Market Overview

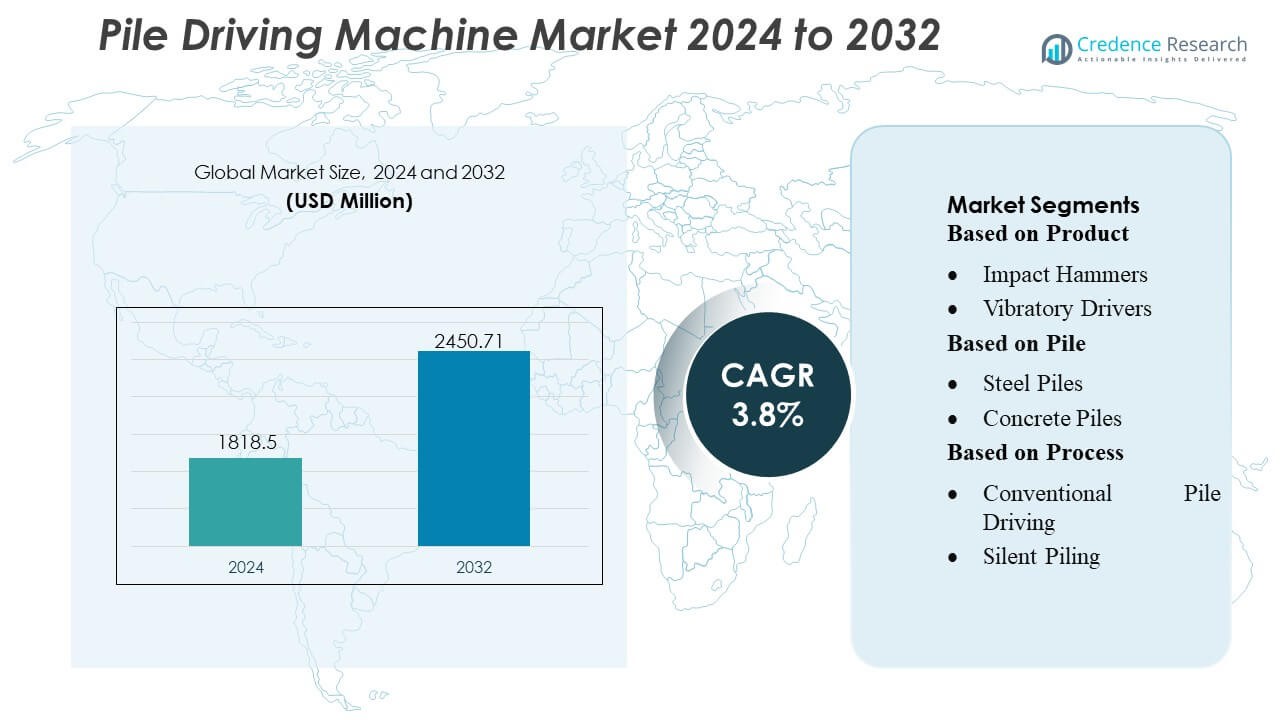

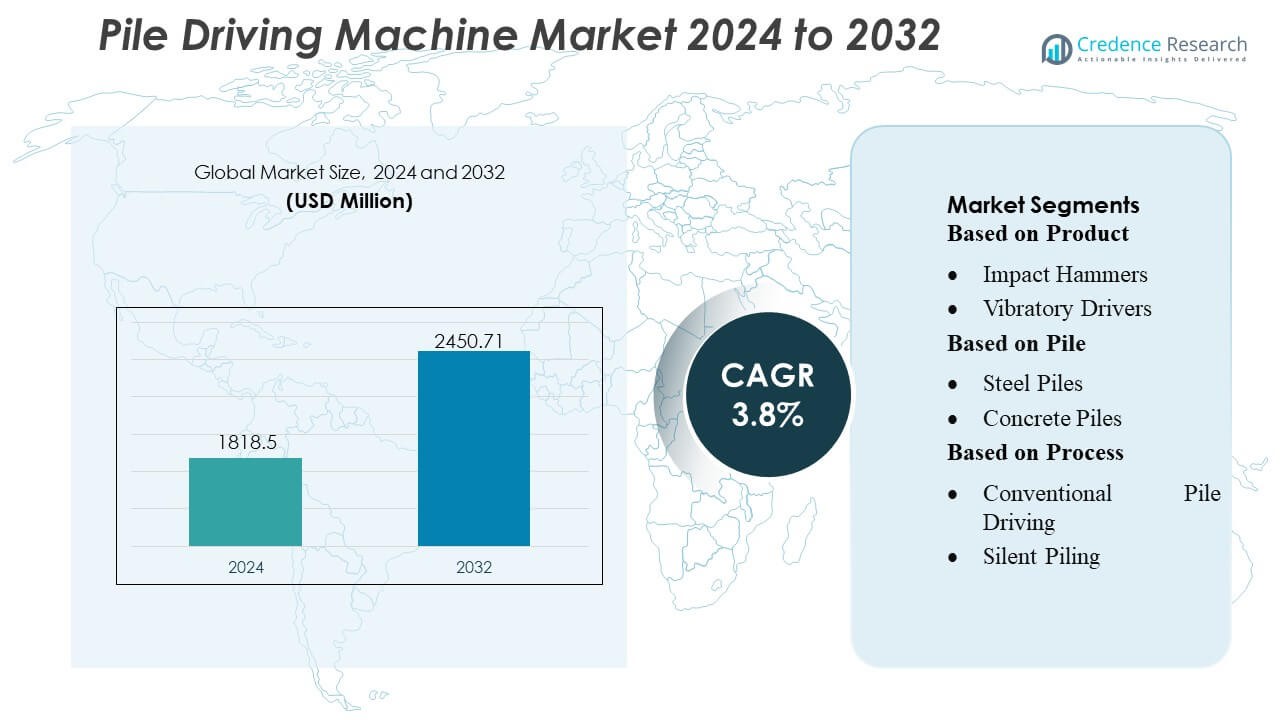

Pile Driving Machine Market size was valued USD 1818.5 million in 2024 and is anticipated to reach USD 2450.71 million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pile Driving Machine Market Size 2024 |

USD 1818.5 Million |

| Pile Driving Machine Market, CAGR |

3.8% |

| Pile Driving Machine Market Size 2032 |

USD 2450.71 Million |

The Pile Driving Machine Market is shaped by a mix of global heavy-equipment manufacturers, engineering solution providers, and specialized foundation-equipment producers that continue to expand capabilities in hydraulic impact hammers, vibratory drivers, and silent piling systems. Competitors strengthen their portfolios through automation, telematics integration, and emission-compliant powertrains designed for complex civil, marine, and industrial applications. The market benefits from rising investments in infrastructure, offshore wind, and urban development, which drive demand for high-efficiency and low-noise piling technologies. Asia-Pacific leads the global market with an exact 36% share, supported by rapid urbanization, extensive transport projects, and large-scale coastal infrastructure expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pile Driving Machine Market reached USD 1818.5 million in 2024 and is projected to hit USD 2450.71 million by 2032, advancing at a 3.8% CAGR, supported by steady demand from infrastructure renewal and large foundation projects.

- Market growth is driven by rising adoption of hydraulic impact hammers, advanced vibratory drivers, and silent piling systems that enable higher efficiency and compliance with noise-sensitive urban construction requirements.

- Key trends reflect increasing integration of automation, telematics, and emission-controlled powertrains as manufacturers enhance productivity, durability, and real-time performance monitoring across diverse job-site conditions.

- Competitive dynamics intensify as global and regional OEMs expand rental fleets, strengthen after-sales support, and innovate low-vibration, high-torque piling equipment to address marine, civil, and industrial foundation needs.

- Asia-Pacific leads with a 36% regional share, while impact hammers remain the dominant product segment with a strong share, supported by extensive transport corridors, coastal infrastructure upgrades, and accelerated megacity development.

Market Segmentation Analysis:

By Product

Impact hammers dominate the Pile Driving Machine Market, holding the largest share due to their high energy output, adaptability across soil profiles, and suitability for deep foundation and heavy civil engineering works. Their ability to deliver consistent blow energy makes them the preferred choice for bridge piers, marine structures, and large-diameter piles. Growth remains supported by increasing deployment in transport corridor expansion and offshore foundation reinforcement. Vibratory drivers gain traction in sandy and granular terrains, while press-in piling machines expand in noise-sensitive urban zones. Sonic piling machines maintain a niche presence in specialized low-disturbance projects.

- For instance, Fuji Electric’s small Dual In-line Package Intelligent Power Modules (IPMs) use their new 7th generation X-series IGBT technology. The product lineup ranges from 15 A to 70 A at 600 V.

By Pile

Steel piles lead the market with the highest share, driven by their superior load-bearing capacity, durability, and suitability for high-strength structural foundations. Their ability to withstand high bending stress and support deep penetration in dense soils strengthens adoption across ports, industrial bases, and high-rise construction. Concrete piles follow due to widespread use in residential and commercial developments, while timber piles remain relevant in cost-sensitive applications. Composite piles gain momentum for corrosion-prone marine environments and long-life infrastructure where enhanced resistance and lower maintenance costs are critical.

- For instance, Torrid specializes in apparel and accessories for women in sizes 10 to 30W, a range consistently available both online and in its physical stores. The company has operated a nationwide network of over 600 retail locations across the United States.

By Process

Conventional pile driving represents the dominant process segment, securing the largest market share owing to its operational reliability, compatibility with multiple pile types, and established use across global infrastructure programs. Its ability to deliver high penetration energy and support rapid installation drives continued preference in highways, rail foundations, and offshore wind installations. Silent piling grows rapidly in urban redevelopment projects due to its vibration-free operation and compliance with strict noise regulations. Jetting remains focused on coastal zones and soft-soil regions where water-assisted penetration improves installation efficiency and reduces structural disturbance.

Key Growth Drivers

- Rising Global Infrastructure Expansion

Infrastructure modernization across transport, energy, industrial, and urban development projects drives strong demand for advanced pile driving machines. Governments accelerate investments in metro rail corridors, coastal protection structures, and port deepening programs, increasing the requirement for high-capacity piling systems. Growth intensifies as high-rise construction and large-span bridges require deeper and stronger foundations. The shift toward resilient infrastructure, supported by stricter seismic compliance standards, further boosts adoption of machines capable of delivering higher impact energy, faster penetration, and improved stability in complex ground conditions.

- For instance, Dia & Co operates through both a subscription styling box service and a standard e-commerce platform. The service primarily targets women in the 25–45 age bracket, a key group often identified in market analyses as young professionals and working women who drive significant consumer demand.

- Increasing Offshore Wind and Marine Construction Activities

Rapid expansion of offshore wind farms and coastal infrastructure fuels substantial demand for high-performance piling equipment. Turbine foundations, subsea platforms, and breakwater structures rely on machines that can handle large-diameter steel monopiles and deliver precise controlled energy in challenging marine environments. Manufacturers benefit from rising installation of deep-water wind assets requiring enhanced driving force and vibration monitoring capabilities. The development of noise-reduction technologies to comply with marine environmental regulations strengthens long-term equipment utilization across global offshore engineering programs.

- For instance, the United States represented a key market for ASOS, with financial reports for fiscal year 2022 indicating it was a significant driver of online consumer purchasing. Sales were strong across its extensive range of product categories, including the Curve and Plus Size division, contributing substantially to overall revenue.

- Advancements in Low-Noise and Vibration-Control Technologies

Technological innovations in vibration isolation, hydraulic optimization, and real-time load monitoring accelerate the adoption of modern piling systems, especially in urban and regulated environments. Demand rises for equipment that minimizes structural impact, reduces noise emissions, and enhances precision during pile placement. Smart control systems, automated data logging, and AI-assisted penetration analysis enable contractors to improve accuracy and operational uptime. These advancements strengthen the use of press-in piling machines and upgraded impact hammers in metro tunneling, foundation retrofitting, and redevelopment zones.

Key Trends & Opportunities

- Integration of Digital Monitoring and Automated Control Systems

A major trend involves the integration of sensors, telematics, and automated control modules that enhance machine efficiency, safety, and predictive maintenance. Contractors adopt real-time penetration analytics, GPS-driven depth tracking, and cloud-connected vibration monitoring to reduce operational errors and downtime. This shift offers opportunities for manufacturers to introduce intelligent piling systems that optimize blow count, refine energy delivery, and support remote diagnostics. Data-driven decision-making creates a competitive edge in large infrastructure tenders requiring compliance reporting and performance traceability.

- For instance, H&M reported that it collected and recycled exactly 16,855 tonnes of textiles through its global Garment Collecting program in 2023, equivalent to tens of millions of T-shirts being diverted from landfills.

- Growth of Eco-Friendly and Silent Piling Technologies

Rising environmental regulations and urban construction density accelerate the move toward low-noise, low-emission, and vibration-free piling solutions. Press-in piling machines and hydraulic silent drivers gain momentum due to their ability to operate without disturbing surrounding structures, utilities, and communities. Manufacturers explore alternative powertrains, including hybrid and electric drive systems, to reduce emissions and meet sustainability mandates. This trend creates strong opportunities for innovations in noise suppression, energy-efficient hydraulics, and low-disturbance installation techniques suited for sensitive redevelopment zones.

- For instance, Levi Strauss & Co. uses its innovative Water<Less® process for many of its products, a technique that cuts water usage by up to 96% for certain garments compared to traditional finishing methods.

- Expanding Applications in Renewable, Marine, and Port Infrastructure

The growing emphasis on renewable energy, coastal protection, and port automation expands the use of advanced piling equipment. Increasing installation of solar trackers, offshore substations, and liquefied natural gas terminals drives demand for specialized machines capable of handling varying geotechnical conditions. Opportunities arise in supplying high-capacity vibratory drivers and long-stroke impact hammers designed for marine piling, quay wall reinforcement, and land reclamation projects. The focus on resilient maritime infrastructure positions piling machinery as a strategic asset in long-term coastal development plans.

Key Challenges

- High Capital Costs and Maintenance Complexity

Pile driving machines involve significant upfront costs, complex hydraulic systems, and high-maintenance components, limiting adoption among small and mid-sized contractors. Frequent wear of hammer parts, seals, and structural assemblies increases operational expenses, especially in abrasive or marine environments. The need for skilled operators and technicians adds further cost pressure. Budget constraints in developing regions restrain fleet modernization, leading contractors to opt for rentals or refurbished machines rather than investing in advanced models with higher energy output and digital integration.

- Environmental Restrictions and Noise-Impact Regulations

Stringent noise, vibration, and ecological protection regulations create operational challenges across urban and coastal construction sites. Traditional impact hammers often face limitations due to their high acoustic output and associated risk of structural disturbance. Marine construction is further restricted by rules protecting aquatic species from excessive sound exposure. These constraints necessitate costly mitigation measures, such as noise shrouds, bubble curtains, and low-vibration technologies. Compliance requirements delay project timelines and increase operational costs, affecting the deployment of conventional piling equipment.

Regional Analysis

North America

North America holds a 32% share of the global Pile Driving Machine Market, supported by strong construction spending, extensive infrastructure rehabilitation, and early adoption of advanced piling technologies. The U.S. drives most of the demand due to large-scale highway expansions, offshore wind developments, and commercial real estate investments. Contractors increasingly prefer high-efficiency vibratory drivers and low-noise press-in systems to meet stringent environmental standards. The region also benefits from favorable equipment-financing structures and the presence of established OEMs, reinforcing the adoption of automated, telematics-enabled, and fuel-efficient piling solutions across civil and industrial applications.

Europe

Europe accounts for 29% of the market, driven by stringent sustainability regulations, growing offshore wind installations, and government-backed infrastructure modernization. Countries such as Germany, the U.K., and the Netherlands lead equipment adoption, especially for silent piling and low-vibration technologies used in urban zones. Demand rises as major EU economies accelerate renewable-energy-linked foundation works, port expansions, and railway corridor upgrades. The region emphasizes noise-controlled and emission-compliant machines, pushing OEMs to develop electric and hybrid piling systems. Robust contractor networks and strong rental penetration further strengthen machine circulation across complex geotechnical and marine applications.

Asia-Pacific

Asia-Pacific dominates the global landscape with a 36% share, fueled by rapid urbanization, megacity expansion, and large-scale transport corridor construction in China, India, Japan, and Southeast Asia. Massive investments in highways, metro rail, industrial zones, and coastal defense systems create sustained demand for impact hammers, vibratory drivers, and rotary piling equipment. China leads market consumption, while India posts the fastest growth due to increasing public–private partnerships. OEMs benefit from cost-competitive manufacturing, growing rental ecosystems, and rising adoption of automated safety systems. The region’s broad infrastructure pipeline ensures long-term equipment demand across marine, civil, and commercial sectors.

Latin America

Latin America captures a 7% share, supported by gradual recovery in construction activities and expanding investments in urban housing, mining infrastructure, and renewable energy projects. Brazil, Mexico, and Chile generate most of the regional demand due to upgrades in transportation corridors and port capacity enhancements. Contractors increasingly adopt mid-range impact hammers and hydraulic piling systems for flexible deployment across varied terrains. Market growth benefits from improving foreign investment flows and rising government focus on resilient infrastructure, although supply chain fluctuations and import dependency continue to influence equipment availability.

Middle East & Africa

The Middle East & Africa region holds a 6% market share, driven by ongoing mega-infrastructure projects, expanding oil and gas facilities, and large-scale coastal and marine developments. The UAE, Saudi Arabia, and Qatar lead demand through ambitious city-building programs, industrial expansion, and offshore foundation works. Africa contributes through road, bridge, and mining infrastructure improvements, particularly in South Africa and Kenya. High-capacity piling rigs and heavy-duty hydraulic hammers gain traction for deep foundation requirements. Despite periodic economic constraints, strong government-funded projects sustain equipment usage across energy, commercial, and urban construction sectors.

Market Segmentations:

By Product

- Impact Hammers

- Vibratory Drivers

By Pile

- Steel Piles

- Concrete Piles

By Process

- Conventional Pile Driving

- Silent Piling

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Pile Driving Machine Market includes companies such as GEA, Brandt Industries, CNH Industrial, ASML, Caterpillar, ESCO, Alfa Laval, Deere, Atlas Copco, and AGCO. the Pile Driving Machine Market is defined by a diverse group of global and regional manufacturers that focus on high-performance equipment, advanced hydraulic systems, and customizable piling solutions for complex foundation applications. Companies strengthen competitiveness by integrating telematics, automated control functions, and real-time performance diagnostics to enhance job-site productivity and reduce operational risks. The market benefits from continuous innovation in low-noise, low-vibration piling technologies suited for dense urban zones and environmentally sensitive locations. Manufacturers prioritize expanding rental fleets, optimizing maintenance services, and developing emission-compliant engines to support evolving regulatory requirements. Strategic investments in R&D, digital monitoring capabilities, and modular machine designs enable firms to address varied ground conditions and accelerate deployment efficiency across civil, marine, and industrial construction projects. As infrastructure spending rises worldwide, competition intensifies, driving manufacturers to expand distribution networks, strengthen contractor partnerships, and offer lifecycle cost advantages through durable, energy-efficient piling systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Liebherr launched the LB 45.1 and LRB 19 drilling rigs, enhancing deep foundation work with the LB 45.1 offering 450 kW power/450 kNm torque for deep drilling via automation, and the LRB 19 providing 450 kW power/180 kNm torque for versatile foundation applications, with both machines featuring advanced controls, modularity, and ergonomic cabs.

- In January 2025, Junttan, a global leader in pile driving equipment manufacturing, announces the launch of the new Evolution series, starting with the DR5 drilling rig. The DR5 drilling rig, the first model in this lineup, delivers high-performance single pass drilling for both Full Displacement Piling (FDP) and Continuous Flight Auger (CFA) projects.

- In October 2024, Caterpillar and Trimble extended their long-standing joint venture to accelerate innovation in grade control technology. This collaboration aimed to enhance the efficiency and accuracy of construction and mining operations through advanced technology solutions.

Report Coverage

The research report offers an in-depth analysis based on Product, Pile, Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market continues to shift toward low-noise and low-vibration piling systems to meet urban construction regulations.

- Manufacturers increase adoption of electric and hybrid powertrains to align with global emission standards.

- Automation and remote-controlled piling solutions gain wider acceptance for improving on-site safety.

- Demand rises for high-capacity piling rigs driven by large transport and energy infrastructure programs.

- OEMs expand rental and leasing models to support contractors seeking cost-efficient equipment access.

- Telematics and real-time monitoring features become standard to enhance machine uptime and performance.

- Marine and offshore foundation projects drive growth in heavy-duty hydraulic and vibratory drivers.

- Technological upgrades focus on faster cycle times and improved hammer efficiency for complex soil conditions.

- Emerging economies accelerate adoption as urbanization and megaproject development intensify.

- Strategic collaborations strengthen global distribution networks and expand aftermarket service capabilities.