Market Overview

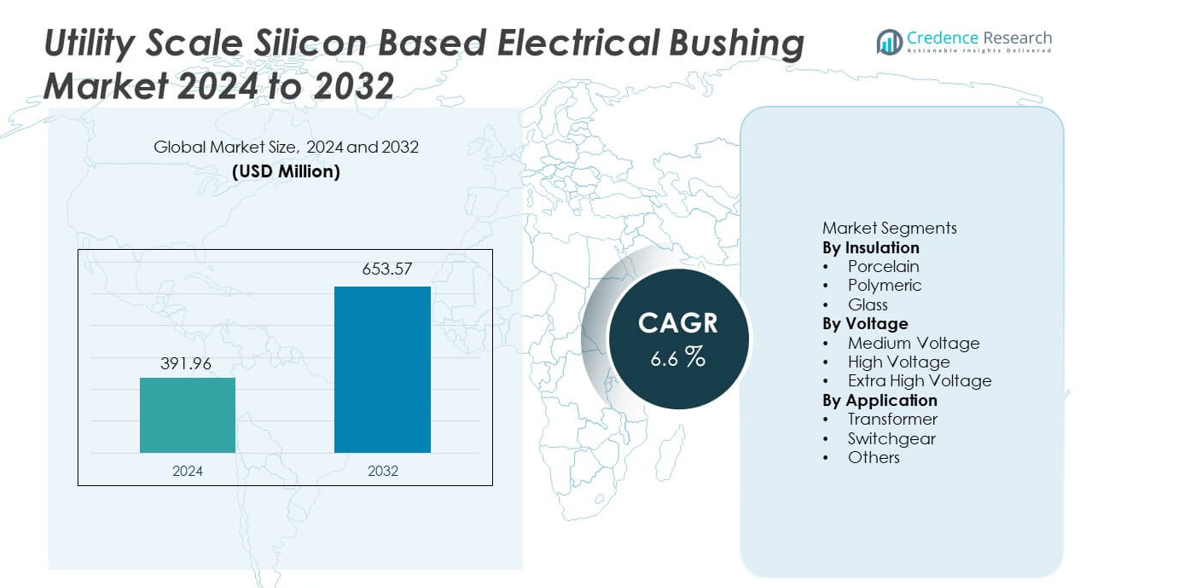

The Utility Scale Silicon Based Electrical Bushing market was valued at USD 391.96 million in 2024 and is projected to reach USD 653.57 million by 2032, registering a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Utility Scale Silicon Based Electrical Bushing Market Size 2024 |

USD 391.96 million |

| Utility Scale Silicon Based Electrical Bushing Market, CAGR |

6.6% |

| Utility Scale Silicon Based Electrical Bushing Market Size 2032 |

USD 653.57 million |

The Utility Scale Silicon Based Electrical Bushing market includes leading players such as ABB, Barberi, CG Power, Eaton, Elliot Industries, General Electric, GIPRO, Hitachi Energy, Hubbell, and Jiangxi Johnson Electric. These companies compete through advanced insulation technologies, strong utility relationships, and broad high-voltage product portfolios. Asia Pacific leads the market with an exact share of 36.9%, driven by rapid grid expansion, renewable energy integration, and large-scale substation development across China and India. North America follows with a 26.8% share, supported by grid modernization and replacement of aging utility equipment. Europe holds a 23.4% share, driven by energy transition initiatives, strict reliability standards, and growing adoption of polymeric silicon bushings. Competitive focus remains on durability, safety, and performance in high-voltage utility applications.

Market Insights

- The Utility Scale Silicon Based Electrical Bushing market was valued at USD 391.96 million in 2024 and is expected to grow at a CAGR of 6.6% during the forecast period.

- Grid modernization, transmission expansion, renewable energy integration, and rising focus on insulation reliability act as key growth drivers for the Utility Scale Silicon Based Electrical Bushing market.

- Polymeric insulation dominates the insulation segment with a market share of 49.6%, supported by lightweight design, hydrophobic performance, and lower maintenance needs in harsh environments.

- Competitive activity remains strong, with leading manufacturers focusing on high-voltage performance, polymeric material innovation, and compliance with strict utility safety standards, while regional players compete on pricing and supply flexibility.

- Asia Pacific leads regional demand with a 36.9% market share, followed by North America at 26.8% and Europe at 23.4%, driven by transmission upgrades, renewable projects, and replacement of aging grid infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Insulation

The Utility Scale Silicon Based Electrical Bushing market, by insulation, includes porcelain, polymeric, and glass bushings, with polymeric bushings leading with a market share of 49.6%. Utilities increasingly prefer polymeric insulation due to superior hydrophobic properties, lower weight, and better performance in polluted and coastal environments. Silicon-based polymeric bushings reduce flashover risk and require less maintenance than traditional materials. Expansion of outdoor substations and harsh-climate installations strengthens adoption. Porcelain bushings retain demand in legacy systems due to proven durability, while glass bushings serve niche applications. Improved safety, longer service life, and ease of handling continue to drive polymeric bushing dominance.

- For instance, Hitachi Energy developed silicone rubber composite bushings rated up to 800 kV with creepage distances exceeding 31,000 mm for polluted environments.

By Voltage

By voltage rating, the market segments into medium voltage, high voltage, and extra high voltage, with high voltage bushings accounting for a dominant share of 44.8%. High voltage bushings see strong demand from transmission substations and large utility transformers. Growing grid expansion and renewable energy integration increase installation of high voltage equipment. Utilities deploy silicon-based bushings to enhance insulation reliability and reduce partial discharge risks. Medium voltage bushings support distribution upgrades, while extra high voltage bushings grow steadily with ultra-high-voltage transmission projects. Grid modernization and rising transmission capacity requirements continue to support high voltage segment leadership.

- For instance, GE developed silicon-based condenser bushings designed for continuous operation at 420 kV with partial discharge levels below 5 pC.

By Application

Application segmentation includes transformers, switchgear, and other equipment, with transformer applications holding the largest market share at 57.2%. Silicon-based electrical bushings are critical components in power transformers for safe current transfer and insulation integrity. Expansion of transmission and distribution infrastructure drives transformer installations across utilities. Replacement of aging transformers further supports demand. Switchgear applications grow with substation automation and compact designs, while other uses include reactors and capacitors. High transformer deployment volumes and stringent reliability requirements keep transformer applications as the primary growth driver.

Key Growth Drivers

Expansion of Utility Transmission and Distribution Infrastructure

Rapid expansion of transmission and distribution networks strongly drives demand for utility scale silicon based electrical bushings. Utilities invest in new substations, transformers, and grid upgrades to meet rising electricity demand. Silicon based bushings offer improved insulation reliability and long-term performance in outdoor environments. Growing electrification and grid modernization programs further increase installations. Replacement of aging electrical assets also supports steady demand. Utilities prioritize components that enhance safety and reduce maintenance needs. These infrastructure investments remain a core driver for sustained market growth.

- For instance, ABB deployed composite bushings rated for continuous operation at 245 kV with thermal endurance up to 120 °C.

Rising Focus on Grid Reliability and Safety Standards

Grid operators increasingly emphasize reliability and operational safety. Electrical bushings play a critical role in preventing insulation failure and flashover incidents. Silicon based materials provide strong hydrophobic properties and stable performance under pollution and moisture exposure. Utilities adopt these bushings to reduce outage risks and maintenance frequency. Stricter safety and performance standards influence procurement decisions. Demand grows for bushings that support long service life and stable electrical insulation. Safety-driven upgrades continue to strengthen market growth.

- For instance, Eaton supplies polymeric bushings validated for short-circuit currents exceeding 40 kA for 3 seconds.

Increasing Integration of Renewable Energy Sources

Renewable energy integration increases stress on transmission equipment. Variable power generation creates fluctuating voltage and load conditions. Silicon based electrical bushings support stable insulation performance under these dynamic operating conditions. Expansion of wind and solar projects drives installation of new transformers and substations. Utilities deploy advanced bushings to ensure reliability in renewable evacuation corridors. Clean energy targets further reinforce demand. This transition toward renewable power supports long-term market expansion.

Key Trends and Opportunities

Shift Toward Polymeric and Lightweight Insulation Materials

Utilities increasingly adopt polymeric silicon based bushings over traditional materials. Lightweight design simplifies installation and reduces mechanical stress on equipment. Improved hydrophobicity enhances performance in polluted and coastal regions. Lower maintenance requirements reduce operational costs. This shift creates strong opportunities for manufacturers offering advanced polymeric solutions. Adoption accelerates in new substations and grid expansion projects. Material innovation remains a key opportunity area.

- For instance, CG Power delivers lightweight composite bushings qualified for operating temperatures up to 120 °C.

Growing Demand from High Voltage and Extra High Voltage Applications

Expansion of high voltage and extra high voltage networks increases demand for advanced bushings. Utilities require components that handle higher electrical stress with minimal risk. Silicon based bushings offer reliable insulation for high-capacity transformers and switchgear. Growth in long-distance transmission projects supports this trend. Manufacturers focusing on high-voltage rated products gain competitive advantage. This trend supports premium product adoption.

- For instance, GIPRO produces resin-impregnated bushings combined with silicone housings for voltage classes reaching 800 kV.

Key Challenges

High Initial Cost Compared to Conventional Materials

Silicon based electrical bushings involve higher upfront costs than traditional options. Budget constraints influence procurement decisions for utilities. Cost sensitivity remains strong in developing regions. Although long-term benefits exist, initial pricing can delay adoption. Utilities balance performance needs with capital expenditure limits. This cost factor remains a key challenge for market penetration.

Complex Qualification and Testing Requirements

Utility scale electrical bushings require extensive testing and certification. Qualification processes increase development time and costs. Utilities demand proven field performance and compliance with strict standards. Long approval cycles delay market entry for new designs. Manufacturers must invest heavily in testing infrastructure. These requirements increase operational complexity and slow innovation adoption.

Regional Analysis

North America

North America holds a market share of 26.8% in the Utility Scale Silicon Based Electrical Bushing market. Demand is driven by grid modernization and replacement of aging transmission and substation equipment across the United States and Canada. Utilities increasingly adopt silicon based bushings to improve reliability and reduce maintenance in outdoor installations. Expansion of renewable energy projects also supports new transformer and switchgear deployments. Strict safety and performance standards encourage adoption of advanced insulation materials. Ongoing investments in transmission upgrades and resilience programs sustain steady regional market growth.

Europe

Europe accounts for 23.4% of the global market share. Strong focus on energy transition and grid reliability drives demand for silicon based electrical bushings. Countries such as Germany, France, and the United Kingdom invest heavily in transmission upgrades and renewable integration. Utilities prefer polymeric silicon bushings for improved performance in polluted and coastal environments. Replacement of legacy porcelain bushings further supports demand. Strict regulatory standards and emphasis on long service life influence purchasing decisions. Grid reinforcement projects continue to support stable market expansion.

Asia Pacific

Asia Pacific leads the market with a share of 36.9%. Rapid expansion of transmission and distribution infrastructure across China, India, Japan, and Southeast Asia drives strong demand. Large-scale renewable energy projects increase installation of transformers and substations requiring advanced bushings. Utilities favor silicon based insulation for reliability under harsh climatic conditions. Urbanization and industrial growth accelerate power network expansion. Government-led grid development programs support high adoption rates. Strong infrastructure investment positions Asia Pacific as the dominant regional market.

Latin America

Latin America holds a market share of 7.4%. Growth is supported by transmission upgrades and renewable energy projects in Brazil, Mexico, and Chile. Utilities deploy silicon based bushings to improve insulation reliability and reduce outage risks. Expansion of wind and solar installations drives demand for new substations. Budget constraints limit rapid adoption, but gradual replacement of aging equipment supports steady growth. Focus on improving grid stability and performance strengthens long-term market potential across the region.

Middle East & Africa

The Middle East & Africa region accounts for 5.5% of the global market share. Demand is driven by power infrastructure expansion in Gulf countries and ongoing electrification efforts in Africa. Utilities adopt silicon based bushings for reliable performance in extreme temperatures and dusty environments. Large transmission and substation projects support new installations. Renewable energy developments also contribute to demand growth. Investment remains concentrated in major infrastructure initiatives, supporting gradual but consistent regional market expansion.

Market Segmentations:

By Insulation

- Porcelain

- Polymeric

- Glass

By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Application

- Transformer

- Switchgear

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights a competitive and technology-driven market led by ABB, Barberi, CG Power, Eaton, Elliot Industries, General Electric, GIPRO, Hitachi Energy, Hubbell, and Jiangxi Johnson Electric. These players compete on insulation reliability, material innovation, and compliance with stringent utility standards. Leading manufacturers focus on silicon-based polymeric bushings to improve hydrophobic performance, reduce flashover risk, and extend service life in harsh environments. Investments in advanced testing, quality control, and high-voltage design capabilities strengthen competitive positioning. Global players leverage established utility relationships and broad product portfolios, while regional manufacturers compete through cost efficiency and localized supply. Replacement demand from aging grid infrastructure and new substation projects supports sustained competition. Continuous product development, focus on high-voltage applications, and adherence to international safety standards remain central to competitive strategies in the Utility Scale Silicon Based Electrical Bushing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2024, Jiangxi Electric has began construction in its Qiangsheng Electric Porcelain factory, indicating that they are keen on developing and increasing their electric porcelain production capabilities.

- In November 2023, the Hitachi Energy factory at Vadodara received a “Recognition Award” from its main partner, Bharat Heavy Electricals Limited (BHEL), for the Resin Impregnated Paper (RIP) bushings produced there.

Report Coverage

The research report offers an in-depth analysis based on Insulation, Voltage, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Grid modernization will continue to drive demand for advanced silicon based bushings.

- Polymeric insulation adoption will increase across utility applications.

- High-voltage and extra high-voltage projects will support market growth.

- Renewable energy integration will raise demand for reliable insulation components.

- Utilities will prioritize bushings with longer service life and lower maintenance.

- Replacement of aging porcelain bushings will accelerate adoption.

- Asia Pacific will remain the fastest-growing regional market.

- Harsh climate installations will favor silicon based insulation solutions.

- Manufacturers will invest in improved testing and quality assurance.

- Competition will intensify through material innovation and performance reliability.