Market Overview:

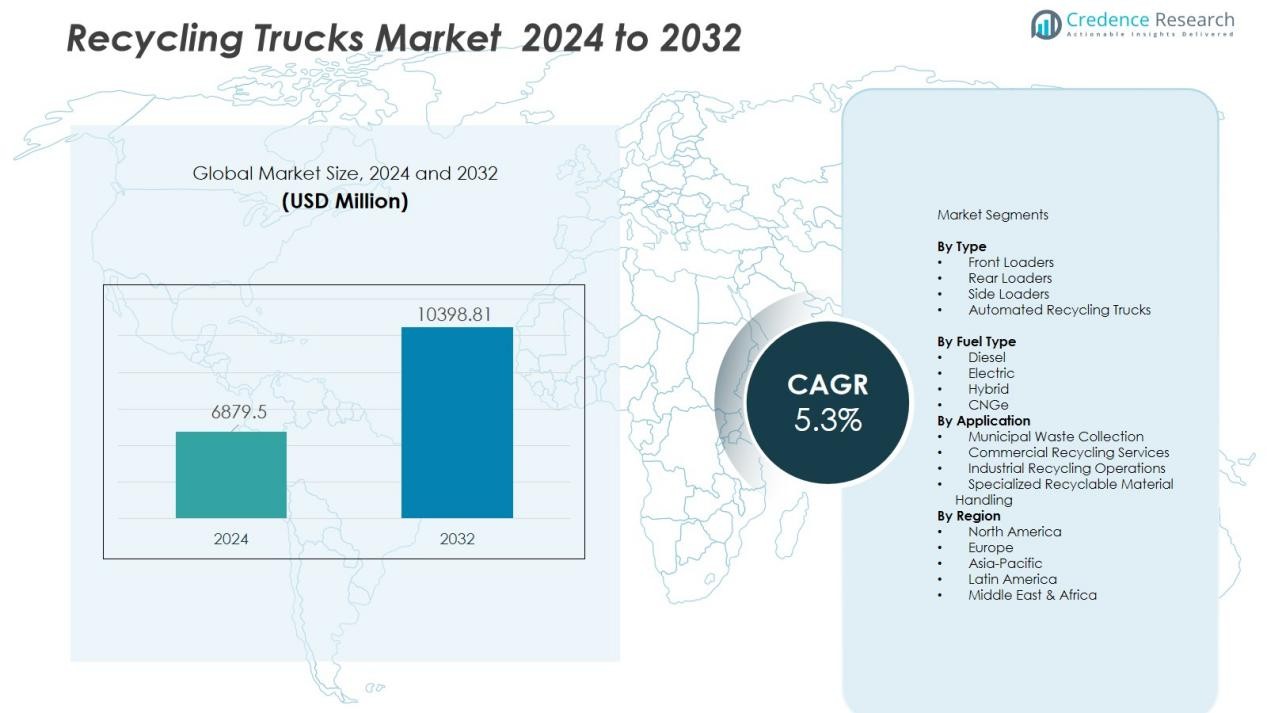

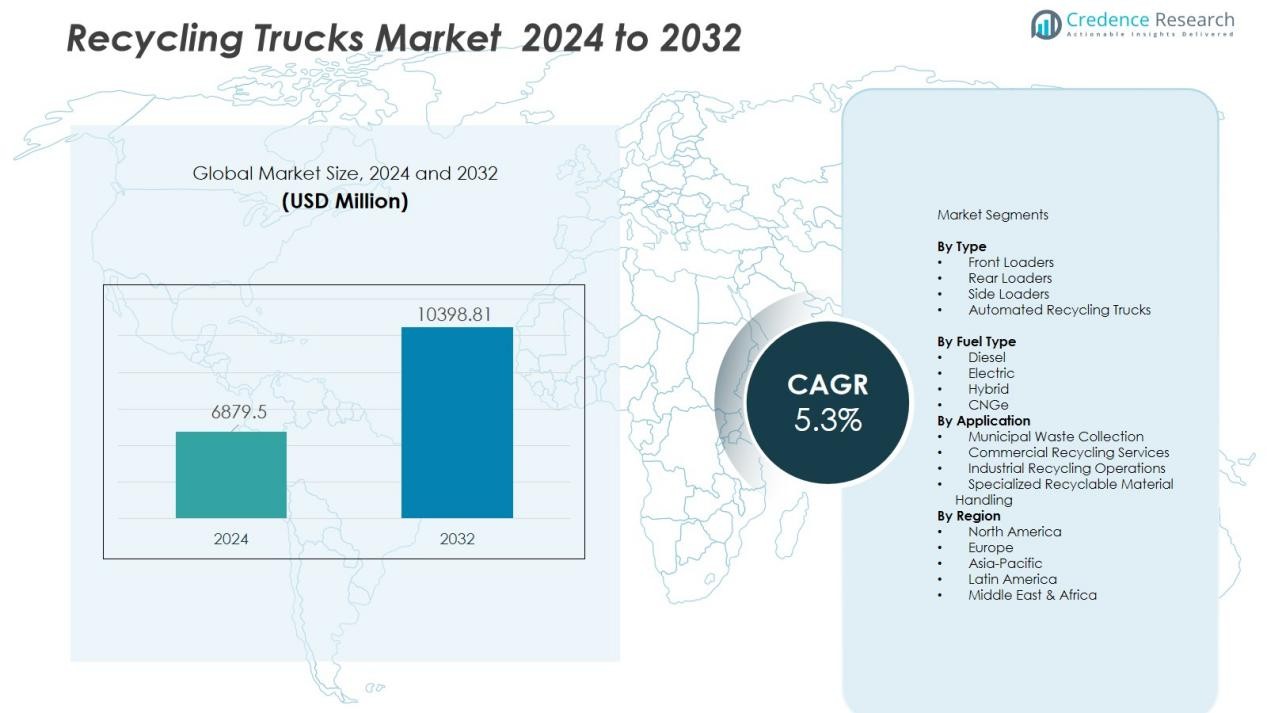

The Recycling Trucks Market size was valued at USD 6879.5 million in 2024 and is anticipated to reach USD 10398.81 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recycling Trucks Market Size 2024 |

USD 6879.5 Million |

| Recycling Trucks Market, CAGR |

5.3% |

| Recycling Trucks Market Size 2032 |

USD 10398.81 Million |

Key market drivers include rapid urbanization, escalating recycling targets set by governments, and growing corporate emphasis on environmental compliance. Technological advancements—such as smart bins, telematics integration, and automated side loaders—are optimizing collection processes and reducing manpower dependency. Additionally, the need to handle segregated waste streams responsibly, including plastics, paper, metals, e-waste, and organics, is boosting the adoption of specialized recycling truck models. Fleet modernization programs by municipalities further support market momentum.

Regionally, North America and Europe dominate the market due to stringent waste reduction laws, large-scale recycling infrastructure, and incentives for green vehicle adoption. Asia-Pacific is expected to register the fastest growth, supported by expanding smart city initiatives, infrastructure upgrades, and heightened environmental awareness in high population nations such as China and India. Emerging regions in Latin America and the Middle East are gradually investing in organized recycling systems, contributing to incremental market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Recycling Trucks Market was valued at USD 6,879.5 million in 2024 and is projected to reach USD 10,398.81 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- North America leads with a 34.1% share due to established municipal recycling infrastructure, regulatory mandates, and strong investment in automated and electric fleets; Europe follows at 30.7%, supported by circular economy policies and advanced vehicle adoption; Asia-Pacific holds 22.5%, driven by population growth and rising waste collection demands in urban centers.

- Asia-Pacific is the fastest-growing region with a projected CAGR above 6.1%, fueled by smart city programs, public infrastructure upgrades, and increased demand for compact and automated recycling fleets in countries like China and India.

- By vehicle type, automated side loader trucks hold the largest share at 39.2%, favored for their labor efficiency, route consistency, and reduced contamination during waste collection.

- Rear loader trucks account for 28.6% of the market, supported by their continued use in residential zones and flexible operation across mixed and dense urban routes.

Market Drivers:

Market Drivers:

Rising Regulatory Mandates for Waste Collection and Segregation

Governments enforce recycling targets and strict waste management regulations that push municipalities to upgrade their fleet. These mandates encourage the use of specialized trucks designed for segregated waste streams such as plastics, paper, and organics. Compliance drives investment in mechanized and automated vehicles with higher collection efficiency. Recycling Trucks Market benefits from stronger environmental policies that demand organized collection systems. It supports cleaner cities and improved recycling outcomes for both urban and semi-urban areas.

- For instance, Prairie Robotics equipped Bay City, Michigan’s recycling trucks with AI cameras and GPS in a December 2023 pilot, monitoring bin contents to cut contamination.

Growing Urban Population and Increasing Municipal Waste Volumes

Rapid urbanization expands household and commercial waste generation, placing pressure on collection networks. Municipal authorities focus on modernizing infrastructure to manage rising waste volumes effectively. Recycling vehicles with greater payload capacity and smart route systems help improve operational throughput. It enables consistent waste recovery and reduces landfill dependence. Higher waste volumes directly enhance demand for advanced recycling trucks across developing and developed regions.

- For instance, Tata Motors’ Prima 2528.K tipper truck, which is designed for a 16-ton application segment, features an actual payload capacity of approximately 10 to 14.6 tons (10,000 kg to 14,600 kg).

Fleet Modernization and Shift Toward Automated Waste Handling

Municipalities and private waste management firms upgrade outdated fleets to reduce manual labor and improve safety. Automated side loaders, compactors, and hydraulic handling systems reduce physical strain on workers and cut operational time. These systems improve waste loading accuracy and minimize contamination during transfer. It supports faster turnaround on routes and improves overall productivity. The market sees strong demand for vehicles that deliver standardized performance through automation.

Transition to Low-Emission and Electric Recycling Vehicles

The industry adopts electric and hybrid recycling trucks to reduce emissions and fuel expenditures. Governments introduce incentives and clean mobility programs that encourage the purchase of sustainable waste collection vehicles. Electric fleets provide quieter operation, lower maintenance needs and predictable long-term operating costs. It helps cities meet climate goals while improving air quality metrics. The preference for sustainable truck models strengthens demand for clean powertrains in waste collection fleets.

Market Trends:

Expansion of Fully Electric and Hybrid Recycling Fleets

Cities and private operators steadily deploy electric and hybrid recycling vehicles to support net-zero and low-emission mobility goals. Fleet owners seek lower lifecycle costs and quieter operations that suit dense residential areas. Charging infrastructure expands across municipal depots, allowing efficient overnight power management. Battery performance improves with higher durability and extended range, making electric fleets suitable for long collection routes. Manufacturers integrate regenerative braking and energy-efficient compaction systems that reduce power consumption. Recycling Trucks Market gains traction as governments provide incentives for cleaner technologies. It encourages truck makers to scale production of emission-free models tailored for urban and semi-urban waste systems.

- For instance, Volvo’s FE Electric refuse truck manages gross vehicle weights (GVW) of up to 27 tonnes and has a typical operational payload of around 10-11 tonnes, delivering zero tailpipe emissions during urban collections.

Integration of Smart Telematics and Automated Waste Handling Technologies

Telematics systems support route planning, real-time fleet monitoring, and predictive maintenance for waste collection trucks. Automation grows through hydraulic lifters, robotic arms, and optical sensing units that reduce manual contact with waste. Smart load sensors optimize compaction capacity, helping operators avoid overflow trips and unnecessary fuel use. Cloud-based interfaces enable municipal authorities to track collection efficiency and vehicle performance metrics. The market shifts toward data-driven operations that improve sustainability and service reliability. AI-supported route algorithms help reduce idle time and prioritize high-volume pickups. It promotes a streamlined and safer collection model that supports scalable waste management infrastructures.

- For instance, Parker Hannifin’s electric hybrid system in automated side loaders uses a 10.4 kWh battery to handle over 300 garbage can pickups per charge on dense routes.

Market Challenges Analysis:

High Capital Costs and Limited Budget Allocation for Fleet Upgrades

Municipalities face high procurement costs when replacing conventional vehicles with specialized recycling fleets. Limited public funding slows large-scale adoption, especially in small towns and emerging economies. Some waste management operators rely on older trucks because new vehicles require advanced maintenance skills and higher spare part expenses. Training requirements for automated systems increase operational spending. Recycling Trucks Market experiences slower penetration in regions with constrained budgets. It creates a gap between regulatory expectations and actual deployment capacity.

Operational Complexity and Inadequate Waste Segregation Infrastructure

Recycling trucks require efficient segregation at source to operate at full capacity. Poor community participation in waste sorting reduces vehicle efficiency and increases contamination risk during pickup. Operators face challenges in route optimization when infrastructure for segregated bins or collection points remains underdeveloped. Maintenance requirements for advanced hydraulic and electric systems demand skilled technicians. The lack of standardized waste handling policies complicates fleet planning for private and municipal users. It restricts the scalability of modern recycling vehicle solutions across diverse waste ecosystems.

Market Opportunities:

Growth Potential in Electric and Low-Maintenance Fleet Solutions

Electric recycling trucks create strong opportunities for municipalities seeking long-term cost efficiency and compliance with emission goals. Government rebates for cleaner fleets encourage wider procurement of battery-powered models. Manufacturers can expand their product range with compact vehicles for narrow urban streets and heavy-duty variants for bulk collection routes. Predictable operating costs and reduced maintenance needs improve fleet planning for waste service operators. Recycling Trucks Market benefits from rising interest in low-noise and low-carbon vehicles that support smart city strategies. It enables fleet providers to position sustainable trucks as a core part of waste modernization programs.

Demand for Smart Automation and Digital Waste Collection Systems

Route analytics, telematics, and sensor-based load management offer compelling opportunities for efficiency-driven waste management companies. Smart systems support error-free pickup, resource allocation, and contamination reduction in segregated waste streams. Automated lifters and robotic arms reduce labor risk while enhancing safety standards during collection. Digital dashboards enable municipal authorities to track vehicle performance and optimize service frequency in high-density neighborhoods. Manufacturers can integrate cloud capabilities with compactors, bins, and onboard diagnostics for real-time visibility. It strengthens the business case for data-centric waste collection platforms that scale with urban infrastructure growth.

Market Segmentation Analysis:

By Type

The market features front loaders, rear loaders, and side loaders tailored to municipal and commercial waste collection needs. Front loaders support large-scale recycling pickup from commercial sites with high container volumes. Rear loaders remain popular for urban routes due to strong compaction strength and flexible container compatibility. Side loaders deliver automated handling benefits and reduce manpower dependency for residential pickup. Recycling Trucks Market sees growing demand for automated variants in cities prioritizing safety and labor optimization. It drives manufacturers to focus on multi-capacity and compact truck designs for dense neighborhoods.

- For instance, Mack Trucks offers a front loader chassis model that, when equipped with an industry-standard front-loader body, has a typical hydraulic lift capacity of 4,000 to 8,000 pounds, enabling efficient handling of 8-yard dumpsters (which typically weigh well under this capacity when full) in industrial settings.

By Fuel Type

Diesel-powered trucks dominate fleet deployments because they offer strong torque and proven operational reliability in heavy-duty conditions. Hybrid and electric trucks gain traction due to reduced noise, minimal emissions, and lower lifecycle costs. Governments encourage adoption of clean fleets through tax benefits and procurement incentives. CNG-powered models attract attention in regions focusing on lower fuel costs and air quality improvement. It supports a shift toward diversified powertrains that match specific route conditions and depot infrastructure.

- For instance, Cummins has accumulated hundreds of millions, likely billions, of miles across its X15 diesel engines in North American fleets by 2024, with individual engines often exceeding one million miles before overhaul.

By Application

Municipal services represent the largest application segment due to rising recycling mandates, household waste generation, and fleet modernization programs. Commercial waste collection expands steadily with increasing recycling demand from industries, retail chains, and institutional facilities. Specialized applications grow in areas handling e-waste, construction debris, and recyclable metals that require dedicated truck configurations. Waste management companies seek automated and low-maintenance trucks to improve turnaround time and reduce contamination risk. It encourages the development of segment-specific trucks designed for varied recycling streams.

Segmentations:

By Type

- Front Loaders

- Rear Loaders

- Side Loaders

- Automated Recycling Trucks

By Fuel Type

- Diesel

- Electric

- Hybrid

- CNG

By Application

- Municipal Waste Collection

- Commercial Recycling Services

- Industrial Recycling Operations

- Specialized Recyclable Material Handling

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Presence in North America and Europe

North America maintains solid demand for advanced recycling fleets supported by strict environmental regulations and well-established municipal collection systems. Cities invest in automated trucks to improve recycling consistency and reduce labor dependency. Government programs encourage clean fleet adoption through grants and procurement incentives for low-emission vehicles. Europe strengthens its position with rigid recycling targets and circular economy policies that require efficient segregated waste collection. Municipalities prioritize automated side loaders and electric trucks to meet climate goals. Recycling Trucks Market benefits from these regions due to high investment capacity and strong commitment to organized waste handling. It encourages continued innovation in sustainable vehicle powertrains and automation features.

Rapid Growth Driven by Smart City Programs in Asia-Pacific

Asia-Pacific expands rapidly due to increasing urban populations and investments in large-scale municipal infrastructure. Governments introduce policies to improve solid waste segregation and integrate advanced fleets into smart city initiatives. China upgrades waste logistics with automated and electric truck procurement to reduce emissions in high-density zones. India and Southeast Asian nations focus on improving route optimization through telematics and compact vehicle models suitable for narrow streets. Growing awareness of recycling practices fuels demand for trucks designed for segregated waste streams. Private waste companies modernize fleets to meet regulatory expectations and growing commercial waste volumes. It supports strong expansion potential across emerging and industrialized economies in the region.

Gradual Advancement in Latin America and the Middle East & Africa

These regions show gradual adoption driven by pilot programs, infrastructure upgrades, and rising awareness of organized recycling. Limited funding slows large-scale deployment, but partnerships with private waste contractors help introduce modern trucks. Countries invest in compact and multi-collection vehicles to improve cost efficiency across mixed waste streams. Increasing urbanization creates pressure to replace outdated fleets and improve waste segregation standards. Emphasis on air quality improvement encourages interest in CNG and hybrid trucks. Governments explore integrated waste management strategies that rely on automated collection models. It creates new opportunities for manufacturers to introduce scalable and low-maintenance fleet solutions.

Key Player Analysis:

- Amrep Inc.

- Daimler Truck AG

- Dennis Eagle

- Faun Umwelttechnik GmbH & Co. KG

- Heil – An Environmental Solutions Group Company

- Labrie Trucks

- McNeilus Truck and Manufacturing, Inc.

- Schwarze Industries

- Volvo Trucks

- WM Intellectual Property Holdings, L.L.C.

Competitive Analysis:

The Recycling Trucks Market features strong competition among global manufacturers focused on automation and sustainable fleet solutions. Key players include Amrep Inc., Daimler Truck AG, Dennis Eagle, Faun Umwelttechnik GmbH & Co. KG, Heil – An Environmental Solutions Group Company, and Labrie Trucks. Companies prioritize advanced hydraulic systems, automated side loaders, and efficient compaction units to improve pickup accuracy and reduce operational labor. Electric and hybrid truck development remains a crucial strategy as municipalities seek low-emission vehicles for urban routes. Leading manufacturers invest in telematics integration to support route monitoring and predictive maintenance. Partnerships with municipal authorities and waste management firms help expand regional presence and secure long-term fleet contracts. It drives continued innovation in high-capacity, low-maintenance, and smart recycling vehicle platforms tailored for diverse waste collection needs.

Recent Developments:

- In June 2025, Daimler Truck, DHL Group, and hylane GmbH formed a partnership to supply 30 Mercedes-Benz eActros 600 electric trucks under a “Transport as a Service” model for zero-emission logistics.

- In March 2025, Daimler Truck and ARX Robotics signed a letter of intent for a strategic partnership in defence mobility, emphasizing digital networking and autonomous military vehicle systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Fuel Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Electric and hybrid recycling trucks will gain wider adoption to support low-emission fleet transitions and long-term operating cost efficiency.

- Telematics, predictive maintenance, and AI-assisted route optimization will shape fleet management strategies and reduce downtime.

- Automation in loading and handling mechanisms will help limit labor dependency and improve safety during collection activities.

- Compact truck models designed for dense urban localities will see higher demand in rapidly growing metropolitan regions.

- Integration of smart sensors and load monitoring systems will improve compaction accuracy and reduce contamination in segregated waste streams.

- Municipal procurement programs will favor sustainable fleet solutions backed by lifecycle service contracts and lower maintenance intensity.

- Growing awareness of recycling practices will expand adoption of specialized trucks for e-waste, construction debris, and high-value recyclables.

- Government incentives and stricter emission rules will accelerate new fleet upgrades and retirement of older diesel-based models.

- Manufacturers will pursue product customization for differing road conditions, container types, and regional regulatory standards.

- Digital and data-driven waste handling platforms will merge with recycling vehicle systems, creating scalable, smart waste collection ecosystems.

Market Drivers:

Market Drivers: