Market Overview

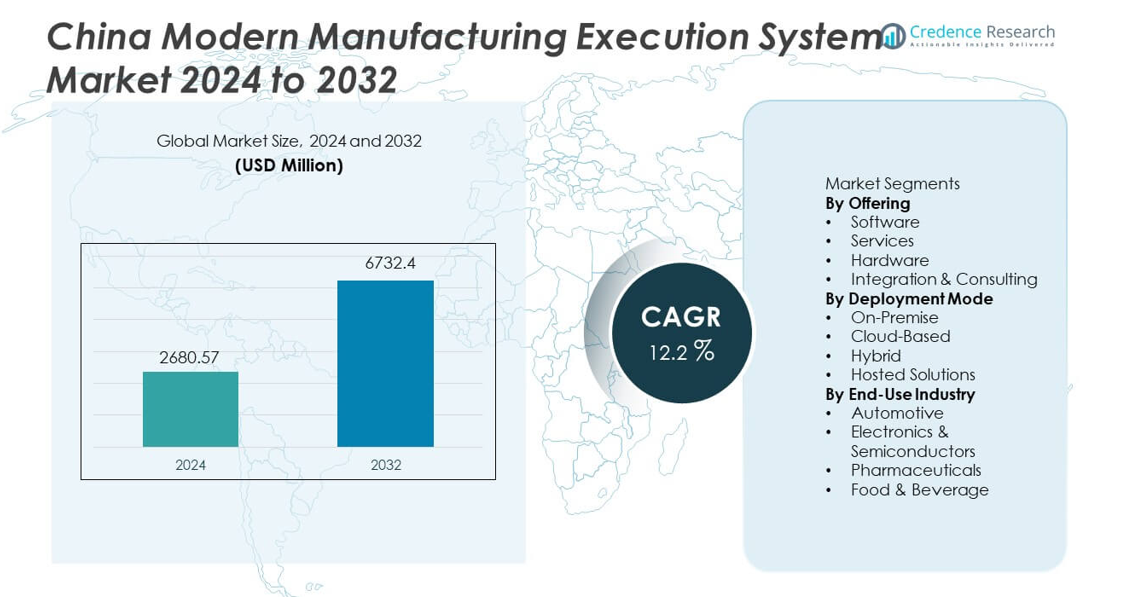

The China Modern Manufacturing Execution System (MES) market reached USD 2,680.57 million in 2024 and is expected to reach USD 6,732.4 million by 2032, expanding at a CAGR of 12.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Modern Manufacturing Execution System Market Size 2024 |

USD 2,680.57 million |

| China Modern Manufacturing Execution System Market , CAGR |

12.2% |

| China Modern Manufacturing Execution System Market Size 2032 |

USD 6,732.4 million |

The China Modern Manufacturing Execution System market is driven by major players such as Siemens, Rockwell Automation, Honeywell, ABB, Schneider Electric, Dassault Systèmes, SAP, Yokogawa Electric, Kingdee, and Inspur Software, all of which enhance MES adoption through advanced automation, real-time production control, and integrated digital platforms. These companies support China’s shift toward intelligent manufacturing by offering scalable and industry-specific MES solutions. East China leads the market with a 38% share, followed by South China at 27% and North China at 21%, driven by strong industrial clusters, rapid digital transformation, and increased adoption of smart factory technologies.

Market Insights

- The China Modern Manufacturing Execution System market reached USD 2,680.57 million in 2024 and will reach USD 6,732.4 million by 2032 at a CAGR of 12.2%, driven by rapid smart factory adoption.

- Strong demand for real-time production control supports growth, with Software holding 48% share as manufacturers prioritize automation, visibility, and digital workflow optimization across high-volume operations.

- Key trends include wider integration of AI, IoT, and cloud-enabled MES platforms that enhance predictive maintenance, quality traceability, and intelligent decision-making across Chinese factories.

- Competitive activity intensifies as Siemens, ABB, Rockwell Automation, Honeywell, and Kingdee expand MES portfolios, while integration complexity and legacy system constraints remain major restraints.

- East China leads with 38% share, followed by South China at 27% and North China at 21%, supported by strong industrial hubs, advanced manufacturing clusters, and accelerated digital transformation initiatives across key sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

Software dominates the China Modern Manufacturing Execution System market with a 48% share, driven by strong adoption of real-time production monitoring, workflow automation, and quality management applications across large and mid-sized factories. Chinese manufacturers prioritize MES software to support digital transformation, improve production visibility, and enhance traceability. Services follow as enterprises seek system integration, customization, and maintenance support to align MES with existing IT and OT systems. Hardware demand grows with increased deployment of sensors and control devices. Integration & Consulting expands steadily as companies require expert guidance to optimize plant operations and transition toward smart manufacturing.

- For instance, Siemens expanded its Opcenter MES suite by adding integration APIs that link production equipment with ERP systems to enhance visibility in automotive plants.

By Deployment Mode

On-Premise deployment holds a 46% share, supported by strong preference among large Chinese manufacturers for secure, locally controlled MES environments. Industries such as automotive, semiconductors, and pharmaceuticals adopt on-premise systems to ensure data protection and compliance with internal operational protocols. Cloud-Based solutions gain momentum due to lower upfront costs and faster implementation, particularly among mid-sized factories. Hybrid deployment expands as companies combine on-premise security with cloud scalability. Hosted Solutions grow slowly but attract users seeking simplified maintenance and outsourced system management as digital adoption broadens.

- For instance, Yokogawa installed its on-premise Exaquantum system at a Chinese chemical site to monitor production units and store data points for compliance control.

By End-Use Industry

Electronics & Semiconductors lead the market with a 41% share, driven by high demand for precise production control, defect reduction, and real-time equipment monitoring across China’s rapidly expanding semiconductor and electronics manufacturing base. Automotive manufacturers also adopt MES to support flexible production lines, automated workflows, and stricter quality requirements. Pharmaceuticals deploy MES to improve batch traceability and compliance with regulatory standards. Food & Beverage companies adopt MES to enhance safety, streamline packaging operations, and reduce waste. The sector’s shift toward intelligent, high-precision manufacturing keeps Electronics & Semiconductors as the dominant user group.

Key Growth Drivers

Rapid Advancement of Smart Factory Initiatives

China accelerates smart factory adoption, driving strong demand for modern MES platforms that improve real-time production visibility and operational efficiency. Manufacturers deploy MES to support automated workflows, digital quality control, and predictive maintenance across high-volume production lines. Government programs promoting intelligent manufacturing further strengthen implementation across automotive, electronics, and machinery sectors. Companies use MES to reduce downtime, enhance traceability, and optimize resource utilization. Growing integration of IoT devices and industrial automation strengthens MES as a core component of China’s digital manufacturing landscape.

- For instance, Schneider Electric deployed its EcoStruxure MES in a plant to connect machines and automate production processes, enabling real-time monitoring across workstations.

Expansion of Electronics and Semiconductor Manufacturing

China’s fast-growing electronics and semiconductor industries significantly increase MES demand due to the need for precise production control and stringent quality requirements. MES solutions help manage complex workflows, reduce defect rates, and monitor equipment performance in real time. As chip manufacturing capacity expands nationwide, factories adopt MES to improve yield rates and maintain competitive production standards. Investments in high-tech manufacturing zones accelerate deployment, while global supply chain shifts strengthen domestic semiconductor production. This industry’s complexity and scale make MES essential for operational success.

- For instance, Honeywell implemented its Manufacturing Excellence Platform (MXP) MES for a major life sciences facility, enabling paperless batch records and linking process tools for real-time equipment performance diagnostics.

Increasing Adoption of Cloud and Digital Platforms

Cloud-enabled MES platforms gain momentum as Chinese manufacturers seek flexibility, scalability, and lower IT infrastructure costs. Small and mid-sized factories adopt cloud MES to accelerate digital transformation without extensive upfront investment. Cloud solutions support fast integration with IoT devices, AI-driven analytics, and enterprise systems. These capabilities help manufacturers enhance decision-making, predict operational risks, and streamline production planning. As cloud usage expands across industrial sectors, MES adoption grows rapidly, supporting China’s push toward connected and data-driven manufacturing environments.

Key Trends & Opportunities

Integration of AI, IoT, and Real-Time Analytics

AI, IoT, and advanced analytics reshape MES capabilities by enabling predictive insights, automated quality checks, and intelligent workflow optimization. Factories adopt these technologies to reduce downtime, improve product consistency, and increase throughput. As industrial IoT networks expand, MES platforms gain richer data streams, enhancing real-time visibility. AI-driven decision engines help manufacturers respond quickly to production deviations. These advancements create strong opportunities for vendors offering next-generation MES solutions tailored to China’s high-volume manufacturing environment.

- For instance, ABB integrated its Ability Manufacturing Insights with smart sensors at a plant to generate real-time analytics that reduced unplanned stoppages through automated alerts.

Growing Demand for Customized and Industry-Specific MES Solutions

Chinese manufacturers increasingly seek MES systems customized to their sector-specific requirements, especially in electronics, automotive, and pharmaceuticals. Vendors develop specialized modules for batch production, cleanroom monitoring, traceability, and automated inspection. Tailored solutions help factories reduce deployment time and achieve faster operational benefits. This trend supports strong opportunities for MES providers offering modular, scalable, and industry-focused platforms that align with regulatory and performance needs. As customization becomes a priority, demand continues to shift toward flexible MES architectures.

- For instance, Dassault Systèmes implemented a sector-focused Apriso MES at a medical device facility in China, which allowed for comprehensive traceability of production data and improved management efficiency.

Key Challenges

High Complexity of MES Integration with Legacy Systems

Many Chinese factories still operate with legacy production equipment and outdated IT infrastructure, making MES integration challenging. Customization, data migration, and system compatibility issues slow implementation timelines and increase deployment costs. Manufacturers face difficulty aligning MES with ERP, SCADA, and IoT platforms. Smaller factories often lack technical expertise, further complicating integration. These barriers restrict smooth MES adoption and require vendors to provide stronger integration support and long-term technical partnerships.

Shortage of Skilled Digital Manufacturing Professionals

China faces a growing talent gap in MES deployment, industrial IT, and automation engineering. Manufacturers struggle to hire professionals skilled in data analytics, system configuration, and digital production management. This shortage slows the pace of MES adoption and increases reliance on external consultants. Demand for workforce training programs continues to rise as factories transition to smart manufacturing. Without adequate technical expertise, companies face delays in achieving full MES benefits, limiting the overall impact of digital transformation.

Regional Analysis

East China

East China holds a 38% share of the China Modern Manufacturing Execution System market, driven by its strong industrial base across automotive, electronics, and machinery sectors. Cities such as Shanghai, Suzhou, and Hangzhou lead MES adoption due to advanced manufacturing clusters and higher digital maturity. Companies invest heavily in smart factory upgrades, real-time production monitoring, and automation solutions. Strong government support for digital manufacturing accelerates MES deployment across large enterprises. The region’s dense concentration of high-tech manufacturers continues to strengthen demand for scalable and integrated MES platforms.

South China

South China accounts for a 27% share, supported by strong growth in electronics, semiconductors, and consumer goods manufacturing. Guangdong remains a major MES adopter as factories upgrade to meet global quality standards and manage complex production workflows. Rapid expansion of smart factories and automation technologies increases MES integration across mid-sized and large plants. The region benefits from robust export-driven manufacturing and strong adoption of cloud-based production systems. Growing investments in digital transformation and IoT-enabled production further enhance MES demand across South China.

North China

North China holds a 21% share, driven by active deployment of MES solutions across heavy machinery, steel, energy equipment, and automotive manufacturing. Beijing and Tianjin support adoption through strong policy focus on intelligent manufacturing and industrial digitalization. Manufacturers implement MES to enhance operational transparency, reduce downtime, and improve production traceability. The region’s emphasis on upgrading traditional industries accelerates demand for integrated MES systems. Investments in smart industrial parks and automation technologies continue to push MES adoption within large state-owned and private enterprises.

Central & Western China

Central & Western China captures a 14% share, with MES adoption rising as industrial development expands into inland provinces. The region focuses on upgrading manufacturing capabilities across pharmaceuticals, food processing, and equipment manufacturing. Government incentives encouraging digital transformation and smart factory adoption support gradual MES penetration. Cloud-based MES solutions gain traction due to lower upfront investment and easier deployment for growing mid-sized factories. While adoption remains slower than coastal regions, rising industrial relocation and new manufacturing hubs strengthen long-term MES demand in Central & Western China.

Market Segmentations:

By Offering

- Software

- Services

- Hardware

- Integration & Consulting

By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid

- Hosted Solutions

By End-Use Industry

- Automotive

- Electronics & Semiconductors

- Pharmaceuticals

- Food & Beverage

Competitive Landscape

Competitive landscape features leading companies such as Siemens, Rockwell Automation, Honeywell, ABB, Schneider Electric, Dassault Systèmes, SAP, Yokogawa Electric, Kingdee, and Inspur Software. These players strengthen their presence by offering advanced MES platforms that support real-time production monitoring, workflow automation, and integrated quality control across China’s expanding smart manufacturing ecosystem. Global vendors focus on deep integration with IoT, AI, and cloud technologies to meet rising demand for intelligent and connected factory solutions. Domestic providers enhance competitiveness through localized customization, cost-effective deployment models, and strong collaboration with Chinese manufacturers. Continuous investment in digital transformation, industrial automation, and tailored MES solutions drives innovation as companies compete to deliver scalable, flexible, and high-performance manufacturing execution systems for both large enterprises and fast-growing mid-sized factories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Rockwell Automation

- Honeywell International

- ABB Ltd.

- Schneider Electric

- Dassault Systèmes

- SAP SE

- Yokogawa Electric Corporation

- Kingdee

- Inspur Software

Recent Developments

- In July 2025, Siemens AG, Dassault Systèmes, and SAP SE were cited as leading firms driving the global MES market with scalable digital manufacturing and automation solutions.

- In April 2025, an article was published on the SAP News Center, outlining trends toward cloud-enabled MES, integration with supply-chain platforms, and support for smart manufacturing.

Report Coverage

The research report offers an in-depth analysis based on Offering, Deployment Mode, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart factory expansion will accelerate MES adoption across major manufacturing clusters.

- AI-driven analytics will enhance predictive maintenance and real-time decision-making.

- Cloud-based MES platforms will gain stronger traction among mid-sized factories.

- Semiconductor and electronics growth will drive higher demand for high-precision MES solutions.

- Integration of IoT devices will strengthen data visibility across production lines.

- Customized MES modules will rise as industries require sector-specific functionality.

- Domestic MES vendors will expand capabilities to compete with global providers.

- Digital twin integration will improve simulation, planning, and operational optimization.

- Workforce training in digital manufacturing will become essential for effective MES use.

- Government-led industrial digitalization programs will continue to boost MES deployment.