Market overview

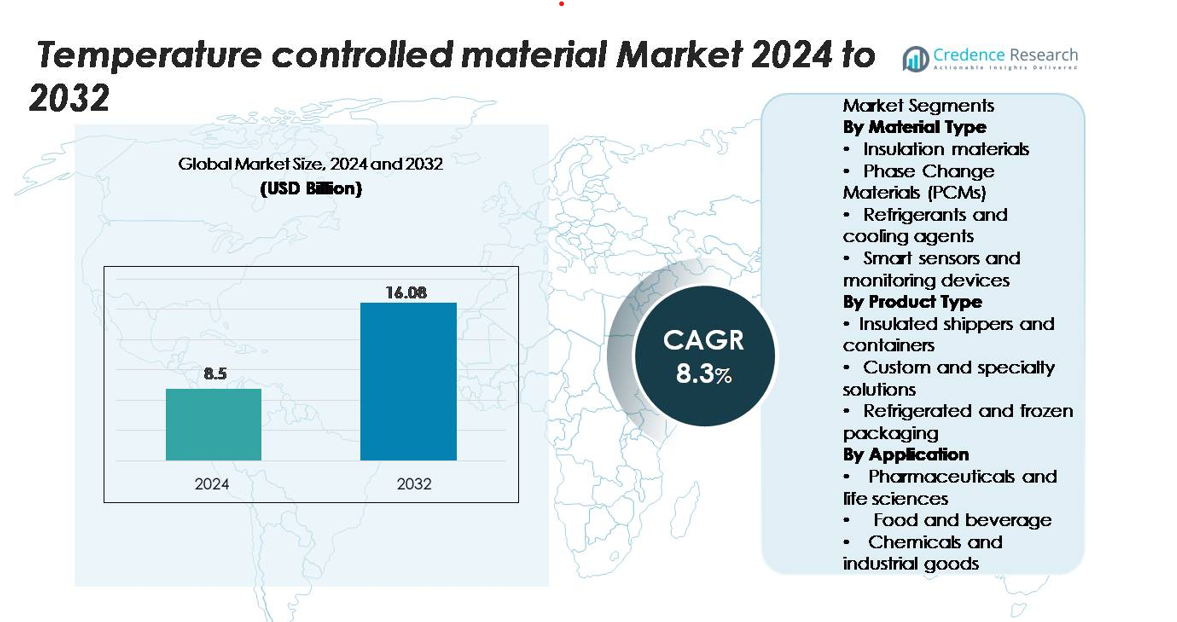

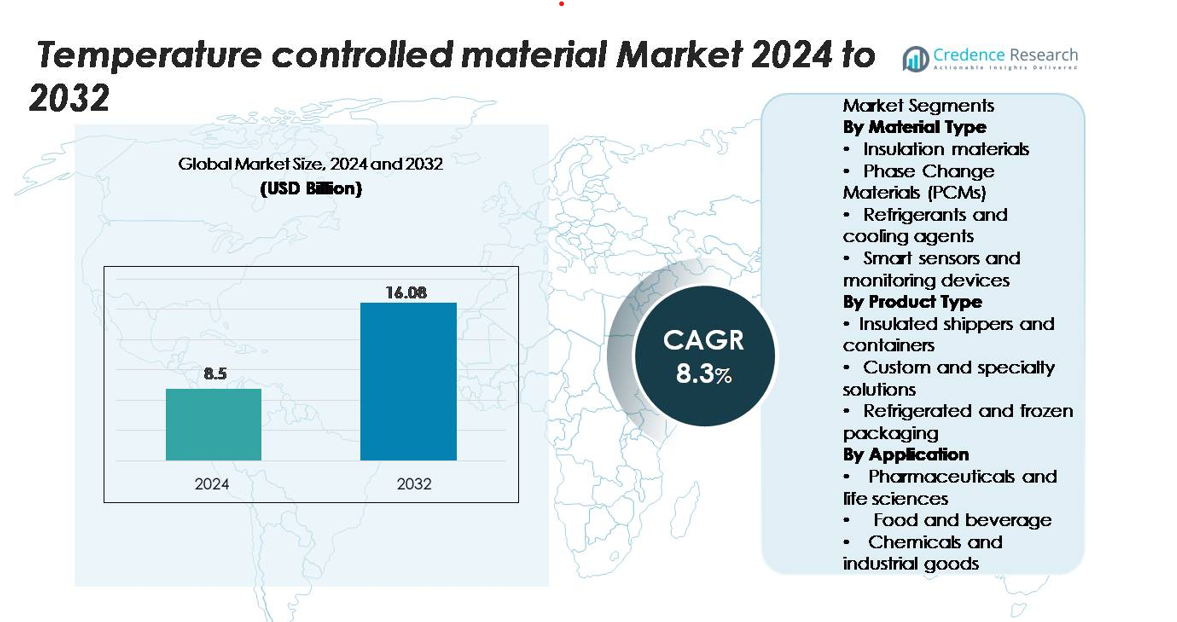

The temperature-controlled materials market was valued at USD 8.5 billion in 2024. It is projected to reach USD 16.08 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Temperature Controlled Material Market Size 2024 |

USD 8.5 billion |

| Temperature Controlled Material Market, CAGR |

8.3% |

| Temperature Controlled Material Market Size 2032 |

USD 16.08 billion |

The temperature-controlled materials market is shaped by major players such as Sonoco ThermoSafe, Pelican BioThermal, Cryopak, Cold Chain Technologies, and Softbox Systems. These companies supply insulated shippers, PCM-based solutions, refrigerants, and reusable temperature-stable containers for pharmaceuticals, biologics, chemicals, and frozen foods. Vendors compete on thermal efficiency, regulatory compliance, sustainability, and smart monitoring integration. Asia Pacific remains the fastest-growing region, while North America leads the market with a 35.6% share due to its large pharmaceutical distribution network, strong biologics production, and advanced cold chain infrastructure. As demand rises for real-time tracking, reusable packaging, and cross-border frozen transport, top companies continue expanding partnerships with logistics providers and healthcare distributors.

Market Insights

- The temperature-controlled materials market reached USD 8.5 billion in 2024 and will expand at a CAGR of 8.3% through 2032.

- Pharmaceutical cold chain compliance drives strong demand for insulation materials and PCM-based packaging, as biologics and vaccines require strict thermal protection during storage and transport.

- Smart sensor-enabled packaging, reusable containers, and eco-friendly refrigerants are trending as companies shift from single-use systems to recyclable and multi-trip solutions that reduce overall waste and lifetime cost.

- Major players, including Sonoco ThermoSafe, Pelican BioThermal, Cryopak, and Cold Chain Technologies, compete on reliability, sustainability, regulatory validation, and global logistics partnerships, while new regional suppliers attract buyers with low-cost alternatives.

- North America leads the market with 35.6% share, followed by Europe at 28.4% and Asia Pacific at 26.7%, while pharmaceuticals remain the dominant application segment and insulated shippers and containers hold the highest product share due to widespread use in global cold chain transport.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Insulation materials lead the temperature-controlled materials market and account for the largest share due to widespread use in pharmaceutical logistics, cold chain storage, and perishable food transport. These materials provide stable thermal resistance, low cost, and high compatibility with various packaging formats. Their dominance is driven by strict regulatory standards for biologics and vaccines, along with rapid expansion of refrigerated logistics. Phase change materials and refrigerants are gaining adoption in advanced, reusable systems, while smart sensors and monitoring devices continue to rise as real-time temperature tracking becomes a mandatory requirement in global supply chains.

- For instance, Pelican BioThermal’s Crēdo Cube shipper uses vacuum-insulated panels and phase-change inserts that maintain a 2–8°C range for up to 96 hours across international shipments.

By Product Type

Insulated shippers and containers hold the dominant share in this segment as they are widely deployed for vaccine transport, blood components, dairy, and frozen goods. Their durability, long hold times, and ability to comply with good distribution practices make them the preferred solution across air, road, and sea logistics. Demand for these products is driven by temperature-sensitive pharmaceutical movement and cross-border food shipments. Custom and specialty solutions and refrigerated packaging are growing steadily as companies adopt reusable crates, lightweight formats, and eco-friendly materials to improve cost efficiency and reduce waste in cold chain operations.

- For instance, Sonoco ThermoSafe’s Pegasus ULD active container is used on international air cargo routes and can maintain controlled temperatures across more than 40 certified airline networks, supporting global biological and clinical shipments.

By Application

Pharmaceuticals and life sciences represent the largest application segment, holding a significant share of the temperature-controlled materials market. Growth is driven by rising biologics production, vaccine distribution, precision medicines, and strict temperature mandates from regulatory bodies. Temperature failures can compromise product integrity, which supports continuous demand for high-performance insulation and smart monitoring. The food and beverage sector also contributes strong growth due to frozen food exports and online grocery deliveries, while chemicals and industrial goods adopt these systems to maintain material stability during storage and transportation.

Key Growth Drivers

Strict Cold Chain Compliance in Pharmaceuticals

Pharmaceutical distribution needs stable thermal protection. Biologics, vaccines, and cell-based therapies lose effectiveness when exposed to temperature swings. Global regulatory bodies demand controlled shipping, validated packaging, and continuous monitoring. This pressure increases the use of advanced insulation, PCMs, and smart tracking devices. Cold chain failures lead to product loss and safety risks, so pharma companies invest in reliable temperature-controlled materials. Contract logistics firms also expand capacity to handle sensitive products. Growth in cross-border clinical trials and home-based healthcare drives demand for solutions that maintain thermal stability during longer transit times. These factors make pharmaceutical logistics the strongest growth engine in this market.

- For instance, Cryopak’s TimeStrip-equipped containers include data loggers that record temperature at intervals as short as 60 seconds and store up to 8,000 readings per shipment, ensuring full traceability for regulated pharmaceutical deliveries.

Growth of Online Food Delivery and Cross-Border Frozen Trade

Frozen foods, dairy, meat, seafood, and ready-to-cook meals now ship over long distances. Online grocery platforms need reliable temperature protection from warehouse to doorstep. Insulated shippers and frozen packaging support this model. Countries also expand frozen exports, which increases demand for durable packaging with long hold times. Food safety rules add more pressure. Companies must prevent spoilage and contamination, so they use stronger materials and refrigerants. Rising consumer preference for frozen meals and premium foods strengthens this driver. The food sector will remain a major demand source.

- For instance, Softbox Systems (now part of CSafe Global) provides high-performance, reusable insulated containers that, in pharmaceutical applications, have been qualified to maintain frozen products (below -20°C or even below -60°C) for up to 120 hours, although this typically involves the use of dry ice

Shift Toward Reusable and Sustainable Packaging

Single-use packaging creates waste and cost pressure. Many companies now choose reusable insulated boxes, PCM-based systems, and recyclable materials. Brands also replace dry ice with cleaner cooling agents to improve worker safety and reduce emissions. Clear sustainability targets in retail, pharma, and logistics accelerate this shift. Reusable systems cut long-term cost, extend performance, and reduce landfill waste. Digital tracking supports reuse cycles, so assets return safely. These factors create a strong push toward eco-friendly temperature-controlled solutions.

Key Trends & Opportunities

Smart Sensors and Data-Driven Cold Chain Visibility

Cold chain users want real-time visibility. Smart sensors track temperature, location, shock, and humidity during transit. This prevents product loss and helps companies meet audit requirements. IoT devices record data and send alerts when conditions drift from the safe range. Better tracking also improves supply chain planning and reduces insurance claims. As logistics become more global, real-time records become mandatory. This trend supports growth for connected packaging and monitoring devices.

- For instance, Sensitech’s TempTale Ultra sensor can log up to 16,000 (or 64,000 for the 64K model) temperature data points per shipment and transmits updates through Bluetooth or USB communication, enabling continuous oversight for pharmaceutical and frozen food

Expansion of Reusable PCM-Based Systems

PCM-based packaging offers better thermal stability and long hold times. These systems support multi-trip use. Reusable products reduce waste and lower lifetime cost. Many logistics firms now adopt PCM containers for pharma and frozen exports. Demand rises as sustainability rules tighten. This creates an opportunity for manufacturers that design durable, lightweight solutions.

- For instance, Pelican BioThermal’s Crēdo ProMed reusable PCM shippers are part of a durable product line designed for repeated use over a 5+ year lifespan.

Key Challenges

High Initial Investment for Advanced Packaging

Reusable systems, smart sensors, and PCM-based containers demand higher upfront spending. Small companies face greater pressure due to tight budgets. These firms often delay upgrades and rely on cheaper single-use products. The capital need slows adoption in regions with limited financing support. Buyers wait for large shipment volumes to reduce unit cost. Long payback periods create hesitation among new adopters. This weakens conversion rates for premium packaging solutions. Market penetration slows when companies avoid cost-heavy modern systems. Rising component prices further stretch investment cycles. Limited access to funding blocks many operators from moving to advanced formats.

Regulatory Complexity and Temperature Failure Risks

Cold chain errors can lead to spoilage, safety hazards, and rejected shipments. Regulations differ across regions and demand strict documentation. Companies manage ongoing validation checks, audits, and temperature-control tests. These steps raise training needs and operational workload. Startups struggle more due to limited compliance teams. A single temperature failure may cause cargo loss and insurance issues. Meeting rules demands regular system upgrades and constant monitoring. Firms spend more on labels, data tools, and insulated carriers. This complex compliance structure remains a major barrier for new entrants. Many avoid large logistics zones due to high certification burden.

Regional Analysis

North America

North America holds the largest share of the temperature-controlled materials market at 35.6%. Demand is led by pharmaceutical logistics, biologics production, and vaccine distribution networks. Cold chain failures have strict penalties, so companies invest in advanced insulation, PCM systems, and real-time monitoring devices. Growth in meal-kit delivery and online grocery shipments strengthens adoption in food transportation. The U.S. dominates regional demand due to strong healthcare spending and regulatory oversight. Canada also expands cross-border frozen trade with the U.S., supporting steady use of insulated shippers and refrigerated packaging.

Europe

Europe accounts for 28.4% of the global market, driven by strong pharmaceutical manufacturing, biotech exports, and strict GDP (Good Distribution Practice) regulations. Cold chain packaging must meet thermal validation and sustainability requirements, which accelerates the shift toward recyclable and reusable solutions. EU food safety laws push demand for durable refrigerated packaging, especially for meat, dairy, and frozen bakery exports. Germany, the U.K., and France lead consumption due to well-developed logistics networks. Investments in green cold chain solutions continue to rise as companies attempt to reduce dry ice usage and improve energy efficiency.

Asia Pacific

Asia Pacific holds 26.7% market share, supported by a large population, growth in biologics manufacturing, and rapid expansion of frozen food exports. India and China increase temperature-regulated pharmaceutical shipments, boosting demand for insulation materials and PCM-based containers. Online grocery platforms in Japan, South Korea, and Southeast Asia deploy large volumes of insulated boxes for fast-moving fresh and frozen foods. Cold chain investments for vaccines, seafood, and meat exports continue to rise. Lower cost materials gain traction, while global suppliers partner with regional logistics companies to expand market presence.

Latin America

Latin America holds 5.2% market share, with most demand coming from food exports, dairy transport, and temperature-sensitive fresh produce. Countries such as Brazil, Mexico, and Chile increase use of insulated shippers and cooling agents to maintain product quality during long-distance shipments. Pharmaceutical imports also require regulated cold chain packaging, pushing logistics providers to adopt better insulation and tracking solutions. Growth remains steady but slower than major regions because high-performance solutions have higher cost barriers. However, rising frozen food consumption and retail modernization are boosting gradual adoption.

Middle East & Africa

Middle East & Africa hold 4.1% market share, supported mainly by pharmaceutical imports, clinical trial shipments, and packaged food distribution. Hot climates create strong need for reliable insulation to prevent spoilage and heat exposure. Gulf countries expand cold storage infrastructure for food security, boosting use of refrigerants and frozen packaging. Africa sees rising vaccine distribution and agricultural exports, but adoption remains cost-sensitive. International health agencies and logistics firms deploy insulated containers and remote temperature sensors to prevent losses in long-distance transit. Growth will accelerate as cold storage and e-commerce networks expand.

Market Segmentations:

By Material Type

- Insulation materials

- Phase Change Materials (PCMs)

- Refrigerants and cooling agents

- Smart sensors and monitoring devices

By Product Type

- Insulated shippers and containers

- Custom and specialty solutions

- Refrigerated and frozen packaging

By Application

- Pharmaceuticals and life sciences

- Food and beverage

- Chemicals and industrial goods

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The temperature-controlled materials market features a mix of global packaging leaders, cold chain logistics providers, and specialized insulation and PCM system manufacturers. Competition focuses on thermal performance, regulatory compliance, material sustainability, and cost efficiency. Companies invest in advanced insulation foams, durable reusable containers, and smart sensor-enabled packaging to support pharmaceuticals, frozen foods, and chemical shipments. Vendors also expand reusable portfolios to reduce waste and lower lifetime cost for high-volume shippers. Partnerships with 3PL logistics firms and healthcare distributors strengthen market reach, while regional manufacturers compete through low-cost materials. Firms that validate packaging under GDP, FDA, or WHO standards gain stronger acceptance in pharmaceutical distribution. As frozen food exports and biologics shipments grow, market leaders enhance PCM performance, introduce lightweight shipper formats, and integrate data-tracking solutions to prevent cold chain failures. Innovation, regulatory compliance, and global service capabilities remain the main competitive factors shaping this sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Constantia Flexibles (Austria)

- WestRock Company (United States)

- Wipak Group (Finland)

- Sonoco Products Company (United States)

- AR Packaging (Sweden)

- Huhtamäki Oyj (Finland)

- CLONDALKIN GROUP (Netherlands)

- Cryopak (Canada)

- Schott Packaging (Germany)

- West Pharmaceutical Services, Inc. (United States)

Recent Developments

- In 2025, Constantia Flexibles completed acquisition of Aluflexpack and invested over €100 million to expand its product portfolio, particularly for food and pharmaceutical flexible packaging.

- In June 2025, Cryopak launched the NexBlu Cube 10, which is a universal temperature-controlled shipper designed in two versions, standard EPS and sustainable GPS, capable of supplying 96 hours of thermal protection, optimized for JUNE 2025 ISTA 7D/7E qualification.

- In April 2025, Sonoco sold its Thermoformed & Flexibles Packaging (TFP) to Toppan Holdings Inc. which was worth about USD 1.8 billion including circa 4,500 employees transferred to the firm as part of the transaction.

Report Coverage

The research report offers an in-depth analysis based on Material type, Product type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for temperature-controlled materials will rise as biologics and vaccines expand in global supply chains.

- Reusable insulated shippers and PCM systems will replace many single-use packaging formats.

- Companies will adopt smart sensors that provide real-time temperature and location tracking.

- Sustainability goals will drive wider use of recyclable insulation and eco-friendly refrigerants.

- Online grocery and frozen meal delivery will create steady demand for durable cold packaging.

- Lightweight shipper designs will reduce transport cost and improve logistics efficiency.

- Process validation and regulatory compliance will remain a key purchasing factor in pharma distribution.

- Partnerships between packaging manufacturers and logistics providers will strengthen distribution networks.

- Adoption in emerging markets will grow as cold storage and healthcare infrastructure improve.

- Material innovation will focus on longer hold times, improved durability, and lower environmental impact.