Market Overview

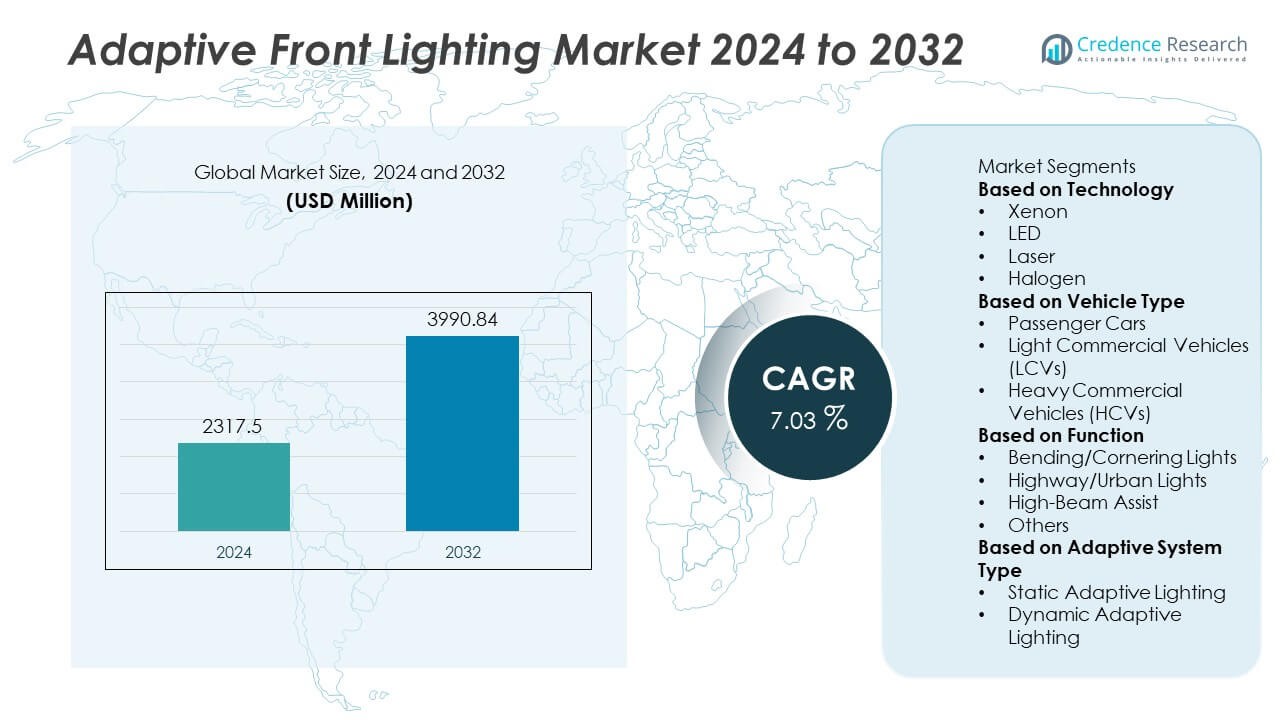

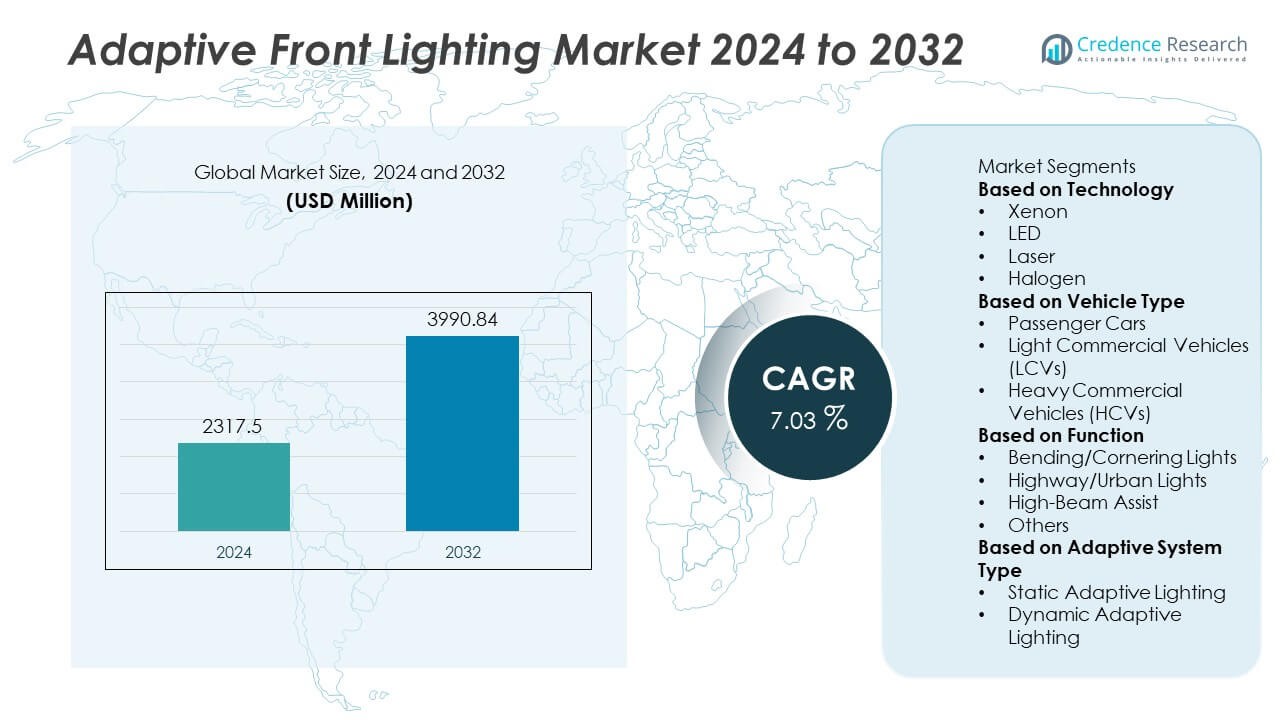

The Adaptive Front Lighting market reached USD 2,317.5 million in 2024 and is projected to rise to USD 3,990.84 million by 2032, supported by a CAGR of 7.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adaptive Front Lighting Market Size 2024 |

USD 2,317.5 Million |

| Adaptive Front Lighting Market, CAGR |

7.03% |

| Adaptive Front Lighting Market Size 2032 |

USD 3,990.84 Million |

The Adaptive Front Lighting market is shaped by leading players such as HELLA GmbH & Co. KGaA, Koito Manufacturing Co., Ltd., Valeo SA, Stanley Electric Co., Ltd., Magneti Marelli S.p.A., OSRAM Licht AG, ZKW Group, Hyundai Mobis Co., Ltd., Varroc Lighting Systems, and Philips (Signify). These companies focus on advanced LED, laser, and matrix lighting technologies to improve visibility, energy efficiency, and safety performance. Asia Pacific leads the global market with a 35% share, driven by strong vehicle production and rapid ADAS adoption. Europe follows with a 32% share, supported by strict safety regulations and high premium vehicle penetration, while North America holds a 27% share, backed by rising demand for intelligent lighting in SUVs and electric vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 2,317.5 million in 2024 and is projected to reach USD 3,990.84 million by 2032, expanding at a 7.03% CAGR during the forecast period.

- Rising demand for safety-focused vehicle systems drives strong adoption of adaptive front lighting, supported by LED-based technologies and growing integration with ADAS features across passenger cars and commercial vehicles.

- LED technology leads with a 52% share, driven by high efficiency and precise beam control, while high-beam assist remains the dominant function with a 41% share due to wide OEM adoption.

- Asia Pacific leads the regional landscape with a 35% share, followed by Europe at 32% and North America at 27%, reflecting strong automotive production and rising deployment of intelligent lighting systems.

- Competition intensifies as key players expand LED, matrix, and laser lighting portfolios, but high system costs and complex electronic integration remain restraints in cost-sensitive markets.

Market Segmentation Analysis:

By Technology

LED technology dominates the segment with a 52% market share, driven by its strong energy efficiency, longer lifespan, and faster response time compared to halogen and xenon systems. Automakers prefer LED-based adaptive front lighting due to improved brightness control, flexible beam shaping, and compatibility with advanced driver assistance systems. Xenon lights follow in applications requiring high-intensity output, while laser systems gain traction in premium models for long-range illumination. Halogen remains present in low-cost vehicles but continues to decline as OEMs shift toward high-performance, low-power lighting technologies across global production lines.

- For instance, Koito Manufacturing introduced its BladeScan™ ADB LED module, a headlamp system that emits LED light to fast-revolving blade mirrors to ensure high-resolution light distribution, which is equivalent to the use of 300 LEDs.

By Vehicle Type

Passenger cars lead the segment with a 63% market share, supported by rising integration of adaptive lighting in mid-range and premium vehicle models. Automakers adopt intelligent lighting systems to enhance road visibility, meet safety regulations, and improve nighttime driving comfort. Light commercial vehicles follow with growing demand for improved illumination in delivery and fleet operations. Heavy commercial vehicles also adopt adaptive lighting to reduce accident risks during long-distance and highway travel. Increasing vehicle electrification and safety-centric consumer preferences further strengthen adoption across major passenger car platforms.

- For instance, Valeo supplied the Peugeot 408 program with Matrix LED headlights that automatically adjust the beam based on driving conditions to provide optimal lighting without blinding other road users.

By Function

High-beam assist holds the dominant position with a 41% market share, driven by its ability to automatically adjust beam intensity based on surrounding traffic, improving visibility without causing glare. Automakers integrate this function widely due to its compatibility with cameras, sensors, and advanced driver assistance systems. Bending and cornering lights follow as users demand better illumination during sharp turns and low-speed maneuvers. Highway and urban lighting modes support optimized brightness for varying speed conditions. Other functions, including dynamic leveling and smart beam shaping, gain traction as manufacturers adopt intelligent lighting to enhance road safety and driving comfort.

Key Growth Drivers

Rising Adoption of Advanced Driver Assistance Systems (ADAS)

Growing implementation of ADAS features drives strong demand for adaptive front lighting as automakers enhance visibility and reduce collision risks. Adaptive lighting works with sensors and cameras to adjust beam angles, improving night-time and curve-driving safety. Governments enforce stricter safety standards, pushing OEMs to integrate intelligent lighting in both premium and mid-range vehicles. Rising consumer preference for safety-equipped cars and expanding electrification further accelerate adoption. Automakers also use adaptive lighting to improve brand differentiation and meet global crash-prevention requirements.

- For instance, HELLA integrated an 84-pixel LED matrix module in the Audi A7, which adjusts beam patterns in real time using a camera delivering 1.3-megapixel detection resolution. The system controls each pixel independently and illuminates a 70-meter forward zone without glare.

Shift Toward LED and Intelligent Lighting Technologies

LED-based adaptive front lighting grows rapidly due to high energy efficiency, long lifespan, and precise beam control. OEMs prefer LED modules because they support lightweight vehicle design and offer faster illumination response. Advanced beam-shaping and pixel-level control enhance driving safety in changing road conditions. The shift toward intelligent lighting also aligns with the increased adoption of digital headlamp systems. Reduced power consumption is another key driver, especially for electric vehicles where energy efficiency remains critical.

- For instance, ZKW Group uses advanced thermal management systems to ensure optimal performance and longevity of their LED modules, such as those with over 50,000 pixels in new Opel models or their laser modules that generate around 500 lumens with precise thermal control, which is essential for maintaining consistent light output and reliability.

Increasing Premium and Mid-Range Vehicle Production

Automakers expand production of premium and mid-range vehicles equipped with smart lighting systems, boosting the use of adaptive front lighting. Rising disposable incomes and strong global demand for feature-rich cars support this trend. Consumers choose vehicles with enhanced visibility, stylish lighting designs, and improved driving comfort. OEMs integrate adaptive lights to strengthen safety ratings and comply with global regulations. Growing urbanization and longer commute times further increase the need for advanced illumination solutions.

Key Trends & Opportunities

Integration of Matrix LED and Laser Lighting Systems

Matrix LED and laser-based adaptive lighting create new opportunities by offering superior illumination range, pixel-level beam control, and glare-free high-beam performance. Premium automakers lead adoption as these systems improve visibility in complex driving environments. Advancements in micro-optics and beam-forming technologies enable precise light distribution. Manufacturers explore cost-effective variants for mid-range vehicles, expanding market reach. As automotive design shifts toward futuristic lighting signatures, matrix and laser systems strengthen the value proposition for OEMs.

- For instance, BMW equipped its Laserlight module with a 600-meter high-beam reach and a laser diode output of 450 milliwatts. The system uses micro-lenses to split the beam into controlled segments for accurate road targeting.

Growing Adoption in Electric and Autonomous Vehicles

Electric and autonomous vehicles create strong opportunities for adaptive front lighting due to the need for efficient, sensor-integrated illumination. EV manufacturers prefer intelligent lighting to reduce power consumption and improve night-time efficiency. Autonomous driving systems rely on adaptive lighting to enhance sensor performance and road-object visibility. Smart headlights that communicate with onboard cameras and navigation systems enhance overall safety. This trend accelerates innovation in dynamic beam-shaping and predictive lighting.

- For instance, Hyundai Mobis engineered an EV-focused headlamp that limits power use to 15 watts per module while delivering a 180-meter forward range. The unit communicates with navigation data to adjust the beam before entering curves.

Key Challenges

Higher Cost of Advanced Lighting Technologies

Adaptive front lighting systems, particularly LED matrix and laser units, remain expensive due to complex optics, sensors, and control electronics. Higher production costs limit penetration in low-cost and entry-level vehicles. OEMs face pricing pressure as they balance regulatory compliance with affordability. Cost-sensitive markets may prefer traditional halogen or basic LED units instead of advanced adaptive systems. Manufacturers must optimize design and scale production to lower costs and expand global adoption.

Complex Integration with Vehicle Electronics and ADAS Systems

Adaptive lighting requires seamless integration with sensors, cameras, steering systems, and electronic control units, creating technical complexity. Calibration issues, software compatibility, and system reliability pose challenges for manufacturers. Any malfunction in sensors can affect beam performance and reduce safety benefits. OEMs must ensure precise coordination between lighting modules and vehicle dynamics. This complexity increases development time and raises engineering costs, slowing adoption in emerging markets.

Regional Analysis

North America

North America holds a 27% market share, supported by strong adoption of ADAS-equipped vehicles and rising demand for premium automotive lighting systems. The United States leads due to higher production of SUVs and luxury cars that integrate LED and high-beam assist technologies. Safety regulations encouraging advanced illumination features also drive market growth. Automakers invest in adaptive lighting to enhance visibility during highway driving and nighttime travel. Growing EV adoption further boosts integration of energy-efficient LED and matrix systems. The region benefits from strong R&D capabilities and expanding partnerships between lighting suppliers and OEMs.

Europe

Europe accounts for a 32% market share, driven by strict road-safety regulations and high penetration of premium vehicles. Germany, France, and the United Kingdom lead adoption due to active use of LED matrix, laser systems, and dynamic bending lights. Automakers invest heavily in intelligent lighting to comply with Euro NCAP safety ratings. Strong presence of luxury brands accelerates innovation in high-precision adaptive beams. Growing EV and hybrid vehicle production also supports advanced illumination technologies. The region’s mature automotive infrastructure and strong engineering capabilities reinforce Europe’s leadership in adaptive front lighting adoption.

Asia Pacific

Asia Pacific leads the global market with a 35% market share, supported by rising vehicle production in China, Japan, South Korea, and India. Growing consumer adoption of mid-range and premium vehicles boosts integration of adaptive lighting systems. Automakers accelerate LED and intelligent lighting adoption to meet safety standards and improve nighttime visibility. Expanding EV manufacturing strengthens demand for energy-efficient headlamp technologies. The region benefits from large-scale automotive manufacturing, cost-effective production capabilities, and rapid adoption of ADAS features. Increasing urbanization and rising road-safety awareness further support long-term growth.

Latin America

Latin America holds a 4% market share, driven by gradual adoption of advanced lighting technologies in Brazil, Mexico, and Argentina. Improving safety regulations and rising sales of mid-range vehicles support the uptake of LED-based adaptive lighting. OEMs introduce upgraded lighting packages to enhance visibility during highway and rural-road driving. Growth in passenger car production and expanding automotive imports also support market penetration. Although cost-sensitive buyers slow premium adoption, rising urban mobility upgrades create steady demand for intelligent headlamp features across regional vehicle fleets.

Middle East & Africa

The Middle East & Africa region holds a 2% market share, supported by rising demand for premium and high-performance vehicles across the UAE, Saudi Arabia, and South Africa. Harsh driving conditions and long-distance travel increase the need for advanced visibility solutions, boosting interest in LED and adaptive systems. Luxury and imported vehicles drive adoption as automakers introduce cornering lights and high-beam assist features. Growing urban development and rising safety awareness support wider market growth. However, cost constraints and limited regional manufacturing restrict deeper penetration across mass-market vehicle segments.

Market Segmentations:

By Technology

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Function

- Bending/Cornering Lights

- Highway/Urban Lights

- High-Beam Assist

- Others

By Adaptive System Type

- Static Adaptive Lighting

- Dynamic Adaptive Lighting

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major participants such as HELLA GmbH & Co. KGaA, Koito Manufacturing Co., Ltd., Valeo SA, Stanley Electric Co., Ltd., Magneti Marelli S.p.A., OSRAM Licht AG, ZKW Group, Hyundai Mobis Co., Ltd., Varroc Lighting Systems, and Philips (Signify). These companies compete through advancements in LED, laser, and matrix lighting technologies that enhance visibility, energy efficiency, and adaptive beam control. Global suppliers strengthen their positions by expanding production capacity, optimizing optical designs, and integrating intelligent sensors for real-time illumination adjustments. Partnerships with leading automakers support wider deployment of dynamic bending lights, high-beam assist systems, and highway/urban adaptive modes. Firms also invest in software-driven headlamp control units to improve precision and align with ADAS requirements. The market remains highly competitive as suppliers race to deliver lightweight, energy-efficient, and cost-effective lighting modules for both premium and mid-range vehicle platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HELLA GmbH & Co. KGaA

- Koito Manufacturing Co., Ltd.

- Valeo SA

- Stanley Electric Co., Ltd.

- Magneti Marelli S.p.A.

- OSRAM Licht AG

- ZKW Group

- Hyundai Mobis Co., Ltd.

- Varroc Lighting Systems

- Philips (Signify)

Recent Developments

- In April 2025, Valeo announced a strategic partnership with Appotronics to co-develop next-generation front-lighting systems combining Valeo’s expertise in lighting and ECU/software and Appotronics’ full-colour laser headlight technology.

- In July 2024, HELLA GmbH & Co. KGaA (FORVIA HELLA) developed a new head-lamp concept for the Audi Q6 e-tron that features adaptive lighting functions including glare-free high beam and a digital daytime-running-light matrix with up to eight selectable design signatures.

- In January 2024, ZKW Group (with LG) showcased at CES 2024 intelligent front-lighting modules including digital HD LED modules that dynamically adapt to traffic situations and precisely mask other road users, plus show-car projections of over 1.3 million pixels.

Report Coverage

The research report offers an in-depth analysis based on Technology, Vehicle Type, Function, Adaptive System Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for adaptive lighting will rise as ADAS-equipped vehicles increase worldwide.

- LED and matrix technologies will become standard in mid-range and premium vehicles.

- Laser-based lighting systems will expand in luxury models due to long-range visibility.

- Automakers will integrate predictive lighting linked to navigation and sensor systems.

- Electric vehicles will drive adoption of energy-efficient, lightweight lighting modules.

- Regulatory pressure will increase the use of advanced illumination for safety compliance.

- OEM–supplier partnerships will strengthen to accelerate intelligent lighting innovation.

- Software-driven beam control and dynamic shaping will gain wider deployment.

- Cost reduction strategies will help adaptive lighting enter more entry-level vehicles.

- Asia Pacific will remain the fastest-growing region due to strong vehicle production.