Market Overview

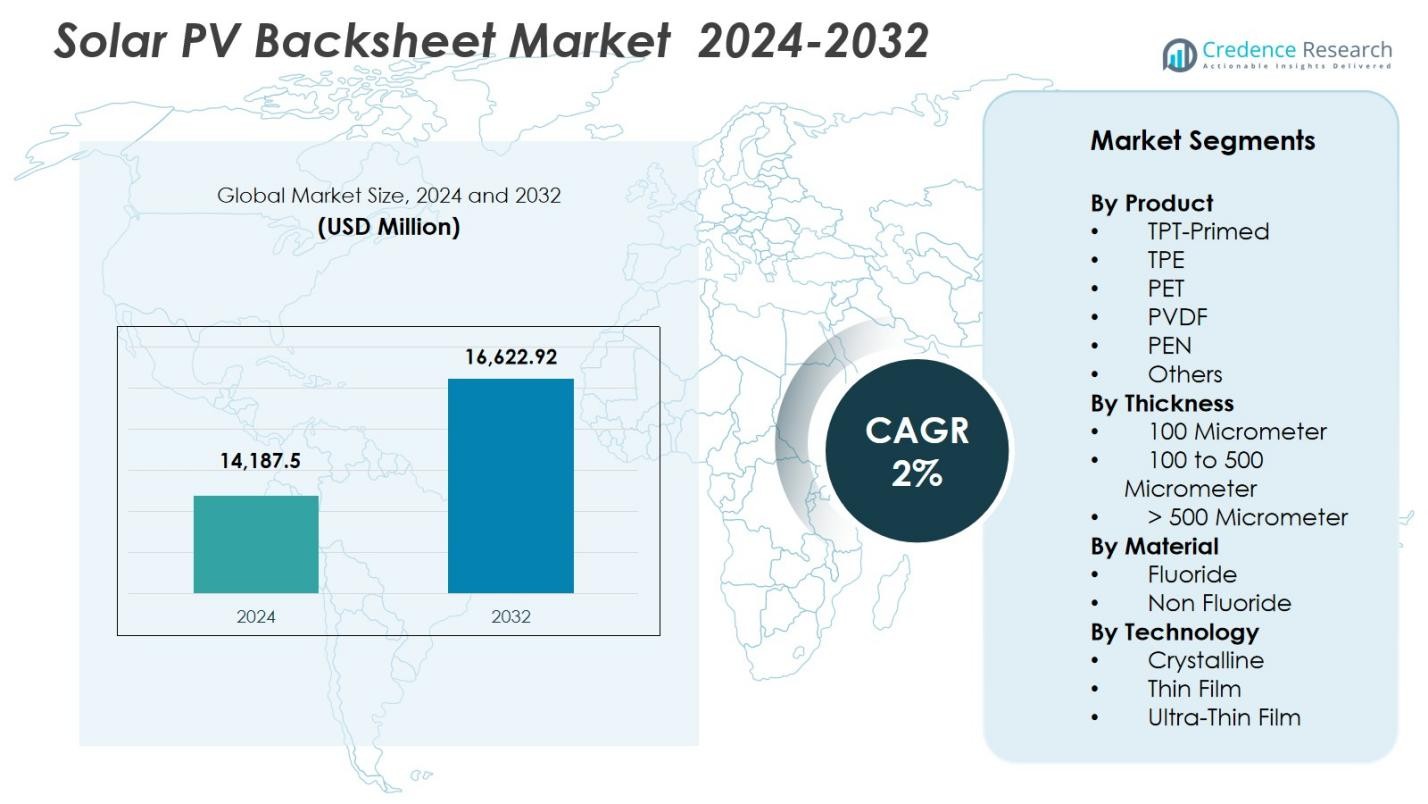

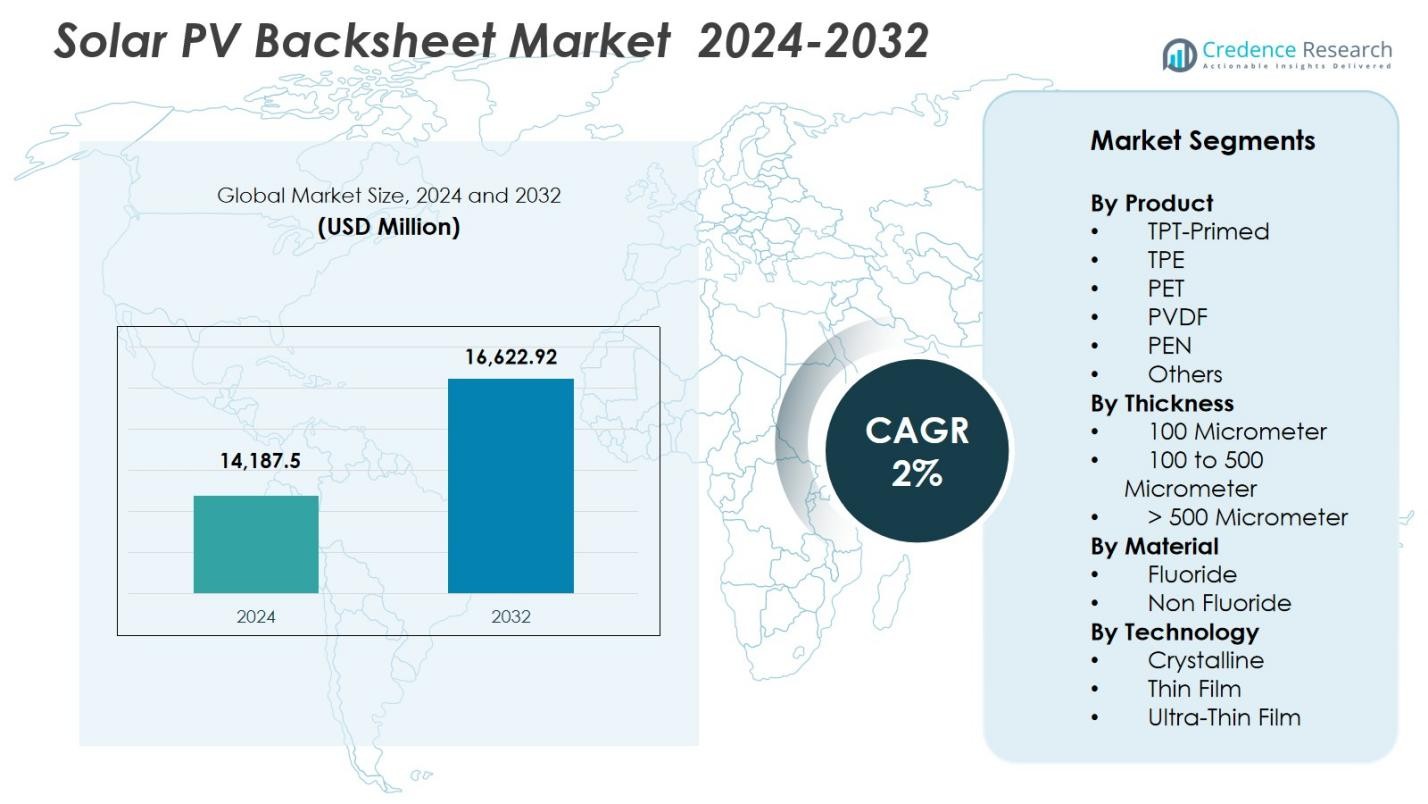

Solar PV Backsheet Market size was valued at USD 14,187.5 Million in 2024 and is anticipated to reach USD 16,622.92 Million by 2032, at a CAGR of 2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar PV Backsheet Market Size 2024 |

USD 14,187.5 Million |

| Solar PV Backsheet Market, CAGR |

2% |

| Solar PV Backsheet Market Size 2032 |

USD 16,622.92 Million |

Solar PV Backsheet Market demonstrates a robust presence of global and regional manufacturers, with key players including 3M, Arkema, Coveme, Dupont, Dunmore, Endurans Solar, Isovoltaic, Jiangsu Zhongtian Technology, Krempel, and Renewsys India. These companies focus on advanced polymer technologies, non-fluoride materials, and multilayer backsheet designs to meet performance and sustainability requirements for modern PV modules. Asia-Pacific leads the market with a 41.8% share, supported by large-scale manufacturing capacity and rapid solar deployment across China and India. Europe follows with 27.1% share due to strong regulatory emphasis on eco-friendly materials, while North America maintains 22.4% share driven by utility-scale installations and technological innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Solar PV Backsheet Market was valued at USD 14,187.5 million in 2024 and is projected to grow at a CAGR of 2% through 2032.

- Market growth is driven by rising global solar installations, enhanced focus on module longevity, and increasing adoption of cost-efficient PET backsheets, which accounted for 38.6% share in 2024.

- Key trends include the shift toward non-fluoride, sustainable materials and increased demand for backsheets compatible with advanced PV technologies such as TOPCon and HJT.

- The market features strong participation from players such as 3M, Arkema, Coveme, Dupont, Dunmore, Endurans Solar, Isovoltaic, Jiangsu Zhongtian Technology, Krempel, and Renewsys India, each investing in material innovation and co-extrusion technologies.

- Regionally, Asia-Pacific leads with 41.8% share, followed by Europe at 27.1% and North America at 22.4%, supported by strong installation pipelines and evolving sustainability regulations.

Market Segmentation Analysis

By Product

The Solar PV Backsheet Market by product is led by PET, accounting for 38.6% share in 2024, driven by its cost efficiency, strong dielectric strength, and suitability for high-volume module production. PET backsheets are widely adopted in utility-scale installations due to their durability and competitive pricing compared to fluoropolymer-based alternatives. Meanwhile, TPT-Primed and PVDF variants gain traction in harsh climatic conditions where enhanced UV and moisture resistance are required. The shift toward high-efficiency modules and increasing installations in emerging markets continues to support PET’s dominance, reinforced by ongoing material innovations.

- For instance, Arkema’s Kynar PVDF technology has been adopted in high-durability backsheets for solar farms operating in desert environments, where temperatures regularly exceed 45°C and require superior UV protection

By Thickness

Within thickness-based segmentation, the 100 to 500 Micrometer category dominates with 52.4% market share in 2024, as it offers optimal mechanical strength, insulation performance, and cost balance for mainstream PV modules. This thickness range suits both residential and commercial applications, providing long-term protection against abrasion, UV exposure, and electrical stress. Demand is further supported by advancements in multilayer extrusion and lamination technologies, improving moisture barrier properties. The growing global focus on enhancing module lifespan and reliability continues to drive manufacturers toward this widely adopted thickness segment.

- For instance, Coveme upgraded its Dymat® PET backsheet line with improved multi-layer lamination designed specifically for 100–500 μm structures, enhancing resistance to hydrolysis in high-humidity climates.

By Material

By material type, Non-Fluoride backsheets lead the market with 55.1% share in 2024, propelled by lower manufacturing costs, reduced environmental impact, and strong adoption in standard crystalline silicon modules. These backsheets appeal to developers seeking cost-effective yet durable solutions for large-scale solar projects. Fluoride-based materials such as PVDF and TPT remain relevant in extreme environments due to superior UV and weather resistance, but rising sustainability mandates and regulatory pressures favor the shift toward non-fluoride alternatives. Improved polymer formulations and barrier enhancements further strengthen their position across global PV installations.

Key Growth Drivers

Key Growth Drivers

Expanding Global Solar Installations and Utility-Scale Projects

The rapid expansion of global solar PV installations remains a major growth catalyst for the Solar PV Backsheet Market, driven by rising renewable energy targets, declining module prices, and accelerated deployment of utility-scale solar farms. Countries across Asia-Pacific, Europe, and the Middle East continue to add large photovoltaic capacities, creating sustained demand for durable backsheet materials that ensure electrical insulation, moisture protection, and long-term reliability. Utility-scale developers increasingly prefer high-performance PET and non-fluoride backsheets due to their cost advantages and compatibility with advanced module architectures, including bifacial and PERC technologies. Government incentives, net-metering policies, and grid modernization efforts further strengthen installation rates. As solar becomes central to decarbonization strategies, module manufacturers prioritize extended lifespan and reduced LCOE, directly boosting demand for high-durability, UV-resistant backsheet materials engineered for diverse climates.

- For instance, China added over 260 GW of new solar capacity in 2023 (NEA data), prompting major module producers to scale adoption of improved PET backsheets optimized for high-volume manufacturing.

Advancements in PV Module Technologies and Material Innovation

Technological advancements in PV modules—such as PERC, TOPCon, heterojunction, and bifacial technologies—are significantly influencing the evolution of the backsheet market. These high-efficiency modules generate more heat and operate under greater electrical stress, increasing the requirement for backsheets with superior dielectric properties, thermal stability, and enhanced barrier protection. Innovations in multilayer polymer structures, co-extrusion processes, and non-fluoride formulations allow manufacturers to deliver lighter, cost-effective backsheets without compromising durability. Material improvements such as reinforced PET, advanced coatings, and improved adhesive layers support resistance against hydrolysis, UV degradation, and delamination. The shift toward sustainable, lead-free, and recyclable materials aligns closely with global ESG goals. Continuous R&D investments and partnerships among chemical companies and module manufacturers help ensure backsheets remain compatible with next-generation PV technologies.

- For instance, Jolywood’s bifacial TOPCon modules rely on high-temperature-resistant backsheet formulations engineered to withstand elevated operating temperatures and increased rear-side irradiance.

Rising Focus on Module Longevity and Lower Levelized Cost of Energy (LCOE)

A strong industry emphasis on enhancing module lifespan and reducing LCOE is driving significant demand for high-performance solar backsheets. As developers aim for 25–30 years of field reliability, backsheets play a critical role in preventing moisture ingress, electrical faults, and thermal degradation. Improved backsheet performance directly reduces O&M costs, minimizes failure rates, and enhances overall energy yield key factors for utility-scale solar operators. Advancements in polymer processing, barrier coatings, and fluorine-free materials strengthen backsheet durability in harsh environments, including deserts, coastal zones, and high-humidity regions. The rising deployment of solar farms in climate-sensitive areas accelerates demand for backsheets engineered to withstand prolonged exposure to UV radiation and temperature fluctuations. With solar module pricing declining, developers seek cost-effective yet durable materials, intensifying the market’s focus on reliability and long-term operational efficiency.

Key Trends & Opportunities

Shift Toward Non-Fluoride Backsheets and Sustainable Materials

A major trend shaping the Solar PV Backsheet Market is the accelerating shift toward non-fluoride backsheets driven by cost savings, sustainability goals, and growing global scrutiny of fluoropolymers. Manufacturers increasingly adopt advanced PET and hybrid polymer structures that deliver strong UV protection and hydrolysis resistance without fluorinated coatings. The solar industry’s focus on recyclability and lifecycle emissions reduction supports this transition, aligning with ESG commitments and evolving regulations, especially in Europe and North America. Opportunities emerge for suppliers developing solvent-free coatings, recyclable backsheet films, and low-carbon production technologies. As global procurement shifts away from PFAS-related materials, companies offering durable, high-performance, fluorine-free alternatives are positioned for strong growth and premium partnerships with module manufacturers.

- For instance, Coveme launched enhanced PET backsheets with solvent-free coatings designed to improve recyclability while maintaining long-term UV and moisture protection.

Increasing Adoption of Double-Glass Modules & Demand for Specialized Materials

The rising adoption of double-glass (glass–glass) modules is reshaping the backsheet landscape and creating new opportunities for material suppliers. Although these modules eliminate the need for traditional backsheets, their growing popularity drives demand for complementary materials such as advanced edge sealants, adhesives, and high-durability encapsulants. At the same time, many manufacturers continue to favor backsheet-based modules due to advantages like lower weight, easier handling, and reduced production cost. This transition opens opportunities to develop next-generation backsheets—including transparent PET films, weather-resistant multilayer structures, and solutions tailored for bifacial technologies. As module architectures evolve, suppliers focusing on differentiated, high-performance materials will gain a competitive edge in meeting the diverse requirements of emerging PV technologies.

- For instance, 3M expanded its portfolio of high-durability edge sealants specifically engineered for glass–glass modules, improving moisture resistance and field reliability under high-humidity conditions.

Key Challenges

Performance Failures, Delamination, and Long-Term Material Degradation

One of the most critical challenges in the Solar PV Backsheet Market is the growing incidence of long-term material degradation, including cracking, chalking, and delamination. Exposure to high UV radiation, extreme temperatures, and humidity accelerates chemical breakdown, particularly in regions with harsh climatic conditions. Poor lamination quality or substandard materials may lead to premature failures, compromising electrical safety and reducing module lifespan. These field failures increase warranty claims and tarnish manufacturer credibility. As modern high-efficiency modules operate at higher temperatures and power densities, the need for thermally stable, chemically robust backsheets becomes even more urgent. Addressing these issues requires rigorous qualification testing, improved polymer formulations, and tighter quality control factors that raise production costs and operational complexity for manufacturers.

Price Pressure and Margin Constraints in a Highly Cost-Sensitive Market

The solar industry’s intense cost sensitivity presents a major challenge for backsheet suppliers, who face continuous pressure to reduce prices despite rising raw material costs and the need for improved durability. Manufacturers often prioritize affordability, making it difficult for suppliers to justify premium materials or advanced formulations. Volatility in polymer feedstock prices further compresses margins and complicates long-term pricing strategies. Additionally, competition from double-glass modules threatens demand for traditional backsheets, forcing suppliers to diversify or innovate. Balancing cost competitiveness with high performance and sustainability requirements remains a significant hurdle. To stay viable, companies must scale production, optimize processes, and invest in differentiated technologies without exceeding the narrow cost thresholds demanded by module manufacturers.

Regional Analysis

North America

North America holds 22.4% share of the Solar PV Backsheet Market in 2024, supported by expanding solar installations across the U.S. and Canada, rising decarbonization mandates, and increasing adoption of high-efficiency PV modules. The region’s demand is driven by growing utility-scale solar projects and strong emphasis on durable, weather-resistant backsheets suited for diverse climatic conditions, including deserts and snow-prone regions. Tax credits, federal incentives, and state-level clean energy programs continue to accelerate module deployment. Manufacturers benefit from a shift toward non-fluoride solutions and advanced polymer technologies to meet sustainability and long-term reliability requirements.

Europe

Europe accounts for 27.1% share of the Solar PV Backsheet Market, driven by strong renewable energy policies, rapid solar rooftop adoption, and strict environmental regulations influencing backsheet material choices. The EU’s focus on reducing fluoropolymer usage accelerates demand for sustainable, recyclable PET-based backsheets. High solar penetration in Germany, Spain, Italy, and France supports consistent procurement of advanced multilayer structures with enhanced UV and moisture resistance. The region also sees rising demand for backsheets compatible with high-efficiency module technologies. Ongoing sustainability commitments and the shift toward circular manufacturing strengthen Europe’s position as a leading consumer of eco-friendly backsheet solutions.

Asia-Pacific

Asia-Pacific dominates the Solar PV Backsheet Market with 41.8% share in 2024, driven by massive solar deployment in China, India, Japan, and South Korea. The region benefits from large-scale manufacturing ecosystems, cost-efficient production capabilities, and strong government support for renewable expansion. Rapid installation of utility-scale and distributed PV systems increases demand for durable, cost-effective PET and non-fluoride backsheets. China’s technological advancements in TOPCon and HJT modules further push innovation in backsheet durability and thermal stability. Growing energy demand, favorable policies, and competitive manufacturing enable Asia-Pacific to remain the largest and fastest-growing market for backsheets.

Latin America

Latin America captures 4.7% share of the Solar PV Backsheet Market, supported by expanding solar investments in Brazil, Mexico, Chile, and Colombia. The region’s high solar irradiance and large utility-scale project pipelines drive demand for robust backsheets with superior UV stability and long-term environmental resistance. Cost-efficient module technologies dominate the market, increasing adoption of PET-based solutions. Government tenders and renewable auctions continue to accelerate solar deployment, particularly in Brazil and Chile. Despite economic fluctuations, growing private-sector investment and grid modernization initiatives support steady demand for reliable backsheet materials in both commercial and industrial solar segments.

Middle East & Africa

The Middle East & Africa region holds 4.0% share of the Solar PV Backsheet Market, fueled by large-scale solar projects in the UAE, Saudi Arabia, South Africa, and Egypt. Extreme temperatures, sand exposure, and intense UV radiation create strong demand for high-durability backsheets engineered for challenging environmental conditions. Mega solar parks such as those in NEOM and Dubai drive procurement of advanced multilayer and PVDF-based solutions. Increasing electrification needs across Africa and rising renewable energy targets in the Gulf strengthen market opportunities. Continued investments in utility-scale installations and green hydrogen initiatives support the region’s future growth potential.

Market Segmentations

By Product

- TPT-Primed

- TPE

- PET

- PVDF

- PEN

- Others

By Thickness

- 100 Micrometer

- 100 to 500 Micrometer

- > 500 Micrometer

By Material

By Technology

- Crystalline

- Thin Film

- Ultra-Thin Film

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Solar PV Backsheet Market is shaped by a mix of global material suppliers and specialized photovoltaic component manufacturers focusing on durability, cost efficiency, and technological innovation. Key players such as 3M, Arkema, Coveme, Dupont, Dunmore, Endurans Solar, Isovoltaic, Jiangsu Zhongtian Technology, Krempel, and Renewsys India actively expand their portfolios with advanced PET, non-fluoride, and high-performance multilayer backsheets designed for next-generation PV modules. Companies invest heavily in R&D to enhance UV stability, thermal resistance, and long-term field reliability while meeting rising sustainability requirements and PFAS reduction mandates. Strategic partnerships with module manufacturers, capacity expansions in Asia-Pacific, and the adoption of co-extrusion technologies strengthen competitive positioning. As demand increases for backsheets compatible with TOPCon, HJT, and bifacial modules, leading vendors prioritize material innovation and cost optimization to maintain market advantage in an increasingly performance-driven and environmentally regulated industry.

Key Player Analysis

- Jiangsu Zhongtian Technology

- Dupont

- Renewsys India

- Krempel

- Coveme

- Endurans Solar

- Arkema

- 3M

- Isovoltaic

- Dunmore

Recent Developments

- In February 2025, Arkema announced a 15% expansion of its PVDF production capacity in North America through a USD 20 million investment. This move aligns with the company’s strategy to strengthen its global PVDF presence and meet rising market needs.

- In October 2024, Arkema introduced its advanced waterborne PVDF portfolio designed for cool roof and restoration coatings, capable of delivering service life improvements of 300% to 400% compared to conventional chemistries.

- In February 2023, SILFAB SOLAR INC. launched its Elite series of residential PV modules in the U.S., incorporating conductive backsheet technology. The Silfab Elite 410 BG, featuring an efficient x-pattern design and a maximum system voltage of 1,000 V (DC), reinforces the company’s market position and is expected to drive further growth in the PV module sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Thickness, Material, Technology, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as global solar capacity expands across utility, commercial, and residential sectors.

- Non-fluoride backsheets will gain stronger adoption due to regulatory pressure and rising demand for sustainable materials.

- Advanced PET and multilayer polymer technologies will increasingly replace traditional fluorinated structures.

- Demand for backsheets compatible with TOPCon, HJT, and bifacial modules will accelerate as high-efficiency PV technologies scale.

- Manufacturers will invest more in co-extrusion processes to improve durability, cost efficiency, and recyclability.

- Regions with extreme climates will drive demand for high-performance backsheets engineered for UV, moisture, and thermal stability.

- Strategic partnerships between module producers and material suppliers will expand to support innovation and supply security.

- The shift toward circular manufacturing and recyclability will influence product design and material selection.

- Competition from double-glass modules will encourage suppliers to diversify into advanced coatings and encapsulation materials.

- Asia-Pacific will continue to dominate production and consumption, driven by strong manufacturing ecosystems and installation pipelines.

Key Growth Drivers

Key Growth Drivers