Market Overview

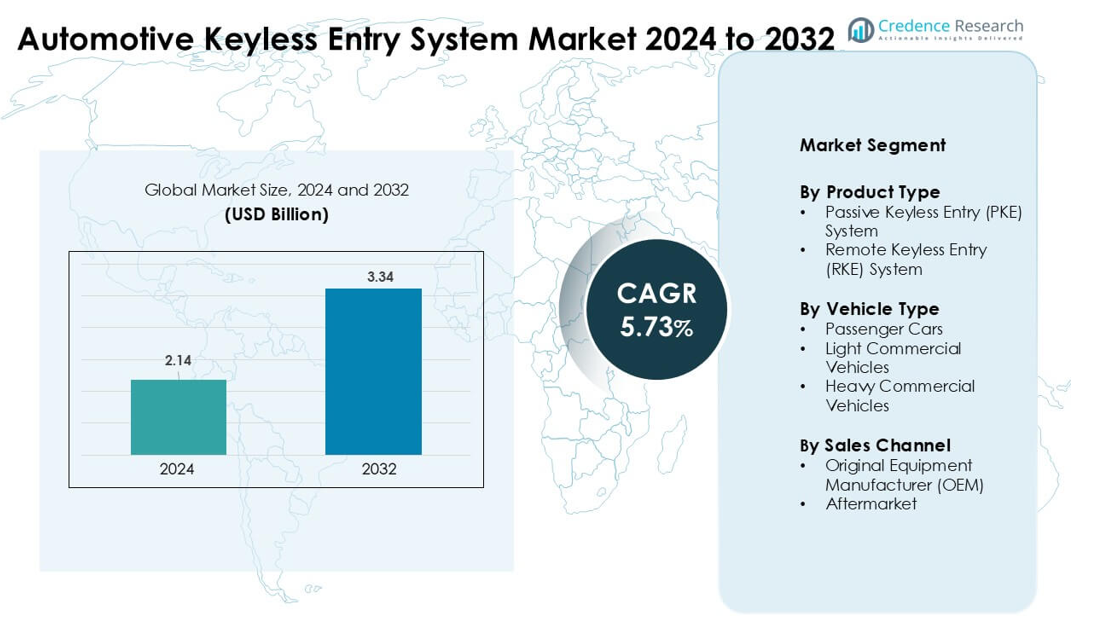

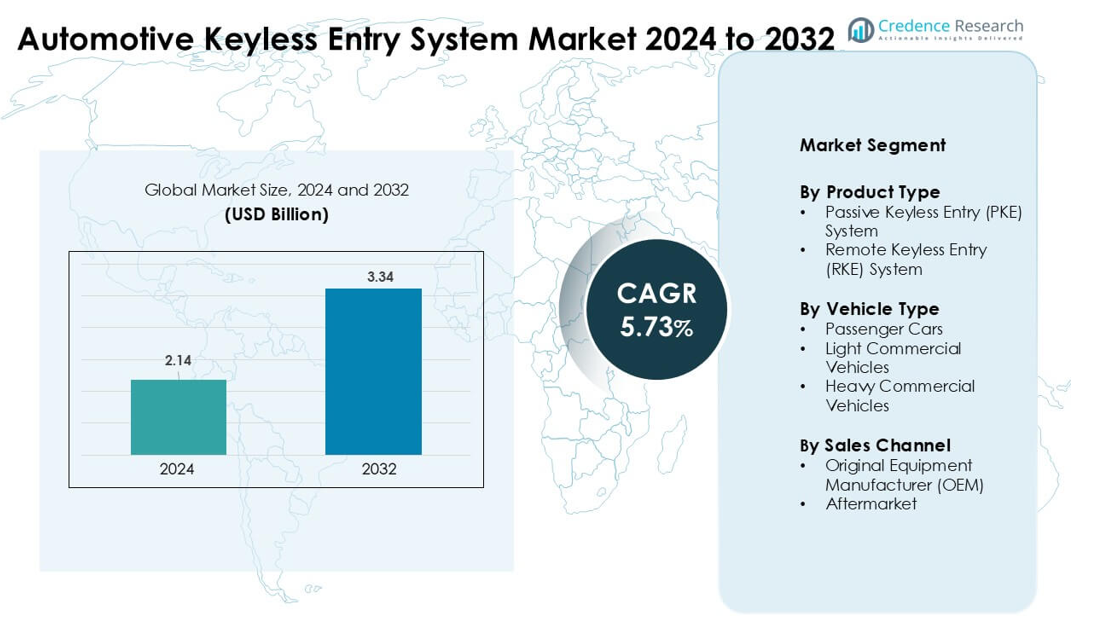

Automotive Keyless Entry System Market was valued at USD 2.14 billion in 2024 and is anticipated to reach USD 3.34 billion by 2032, growing at a CAGR of 5.73 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Keyless Entry System Market Size 2024 |

USD 2.14 billion |

| Automotive Keyless Entry System Market, CAGR |

5.73% |

| Automotive Keyless Entry System Market Size 2032 |

USD 3.34 billion |

The Automotive Keyless Entry System Market is shaped by major players such as Robert Bosch GmbH, Valeo, Hyundai Mobis, Denso, ASSA ABLOY AB, Mitsubishi Electric, 3M Cogent, Alpha Electric, ELLA GmbH & Co., and Delphi Continental AG. These companies compete through advanced PKE and RKE platforms, ultra-wideband security features, mobile-based digital keys, and improved encrypted communication modules. Their strong partnerships with global automakers support large-scale OEM integration across new vehicle platforms. North America emerged as the leading region in 2024 with a 34% share, driven by high adoption of connected vehicles, strong EV sales, and rising demand for smart access technologies.

Market Insights

- The Automotive Keyless Entry System Market reached USD 14 billion in 2024 and is projected to hit USD 3.34 billion by 2032, growing at a CAGR of 5.73%.

- Rising demand for comfort and anti-theft security in passenger cars drives strong adoption, with PKE systems holding about 62% share due to high convenience and improved authentication.

- Digital key technology, smartphone integration, and UWB-based security remain key trends as automakers shift toward connected and software-centric platforms.

- Major players such as Robert Bosch GmbH, Valeo, Hyundai Mobis, and Denso strengthen competitiveness through advanced encryption, AI-based access control, and OEM partnerships, while high system costs remain a restraint in entry-level models.

- North America led the market in 2024 with a 34% share, followed by Asia-Pacific at about 31%, supported by strong vehicle production; passenger cars dominated the vehicle type segment with nearly 71% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Passive Keyless Entry (PKE) systems led the product type segment in 2024 with about 62% share. Growing demand for enhanced convenience and improved anti-theft protection supported this lead. Automakers adopted PKE systems due to rising integration of proximity sensors and encrypted communication modules. Remote Keyless Entry (RKE) systems also expanded as entry-level models continued to use cost-effective wireless remotes. Wider use of smart fobs in mid-range vehicles strengthened PKE growth, while software upgrades and vehicle access personalization further pushed adoption across global markets.

- For instance, Continental’s passive access solutions integrate ultra-wideband technology to enable highly precise distance measurement, significantly reducing relay-attack risks compared with conventional RF-based keyless entry systems.

By Vehicle Type

Passenger cars dominated the vehicle type segment in 2024 with nearly 71% share. Rising production of compact and mid-size cars and stronger demand for comfort features supported this lead. Keyless systems gained traction in mass-market cars as manufacturers integrated smart access technology across new platforms. Light commercial vehicles increased adoption due to improved fleet security needs, while heavy commercial vehicles followed with telematics-linked entry solutions. Consumer preference for touch-free vehicle access and rising connected-car penetration helped expand market reach.

- For instance, Denso supplies OEM keyless entry and immobilizer modules that implement AES-128 encryption and are qualified for automotive operating temperatures typically ranging from –40°C to +85°C, meeting global vehicle electronics standards.

By Sales Channel

Original Equipment Manufacturers (OEMs) led the sales channel segment in 2024 with about 82% share. Automakers fitted keyless entry systems as standard or optional features across new vehicle lines. Strong integration of electronic control units, improved communication modules, and platform-wide digital key functions increased OEM installations. The aftermarket segment grew as owners upgraded older vehicles with remote access kits and security add-ons. Rising digital-key adoption and improved compatibility with mobile ecosystems continued to boost OEM-driven demand worldwide.

Key Growth Drivers

Growing Demand for Safety and Convenience Features

Rising preference for advanced comfort and safety features drives strong adoption of keyless entry systems across global vehicle platforms. Buyers now expect seamless entry, push-button start, and enhanced theft protection even in mid-range cars. Automakers respond by expanding smart key integration across new models to stay competitive. Modern systems use encrypted radio signals, proximity sensors, and rolling-code technology to reduce unauthorized access. This shift supports higher penetration in both passenger cars and light commercial vehicles. Increasing awareness of vehicle theft also strengthens demand for secure entry solutions, pushing manufacturers to adopt multilayer authentication and improved access control.

- For instance, Bosch offers a Digital Key solution combining Bluetooth Low Energy and ultra-wideband communication, enabling secure smartphone-based vehicle access and compliant with Car Connectivity Consortium standards across multiple OEM vehicle platforms.

Rapid Electrification and Connected-Car Expansion

Growth in electric vehicles and connected-car architectures boosts demand for digital access systems. EV makers include keyless entry as a standard feature to align with premium user experience expectations. Integration with telematics, cloud-based authentication, and mobile apps enhances system value. Digital keys enable remote lock-unlock, vehicle location tracking, and personalized driver profiles, improving usability. Rising investment in IoT-based automotive electronics accelerates adoption, as vehicles increasingly rely on smart modules for communication and security. Over-the-air updates also push upgrades without hardware changes, boosting long-term system relevance.

- For instance, in 2024, Kia expanded its Digital Key 2.0, using NFC, Bluetooth Low Energy, and ultra-wideband to enable passive smartphone-based locking, unlocking, and vehicle start across selected connected and electric models.

Rising Integration of Advanced Sensors and Security Algorithms

Automotive safety regulations and rising cybersecurity threats push automakers to adopt improved keyless systems with next-generation sensors and encryption. Modern PKE and RKE platforms use ultra-wideband technology, biometric authentication, and high-frequency communication to prevent relay attacks. Sensor fusion improves accuracy in proximity detection, reducing false triggers and enhancing user confidence. Manufacturers invest in algorithmic improvements to avoid cloning, hacking, and signal jamming. These advancements enhance reliability and support wider adoption across mass-market vehicle segments. Growing supplier focus on standardized security frameworks further strengthens industry growth.

Key Trends & Opportunities

Growth of Digital Key Technology and Smartphone Integration

Digital key technology emerges as a major trend as consumers seek mobile-based access solutions. Automakers offer app-based entry, remote start, and personalized driver settings linked to smartphones. Integration with Bluetooth Low Energy, NFC, and cloud authentication creates new revenue opportunities for software-driven services. Shared mobility fleets use digital keys to support remote onboarding, usage tracking, and multi-user access. This trend also supports subscription-based features, boosting long-term value for automakers and suppliers.

- For instance, Thales reports growing adoption of digital key solutions by vehicle OEMs and smartphone manufacturers, driven by demand for seamless access and secure IoT-enabled mobility, aligned with Car Connectivity Consortium standards.

Expansion of Ultra-Wideband (UWB) and Biometric Access Features

UWB-based systems gain momentum because they significantly reduce relay attack risks and enhance location accuracy. High-end vehicles increasingly adopt UWB chips and secure localization to improve user safety. Biometric technologies, including fingerprint and facial recognition, appear in next-generation key modules and digital key apps. These advancements enable high-security, personalized access experiences. Suppliers invest in miniaturized sensors, faster processing units, and AI-driven authentication, creating new opportunities in premium and mid-range vehicle categories.

- For instance, Marquardt has developed a modular vehicle access platform integrating ultra-wideband, Bluetooth Low Energy, and NFC, enabling secure digital key functionality and scalable personalization for premium and mid-range vehicle programs.

Rising Aftermarket Demand for Retrofit Systems

The aftermarket sees growing interest as consumers upgrade older vehicles with smart access kits. Retrofit systems offer improved convenience and enhanced security without replacing factory hardware. Suppliers introduce plug-and-play modules, universal wiring harnesses, and remote-based kits to attract budget-conscious buyers. Rising vehicle age in several markets supports this trend, as owners seek modern features without purchasing new cars.

Key Challenges

Cybersecurity Risks and Increasing Relay Attacks

Rising cyber threats challenge market expansion as criminals use signal amplification and relay attacks to bypass keyless systems. Manufacturers must invest heavily in encryption upgrades, UWB technology, and multi-factor authentication to maintain consumer trust. These security requirements increase development costs and slow adoption in cost-sensitive vehicle segments. Regulatory bodies push for stricter cybersecurity compliance, adding complexity for global suppliers. Ensuring secure communication across smartphones, vehicle modules, and cloud systems also remains a critical challenge.

High System Cost and Integration Complexity

Complex integration of sensors, antennas, ECUs, and software modules increases production costs, especially for mass-market models. Automakers face pressure to balance feature-rich systems with vehicle pricing constraints. Keyless platforms require robust compatibility with electrical architectures, testing cycles, and regulatory norms, which adds engineering time and expense. These factors limit adoption in entry-level vehicles and delay large-scale rollout in developing markets. Suppliers must keep improving cost efficiency to support wider market penetration.

Regional Analysis

North America

North America led the Automotive Keyless Entry System Market in 2024 with about 34% share. Strong adoption of advanced safety features in passenger cars and light commercial vehicles supported regional dominance. Automakers expanded PKE and digital key integration across mid-range and premium models. Rising EV sales in the U.S. further pushed demand for connected access systems. Regulatory focus on anti-theft protection encouraged wider use of encrypted communication and UWB-based solutions. Aftermarket upgrades also gained traction as owners replaced traditional remotes with smart entry kits, strengthening long-term growth across the region.

Europe

Europe held nearly 29% share in 2024, driven by strong vehicle connectivity norms and rapid electrification. German and French automakers integrated high-security keyless platforms with UWB and advanced encryption. Demand increased as premium and luxury brands expanded biometric and digital key features. Strict safety and cybersecurity standards encouraged manufacturers to enhance authentication layers. Rising fleet modernization in Western Europe boosted adoption in light commercial vehicles. Consumer preference for comfort and smart access functions continued to push system installations across both OEM and aftermarket channels.

Asia-Pacific

Asia-Pacific accounted for about 31% share in 2024, supported by expanding passenger car production and rising disposable income. China, Japan, and South Korea led adoption due to strong presence of connected-car manufacturers. Automakers offered PKE systems even in mid-segment models to appeal to tech-oriented buyers. Growth of EVs and hybrid vehicles accelerated keyless system penetration across new platforms. Large aftermarket demand in India and Southeast Asia also contributed to system upgrades. Increasing focus on vehicle security and remote-access convenience continued strengthening market expansion across the region.

Latin America

Latin America captured around 4% share in 2024, with growth driven by rising adoption of smart features in mid-priced vehicles. Brazil and Mexico led the regional market as automakers introduced RKE and entry-level PKE systems in newer models. Aftermarket installation remained strong due to aging vehicle fleets and demand for added security. Cost sensitivity limited rapid rollout of advanced features, but improving economic conditions and rising vehicle replacement rates supported gradual expansion. Growing exposure to connected-car technologies also encouraged adoption of app-based remote access tools.

Middle East & Africa

The Middle East & Africa held nearly 2% share in 2024, with adoption concentrated in premium and imported vehicle segments. Gulf countries saw higher penetration of PKE and digital key systems due to strong demand for luxury cars. Expanding automotive distribution networks in the UAE and Saudi Arabia supported OEM installations. Africa experienced slower deployment because of cost constraints, but aftermarket upgrades improved penetration in urban markets. Growing interest in anti-theft technologies and rising import of tech-equipped vehicles are expected to support steady regional growth.

Market Segmentations:

By Product Type

- Passive Keyless Entry (PKE) System

- Remote Keyless Entry (RKE) System

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Keyless Entry System Market features strong competition among leading suppliers such as Robert Bosch GmbH, Valeo, Hyundai Mobis, Denso, ASSA ABLOY AB, Mitsubishi Electric, 3M Cogent, Alpha Electric, ELLA GmbH & Co., and Delphi Continental AG. These companies expand their portfolios through advanced PKE and RKE platforms, digital key technologies, and ultra-wideband security enhancements. Automakers partner with these suppliers to integrate encrypted communication modules, proximity sensors, and mobile-based authentication across vehicle lines. Firms invest in AI-enabled access control, cloud-linked digital keys, and cybersecurity frameworks to meet rising safety norms. Strategic moves include R&D spending, platform standardization, cross-industry collaborations, and software-driven feature upgrades. Global players also strengthen regional production and supply chains to support OEM programs and aftermarket demand

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, At IAA Mobility 2025 (Munich), Hyundai Mobis showcased its future mobility vision and core technology roadmap focusing on electrification, integrated control solutions, and advanced in‑vehicle user experience (UX). Though the highlight was on electrification, software-defined vehicles (SDV) and integrated electronics key enablers for functions like digital key / keyless entry were emphasized as part of their integrated mobility solutions strategy.

- In September 2024, Hyundai Mobis became the first Asian automotive supplier to obtain a comprehensive cybersecurity certification from the European automotive authority, signaling that their electronic systems potentially including digital key or keyless entry solutions meet rigorous European security standards.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Keyless entry systems will gain deeper integration with digital key platforms across new vehicle models.

- Ultra-wideband technology will expand as automakers strengthen protection against relay attacks.

- Smartphone-based access and cloud authentication will become standard features in connected vehicles.

- EV manufacturers will increase adoption of advanced access systems to enhance user experience.

- Biometric authentication will grow, offering fingerprint and facial recognition for secure entry.

- Over-the-air updates will support continuous security upgrades without hardware changes.

- Aftermarket demand will rise as older vehicles adopt retrofit smart entry kits.

- Automakers will unify access control with driver profiles and personalized cabin settings.

- Cybersecurity frameworks will tighten, pushing suppliers to enhance encryption and authentication layers.

- Partnerships between automotive OEMs and tech firms will accelerate innovation in keyless access ecosystems.