Market Overview

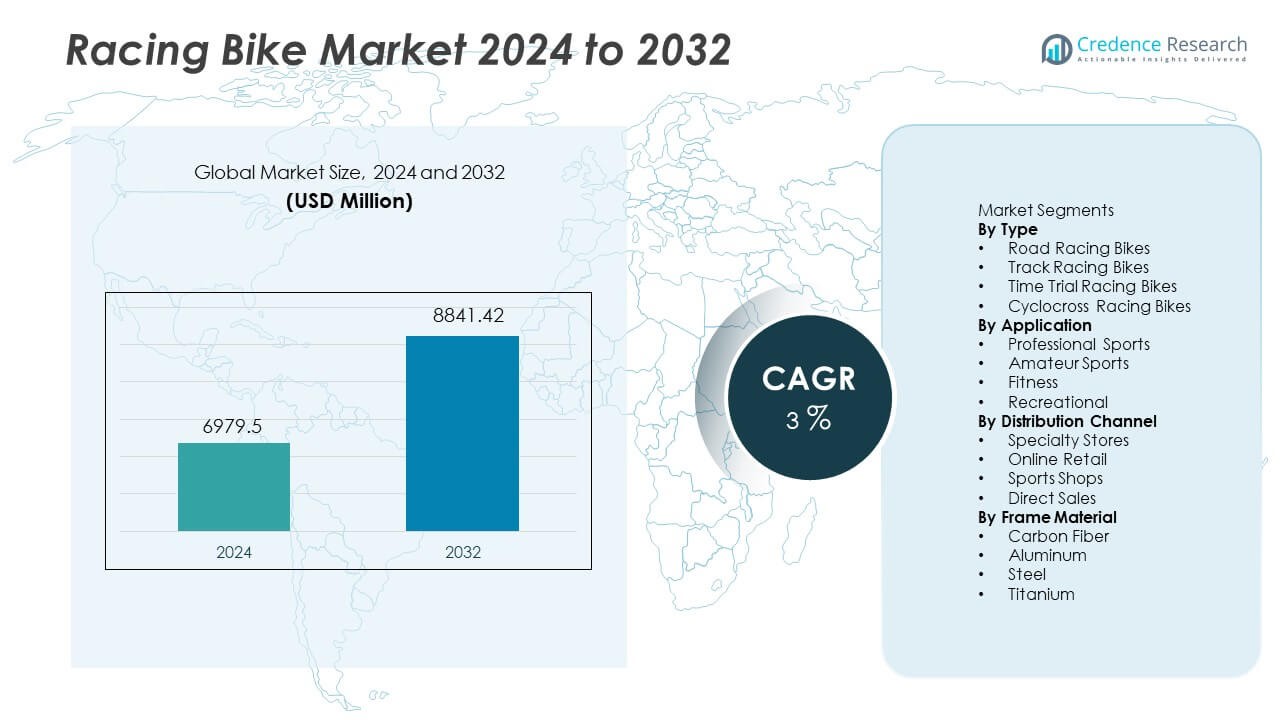

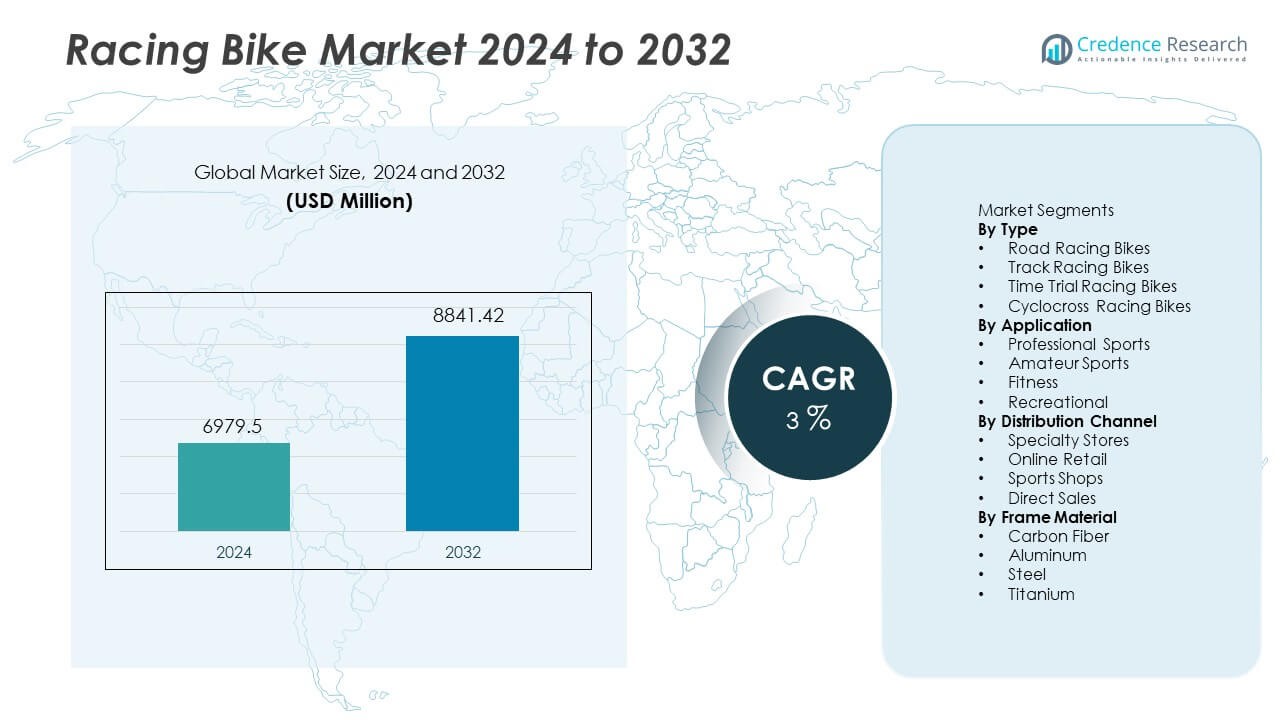

The racing bike market reached USD 6,979.5 million in 2024. The market is forecast to grow to USD 8,841.42 million by 2032. This sector is expected to expand at a CAGR of 3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Racing Bike Market Size 2024 |

USD 6,979.5 Million |

| Racing Bike Market, CAGR |

3% |

| Racing Bike Market Size 2032 |

USD 8,841.42 Million |

Top players in the racing bike market include Specialized Bicycle Components, Trek Bicycle, Giant Bicycles, Cannondale, Canyon Bicycles, BMC Switzerland, Merida Industry, Focus Bikes, Colnago, and Bianchi. These companies focus on advanced carbon frames, aerodynamic geometry, and integrated performance components that support professional racing standards and endurance cycling needs. Europe stands as the leading region with 34% share, supported by strong cycling culture, established tournaments, and high participation in professional road racing events. Asia Pacific follows with rising demand driven by expanding fitness adoption, increasing cycling clubs, and growth in competitive events across China, Japan, and Australia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The racing bike market reached USD 6,979.5 million in 2024 and is forecast to hit USD 8,841.42 million by 2032 at a CAGR of 3%.

- Growing participation in competitive cycling and rising interest in endurance fitness drive advanced frame adoption and premium product replacement across professional and amateur racing segments.

- Carbon frame innovation, aerodynamic integration, and rising customization trends support premium demand and encourage rapid component upgrades across Road Racing Bikes, which held 42% share.

- Leading companies focus on sponsorships, performance engineering, and lightweight material development, while high cost and limited cycling infrastructure in developing regions restrict wider adoption and volume penetration.

- Europe leads with 34% share, followed by Asia Pacific at 29% and North America at 28%, while Latin America and Middle East and Africa remain smaller markets due to limited racing culture and lower spending on premium performance equipment.

Market Segmentation Analysis:

By Type

Road racing bikes remained the dominant type and held 42% share in 2024, supported by their strong use in global racing tournaments and rising interest in long-distance endurance events. Track models gained steady demand from velodrome facilities and national cycling programs, while time trial products benefited from aerodynamic frame advances and carbon integration. Cyclocross racing bikes saw higher uptake across mixed-terrain competitions and winter sports clubs, which widened adoption outside traditional road segments. Manufacturers continued to launch lightweight frames and integrated braking systems that improved speed and safety, directly lifting demand in premium ranges. Endurance racing remains the primary growth driver as consumer focus shifts toward long-distance performance training and organized road events across developed markets worldwide.

- For instance, Specialized introduced the S-Works Tarmac SL8 with frame weight near 685 grams and reported drag reduction of 16 watts at 45 km/h compared with its earlier SL7 platform.

By Application

Professional sports accounted for the highest application share, representing 46% of total demand due to strong participation in international cycling events and brand sponsorship programs. Amateur riders expanded the consumer base through regional events and cycling clubs, while fitness-focused consumers adopted racing models as part of endurance and health routines. Recreational riders increasingly selected entry-level racing frames that offer competitive performance without premium pricing. The growth of televised cycling competitions and rising sponsorship investments strengthened product visibility across new countries. Expanding cycling academies and training institutions accelerated equipment replacement cycles. Product innovation, improved aerodynamics, and custom frame geometry further boosted professional usage, while amateur participation benefited from growing sports tourism and wider access to certified racing tracks.

- For instance, Canyon released the Aeroad CFR and used premium Toray M40X carbon to create a frame with next-level stiffness proven by many pro victories in UCI WorldTour stages.

By Distribution Channel

Specialty stores dominated distribution and captured 41% share, driven by greater preference for expert consultation, customized sizing, and professional component fitting that supports improved performance. Online retail expanded quickly through digital catalogs and configuration tools, while sports shops maintained steady volumes across urban locations offering mid-range racing products. Direct sales models increased due to brand-owned stores and test-ride events that promoted product engagement and brand loyalty. Better availability of premium carbon frames within specialty channels encouraged higher spending among professional and amateur riders. Online platforms capitalized on global shipping and seasonal promotions. Growing digital awareness and direct customization remained key drivers, while specialty stores continued to lead due to strong after-sales services and technical support advantages.

Key Growth Drivers

Rising Participation in Competitive Cycling

Competitive cycling events continue to expand across international and regional levels. Racing tournaments encourage higher product demand among professional and amateur riders. Sponsorship investments increase media exposure and improve athlete engagement with premium bikes. National cycling federations provide training support that drives equipment upgrades. Growing interest in endurance events attracts new entrants, who prefer advanced frames and lighter components. Youth programs encourage participation and help expand long-term cycling culture. Major brands partner with global competitions to promote performance models. This factor strengthens adoption in regions with established cycling networks and expanding sports tourism across many developed economies.

- For instance, Trek supplied the Madone SLR platform to the Lidl-Trek WorldTour team, which used it successfully in various stages, including mountainous terrain, demonstrating its capability as a versatile race bike.

Advances in Lightweight Materials

Innovations in carbon fiber and titanium frames support better aerodynamics and higher performance during long distance rides. Manufacturers focus on weight reduction without weakening durability or rigidity. Advanced components improve speed, handling, and climbing efficiency for competitive use. Integrated braking and aerodynamic profiles enhance safety and stability. Material innovation drives premium pricing and encourages professional riders to replace older frames. Composite structures deliver improved shock absorption during tough terrain rides. Investments in research and racing technology push steady product upgrades. This factor maintains brand differentiation and strengthens demand for high-end professional segments across competitive events.

- For instance, Pinarello used Torayca T1100 1K carbon on the Dogma F platform delivering frame stiffness near 128 N/mm during lab testing, Wilier Triestina applied HUS-MOD carbon on the Filante SLR and achieved sub-800 gram framesets across size medium builds, and Scott introduced the Foil RC using F01 airfoil shaping that reduced drag values by 13 watts at 45 km/h in wind tunnel measurements conducted in Switzerland.

Growing Fitness and Endurance Culture

Fitness demand rises as consumers adopt cycling for health improvement and personal performance goals. Social media platforms encourage participation through cycling groups and virtual long-distance challenges. Fitness apps promote tracking features that increase daily use of racing bikes. Gyms and sports academies add endurance cycling programs that raise adoption among new riders. Urban populations shift toward low-impact exercise and sustainable outdoor sports. Rising awareness of cardiovascular benefits supports consistent demand. The growing preference for long weekend rides also supports racing format choices. This driver expands customer interest beyond competitive sports and strengthens long-term product demand.

Key Trends and Opportunities

Expansion of E-Racing Platforms

Virtual racing events create new participation channels for global cyclists. Online simulation platforms host competitions that replicate professional circuits and endurance races. Riders invest in racing models that support digital resistance systems and precision drivetrain inputs. Smart trainers and connectivity solutions strengthen interest among home users. Brands sponsor e-racing leagues that attract large audiences and new athletes. Demand for data-enabled components grows due to performance analytics integration. Technology partnerships with sporting platforms generate long-term engagement. This trend opens cross-selling opportunities for digital accessories and performance upgrades across professional and recreational users.

- For instance, Wahoo Fitness integrated dual-band ANT+ and Bluetooth connectivity on its KICKR Smart Trainer supporting very high power accuracy, Tacx deployed Neo 2T direct drive technology enabling significant max torque output during virtual climbs, and Elite developed RealMotion inertia control delivering a substantial flywheel resistance on the Direto XR model for immersive e-racing training.

Customization and Premium Component Adoption

Consumers demand customized racing bikes that match fit, aerodynamics, and handling preferences. Riders select frame geometry, wheel profiles, and gearing based on competition needs or terrain type. Custom options support premium pricing and higher brand loyalty. Professional teams adopt precision-engineered drivetrains and aero components that showcase technology advantages. Demand for integrated cockpit designs and hidden cable routing expands across new launches. Lightweight wheels and advanced braking systems become standard in mid-premium ranges. This opportunity supports higher margins for leading brands and promotes frequent replacement cycles across professional riders and serious enthusiasts.

- For instance, Shimano delivered 12-speed Dura-Ace R9200 drivetrains with closer gear steps in the cassette’s “sweet spot” for race efficiency, enabling smooth and continuous pedaling cadence. SRAM introduced RED AXS wireless shifting known for being its most responsive, quick, and precise front shifting to date.

Key Challenges

High Cost of Premium Racing Products

Premium racing bikes require advanced materials and high-precision engineering, which keeps pricing elevated for most consumer groups. Cost barriers limit adoption among amateurs and recreational cyclists in price-sensitive markets. Elite professional models require frequent component upgrades that further increase total spending. Many buyers postpone replacement decisions due to high investment requirements. Limited affordability slows penetration in emerging regions where cycling culture remains developing. Competitive brands introduce entry-level models, yet price remains a core restraint. This challenge continues to restrict volume expansion across non-professional user bases.

Limited Infrastructure in Developing Regions

Many developing regions lack dedicated cycling tracks and training facilities, which restricts participation in competitive racing formats. Urban traffic congestion and safety concerns discourage regular road usage among amateur riders. Limited access to skilled service centers slows adoption of advanced performance models. Racing events remain concentrated in established markets with strong cycling infrastructure. Developing countries need public programs and community support to encourage long-term participation. Without track networks and safe cycling lanes, market penetration stays uneven. This challenge slows brand expansion and limits racing culture development across emerging markets.

Regional Analysis

North America

North America accounted for 28% share in 2024, supported by strong cycling sports culture and widespread adoption of premium racing components. The United States leads demand due to large endurance communities and increasing participation in triathlon events. Canada benefits from organized cycling leagues and expanding investment in training facilities across urban centers. Product replacement rates remain high due to technology upgrades and performance optimization trends. Brands focus on carbon frames and advanced wheel systems that appeal to competitive users. Growth continues to depend on cycling infrastructure development and promotional activities from regional sports associations across both countries.

Europe

Europe held 34% share and remained the leading regional market owing to deep-rooted cycling traditions and strong professional racing tournaments such as Tour de France and Giro d’Italia. Western European countries support large-scale cycling participation and early adoption of lightweight materials in high-performance models. Increasing interest in recreational cycling improves entry-level segment penetration. Manufacturers expand sponsorship programs across European racing events, improving consumer engagement and brand recall. Product innovation focuses on aerodynamic frames tailored to European racing routes and climatic conditions. Rising government support for cycling-friendly mobility solutions continues to reinforce demand across professional and amateur riders.

Asia Pacific

Asia Pacific represented 29% share and recorded the fastest growth due to rising interest in competitive cycling events and emerging sports culture across China and Japan. Expanding urban cycling clubs support strong adoption of high-performance bikes among younger riders. Technological improvements in carbon fiber manufacturing across Asian countries enable competitive pricing compared with Western brands. Australia and South Korea report increasing cycling sports participation and rising demand for advanced racing components. Government focus on outdoor sports and health improvement contributes to broader consumer awareness. Asia Pacific remains a significant growth opportunity due to expanding recreational and competitive user bases.

Latin America

Latin America accounted for 5% share, driven by increasing interest in endurance cycling across Mexico, Brazil, and Argentina. Growth remains supported by regional cycling tournaments, expanding sports retail chains, and rising availability of imported premium models. High cost remains a challenge for wider market penetration, which keeps professional and amateur segments relatively narrow. Urban cycling initiatives and fitness awareness encourage long-distance riding and weekend activities, which support future adoption. Retail expansion and online sales channels help improve product accessibility. Market outlook remains positive but depends on economic stability and local sponsorship support across regional cycling events.

Middle East and Africa

Middle East and Africa held 4% share with gradual adoption driven by rising sports tourism and premium lifestyle spending in Gulf countries. Regional cycling events in the UAE and Qatar encourage greater participation in competitive racing and high-performance road biking. Local climate conditions favor indoor cycling clubs and specialized training centers, supporting niche demand for advanced frames. Africa shows early-stage growth led by recreational cycling and limited racing infrastructure. Price sensitivity remains a key barrier to expansion in many markets. Further development depends on sports promotion initiatives, cycling infrastructure, international events, and investment in professional training programs across major cities.

Market Segmentations:

By Type

- Road Racing Bikes

- Track Racing Bikes

- Time Trial Racing Bikes

- Cyclocross Racing Bikes

By Application

- Professional Sports

- Amateur Sports

- Fitness

- Recreational

By Distribution Channel

- Specialty Stores

- Online Retail

- Sports Shops

- Direct Sales

By Frame Material

- Carbon Fiber

- Aluminum

- Steel

- Titanium

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape includes Specialized Bicycle Components, Trek Bicycle, Giant Bicycles, Cannondale, Canyon Bicycles, BMC Switzerland, Merida Industry, Focus Bikes, Colnago, and Bianchi. Leading companies focus on lightweight carbon frames, aerodynamic designs, and integrated braking systems to enhance racing performance. Global brands continue to invest in sponsorships and professional cycling teams, which strengthen brand visibility and encourage adoption among amateur and professional users. Manufacturers emphasize research and material innovation, especially in carbon composites and advanced wheel systems, to support speed and handling advantages. Digital platforms help companies promote direct sales and customized configurations, improving premium revenue opportunities. Many players expand distribution partnerships with specialty retailers and online channels to reach diverse user groups, while selective localization strategies support competitive positioning across key regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Colnago launched a new track racing bike – the T1Rs, dubbed the fastest bike in Colnago’s range.

- In September 2025, Bianchi unveiled limited-edition “Founder’s Edition” versions of its top racing bikes – the Specialissima RC and Oltre RC – to mark its 140th anniversary.

- In July 2025, teams riding for the top pro tours used bikes from Canyon and Specialized as the most common brands at the Tour de France, showing these brands’ dominance in high-level road racing this season.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel, Frame Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for aerodynamic frames will increase due to growing competition levels.

- Lightweight carbon components will expand across mid-premium ranges.

- Professional sponsorships will strengthen adoption among emerging racing teams.

- Fitness and endurance cycling will boost sales across urban markets.

- E-racing platforms will encourage digital engagement and product upgrades.

- Smart connectivity in drivetrains will support real-time performance feedback.

- Replacement cycles will shorten in premium racing and triathlon segments.

- Regional brands will expand through online retail and customization.

- Government cycling programs will raise participation in new regions.

- Continued material innovation will drive safety, speed, and long-distance performance.