Market Overview:

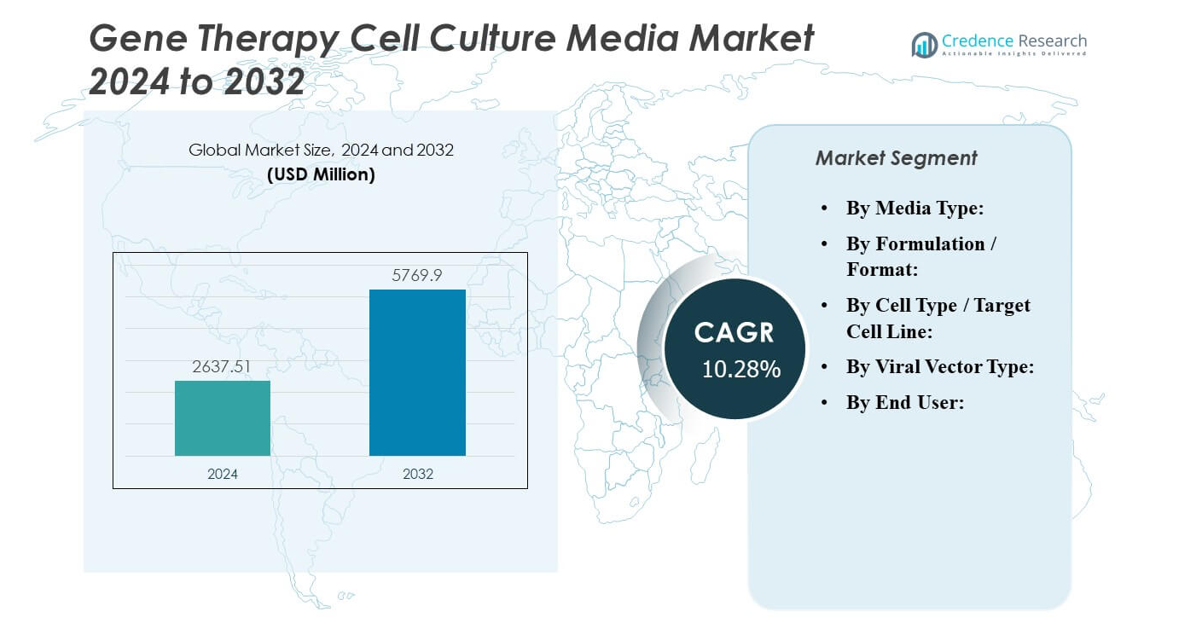

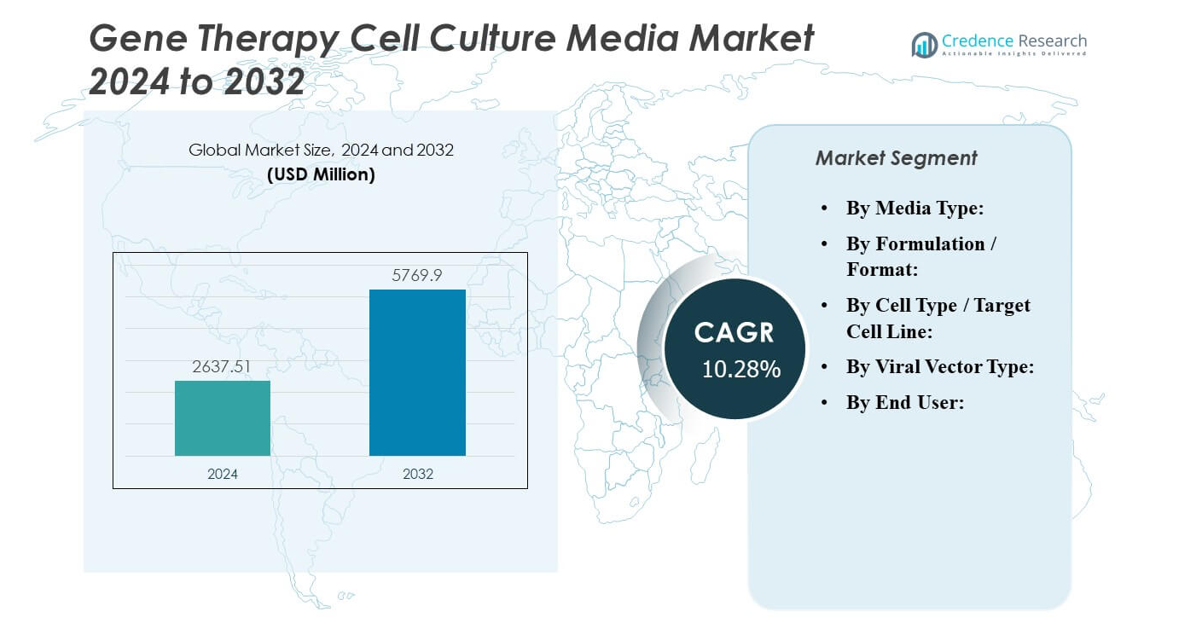

The Gene Therapy Cell Culture Media Market is projected to grow from USD 2,637.51 million in 2024 to an estimated USD 5,769.90 million by 2032, with a compound annual growth rate (CAGR) of 10.28% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gene Therapy Cell Culture Media Market Size 2024 |

USD 2,637.51 million |

| Gene Therapy Cell Culture Media Market, CAGR |

10.28% |

| Gene Therapy Cell Culture Media Market Size 2032 |

USD 5,769.90 million |

The market expands due to strong demand for scalable, consistent, and regulatory-compliant media supporting viral vector and cell manufacturing. Pharmaceutical and biotechnology companies increasingly invest in advanced formulations that enhance transfection efficiency and process yield. Growth in gene therapy approvals and expanding clinical pipelines strengthen commercial demand. Media suppliers focus on serum-free and chemically defined compositions to ensure quality and reproducibility across production stages.

North America leads the market due to advanced biomanufacturing facilities, supportive regulatory frameworks, and extensive clinical research activity. Europe follows with strong academic–industry collaboration and well-established contract manufacturing capabilities. Asia-Pacific emerges as the fastest-growing region, driven by government investment in biotech infrastructure, increasing clinical trial activity, and rising production of gene-based therapies. The region’s expanding manufacturing base attracts global media suppliers seeking cost-effective and high-growth opportunities.

Market Insights:

- The Gene Therapy Cell Culture Media Market is projected to grow from USD 2,637.51 million in 2024 to USD 5,769.90 million by 2032, expanding at a CAGR of 10.28%.

- Growth is driven by rising adoption of viral vector platforms and scalable gene therapy production.

- Increasing clinical approvals for gene therapies continue to elevate the need for optimized media formulations.

- High production costs and complex bioprocessing requirements create operational challenges for smaller biotech firms.

- North America dominates due to its advanced R&D infrastructure and large gene therapy pipeline.

- Europe follows with strong regulatory support and growing investment in manufacturing capacity.

- Asia-Pacific is the fastest-growing region, supported by expanding biotech ecosystems and government-backed infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Emphasis on Scalable and Efficient Manufacturing Processes

The Gene Therapy Cell Culture Media Market grows due to increased demand for scalable bioprocessing systems. Manufacturers focus on improving media formulations to enhance cell growth, vector yield, and productivity. Companies invest in serum-free and chemically defined media to ensure consistent results across production batches. This shift supports regulatory compliance and product quality in gene therapy manufacturing. Continuous improvements in transfection efficiency also enhance cost effectiveness. Contract manufacturing organizations adopt advanced media for large-scale production. The industry prioritizes solutions that streamline development and reduce process variability. It benefits from the rising need for reproducible and efficient manufacturing workflows.

- For instance, Oxford Biomedica, during collaborations with Cytiva, transitioned from an adherent to a suspension process for lentiviral vector manufacturing, resulting in an iterative improvement in upstream vector titers by a factor of 10–20 fold and a threefold increase in process scale. These improvements were confirmed with successful titer scaling from 5 L to 50 L and 200 L production bioreactors, enabling robust commercial vector supply for gene therapy clients.

Rising Clinical Approvals and Expansion of Gene Therapy Pipelines

The market benefits from growing clinical success and regulatory approvals for gene therapies targeting rare and chronic diseases. Increased trial volumes drive greater demand for optimized media formulations supporting vector and cell line development. Companies design specialized media for adeno-associated virus (AAV) and lentiviral vector production. The expanding pipeline creates opportunities for suppliers offering high-performance culture systems. Pharmaceutical firms collaborate with media developers to enhance production speed. Cell therapy research institutions prefer formulations that support long-term culture stability. It strengthens supply networks to meet increasing clinical and commercial manufacturing needs. The overall expansion in therapy pipelines sustains market momentum.

Technological Advancements in Cell Culture Formulations and Ingredients

Advances in nutrient design and bioactive compounds transform the performance of gene therapy media. Suppliers develop optimized amino acid blends, growth factors, and buffer systems to sustain cell viability. Single-use technologies simplify process handling and contamination control. Automation reduces manual intervention in large-scale production. New formulations improve transfection efficiency and viral vector recovery. Research centers validate synthetic media components for consistent batch quality. It gains traction among manufacturers seeking safer and animal-free alternatives. Technological innovation directly supports the scalability of gene therapy processes.

Increased Investment by Biotechnology and Pharmaceutical Companies

Large biopharmaceutical firms allocate significant funds to strengthen gene therapy production capabilities. The growing presence of dedicated facilities increases the demand for advanced media solutions. Strategic partnerships with media suppliers enhance manufacturing precision and flexibility. Contract manufacturers expand infrastructure to meet rising client demand. The market benefits from investment in R&D for improved vector systems. Government initiatives and venture capital funding accelerate the establishment of new therapy platforms. Companies implement robust quality control systems aligned with Good Manufacturing Practices (GMP). It reflects the expanding confidence in the gene therapy supply chain ecosystem.

- For instance, Catalent’s commercial gene therapy manufacturing campus in Harmans, Maryland, features more than 200,000 square feet of late-stage clinical and commercial gene therapy production space, comprising 15 cGMP manufacturing suites (with potential expansion to 18 suites, each up to 2,000 liters). Catalent announced an additional investment of $130 million to expand manufacturing capabilities, supporting increased demand from clients advancing through the clinical and commercial pipeline.

Market Trends

Shift Toward Chemically Defined and Serum-Free Media Adoption

Manufacturers in the Gene Therapy Cell Culture Media Market increasingly transition to serum-free and chemically defined formulations. These products offer improved consistency and reduced contamination risk. Regulatory agencies encourage the elimination of animal-derived components. The transition ensures reproducibility in large-scale bioproduction. Suppliers integrate advanced nutrient systems supporting sustained cell productivity. The shift aligns with global manufacturing standards and safety guidelines. It enhances scalability and facilitates regulatory approval. The trend continues to strengthen across commercial production facilities.

Integration of Single-Use and Automated Bioprocess Technologies

Single-use bioreactors and closed-system media handling solutions redefine manufacturing efficiency. Automation reduces process variability and labor dependency. Standardized disposable systems minimize cleaning validation and contamination risks. The trend supports flexible production in multi-product facilities. Media developers customize formulations compatible with automated platforms. Integration of monitoring sensors enhances process control and data collection. It contributes to higher productivity in commercial gene therapy operations. Adoption accelerates due to its cost and time efficiency benefits.

- For instance, the Sartorius ambr® 250 High Throughput bioreactor system enables parallel operation of up to 24 single-use bioreactors, with published studies and manufacturer data showing a 50% reduction in system hands-on time for bioprocess development compared to conventional scale-down models, while maintaining high data quality.

Emergence of Tailored Media for Specific Vector Platforms

Viral vector manufacturing drives innovation in media customization. Suppliers design formulations optimized for AAV, lentivirus, and adenovirus production. These specialized media improve vector titers and reduce batch variability. Manufacturers rely on defined nutrient profiles for high-density culture conditions. Development teams align product performance with vector type and host cell preference. The approach enhances reproducibility in research and GMP environments. It allows better scalability from lab to production scale. It strengthens market differentiation among leading media providers.

- For instance, FUJIFILM Irvine Scientific’s BalanCD HEK293 Viral Feed achieved a 3-fold to 10-fold increase in adeno-associated virus (AAV) yields compared to conventional basal media, with verifiable results demonstrating this improvement at 10-liter bioreactor scale, as reported in their 2024–2025 product literature and validation studies.

Growing Outsourcing of Gene Therapy Manufacturing Services

The rising complexity of gene therapy production increases outsourcing to contract development and manufacturing organizations (CDMOs). These firms require flexible media compatible with multiple production lines. Media suppliers collaborate closely to ensure supply continuity and customization. The trend helps smaller biotech firms accelerate clinical development. Outsourcing reduces infrastructure investment and shortens time to market. CDMOs implement platform-based production strategies using advanced formulations. It fosters partnerships across the global therapeutic manufacturing ecosystem. The outsourcing expansion fuels stable media demand worldwide.

Market Challenges Analysis

High Production Costs and Stringent Quality Control Requirements

The Gene Therapy Cell Culture Media Market faces high costs linked to raw materials and advanced formulation processes. Manufacturers manage strict regulatory standards to ensure batch consistency and sterility. Achieving GMP compliance increases operational complexity. Quality testing for each batch delays production cycles. Dependence on specialized ingredients raises supply chain risks. Cost pressure limits adoption by smaller biotech companies. It requires continuous optimization to balance performance and affordability. Market participants focus on innovation to mitigate financial constraints while maintaining quality standards.

Limited Scalability and Technical Expertise in Manufacturing

Gene therapy manufacturing involves complex vector production and cell culture handling. Many organizations lack expertise to scale laboratory methods to commercial levels. Integration of advanced automation tools demands technical training and infrastructure upgrades. Limited access to qualified personnel hinders efficiency. Supply chain disruptions of critical ingredients add unpredictability to production planning. Media developers must design robust formulations for varied process parameters. It creates a learning curve for emerging biotech manufacturers. Addressing scalability challenges remains key to sustainable market expansion.

Market Opportunities

Expansion of Contract Manufacturing and Research Collaborations

The Gene Therapy Cell Culture Media Market gains major opportunities from expanding partnerships between biopharma companies and CDMOs. Contract manufacturing enables flexible production capacity for clinical and commercial applications. Collaboration supports rapid process optimization and technology transfer. Research institutions partner with media suppliers to create next-generation formulations. Government funding for advanced therapy manufacturing promotes innovation hubs. These collaborations improve accessibility to specialized media solutions. It strengthens global supply networks and accelerates therapy commercialization. Strategic alliances continue to drive growth across multiple regions.

Growing Investment in Emerging Economies and Personalized Therapies

Rapidly developing biotechnology sectors in Asia-Pacific and Latin America open new growth avenues. Local manufacturing encourages adoption of affordable and high-performance culture media. Expansion of clinical trials for rare and genetic diseases increases demand. Governments support infrastructure development through tax incentives and grants. The rising focus on personalized medicine fuels innovation in customized formulations. Media developers invest in region-specific product lines to meet localized needs. It creates sustainable long-term opportunities in global production ecosystems. Market players benefit from expanding reach and patient accessibility.

Market Segmentation Analysis:

By Media Type

The Gene Therapy Cell Culture Media Market includes diverse media such as stem cell media, serum-free, chemically defined, and specialty formulations. Serum-free and chemically defined media lead demand due to their consistency and regulatory acceptance. Stem cell media maintain importance in regenerative medicine and personalized therapy production. Specialty and custom media meet niche manufacturing requirements for advanced therapies. Basal and complex media support standard culture applications in R&D environments. Lysogeny broth remains relevant for bacterial expression systems used in upstream research. It grows with increasing adoption of high-quality, animal-origin–free formulations for reproducible performance.

- For instance, Thermo Fisher Scientific’s Gibco CTS OpTmizer T-Cell Expansion SFM has become widely adopted in clinical T-cell research applications including CAR-T-cell culture where it supports high-density T-cell expansion above 4 x 10⁶ CD3+ T-cells/mL, and maintains greater than 90% average T-cell fold expansion from healthy donors.

By Formulation / Format

Liquid ready-to-use media dominate due to convenience, quality assurance, and reduced preparation time. Powder or concentrate forms gain attention for their cost-effectiveness and storage benefits in bulk manufacturing. Kit-based combinations simplify research-scale workflows, integrating supplements and feeds. Custom blends address the needs of contract development and manufacturing organizations seeking tailored process solutions. It demonstrates strong demand for flexible supply formats suitable for both clinical and commercial environments. Suppliers focus on ensuring compatibility with automated systems and GMP processes. Packaging innovations continue to improve ease of handling and minimize contamination risk.

By Cell Type / Target Cell Line

HEK293 and HEK293T cell lines hold the largest usage share in gene therapy applications. Media optimized for adherent and suspension HEK cultures enable high viral vector yield. CHO cells support select biologics and vector processes, maintaining moderate adoption. Primary T-cell media demand rises with expanding CAR-T therapy pipelines. Stem cell media advance through innovations supporting iPSC and MSC culture systems. Other producer and insect cell lines add versatility in platform manufacturing. It continues to gain traction from increasing diversification of therapeutic production models.

By Viral Vector Type

Adeno-associated virus (AAV) dominates the vector category, driven by its safety profile and therapeutic success. Lentivirus and retrovirus platforms sustain strong adoption for stable gene delivery applications. Adenovirus use continues in vaccine and oncolytic therapy production. Media formulations tailored to these vector types enhance transfection efficiency and culture viability. Specialized media support herpes simplex, poxvirus, and vaccinia production in niche workflows. Emerging viral systems expand the portfolio of optimized formulations. It reflects an evolving balance between established and next-generation vector technologies.

- For instance, Sartorius’ BIOSTAT STR 2000 single-use bioreactor has delivered viability above 90% and demonstrated process equivalency for large-scale viral vector manufacturing at the 2,000-L scale, with successfully benchmarked titers and performance in continuous cell culture operation against stainless steel reference systems, as published in functional equivalence studies.

By End User

Pharmaceutical and biotechnology companies lead the market due to large-scale biologics and gene therapy production. Research laboratories form the second major segment, focusing on development and optimization of new therapies. Academic institutes contribute to innovation through early-stage studies and vector platform refinement. Diagnostics players adopt specialized media for assay development and validation. It experiences steady growth from collaborations between industrial and academic research networks. Demand from emerging biotech startups enhances long-term market expansion and diversification.

Segmentation:

By Media Type:

- Stem Cell Media

- Serum-Free Media

- Chemically Defined Media

- Specialty Media

- Lysogeny Broth

- Custom Media

- Basal Media

- Complex Media

- Serum Containing Media

By Formulation / Format:

- Liquid Ready-to-Use Media

- Powder / Concentrate Media

- Kits (media + supplements + feeds)

- Custom Blends

By Cell Type / Target Cell Line:

- HEK293 / HEK293T

- Adherent HEK media subvariants

- Suspension HEK optimized media

- CHO (Biologics / Some Vector Workflows)

- Primary T Cells

- T-cell activation & expansion media

- Cytokine-supplemented feeds (IL-2, IL-7/15 supports)

- Stem Cells (iPSC / MSC)

- Other Producer or Specialist Cell Lines

- Producer lines

- Insect cells for certain vectors

By Viral Vector Type:

- Retroviruses

- Lentiviruses

- Adenoviruses

- Adeno-Associated Virus (AAV)

- Herpes Simplex Virus

- Poxvirus

- Vaccinia Virus

- Others

By End User:

- Pharmaceutical and Biotechnology Companies

- Research Laboratories

- Academic Institutes

- Diagnostics

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North American region holds approximately 44 % of the global share of the Gene Therapy Cell Culture Media Market. This dominant position comes from strong investments in biotechnology, a high number of clinical gene-therapy trials, and a mature commercial manufacturing base. It leads in adoption of advanced culture media formats and viral-vector production processes. The United States drives most of this regional demand given its large pharma and biotech presence. Ongoing infrastructure expansion and regulatory support reinforce the region’s leadership. It remains the focal point for suppliers targeting scale-up of gene therapy manufacturing.

Europe captures roughly 30 % of the global market share in this segment. The region benefits from growing gene-therapy approvals, increasing research funding and expanding contract manufacturing operations in countries like Germany, UK and France. It shows steady demand for optimized cell-culture media tailored for vector and cell-therapy workflows. Suppliers establish European-based manufacturing and distribution hubs to serve regional demand efficiently. It plays a key role in the global supply chain for advanced media products and manufacturing solutions.

The Asia-Pacific region accounts for about 20 % of the global market share and stands out for its rapid growth trajectory. Countries such as China and India expand their biotech manufacturing capacity and work through supportive government policies to boost gene-therapy development. The region attracts foreign investment in media manufacturing and distribution, responding to local demand for cost-effective solutions and growing clinical trial activity. It presents high potential for media suppliers to establish production facilities and partnerships. It increasingly contributes to the global gene-therapy media ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

In the Gene Therapy Cell Culture Media Market, the competitive landscape features leading global suppliers that offer broad product portfolios and manufacturing scale. Companies such as Thermo Fisher Scientific, Lonza Group and Sartorius AG hold strong positions thanks to integrated capabilities across media development, process support and global supply networks. These firms invest in custom media solutions, assay optimization and process validation for gene-therapy workflows. Smaller or niche players compete by offering tailored formulations, regional support and specialized customer service. Suppliers differentiate through regulatory compliance, animal-origin-free media and high-throughput scalability. It requires continuous innovation in formulation science and strong collaboration with CDMOs and gene-therapy developers to sustain competitive advantage.

Recent Developments:

- In September 2025, Fujifilm Biosciences launched the BalanCD HEK293 Perfusion A medium. This specialized medium supports scalable, high-density viral vector production for gene therapies by utilizing suspension HEK293 cells combined with perfusion technology and ensuring broad workflow compatibility.

- In July 2025, BioLife Solutions made a strategic investment in Pluristyx, a developer of induced pluripotent stem cell (iPSC) products for cell therapy developers. In addition to this investment, BioLife secured certain rights for potential future acquisition of Pluristyx, aligning with its expansion into next-generation biopreservation and bioprocessing products.

- In June 2024, Takara Bio announced a business partnership with Gap Junction Therapeutics to jointly develop an AAV gene therapy for hereditary hearing loss. This strategic collaboration expands Takara Bio’s presence in the gene therapy domain, leveraging its expertise in cell manufacturing and media solutions to innovate new therapy pipelines for genetic disorders.

- In April 2024, Miltenyi Biotec entered into a strategic partnership with MiLaboratories, a company specializing in RNA immune technologies and NGS data analysis software, to advance the field of next-generation therapies. This partnership integrates MiLaboratories’ RNA kit technology and software platforms into Miltenyi Biotec’s offerings, further supporting genomic data analysis capabilities for gene therapy research.

Report Coverage:

The research report offers an in-depth analysis based on Media Type, Formulation / Format, Cell Type / Target Cell Line, Viral Vector Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for scalable and GMP-compliant media will strengthen manufacturing reliability.

- Increased approval of gene therapy products will accelerate adoption of optimized culture media.

- Transition to chemically defined and xeno-free formulations will drive process consistency.

- Custom media development by CDMOs will expand to meet client-specific process needs.

- Automation and closed-system integration will enhance production efficiency and contamination control.

- Expansion of biomanufacturing facilities across Asia-Pacific will boost regional supply capabilities.

- Strategic collaborations between biotech firms and media suppliers will support faster innovation.

- Research advances in viral vector systems will encourage continuous formulation upgrades.

- Regulatory alignment across major markets will simplify product standardization and commercialization.

- The industry will focus on cost reduction through concentrated and ready-to-use media formats.