Market Overview

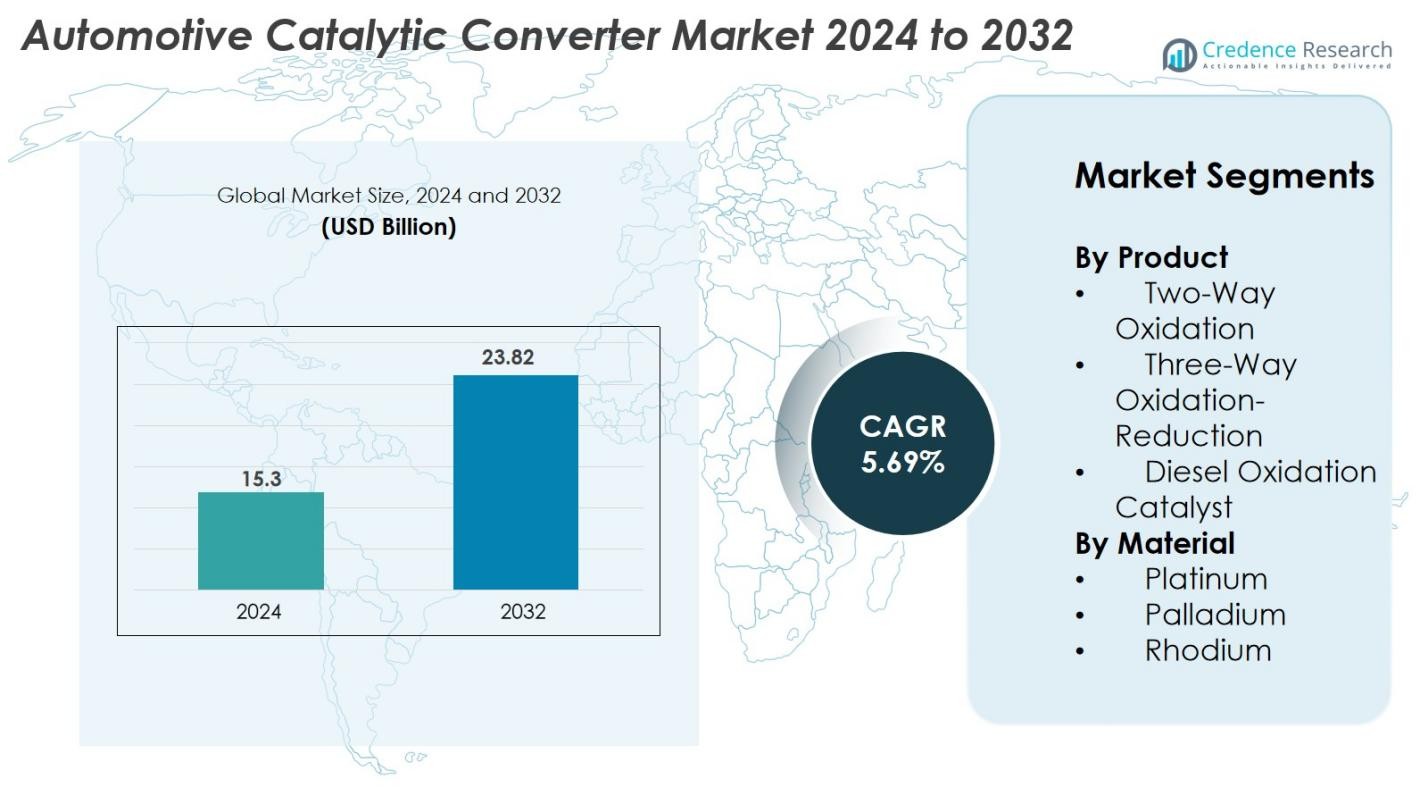

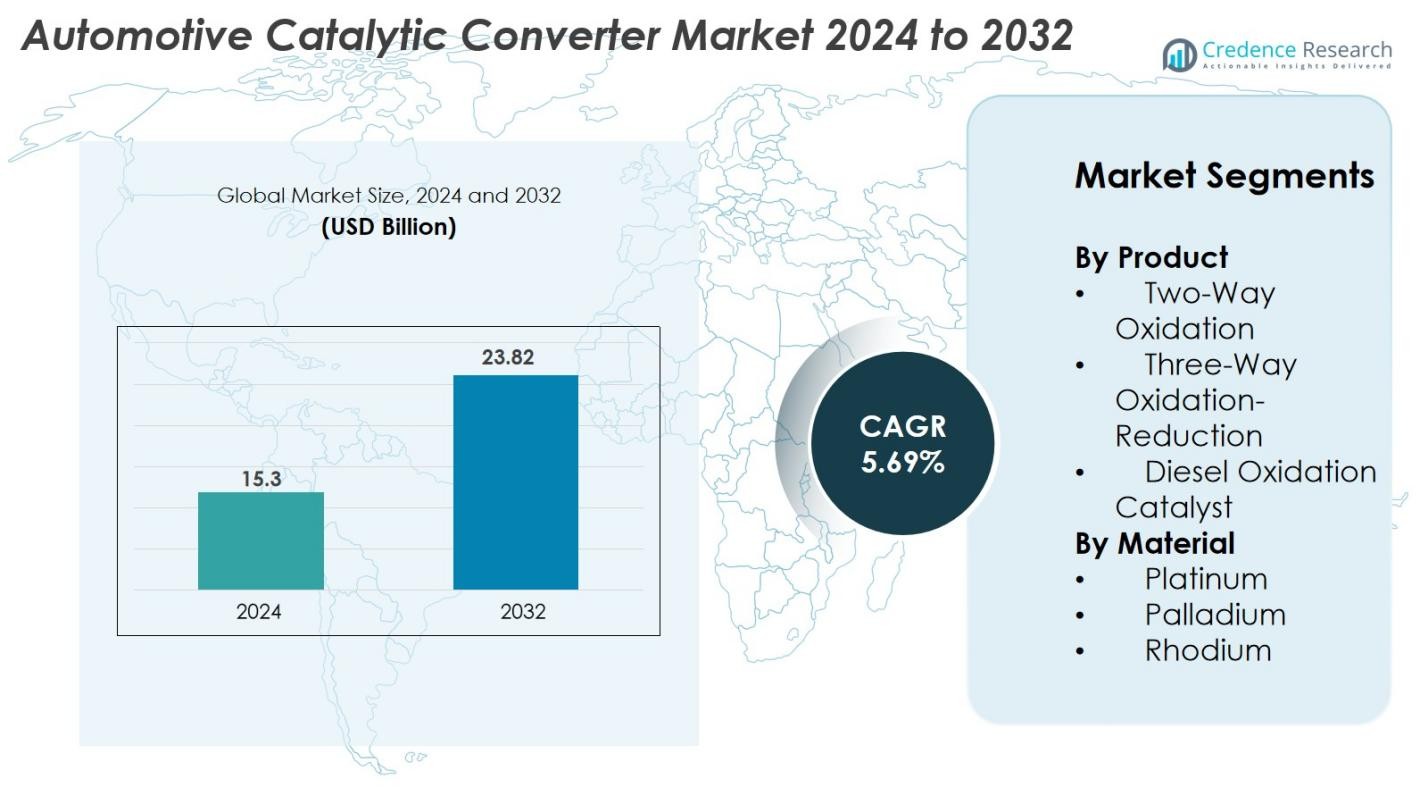

Automotive Catalytic Converter Market size was valued at USD 15.3 Billion in 2024 and is anticipated to reach USD 23.82 Billion by 2032, at a CAGR of 5.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Catalytic Converter Market Size 2024 |

USD 15.3 Billion |

| Automotive Catalytic Converter Market, CAGR |

5.69% |

| Automotive Catalytic Converter Market Size 2032 |

USD 23.82 Billion |

Automotive Catalytic Converter Market is characterized by the presence of prominent global players such as BASF SE, Eberspächer, FORVIA Faurecia, BOSAL, BM Catalysts, Calsonic Kansei, Marelli Corporation, European Exhaust & Catalyst Ltd, Deccats, and BENTELER International. These companies maintain strong OEM relationships and focus on high-efficiency catalyst formulations, PGM optimization, and advanced converter designs to comply with tightening emission standards. Regionally, Europe leads the market with approximately 32% share due to stringent Euro norms and a mature automotive manufacturing base, followed by Asia-Pacific at around 34%, driven by large-scale vehicle production and regulatory upgrades across China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Catalytic Converter Market was valued at USD 15.3 billion in 2024 and is projected to reach USD 23.82 billion by 2032, growing at a CAGR of 5.69% during the forecast period.

- Strong regulatory enforcement worldwide, including Euro 6/7, EPA Tier 3, and China 6 standards, continues to drive demand for advanced catalytic systems across passenger and commercial vehicles.

- Key market trends include rising hybrid vehicle adoption, increased focus on PGM recycling, and the development of high-efficiency catalyst formulations with lower material costs.

- The market remains competitive, with major players such as BASF SE, Eberspächer, FORVIA Faurecia, BOSAL, BM Catalysts, and Marelli Corporation investing in R&D, lightweight designs, and optimized PGM usage; however, rising platinum, palladium, and rhodium prices act as major restraints.

- Asia-Pacific holds around 34% market share, followed by Europe at 32% and North America at 28%, while the Three-Way Oxidation-Reduction segment leads with over 55% share.

Market Segmentation Analysis

By Product

The Three-Way Oxidation-Reduction converters dominated the Automotive Catalytic Converter Market in 2024, accounting for 55% market share, driven by their ability to simultaneously reduce NOx, CO, and HC emissions in gasoline vehicles. Their strong adoption across passenger cars and light commercial vehicles is supported by increasingly stringent global emission norms such as Euro 6 and EPA Tier 3. Two-Way Oxidation converters continued to serve older gasoline engine platforms, while Diesel Oxidation Catalysts gained traction in commercial fleets seeking improved particulate oxidation and enhanced fuel efficiency.

- For instance, Johnson Matthey’s “TRI-METAL” TWC introduced for North American OEMs reduced rhodium use by up to three-fold, while maintaining full emission-control performance across NOx, CO, and HC cycles

By Material

Palladium emerged as the leading material segment in 2024 with 48% market share, primarily due to its high catalytic efficiency in oxidizing hydrocarbons and carbon monoxide in gasoline vehicles. Its cost-effectiveness relative to platinum and rhodium has further accelerated its adoption across three-way catalytic converters. Platinum maintained stable demand in diesel applications due to its superior oxidation properties, while rhodium—though the most expensive PGM—remained essential in reducing NOx emissions. Growing regulatory pressure on vehicle emissions continues to propel demand for advanced PGM combinations across catalytic systems.

- For instance, BASF developed its FWC™ (Four-Way Conversion) catalyst which, even after more than 160,000 kilometres of test driving, maintained full exhaust-cleaning functionality combining particulate removal with NOx/HC/CO conversion in gasoline engines.

Key Growth Drivers

Stringent Global Emission Regulations

Stringent emission regulations remain one of the strongest growth drivers in the Automotive Catalytic Converter Market. Governments across North America, Europe, and Asia-Pacific continue enforcing tighter norms such as Euro 6/7, EPA Tier 3, and China 6a/6b to reduce NOx, CO, and hydrocarbon emissions. These regulations compel automakers to adopt advanced catalytic systems with improved conversion efficiency, thermal durability, and long-term stability. As compliance becomes mandatory, OEMs prioritize technologies capable of performing under diverse driving conditions. This regulatory push consistently stimulates demand for upgraded catalytic converters in new vehicles and the aftermarket, ensuring sustained market expansion.

- For instance, Johnson Matthey validated its latest three-way catalyst system achieving NOx emissions as low as 56 mg/km under NEDC and 82 mg/km under WLTC performance tests, meeting Euro 6 limits.

Increasing Vehicle Production and Expanding Aftermarket Demand

Growing vehicle production worldwide, especially in developing regions, continues to boost catalytic converter demand. Rising incomes, expanding logistics networks, and increasing urban mobility have accelerated sales of gasoline, diesel, and hybrid vehicles requiring efficient emission control systems. The aftermarket also contributes significantly due to aging vehicle fleets, stricter inspection norms, and frequent converter replacements caused by wear, contamination, or theft. Commercial vehicles, which often experience severe operating conditions, further reinforce replacement demand. With OEM and aftermarket channels both growing steadily, catalytic converter manufacturers benefit from consistent and diverse revenue streams across global markets.

- For instance, manufacturers like Tenneco Inc., Faurecia SA, and Johnson Matthey are supplying advanced three-way catalytic converters and Selective Catalytic Reduction systems to meet Bharat Stage VI compliance requirements for India’s commercial vehicle fleet.

Advancements in Catalyst Materials and Converter Design

Rapid technological advancements in catalyst materials and converter configurations are reshaping market growth. Innovations in platinum group metal optimization, washcoat chemistry, and substrate architecture enhance conversion efficiency, lower light-off temperatures, and extend operational life. Nanostructured PGMs, high-cell-density substrates, and improved oxygen storage materials support modern engine downsizing while ensuring emission compliance. Advanced simulation tools and thermal management designs also improve durability in high-temperature conditions. These technical improvements enable OEMs to meet evolving emission norms more effectively and cost-efficiently, positioning material and design innovations as pivotal drivers of industry progress.

Key Trends & Opportunities

Growing Adoption of Hybrid and Mild-Hybrid Vehicles

The rising adoption of hybrid and mild-hybrid vehicles presents significant opportunities for catalytic converter manufacturers. Although hybrids reduce overall emissions, they rely on high-efficiency catalytic systems to manage cold-start emissions, which constitute a major portion of pollutants. Frequent switching between electric and combustion modes demands converters with rapid light-off capability, high thermal resistance, and optimized PGM formulations. Automakers increasingly design hybrid-specific converters that maintain performance under intermittent exhaust flow. As global markets transition toward electrification, hybrid vehicles will continue to create strong demand for advanced catalytic solutions over the medium term.

- For instance, Cataler Corporation (a Toyota Group company) developed its high-cell-density substrates for hybrid vehicles with over 900 cells per square inch, enabling faster catalyst activation and improved exhaust flow during frequent engine stop-start cycles.

Increasing Focus on PGM Recycling and Circular Economy Initiatives

Growing emphasis on PGM recycling has emerged as a major trend due to the rising cost and limited supply of platinum, palladium, and rhodium. Recycling end-of-life catalytic converters supports raw material availability, reduces production costs, and aligns with global sustainability objectives. Advances in smelting and hydrometallurgical processes improve metal recovery efficiency, enabling manufacturers to reclaim high-purity PGMs. With vehicle scrappage rates increasing globally, recycling plays an essential role in strengthening supply chain resilience and promoting circular economy practices. This trend creates long-term opportunities for recyclers, OEMs, and catalyst producers.

· For instance, Umicore’s PGM recycling facility in Hoboken processes more than 350,000 tons of spent materials annually (with capacity expanding to 500,000 tons) and recovers more than 20 different metals (up to 30 across all recycling operations), including platinum-group metals, using high-temperature metallurgical processes.

Key Challenges

Rising PGM Prices and Supply Chain Constraints

Volatility in platinum group metal prices remains a major challenge for the Automotive Catalytic Converter Market. Palladium and rhodium, in particular, have seen sharp price fluctuations due to limited mining output, geopolitical issues, and high industrial demand. Since PGMs constitute a substantial portion of manufacturing costs, price instability directly affects profitability and production planning. Additionally, supply constraints from key producing regions such as South Africa and Russia intensify supply chain risks. Manufacturers must adopt strategic sourcing, increase recycling efforts, and explore low-PGM or alternative catalyst technologies to mitigate cost pressures and ensure reliability.

Transition Toward Electric Vehicles

The accelerating shift toward battery electric vehicles presents a structural challenge, as BEVs do not require catalytic converters. Policy-driven electrification, government incentives, and robust investments in charging infrastructure continue to support EV adoption, gradually reducing future demand for exhaust aftertreatment systems. Although internal combustion engines and hybrids remain dominant in the near term, long-term market contraction is inevitable without strategic diversification. Manufacturers are responding by expanding hybrid-specific converter technologies, strengthening PGM recycling initiatives, and exploring adjacent markets. Managing this transition effectively will be critical for sustaining long-term industry competitiveness.

Regional Analysis

North America

North America held 40 % of the automotive catalytic converter market in 2024, supported by strong regulatory enforcement under the Environmental Protection Agency (EPA) Tier 3 standards and rising investments in advanced emission‑control technologies. The U.S. leads adoption due to its large vehicle parc, high replacement demand, and growing hybrid vehicle penetration. The expanding aftermarket, driven by aging vehicles and stringent inspection programs, further accelerates converter installations. Additionally, the presence of global OEMs and established catalytic converter manufacturers strengthens the region’s technological capabilities, ensuring continued demand across passenger and commercial vehicle categories.

Europe

Europe accounted for 32% market share in 2024, making it the leading region due to strict emission regulations, including Euro 6 and the transition toward Euro 7 standards. Countries such as Germany, France, and the U.K. drive demand through strong automotive production and a mature regulatory environment focused on reducing NOx and particulate emissions. The region’s emphasis on sustainability and cleaner mobility solutions, along with increasing hybrid vehicle sales, supports the need for high-efficiency catalytic systems. Europe’s robust aftermarket, driven by older diesel fleets, also contributes significantly to catalytic converter replacement volumes.

Asia-Pacific

Asia-Pacific dominated several growth indicators and held 34% market share in 2024, driven by large-scale automotive production in China, India, Japan, and South Korea. Rapid urbanization, rising disposable incomes, and expanding commercial logistics bolster vehicle sales, directly increasing demand for catalytic converters. China’s stringent China 6 norms and India’s Bharat Stage VI emission standards have accelerated OEM adoption of advanced three-way and diesel oxidation catalysts. The region also benefits from cost-effective manufacturing capabilities and a growing aftermarket ecosystem, positioning Asia-Pacific as the fastest-growing region in catalytic converter integration.

Latin America

Latin America captured 4% market share in 2024, supported by gradual improvements in vehicle emission regulations and increasing automotive production in Brazil, Mexico, and Argentina. The shift toward adopting stricter standards, including PROCONVE L7 and L8 in Brazil, is driving OEM and aftermarket demand for advanced catalytic converters. Economic recovery and growth in commercial transportation fleets further support market expansion. While the region’s adoption pace is slower than North America and Europe, rising urban pollution concerns and government-led initiatives to reduce vehicular emissions are strengthening long-term demand for efficient catalytic systems.

Middle East & Africa

The Middle East & Africa region held 2% market share in 2024, with growth primarily driven by expanding vehicle fleets in the Gulf countries and South Africa. Increasing adoption of emission standards and rising awareness of air quality issues are pushing OEMs to integrate catalytic converters across light and heavy vehicle categories. The aftermarket is also growing due to high vehicle penetration and long vehicle lifecycles. While regulatory frameworks remain uneven across the region, ongoing economic diversification initiatives and infrastructure development are expected to gradually strengthen demand for effective emission control technologies.

Market Segmentations

By Product

- Two-Way Oxidation

- Three-Way Oxidation-Reduction

- Diesel Oxidation Catalyst

By Material

- Platinum

- Palladium

- Rhodium

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Catalytic Converter Market features a highly competitive landscape dominated by global manufacturers with strong technological capabilities and extensive OEM partnerships. Leading companies such as BASF SE, Eberspächer, FORVIA Faurecia, BOSAL, BM Catalysts, Calsonic Kansei, Marelli Corporation, European Exhaust & Catalyst Ltd, Deccats, and BENTELER International focus on product innovation, cost-efficient platinum group metal (PGM) optimization, and advanced substrate designs to meet evolving emission regulations. These players continually invest in R&D to enhance conversion efficiency, thermal durability, and catalyst longevity. Strategic priorities include expanding production footprints, strengthening aftermarket distribution, and forming collaborations with automakers to support Euro 6/7, EPA Tier 3, and China 6 standards. Competition is further shaped by price volatility in PGMs, prompting companies to accelerate recycling programs and reduce material dependency. As hybrid vehicles grow, market leaders are also developing tailored catalytic solutions to support variable exhaust conditions and future regulatory demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eberspächer

- BM Catalysts Limited

- European Exhaust & Catalyst Ltd

- BASF SE

- FORVIA Faurecia

- BOSAL

- Deccats

- Calsonic Kansei

- Marelli Corporation

- BENTELER International Aktiengesellschaft

Recent Developments

- In November 2025, Tenneco LLC announced the public listing of its subsidiary Tenneco India (Clean Air business) on BSE & NSE, reflecting its growth focus in clean-air exhaust systems including catalytic converters.

- In September 2025, Aether Catalyst Solutions, Inc. filed a national-stage patent application for a base-metal (non-precious-metal) catalyst targeted at automotive emissions treatment.

- In February 2025, Elemental Econrg India Private Ltd. (a branch of Elemental Group) opened a new catalyst-recycling plant in Maharashtra, India, aimed at processing 130 tons of material in 2025.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as global emission regulations continue tightening across major automotive-producing regions.

- Automakers will increasingly adopt advanced catalyst formulations with optimized PGM content to balance performance and cost.

- Hybrid vehicles will sustain long-term demand for catalytic converters due to their ongoing need for efficient cold-start emission control.

- PGM recycling will gain greater industry focus as manufacturers seek to reduce dependency on volatile raw material markets.

- Technological innovations in substrate design and washcoat chemistry will enhance converter efficiency and durability.

- Aftermarket demand will rise as aging vehicle fleets in developed regions require frequent converter replacements.

- Asia-Pacific will remain the fastest-growing region due to expanding vehicle production and stricter emission standards.

- Cost pressures from fluctuating palladium and rhodium prices will push manufacturers toward alternative materials and low-PGM technologies.

- OEM partnerships will strengthen as automakers integrate next-generation emission control systems.

- The shift toward electrification will gradually reduce long-term demand, increasing the importance of hybrid-focused product strategies.