Market Overview:

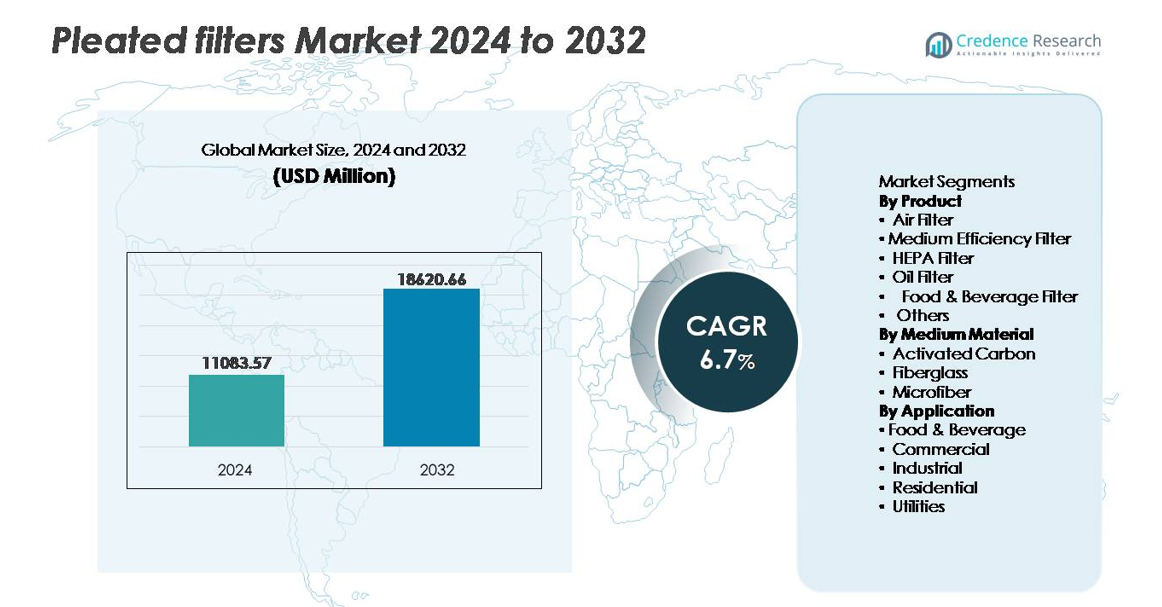

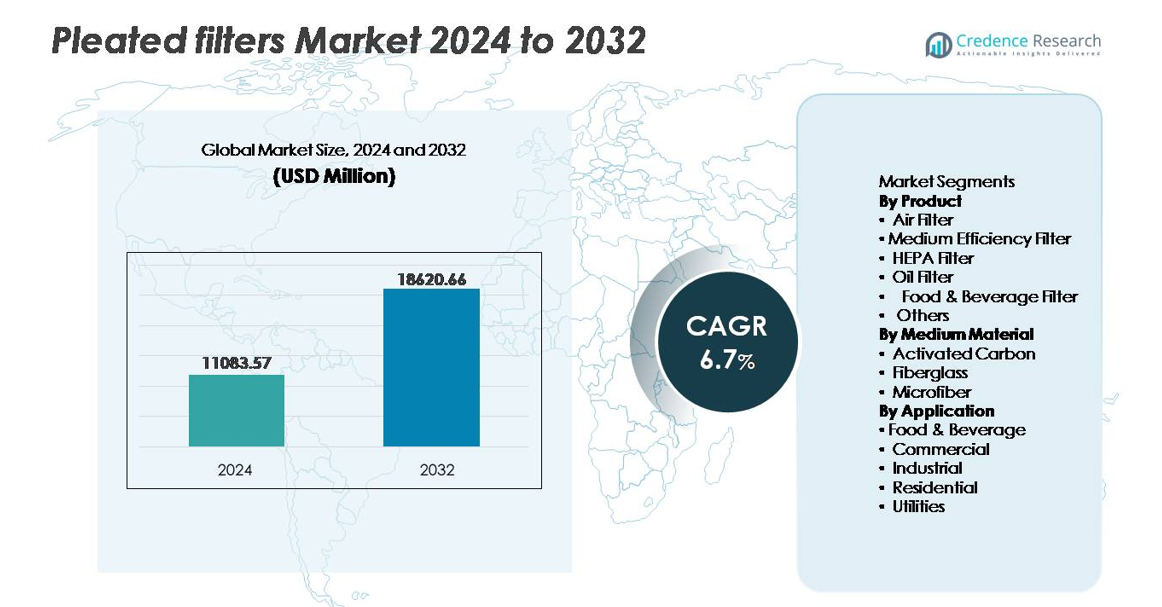

The global pleated filters market was valued at USD 11,083.57 million in 2024 and is projected to reach USD 18,620.66 million by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pleated Filters Market Size 2024 |

USD 11,083.57 million |

| Pleated Filters Market, CAGR |

6.7% |

| Pleated Filters MarketSize 2032 |

USD 18,620.66 million |

The pleated filters market features strong participation from global and regional manufacturers, with Delta Filtration, Camfil AB, Honeywell International Inc., Freudenberg and Company, Absolent Group, General Motors Company, Donaldson Company, Inc., Atlas Copco, Clarcor Air Filtration, and 3M Company positioned as key players. These companies compete through advanced filter media innovations, energy-efficient designs, and customized solutions for industrial, commercial, and residential applications. North America remains the leading regional market, holding approximately 32% of global share, driven by stringent indoor air quality standards, mature HVAC adoption, and large-scale industrial operations requiring high-performance filtration systems.

Market Insights:

- The global pleated filters market was valued at USD 11,083.57 million in 2024 and is expected to reach USD 18,620.66 million by 2032, expanding at a CAGR of 6.7% during the forecast period.

- Market growth is propelled by rising air pollution concerns, regulatory standards for indoor air quality, and increased adoption of HVAC systems across commercial, industrial, and residential sectors.

- Advancements in nanofiber-coated media, antimicrobial filtration, and smart filter monitoring systems represent key trends supporting premium product adoption.

- The market remains moderately competitive, with players focusing on product durability, energy efficiency, and recyclable filter components to differentiate in price-sensitive segments.

- North America leads with 32% share, followed by Asia-Pacific at 29% and Europe at 27%, while air filters represent the dominant product segment, driven by high installation and replacement rates across buildings and manufacturing facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Air filters represent the dominant product segment, holding the largest share due to their widespread adoption in HVAC systems and their ability to capture particulate matter in indoor environments. The demand is driven by regulatory emphasis on indoor air quality, increasing urban pollution, and the construction of commercial complexes and cleanrooms. HEPA filters are expanding rapidly, particularly in healthcare, microelectronics, and aerospace, where ultra-fine particulate removal is critical. Oil and food & beverage filters demonstrate steady growth, supported by rising industrial processing and hygiene compliance standards.

- For instance, Camfil’s Megalam EnerGuard filter incorporates a proprietary polymeric media capable of achieving ultra-low penetration on the Most Penetrating Particle Size (MPPS). This filter is available in various efficiencies, including U15 (an ULPA classification), which enables installations designed for cleanroom classifications up to and including ISO Class 3 environments. The general MPPS for HEPA/ULPA filters is typically around 0.12–0.15 microns (within the 0.1 to 0.2 micron range).

By Medium Material

Fiberglass stands as the leading medium material, driven by its durability, flame resistance, and suitability for high-temperature industrial environments including chemical processing and power generation. Activated carbon pleated filters are gaining momentum due to their capacity to adsorb odors, gases, and volatile organic compounds, making them ideal for commercial kitchens, laboratories, and waste management facilities. Microfiber-based filters continue to expand in high-precision applications, particularly pharmaceutical and electronics manufacturing, where fine particulate removal and low-pressure drop performance support operational efficiency.

- For instance, AAF Flanders manufactures high-temperature fiberglass filter media used in environments reaching up to 260°C, enabling deployment in gas-turbine inlet systems and chemical furnaces where thermal cycling stability and dimensional retention are critical.

By Application

The industrial sector dominates the application landscape, supported by filtration requirements across manufacturing, oil & gas, metalworking, cement, and automotive production. Stringent worker safety regulations and emission control policies drive higher-grade filtration installations. The commercial segment follows, propelled by retail, corporate buildings, hospitals, and hospitality infrastructure prioritizing clean indoor air quality. Residential use is increasing gradually due to consumer awareness of health risks associated with airborne pollutants. Utilities integrate pleated filters in power generation and water treatment, focusing on equipment protection and process reliability.

Key Growth Drivers:

Rising Air Quality Concerns and Regulatory Compliance

Growing public health concerns associated with airborne particulate matter, allergens, and industrial emissions serve as a primary driver for pleated filter adoption. Governments across North America, Europe, and Asia-Pacific are tightening regulatory frameworks related to indoor and outdoor air quality, including filtration standards for commercial buildings, manufacturing facilities, and clean air zones. The rise of respiratory disorders linked to pollution and occupational exposure is prompting organizations to invest in higher-grade filtration systems. Urbanization and increased vehicle density add to particulate concentration, placing filtration infrastructure among priority installations. The expansion of healthcare infrastructure, biotechnology labs, and semiconductor cleanrooms where even micro-particle contamination can inhibit operational processes further accelerates demand. Pleated filters benefit from low maintenance, better airflow, and extended service life compared to traditional panel filters, which aligns with end-user requirements for energy efficiency and cost optimization.

- For instance, 3M High Airflow (HAF) pleated filter media offers up to 25 Pascals lower initial pressure drop than comparable mechanical filters at similar efficiency ratings, reducing HVAC energy consumption and extending operational runtime between filter replacements in hospitals and life science facilities.

Industrial Growth and Expansion of Process Manufacturing

The growth of process-heavy industries such as pharmaceuticals, food and beverage, cement, metals, and chemical manufacturing drives the adoption of pleated filters for air, liquid, and oil filtration. As companies scale operations and expand globally, filtration systems become mission-critical to safeguard equipment, maintain sterile production environments, and comply with HACCP, GMP, and emission-monitoring standards. Preventive maintenance strategies are also catalyzing integration of advanced pleated filters to reduce downtime and extend asset lifecycle. Increasing automation and robotics in factories require cleaner air and controlled particulate levels to protect sensitive assemblies. The expansion of the global supply chain has brought strict quality inspection and cross-border compliance, motivating enterprises to deploy filtration that delivers higher capture rates and lower pressure drops. Rising investments in renewable energy, including battery manufacturing and hydrogen infrastructure, further broaden industrial filtration needs.

- For instance, Eaton’s industrial filtration solutions include DCF self-cleaning pleated filters capable of handling flow rates up to 1,500 liters per minute in continuous chemical production, supporting uninterrupted operation while reducing filter changeout labor requirements.

Growth in Residential and Commercial Construction Activities

Rapid development of residential and commercial infrastructure, including hospitality properties, hospitals, educational institutions, and retail complexes, significantly supports pleated filter demand. Modern building designs integrate centralized HVAC systems that require efficient filters to maintain indoor air quality and improve energy conservation. Smart building initiatives and green certification programs are driving the installation of advanced filtration systems that reduce operational energy expenditure and support sustainability goals. The surge in co-working spaces, shopping malls, and mixed-use facilities increases the need for standardized air filtration across shared environments. In parallel, consumer awareness about airborne contaminants including viruses, mold spores, VOCs, and dust mites is rising, prompting homeowners to use upgraded pleated filters compatible with ducted air conditioning systems. Post-pandemic risk mitigation has shifted filtration from optional cost to operational necessity, influencing both private and institutional purchases.

Key Trends & Opportunities:

Integration of Nanofiber and Multifunctional Filter Media

A notable trend shaping market innovation is the adoption of nanofiber-coated pleated filters that offer superior filtration efficiency without significantly restricting airflow. Manufacturers are exploring hybrid media incorporating antimicrobial coatings, electrostatic fiber layers, and moisture-resistant surfaces to cater to healthcare, food handling, and laboratory applications. Multifunctional filter media capable of capturing microplastics, odors, gaseous compounds, and chemical aerosols present further commercial opportunities. As industries pursue carbon-neutral operations, demand grows for recyclable filter components and biodegradable frames, enabling circular-economy filtration models. In addition, the opportunity to customize media properties fire resistance, oil repellence, or electrostatic charge retention creates differentiated market offerings and premium pricing potential.

- For instance, Donaldson’s Ultra-Web® nanofiber technology applies fibers with diameters as small as 0.2 microns onto pleated media, enhancing surface loading and improving particulate capture of submicron dust while maintaining lower pressure drop, making it suitable for industrial dust collectors handling high particulate concentrations.

Adoption of Smart Filtration and Predictive Maintenance Systems

Digital transformation is creating new opportunities through sensor-embedded pleated filters and IoT-connected HVAC units capable of monitoring airflow resistance, particulate loading, and pressure drops in real time. As organizations shift toward predictive maintenance, data-driven filtration management supports cost reduction by extending replacement intervals and improving energy efficiency. Commercial buildings, large industrial campuses, and healthcare systems are adopting cloud-monitoring dashboards to optimize filter usage remotely. Smart filtration aligns with growing ESG and energy-efficiency requirements, enabling organizations to reduce carbon footprints associated with HVAC energy consumption. The integration of automated filter alerts and compliance reporting tools further drives adoption among regulated sectors.

- For instance, Camfil’s Air Image Sensor platform measures PM1, PM2.5, PM10, temperature, humidity, VOC levels, and CO₂ concentration with real-time monitoring at a data refresh rate of 60 seconds, enabling precise air quality adjustments for commercial and pharmaceutical environments.

Key Challenges:

Environmental Impact of Waste Disposal and Recycling Limitations

A major challenge confronted by the pleated filter market relates to waste management and disposal. Many filters combine synthetic fibers, adhesives, plastics, and metal components that complicate recycling and increase landfill accumulation. Incineration may reduce bulk but releases toxic gases if media contain treated fibers or chemical coatings. Industries with high-frequency replacement cycles, such as food processing and pharmaceuticals, generate substantial filtration waste, raising environmental and regulatory burdens. As sustainability goals intensify, manufacturers face pressure to develop compostable housings, mono-material filters, or return-and-recycle programs-yet these require higher production costs and redesigned supply chains.

Price Pressure and Availability of Low-Cost Alternatives

The market faces competitive pressure from low-cost manufacturers offering non-branded pleated filters, particularly in regions where price outweighs performance. Fluctuations in raw material prices-especially fiberglass, polymers, and activated carbon-also influence production margins. While high-efficiency filters deliver superior performance, many end-users still prioritize upfront cost over lifecycle benefits, slowing premium segment expansion. Industrial customers may delay replacement cycles to reduce expenses, resulting in decreased recurring sales. The presence of alternative filtration technologies such as electrostatic precipitators or washable filters can influence procurement decisions, especially where operating conditions are moderate and regulatory oversight is limited.

Regional Analysis:

North America

North America holds the largest share of the pleated filters market, accounting for approximately 32%, driven by stringent indoor air quality regulations imposed by OSHA, EPA, and ASHRAE standards. The region benefits from extensive HVAC penetration in residential and commercial buildings, alongside strong adoption across pharmaceutical production, food processing, and semiconductor manufacturing. Rising replacement frequency, the expansion of cleanroom-capable facilities, and heightened consumer focus on allergy and pollutant control further support demand. The United States leads growth, supported by infrastructure modernization and investments in energy-efficient filtration for public buildings and healthcare institutions.

Europe

Europe represents around 27% of the global market, supported by robust regulatory frameworks related to emission controls, workplace safety, and green building certifications. The EU’s carbon-reduction commitments and air pollution mitigation programs are accelerating upgrades across industrial filtration systems. Germany, France, and the United Kingdom remain major demand centers due to advanced manufacturing, automotive production, and healthcare infrastructure. Aging buildings transitioning to modern HVAC systems also drive retrofitted filtration solutions. Strict food hygiene compliances and pharmaceutical production standards create sustained demand for high-efficiency pleated filters designed for sterile and contamination-controlled environments.

Asia-Pacific

Asia-Pacific accounts for approximately 29% market share and is the fastest-growing regional segment due to rapid industrialization, urban population expansion, and increasing air pollution indices in major cities. China and India dominate demand, propelled by manufacturing growth in electronics, chemicals, and heavy industries. Rising middle-class purchasing power and adoption of centralized air conditioning in commercial and residential spaces elevate filtration requirements. Government investments in hospital construction and industrial safety compliance further boost consumption. Multinational companies expanding production capacity across Southeast Asia support accelerated filtration adoption aligned with global quality standards.

Latin America

Latin America captures around 6% of the market, with Brazil and Mexico leading due to expanding industrial and food processing operations. Demand is driven by increased commercial building development, particularly in urban centers focused on modern infrastructure. The region’s improving healthcare investments, adoption of cleaner industrial practices, and awareness of airborne contaminants are gradually strengthening the market presence. However, budget sensitivity and dependency on imported filtration materials limit rapid penetration of advanced filters. Opportunities lie in mining, cement, and oil processing sectors where equipment protection and emission compliance requirements continue rising.

Middle East & Africa

The Middle East & Africa region represents approximately 6% of global market share, supported by air filtration needs in power plants, oil refineries, and desalination facilities. The Gulf region, led by Saudi Arabia and the UAE, shows increasing installation of high-performance filters in commercial complexes, airports, and healthcare networks. Harsh climatic conditions characterized by dust and sandstorms emphasize durable and frequent air filtration cycles. Industrial diversification programs, such as Saudi Vision 2030 and UAE manufacturing expansion, support long-term filtration investments. Adoption remains slower in parts of Africa due to cost barriers and limited HVAC infrastructure.

Market Segmentations:

By Product

- Air Filter

- Medium Efficiency Filter

- HEPA Filter

- Oil Filter

- Food & Beverage Filter

- Others

By Medium Material

- Activated Carbon

- Fiberglass

- Microfiber

By Application

- Food & Beverage

- Commercial

- Industrial

- Residential

- Utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the pleated filters market is moderately fragmented, characterized by a mix of global manufacturers and specialized regional suppliers competing on performance reliability, product customization, and pricing. Leading companies focus on expanding their portfolios with advanced filter media, including nanofiber composites and antimicrobial coatings designed for industrial, healthcare, and cleanroom environments. Strategic initiatives involve geographic expansion, OEM partnerships with HVAC system manufacturers, and solutions aligned with energy-efficiency and sustainability requirements. The market is witnessing increased investment in digital filtration monitoring and predictive maintenance tools, enabling manufacturers to differentiate through value-added services. Supply chain optimization and backward integration in media production remain key profitability levers, particularly as raw material cost fluctuations continue. Companies that offer reusable, recyclable, or bio-based filter components are gaining competitive momentum as end-users prioritize environmentally responsible filtration solutions across commercial and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In April 2025, 3M introduced a new product under its Filtrete brand: the “Filtrete Refillable Air Filter Kit”. The kit uses a reusable frame (rated to last up to 20 years) and a replaceable filter insert that lasts up to 12 months.

- In March 2025, Absolent described its new “True Downflow” dust/fume-extraction configuration, where filter elements use vertical alignment and top-to-bottom airflow so that dust released during pulse-jet cleaning is pulled downward by gravity, reducing upflow or crossflow. This design reduces required filter media surface area and enables a more compact filtration unit compared to traditional designs.

Report Coverage:

The research report offers an in-depth analysis based on Product, Medium material Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for pleated filters will continue increasing as indoor air quality and workplace safety regulations intensify across global industries.

- Nanofiber and multifunctional media will gain traction for higher filtration efficiency with low pressure drop.

- Smart, sensor-enabled filters will support predictive maintenance and reduce operational energy consumption.

- Sustainable and recyclable filter materials will emerge as a competitive differentiator among manufacturers.

- Growth in process manufacturing and cleanroom environments will boost adoption of high-performance filtration solutions.

- Construction expansion and smart building deployments will drive installation in HVAC systems.

- Customized filter designs will become more common in oil, gas, and chemical applications.

- E-commerce channels will accelerate aftermarket replacement filter sales.

- Integration with digital building management systems will influence commercial and industrial adoption.

- Asia-Pacific will surface as the fastest-growing market due to rapid industrialization and infrastructure development.