Market Overview

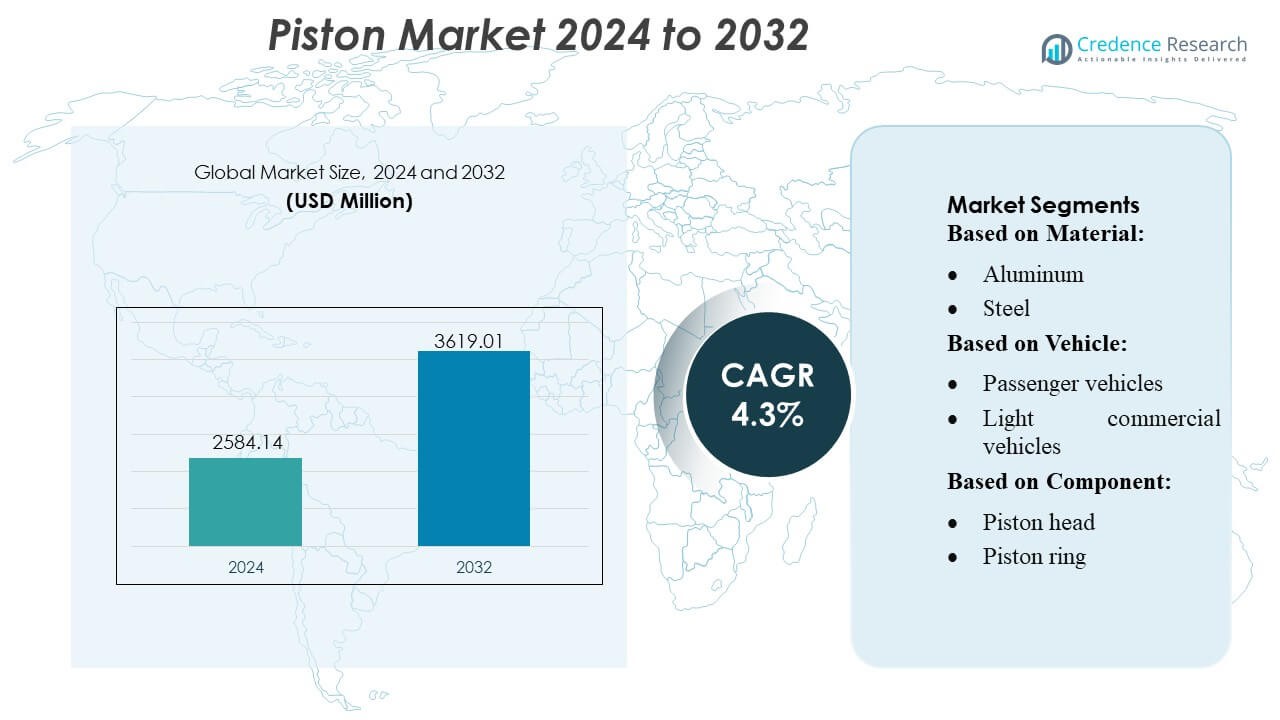

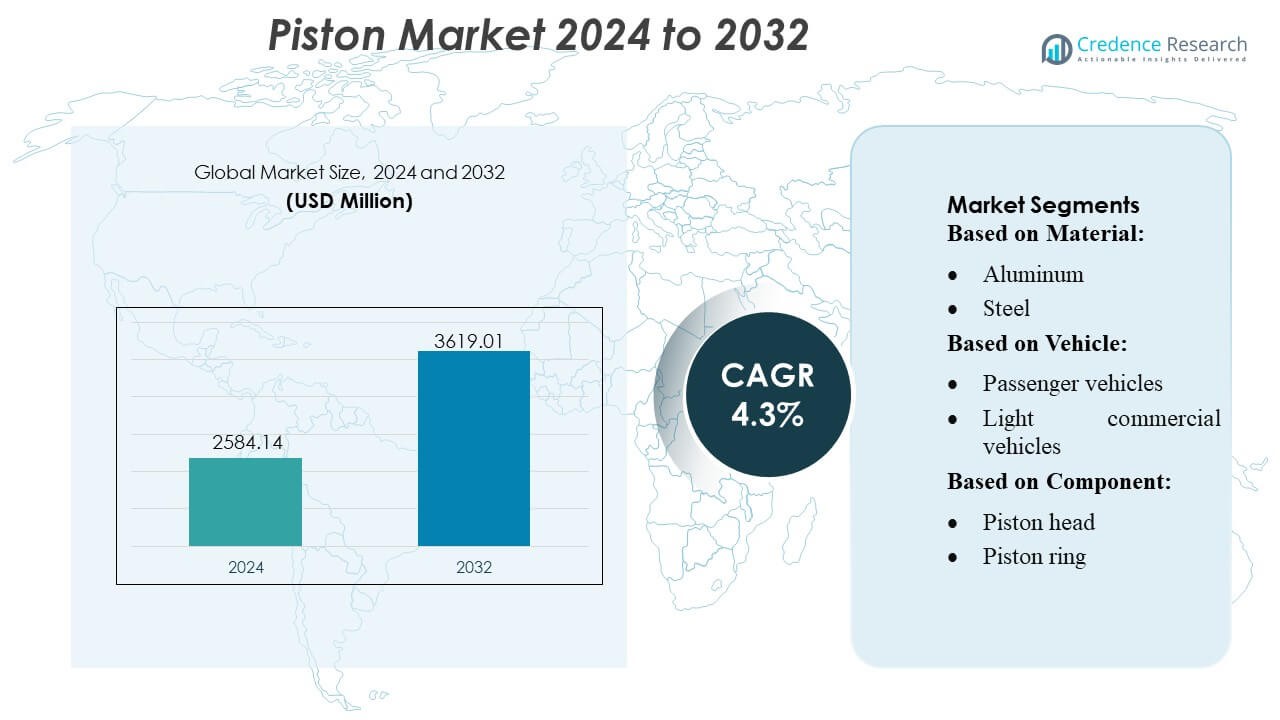

Piston Market size was valued USD 2584.14 million in 2024 and is anticipated to reach USD 3619.01 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Piston Market Size 2024 |

USD 2584.14 Million |

| Piston Market, CAGR |

4.3% |

| Piston Market Size 2032 |

USD 3619.01 Million |

The piston market is shaped by a competitive group of global manufacturers that continue to advance lightweight materials, precision machining, and low-friction coating technologies to meet evolving engine efficiency and emission requirements. Companies strengthen their positions through OEM partnerships, expanded aftermarket networks, and investments in high-performance pistons for turbocharged and hybrid powertrains. Innovation in aluminum alloys, steel pistons, and advanced ring geometries remains central to product differentiation. North America leads the global market with an exact 38% share, supported by strong automotive production, high aftermarket activity, and widespread adoption of fuel-efficient engine platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Piston Market reached USD 2584.14 million in 2024 and is expected to hit USD 3619.01 million by 2032, registering a 4.3% CAGR, driven by rising vehicle production and ongoing engine modernization.

- Strong market drivers include rapid adoption of lightweight aluminum pistons, increased demand for fuel-efficient powertrains, and expanding aftermarket replacement cycles across aging vehicle fleets.

- Key market trends reflect growing use of low-friction coatings, optimized ring geometries, and high-strength steel pistons designed for turbocharged and downsized engines.

- Competitive activity intensifies as manufacturers enhance precision machining capabilities, form OEM partnerships, and prioritize product differentiation through advanced material technologies.

- Regional analysis shows North America leading with 38% share, followed by Asia-Pacific’s fast-growing production ecosystem, while aluminum pistons dominate material segmentation due to broad adoption in passenger vehicles.

Market Segmentation Analysis:

By Material

Aluminum pistons hold the dominant market share due to their lightweight structure, superior heat dissipation, and strong suitability for high-speed gasoline engines. Their wide adoption across passenger vehicles and small commercial fleets strengthens demand, particularly as OEMs prioritize weight reduction and fuel efficiency. Steel pistons continue to expand in heavy-duty engines requiring higher load tolerance and thermal stability, yet aluminum remains preferred for mass-produced vehicles. Growing emphasis on efficient combustion, reduced emissions, and advanced alloy formulations further reinforces aluminum’s leadership across global automotive manufacturing.

- For instance, Hitachi’s rigid-frame RWD model EH4000AC‑3 features a nominal payload of 221 tonnes (221 000 kg) and a travel speed of 56 km/h. Its strong torque delivery at the rear wheels supports reliable hauling over long distances.

By Vehicle

Passenger vehicles constitute the leading segment with the largest market share, driven by high production volumes, expanding urban mobility, and rising consumer demand for fuel-efficient engines. Their extensive use of lightweight aluminum pistons supports performance optimization and emission compliance. Light commercial vehicles show steady adoption as logistics and e-commerce activities increase, while heavy commercial vehicles rely on high-strength steel pistons for durability under extreme loads. Nevertheless, the consistent growth in passenger car manufacturing, supported by regulatory pushes for improved engine efficiency, sustains this segment’s dominance across all regions.

- For instance, Caterpillar’s rigid-frame haul truck model 797F is powered by the Cat C175-20 20-cylinder diesel engine rated at 4,000 hp (2,983 kW) under SAE J1995, with a net output of 3,793 hp (2,828 kW) under SAE J1349.

By Component

Piston rings lead the component segment with the highest market share, supported by their critical role in sealing combustion chambers, controlling oil consumption, and ensuring optimal engine compression. Their regular replacement cycles and integration across all vehicle classes reinforce demand. Piston heads and piston pins remain essential for structural integrity and motion transfer, yet piston rings dominate due to their direct influence on efficiency, performance, and emission standards. Increasing adoption of advanced coating technologies and high-precision manufacturing further accelerates growth in this component category, strengthening its leadership in the global market.

Key Growth Drivers

1. Rising Vehicle Production and Engine Modernization

Global growth in passenger and commercial vehicle production remains the strongest driver of piston demand, supported by increased engine outputs, improved thermal efficiency requirements, and expanding mid-range vehicle sales. Automakers continue to upgrade combustion platforms with lightweight pistons, optimized skirt geometries, and precision-coated rings to meet evolving fuel-efficiency norms. The shift toward turbocharged engines amplifies the need for high-strength pistons capable of withstanding elevated pressures and temperatures, reinforcing continuous innovation across OEM and aftermarket segments.

- For instance, Parker Hannifin manufactures several lines of hydraulic pumps for direct Power Take-Off (PTO) mounting that are rated for pressures up to 400 bar (approximately 5,800 psi), which are used in construction-grade machinery and other mobile applications.

2. Increasing Demand for Fuel-Efficient and Low-Emission Engines

Stringent emission norms encourage manufacturers to adopt pistons designed for higher combustion efficiency, reduced friction, and better sealing performance. Advanced piston coatings, optimized ring packs, and lightweight aluminum alloys help OEMs enhance mileage and minimize particulate emissions. Demand for compact, high-output engines further pushes the adoption of pistons engineered for controlled expansion and stable thermal behavior. This transition aligns with global regulatory frameworks prioritizing sustainability, boosting piston technologies that enable cleaner and more efficient internal combustion engines.

- For instance, SANY’s electric off-highway truck model is the SKT90E. The standard battery capacity is listed as 422 kWh in several official specifications (a 350 kWh option may also exist depending on the market/version).

3. Expansion of Aftermarket Replacement and Engine Rebuild Activities

Aging vehicle fleets, rising average vehicle life, and increased engine maintenance activities are driving strong growth in the aftermarket piston segment. Frequent replacement of piston rings, pins, and associated components ensures consistent performance and emission compliance in older engines. Independent repair networks and regional distributors report increasing demand for high-durability piston assemblies suited for both gasoline and diesel engines. This growth is further supported by expanding commercial fleet utilization, which accelerates replacement cycles and drives higher consumption of aftermarket piston components.

Key Trends & Opportunities

1. Adoption of Lightweight Materials and Advanced Manufacturing

OEMs increasingly invest in lightweight piston materials—including reinforced aluminum alloys and steel variants—to improve combustion efficiency and reduce engine mass. Additive manufacturing, precision forging, and automated machining technologies create opportunities for enhanced durability and optimized cooling channel designs. Manufacturers are adopting friction-reducing coatings and advanced ring geometries to support high-pressure, low-viscosity lubricant environments. These innovations strengthen product differentiation and open new revenue opportunities for suppliers specializing in high-performance piston technologies.

- For instance, Liebherr’s T 264 Battery Electric truck offers a payload class of 240 t and a gross vehicle weight (GVW) of 416 t, using its Litronic Plus AC drive system with IGBT technology.

2. Growth of Turbocharged and Downsized Engines

The global transition toward engine downsizing with turbocharging presents significant opportunities for manufacturers offering pistons capable of withstanding higher cylinder pressures and thermal loads. Compact engines require robust piston crowns, optimized ring packs, and reinforced pin designs to deliver higher power density. This shift boosts demand for precision-engineered pistons with improved fatigue resistance and controlled expansion characteristics. Suppliers leveraging advanced simulation tools and thermally stable materials benefit significantly from the growing adoption of small-displacement turbocharged platforms.

- For instance, Scania’s Autonomous Mining Solutions include a 40-tonne autonomous heavy tipper now available for order. These trucks use GPS, lidar and sensor arrays for obstacle detection and route optimisation.

3. Increasing Integration of Coated and Low-Friction Piston Technologies

Engine manufacturers increasingly adopt specialized coatings—such as DLC, graphite, and ceramic layers—to minimize friction, enhance wear resistance, and improve lubrication performance. These coatings enable longer service intervals and support compliance with stricter emission regulations. Advances in laser texturing and plasma spray deposition further enhance material bonding and surface integrity. Rising interest in low-viscosity oils accelerates opportunities for coated pistons that maintain stability under reduced lubrication thickness, creating a strong pathway for premium piston technologies.

Key Challenges

1. Rising Shift Toward Electric Vehicles (EVs)

The rapid acceleration of EV adoption poses a significant long-term challenge for piston manufacturers, as electric powertrains eliminate the need for combustion engine pistons. Governments strengthening EV incentives and automakers shifting investments toward battery-electric platforms reduce projected demand for traditional engine components. While hybrid vehicles still require pistons, full-electric models diminish long-term growth prospects. This transition increases pressure on piston suppliers to diversify product portfolios and strengthen their presence in non-ICE automotive segments.

2. Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuations in prices of aluminum, steel, and specialty coating materials present a major cost challenge for piston manufacturers. Supply chain disruptions, geopolitical tensions, and logistics constraints intensify pressure on production planning and inventory management. Manufacturers face rising operational expenses due to the need for precision machining and strict quality standards. These uncertainties force suppliers to optimize sourcing strategies, improve cost efficiency, and invest in material engineering to mitigate vulnerabilities inherent in unstable global supply markets.

Regional Analysis

North America

North America holds a 38% market share, supported by strong automotive production, extensive use of high-performance gasoline engines, and consistent demand for aftermarket piston replacements. The region benefits from advanced manufacturing capabilities, widespread adoption of lightweight aluminum pistons, and rapid integration of friction-reduction technologies across passenger and light commercial vehicles. Regulatory pressures for improved engine efficiency drive OEMs to invest in coated piston rings and optimized geometries. Growth also stems from robust commercial fleet activity and a mature service ecosystem that ensures steady consumption of replacement piston components.

Europe

Europe accounts for 27% of the market, driven by its engineering-focused automotive sector, high adoption of turbocharged engines, and strong demand for low-emission piston technologies. The presence of leading OEMs encourages innovation in steel pistons, advanced alloys, and thermal barrier coatings suited for high-compression engines. Stringent EU emission regulations influence demand for pistons with reduced friction and improved sealing efficiency. Replacement demand remains stable due to aging vehicle fleets across Western Europe. Eastern European manufacturing hubs additionally support regional growth by supplying cost-effective piston assemblies to global automotive markets.

Asia-Pacific

Asia-Pacific leads with a 30% market share, driven by high passenger car production, expanding two-wheeler markets, and strong commercial vehicle demand across China, India, Japan, and Southeast Asia. The region’s large-scale automotive manufacturing ecosystem accelerates adoption of lightweight pistons, advanced ring coatings, and fuel-efficient designs. Growing urbanization and rising middle-class vehicle ownership reinforce OEM production volumes. APAC also benefits from extensive aftermarket activity, particularly in India and ASEAN countries, where engine rebuilding and maintenance cycles remain frequent. Increasing adoption of small turbocharged engines further boosts demand for high-strength piston assemblies.

Latin America

Latin America holds a 3% market share, shaped by moderate automotive production and a strong dependence on aftermarket piston replacements. Brazil and Mexico remain the key contributors, driven by commercial fleet usage and rising demand for durable piston rings and pins. Economic fluctuations affect OEM production rates, yet steady growth in logistics, agriculture, and light commercial vehicles supports replacement consumption. Older vehicle fleets extend service needs, increasing demand for cost-efficient piston components. Local manufacturing expansion and partnerships with global suppliers gradually strengthen product availability across the region.

Middle East & Africa (MEA)

The Middle East & Africa region captures a 2% market share, supported primarily by commercial and off-highway vehicle demand across the Gulf states, South Africa, and North Africa. The region’s dependence on rugged engines used in mining, construction, and oilfield operations drives demand for high-strength steel pistons and wear-resistant rings. Limited local manufacturing increases reliance on imported components, while growing industrialization and infrastructure development stimulate fleet expansion. Aftermarket sales dominate the region as extended vehicle lifecycles and harsh operating conditions accelerate replacement requirements for piston assemblies.

Market Segmentations:

By Material:

By Vehicle:

- Passenger vehicles

- Light commercial vehicles

By Component:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The piston market features a diverse competitive environment shaped by leading manufacturers such as RIKEN CORPORATION, Hitachi, Ltd., Art-Serina Piston Co., Ltd., MAHLE GmbH, Shriram Pistons & Rings Ltd., AISIN CORPORATION, Aditya Birla Nuvo, Rheinmetall AG, Tenneco Inc., and Dongsuh Federal-Mogul Co., Ltd. The piston market reflects a highly competitive structure driven by continuous advancements in material engineering, precision manufacturing, and engine efficiency requirements. Manufacturers focus on developing lightweight aluminum pistons, high-strength steel variants, and low-friction ring coatings to meet the demands of turbocharged, downsized, and hybrid powertrains. Growing emphasis on emission reduction and fuel optimization encourages the adoption of advanced thermal barrier coatings, optimized skirt profiles, and enhanced lubrication compatibility. Competition intensifies as suppliers expand automation, integrate CNC machining, and leverage simulation-based design to strengthen product durability and performance. The aftermarket remains a key battleground, supported by large aging vehicle fleets and rising replacement intervals for piston rings, pins, and assemblies. Companies increasingly invest in capacity expansion, strategic partnerships with OEMs, and region-specific product customization to align with evolving regulatory and performance standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, AxFlow acquired Advanced Pump Technologies (APT Water) in Western Australia, expanding their fluid handling solutions, particularly in water treatment, mining (iron ore, gold), and industry, solidifying their regional presence with APT’s strong local base.

- In July 2024, Vale, a prominent mining company, special technologies developer Komatsu, and Cummins Inc., a key participant in the power solutions market, announced a collaboration aimed at developing large trucks with payload capacity of 230 to 290 tons, empowered by ethanol and diesel.

- In January 2024, Hitachi Construction Machinery and ABB reached a critical milestone in their collaboration by completing a prototype of a 240-ton fully electric dump truck and shipping it to a mine in Zambia for real-world testing.

Report Coverage

The research report offers an in-depth analysis based on Material, Vehicle, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue advancing lightweight piston materials to support fuel-efficient engine designs.

- Manufacturers will increase adoption of low-friction coatings to improve engine durability and thermal performance.

- Turbocharged and downsized engines will drive demand for high-strength pistons with enhanced pressure tolerance.

- Hybrid vehicle growth will sustain piston consumption despite the long-term shift toward full electrification.

- Aftermarket demand will rise as global vehicle fleets age and engine rebuild cycles increase.

- Automated machining and precision forging will reshape production efficiency across manufacturing plants.

- Advanced simulation tools will accelerate piston design optimization for high-output engines.

- Regional customization of pistons will expand as OEMs tailor engines to local fuel quality and regulations.

- Material innovations will increasingly focus on improving wear resistance under low-viscosity lubrication.

- Strategic collaborations between OEMs and component suppliers will drive development of next-generation piston assemblies.