Market Overview

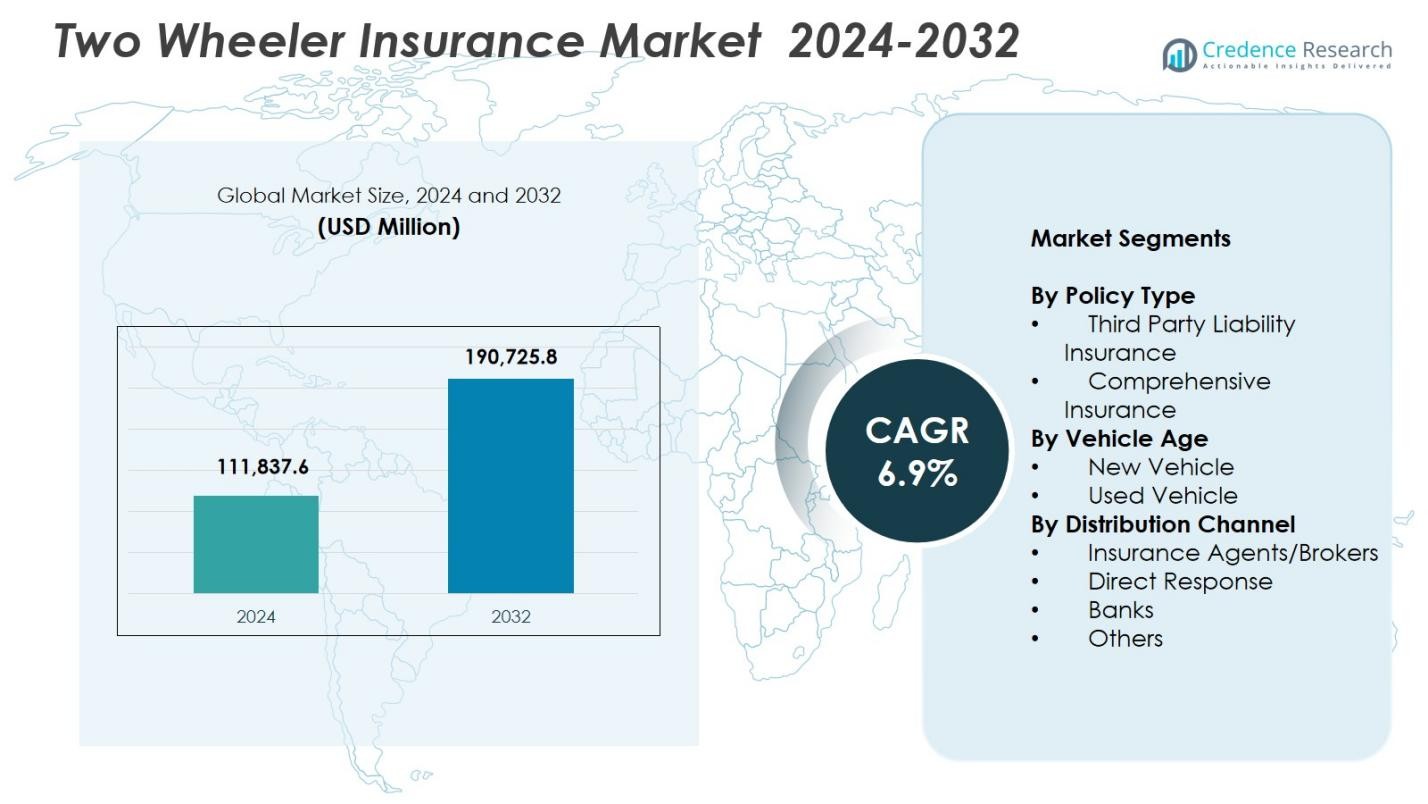

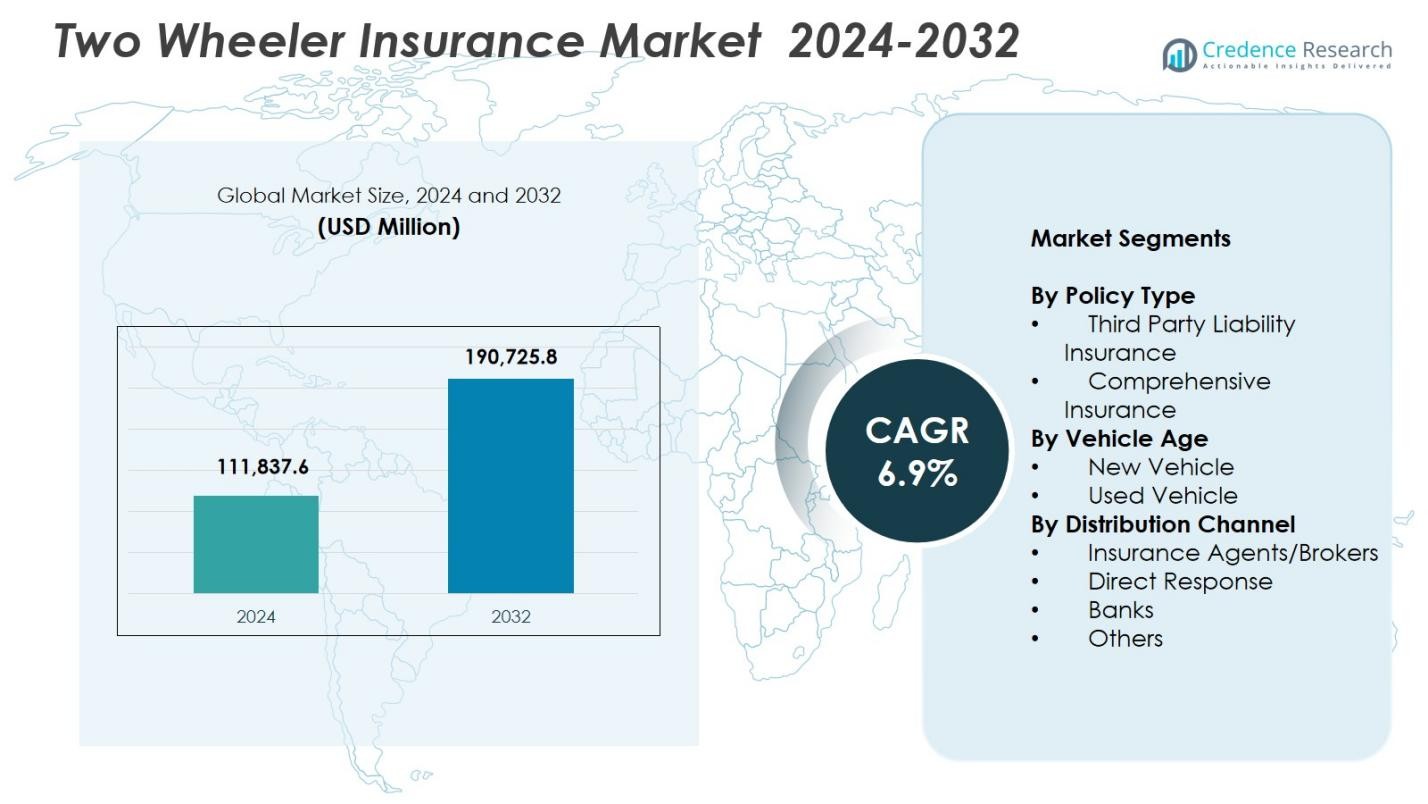

Two Wheeler Insurance Market size was valued at USD 111,837.6 Million in 2024 and is anticipated to reach USD 190,725.8 Million by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Two Wheeler Insurance Market Size 2024 |

USD 111,837.6 Million |

| Two Wheeler Insurance Market, CAGR |

6.9% |

| Two Wheeler Insurance Market Size 2032 |

USD 190,725.8 Million |

Two Wheeler Insurance Market is shaped by leading insurers such as State Farm Mutual Automobile Insurance, GEICO, Allstate Insurance Company, Bajaj Allianz General Insurance, Farmers, Dairyland, Liberty General Insurance Ltd., ACKO General Insurance Limited, Progressive Casualty Insurance Company, and USAA, each strengthening their presence through product innovation, digital servicing, and expanded distribution networks. Asia-Pacific remained the dominant region in 2024 with a 71.6% share, driven by high two-wheeler density, strong regulatory enforcement, and growing adoption of comprehensive policies. Europe and North America followed, supported by rising motorcycle usage and strong insurer–OEM collaborations, reinforcing regional market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Two Wheeler Insurance Market size reached USD 111,837.6 Million in 2024 and will grow USD 190,725.8 at a CAGR of 6.9% through 2032.

- Rising two-wheeler ownership and mandatory insurance regulations strongly drive market expansion, with Comprehensive Insurance holding a 62.4% share in 2024 due to higher protection demand.

- Digital adoption, telematics-based pricing, and customizable add-on covers represent key trends reshaping product innovation and improving customer engagement.

- Leading insurers enhance their presence through AI-based underwriting, faster claims processing, and strong OEM partnerships, improving policy penetration across new and used vehicle segments.

- Asia-Pacific dominated with a 71.6% regional share, followed by Europe at 9.8% and North America at 7.9%, reflecting strong mobility patterns and varying insurance maturity across global markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Policy Type

The Two Wheeler Insurance Market is led by Comprehensive Insurance, holding a 62.4% share in 2024, driven by rising accident rates, increasing consumer awareness of full financial protection, and growth in high-value motorcycles requiring broader coverage. Comprehensive policies attract customers with add-ons such as zero depreciation, roadside assistance, and engine protection, strengthening adoption across both urban and semi-urban markets. Third Party Liability Insurance, while mandatory, accounts for the remaining market share as budget-conscious riders prefer basic legal compliance; however, insurers continue to push comprehensive plans through bundled features and digital promotions.

- For instance, Tata AIG offers its Auto Secure Two Wheeler Package Policy, which bundles own-damage coverage with third-party liability and includes ₹15 lakhs personal accident cover for the owner-driver.

By Vehicle Age

New Vehicles dominated the vehicle age segment with a 58.7% share in 2024, supported by regulatory requirements mandating multi-year policies for new two-wheelers and increased preference for comprehensive coverage during vehicle purchase. OEM-insurance partnerships and dealership-level bundling strongly influence buyer decisions, ensuring higher penetration in the new vehicle category. The Used Vehicle segment, holding the balance of the share, grows steadily as digital verification tools, telematics-based risk assessment, and simplified renewal processes improve trust and affordability for previously owned two-wheelers.

- For instance, Roadzen partnered with a top global two-wheeler OEM serving over 60 million two-wheelers in India to launch AI-powered connected roadside assistance for new electric vehicles, accessible via dashboard or app for seamless support.

By Distribution Channel

Insurance Agents/Brokers held the dominant position with a 46.3% share in 2024, driven by strong offline networks, personalized policy guidance, and higher conversion rates among first-time buyers. Their influence remains strong in rural and semi-urban regions where in-person assistance is preferred. Direct Response channels follow closely, supported by rapid expansion of digital platforms, instant policy issuance, and competitive pricing. Banks and Others contribute the remaining segment share as bancassurance partnerships grow and e-commerce, fintech platforms, and OEM-integrated insurance solutions attract younger, digitally active customers.

Key Growth Drivers

Rising Two-Wheeler Ownership Across Urban and Semi-Urban Regions

Rapid growth in two-wheeler sales, particularly in densely populated urban and expanding semi-urban regions, drives the Two Wheeler Insurance Market significantly. Increasing affordability, convenient financing, and congestion-friendly mobility solutions boost motorcycle and scooter adoption. Mandatory insurance regulations further support policy uptake as new vehicle owners prioritize immediate coverage. The surge in delivery and gig-economy riders also amplifies demand for broader protection plans. Together, these dynamics strengthen overall market expansion and encourage insurers to develop tailored offerings for diverse rider profiles.

- For instance, Honda Activa crossed 35 million cumulative sales in India by 2025, revolutionizing urban scooter mobility since 2001 with milestones of 10 million by 2015 and 20 million by 2018. It contributes over 50% to Honda’s two-wheeler sales.

Mandatory Motor Insurance Regulations Strengthening Market Penetration

Government regulations mandating third-party insurance and promoting long-term coverage for new vehicles remain a major growth catalyst. Enforcement measures, digital verification systems, and penalties for uninsured vehicles have increased adherence across regions. Regulatory pushes toward multi-year policies enhance renewal stability and reduce coverage lapses. Additionally, authorities encourage digital policy issuance, improving accessibility and compliance. As regulatory frameworks evolve to address road safety and accident risk, insurers witness sustained demand, creating a resilient foundation for growth in both basic and comprehensive policies.

- For instance, under the Motor Vehicles (Amendment) Act 2019, first-time offenders driving without valid insurance face a fine of ₹2,000 and/or up to three months imprisonment, with repeat offences escalating to ₹4,000 and/or the same jail term.

Digital Distribution Expansion and Insurtech Innovation

The rapid adoption of digital channels, AI-based underwriting, and seamless online policy issuance drives substantial growth in the Two Wheeler Insurance Market. Insurtech platforms simplify comparison, customization, and instant claim filing, appealing to tech-savvy consumers. Data analytics, telematics, and automated risk assessment improve pricing accuracy and enhance customer satisfaction. Subscription-based renewals, mobile-first experiences, and digital KYC processes further accelerate market penetration. This transformation enhances operational efficiency for insurers while enabling customers to access more transparent, affordable, and personalized coverage.

Key Trends & Opportunities

Rising Demand for Add-On Covers and Customizable Insurance Products

A growing shift toward personalized insurance solutions presents a major opportunity for market players. Riders increasingly opt for add-ons such as zero-depreciation, roadside assistance, personal accident cover, and engine protection to enhance financial security. Premium two-wheeler owners, delivery riders, and frequent commuters drive demand for advanced riders. Insurers respond by offering modular, customizable plans tailored to riding habits and vehicle types. This trend supports market premiumization and encourages insurers to innovate through flexible, value-added features and subscription-based add-on models.

- For instance, HDFC ERGO includes optional personal accident cover up to ₹15 lakhs and zero depreciation add-ons in its comprehensive plans, with emergency roadside assistance available for repairs anywhere.

Telematics Adoption Enabling Usage-Based and Behavior-Based Insurance Models

The integration of telematics devices and smartphone-based monitoring opens significant opportunities for usage-based and behavior-based insurance models. Real-time driving data helps insurers reward safe riders with lower premiums while reducing risk-related losses. Delivery fleets and commercial two-wheeler operators increasingly adopt telematics-driven policies to optimize cost and safety. As connected mobility grows, insurers can implement dynamic pricing, automated claim validation, and proactive risk alerts. This evolution positions telematics as a transformative trend shaping the future of two-wheeler insurance offerings.

- For instance, Zurich Kotak General Insurance leverages telematics devices in its bike insurance policies to track real-time data such as distance traveled, speed, braking patterns, and driving times. The data supports personalized premiums and incentivizes safer riding habits among policyholders.

Key Challenges

High Claim Fraud Incidences and Limited Risk Transparency

The Two Wheeler Insurance Market faces persistent challenges from fraudulent claims, staged accidents, and manipulated repair costs, which elevate insurer losses. Limited access to verified customer and vehicle data further complicates accurate risk assessment. Small workshops and unorganized repair networks amplify inconsistencies in claim estimates. Although digital tools and AI-driven fraud detection systems help mitigate risks, enforcement gaps remain. These challenges increase operational burdens for insurers and contribute to higher premiums for genuine policyholders.

Low Insurance Penetration in Rural Markets and Renewal Lapses

Despite regulatory requirements, insurance penetration remains low in rural regions due to limited awareness, affordability concerns, and reliance on informal transport practices. Many riders allow policies to lapse after the first year, reducing long-term market stability. Lack of digital literacy and limited distribution channels further hinder rural adoption. Insurers struggle to maintain renewal rates without targeted outreach. Expanding micro-insurance products, simplified digital processes, and rural agent networks is essential to overcome this barrier and unlock untapped growth potential.

Regional Analysis

Asia-Pacific

Asia-Pacific led the Two Wheeler Insurance Market with a 71.6% share in 2024, driven by high two-wheeler ownership, expanding urban mobility, and strong regulatory enforcement in countries such as India, China, Indonesia, and Vietnam. The surge in delivery services and rising disposable incomes further boosts demand for comprehensive insurance plans. Government initiatives promoting digital insurance adoption and multi-year policies strengthen market penetration. Increasing OEM–insurer partnerships at the dealership level continue to shape customer preferences. The region’s rapid economic growth and large commuter base position Asia-Pacific as the core revenue generator throughout the forecast period.

Europe

Europe accounted for a 9.8% share in 2024, supported by rising adoption of motorcycles for leisure and urban commuting, especially in Italy, Spain, Germany, and France. Strong road safety regulations, higher vehicle maintenance standards, and well-established insurance frameworks contribute to steady market expansion. The region shows increasing demand for premium comprehensive policies, reflecting the popularity of high-end motorcycles. Digitalization of insurance services and the emergence of telematics-based pricing models enhance consumer engagement. Growth is further encouraged by insurer initiatives promoting personalized products tailored to commuter behavior and evolving mobility trends.

North America

North America held a 7.9% share in 2024, driven by a stable market for motorcycles used for leisure, sports, and adventure touring. The United States dominates the regional landscape due to strong penetration of comprehensive insurance products and a mature regulatory structure. Consumer preference for high-value bikes supports higher premium generation. Additionally, digital insurance adoption, improved risk assessment tools, and rising interest in add-on protection features enhance policy uptake. Market growth continues as insurers expand telematics-based offerings and strengthen partnerships with motorcycle manufacturers and dealerships to streamline purchase-linked insurance.

Latin America

Latin America captured a 6.3% share in 2024, with countries such as Brazil, Argentina, Colombia, and Mexico contributing significantly to demand. Growing urban congestion drives motorcycle adoption as a cost-effective mobility solution, directly boosting insurance requirements. Regulatory authorities increasingly enforce mandatory third-party policies, improving market penetration. Economic fluctuations influence premium affordability, yet digital channels and micro-insurance offerings are expanding access. The region also benefits from rising delivery service usage and improving financial inclusion. Enhanced insurer focus on localized distribution strategies continues to strengthen market presence across Latin America.

Middle East & Africa

The Middle East & Africa region held a 4.4% share in 2024, driven by rising motorcycle usage in Africa for essential mobility and increasing adoption in Middle Eastern urban centers. Gradual improvements in insurance regulations and road safety awareness support moderate market expansion. Affordability challenges and low awareness remain constraints, particularly in rural areas. However, digital distribution, mobile-based policy renewal, and government-led compliance measures are improving accessibility. Growth is supported by expanding gig-economy transportation and efforts by insurers to introduce low-cost, simplified plans tailored to income-sensitive riders across the region.

Market Segmentations:

By Policy Type

- Third Party Liability Insurance

- Comprehensive Insurance

By Vehicle Age

By Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Two Wheeler Insurance Market is shaped by leading insurers such as STATE FARM MUTUAL AUTOMOBILE INSURANCE, GEICO, ALLSTATE INSURANCE COMPANY, Bajaj Allianz General Insurance, Farmers, Dairyland, Liberty General Insurance Ltd., ACKO General Insurance Limited, Progressive Casualty Insurance Company, and USAA. Market players focus on product differentiation through customized add-on covers, digital-first policy issuance, and telematics-driven premium models to strengthen customer retention. Insurers increasingly invest in AI-based underwriting, automated claims processing, and fraud detection to enhance operational efficiency and service accuracy. Strategic partnerships with OEMs, fintech platforms, and dealership networks significantly expand customer reach, particularly across emerging markets with rising two-wheeler ownership. Companies also intensify efforts to improve renewal rates through subscription-based models, reward programs for safe riding, and mobile-based engagement tools. As competition heightens, insurers prioritize customer experience, competitive pricing strategies, and innovation to capture market share in a rapidly evolving mobility landscape.

Key Player Analysis

- Liberty General Insurance Ltd.

- GEICO

- Progressive Casualty Insurance Company

- Bajaj Allianz General Insurance

- Farmers

- USAA

- ALLSTATE INSURANCE COMPANY

- Dairyland

- ACKO General Insurance Limited

- STATE FARM MUTUAL AUTOMOBILE INSURANCE

Recent Developments

- In March 2025, PhonePe launched a new vehicle insurance offering specifically for two-wheelers and four-wheelers, enabling users to compare policies digitally and save up to ₹4,000 compared to dealership prices.

- In January 2025, Sentry Insurance acquired The General for USD 1.7 billion, bolstering its non-standard motor insurance segment that includes two-wheeler coverage for higher-risk riders.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Policy Type, Vehicle Age, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as rising two-wheeler ownership strengthens long-term insurance demand.

- Digital insurance adoption will expand rapidly, driven by mobile-first policy issuance and automated claim processing.

- Telematics-enabled, behavior-based premium models will gain wider acceptance among insurers and customers.

- Customized add-on covers will become essential as consumers seek more personalized protection solutions.

- OEM–insurer partnerships will intensify, making bundled insurance a standard part of new vehicle purchases.

- AI-driven underwriting and fraud detection will significantly improve risk assessment accuracy.

- Rural and semi-urban penetration will increase as insurers introduce low-cost micro-insurance products.

- Renewal rates will improve with subscription-based models and digital reminders enhancing customer retention.

- Insurtech platforms will shape future competition by offering seamless comparison and customized policy options.

- Sustainability initiatives will drive insurers to develop eco-friendly products aligned with electric two-wheeler adoption.

Market Segmentation Analysis:

Market Segmentation Analysis: