, and may slow down the adoption rate in certain regions.

Limited Infrastructure for Electric Pickups

While the shift toward electrification presents vast opportunities, the limited availability of adequate charging infrastructure remains a significant roadblock in France. Electric pickup trucks require fast-charging stations capable of supporting larger batteries and higher energy demands. Rural areas, where pickup usage is high, often lack sufficient charging points, resulting in range anxiety for users. Although government initiatives are underway to expand the charging network, the current infrastructure gap hinders fast adoption of electric pickups, particularly among fleets requiring long-distance travel and fast turnaround times.

Regional Analysis

Northern France

Northern France holds around 28% share of the France Pickup Truck Market, driven by its strong industrial base, logistics hubs, and proximity to major transport corridors like Calais and Lille. The demand for pickup trucks is supported by cross-border trade and agricultural operations, where reliable utility vehicles play a key role. Businesses in construction and warehousing are also adopting light-duty pickups for everyday fleet needs. Furthermore, the presence of active freight and mining activities promotes demand for heavy-duty models, ensuring consistent uptake across both commercial and industrial sectors in this region.

Southern France

Southern France commands about 22% market share due to its vibrant tourism sector, expanding construction activities, and increasing preference for lifestyle-oriented vehicles. Regions like Provence-Alpes-Côte d’Azur and Occitanie are witnessing rising adoption of pickup trucks among hospitality and recreational service providers, who value versatility and off-road capability. Additionally, agricultural operations in rural areas fuel demand for diesel and electric-powered pickups. The region’s consumer market shows steady growth, supported by rising disposable incomes and greater interest in multi-purpose vehicles suited for both work and recreation.

Eastern France

Eastern France accounts for nearly 18% share, attributed to its significant automotive, manufacturing, and forestry sectors. Regions such as Grand Est and Bourgogne-Franche-Comté see strong demand for light-duty and medium-duty pickup trucks, especially for industrial and SME use. Cross-border activities with Germany and Switzerland also contribute to vehicle uptake, especially among logistics and small-scale exporters. Government-backed incentives for electric and fuel-efficient vehicles are gaining traction in this region, with rising interest in sustainable transport solutions. The stable industrial landscape ensures ongoing demand across various applications.

Western France

Western France holds close to 20% market share, driven by its maritime industries, agricultural businesses, and growing logistics operations. The regions of Brittany and Pays de la Loire rely heavily on pickup trucks for coastal infrastructure projects, farming, and fisheries. Light-duty pickups remain popular due to their flexibility and ease of operation in both rural and suburban environments. Manufacturers are targeting this region with compact, fuel-efficient models to cater to small business owners and agricultural users. Increasing interest in electric pickups is also emerging, especially in cities like Nantes and Rennes.

Central France

Central France represents around 12% of the market, with demand largely driven by government services, infrastructure maintenance, and smaller-scale agricultural operations. The region’s mix of urban centers and rural communities fosters steady demand for pickup trucks, particularly in municipalities for utility work and fleet services. Although this region has relatively lower penetration compared to others, the potential for growth is notable. Long-term prospects are backed by initiatives to modernize fleet operations and integrate electric mobility, supported by rural electrification programs and transport subsidies aimed at improving regional accessibility.

Market Segmentations:

By Vehicle Type

- Light-duty Pickup Trucks

- Heavy-duty Pickup Trucks

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light Towing (Up to 7,500 lbs)

- Medium Towing (7,501–12,000 lbs)

- Heavy Towing (12,001+ lbs)

By Region

- Northern France

- Southern France

- Eastern France

- Western France

- Central France

Competitive Landscape

The competitive landscape in the France Pickup Truck Market features leading players such as Ford Motor Company, Toyota Motor Corporation, Isuzu Motors Ltd., Volkswagen AG, Nissan Motor Co., Ltd., and Mitsubishi Motors Corporation. These companies collectively drive market momentum through continuous product innovation, focused regional strategies, and diversified model portfolios designed to meet both commercial and personal vehicle demands. Ford and Toyota maintain a strong presence, offering advanced pickup models known for durability, technology integration, and performance. Volkswagen and Nissan are expanding their portfolio through electric and hybrid options to align with France’s evolving sustainability targets. Meanwhile, Isuzu and Mitsubishi Motors emphasize utility value, positioning their vehicles for rural and industrial customers with high towing and payload needs. Strategic partnerships, dealership network expansions, and localized manufacturing initiatives are also key to sustaining growth. With electric mobility on the rise, players are investing heavily in EV platforms and connectivity features to stay competitive in an increasingly regulated market.

Key Player Analysis

Recent Developments

- In July 2025, Arquus (France) and Daimler Truck (Germany) entered a strategic partnership to develop and supply new military-truck vehicles (including pickup/utility formats) for the French Armed Forces.

- In June 2025, Ford Motor Company launched the plug-in-hybrid version of its best-selling European pickup, the “Ranger PHEV”, bringing hybrid powertrain capability into the Europe pickup segment (impacting France).

- In April 2025, Isuzu Motors revealed its new fully electric commercial pickup truck (the “D-Max EV”) for the European market, featuring more than 1-tonne payload and 3.5-tonne towing capacity.

- In February 2025, DB Schenker France placed an order for 66 battery-electric trucks from Renault Trucks (including six electric tractor units) in France as part of fleet electrification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Pickup Truck Market will continue expanding due to rising demand from small and medium-sized commercial sectors.

- Electric pickup models will gain momentum driven by sustainability goals and supportive government incentives.

- Manufacturers will increasingly focus on hybrid powertrains to balance performance with emissions control.

- Urban areas will see growing adoption of compact pickups for last-mile delivery and personal use.

- Connectivity features and advanced telematics will become standard for fleet efficiency and safety.

- Lifestyle and recreational usage will drive upgrades in design, comfort, and customization options.

- Heavy-duty models will see limited but steady demand from construction and industrial sectors.

- Integrated ADAS safety systems will help differentiate premium models in a competitive market.

- Competitive pressure will accelerate partnerships and localization of assembly to reduce costs.

- Charging infrastructure development will be critical for wider electric pickup adoption in rural regions.

Market Segmentation Analysis:

Market Segmentation Analysis: