Market Overview:

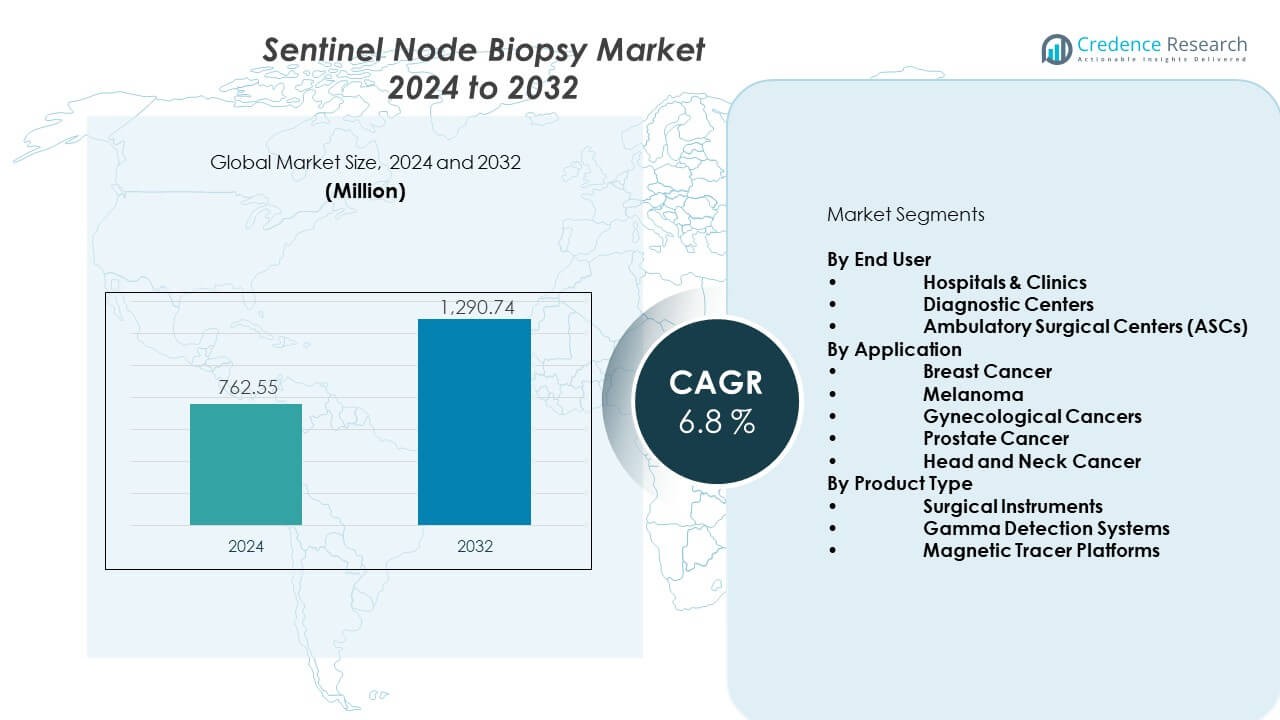

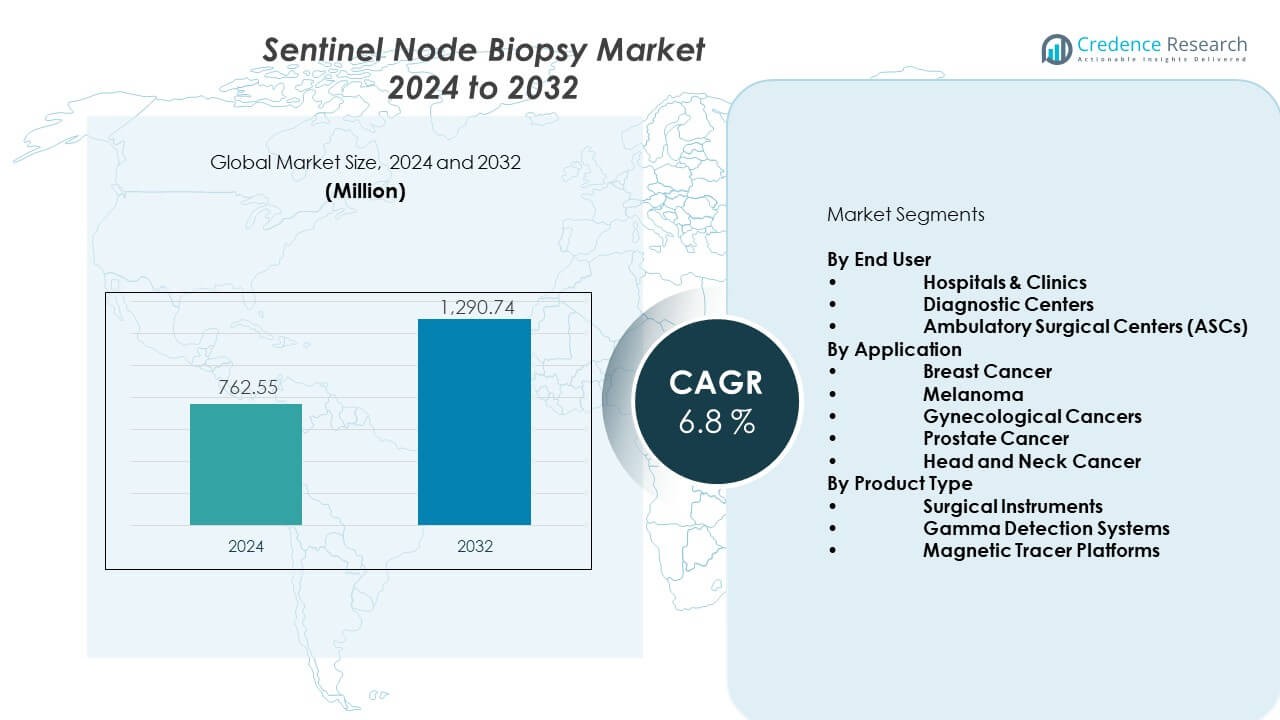

The Sentinel node biopsy market is projected to grow from USD 762.55 million in 2024 to an estimated USD 1,290.74 million by 2032, with a CAGR of 6.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sentinel Node Biopsy Market Size 2024 |

USD 762.55 Million |

| Sentinel Node Biopsy Market, CAGR |

6.8% |

| Sentinel Node Biopsy Market Size 2032 |

USD 1,290.74 Million |

The market gains strength from rising preference for minimally invasive staging across oncology. Hospitals invest in hybrid imaging tools that speed detection and reduce surgical strain. Surgeons rely on advanced tracers that provide clearer lymphatic mapping and reduce false negatives during procedures. New regulatory approvals for targeted agents expand clinical access and support safer workflows. Growing awareness among patients increases screening rates and supports early intervention. Strong adoption across oncology centers boosts procedure volumes and raises demand for next-generation tracers. Research upgrades also push better localization and improve overall care quality.

Regional growth varies based on healthcare maturity and cancer screening frameworks. North America leads due to advanced oncology infrastructure, strong reimbursement, and rapid integration of new tracers. Europe follows with wide breast cancer screening coverage and rising focus on precision diagnostics. Asia Pacific is emerging quickly as cancer cases rise and hospitals modernize diagnostic pathways. Countries in the Middle East and Latin America show steady adoption, driven by rising investments in oncology care and expanding clinical capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Sentinel node biopsy market reached USD 762.55 million in 2024 and is expected to hit USD 1,290.74 million by 2032, supported by a 6.8% CAGR driven by rising adoption of minimally invasive cancer staging.

- North America leads with 38% share, Europe follows with 32%, and Asia Pacific holds 22%, each dominating due to strong oncology capacity, broad screening programs, and expanding tracer availability.

- Asia Pacific is the fastest-growing region with 22% share, driven by rising cancer incidence, new nuclear medicine facilities, and wider integration of tracer-guided staging.

- By End User, hospitals and clinics dominate with 62% share, supported by advanced surgical units and established tracer workflows.

- By Application, breast cancer holds 49% share, reflecting its status as the primary clinical domain where sentinel node biopsy is a standard staging method.

Market Drivers:

Growing Use of Minimally Invasive Cancer Staging Techniques

The Sentinel node biopsy market expands due to strong demand for minimally invasive cancer staging. Hospitals prefer targeted node sampling that reduces surgical load for patients. Surgeons adopt precision tracers that improve lymphatic mapping accuracy. Rising breast cancer and melanoma cases push higher clinical uptake. Oncology teams rely on hybrid imaging that sharpens localization. Healthcare systems support early detection programs that raise screening volumes. Regulatory bodies approve new tracer formulations that support safer workflows. Research groups build strong evidence that strengthens clinical acceptance.

- For instance, the FDA-cleared Magtrace® iron-oxide tracer by Endomag enables sentinel node detection for up to 30 days, offering a non-radioactive staging option documented in U.S. breast cancer centers.

Rising Integration of Advanced Radiopharmaceutical and Dye-Based Tracers

Growth accelerates due to improved radiopharmaceutical agents that support faster detection. Clinicians trust hybrid tracers that reduce false negatives during node identification. Hospitals deploy fluorescence imaging to guide cleaner incisions and lower tissue disruption. It supports consistent outcomes in high-volume oncology centers. Manufacturers upgrade tracer stability and handling protocols. Strong safety profiles encourage wider use across breast cancer units. Oncology surgeons value multi-modal mapping that boosts procedural confidence. Demand strengthens in regions modernizing diagnostic pathways.

- For instance, GE Healthcare’s Lymphoseek® (technetium-99m tilmanocept) is clinically validated for rapid sentinel node localization with documented high receptor-target binding efficiency in melanoma and breast cancer surgery.

Expanding Training Programs and Strong Clinical Adoption Among Oncology Surgeons

Training initiatives strengthen surgeon capability and push wider adoption of sentinel node techniques. Oncology teams follow structured protocols that support smoother integration in hospitals. Medical societies promote standardized workflows that cut variability. It helps smaller facilities improve staging quality. Cross-specialty collaboration increases success rates within cancer care units. Imaging specialists enable sharper pre-operative assessments. Surgeons value real-time localization support during complex procedures. Expanded training pipelines raise procedure volumes across global markets.

Increasing Shift Toward Personalized Cancer Care and Early Intervention Models

Personalized oncology frameworks support rising reliance on targeted node sampling. Hospitals align with early detection models that prioritize rapid, low-impact staging. Precision diagnostics strengthen treatment planning for diverse cancer groups. It helps clinicians match therapies with patient-specific tumor profiles. Technological upgrades support higher confidence in staging accuracy. Integrative imaging enhances surgical precision in busy cancer centers. Patient awareness campaigns encourage early checks that grow biopsy volumes. Demand rises in regions investing in advanced oncology infrastructure.

Market Trends:

Adoption of Hybrid Imaging Platforms for Enhanced Localization Accuracy

The Sentinel node biopsy market experiences strong momentum from hybrid imaging adoption. Hospitals integrate gamma cameras with fluorescence systems to sharpen mapping. Surgeons value multi-signal detection that improves operative clarity. It reduces the chance of missing key lymphatic channels. Radiology departments support intraoperative visualization for rapid decision-making. Manufacturers enhance device ergonomics for smoother workflow. Growth follows rising need for precise node targeting. Demand strengthens in advanced oncology centers.

- For instance, Stryker’s SPY-PHI fluorescence imaging system provides real-time lymphatic visualization and is documented to improve intraoperative mapping accuracy in oncology surgeries.

Development of Novel Tracer Chemistries Supporting Improved Tissue Penetration

New tracer chemistries reshape clinical practice with stronger penetration and cleaner signal output. Oncology teams prefer tracers that reduce background noise during detection. It creates a stable framework for high-accuracy staging. Hospitals evaluate dual-agent systems that support both optical and nuclear mapping. Research groups refine tracer formulations to increase workflow safety. Surgeons adopt agents that support faster visualization in complex cases. Clean uptake patterns help guide surgical precision. This trend gains traction in high-volume cancer hospitals.

- For instance, the indocyanine-green (ICG) fluorescence tracer used with systems like Karl Storz’s IMAGE1 S platform provides documented deep-tissue optical penetration that supports accurate sentinel node visualization.

Growing Shift Toward Outpatient Surgical Pathways and Streamlined Recovery Models

Market growth increases as hospitals shift sentinel node procedures into outpatient settings. Clinical teams prefer short-stay formats supported by efficient workflow tools. It shortens patient recovery timelines and cuts facility burden. Surgeons rely on portable imaging units that support rapid turnover. Oncology teams adopt protocols that minimize time in surgical theaters. Medical centers improve perioperative care around biopsy procedures. This shift aligns with broader cost-efficiency goals in cancer care. Fresh investments support this transition across regions.

Rising Integration of AI-Driven Surgical Guidance and Workflow Optimization Tools

AI-enabled tools reshape the field by supporting stronger localization and predictive planning. Machine learning enhances tracer distribution analysis for better interpretation. It strengthens clinician confidence during node mapping. AI systems support pre-operative planning through automated prediction models. Hospitals adopt platforms that assist with intraoperative guidance. Surgical teams rely on real-time data streams for precise navigation. Workflow optimization tools cut procedure time. Adoption rises in centers pursuing digital transformation targets.

Market Challenges Analysis:

Limited Access to Advanced Tracers and Imaging Devices in Developing Healthcare Systems

The Sentinel node biopsy market faces challenges due to uneven access to advanced tracers. Many hospitals lack nuclear medicine units that support radiotracer handling. It restricts clinical uptake in low-resource regions. Surgeons in smaller facilities depend on older dye-based methods with lower accuracy. Limited training pipelines slow capability growth across developing markets. Regulatory barriers delay approvals for new tracers in some countries. Supply constraints limit high-quality radiopharmaceutical availability. These gaps create slower integration in emerging healthcare systems.

Workflow Complexity, High Costs, and Stringent Regulatory Demands

Workflow complexity challenges facilities that lack integrated imaging support. Device costs remain high for smaller oncology units. It creates financial strain for centers serving large populations. Strict regulatory oversight extends approval timelines for innovative tracers. Hospitals must maintain radiation safety standards that increase operational load. Training requirements demand continuous investment in surgeon skill development. Clinical variability remains an issue where protocols differ. These factors limit rapid standardization across global markets.

Market Opportunities:

Expansion of Hybrid Tracers, Fluorescent Imaging, and Precision Oncology Pathways

The Sentinel node biopsy market holds strong opportunities as hybrid tracers mature. Hospitals seek fluorescence-nuclear agents that improve mapping accuracy. It opens doors for precision oncology planning across diverse cancer types. Manufacturers can introduce next-generation imaging tools for rapid intraoperative guidance. Growth emerges from rising investment in high-definition surgical visualization. Strong clinical adoption creates space for innovative device portfolios. Early diagnosis programs boost biopsy volumes in expanding markets. New partnerships help scale advanced products across regions.

Surge in Demand Across Emerging Oncology Hubs and Growing Focus on Outpatient Models

Emerging regions create fresh opportunities through oncology infrastructure upgrades. Hospitals adopt efficient outpatient pathways that support sentinel node procedures. It helps clinical teams increase throughput without quality loss. Governments invest in early detection programs that expand patient access. Training programs build strong clinical expertise in developing markets. Manufacturers can target these regions with cost-efficient product lines. Rising cancer incidence increases the need for accurate staging. Global expansion strategies support long-term market growth.

Market Segmentation Analysis:

By End User

The Sentinel node biopsy market shows strong dominance of hospitals and clinics due to their advanced oncology units and structured surgical workflows. These facilities manage higher cancer caseloads and run specialized programs that support precise node mapping. Diagnostic centers expand their role through nuclear medicine capabilities that improve tracer handling and imaging output. It gains momentum in ambulatory surgical centers that perform low-risk, same-day procedures supported by efficient recovery models. ASCs benefit from streamlined operations and rising patient preference for shorter stays. Growth reflects steady upgrades in clinical pathways across all end-user groups. Each segment strengthens adoption through targeted investments in imaging functions. Wider access to skilled teams sustains stable procedure volumes across regions.

- For instance, many U.S. hospital networks use Siemens Healthineers’ Symbia SPECT systems in nuclear medicine units, supporting high-volume sentinel node detection workflows.

By Application

Breast cancer leads the application segment due to strong integration of sentinel node biopsy in global staging guidelines. Melanoma follows with widespread reliance on precise lymphatic mapping for early spread assessment. Gynecological cancers adopt selective node sampling to reduce radical procedures. Prostate cancer teams evaluate sentinel mapping to improve staging accuracy in localized disease. Head and neck cancers benefit from targeted tracer strategies that support cleaner surgical fields. Each specialty uses tracer-guided workflows to reduce unnecessary node removal. It supports better quality-of-life outcomes for diverse cancer groups. Strong clinical evidence keeps these applications central to oncology.

- For instance, the use of ICG-guided sentinel mapping in breast cancer is supported by large clinical adoption in centers using Fluoptics’ Fluobeam® imaging system, documented for high detection sensitivity.

By Product Type

Surgical instruments hold a leading share due to routine use in node extraction and tissue handling. Gamma detection systems support intraoperative localization with high signal reliability. Magnetic tracer platforms gain attention for radiation-free workflows and flexible handling. Hospitals adopt each product type to meet varied clinical needs. It enables surgeons to select tools that match procedure complexity. Innovation strengthens performance across all platforms. This structure supports steady product demand across global oncology centers.

Segmentation:

By End User

- Hospitals & Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

By Application

- Breast Cancer

- Melanoma

- Gynecological Cancers

- Prostate Cancer

- Head and Neck Cancer

By Product Type

- Surgical Instruments

- Gamma Detection Systems

- Magnetic Tracer Platforms

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The sentinel node biopsy market holds its largest share in North America at around 38% due to advanced oncology care, strong adoption of hybrid imaging, and wide access to nuclear medicine units. Hospitals in the United States integrate tracer-guided mapping into routine cancer staging, which drives steady procedure volumes. Cancer screening programs run across state networks and support early intervention pathways. It gains further traction from strong reimbursement frameworks that encourage adoption of minimally invasive staging tools. Canada strengthens regional demand with investments in precision oncology platforms. Academic centers push clinical research that expands tracer innovation and supports broader use across cancer specialties.

Europe

Europe accounts for roughly 32% of the global share, supported by well-established breast cancer screening programs and widespread acceptance of standardized staging protocols. Hospitals across Germany, France, Italy, and the United Kingdom use tracer-guided mapping in routine surgical practice. Oncology centers rely on strong nuclear medicine capacity that supports clean and reliable localization. It benefits from continuous upgrades in fluorescence imaging and hybrid tracers. Regulatory bodies encourage safe tracer use through harmonized quality guidelines. Market growth accelerates in Eastern Europe where hospitals modernize cancer care pathways and increase access to node-mapping tools.

Asia Pacific

Asia Pacific captures nearly 22% of the global share and remains the fastest-expanding regional segment due to rising cancer incidence and large-scale investment in modern oncology infrastructure. Hospitals in China, Japan, India, and South Korea adopt sentinel mapping to reduce surgical burden and improve staging accuracy. Rapid expansion of nuclear medicine facilities strengthens tracer availability across major metropolitan centers. It gains momentum from growing awareness and broader screening participation. Emerging economies raise demand for cost-efficient devices and portable gamma detection systems. Regional governments support oncology capacity-building programs that push long-term adoption across clinical networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hologic, Inc.

- Devicor Medical Products, Inc. (Leica Biosystems)

- KUB Technologies, Inc. (KUBTEC)

- SurgicEye GmbH

- LabLogic Systems Ltd (Care Wise)

- Gamma Medical Technology

- Stryker Corporation

- Varay Laborix

- Navidea Biopharmaceuticals, Inc.

- BD (Becton, Dickinson & Company)

- Medtronic

- GE Healthcare

Competitive Analysis:

The Sentinel node biopsy market features strong competition driven by technology upgrades, imaging precision, and specialized tracer innovation. Key players expand their portfolios with hybrid imaging platforms and stable tracer chemistries that support accurate node localization. It grows through strategic investment in fluorescence systems, digital gamma probes, and surgical navigation tools. Companies strengthen distribution networks to reach oncology centers with high procedure volumes. Partnerships with hospitals accelerate training and device adoption. Product differentiation remains tied to workflow efficiency, detection accuracy, and safety profiles. Competitive intensity rises as new platforms target radiation-free workflows and portable tracing options that align with modern surgical needs.

Recent Developments:

- In July 2024, Hologic, Inc. completed the acquisition of Endomagnetics (Endomag), a company specializing in non-radioactive tumor localization technologies, including the Magtrace solution for sentinel lymph node biopsies. This acquisition expanded Hologic’s portfolio with technologies that enable precise lymph node and tumor localization without radioactive materials, enhancing options for breast cancer surgery and staging.

Report Coverage:

The research report offers an in-depth analysis based on By End User and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Strong growth expected as hospitals expand minimally invasive oncology programs.

- Broader acceptance of hybrid tracers will reshape intraoperative mapping practices.

- AI-based imaging interpretation will support faster and more accurate localization.

- Radiation-free magnetic platforms will gain traction across smaller surgical centers.

- Integrated surgical navigation tools will strengthen clinical workflow efficiency.

- Emerging markets will expand adoption through growing oncology infrastructure.

- Manufacturers will invest in ergonomic, portable gamma detection devices.

- Personalized cancer care models will increase reliance on targeted node staging.

- Training programs will scale to support adoption across diverse oncology teams.

- Regulatory pathways will favor safer tracer chemistries with stable performance.