Market Overview

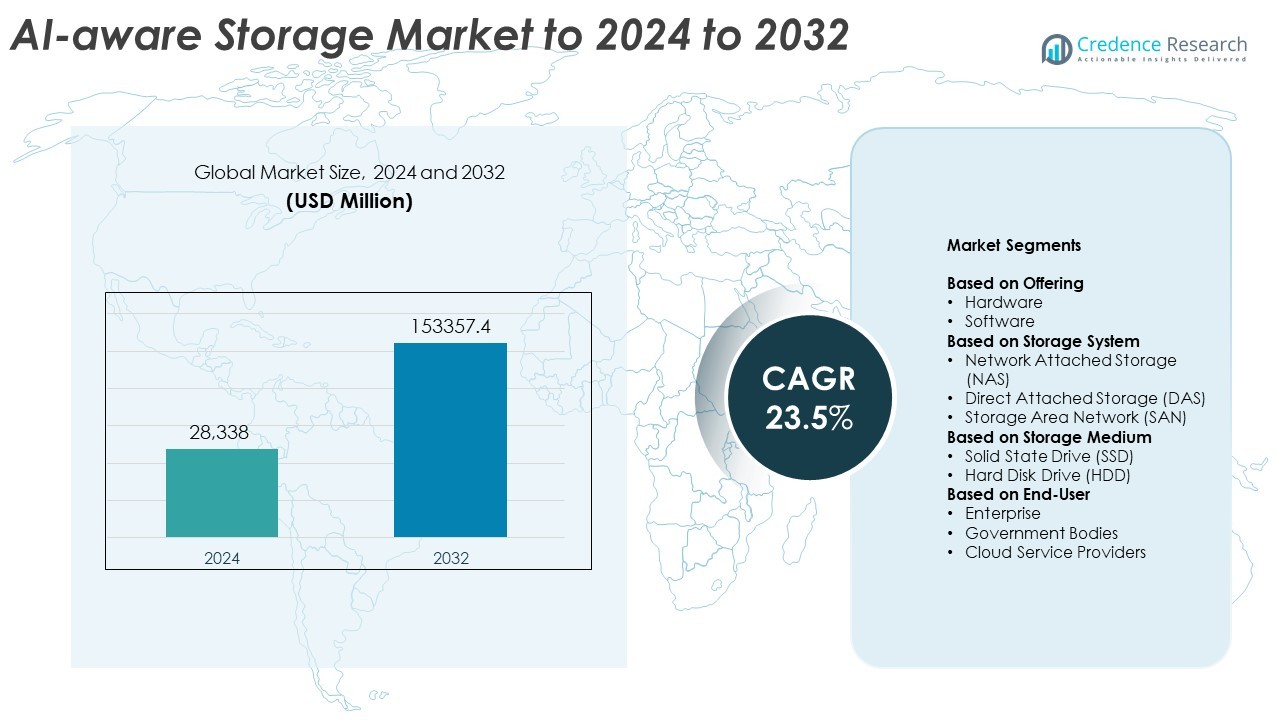

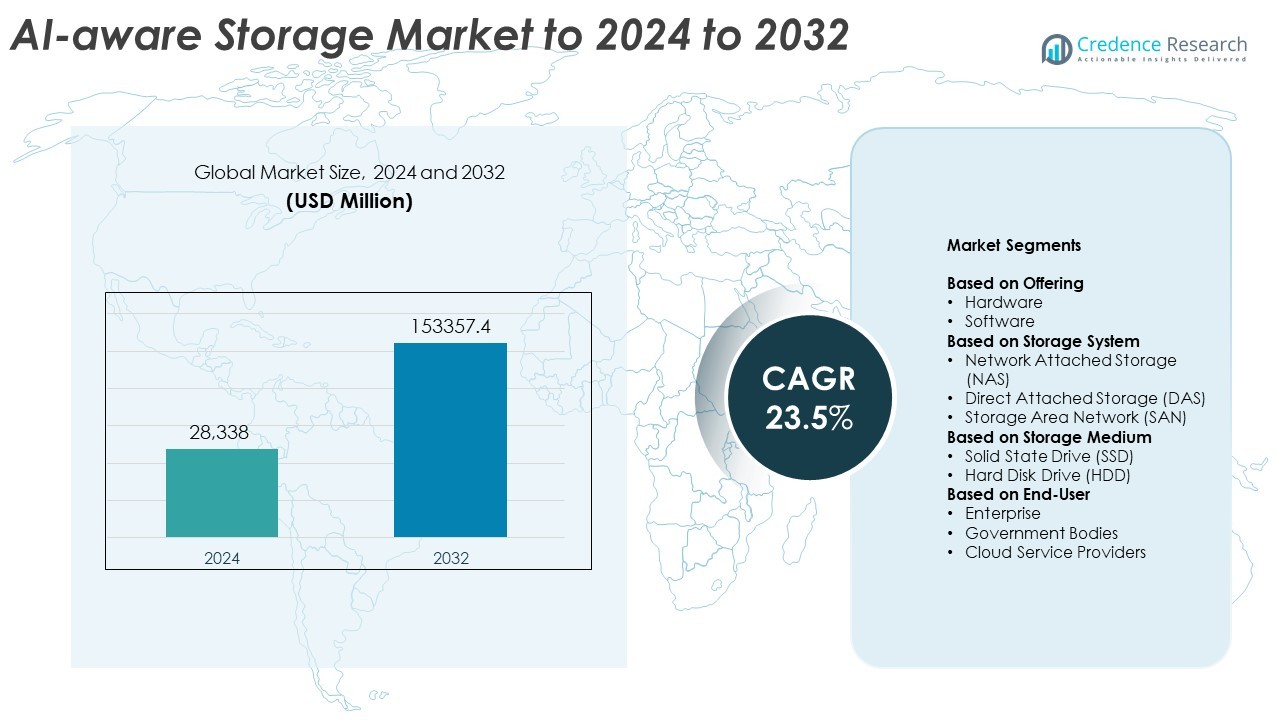

AI-aware storage market size was valued USD 28,338 million in 2024 and is anticipated to reach USD 153,357.4 million by 2032, at a CAGR of 23.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AI Aware Storage Market Size 2024 |

USD 28,338 Million |

| AI Aware Storage Market, CAGR |

23.5% |

| AI Aware Storage Market Size 2032 |

USD 153,357.4 Million |

The AI-aware storage market is shaped by major players such as Google Cloud, Pure Storage, Hitachi Vantara, Lenovo, NetApp, NVIDIA, Dell Technologies, Amazon Web Services (AWS), IBM Corporation, and HPE. These companies drive innovation through high-speed NVMe platforms, scalable SSD arrays, and intelligent data-management software designed for intensive AI workloads. North America emerged as the leading region with about 38% share in 2024, supported by strong cloud expansion, advanced data-center ecosystems, and higher enterprise AI adoption. Asia Pacific and Europe followed with rising demand for high-performance storage to manage growing volumes of unstructured data.

Market Insights

- The AI-aware storage market reached USD 28,338 million in 2024 and will hit USD 153,357.4 million by 2032, growing at a CAGR of 23.5%.

• Strong demand for high-speed data processing and rising AI adoption in enterprises drive the market as organizations depend on NVMe systems, SSD arrays, and low-latency architectures for model training and analytics.

• Key trends include rapid migration toward SSD-centric infrastructure, expansion of edge AI storage, and increased use of hybrid and multi-cloud environments supporting flexible AI workloads.

• Competition intensifies as leading vendors enhance AI-optimized hardware, scalable storage clusters, and automated data-management tools to support growing datasets across major industries.

• North America held about 38% share in 2024, Asia Pacific captured around 25%, and Europe accounted for nearly 22%, while hardware dominated the offering segment with nearly 67% share due to rising deployment of high-performance AI storage platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

Hardware held the dominant share in 2024 with about 67% of the AI-aware storage market. Strong growth came from higher deployment of GPU-optimized storage arrays and high-bandwidth NVMe systems that support faster model training and inference. Enterprises selected hardware-centric setups because they deliver predictable throughput for large datasets and real-time AI workloads. Software showed steady uptake as firms adopted data management layers and automated tiering tools, but hardware remained ahead due to rising investments in AI infrastructure across cloud, telecom, and hyperscale data centers.

- For instance, the Pure Storage FlashBlade//S is certified for NVIDIA AI infrastructure. The newer FlashBlade//EXA system, which is part of the FlashBlade family designed for large-scale AI, has demonstrated read performance of over 10 terabytes per second (TB/s) within a single namespace in preliminary testing.

By Storage System

Network Attached Storage led this segment in 2024 with nearly 49% share. NAS gained traction because organizations needed scalable file-based access for unstructured training datasets and multi-user AI pipelines. The architecture supported smooth integration with analytics clusters and provided high-capacity expansion at lower operating costs. DAS saw use in edge and device-level AI tasks, while SAN grew in high-performance enterprise environments, but NAS maintained leadership due to strong demand from healthcare, automotive, and research workloads that process large volumes of image and sensor data.

- For instance, QNAP’s QuTS hero NAS model TS-h2490FU delivers up to 661K (661,000) iSCSI 4K random read IOPS and up to 245K random write IOPS, according to its official performance specifications, utilizing the ZFS-based operating system for high-performance, low-latency applications.

By Storage Medium

Solid State Drives dominated the storage medium segment in 2024 with close to 61% share. The leadership resulted from higher read-write speeds, lower latency, and better energy efficiency required for AI inference and training cycles. SSD-based systems enabled faster retrieval of large datasets and reduced training bottlenecks in multiprocessor environments. HDDs remained relevant for archival and cold AI data storage due to lower cost per terabyte, yet SSDs maintained dominance as companies scaled real-time analytics, autonomous system datasets, and machine learning pipelines.

Key Growth Drivers

Rising demand for high-speed data processing

Growing use of AI models pushed enterprises to adopt storage systems that handle rapid data movement with low latency. Training large models created heavy workloads that required faster throughput and scalable architectures. Companies upgraded to NVMe-based platforms and GPU-aligned storage to maintain smooth model execution. This shift increased adoption across cloud providers, research labs, and enterprise AI pipelines. As more industries integrate predictive analytics and automation, the need for high-speed storage continues to expand and supports strong market acceleration.

- For instance, the Lenovo ThinkSystem SR675 V3 server supports the NVIDIA HGX H100 4-GPU complex, which utilizes NVIDIA NVLink technology to provide GPU-to-GPU direct connection bandwidth of up to 900 GB/s.

Expansion of unstructured data volumes

Organizations generated rising volumes of images, videos, sensor logs, and text data, which demanded advanced storage frameworks. Unstructured datasets became central to training modern AI applications in healthcare, retail, transport, and security. Businesses invested in scalable file and object storage that could handle large datasets without slowing pipelines. This trend encouraged wider use of distributed storage clusters across data-heavy environments. The steady expansion of unstructured data now drives adoption of intelligent storage optimized for indexing, retrieval, and processing.

- For instance, Seagate’s Exos X24 enterprise hard drive line offers a market-leading capacity of 24 TB per single 3.5-inch drive.

Growing integration of AI in enterprise workflows

Enterprises embedded AI across decision-making, automation, and real-time monitoring systems, which increased pressure on storage infrastructure. AI-aware storage supported automated tiering, dynamic resource allocation, and predictive analytics for data management. These features reduced operational delays and improved efficiency for complex workflows. Adoption grew in banking, manufacturing, and telecom operations that needed continuous data availability. As AI becomes a core element of business transformation, demand for intelligent storage systems rises steadily.

Key Trends and Opportunities

Shift toward SSD-centric AI infrastructure

Many companies adopted SSD-based systems to support faster AI inference and training tasks. SSDs offered low latency and higher data handling speeds, making them suitable for real-time analytics and model development. Their energy efficiency and durability improved long-term operational value for data centers. Wider migration from HDD to SSD created opportunities for vendors specializing in high-performance AI storage. This shift is expected to continue as enterprises expand AI workloads and require more responsive storage environments.

- For instance, SK hynix’s Platinum P51 PCIe 5.0 SSD, which utilizes an in-house “Alistar” controller and 238-layer NAND, is rated for sequential read speeds of up to 14,700 MB/s and write speeds of up to 13,400 MB/s, based on its official performance specifications.

Increasing adoption of edge AI storage

Industries embraced edge computing to process data closer to devices, reducing delays in AI applications. Edge AI storage supported faster decision cycles in areas like autonomous systems, industrial automation, and remote surveillance. Companies deployed compact, rugged storage nodes capable of handling localized data bursts. This trend opened new opportunities for vendors offering low-latency storage optimized for edge workloads. Growth in IoT devices and real-time systems ensures strong demand for distributed and intelligent storage solutions.

- For instance, ADLINK’s EOS-JNX edge AI platform is powered by the NVIDIA Jetson Xavier NX module and provides up to 21 TOPS of AI compute power.

Growth of hybrid and multi-cloud environments

Businesses moved toward hybrid and multi-cloud setups to store, manage, and deploy AI data more flexibly. These environments enabled smooth scaling of AI workloads while maintaining cost control. Vendors responded with unified storage platforms that ensured consistent performance across on-premise and cloud resources. This shift created opportunities for solutions with advanced data mobility, security, and orchestration capabilities. As multi-cloud adoption expands, demand for interoperable AI-ready storage continues to increase.

Key Challenges

High infrastructure and deployment costs

AI-aware storage required significant investment in high-performance hardware, NVMe systems, and scalable architectures. Many enterprises found initial costs difficult to manage, especially smaller organizations or those with limited AI budgets. Ongoing expenses for upgrades, cooling, and power use added financial pressure. These challenges slowed adoption among cost-sensitive industries. Despite strong long-term benefits, high upfront spending remains a major barrier for widespread deployment of intelligent storage solutions.

Complexity in managing large-scale AI data pipelines

AI workloads involved diverse data formats and required continuous movement across storage layers. Managing these pipelines demanded advanced orchestration tools and skilled IT teams. Many enterprises struggled with data fragmentation, latency control, and integration across cloud and on-premise systems. These issues created operational delays and affected model performance. As datasets grow and applications become more complex, pipeline management challenges remain a significant hurdle for the AI-aware storage market.

Regional Analysis

North America

North America held about 38% share of the AI-aware storage market in 2024 and remained the leading region due to strong investment in AI infrastructure, cloud platforms, and large-scale data centers. Enterprises in healthcare, finance, retail, and technology adopted high-performance storage to support advanced analytics and large training datasets. The region benefited from early deployment of NVMe systems and AI-optimized hardware. Expanding edge AI applications and continued leadership of hyperscale providers helped reinforce North America’s dominant position in the market.

Europe

Europe accounted for nearly 22% share in 2024, driven by rising adoption of AI-enabled workflows across automotive, telecom, and industrial sectors. Strict data protection regulations encouraged organizations to implement secure, hybrid storage models that support AI workloads. Advanced manufacturing patterns and strong enterprise digitalization boosted demand for scalable NAS and SSD-based systems. Western Europe led regional uptake, while Eastern Europe showed steady progress as infrastructure modernization accelerated. Growing focus on real-time analytics supported broader market expansion.

Asia Pacific

Asia Pacific held about 25% share in 2024 and emerged as the fastest-growing region, supported by rapid digital transformation in China, India, South Korea, and Southeast Asia. Rising volumes of unstructured data and large AI deployments in e-commerce, manufacturing, and telecom pushed demand for high-speed storage. Investments in new data centers and strong government support for AI innovation strengthened adoption across enterprises. Wider use of edge AI and cloud-based systems contributed to robust regional momentum and long-term growth potential.

Latin America

Latin America captured around 8% share in 2024, supported by growing cloud adoption and rising use of AI applications in banking, retail, and public services. Regional enterprises increased investment in modern storage systems to manage larger datasets and real-time workloads. Countries such as Brazil and Mexico led adoption as digital transformation accelerated. Limited high-end infrastructure in some markets slowed progress, yet improving connectivity and enterprise modernization continued to create demand for scalable AI-ready storage.

Middle East & Africa

Middle East & Africa held close to 7% share in 2024, with growth driven by rising deployment of AI technologies in smart cities, telecom modernization, and government digital transformation programs. Investments in regional data centers supported demand for AI-aware storage capable of handling large and complex datasets. The Gulf countries led adoption, while broader uptake in Africa remained slower due to infrastructure gaps. However, increasing enterprise cloud usage and expanding AI-based applications created steady opportunities for market growth.

Market Segmentations:

By Offering

By Storage System

- Network Attached Storage (NAS)

- Direct Attached Storage (DAS)

- Storage Area Network (SAN)

By Storage Medium

- Solid State Drive (SSD)

- Hard Disk Drive (HDD)

By End-User

- Enterprise

- Government Bodies

- Cloud Service Providers

- Telecom Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The AI-aware storage market features leading participants such as Google Cloud, Pure Storage, Hitachi Vantara, Lenovo, NetApp, NVIDIA, Dell Technologies, Amazon Web Services (AWS), IBM Corporation, and HPE (Hewlett Packard Enterprise). Competition strengthened as vendors focused on delivering high-performance storage platforms optimized for AI training, inference, and real-time analytics. Companies expanded portfolios with NVMe systems, scalable SSD arrays, and intelligent data-management software to handle rapid data growth. Many providers integrated advanced automation, tiering capabilities, and AI-driven optimization tools to improve workload efficiency. Strategic investments in hybrid and multi-cloud architectures enhanced cross-platform compatibility and reduced latency for enterprise AI pipelines. Vendors also increased collaboration with data-center operators and enterprises pursuing large-scale machine-learning deployments. Growing demand for edge AI pushed suppliers to develop compact, low-latency storage nodes tailored for distributed environments. Continuous innovation and infrastructure modernization across industries are expected to intensify competition throughout the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, NetApp introduced its AI Data Engine, a secure, unified extension of its ONTAP operating system designed to manage AI data pipelines across cloud, virtualized, and on-premises environments.

- In 2025, Dell Technologies doubled storage density for AI workloads by integrating new 122TB Solidigm SSDs into its PowerScale systems, enabling up to 6 petabytes per node.

- In 2023, Lenovo Launched new data management solutions, including ThinkSystem DG and DM3010H Enterprise Storage Arrays, designed to simplify AI workload deployment.

Report Coverage

The research report offers an in-depth analysis based on Offering, Storage System, Storage Medium, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as enterprises scale AI workloads across core operations.

- Demand for NVMe-based systems will rise due to faster model training needs.

- SSD adoption will accelerate as organizations reduce latency in AI pipelines.

- Hybrid and multi-cloud storage models will gain broader acceptance.

- Edge AI deployments will boost demand for compact, high-speed storage nodes.

- Unstructured data growth will push companies toward scalable file and object storage.

- Data-center modernization will increase investments in AI-optimized storage hardware.

- Automated tiering and intelligent data management will become standard features.

- Industry-specific AI applications will drive customized storage solutions.

- Vendors will focus on energy-efficient architectures to support sustainable AI expansion.