Market Overview

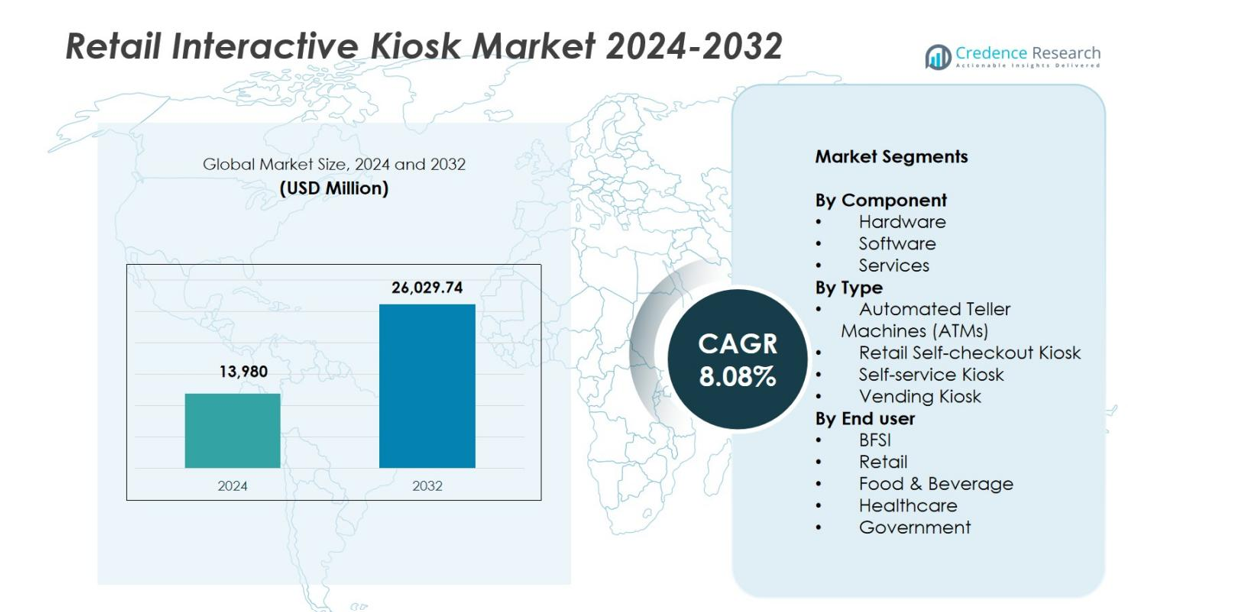

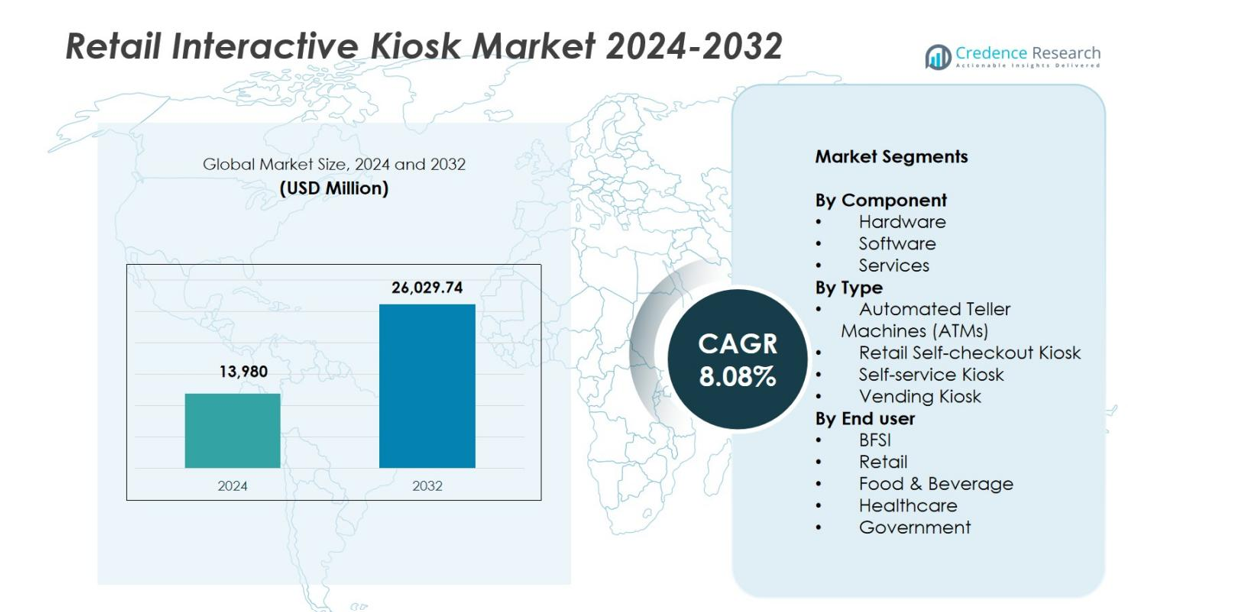

Retail Interactive Kiosk Market size was valued at USD 13,980 million in 2024 and is anticipated to reach USD 26,029.74 million by 2032, at a CAGR of 8.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Retail Interactive Kiosk Market Size 2024 |

USD 13,980 million |

| Retail Interactive Kiosk Market, CAGR |

8.08% |

| Retail Interactive Kiosk Market Size 2032 |

USD 26,029.74 million |

Retail Interactive Kiosk Market features strong participation from key players such as Advantech Co., Ltd., Diebold Nixdorf, Incorporated, DynaTouch Corporation, Embross, Frank Mayer and Associates, Inc., Glory Global Solutions Ltd., GRGBanking, IER, Kiosk Innovations, and Meridian Kiosks, each contributing to technological innovation and large-scale deployment across retail environments. These companies focus on advanced hardware design, AI-enabled software, and secure payment integration to support frictionless customer interactions. Regionally, North America led the market in 2024 with a 36.4% share, supported by rapid digital transformation and high adoption of self-service technologies across retail, BFSI, and food service sectors.

Market Insights

- Retail Interactive Kiosk Market was valued at USD 13,980 million in 2024 and is projected to reach USD 26,029.74 million by 2032, growing at a CAGR of 8.08%.

- Strong market growth is driven by rising demand for contactless services, self-checkout systems, and automated retail experiences, supported by rapid digital transformation across retail and BFSI sectors.

- Key trends include increasing adoption of AI-enabled kiosks, biometric authentication, cloud-based remote management, and the expansion of unmanned and hybrid retail formats globally.

- Leading players such as Advantech, Diebold Nixdorf, GRGBanking, Embross, and Meridian Kiosks strengthen the market through innovation in hardware, software, and modular kiosk solutions; the hardware segment held a dominant 52.4% share in 2024.

- Regionally, North America led with a 36.4% share, followed by Europe at 28.1% and Asia-Pacific at 24.7%, supported by strong retail modernization efforts and increasing adoption of frictionless, automated service technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The Retail Interactive Kiosk Market by component is dominated by the hardware segment, accounting for 52.4% of the market share in 2024, driven by the growing integration of advanced touchscreens, RFID modules, biometric systems, high-resolution displays, and payment technologies. Rising deployment of durable, vandal-resistant kiosk units across retail, BFSI, and transportation environments further strengthens hardware demand. Software holds steady growth as retailers adopt analytics-driven platforms for personalization and remote management, while services gain traction through increasing demand for installation, maintenance, and lifecycle support.

- For instance, PARTTEAM & OEMKIOSKS recently highlighted RFID self-checkout kiosks that bundle an RFID reader, touchscreen, printer, and payment terminal in a modular unit tailored for supermarkets, airports, and other high-traffic venues

By Type

Among kiosk types, automated teller machines (ATMs) captured the largest share at 38.7% in 2024, supported by the expansion of self-banking infrastructure, 24/7 financial accessibility, and upgrades to secure, cash-recycling ATM models. Retail self-checkout kiosks continue to accelerate due to rising adoption of contactless shopping and queue-reduction strategies in supermarkets and convenience stores. Self-service kiosks gain momentum in ticketing, hospitality, and transportation, while vending kiosks benefit from the growth of automated retail and smart dispensing systems.

- For instance, Diebold Nixdorf expanded its partnership with Geldmaat to deliver fully managed ATM services across the Netherlands, including monitoring, helpdesk support, and advanced maintenance reflecting continued investment in modern ATM networks

By End User

The retail segment emerged as the leading end-user group, holding 41.2% of the market share in 2024, fueled by rapid digital transformation, demand for frictionless in-store experiences, and the adoption of self-checkout, wayfinding, and product-information kiosks. BFSI remains a major contributor due to ATM modernization and customer service automation. Food & beverage leverages kiosks to improve ordering efficiency and reduce labor dependency, while healthcare expands usage for patient check-ins and queue management. Government adoption continues to grow for digital public service delivery and self-service citizen portals.

Key Growth Drivers

Rising Demand for Contactless and Self-Service Interactions

The increased preference for contactless experiences remains a major growth catalyst for the Retail Interactive Kiosk Market. Post-pandemic behavioral shifts have accelerated consumer adoption of self-checkout, digital ordering, and automated service delivery, pushing retailers, F&B chains, and BFSI institutions to deploy more interactive kiosks. These systems enhance operational efficiency by reducing queue times, lowering labor dependency, and enabling 24/7 service accessibility. Retailers leverage kiosks to streamline product browsing, payments, and returns, while restaurants use them to speed order processing and reduce human error. Advancements in NFC-enabled payments, QR-code interactions, antimicrobial touch surfaces, and voice-assisted interfaces strengthen kiosk usability. As consumer comfort with automation rises, businesses increasingly invest in kiosk ecosystems that support scalable, consistent customer service across high-traffic environments.

- For instance, NCR Voyix and GRUBBRR expanded rollout of the Aloha self-service platform, enabling contactless ordering and payments through large-format touchscreens, QR-code interactions, and integrated mobile wallets reducing queue times in high-volume restaurants.

Retail Digitization and Omnichannel Integration

Accelerating retail digital transformation is another key growth driver, as brands increasingly adopt omnichannel strategies to create seamless customer journeys. Interactive kiosks act as vital digital touchpoints, enabling click-and-collect services, endless-aisle browsing, personalized recommendations, and real-time inventory checks. These capabilities minimize lost sales and enhance customer engagement through data-driven personalization. AI-powered recommendation engines and cloud-connected kiosk networks improve responsiveness and operational insights. Retailers benefit from analytics that reveal shopper behavior and service usage patterns. Unified commerce initiatives drive demand for kiosks integrated with POS systems, ERP platforms, and digital catalogs. With adoption rising across supermarkets, apparel stores, pharmacies, and specialty outlets, kiosk-enabled digital integration significantly strengthens retail competitiveness.

- For instance, several apparel retailers, including H&M, advanced digital fitting-room kiosks capable of showing alternative sizes and styles while syncing with backend ERP and POS systems.

Advancements in Hardware and Software Technologies

Technological advancements in kiosk design, connectivity, and functionality are fueling substantial market growth. Next-generation kiosks feature high-resolution displays, biometric authentication, AI-driven facial recognition, gesture control, and secure payment modules that improve user experience and security. Enhanced durability, energy efficiency, and remote management tools enable large-scale deployments with reduced maintenance costs. Cloud-based platforms support real-time content updates, predictive maintenance, and enhanced cybersecurity, ensuring operational continuity. IoT sensors and analytics platforms increase kiosk intelligence, supporting personalized content delivery and continuous performance monitoring. Modular kiosk designs streamline customization across retail, BFSI, healthcare, and hospitality sectors. As innovation accelerates in AI, machine vision, and autonomous retail, kiosk technology evolution continues to drive long-term market expansion.

Key Trends & Opportunities

Emergence of AI-Enabled and Data-Driven Retail Experiences

AI integration is emerging as one of the most powerful trends, offering major opportunities to enhance personalization and operational efficiency. Interactive kiosks equipped with AI analyze customer behavior, predict purchasing patterns, and display targeted product suggestions, significantly improving conversion rates. Machine vision supports automated age verification, customer recognition, and product identification, expanding kiosk use across retail categories. Retailers increasingly rely on AI-driven analytics to evaluate footfall, dwell times, and demand fluctuations, optimizing merchandising decisions. Natural language processing enables voice-led self-service, improving accessibility. As retail shifts toward predictive and adaptive models, AI-enabled kiosks help brands deliver intuitive and efficient customer experiences while gaining deeper operational insights.

- For instance, Mashgin’s AI-powered self-checkout kiosks deployed across stadiums, convenience stores, and corporate campuses use computer vision to instantly identify products without barcodes, reducing checkout time to under 10 seconds.

Expansion of Automated and Unmanned Retail Formats

The rapid growth of automated retail ecosystems including unmanned stores, micro-markets, smart vending machines, and hybrid checkout-free concepts presents significant opportunities for kiosk vendors. Retailers are adopting kiosks as the backbone of autonomous shopping models, enabling digital payments, product authentication, and customer verification without staff involvement. This trend is driven by rising labor shortages, increasing operational costs, and the need for 24/7 service availability. Kiosks support key functions such as access control, purchase guidance, transaction execution, and automated dispensing. As the market shifts toward blended human–machine retail models, opportunities expand for kiosk manufacturers to innovate in robotic vending, digital locker systems, and AI-integrated fulfillment counters. This transition is reshaping the future of convenience retail.

- For instance, R-Kiosk GO, Estonia’s first unmanned store opened at Tallinn University of Technology, allows customers to enter via bank card or app, with sensors tracking items added to or removed from a virtual cart for automatic payment upon exit.

Key Challenges

High Initial Investment and Maintenance Costs

Despite strong growth prospects, adoption of interactive kiosks is often limited by high upfront investment and long-term maintenance expenses. Businesses must allocate capital for advanced hardware components, secure payment systems, software licenses, and integrations with existing retail infrastructure. For smaller retailers or multi-location chains, the financial burden can be significant. Kiosks also require continuous updates, hardware servicing, and cybersecurity enhancements, contributing to operating costs. Unexpected breakdowns or downtime can disrupt customer service and reduce ROI. Exposure to harsh environments, heavy usage, or vandalism further increases maintenance needs, making financial planning and lifecycle management essential considerations for kiosk deployment.

Cybersecurity Risks and Data Privacy Concerns

As kiosks process sensitive customer information including payment data, biometrics, and personal details cybersecurity threats pose a critical challenge. Cloud-connected kiosks can be vulnerable to malware attacks, unauthorized access, data breaches, and system manipulation. Ensuring robust encryption, multi-layer authentication, and timely security patching is essential but complex for large-scale deployments. Retailers must also comply with stringent global data protection regulations, increasing administrative and technical requirements. Inadequate security measures can undermine customer trust and damage brand reputation. As kiosks become more intelligent and interconnected, strengthened cybersecurity frameworks and continuous monitoring become indispensable to maintaining safe and reliable kiosk operations.

Regional Analysis

North America

North America dominated the Retail Interactive Kiosk Market in 2024 with a 36.4% share, driven by rapid adoption of self-service technologies across retail, BFSI, and quick-service restaurants. Strong consumer preference for automated checkout, digital ordering, and contactless payment solutions has accelerated kiosk deployments nationwide. Retailers increasingly integrate AI-enabled analytics, biometric authentication, and cloud-connected platforms to enhance customer engagement and operational efficiency. The presence of major kiosk manufacturers and continuous investments in retail digitalization further strengthen regional growth. Expanding omnichannel retail models and demand for frictionless shopping experiences continue to sustain market leadership.

Europe

Europe accounted for 28.1% of the Retail Interactive Kiosk Market in 2024, supported by widespread digital transformation initiatives and increasing deployment of self-checkout systems in supermarkets and hypermarkets. The region’s strict regulatory framework for cybersecurity and payment security drives adoption of advanced kiosk technologies featuring secure authentication and encrypted transactions. Growth is reinforced by rising labor shortages, prompting retailers and hospitality providers to automate customer-facing processes. Smart city projects and public service digitalization across Western and Northern Europe further contribute to market expansion. Additionally, expanding tourism stimulates kiosk installations in airports, transportation hubs, and hotels.

Asia-Pacific

Asia-Pacific held a significant 24.7% market share in 2024, emerging as the fastest-growing region due to booming retail modernization, rising urbanization, and large-scale adoption of digital payment ecosystems. China, Japan, South Korea, and India lead adoption driven by strong investments in smart retail formats, unmanned stores, and AI-enabled kiosks. The expansion of convenience store chains, increasing food service automation, and rising smartphone penetration boost interactive kiosk demand. Government initiatives supporting digital infrastructure and cashless economies further stimulate market growth. Competitive pricing offered by regional kiosk manufacturers strengthens adoption across both large enterprises and small retailers.

Latin America

Latin America captured a 6.2% share in 2024, supported by growing interest in retail automation and the modernization of banking and public service systems. Countries such as Brazil, Mexico, and Chile are increasingly adopting self-service kiosks in supermarkets, pharmacies, and transport terminals to improve customer experience and operational efficiency. Expanding digital payment adoption and rising demand for 24/7 access to services such as ticketing, banking, and food ordering further boost kiosk installations. However, economic fluctuations and high hardware costs pose challenges. Despite this, ongoing urban development and retail expansion offer strong long-term growth prospects.

Middle East & Africa

The Middle East & Africa region accounted for 4.6% of the market in 2024, driven by increasing investments in smart city development, tourism infrastructure, and retail modernization. GCC countries, particularly the UAE and Saudi Arabia, are adopting kiosks across shopping malls, airports, hospitality venues, and government service centers to enhance service speed and reduce operational workloads. Rising deployment of ATMs, self-check-in systems, and digital information kiosks contributes to market momentum. In Africa, growth remains steady as retail chains and financial institutions expand self-service capabilities. Infrastructure constraints persist, but improving digital readiness supports gradual market expansion.

Market Segmentations

By Component

- Hardware

- Software

- Services

By Type

- Automated Teller Machines (ATMs)

- Retail Self-checkout Kiosk

- Self-service Kiosk

- Vending Kiosk

By End user

- BFSI

- Retail

- Food & Beverage

- Healthcare

- Government

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Retail Interactive Kiosk Market features a diverse and expanding ecosystem of technology providers, kiosk manufacturers, and software platform developers focused on enhancing automated customer engagement across retail and service environments. Leading players such as Advantech Co., Ltd., Diebold Nixdorf, Incorporated, DynaTouch Corporation, Embross, Frank Mayer and Associates, Inc., Glory Global Solutions Ltd., GRGBanking, IER, Kiosk Innovations, and Meridian Kiosks continue to strengthen their portfolios through product innovation, modular kiosk design, and integration of AI-driven analytics and secure payment solutions. Companies are increasingly investing in cloud-based remote management systems, biometric authentication technologies, and customized end-user interfaces to support omnichannel retail operations. Strategic partnerships with retailers, QSR chains, BFSI institutions, and government agencies are accelerating deployment at scale. Additionally, competitive differentiation is driven by the ability to deliver durable hardware, advanced software ecosystems, and tailored solutions that address industry-specific requirements, ensuring sustained market growth and technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GRGBanking

- Meridian Kiosks

- Frank Mayer and Associates, Inc.

- Embross

- Glory Global Solutions Ltd.

- Advantech Co., Ltd.

- Kiosk Innovations

- Diebold Nixdorf, Incorporated

- DynaTouch Corporation

- IER

Recent Developments

- In January 2025, Diebold Nixdorf, Incorporated expanded its partnership with Geldmaat, a Dutch consumer financial services provider. As part of the agreement, the company will deliver ATM Managed Services for long-term ATM and cash systems across the Dutch market, including helpdesk support, monitoring services, and extensive maintenance and repair services.

- In October 2024, Advantech Co., Ltd. announced the acquisition of Aures Technologies SA, a French provider of POS and kiosk solutions. This strategic acquisition strengthens Advantech’s global presence in the smart retail sector and enhances its position among leading smart retail solution providers worldwide.

- In May 2024, NCR Voyix unveiled the Aloha Kiosk, a fully integrated and platform-enabled solution powered by GRUBBRR. Developed through their partnership, the offering connects seamlessly with NCR Voyix Payments, improving operational flexibility, enhancing order accuracy, and helping restaurants increase revenue.

Report Coverage

The research report offers an in-depth analysis based on Component, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as retailers accelerate adoption of self-service and automated customer engagement solutions.

- AI-enabled kiosks will become standard, enhancing personalization, analytics, and real-time decision-making.

- Contactless and biometric payment technologies will see wider integration across retail environments.

- Retailers will increasingly adopt cloud-connected kiosk networks for remote management and performance monitoring.

- Unmanned and hybrid retail formats will expand, driving demand for smart vending and autonomous service kiosks.

- Modular and customizable kiosk designs will gain traction to support sector-specific requirements.

- Growth in omnichannel retailing will strengthen kiosk deployment for order pickup, inventory lookup, and loyalty engagement.

- Digital transformation in emerging markets will open new opportunities for large-scale kiosk rollouts.

- Enhanced cybersecurity frameworks will become essential as kiosks handle more sensitive transactions.

- Partnerships between kiosk manufacturers, software providers, and retailers will intensify to deliver integrated service ecosystems.