Market Overview

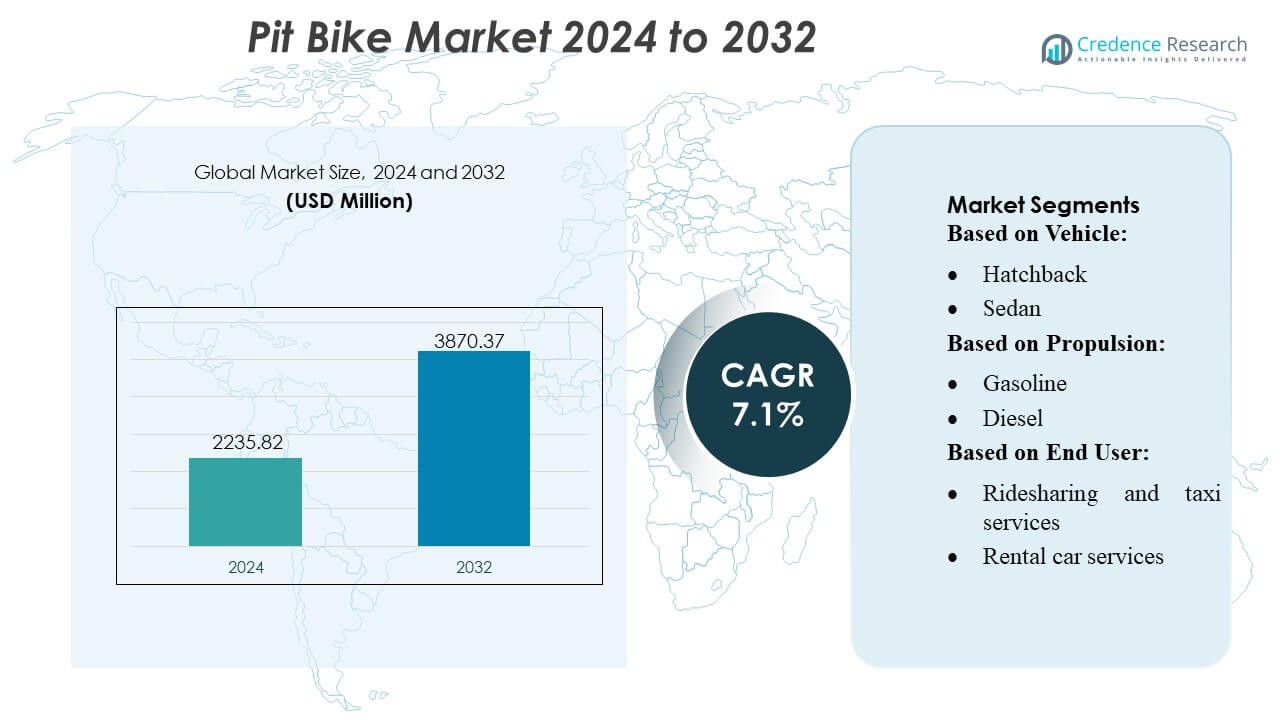

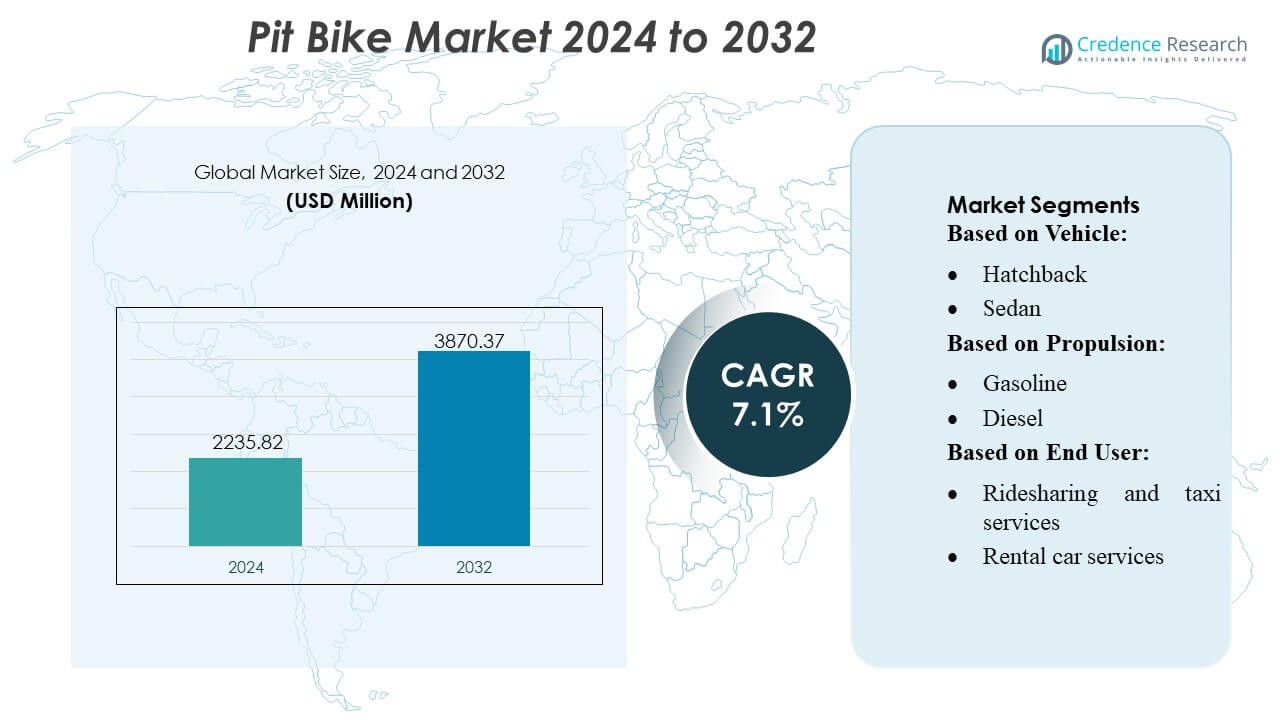

Pit Bike Market size was valued USD 2235.82 million in 2024 and is anticipated to reach USD 3870.37 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pit Bike Market Size 2024 |

USD 2235.82 Million |

| Pit Bike Market, CAGR |

7.1% |

| Pit Bike Market Size 2032 |

USD 3870.37 Million |

The Pit Bike Market is shaped by a mix of global manufacturers that continue to expand product performance, customization options, and distribution strength across recreational and training applications. Key players focus on enhancing engine reliability, suspension systems, and lightweight frames to meet rising demand from youth riders, motorsport academies, and adventure tourism operators. Competitive strategies include broader aftermarket support, electrification initiatives, and deeper penetration of online sales channels. North America leads the global market with an exact 38% share, supported by mature motorsport infrastructure, strong consumer purchasing power, and widespread adoption in organized racing and skill-development programs.

Market Insights

Market Insights

- The Pit Bike Market was valued at USD 2235.82 million in 2024 and will reach USD 3870.37 million by 2032, recording a 1% CAGR, supported by rising recreational adoption and expanding motorsport participation.

- Demand strengthens as hatchback-equivalent compact models hold about 38% share, while gasoline variants lead with nearly 42%, driven by affordability, easier maintenance, and strong suitability for training environments.

- Trends shift toward electrification, customization kits, and lightweight frame engineering, supported by growing youth racing programs and the expansion of indoor and controlled riding tracks.

- Competition intensifies with manufacturers improving suspension systems, engine reliability, and aftermarket upgrade availability, although high safety concerns and fragmented regulations remain key restraints.

- North America leads with an exact 38% regional share, followed by Europe and Asia-Pacific, benefiting from advanced motorsport infrastructure, strong consumer spending, and rapid growth in training academies and rental-based recreational facilities.

Market Segmentation Analysis:

By Vehicle

Hatchbacks hold the dominant share in the Pit Bike Market, capturing nearly 38% of overall demand due to their compact size, cost efficiency, and strong suitability for short-distance mobility. Their widespread use in urban and semi-urban regions reinforces their leadership, supported by easy maneuverability and lower ownership costs. Sedans and SUVs gain traction among buyers seeking enhanced comfort and stability, while sports cars and other niche categories remain limited to performance-oriented users. Rising commuter traffic, parking limitations, and affordability preferences continue to position hatchbacks at the forefront of market growth.

- For instance, Dust Moto integrated a proprietary 80-volt electric drivetrain into its off-road micro-mobility platform, delivering 42 horsepower and a peak wheel torque output of 660 Nm (485 lb-ft), enabling rapid acceleration and high-endurance performance across compact vehicle formats.

By Propulsion

Gasoline-powered models dominate the Pit Bike Market with an approximate 42% share, driven by their widespread availability, strong aftermarket support, and balanced performance for recreational and entry-level riders. Their competitive pricing and easy maintenance make them the preferred choice across emerging and developed regions. Electric models gain momentum as users shift toward low-noise, low-emission options, while diesel and FCEV platforms remain minimal due to limited suitability for lightweight pit bike designs. Government incentives, technological improvements in compact batteries, and lower operational costs are accelerating the transition toward electric variants over the forecast period.

- For instance, Honda Motor Co., Ltd recently advanced its small-displacement engine lineup with the introduction of its 125cc air-cooled SOHC engine used in models like the Honda Grom, delivering 7.2 kW of peak power and achieving a confirmed 66.7 km/l efficiency under WMTC testing.

By End User

Commercial users represent the leading segment in the Pit Bike Market, accounting for nearly 40% of total consumption due to extensive use in events management, motorsport training facilities, and recreational parks. Ridesharing and taxi service operators use pit bikes sparingly for intra-campus or controlled-zone mobility, while rental services gain popularity among adventure tourism providers. Corporate fleets adopt pit bikes selectively for large industrial campuses and logistical support operations. The dominance of commercial users is driven by rising motorsport participation, demand for compact mobility solutions, and growing investments in recreational infrastructure.

Key Growth Drivers

1. Expansion of Recreational Motorsport Activities

The Pit Bike Market grows strongly due to rising participation in recreational motorsport events, off-road training programs, and youth racing leagues. Manufacturers benefit from increasing adoption among hobby riders who seek compact, low-cost, and easy-to-handle bikes for skill development and weekend sport activities. Organized tracks and training schools expand rapidly in emerging regions, encouraging regular usage and repeat purchases. The market gains further momentum as motorsport associations promote entry-level categories that rely heavily on pit bikes for safe and accessible competition formats.

- For instance, Piranha strengthened its performance lineup with the Piranha P140R, powered by a YX 140cc four-stroke engine generating a documented 11 horsepower and equipped with a 4-speed manual transmission, a 26 mm Mikuni-style carburetor, and a long-travel 735 mm front fork.

2. Rising Adoption for Training and Skill Development

Training academies and motorsport coaching facilities drive substantial demand by using pit bikes for controlled skill-building exercises and beginner-level racing drills. Their lightweight design, manageable engine output, and low maintenance requirements make them ideal for new riders, particularly children and early-stage learners. Growing interest in structured riding programs and safety-focused training formats strengthens market penetration. Manufacturers also introduce specialized training models with adjustable suspension and enhanced durability, supporting wider adoption across professional circuits, riding academies, and youth development centers.

- For instance, Pitster Pro expanded its training-oriented lineup with the Pitster Pro MXR 110, equipped with a 107cc four-stroke engine and paired with a semi-automatic 4-speed transmission designed for beginner-level control, featuring a power output typical for its class.

3. Increasing Availability of Affordable and Customizable Models

Affordability acts as a major catalyst as manufacturers expand low-cost pit bike models with flexible engine options and customizable components. Riders increasingly seek personalization through aftermarket exhausts, graphic kits, suspension upgrades, and performance parts, creating a strong ecosystem for accessory sales. Improved manufacturing efficiencies and localization strategies reduce pricing barriers in emerging markets. The combination of low acquisition cost, simple repairability, and broad customization choices attracts recreational users, adventure enthusiasts, and amateur racers, reinforcing sustained market expansion across multiple rider segments.

Key Trends & Opportunities

1. Growth of Electric Pit Bikes

Electric pit bikes emerge as a prominent trend supported by advancements in compact lithium-ion batteries, reduced noise emissions, and zero-exhaust operating benefits. Training academies and indoor tracks increasingly prefer electric variants due to safety advantages and minimal maintenance. Manufacturers leverage this trend by launching lightweight electric platforms optimized for youth riders and short-track performance. Expanding charging infrastructure, rising environmental awareness, and incentive-backed EV adoption policies create long-term opportunities, positioning electric pit bikes as a high-potential growth category within the market.

- For instance, Kawasaki accelerated its small-format EV development through the launch of the Elektrode electric balance bike, integrating a 250-watt rear hub motor, a 36-volt 5.1 Ah lithium-ion battery, and three electronically limited speed modes capped at 8 km/h, 12 km/h, and 20 km/h.

2. Rising Popularity of Adventure Tourism and Rental Services

Adventure tourism operators and rental parks increasingly integrate pit bikes into recreational packages designed for beginners and family-friendly off-road experiences. This shift creates significant opportunities as consumers seek short-duration, low-risk riding experiences without the cost of ownership. Emerging tourist destinations adopt compact off-road mobility solutions to enhance visitor engagement. Rental service providers invest in fleets of durable pit bikes due to their low maintenance and high turnover potential. The trend strengthens market visibility and broadens customer exposure to entry-level off-road riding.

- For instance, Apollo expanded its rental-ready lineup with the Apollo RFZ 125, featuring a documented 124cc single-cylinder engine delivering a typical peak output in its class, a 26 mm carburetor, and a reinforced steel double-beam frame designed for durability and performance.

3. Expansion of Aftermarket Parts and Performance Upgrades

The aftermarket ecosystem grows rapidly as users demand performance enhancements, aesthetic upgrades, and personalized configurations. Suspension kits, carburetors, sprockets, body panels, and high-grip tires experience sustained demand. Manufacturers collaborate with performance brands to offer factory-approved upgrade bundles, creating new revenue streams. This trend supports a vibrant modification culture, especially among youth riders and amateur racers. The expanding aftermarket also improves product lifecycle value, making pit bikes more appealing for long-term recreational use and fostering greater customer retention.

Key Challenges

1. Safety Concerns and Injury Risks

Safety-related issues pose ongoing challenges as pit bikes are often used by inexperienced or younger riders in uncontrolled environments. The risk of falls, improper handling, and limited protective equipment adherence affects market perception and restricts adoption among cautious buyers. Training institutions mitigate this through structured programs, but general consumers remain exposed to misuse risks. Manufacturers respond by integrating improved braking, stability features, and protective design elements, yet safety concerns continue to influence regulatory scrutiny and limit penetration in certain regions.

2. Limited Regulatory Standardization Across Regions

The Pit Bike Market faces fragmented regulatory frameworks governing off-road vehicle usage, emissions standards, and age-related riding permissions. Inconsistent regional rules create compliance burdens for manufacturers and restrict uniform product deployment. Some regions impose strict track-based operation policies or limit public-land use, affecting recreational accessibility. These variations also impact growth of organized events and training programs. The lack of harmonized standards complicates product certification, slows entry of new models, and increases operational complexity for global manufacturers.

Regional Analysis

North America

North America holds the largest share of about 38%, supported by strong motorsport participation, mature recreational infrastructure, and widespread use of pit bikes in training academies and racing circuits. The U.S. dominates regional demand as youth racing programs, organized off-road events, and professional motorsport facilities continue to expand. High disposable incomes and strong aftermarket ecosystems further strengthen adoption. Canada contributes steadily through growing interest in trail riding and adventure parks. The region benefits from well-developed dealer networks and high acceptance of performance-oriented models that cater to both amateur and competitive riders.

Europe

Europe accounts for nearly 27% of the market, driven by structured motorsport culture, strong regulatory oversight, and rising engagement in off-road recreational activities. Countries such as Germany, France, Italy, and the U.K. lead adoption due to established training academies, dedicated racing tracks, and high youth participation. Demand rises as clubs and associations promote entry-level categories that rely heavily on pit bikes for controlled training. The region also sees increasing traction for electric pit bikes due to emission regulations and noise restrictions. Strong manufacturing presence and advanced engineering capabilities support sustained product innovation.

Asia-Pacific

Asia-Pacific captures approximately 24% of global demand, driven by expanding motorsport communities, rising youth engagement, and growth of adventure tourism in emerging economies. China leads the region with strong manufacturing capacity and wide availability of low-cost models, while Japan and Australia contribute through organized racing formats and recreational tracks. Increasing disposable income, urbanization, and interest in affordable outdoor leisure activities boost market penetration. The region benefits from expanding aftermarket parts availability and rising preference for customizable bikes. Government support for recreational infrastructure and motorsport events strengthens long-term regional growth.

Latin America

Latin America holds about 7% of the Pit Bike Market, supported by growing off-road riding culture and increasing adoption among adventure tourism operators. Brazil and Mexico lead demand due to emerging motorsport communities and rising interest among youth riders. Economic conditions favor affordable models, driving manufacturers to expand low-cost product lines. Local racing clubs and recreational parks promote structured events that broaden user participation. Challenges such as limited training infrastructure and inconsistent regulatory frameworks slow pace, yet rising retail availability and aftermarket expansion contribute to steady, incremental growth in the region.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4% share, driven by increasing interest in recreational desert riding, motorsport events, and tourism-based off-road activities. The UAE and Saudi Arabia dominate demand due to growing motorsport festivals, track development, and expanding youth engagement. Africa shows gradual adoption led by South Africa’s recreational riding community and rising tourism-based usage. Economic constraints and limited dealer networks restrict broader penetration, yet rising investment in sports infrastructure and expanding off-road adventure parks support gradual market expansion across targeted segments.

Market Segmentations:

By Vehicle:

By Propulsion:

By End User:

- Ridesharing and taxi services

- Rental car services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pit Bike Market features a competitive landscape shaped by brands such as Dust Moto, Honda Motor Co., Ltd, Piranha, Pitster Pro, Kawasaki, Apollo, SSR Motorsports, Thumpstar, Yamaha Motor Co., Ltd, and NIU Technologies. the Pit Bike Market is defined by continuous innovation, expanding product portfolios, and strong engagement with recreational and training-focused rider communities. Manufacturers emphasize lightweight designs, improved suspension geometries, and efficient powertrains to enhance performance and rider safety. The market benefits from rapid growth in youth racing programs, adventure tourism, and structured riding academies, encouraging companies to develop models tailored to beginners and amateur racers. Electric pit bikes gain momentum as brands invest in battery advancements and low-noise designs suitable for indoor or regulated tracks. Expanding aftermarket support for customization, coupled with global dealership and e-commerce penetration, further strengthens competitive intensity across regions.

Key Player Analysis

- Dust Moto

- Honda Motor Co., Ltd

- Piranha

- Pitster Pro

- Kawasaki

- Apollo

- SSR Motorsports

- Thumpstar

- Yamaha Motor Co., Ltd

- NIU Technologies

Recent Developments

- In August 2024, Uber and BYD announced a strategic partnership aimed at integrating 100,000 electric vehicles (EVs) into Uber’s global ride-hailing platform. This multi-year collaboration will initially launch in Europe and Latin America, with plans to expand to regions including the Middle East, Canada, Australia, and New Zealand. The partnership will provide Uber drivers with competitive pricing and financing options for BYD vehicles. This includes potential discounts on charging, vehicle maintenance, and insurance.

- In February 2024, Yamaha Motor Co., Ltd. and Yamaha Motor Racing announced the launch of desire success at the Sepang International Circuit as the Monster Energy Yamaha MotoGP team opened their garage doors to a select group of media representatives.

- In November 2023, The NIU XQi3 Street Legal Dirt Bike is designed with innovative technologies, created to be multi-functional, all-weather, all-terrain, and cutting-edge. This contemporary electric vehicle combines the latest technology and sleek design to deliver a thrilling, stylish, and smart urban adventure ride, for those seeking on-road and off-road excitement.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as recreational motorsport participation expands across regions.

- Electric pit bikes will gain stronger adoption due to noise restrictions and rising interest in low-emission models.

- Manufacturers will focus on lightweight materials and enhanced durability to improve rider safety and performance.

- Youth training programs and beginner racing formats will drive higher demand for entry-level pit bikes.

- Adventure tourism operators will increase fleet investments to support guided off-road experiences.

- Aftermarket customization parts will grow as riders seek performance upgrades and personalization.

- Online sales channels will strengthen as consumers prefer direct purchase and easy comparison options.

- Compact and modular battery systems will enhance range and efficiency in electric variants.

- Regional motorsport events will expand, creating new opportunities for rental and training segments.

- Manufacturers will localize production and pricing strategies to increase penetration in emerging markets.

Market Insights

Market Insights