Market Overview

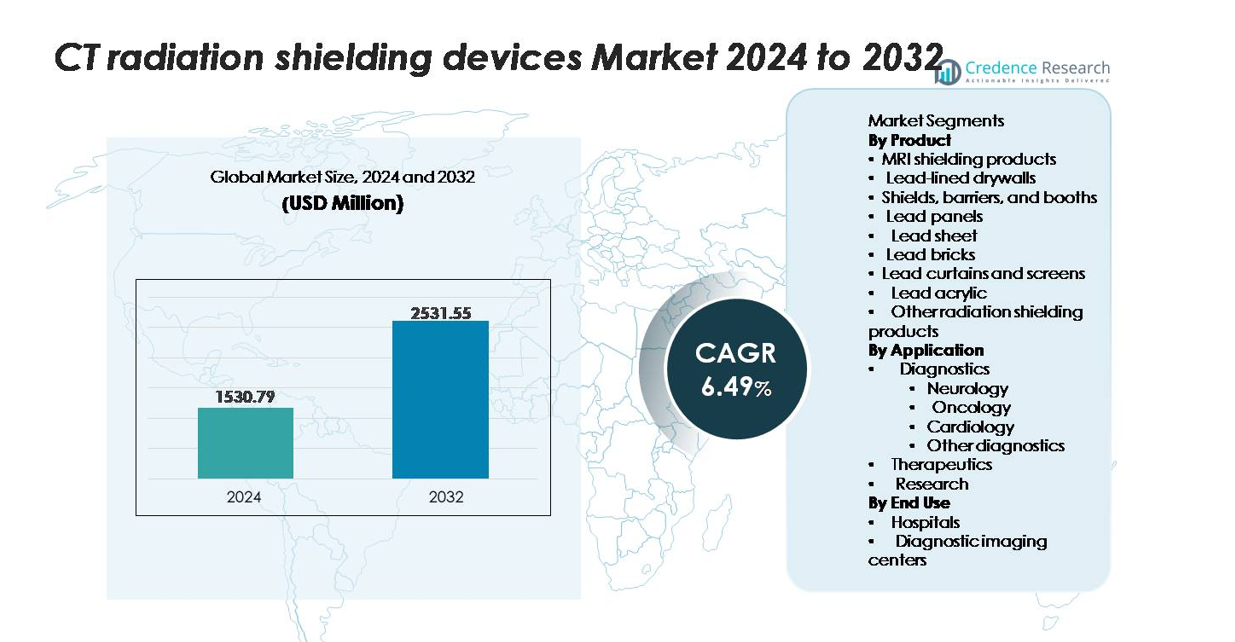

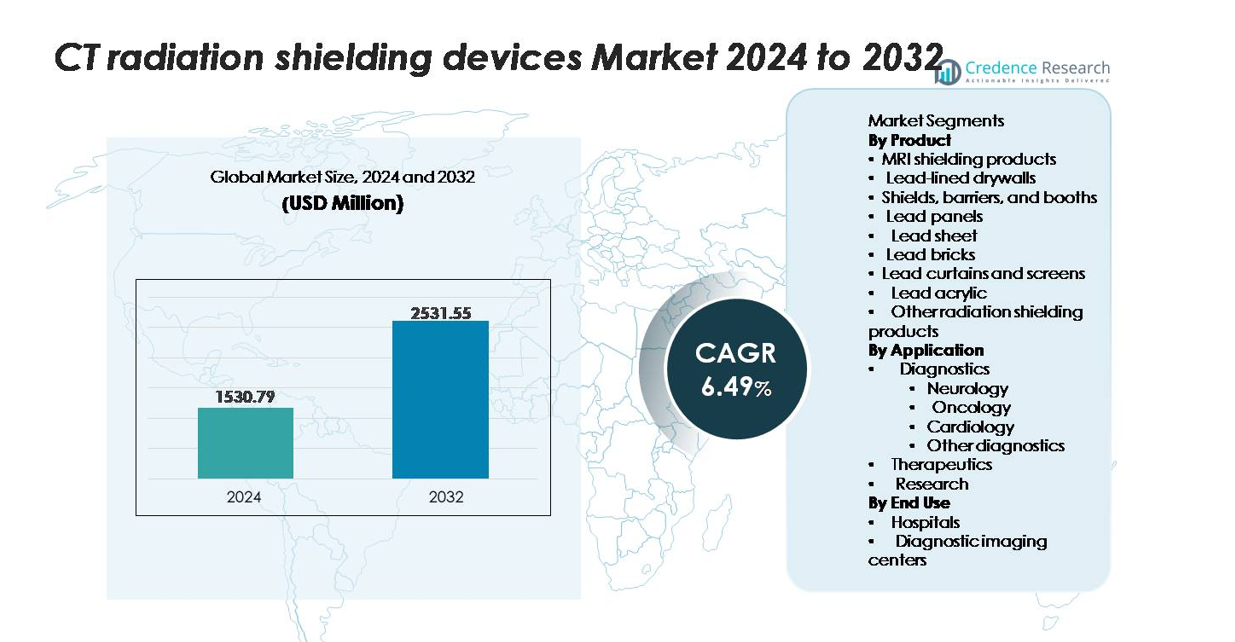

The CT radiation shielding devices market was valued at USD 1,530.79 million in 2024 and is projected to reach USD 2,531.55 million by 2032, reflecting a CAGR of 6.49% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CT Radiation Shielding Devices Market Size 2024 |

USD 1,530.79 million |

| CT Radiation Shielding Devices Market, CAGR |

6.49% |

| CT Radiation Shielding Devices Market Size 2032 |

USD 2,531.55 million |

The CT radiation shielding devices market is dominated by a core group of established manufacturers, including Marshield, INFAB, Burlington Medical, AmRay, Lemer Pax, Nippon Electric Glass, Frank Shields, Modcon, Entromedical Healthcare Solutions, and A&L Shielding. These companies compete through advancements in lead-lined drywalls, mobile barriers, acrylic shields, and composite materials that ensure regulatory compliance and high attenuation performance. North America leads the global market with approximately 34% share, supported by high CT installation rates and strict radiation-safety standards, followed by Europe at around 28%, where strong regulatory frameworks and modernization of diagnostic centers further accelerate demand.\

Market Insights

- The CT radiation shielding devices market was valued at USD 1,530.79 million in 2024 and is projected to reach USD 2,531.55 million by 2032, registering a CAGR of 6.49% over the forecast period.

- Market growth is driven by rising global CT procedure volumes, expansion of diagnostic imaging centers, and strict regulatory requirements mandating structural radiation protection across hospitals and outpatient facilities.

- Key trends include the shift toward modular and mobile shielding systems, increased adoption of eco-friendly non-lead composites, and upgrades aligned with next-generation multi-slice and spectral CT installations.

- Competition intensifies among players such as Marshield, INFAB, Burlington Medical, AmRay, Lemer Pax, and Nippon Electric Glass, with differentiation focused on material performance, room customization, and regulatory certification.

- Regionally, North America leads with ~34% share, followed by Europe (~28%) and Asia Pacific (~26%); within segmentation, lead-lined drywalls hold the dominant product share, while diagnostics remains the largest application segment due to high CT utilization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Lead-lined drywalls represent the dominant product segment, holding the largest market share due to their widespread use in shielding CT suites, ease of installation, and high attenuation performance. Their ability to meet regulatory compliance across hospitals and imaging centers strengthens adoption. Demand is further supported by expansions in diagnostic infrastructure and refurbishment of aging radiology rooms. Complementary products such as lead bricks, panels, curtains, and booths gain traction where modular or temporary shielding is required, while MRI shielding products and lead acrylic benefit from increasing emphasis on visibility, operator protection, and flexible room configurations.

- For instance, MarShield manufactures lead-lined drywall panels using 1.6 mm to 12.7 mm solid-lead thicknesses bonded to gypsum boards, while its standard lead bricks provide 99.9% pure lead with dimensions of 50.8 mm × 101.6 mm × 203.2 mm, ensuring certified attenuation for CT and diagnostic installations.

By Application

Diagnostics is the leading application segment, accounting for the largest share as CT scanners remain central to oncology, neurology, cardiology, and general imaging workflows. The dominance is driven by rising CT utilization rates, increasing patient volumes, and heightened safety standards for technicians and surrounding clinical areas. Oncology and neurology departments contribute significantly as higher-frequency imaging demands more robust shielding solutions. Therapeutics and research applications grow steadily as advanced radiation-based procedures and experimental imaging protocols expand, requiring consistent shielding upgrades to ensure compliance with occupational dose regulations and next-generation scanner specifications.

- For instance, INFAB’s Clear-Pb® lead-acrylic panels provide 00 mm Pb-equivalent protection at 150 kVp with 88% optical clarity, while Nippon Electric Glass’s LX-57B radiation-shielding glass delivers 0.50 mm and 1.00 mm Pb-equivalent attenuation in thicknesses from 8 mm to 25 mm. Additionally, Lemer Pax’s ProtecSom® mobile screens integrate 2.0 mm Pb shielding with reinforced frames tested for >10,000 movement cycles, ensuring durable performance in high-use diagnostic suites.

By End Use

Hospitals constitute the dominant end-use segment, commanding the largest market share owing to their extensive deployment of CT systems, higher patient throughput, and stringent radiation-protection governance. Their involvement in trauma care, oncology diagnostics, and emergency imaging accelerates the need for both permanent and upgraded shielding infrastructures. Diagnostic imaging centers follow as the second-largest users, driven by rapid outpatient imaging expansion and the adoption of multi-slice and spectral CT technologies. Their focus on efficient workflow, safety certification, and room optimization sustains strong demand for modular shielding products, including barriers, panels, and acrylic-based solutions.

Key Growth Drivers

Rising Global CT Procedure Volumes and Expanding Diagnostic Infrastructure

Growing patient dependence on CT imaging for oncology staging, neuro-evaluation, trauma assessment, and cardiac diagnostics significantly increases the need for radiation-shielded environments. Hospitals worldwide are scaling their diagnostic capabilities with multi-slice, spectral, and high-resolution CT systems, each requiring compliant shielding to maintain occupational dose limits. The expansion of emergency departments, cancer centers, and tertiary care facilities further accelerates installation of lead-lined drywalls, barriers, and shielding panels. As developing regions strengthen imaging access through new diagnostic centers and public-health investments, shielding device procurement grows proportionally. Additionally, refurbishment of aging radiology rooms and upgrades to meet updated regulatory standards such as stricter scatter-radiation thresholds drive continuous replacement demand across high-volume imaging hubs.

- For instance, MarShield’s lead-lined drywall systems integrate 1.6 mm to 12.7 mm solid-lead sheets bonded to 15.9 mm gypsum, meeting NCRP-certified attenuation for CT suites.

Strict Radiation Safety Regulations and Increasing Compliance Requirements

National and international safety agencies enforce rigorous standards to limit radiation exposure for healthcare workers, patients, and adjacent departments. Compliance with NCRP, ICRP, and country-specific guidelines necessitates proper structural shielding, certified attenuation materials, and periodic facility assessments. Facilities installing newer high-output scanners must adopt shielding solutions capable of handling stronger radiation profiles, driving upgrades even in existing CT suites. Mandatory radiation-protection audits, licensing, and room-design approvals compel hospitals and imaging centers to invest in high-quality lead sheets, drywalls, acrylic shields, and modular barriers. These regulatory pressures create steady, non-discretionary demand. Furthermore, expansion of accreditation programs such as those for imaging safety, technician protection, and facility certification reinforces the need for compliant shielding infrastructure, making regulatory enforcement one of the strongest market growth catalysts.

- For instance, MarShield’s lead sheets are manufactured in thicknesses from 4 mm to 50 mm, conforming to ASTM B749 for medical shielding, enabling precise compliance with facility shielding reports.

Technological Advancements in Shielding Materials and Modular Room Designs

Innovation in radiation-shielding materials enhances durability, installation efficiency, and attenuation performance, prompting healthcare providers to upgrade their infrastructure. Advanced lead-composite solutions, non-lead alternatives, and high-density metal alloys are increasingly used to reduce weight while preserving shielding efficiency. Modular shielding booths, mobile barriers, and transparent lead-acrylic panels allow flexible room configurations to support multi-scanner environments, evolving care pathways, and ergonomic workflow designs. Prefabricated lead-lined partitions and rapid-installation drywalls reduce downtime and enable faster commissioning of CT rooms an advantage for high-volume hospitals and outpatient imaging centers. These innovations also support retrofit projects where structural limitations prevent heavy traditional shielding. As vendors introduce improved manufacturing consistency, precision-engineered joints, and corrosion-resistant composite layers, end users benefit from longer product life, reduced maintenance, and heightened safety performance, accelerating adoption across developed and emerging markets.

Key Trends & Opportunities

Growing Adoption of Modular and Mobile Shielding Solutions

Healthcare providers increasingly favor modular shielding systems such as movable barriers, mobile booths, and panels because they support dynamic room layouts and multi-purpose imaging environments. This trend aligns with the rise of outpatient imaging networks and high-throughput radiology centers that require rapid, customizable configurations. Mobile radiation barriers allow flexible placement during interventional CT procedures, trauma assessments, and emergency scans. Manufacturers offering lightweight composite structures, transparent lead-acrylic windows, and ergonomic mobility designs benefit from this shift. Additionally, opportunities expand as private imaging operators adopt scalable shielding to accommodate multi-scanner expansion without costly structural renovations. The increasing use of pop-up diagnostic units and temporary imaging suites during hospital refurbishments further strengthens demand for modular and relocatable solutions.

- For instance, INFAB’s Clear-Pb® mobile barriers are built with 00 mm Pb-equivalent protection at 150 kVp and feature viewing panels up to 609 mm × 762 mm, maintaining 88% optical clarity for operator visibility.

Increasing Transition Toward Non-Lead and Eco-Friendly Shielding Materials

Sustainability initiatives and environmental regulations drive the adoption of non-lead shielding materials. Composite solutions that integrate tungsten, bismuth, antimony, or multi-layer alloys provide high attenuation while reducing hazardous-material handling requirements. These alternatives appeal to healthcare facilities aiming to minimize environmental risk, simplify disposal protocols, and eliminate lead-related contamination concerns. Vendors investing in high-density composite engineering and advanced lamination techniques capture new opportunities in markets seeking safer, lightweight, and RoHS-compliant shielding. As governments tighten rules around medical-facility construction waste, eco-friendly shielding gains traction in new-build CT suites and major facility upgrades. This trend broadens opportunities for innovative materials that deliver equivalent or superior performance to traditional lead panels and drywalls.

- For instance, INFAB’s KIARMOR® bi-layer non-lead core provides 50 mm Pb-equivalent protection at 130 kVp while reducing apron weight by 30% compared to traditional lead.

Key Challenges

High Installation Costs and Infrastructure Limitations in Older Facilities

Structural shielding for CT rooms often requires reinforcement, specialized installation, and compliance-driven design customization, which raise upfront capital costs. Older hospitals face challenges when retrofitting heavy lead-lined walls, as existing structures may not support the load without extensive reconstruction. This delays installation timelines and increases overall project expenses. Outpatient imaging centers operating in leased buildings encounter restrictions on major structural modifications, limiting the adoption of heavy shielding solutions and increasing reliance on partial or modular alternatives. High installation costs also discourage small and mid-sized facilities in cost-sensitive regions from timely upgrading, slowing market penetration despite rising imaging demand.

Supply Chain Constraints and Fluctuations in Raw Material Availability

Lead, composite metals, and high-density alloys used in radiation shielding are subject to global supply fluctuations, mining-sector disruptions, and regulatory restrictions on hazardous-material transport. Delays in raw material procurement can extend manufacturing timelines and hinder timely delivery of shielding components. Price volatility further affects budget planning for hospitals and imaging centers, particularly during large-scale facility expansions. Manufacturers also face increasing scrutiny related to environmental compliance and traceability of mined materials, which adds operational complexity. These factors collectively pose challenges in maintaining consistent production output, cost stability, and project schedules especially in fast-growing healthcare markets requiring rapid CT room commissioning.

Regional Analysis

North America

North America holds the largest market share of approximately 34%, driven by high CT utilization rates, stringent radiation-safety regulations, and continuous investments in diagnostic facility upgrades. Hospitals and imaging networks aggressively adopt advanced shielding solutions as they integrate multi-slice and spectral CT systems. Strong regulatory compliance frameworks from bodies such as the NCRP reinforce steady demand for certified lead-lined drywalls, barriers, and modular shielding systems. The presence of established shielding manufacturers and rapid refurbishment cycles across U.S. healthcare infrastructure further strengthen the region’s leadership position in the global market.

Europe

Europe accounts for nearly 28% of global demand, supported by modern radiology infrastructure, robust regulatory mandates, and accelerated adoption of non-lead shielding materials. Public and private healthcare systems in Germany, France, the U.K., and the Nordics continue investing in radiation-safe CT suites as part of broader hospital modernization initiatives. Strict EU-level directives on worker radiation exposure bolster procurement of high-performance shielding solutions. Additionally, Europe’s preference for eco-friendly composites creates opportunities for alternative-material panels and acrylic barriers. Ongoing expansion of oncology and neurology imaging services sustains stable demand across both established and emerging markets.

Asia Pacific

Asia Pacific captures around 26% of the market and represents the fastest-growing regional segment due to rapid expansion of diagnostic imaging capacity across China, India, Japan, and Southeast Asia. Government-funded healthcare infrastructure projects and rising CT installation rates in urban and semi-urban areas strongly support shielding adoption. Private imaging centers are also scaling quickly to meet high patient volumes, driving installation of cost-efficient drywalls, modular barriers, and acrylic solutions. Increasing awareness of radiation-safety compliance and rising investments from international shielding manufacturers position Asia Pacific as a major growth engine within the global market.

Latin America

Latin America accounts for approximately 7% of global market share, with growth concentrated in Brazil, Mexico, Chile, and Colombia. Rising investments in diagnostic imaging, expanding private hospital chains, and modernization of public radiology departments contribute to steady demand for CT shielding products. However, penetration remains uneven due to economic constraints and slower facility renovation cycles. Adoption of modular shielding systems is increasing as facilities seek cost-effective solutions that require minimal structural alteration. Gradual regulatory tightening and rising CT procedure volumes support incremental market expansion across both metropolitan and secondary healthcare clusters.

Middle East & Africa

The Middle East & Africa region holds about 5% of the global market, driven by imaging infrastructure development in the GCC, South Africa, and emerging North African economies. High investment in new hospitals, diagnostic centers, and specialty oncology facilities underpins demand for radiation-compliant CT suites equipped with lead-lined drywalls, booths, and shielding panels. Gulf countries continue prioritizing advanced imaging technologies as part of national healthcare modernization plans. However, adoption remains slower in several African markets due to cost barriers and limited regulatory enforcement. Increasing private-sector participation is expected to support gradual market penetration.

Market Segmentations:

By Product

- MRI shielding products

- Lead-lined drywalls

- Shields, barriers, and booths

- Lead panels

- Lead sheet

- Lead bricks

- Lead curtains and screens

- Lead acrylic

- Other radiation shielding products

By Application

- Diagnostics

- Neurology

- Oncology

- Cardiology

- Other diagnostics

- Therapeutics

- Research

By End Use

- Hospitals

- Diagnostic imaging centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the CT radiation shielding devices market features a mix of established shielding manufacturers, specialized material suppliers, and providers of modular protection systems. Leading companies compete primarily on material quality, regulatory compliance, installation efficiency, and customization capabilities for diverse CT room layouts. Many vendors focus on expanding portfolios of lead-lined drywalls, barriers, acrylic panels, and non-lead composite solutions to address growing demand for safer and lighter shielding materials. Strategic initiatives including facility expansions, product certifications, and partnerships with hospital construction contractors strengthen market positioning. Manufacturers increasingly emphasize modular and mobile shielding systems to meet rising adoption in outpatient imaging centers. Continuous advancements in high-density composites and transparent shielding technologies further intensify competition. Regional players in Asia and Europe contribute to price competitiveness by offering cost-effective shielding materials, while global suppliers differentiate through engineering precision, long product durability, and adherence to international radiation-protection standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Marshield

- INFAB

- Frank Shields

- Modcon

- Nippon Electric Glass

- Burlington Medical

- Lemer Pax

- AmRay

- Entromedical Healthcare Solutions

- A&L Shielding

Recent Developments

- In August 2025, MarShield was named an official ambassador for the Canadians for CANDU® campaign, reinforcing its leadership in radiation-shielding solutions.

- In August 2024, Burlington announced launch of its BAT™ universal radiation-protection garment for breast, axilla and thyroid areas, enhancing operator safety in interventional imaging environments.

- In May 2024, INFAB published a blog post highlighting its new lead acrylic mobile barriers designed to enhance protection from scatter radiation in X-ray and CT environments

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook

- Demand for advanced shielding systems will rise as healthcare facilities expand CT imaging capacity and upgrade to higher-output scanners.

- Adoption of modular and mobile shielding solutions will accelerate to support flexible room layouts and multi-use diagnostic environments.

- Non-lead composite shielding materials will gain traction as hospitals pursue safer, lighter, and environmentally responsible alternatives.

- Growth in outpatient imaging centers will drive increased installation of cost-efficient drywalls, barriers, and acrylic panels.

- Radiation-safety regulations will tighten further, prompting more frequent facility audits and upgrades to compliant shielding infrastructure.

- Technological innovation will enhance material durability, attenuation precision, and installation efficiency across shielding products.

- Emerging markets in Asia Pacific and the Middle East will become key growth contributors due to rapid diagnostic infrastructure expansion.

- Integration of transparent shielding solutions will rise to balance operator visibility and radiation protection.

- Replacement demand will strengthen as older radiology rooms undergo modernization and structural refurbishment.

- Manufacturers will focus on optimized shielding designs that support next-generation CT modalities, including spectral and ultra-fast systems.