Market overview

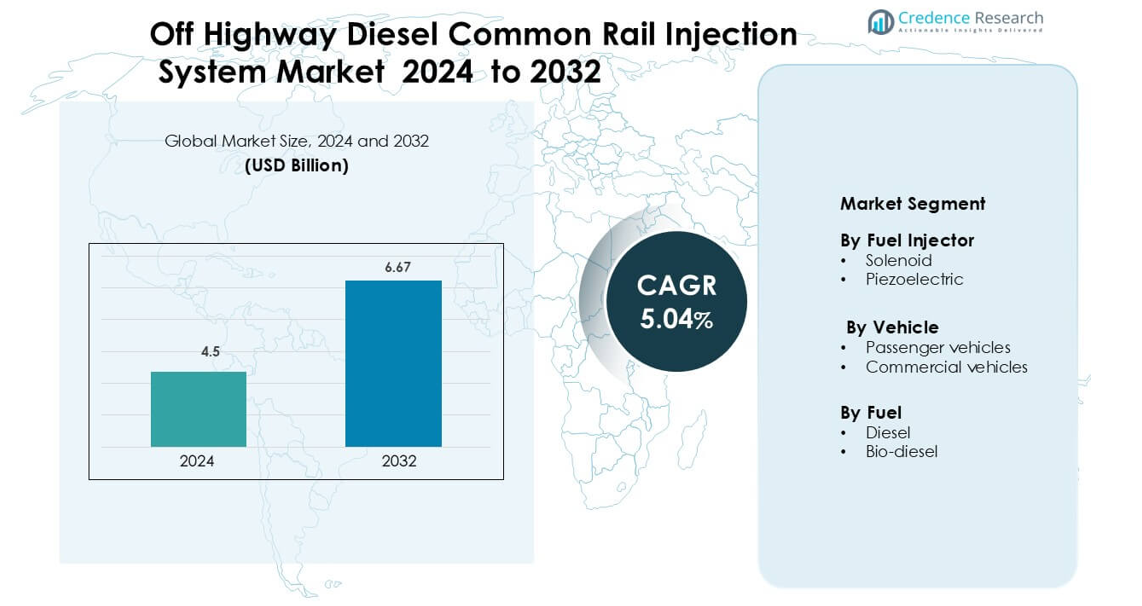

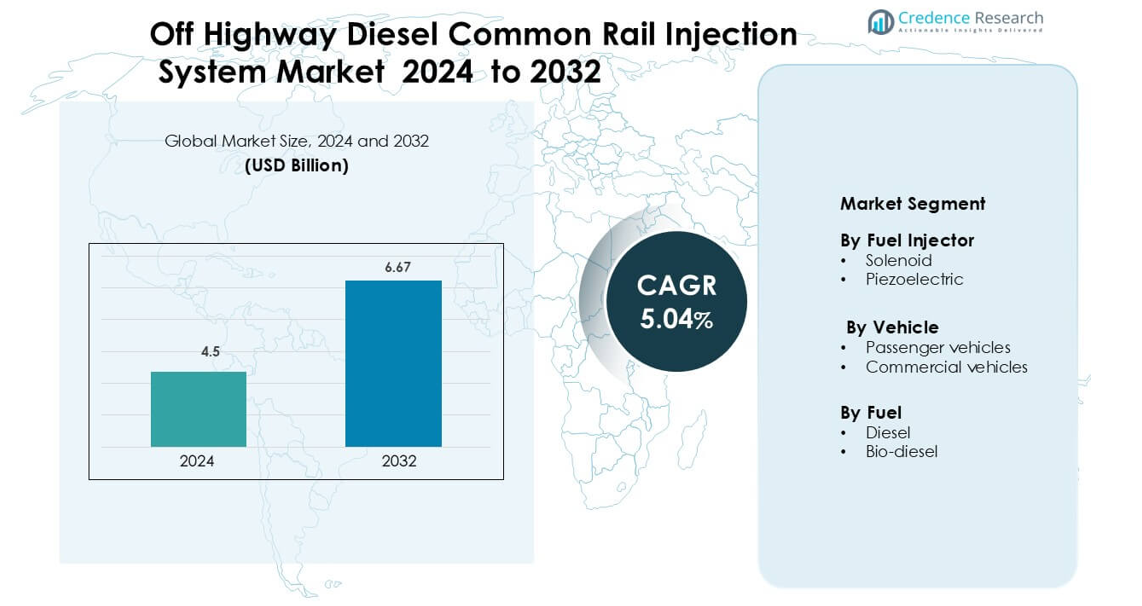

Off Highway Diesel Common Rail Injection System Market was valued at USD 4.5 billion in 2024 and is anticipated to reach USD 6.67 billion by 2032, growing at a CAGR of 5.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off-Highway Diesel Common Rail Injection System Market Size 2024 |

USD 4.5 billion |

| Off-Highway Diesel Common Rail Injection System Market, CAGR |

5.04% |

| Off-Highway Diesel Common Rail Injection System Market Size 2032 |

USD 6.67 billion |

Leading players in the Off-Highway Diesel Common Rail Injection System market include Robert Bosch, Denso Corporation, Continental AG, Cummins, Siemens, Magneti Marelli, Mahle GmbH, Hyundai Kefico, Liebherr Group, and BorgWarner. These companies supply advanced injectors, high-pressure pumps, and electronic control systems for tractors, harvesters, excavators, and mining trucks. Their innovations focus on higher injection pressure, lower emissions, and longer component life under heavy-duty operation. Asia-Pacific remains the leading region with a 35% market share, driven by rapid infrastructure growth, expanding construction activity, and increasing adoption of emission-compliant diesel engines in agricultural and industrial machinery.

Market Insights

- The Off-Highway Diesel Common Rail Injection System market is valued at USD 4.5 in 2024 and is projected to reach USD 6.67 by 2032, growing at a CAGR of 5.04%.

- Emission regulations and fuel-efficiency requirements drive strong adoption of high-pressure common rail systems across agricultural, construction, and mining fleets.

- Solenoid injectors lead the fuel injector segment with close to 65% share due to lower cost, easier service, and wide OEM compatibility, while piezoelectric injectors gain traction in premium diesel platforms.

- Leading players such as Robert Bosch, Denso Corporation, Cummins, Continental AG, and Siemens invest in advanced injectors, pumps, and ECUs to enhance precision, durability, and diagnostics, strengthening competitive intensity.

- Asia-Pacific holds the dominant 35% regional share, supported by infrastructure growth and farm mechanization, followed by North America at 33%; commercial vehicles represent nearly 72% of total demand due to long duty cycles and higher torque requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fuel Injector

Solenoid injectors hold the dominant share in the Off-Highway Diesel Common Rail Injection System market. They capture close to 65% of total adoption due to lower production cost, simple design, and strong durability under harsh load cycles. Solenoid units deliver reliable injection timing for agricultural tractors, construction loaders, and mining equipment. Their serviceability and compatibility with existing engine platforms support wide OEM integration. Fleet operators prefer solenoid injectors because spare parts are easily available, reducing downtime. As machinery manufacturers continue prioritizing cost-efficient engine upgrades, solenoid injectors maintain strong retention, strengthening their leading market position.

- For instance, Bosch is a major global supplier of diesel injection technology and has produced millions of systems (e.g., 10 million common-rail systems for commercial vehicles as of a 2013 report).

By Vehicle

Commercial vehicles account for the largest market share, representing nearly 72% of installations in off-highway diesel common rail systems. Construction excavators, mining trucks, harvesters, and material-handling machinery rely heavily on high-pressure injection for extra torque, fuel savings, and emission compliance. Commercial fleets operate in long work cycles, which drives demand for precision fuel delivery and reduced maintenance. OEMs integrate electronically controlled common rail systems to ensure combustion efficiency and stable power output under heavy loads. The rise in infrastructure projects worldwide and mechanized farming continues to expand commercial vehicle deployment, keeping this segment dominant in the market.

- For instance, Caterpillar Inc. equips The C7.1 engine is indeed available in a maximum power rating of 320 hp (240 kW).

By Fuel

Diesel remains the dominant fuel segment with close to 88% market share in common rail injection systems for off-highway applications. Diesel engines provide higher energy density, better torque generation, and longer operating hours, making them suitable for mining, forestry, construction, and agricultural equipment. The widespread availability of diesel-compatible components and established distribution networks ensures consistent demand. Over the years, common rail technology has improved emissions, soot control, and NOx reduction, helping diesel engines meet global regulatory norms. Although biodiesel adoption increases, diesel-powered machinery continues to dominate due to proven reliability and strong service infrastructure.

Key Growth Drivers

Stringent Emission Regulations and Engine Efficiency Needs

Global emission standards push off-highway equipment makers to adopt advanced fuel injection systems. Common rail technology delivers precise fuel metering, higher injection pressure, and cleaner combustion. These improvements reduce particulate emissions, NOx output, and unburnt hydrocarbons. Governments enforce tighter norms for mining, agriculture, and construction vehicles, creating steady replacement demand for modern injection platforms. OEMs upgrade engines to meet Tier-4 and Stage-V compliance without sacrificing power or fuel efficiency. Common rail systems help operators reduce fuel consumption during long duty cycles, lowering operational costs. The combination of regulatory pressure and efficiency gains positions advanced injection technology as a critical upgrade for most heavy-duty mobile machinery.

- For instance, Cummins Inc. integrated a 2,500-bar high-pressure common rail system in its B6.7 Performance Series engines, achieving full EPA Tier 4 Final and EU Stage V compliance while maintaining output up to 326 horsepower.

Rising Mechanization in Agriculture and Construction

Infrastructure spending and farmland mechanization increase the production and sale of heavy-duty vehicles such as excavators, loaders, tractors, and harvesters. These machines require consistent torque output, fuel efficiency, and long engine life, which common rail systems support with controlled injection timing and pressure stability. As countries invest in road building, mining expansion, irrigation projects, and smart agriculture, off-highway diesel fleets continue to grow. Equipment rental companies also upgrade their fleets to improve productivity per operating hour. Higher machine utilization rates strengthen the need for reliable systems that minimize downtime. The trend ensures sustained demand for common rail injection platforms in both new machinery and aftermarket replacement.

- For instance, John Deere utilizes Denso’s HPCR 1200 bar fuel injection system in its 8R series tractors, enabling precise injection control for engines producing up to 410 horsepower and reducing fuel consumption across long farming cycles.

Advancements in Electronic and Hydraulic Control Systems

Technological innovation in sensors, injectors, and high-pressure pumps increases adoption of common rail systems across varied terrain and load conditions. Electronic control units (ECUs) now enable real-time injection correction, cold-start support, and adaptive fuel mapping. This precision enhances horsepower delivery and reduces smoke generation under heavy load. Improved materials and high-pressure components support injection pressures exceeding 2,000 bar, creating better atomization and cleaner burn cycles. These benefits encourage OEMs to integrate next-generation common rail modules into equipment platforms for construction, mining, and forestry. Performance improvements help fleets meet service life expectations in challenging environments, supporting long-term market growth.

Key Trend & Opportunity

Integration of Digital Diagnostics and Predictive Maintenance

Off-highway vehicle manufacturers add smart diagnostics to engine systems to track injection accuracy, error codes, and fuel pressure changes. Predictive maintenance helps prevent injector fouling, pump wear, and fuel leakage, reducing downtime. Data analytics platforms send alerts to fleet managers for scheduled service, improving machine availability. Remote monitoring allows OEMs to link telematics with fuel system health, creating opportunities for aftermarket service contracts. As diesel machinery becomes more connected, common rail systems gain importance as digitally supported components. This integration expands revenue opportunities in spares, sensors, and calibration software.

- For instance, Multiple official sources from Caterpillar confirm having over 1.2 million, and more recently, up to 1.5 million or 1.4 million+ connected assets as of 2022-2023 and into 2024/2025.

Growing Shift Toward Low-Sulfur Diesel and Biofuel Compatibility

Tighter fuel quality regulations increase the use of low-sulfur diesel to reduce soot and engine deposits. Common rail systems perform efficiently with these cleaner fuels due to improved injector durability and pressure stability. Market players also explore compatibility with biodiesel blends, supporting sustainability targets in agriculture and construction fleets. Manufacturers develop injectors with corrosion-resistant materials and filtration systems to handle varying fuel grades. As mines and farms adopt greener fuel options, demand rises for injection systems engineered for mixed-fuel environments, creating long-term opportunities for innovation.

- For instance, Bosch offers various Common Rail Injection (CRIN) systems, such as the CRSN3-25 for commercial vehicles, which is capable of 2,500 bar pressure.

Key Challenge

High System Cost and Complex Maintenance

Common rail injection systems require precision pumps, electronic controls, and high-pressure lines, leading to higher upfront cost than mechanical systems. Small fleet owners and low-income regions delay upgrades due to budget constraints. Maintenance also needs skilled technicians and diagnostic tools, increasing service expenses. In remote mining or farming sites, limited service access causes longer downtime during system failures. Although efficiency benefits offset long-term costs, high acquisition and repair prices still slow adoption, especially in developing markets.

Vulnerability to Fuel Contamination and Harsh Operating Conditions

Off-highway machinery often works in dusty, muddy, or humid environments. Fuel contamination from water or debris quickly damages injectors and pumps due to narrow nozzle tolerances. Dirty fuel increases wear, reduces pressure stability, and causes misfiring, forcing premature replacement. Operators must use advanced filtration and high-quality fuel, which raises operating expenses. Equipment in remote regions lacks reliable fuel quality control, making system durability a concern. This vulnerability remains a barrier to wider adoption in challenging field operations.

Regional Analysis

North America

North America holds a leading position in the Off-Highway Diesel Common Rail Injection System market with close to 33% share. The region benefits from strong demand for construction equipment, mining fleets, and large-scale agricultural mechanization. OEMs integrate advanced injection platforms to meet Tier-4 and Stage-V emission norms while maintaining high torque and fuel efficiency. The U.S. and Canada focus on infrastructure upgrades, oil and gas extraction, and precision farming, which drives new machinery sales and aftermarket replacement. Strong service networks, availability of high-quality diesel, and adoption of digital diagnostics further strengthen market growth in the region.

Europe

Europe accounts for nearly 28% of total market share, driven by strict environmental standards and rapid adoption of clean-burn diesel engines. Common rail injection systems support Stage-V regulatory compliance and help OEMs reduce emissions without compromising output. Construction machinery, forestry vehicles, and agricultural tractors form the major demand base. Germany, Italy, and France host major machinery manufacturers that export off-highway equipment worldwide. Fleet owners prefer common rail platforms due to lower particulate output and better combustion efficiency. Advanced filtration, electronic engines, and predictive maintenance features also expand aftermarket opportunities and boost long-term system adoption.

Asia-Pacific

Asia-Pacific dominates the market with nearly 35% share, supported by large-scale industrialization, infrastructure projects, and mechanized agriculture. China, India, Japan, and South Korea are major demand centers for excavators, loaders, harvesters, and heavy-duty mining vehicles. Rising construction spending and mining output push OEMs to adopt high-pressure fuel injection systems for improved efficiency and power delivery. The region also sees strong investment in smart farming, boosting tractor and harvester sales. Growing diesel engine production, availability of replacement components, and increasing adoption of emission-compliant engines sustain the region’s leadership position.

Latin America

Latin America captures around 10% of the market, driven by agricultural expansion and mining production in Brazil, Chile, and Argentina. Harvesters, tractors, and construction machinery rely on common rail systems to improve torque and reduce fuel use in large farming areas. Mining operations adopt high-pressure injection engines for improved combustion in heavy-haul trucks and loaders. The market grows steadily as OEMs introduce cleaner diesel platforms to meet emission rules. However, fuel quality variations and limited service coverage in remote areas slow faster adoption, making aftermarket filtration and maintenance solutions important revenue streams.

Middle East & Africa

The Middle East & Africa region holds close to 7% market share, mainly supported by mining, construction, and oilfield operations. Heavy machinery fleets use common rail injection to optimize fuel performance under high temperatures and dusty conditions. GCC countries invest in infrastructure and smart urban development, increasing sales of cranes, excavators, and loaders. African mining regions continue adopting fuel-efficient engines to reduce operating cost. While growth potential is high, challenges such as inconsistent fuel quality and limited access to skilled maintenance restrict faster penetration. Increasing fleet modernization and equipment rental markets provide long-term opportunities.

Market Segmentations:

By Fuel Injector

By Vehicle

By Fuel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Off-Highway Diesel Common Rail Injection System market is characterized by strong participation from global automotive component manufacturers and specialized fuel system suppliers. Companies such as Robert Bosch, Denso Corporation, Cummins, Continental AG, and Siemens invest heavily in next-generation injectors, high-pressure pumps, and electronic control units to improve precision, durability, and emission compliance. These players develop systems that support higher injection pressures, cleaner combustion, and real-time engine diagnostics. OEM collaborations and long-term supply agreements strengthen their market dominance across agriculture, construction, and mining fleets. Emerging manufacturers focus on cost-efficient platforms and aftermarket services to gain traction in developing regions where equipment modernization continues. Strategic initiatives include new product launches, innovation in lightweight materials, and compatibility with low-sulfur diesel and biofuel blends. As emission laws tighten globally, leading companies expand R&D and service networks to maintain competitive advantage and capture replacement demand from aging machinery fleets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mahle GmbH

- Hyundai Kefico

- Robert Bosch

- Magneti Marelli

- Liebherr Group

- Cummins

- Continental AG

- Denso Corporation

- Siemens

- BorgWarner

Recent Developments

- In November 2023, Robert Bosch GmbH issued a press release indicating continued investment in its powertrain technologies-including common‑rail diesel systems—as part of its broader powertrain solutions portfolio.

- In May 2023, MAHLE GmbH (via its subsidiary MAHLE Powertrain) and Clean Air Power deepened collaboration to develop injector technology supporting renewable fuels such as hydrogen or methanol

Report Coverage

The research report offers an in-depth analysis based on Fuel Injector, Vehicle, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as construction and mining fleets adopt cleaner diesel engines.

- Higher injection pressures will improve combustion efficiency and reduce emissions.

- Digital diagnostics and predictive maintenance will expand aftermarket services.

- Biofuel-compatible injectors will support sustainability programs in agriculture.

- OEMs will integrate advanced ECUs for real-time injection control.

- Durable materials and coatings will extend injector life in harsh conditions.

- Developing regions will upgrade older machinery to emission-compliant engines.

- Rental equipment fleets will adopt common rail systems for better fuel savings.

- Hybrid and electrified equipment will still rely on clean diesel for heavy workloads.

- Global emission rules will reinforce investment in new product development.