Market Overview

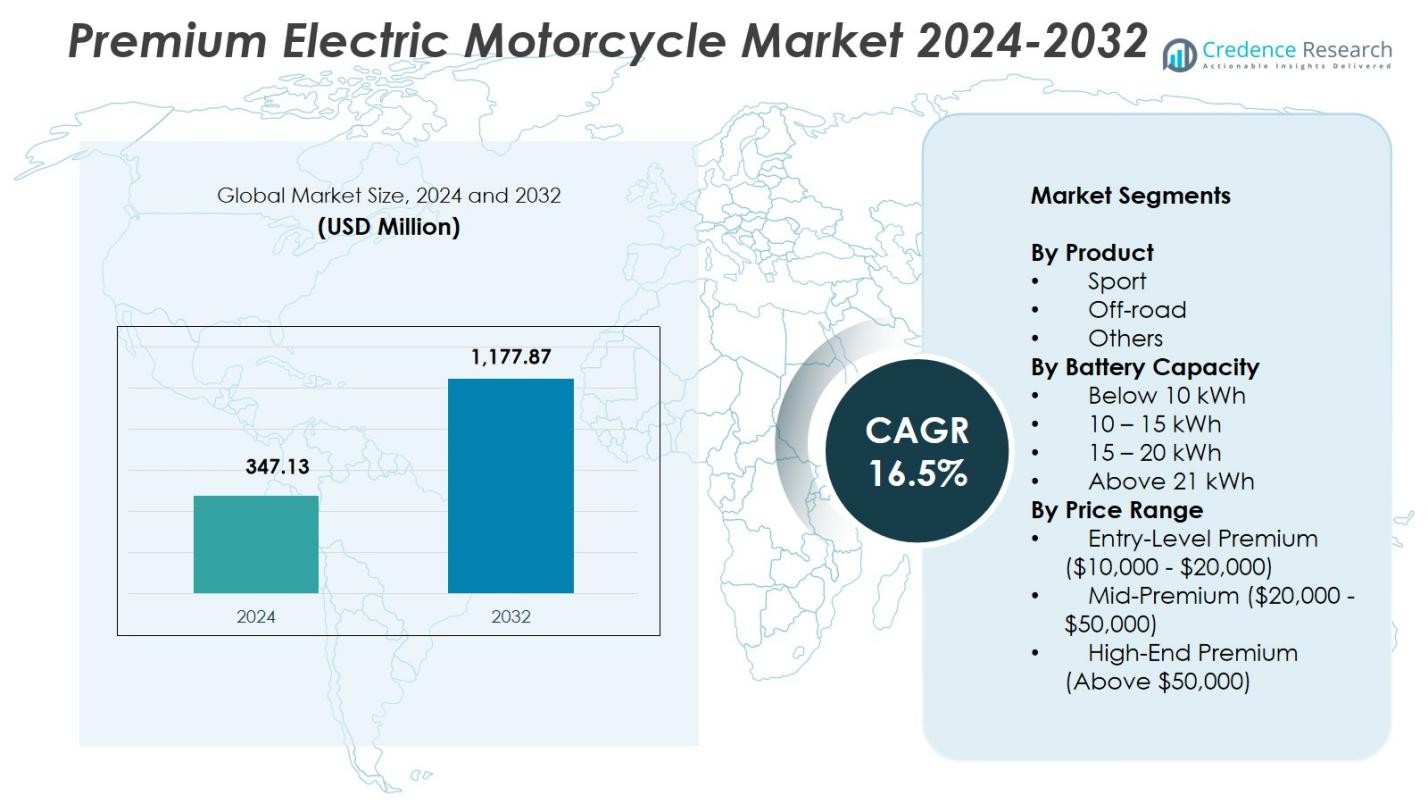

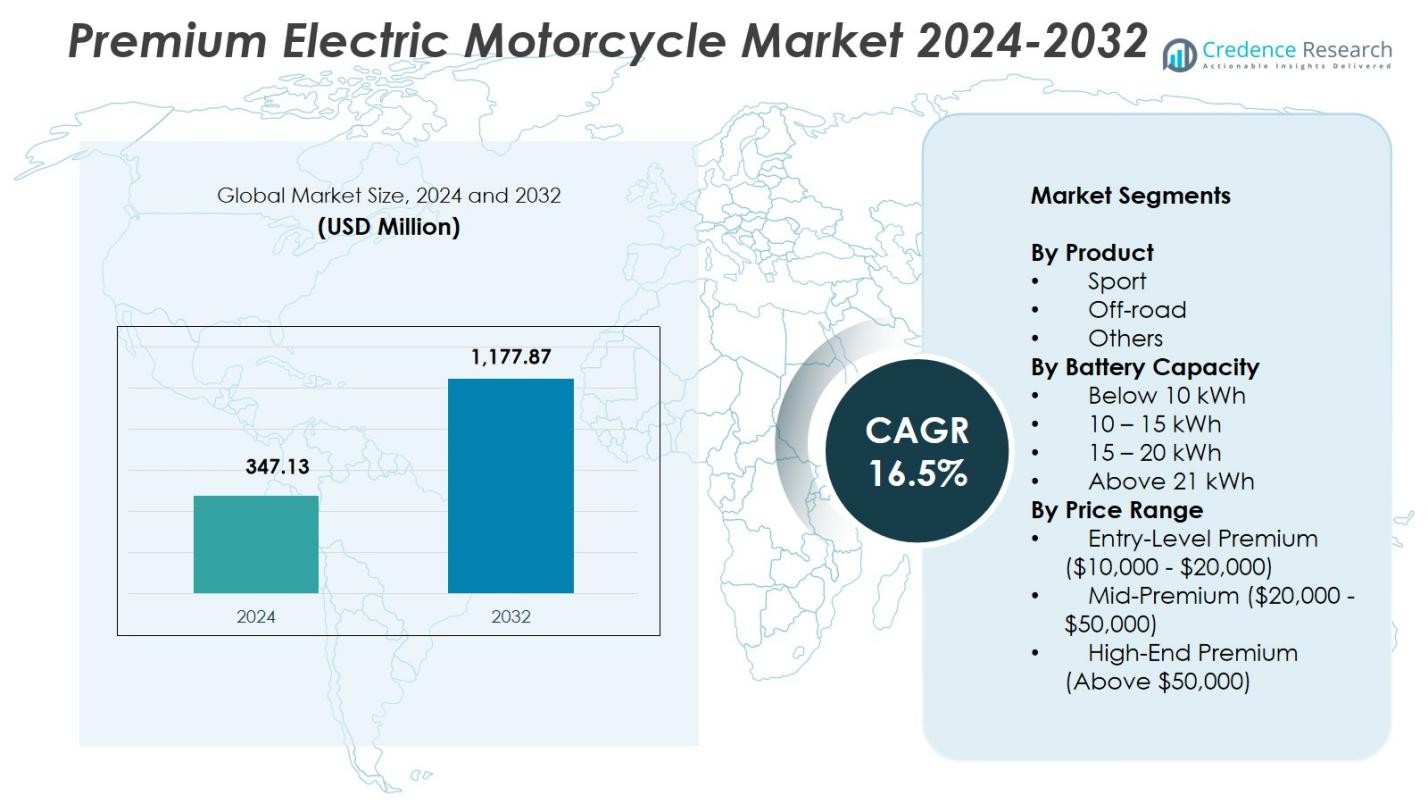

Premium Electric Motorcycle Market size was valued at USD 347.13 Million in 2024 and is anticipated to reach USD 1,177.87 Million by 2032, at a CAGR of 16.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premium Electric Motorcycle Market Size 2024 |

USD 347.13 Million |

| Premium Electric Motorcycle Market, CAGR |

16.5% |

| Premium Electric Motorcycle Market Size 2032 |

USD 1,177.87 Million |

Premium Electric Motorcycle Market shows strong presence of leading manufacturers such as ARC Vehicle Ltd., Brutus Motorcycle, Emflux Motors, Energica Motor Company S.p.A., Evoke Motorcycles, Hadin Motorcycles, Harley-Davidson Inc., IVElectrics, KTM Sportmotorcycle GmbH, and Lightning Motorcycles, each advancing high-performance designs, battery efficiency, and intelligent connectivity features. North America led the market with a 32.4% share in 2024, driven by strong demand for premium electric sports models and expanding fast-charging networks. Europe followed with a 29.7% share, supported by stringent emission norms and rising adoption of luxury electric mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Premium Electric Motorcycle Market reached USD 347.13 Million in 2024 and will grow USD 1,177.87 at a CAGR of 16.5% through 2032.

- The market grows as high-performance electric sports motorcycles gain traction, with the Sport segment holding 54.6% in 2024 due to rising demand for advanced acceleration, long range, and fast-charging capabilities.

- Key trends include rapid adoption of AI-enabled connectivity, OTA updates, and expansion of ultra-premium electric models with higher battery capacities and lightweight chassis.

- Major manufacturers such as ARC Vehicle Ltd., Energica Motor Company S.p.A., Harley-Davidson Inc., KTM, and Lightning Motorcycles enhance product portfolios through technology upgrades and strategic product launches.

- North America led with 32.4% share in 2024, followed by Europe at 29.7% and Asia-Pacific at 27.9%, with expansion supported by EV incentives and strong adoption of mid-premium and high-performance models across regions.

Market Segmentation Analysis:

By Product:

Sport motorcycles dominated the Premium Electric Motorcycle Market with a 54.6% share in 2024, driven by strong consumer demand for high-performance electric models that deliver superior acceleration, advanced aerodynamics, and enhanced riding dynamics. Manufacturers increasingly prioritize lightweight frames, fast-charging systems, and higher torque density to strengthen product appeal in urban and highway performance segments. Off-road models captured 28.3% as adventure and trail-riding adoption rises, supported by improvements in rugged suspension and thermal management. Others accounted for 17.1%, benefiting from niche commuter and touring applications.

- For instance, LiveWire ONE delivers 100 horsepower and 84 lb-ft torque from its Revelation powertrain, achieving 0-60 mph in 3 seconds with DC fast charging support.

By Battery Capacity:

The 10–15 kWh segment led the Premium Electric Motorcycle Market with a 42.8% share in 2024, supported by optimal balance between extended riding range, reduced charging cycles, and affordability for mid-premium models. This capacity range enables strong performance outputs suitable for sport and highway riders, encouraging broad consumer adoption. Below 10 kWh accounted for 21.4% as urban commuters prioritize lightweight models, while the 15–20 kWh segment captured 24.6% due to rising demand for long-range touring. Above 21 kWh held 11.2%, driven by ultra-premium performance motorcycles.

- For instance, Ultraviolette’s F77 features a 10.3 kWh lithium-ion battery pack, delivering up to 323 km range for urban and highway use.

By Price Range:

The Mid-Premium category ($20,000–$50,000) dominated the Premium Electric Motorcycle Market with a 49.7% share in 2024, supported by expanding availability of sport-oriented and high-range models that balance performance, battery capacity, and technological features such as advanced traction control and smart connectivity. Entry-Level Premium models ($10,000–$20,000) held 31.5%, driven by rising adoption among first-time electric motorcycle buyers. High-End Premium motorcycles above $50,000 accounted for 18.8% as affluent consumers seek ultra-high-performance specifications, cutting-edge batteries, and exclusive design elements.

Key Growth Drivers

Key Growth Drivers

Rising Demand for High-Performance Electric Two-Wheelers

Growing consumer preference for premium electric motorcycles with advanced acceleration, high torque, and enhanced riding dynamics strongly accelerates market expansion. Manufacturers integrate fast-charging systems, lightweight composite materials, and improved battery thermal management to meet performance expectations. Increasing availability of sport and mid-premium models attracts riders seeking environmentally sustainable yet powerful alternatives to IC-engine counterparts. Government support for EV adoption, combined with expanding charging networks, encourages higher penetration of premium electric two-wheelers across urban mobility and recreational segments.

- For instance, Asahi Kasei’s XYRON™ 443Z resin forms the lithium-ion battery cover on Giken Mobility’s Iso UNO-X, while LEONA™ 53G33 covers the motor for lightweight durability.

Advancements in Battery Technology and Range Optimization

Rapid improvements in lithium-ion and solid-state battery systems significantly enhance range, energy density, and lifecycle durability, driving strong adoption in the premium motorcycle category. Manufacturers focus on integrating mid-to-high-capacity packs (10–20 kWh) that enable long-distance touring and high-speed performance. Enhanced BMS technologies optimize real-time monitoring and safety, while fast-charging capabilities reduce downtime for premium riders. Ongoing R&D investments strengthen overall efficiency, enabling brands to deliver consistent performance across diverse terrains and riding conditions.

- For instance, Ducati’s V21L prototype integrates QuantumScape solid-state lithium-metal QSE-5 cells, reducing battery pack weight by 8.2 kg compared to the original 18 kWh lithium-ion version while enabling 10-80% charging in just over 12 minutes.

Regulatory Push Toward Zero-Emission Mobility

Stringent emission standards and government-led decarbonization initiatives propel the transition toward premium electric motorcycles. Incentives such as tax rebates, reduced registration fees, and import-duty benefits increase affordability for mid- and high-end models. Urban congestion policies and low-emission zones further encourage riders to shift from ICE-powered motorcycles to electric alternatives. OEMs benefit from supportive EV manufacturing programs, which promote localized production and strengthen supply chain resilience. This regulatory environment reinforces long-term market growth and accelerates premium electric motorcycle adoption globally.

Key Trends & Opportunities

Integration of Intelligent Connectivity and Advanced Rider-Assistance Technology

A major trend shaping the premium electric motorcycle market is the adoption of AI-enhanced connectivity, advanced telematics, and digital rider-assistance systems. Features such as predictive analytics, traction control algorithms, adaptive riding modes, and over-the-air updates elevate user experience and differentiate premium offerings. Integration of smartphone-based ecosystems, cloud connectivity, and remote diagnostics enables seamless monitoring of performance, battery health, and navigation. These digital enhancements create strong opportunities for OEMs to develop subscription-based services and strengthen long-term customer engagement.

- For instance, the Damon Hypersport incorporates the CoPilot™ system, which uses sensors, cameras, and radar to monitor real-time road conditions and warn riders of potential hazards, enhancing safety and confidence on the road.

Expansion of Ultra-Premium and Performance-Focused Electric Motorcycle Lineups

The emergence of models with higher battery capacities, superior aerodynamics, and enhanced powertrain technologies creates new opportunities in the ultra-premium electric sports segment. Brands invest in lightweight carbon-fiber chassis, rapid acceleration capabilities, and race-inspired engineering to target performance enthusiasts. Increasing visibility of electric motorcycles in motorsports and endurance events boosts consumer awareness and accelerates acceptance of high-end electric models. This trend supports broader market diversification and opens new revenue streams in luxury, adventure, and long-range touring segments.

- For instance, Rimac’s Nevera employs a carbon fiber monocoque chassis integrated with a structural 120 kWh battery pack, enabling 1,914 horsepower and a top speed of 258 mph.

Key Challenges

High Vehicle Costs and Limited Affordability Across Key Markets

Premium electric motorcycles remain significantly more expensive than conventional ICE models due to high battery production costs, advanced electronics, and limited economies of scale. The price gap restricts adoption in cost-sensitive markets despite growing environmental awareness. While government incentives soften initial purchase barriers, fluctuating subsidy policies create uncertainty for both consumers and manufacturers. The challenge intensifies in emerging markets where premium segments remain niche, limiting widespread penetration and delaying mass-market transition.

Insufficient Charging Infrastructure for Long-Distance and High-Performance Riding

The lack of widespread, high-speed charging infrastructure continues to hinder market scalability, especially for premium electric motorcycles requiring rapid replenishment for extended rides. Limited availability of fast chargers in rural and intercity routes restricts long-distance touring capabilities, affecting rider confidence. Inconsistent charging standards across regions further complicate compatibility for global OEMs. Infrastructure gaps slow adoption among performance and adventure riders who demand reliable, high-capacity charging options to support premium riding experiences.

Regional Analysis

North America

North America held a 32.4% share of the Premium Electric Motorcycle Market in 2024, driven by strong consumer demand for high-performance electric sports bikes and the rapid expansion of fast-charging networks across the U.S. and Canada. Major manufacturers strengthen market penetration through advanced connectivity features, enhanced battery capacities, and performance-oriented designs tailored to premium riders. Supportive policies, tax incentives, and rising interest in sustainable recreational riding further accelerate adoption. Increased availability of mid-premium and ultra-premium electric motorcycles continues to reinforce North America’s leadership position in the global market.

Europe

Europe accounted for a 29.7% share in 2024, supported by stringent emission regulations, strong environmental awareness, and robust adoption of electric two-wheelers in Germany, France, Italy, and the Nordic region. Premium consumers increasingly prefer high-range and sport-focused electric models equipped with advanced safety and digital features. Investments in high-speed charging corridors and government incentives enhance market accessibility. Growing participation of European OEMs in performance electric motorcycle development further strengthens regional demand. The region’s emphasis on sustainable mobility and luxury electric mobility solutions continues to drive consistent growth.

Asia-Pacific

Asia-Pacific led significant demand momentum with a 27.9% share in 2024, propelled by expanding EV infrastructure, rising disposable incomes, and strong motorcycle culture across China, India, Japan, and Southeast Asia. The region benefits from large-scale EV manufacturing capabilities, enabling cost-effective production of premium electric motorcycles. Consumers increasingly adopt mid-premium and high-performance models as urbanization intensifies and sustainability initiatives expand. Government-backed EV adoption programs and favorable import-duty structures further stimulate sales. Rapid technological advancements from regional manufacturers strengthen Asia-Pacific’s position as a rapidly growing premium electric motorcycle hub.

Latin America

Latin America captured a 5.4% share in 2024, supported by early adoption among premium urban riders and increasing availability of performance electric motorcycles in markets such as Brazil, Mexico, and Chile. Strong interest in sustainable commuting and evolving charging ecosystems contribute to gradual yet steady market expansion. Mid-premium and high-performance electric motorcycles attract affluent consumers seeking advanced technology and reduced operational costs. Government-led EV incentives and pilot charging projects strengthen ecosystem development, although high vehicle costs continue to limit mass adoption. Growing awareness of electric mobility benefits supports long-term regional potential.

Middle East & Africa

The Middle East & Africa region held a 4.6% share in 2024, driven by rising interest in premium electric mobility across the UAE, Saudi Arabia, and South Africa. High-income consumer groups increasingly adopt luxury and high-performance electric motorcycles for recreational and urban use. Investments in smart-city programs and EV charging infrastructure support gradual market growth. The presence of extreme climates encourages manufacturers to enhance battery durability and thermal management capabilities. Despite limited affordability and slower infrastructure expansion in some countries, premium electric motorcycles continue to gain visibility, supporting future regional development.

Market Segmentations:

By Product

By Battery Capacity

- Below 10 kWh

- 10 – 15 kWh

- 15 – 20 kWh

- Above 21 kWh

By Price Range

- Entry-Level Premium ($10,000 – $20,000)

- Mid-Premium ($20,000 – $50,000)

- High-End Premium (Above $50,000)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Premium Electric Motorcycle Market features key players such as ARC Vehicle Ltd., Brutus Motorcycle, Emflux Motors, Energica Motor Company S.p.A., Evoke Motorcycles, Hadin Motorcycles, Harley-Davidson Inc., IVElectrics, KTM Sportmotorcycle GmbH, and Lightning Motorcycles. These manufacturers intensify innovation through advancements in battery technology, fast-charging capabilities, lightweight chassis materials, and high-performance powertrains to differentiate premium offerings. Companies focus on expanding sport and mid-premium product portfolios while integrating intelligent connectivity, rider-assistance systems, and over-the-air software upgrades. Strategic partnerships with battery developers, charging-solution providers, and technology firms strengthen product ecosystems and enhance long-distance usability. Several OEMs are scaling production through localized manufacturing and supply-chain optimization to reduce costs and expand global footprint. Growing involvement in electric racing competitions further boosts brand visibility and accelerates R&D developments, reinforcing strong competition across premium, performance, and ultra-luxury segments.

Key Player Analysis

- Hadin Motorcycles

- KTM Sportmotorcycle GmbH

- Lightning Motorcycles

- ARC Vehicle Ltd.

- Brutus Motorcycle

- Harley Davidson Inc.

- IVElectrics

- Energica Motor Company S.p.A.

- Evoke Motorcycle

- Emflux Motors

Recent Developments

- In August 2025, Energica Motor Company S.p.A. was acquired by a group of Singaporean investors, giving the company renewed support to revive its high-performance electric motorcycle business.

- In November 2025, Ultraviolette Automotive launched its F77 Mach 2 Recon and F77 SuperStreet Recon electric motorcycles in the United Kingdom in partnership with distributor MotoMondo.

- In September 2025, Honda Motor Company unveiled the Honda WN7 its first full-size electric motorcycle at the EICMA show in Milan, marking Honda’s entry into the premium electric motorcycle segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Battery Capacity, Price Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness accelerated adoption of high-performance electric motorcycles driven by advancements in battery density and powertrain efficiency.

- Manufacturers will expand sport and ultra-premium electric lineups to cater to performance-focused riders.

- Fast-charging infrastructure will grow rapidly, improving long-distance usability and rider confidence.

- Integration of AI-driven connectivity, predictive diagnostics, and smart riding modes will become standard in premium models.

- Localized manufacturing and supply-chain optimization will reduce production costs and expand market reach.

- Government EV incentives and stricter emission regulations will continue to drive premium electric motorcycle penetration.

- Lightweight composite materials and aerodynamic designs will enhance speed, handling, and energy efficiency.

- Growing participation in electric motorsports will influence technology innovation and brand competitiveness.

- Subscription-based digital services and OTA-enabled upgrades will create new recurring revenue models.

- Expansion in Asia-Pacific, Europe, and North America will reinforce global premium electric motorcycle market g

Key Growth Drivers

Key Growth Drivers