Market Overview

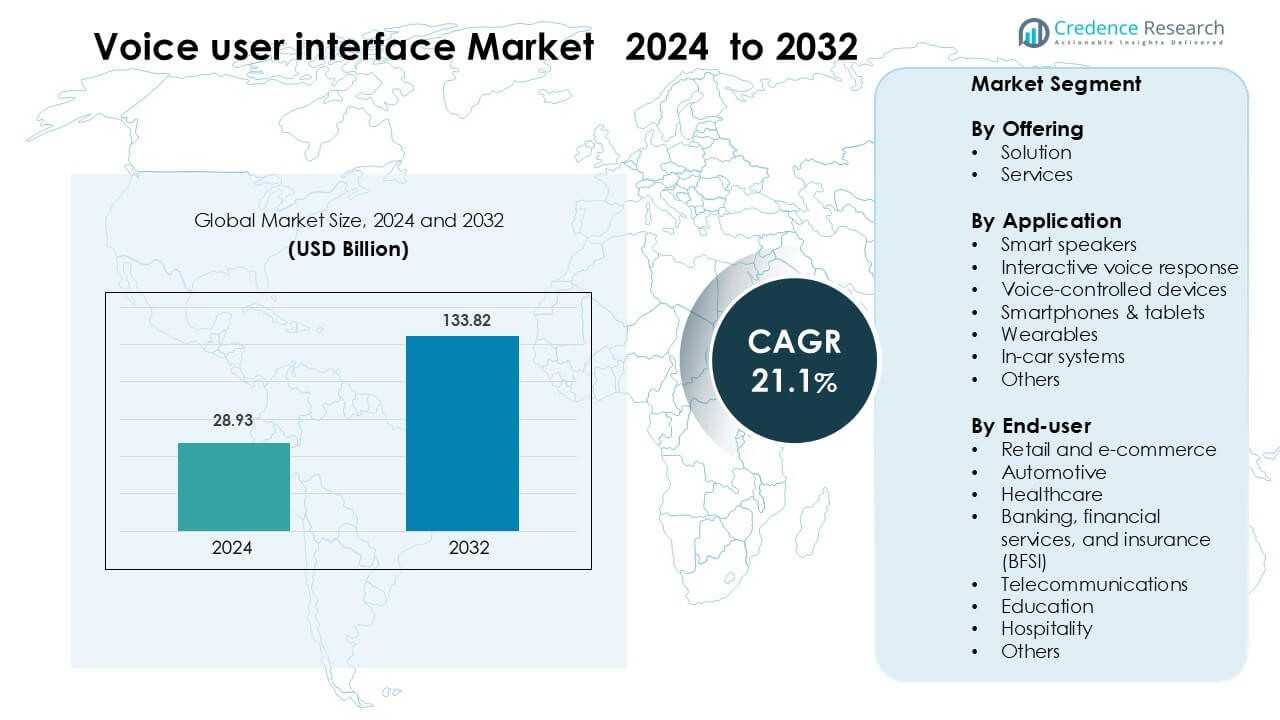

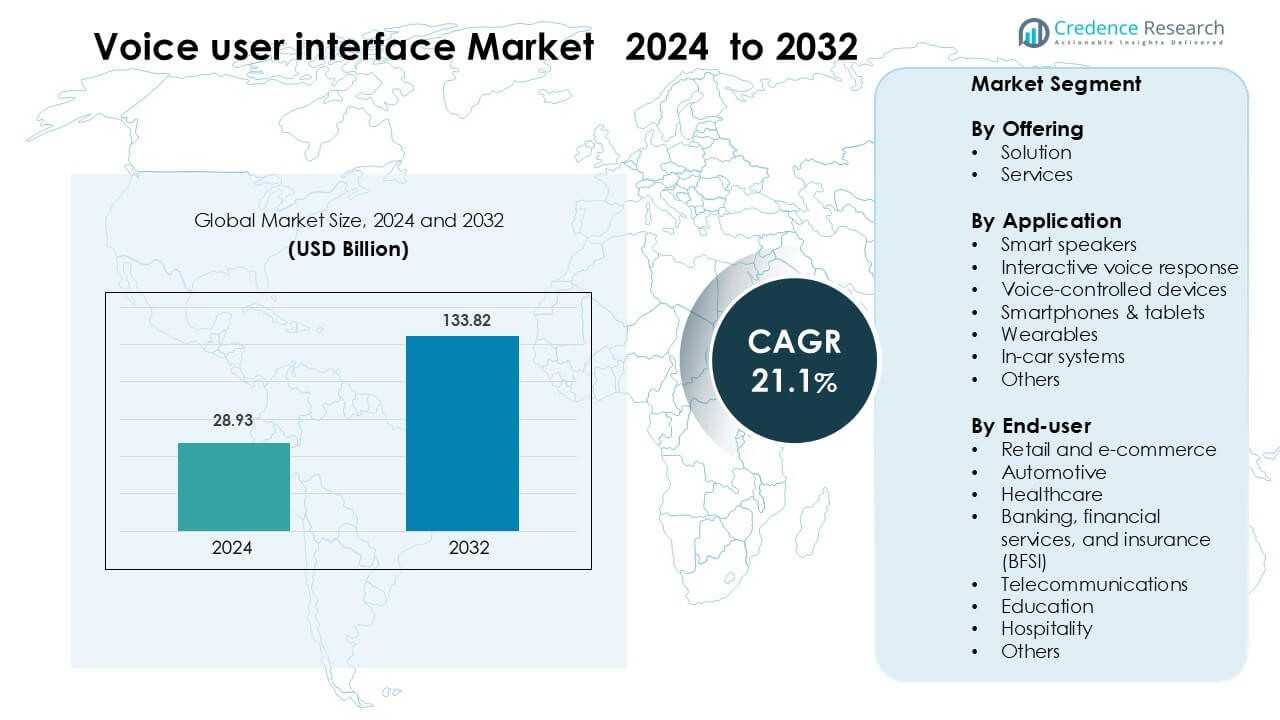

Voice user interface Market was valued at USD 28.93 billion in 2024 and is anticipated to reach USD 133.82 billion by 2032, growing at a CAGR of 21.1 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Voice user interface Market Size 2024 |

USD 28.93 Billion |

| Voice user interface Market, CAGR |

21.1 % |

| Voice user interface Market Size 2032 |

USD 133.82 Billion |

The voice user interface (VUI) market is dominated by major technology leaders such as Meta Platforms, Samsung, Baidu, Speechly, Nuance Communications, Google LLC, SoundHound AI, Apple Inc., IBM, and Amazon Inc., which together drive innovation across consumer devices, enterprise solutions, and edge-AI platforms. Among these, Google, Amazon, and Apple lead in consumer smart-speaker and assistant deployment, while Nuance and IBM focus on specialized enterprise and healthcare VUI applications, and SoundHound and Speechly emphasize real-time voice APIs for developers. Geographically, North America is the leading region in the VUI market, holding approximately 37 percent of global revenue share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Voice user interface Market was valued at USD 28.93 billion in 2024 and is anticipated to reach USD 133.82 billion by 2032, growing at a CAGR of 21.1 % during the forecast period.

- Demand grows as voice engines improve accuracy, enabling faster customer support automation and smooth control across smart speakers, smartphones, and in-car systems, with solutions holding the largest share.

- Trends show rapid adoption of multilingual voice models and on-device processing that boosts privacy and reduces latency for automotive, healthcare, and wearables.

- Competition intensifies as global vendors enhance NLP models, expand partner networks, and refine noise-robust features, while pricing pressure and accuracy limitations in noisy environments remain key restraints.

- North America leads the market with about 37% share, followed by Europe at 29% and Asia-Pacific at 24%, while smart speakers dominate applications and retail & e-commerce remain the top end-user segment.

Market Segmentation Analysis:

By Offering

Solution leads this segment with about 69% share in 2024 due to rising integration of voice-enabled platforms across consumer electronics, vehicles, and enterprise systems. Companies deploy NLP-based engines, speech-to-text modules, and conversational AI layers to enhance automation and reduce manual interaction. Growth improves as brands adopt voice frameworks for customer support, device control, and hands-free operations. Services grow steadily as enterprises seek customization, model tuning, and deployment support, but solutions remain dominant because organizations prioritize scalable voice architectures and faster implementation cycles.

- For instance, Jio Haptik has processed 15 billion AI‑powered conversations across voice and text channels since its inception.

By Application

Smart speakers dominate this segment with nearly 41% share in 2024, driven by expanding use of voice-activated assistants in homes for search, entertainment, and device control. Rising adoption of multi-room audio, privacy-enhanced architectures, and improved far-field microphones strengthens demand. Smartphones and tablets follow due to integration of embedded voice assistants for navigation and task automation. Wearables and in-car systems show fast uptake as users prefer hands-free interaction. Interactive voice response continues to gain enterprise traction for automated customer communication.

- For instance, Amazon surpassed 500 million Alexa-enabled devices sold by May 2023, highlighting the strong consumer adoption of its Echo smart speakers.

By End-user

Retail and e-commerce lead this segment with around 28% share in 2024 as brands deploy voice-enabled search, ordering, and customer support to improve conversion and reduce service load. Automotive follows with rapid integration of voice-controlled infotainment and navigation systems to improve driver safety and reduce distraction. Healthcare grows due to rising use of voice tools for clinical documentation and patient engagement. BFSI and telecommunications expand adoption for secure authentication and faster query handling. Education and hospitality adopt voice interfaces to personalize learning and improve guest services.

Key Growth Drivers

Rising Adoption of Smart Devices

Voice interfaces grow fast because households use more smart devices each year. Smart speakers, smart TVs, and connected appliances now support daily tasks through voice commands. Users prefer hands-free control, which creates steady demand across global markets. Brands integrate natural language engines to improve clarity and reduce friction. Developers also optimize microphones and speech layers for louder environments. These advances make voice systems more reliable and easier for new users. Retail and tech companies push voice features to increase user engagement and product value. Growing comfort with voice commands further strengthens market expansion.

- For instance, Amazon reports that over 600 million Alexa-powered devices are in use globally, underscoring how voice interfaces are embedded across a variety of smart devices such as TVs, speakers, and third‑party appliances.

Growth of Voice-Enabled Customer Support

Enterprises shift toward voice automation to lower support costs and improve service speed. Banks, telecom providers, and retail firms use conversational engines to handle routine queries. This reduces wait time and boosts customer satisfaction. Companies deploy voice bots to manage large call volumes during peak periods. Improved accuracy from AI models supports better routing and faster resolution. Voice systems also help brands run 24/7 support without heavy staffing. Firms embrace voice interfaces to personalize responses and analyze customer intent. These advantages drive broader adoption across service industries.

- For instance, Vodafone’s AI chatbot system across Europe (including the UK) handles around 45 million customer questions per month across 13 countries. The AI fully resolves 70% of customer inquiries that come through its digital channels without needing a human agent.

Strong Integration in Automotive and Healthcare

Automotive brands adopt voice systems to improve safety and reduce distraction. Drivers control navigation, calls, and media without touching screens. This boosts regulatory alignment and enhances user comfort. Healthcare facilities use voice tools for clinical documentation and patient interaction. Voice dictation cuts manual data entry and supports faster reporting. Doctors use hands-free commands during procedures, which improves workflow. Voice tools also support elder-care systems by enabling simple interaction. These benefits increase adoption in both sectors and widen the overall market potential.

Key Trend and Opportunities

Growth of Multilingual and Regional Language Support

Developers expand voice engines to include more regional languages. This helps reach new users in large and diverse markets. Companies adopt localized vocabularies to improve recognition accuracy. Better language support reduces friction for first-time users and older populations. Regional support also strengthens adoption within government and public services. Brands design dialect-aware models for higher precision. This trend helps voice systems grow beyond urban centers and improves digital accessibility. Wider linguistic coverage builds trust and expands market reach across many countries.

- For instance, Tata Motors has partnered with Mihup.ai to deploy a voice assistant in cars that recognizes 50 Indian languages and dialects, including Hindi, Tamil, Telugu, Bengali, Marathi, Punjabi, Haryanvi, Kannada, and Marwari.

Rising Use of On-Device Voice Processing

Manufacturers shift toward on-device processing to improve privacy and response speed. Local processing reduces data transfer and protects sensitive information. Devices also respond faster because commands stay within the hardware. This helps in cars, wearables, and medical devices where low latency matters. Firms adopt compact AI models to support offline use cases. Users prefer systems that avoid cloud dependence. On-device solutions also reduce network load for enterprises. This creates strong opportunities for hardware-optimized voice innovations.

- For instance, Apple’s Siri in iOS 15 can process a wide range of requests like launching apps, setting timers, and controlling music without an internet connection, because its speech-recognition engine runs fully on the device.

Expansion in Enterprise Workflow Automation

Enterprises explore voice tools for internal workflow tasks. Employees use voice commands to schedule meetings, generate reports, and retrieve data. This boosts productivity and reduces task time. Voice tools also support warehouse work by enabling quick hands-free updates. Companies use voice inputs to inspect equipment and log field data. Enterprise adoption grows as models become more secure and more accurate. The opportunity expands with remote work where workers rely on voice aids for multitasking. Firms view voice automation as a key step toward digital transformation.

Key Challenge

Privacy and Data Security Concerns

Many users remain unsure about how voice data is stored and processed. Concerns rise when devices record background audio or send data to external servers. Companies face strict rules for data handling and consent. Heavy compliance needs increase development cost. Firms must encrypt data and limit audio retention to build trust. Misuse or leaks can harm brand credibility. Privacy fears slow adoption in industries with sensitive information. This challenge forces companies to invest in transparent and secure systems.

Accuracy Issues in Noisy or Diverse Environments

Voice engines often fail in loud surroundings or strong accents. Background noise affects microphone clarity and slows recognition. Users with speech variations face repeated errors. This reduces confidence and lowers usage rates. Developers train larger datasets to improve recognition, but progress is uneven. Accuracy gaps create barriers in cars, factories, and crowded locations. Companies must invest in noise-canceling hardware and adaptive AI. Without better precision, adoption will grow slower in many real-world settings.

Regional Analysis

North America

North America holds the leading share at about 37% in 2024 due to high adoption of smart speakers, advanced voice assistants, and strong integration of voice features across retail, automotive, and healthcare sectors. Major technology vendors expand AI-based voice engines to support hands-free control, customer service, and in-car systems. Enterprises adopt voice bots to manage large query volumes and enhance service automation. Strong investments in natural language processing and on-device processing improve performance and privacy. Consumer willingness to shift toward voice interaction keeps regional growth steady across residential and commercial applications.

Europe

Europe accounts for nearly 29% share in 2024, driven by rising demand for voice-enabled consumer electronics, automotive infotainment, and multilingual digital services. Automakers integrate advanced voice controls to support driver safety and comply with regional regulations. Retail and BFSI expand conversational platforms to improve customer experience and reduce service load. Growing investments in data-secure voice solutions strengthen adoption across enterprises. The region benefits from strong digital literacy and wider acceptance of AI-based interfaces. Expanding support for regional languages and stronger privacy frameworks help voice systems gain deeper market penetration.

Asia-Pacific

Asia-Pacific captures around 24% share in 2024 and grows fastest due to rapid expansion of smartphones, connected devices, and smart home ecosystems. China, India, Japan, and South Korea adopt voice assistants across entertainment, payments, and home automation. Localized voice engines in multiple regional languages boost user engagement. Automakers integrate voice controls in mid-range and premium vehicles to improve convenience. Enterprises use voice tools for customer support and workflow automation. Rising internet penetration and strong consumer interest in AI-driven experiences accelerate adoption. The region’s large population base supports long-term scaling of voice solutions.

Latin America

Latin America holds about 6% share in 2024, supported by growing adoption of affordable smart speakers, mobile-based voice assistants, and voice-enabled customer support tools. Retailers use voice search and guided shopping to improve digital engagement. Telecom providers deploy interactive voice platforms to manage high call volumes. Regional growth improves as consumers embrace hands-free interaction for routine tasks. Expanding smartphone access and localized language support increase usage. Cloud-based conversational systems become popular among small and mid-sized enterprises. Despite slower infrastructure development, consistent investment in digital services drives steady adoption.

Middle East & Africa

The Middle East & Africa represent nearly 4% share in 2024, with growth driven by rising deployment of voice assistants in smartphones, cars, and smart home devices. GCC countries adopt voice systems across banking, retail, and hospitality to improve service efficiency. Automakers introduce voice-controlled infotainment to support safer driving. Enterprises use voice bots to automate customer queries and reduce operational pressure. Localized Arabic voice engines enhance accuracy and expand adoption. Although infrastructure limitations exist in parts of Africa, increasing mobile penetration and digital transformation initiatives support gradual market expansion.

Market Segmentations:

By Offering

By Application

- Smart speakers

- Interactive voice response

- Voice-controlled devices

- Smartphones & tablets

- Wearables

- In-car systems

- Others

By End-user

- Retail and e-commerce

- Automotive

- Healthcare

- Banking, financial services, and insurance (BFSI)

- Telecommunications

- Education

- Hospitality

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The voice user interface (VUI) market remains highly competitive, driven by continuous innovation in AI-powered speech recognition, edge processing, and multimodal interaction. Major players such as Meta Platforms, Google, Apple, Amazon, IBM, Samsung, and Baidu leverage extensive R&D capabilities and cloud ecosystems to integrate VUI into smartphones, smart speakers, AR/VR devices, vehicles, and enterprise platforms. Companies like Nuance Communications and SoundHound AI strengthen their position with domain-specific conversational AI, on-device speech processing, and advanced natural-language models tailored for healthcare, automotive, and contact-center applications. Speechly adds specialization in real-time voice APIs that support low-latency voice experiences for developers. Strategic partnerships, acquisitions, and continuous enhancements in accuracy, contextual understanding, and multilingual capabilities shape market competition. As VUI adoption expands across consumer electronics, smart homes, automotive infotainment, and enterprise automation, vendors focus on reducing error rates, enhancing privacy through on-device processing, and delivering seamless conversational interfaces to differentiate their offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Meta Platform, Inc.

- SAMSUNG

- Baidu, Inc.

- Speechly

- Nuance Communication

- Google LLC

- SoundHound AI Inc.

- Apple, Inc.

- IBM

- Amazon, Inc.

Recent Developments

- In November 2025, Google has begun replacing Google Assistant with Gemini in Android Auto, bringing more conversational, LLM-powered interactions in cars.

- In August 2025, SAMSUNG updated Bixby on 2025 smart TVs with generative-AI enhancements. The smarter Bixby now supports more conversational, context-aware voice search and smart-home control.

- In 2025, Nuance released Dragon Professional Anywhere 2025.1, which adds support for Windows Remote Desktop (RDS) and Azure Virtual Desktop (AVD) for its voice-to-text clients.

Report Coverage

The research report offers an in-depth analysis based on Offering, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Voice assistants will become more context-aware and deliver smoother, human-like conversations.

- On-device processing will expand, improving privacy and reducing response delays.

- Multilingual and dialect-specific models will help brands reach wider global users.

- Automotive integration will rise as carmakers adopt safer hands-free systems.

- Healthcare usage will grow with voice tools supporting clinical notes and patient interaction.

- Enterprises will use voice automation to streamline operations and lower support costs.

- Wearables will adopt enhanced voice control for fitness, navigation, and quick tasks.

- Smart home ecosystems will rely more on unified voice control for connected devices.

- Retail platforms will use voice shopping to increase conversion and customer engagement.

- AI-powered voice biometrics will gain traction for secure authentication across industries.