Market Overview

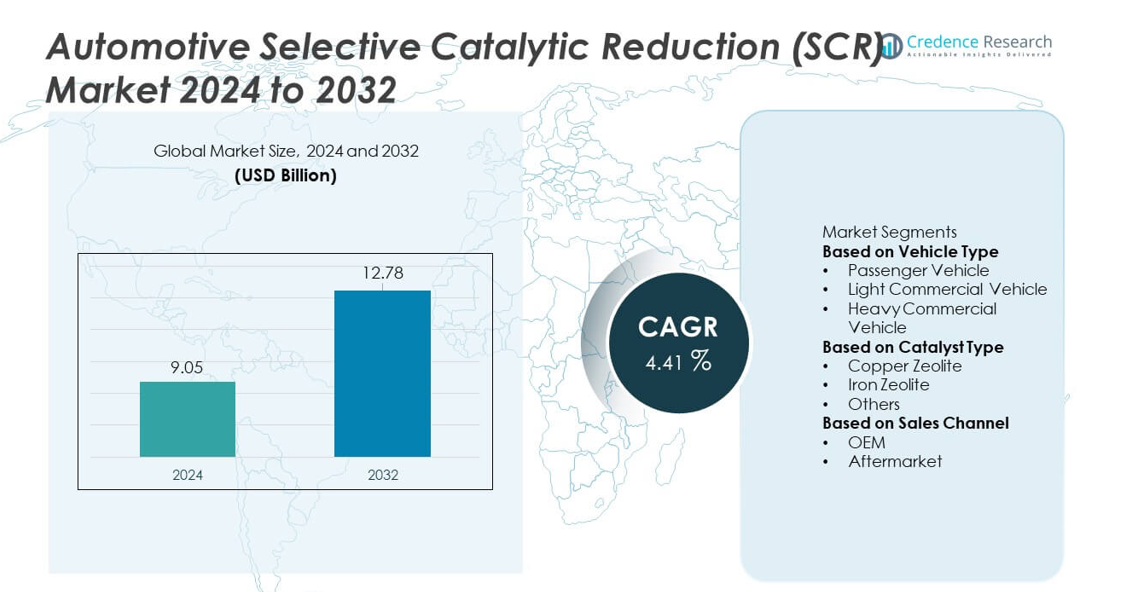

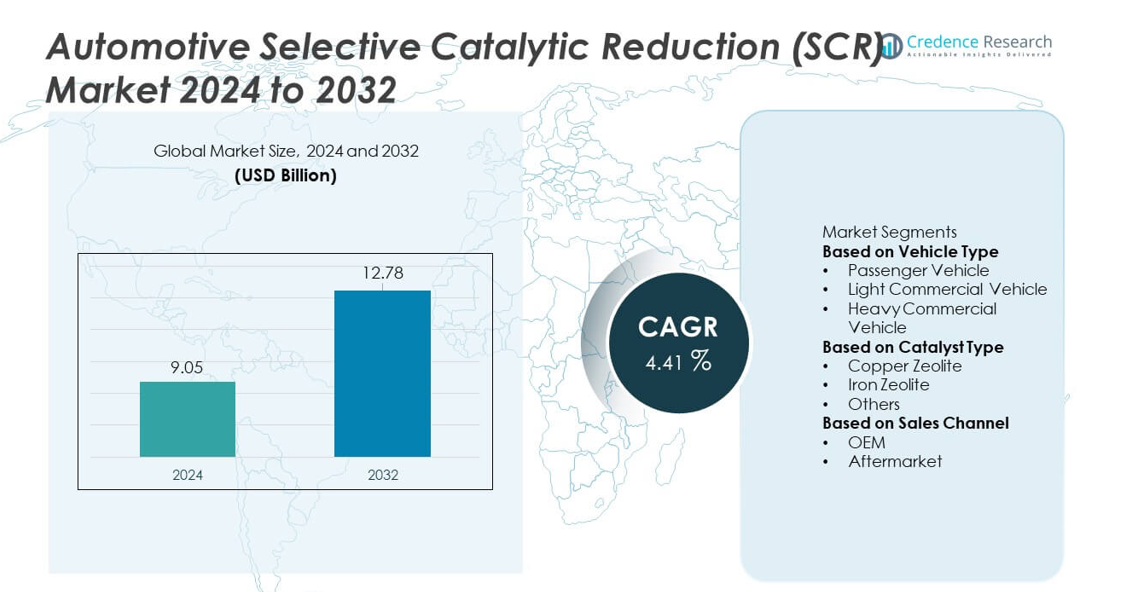

The Automotive Selective Catalytic Reduction (SCR) market reached USD 9.05 billion in 2024 and is projected to grow to USD 12.78 billion by 2032, registering a CAGR of 4.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Selective Catalytic Reduction (SCR) Market Size 2024 |

USD 9.05 billion |

| Automotive Selective Catalytic Reduction (SCR) Market, CAGR |

4.41% |

| Automotive Selective Catalytic Reduction (SCR) Market Size 2032 |

USD 12.78 billion |

The Automotive Selective Catalytic Reduction (SCR) market is shaped by top players such as Bosch Mobility Solutions, Continental AG, Cummins Inc., Faurecia (FORVIA Group), Tenneco Inc., BASF SE, Johnson Matthey, Umicore, Marelli Holdings Co. Ltd., and Weifu High-Technology Group, all of which focus on advanced catalyst formulations and high-efficiency dosing systems to support global emission compliance. These companies strengthen OEM partnerships and expand aftermarket offerings to meet rising demand from commercial fleets and passenger diesel vehicles. North America leads the market with a 34% share, supported by strong regulatory enforcement, followed by Europe with a 31% share, driven by stringent Euro standards, while Asia Pacific holds a 26% share due to growing diesel vehicle production and rapid adoption of emission-control technologies.

Market Insights

- The Automotive Selective Catalytic Reduction (SCR) market reached USD 9.05 billion in 2024 and will grow at a CAGR of 4.41% through 2032, driven by strong adoption across diesel vehicle segments.

- Strict global emission rules boost SCR demand, with passenger vehicles holding a 46% share and OEM sales dominating with a 71% share due to factory-level integration of high-efficiency systems.

- Advancements in copper-zeolite catalysts and compact SCR designs shape key trends as manufacturers improve cold-start performance, reduce ammonia slip, and support lightweight vehicle platforms.

- Leading companies, including Bosch Mobility Solutions, Continental AG, Cummins Inc., and Faurecia, strengthen competition through durable catalysts, optimized dosing units, and expanded aftermarket offerings, while high component costs remain a major restraint for price-sensitive markets.

- Regionally, North America leads with a 34% share, Europe follows with 31%, and Asia Pacific holds 26%, supported by rising diesel fleet modernization and stricter emission norms in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type

Passenger vehicles lead the Automotive SCR market with a 46% share, driven by strict emission rules for diesel cars in major regions. Growing adoption of compact SCR systems in SUVs and premium models increases demand for advanced catalysts. Light commercial vehicles hold a strong position due to rising logistics activity and fleet upgrades. Heavy commercial vehicles also contribute stable growth as long-haul trucks rely on high-capacity SCR units to meet NOx limits. Automakers invest in durable dosing systems and optimized converters to support compliance and reduce maintenance costs across all vehicle types.

- For instance, Bosch Mobility Solutions developed its Denoxtronic system, which supports compliance with emission requirements by precisely injecting an optimal amount of urea solution into the exhaust system.

By Catalyst Type

Copper zeolite dominates the catalyst segment with a 58% share, supported by strong NOx conversion efficiency at low temperatures. This catalyst type performs well in cold starts and urban driving conditions, making it preferred by major OEMs. Iron zeolite holds notable demand due to its thermal stability and suitability for heavy-duty engines. Other catalyst types serve niche applications that require moderate performance and cost-effective formulations. Increasing focus on improving durability, reducing ammonia slip, and supporting Euro 6 and EPA standards drives advancements across all catalyst categories.

- For instance, Johnson Matthey’s Cu-zeolite SCR catalyst achieves more than 90% NOx conversion at exhaust temperatures near 200 °C and withstands thermal aging up to 800 °C. The catalyst is produced in monolith blocks with up to 400 cpsi cell density.

By Sales Channel

OEM sales account for a 71% share, driven by strict factory-level integration of SCR systems to meet global emission norms. Automakers rely on pre-tested, high-performance SCR units to ensure compliance and improve fuel efficiency. The aftermarket segment grows steadily as aging diesel fleets require replacement catalysts, dosing valves, and DEF tanks. Rising commercial fleet maintenance and higher awareness of emission compliance support aftermarket purchases. Increasing durability standards and adoption of long-life catalysts further strengthen OEM demand across global vehicle platforms.

Key Growth Drivers

Stringent Global Emission Regulations

Governments enforce strict limits on NOx emissions, driving strong adoption of SCR systems across diesel vehicles. Automakers integrate advanced catalysts, optimized dosing units, and durable converters to meet Euro 6, EPA Tier standards, and China VI norms. Regulatory pressure accelerates SCR installation in passenger cars, commercial fleets, and off-highway machinery. Growing oversight on heavy-duty trucks further strengthens demand for high-efficiency SCR units. This regulatory landscape encourages continuous technological upgrades, pushing manufacturers to improve conversion rates, system durability, and overall compliance.

- For instance, Cummins’ SCR catalyst for heavy-duty engines achieves NOx conversion above 0.2 g/bhp-hr while supporting engine displacements up to 15 L. The system uses a dosing control valve capable of metering 0.05–5 g/s of DEF with high accuracy.

Rising Production of Diesel Commercial Vehicles

Growing logistics, construction, and industrial activity increases demand for diesel-powered trucks and vans. These vehicles require high-capacity SCR units to maintain NOx reduction under heavy loads and long operating hours. Fleet expansions in emerging markets strengthen SCR system installations across light and heavy commercial vehicles. Manufacturers develop robust catalysts and DEF dosing solutions that support continuous operation and lower fuel penalties. The rise of e-commerce and cross-border transport further boosts fleet modernization, increasing SCR penetration in new-generation diesel platforms.

- For instance, Tenneco’s Smart Dosing System delivers DEF flow rates up to 9 kg/h for large commercial trucks and maintains consistent atomization at exhaust temperatures ranging from –11 °C to 600 °C. The unit integrates a pump generating up to 450 kPa pressure to ensure uniform injection.

Advancements in Catalyst and Dosing Technologies

Technological improvements enhance SCR efficiency, durability, and temperature tolerance. Copper and iron zeolite catalysts deliver higher conversion rates under varied driving conditions, improving cold-start performance and reducing ammonia slip. Smart dosing control units integrate sensors and software that maintain precise DEF injection. Automakers adopt compact and modular SCR designs to fit diverse vehicle layouts without compromising performance. Continuous R&D in catalyst coatings, thermal stability, and system integration supports cleaner combustion, enabling manufacturers to meet strict emission rules while lowering maintenance needs.

Key Trends & Opportunities

Increasing Adoption of Compact and Integrated SCR Systems

Vehicle manufacturers shift toward compact SCR units that combine catalysts, mixers, and filters in a single housing. These integrated systems help reduce vehicle weight, save space, and simplify installation. Demand rises in passenger cars and SUVs as automakers prioritize fuel efficiency and lightweight emission controls. This trend creates opportunities for suppliers offering modular designs suitable for varied engine platforms. With growing hybrid diesel models, compact SCR layouts gain more relevance, supporting efficient NOx management while meeting packaging constraints.

- For instance, Faurecia (FORVIA) developed its compact SCR on filter (SCR-F) system with a wall-flow substrate measuring only 130 mm in thickness and a cell density of 300 cpsi. The integrated unit combines particulate filtration and NOx reduction in one module, cutting overall system length by 120 mm.

Growing Demand for High-Efficiency Catalysts in Cold-Start Conditions

Urban driving and stricter real-world emission tests increase the need for SCR systems that perform well at low temperatures. High-activity copper zeolite catalysts attract strong interest due to superior conversion rates during cold starts. Manufacturers invest in formulations that activate faster and reduce nitrogen oxide peaks in city traffic. This creates opportunities for suppliers specializing in advanced thermal-management materials and rapid-light-off catalysts. As cities adopt cleaner transport rules, cold-start-optimized SCR units gain broader market acceptance across vehicle categories.

- For instance, commercial SCR systems utilizing various catalysts, including advanced Cu-zeolite formulations, can achieve high NOx conversion efficiency, often greater than 90%, to meet stringent emissions standards.

Key Challenges

High Cost of Advanced SCR Components

SCR systems require costly catalysts, sensors, DEF dosing units, and thermal-management materials. These components increase vehicle manufacturing expenses, especially in budget-sensitive markets. Compliance with global emission norms pushes OEMs to invest in high-performance catalyst formulations, which further raises system prices. Small commercial fleet owners often hesitate to adopt advanced SCR solutions due to higher upfront costs. Managing production costs while maintaining emission compliance remains a key challenge for manufacturers worldwide.

Maintenance Requirements and DEF Dependency

SCR systems depend on consistent use of diesel exhaust fluid (DEF) and regular servicing to sustain performance. Irregular DEF refilling or poor-quality fluid leads to ammonia slip, catalyst degradation, and reduced NOx conversion. In regions with weak supply chains, DEF availability becomes a bottleneck for fleet operators. SCR components also require periodic inspection to prevent clogging and maintain optimal dosing accuracy. These maintenance needs raise operational burdens, slowing adoption among aging fleets and cost-conscious users.

Regional Analysis

North America

North America leads the Automotive SCR market with a 34% share, driven by strong enforcement of EPA emission standards for diesel vehicles. Growing deployment of SCR systems in heavy-duty trucks, buses, and off-highway machinery supports regional dominance. Manufacturers invest in high-efficiency catalysts and advanced dosing units to manage NOx levels in long-haul applications. Rising fleet modernization across logistics and mining sectors strengthens demand for durable SCR systems. Expansion of e-commerce and freight movement further increases diesel vehicle usage, boosting SCR installations across both OEM and aftermarket channels.

Europe

Europe holds a 31% share, supported by strict Euro 6 and Euro 7 regulations that continue to push SCR adoption across passenger and commercial vehicles. The region sees strong integration of compact SCR units in diesel cars and light commercial fleets, particularly in Germany, France, and the UK. Growth in long-distance freight transport drives high demand for large-capacity SCR systems in heavy trucks. Automakers enhance catalyst performance to address cold-start efficiency and ammonia slip. Increasing investments in cleaner diesel technologies sustain market growth despite rising interest in electric mobility.

Asia Pacific

Asia Pacific commands a 26% share, fueled by expanding automotive production and strong demand for commercial diesel vehicles. China and India enforce stringent emission norms like China VI and Bharat Stage VI, accelerating the integration of SCR systems across new diesel platforms. Rapid industrialization and infrastructure development boost heavy-duty truck usage, creating sustained demand for robust SCR solutions. Local manufacturers invest in cost-optimized catalysts and dosing systems to support large-scale adoption. Rising logistics activity and growing urban pollution concerns further strengthen the region’s SCR market outlook.

Latin America

Latin America holds a 6% share, driven by gradual upgrades in emission standards and increasing adoption of SCR systems in heavy commercial vehicles. Brazil and Mexico lead regional demand as logistics and mining sectors expand their diesel fleets. OEMs introduce improved SCR units designed for high-temperature and heavy-load conditions common in long-distance transport. Government efforts to manage urban pollution encourage wider adoption in buses and public transport fleets. Despite economic fluctuations, rising fleet modernization and aftermarket replacements support steady growth.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, supported by growing demand for SCR systems in commercial vehicles used in oil, gas, and construction sectors. Increasing adoption of emission control technologies in GCC countries strengthens market presence. Heavy-duty trucks operating in mining and industrial projects rely on high-capacity SCR units for stable NOx reduction. Limited emission regulations in some countries restrict faster growth, but expanding fleet upgrades create new opportunities. Rising infrastructure investment and aftermarket servicing needs contribute to steady market expansion.

Market Segmentations:

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Catalyst Type

- Copper Zeolite

- Iron Zeolite

- Others

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading companies such as Bosch Mobility Solutions, Continental AG, Cummins Inc., Faurecia (FORVIA Group), Tenneco Inc., BASF SE, Johnson Matthey, Umicore, Marelli Holdings Co. Ltd., and Weifu High-Technology Group, all of which strengthen market growth through advanced catalyst technologies and durable dosing systems. These players invest in high-performance copper and iron zeolite catalysts to enhance NOx conversion under varied driving conditions. Many manufacturers focus on compact SCR designs that support efficient packaging in passenger and commercial vehicles. Strategic partnerships with OEMs help expand global supply networks, while continuous R&D improves catalyst coatings, thermal stability, and ammonia slip control. Companies also scale aftermarket offerings, including replacement catalysts and DEF dosing units, to meet rising demand from aging diesel fleets. Growing compliance requirements encourage suppliers to develop long-life SCR systems that reduce maintenance needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Johnson Matthey and Bosch announced a long-term collaboration to develop catalyst coated membranes (CCM) for hydrogen fuel cells for commercial vehicles — a move that could influence future SCR and emission-control tech.

- In February 2024, ANDRITZ has secured an order from TPC Group to provide a Selective Catalytic Reduction (SCR) system for reducing nitrogen oxide (NOx) emissions at the power boiler in Houston, TX, U.S.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Catalyst Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Stricter global emission norms will increase SCR system installation across all diesel vehicle categories.

- Demand for compact and lightweight SCR units will rise as automakers optimize vehicle design.

- Advanced copper-zeolite catalysts will gain wider use due to higher conversion efficiency.

- Growth in commercial fleets will drive strong SCR adoption in long-haul and heavy-duty trucks.

- Integration of smart sensors and digital dosing control will improve system accuracy.

- Aftermarket demand will expand as aging diesel fleets require replacement catalysts and DEF components.

- Manufacturers will invest more in cold-start performance to meet real-world driving test standards.

- Emerging markets will accelerate SCR adoption as emission regulations tighten.

- Modular SCR architectures will support flexible installation across diverse engine platforms.

- Collaboration between OEMs and catalyst suppliers will strengthen innovation and reduce maintenance needs.