Market Overview

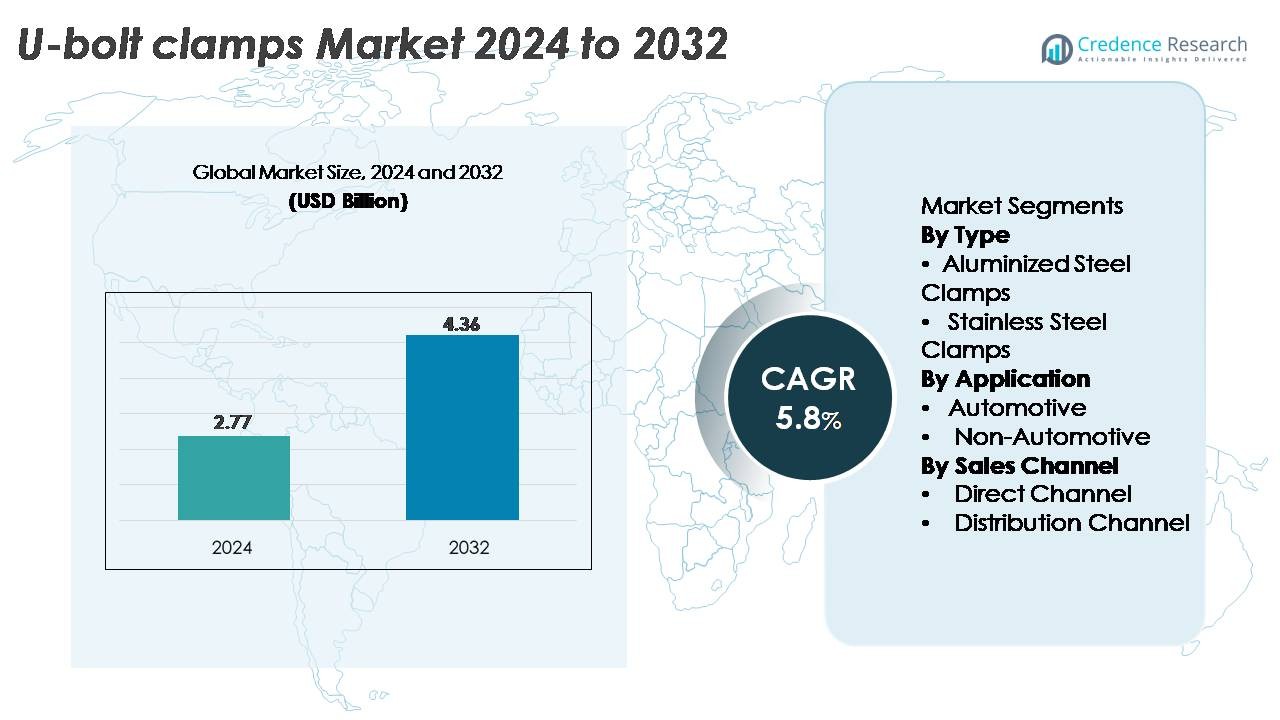

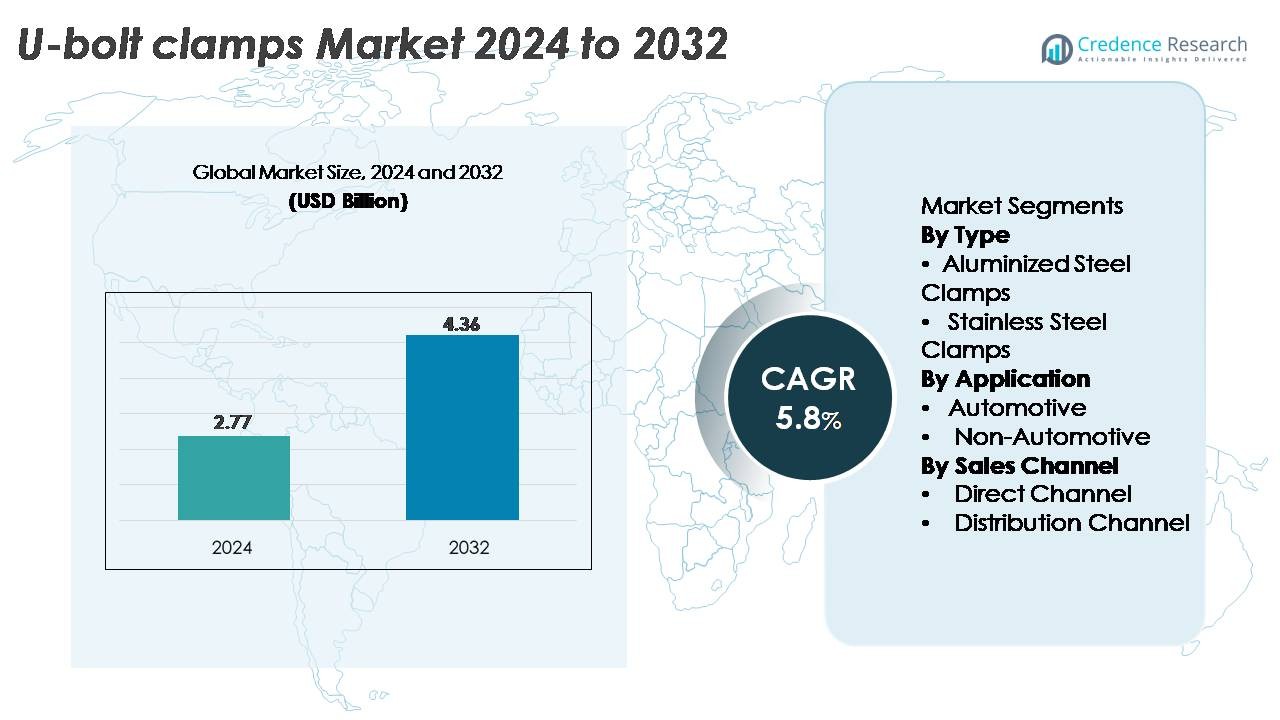

The global U-bolt Clamps Market was valued at USD 2.77 billion in 2024 and is projected to reach USD 4.36 billion by 2032, expanding at a CAGR of 5.8% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U-bolt Clamps Market Size 2024 |

USD 2.77 Billion |

| U-bolt Clamps Market, CAGR |

5.8% |

| U-bolt Clamps Market Size 2032 |

USD 4.36 Billion |

The U-bolt clamps market is shaped by a diverse group of established manufacturers, including Peterson Spring, Kale Clamp, Ideal Clamp, Yushin Precision Industrial, BAND-IT, Togo Seisakusyo, Oetiker Group, Rotor Clip, Norma Group SE, and Clampco. These companies compete by offering high-strength, corrosion-resistant clamps engineered for automotive, industrial, and construction applications. Many focus on material innovation, precision forming, and expanded distribution networks to strengthen market presence across OEM and aftermarket segments. North America leads the global market with a 34% share, driven by strong automotive production, advanced industrial infrastructure, and sustained demand for premium stainless-steel clamp solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U-bolt clamps market was valued at USD 2.77 billion in 2024 and is projected to reach USD 4.36 billion by 2032, registering a 5.8% CAGR, reflecting stable growth across automotive and industrial applications.

- Strong market drivers include rising automotive production, expanding aftermarket maintenance demand, and increasing use of corrosion-resistant stainless-steel clamps, which hold the largest share within the type segment due to superior durability and load performance.

- Key trends center on customized clamp designs, precision manufacturing, and broader adoption of high-strength materials, supported by competitive innovation from global players prioritizing reliability, certification, and application-specific engineering.

- Market restraints primarily stem from raw material price volatility, supply chain disruptions, and pricing pressure from low-cost regional manufacturers affecting margins in standard clamp categories.

- Regionally, North America leads with 34%, followed by Asia-Pacific at 29% and Europe at 28%; the automotive segment remains the dominant application, while the distribution channel accounts for the largest share in overall sales.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Stainless steel clamps represent the dominant sub-segment, capturing the largest market share due to their superior corrosion resistance, high tensile strength, and long service life in demanding environments. Their reliability in high-temperature and high-vibration settings drives widespread use across automotive, industrial machinery, and construction applications. Aluminized steel clamps continue to grow steadily as cost-efficient alternatives, particularly in exhaust systems and moderate-corrosion environments. The dominance of stainless steel is further reinforced by OEM standards that increasingly emphasize durability, reduced maintenance cycles, and compliance with performance and safety specifications.

- For instance, Oetiker’s Stainless-Steel StepLess® Ear Clamp 167 Series is engineered from 304 stainless steel to provide a corrosion-resistant finish and ensures a secure, leak-free seal under dynamic loads, utilizing a 360° StepLess® design for uniform surface pressure.

By Application

The automotive segment holds the dominant market share, driven by the extensive use of U-bolt clamps in exhaust systems, suspension assemblies, chassis stabilization, and fluid line support. Automakers prioritize components that provide high structural integrity, vibration resistance, and long-term reliability, supporting strong demand for premium clamp materials such as stainless steel. Meanwhile, the non-automotive segment including construction, HVAC, power generation, and industrial equipment continues expanding with increased investments in infrastructure and heavy-duty mechanical systems. However, the automotive industry maintains its lead due to standardized usage volumes and stringent manufacturing specifications.

- For instance, Rotor Clip supplies spring steel retaining clamps and fasteners designed and tested in an IATF 16949 and AS9100 certified lab to withstand the demanding vibration frequencies and axial loads encountered in powertrain assemblies, ensuring safety and stability under dynamic vehicle conditions.

By Sales Channel

The distribution channel dominates the market, accounting for the largest share as manufacturers rely on extensive distributor networks to reach automotive aftermarket buyers, industrial contractors, and maintenance service providers. Distributors offer broad product availability, quicker fulfillment, and multi-brand options, strengthening their position across diverse end-use sectors. Direct sales channels grow steadily, particularly among large OEMs and industrial clients seeking customized clamp designs, bulk procurement efficiency, and long-term supply partnerships. Despite this growth, the distribution channel remains dominant due to its scale, accessibility, and strong presence in both B2B and aftermarket segments.

Key Growth Drivers

Expansion of Automotive Manufacturing and Aftermarket Demand

The global expansion of automotive production and the steady rise of aftermarket servicing strongly drive demand for U-bolt clamps, as these components are essential for exhaust assemblies, suspension stabilization, drivetrain alignment, and fluid line fastening. Automakers increasingly prioritize high-strength, corrosion-resistant clamps to meet evolving emission norms and durability standards. The growing vehicle parc fuels replacement demand, with U-bolt clamps commonly replaced during maintenance cycles due to heat exposure, vibration stress, and corrosion. Additionally, the shift toward lightweight exhaust architectures and compact engine layouts boosts the need for precision-engineered clamps capable of delivering tight tolerances and high load-carrying capacity. Commercial vehicle fleet expansion in logistics, construction, and urban mobility adds sustained volume growth, as heavy-duty trucks and buses rely extensively on large-diameter U-bolt clamps for chassis and suspension safety. Together, OEM and aftermarket demand creates a stable, long-term growth pathway.

- For instance, BAND-IT’s high-strength Ultra-Lok® stainless fastening system delivers a tensile strength of 4,448 N and withstands exhaust temperatures exceeding 538 °C, supporting secure attachment in heavy-vibration automotive environments.

Industrial Infrastructure Modernization and Equipment Upgrades

Growing investments in industrial infrastructure spanning oil and gas, power generation, construction equipment, and heavy machinery serve as a major growth catalyst for U-bolt clamps. These clamps are critical for securing pipelines, HVAC ducting, mechanical tubing, and heavy structural components, making them integral to large-scale installations and plant expansion projects. As facilities upgrade to more energy-efficient and safety-compliant frameworks, demand increases for high-performance clamps with greater load endurance, rust protection, and vibration damping. The rise in refurbishment and retrofitting of aging infrastructure also contributes to recurring sales, particularly where metal fatigue and equipment vibration pose operational risks. Industrial contractors increasingly specify stainless steel and coated clamps to meet strict environmental, seismic, and mechanical stability requirements. With sectors such as water treatment, chemical processing, and renewable energy installations expanding globally, the adoption of robust U-bolt clamping solutions continues to strengthen across high-stress engineered environments.

- For instance, the BAND-IT Uncoated 316 Stainless Steel Band (Part Number C40699), measuring 3/4 inch wide by 0.030 inches thick, provides an average breaking strength of approximately 8,006 N (1,800 lbs).

Rising Adoption of Corrosion-Resistant Materials and Advanced Manufacturing

The market benefits significantly from the rising preference for advanced materials that enhance clamp durability, reduce maintenance, and ensure long-term safety under harsh operating conditions. Manufacturers are shifting toward stainless steel grades, aluminized coatings, and heat-treated fasteners that offer improved corrosion resistance, higher tensile strength, and thermal stability. This adoption is driven by stricter quality standards across automotive, marine, and industrial sectors, where prolonged exposure to heat, moisture, and chemical agents is common. Advanced manufacturing such as CNC-bent rods, automated forging, robotic welding, and precision threading improves dimensional accuracy and load uniformity, enabling clamps to withstand higher torque and dynamic stresses. These technological upgrades also reduce production errors, improve consistency in large-volume manufacturing, and support customized clamp geometries for specialized applications. As end-users demand longer service life and reduced downtime, high-performance materials and automated production techniques significantly accelerate market growth.

Key Trends & Opportunities

Growing Shift Toward Customized, Application-Specific Clamp Designs

A key opportunity emerges from the rising demand for customized U-bolt clamps designed for specific load conditions, pipe diameters, and environmental exposures. Automotive OEMs increasingly request model-specific clamps engineered to meet exact torque, vibration, and thermal thresholds. Industrial operators similarly require purpose-built clamps for high-pressure pipelines, corrosive atmospheres, and heavy structural anchoring. Manufacturers are responding by integrating CAD/CAM platforms, rapid prototyping, and modular tooling systems that enable shorter design cycles and flexible production. This customization trend enhances product performance, improves operational safety, and supports compliance with industry-specific standards such as ASTM, ISO, and DIN. As sectors like renewable energy, chemical processing, and construction adopt more complex mechanical systems, customized clamping solutions present a high-value opportunity for manufacturers aiming to differentiate through engineering excellence and specialized product suites.

- For instance, Ideal Tridon’s engineered clamp program uses CAD/CAM tooling and supports custom diameters up to 762 mm, with 300-series stainless-steel variants validated through ASTM F2098 fatigue testing to ensure durability in high-vibration assemblies.

Expansion of Aftermarket Distribution Networks and E-Commerce Platforms

Growth in multi-brand distribution networks and online procurement platforms is reshaping market accessibility and enabling manufacturers to reach wider customer segments. Industrial buyers, automotive workshops, and DIY consumers increasingly rely on e-commerce portals for a broad selection of clamp sizes, materials, and performance grades. This trend opens opportunities for manufacturers to expand their digital catalogues, offer ready inventory, and strengthen visibility across global markets. Enhanced logistics, real-time stock management, and improved product comparison tools further support this shift. Distributors are also investing in value-added services such as technical recommendations, compatibility charts, and application guides that help buyers make informed decisions. As digital procurement becomes more mainstream, suppliers with strong online presence, efficient fulfilment capabilities, and competitive multi-tier pricing models stand to gain significant market advantage.

· For instance, Fastenal integrates more than 800,000 active SKUs into its digital supply chain system and supports same-day local pickup through 3,300 branches, improving access for high-volume clamp buyers.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

The market faces significant challenges due to fluctuations in the prices of stainless steel, carbon steel, coatings, and alloying materials used in U-bolt clamp manufacturing. Price volatility directly impacts production costs and narrows margins, especially for manufacturers reliant on bulk steel purchases or imported materials. Additionally, global supply chain disturbances from shipping delays to logistics bottlenecks disrupt inventory planning and increase lead times. These inconsistencies complicate OEM supply contracts, which often require strict delivery schedules and stable pricing. Smaller manufacturers face heightened vulnerability due to limited bargaining power with suppliers and distributors. The need for maintaining high inventory levels further increases working capital pressure. As markets tighten regulatory requirements around material traceability and quality compliance, the challenge of balancing cost efficiency with material performance becomes increasingly complex.

Intense Market Competition and Price Pressure from Low-Cost Manufacturers

The U-bolt clamps market is highly competitive, with numerous regional and international players offering similar product configurations, leading to strong price pressure. Low-cost manufacturers, particularly in regions with lower labor and production expenses, intensify competition by supplying budget-friendly clamps to wholesalers and aftermarket distributors. This dynamic compels established manufacturers to differentiate through quality, certification, material upgrades, and engineering precision efforts that increase production costs. Maintaining competitiveness becomes difficult in price-sensitive segments, especially where buyers prioritize cost over long-term performance. Furthermore, counterfeit and substandard clamps circulating in certain markets create additional challenges, as they compromise application safety and undermine brand credibility. Manufacturers must invest in quality assurance, brand protection, and distribution governance to sustain market position amid aggressive global pricing strategies.

Regional Analysis

North America

North America holds the largest share of the U-bolt clamps market at 34%, supported by strong automotive production, extensive aftermarket activity, and high adoption of corrosion-resistant stainless steel clamps. The region’s well-established industrial base including oil and gas, HVAC, construction, and heavy machinery drives continuous demand for high-strength fastening components. Strict performance and safety standards in the U.S. and Canada push manufacturers to supply precision-engineered clamps with enhanced load-bearing capacity. Additionally, technological advancements in exhaust systems, fleet maintenance, and pipeline infrastructure sustain long-term consumption across both OEM and aftermarket channels.

Europe

Europe accounts for approximately 28% of the global market, driven by advanced automotive engineering standards, strong industrial manufacturing, and rising investments in energy-efficient infrastructure. Germany, France, Italy, and the UK lead demand, supported by stringent EU regulations promoting durable, corrosion-resistant clamp materials. The region’s expanding renewable energy, chemical processing, and water management sectors further boost consumption of high-performance clamps. The presence of established automotive OEMs and machinery manufacturers also ensures steady procurement volumes. Europe’s focus on quality-certified components, sustainability, and long service life continues to strengthen clamp adoption across multiple end-use industries.

Asia-Pacific

Asia-Pacific captures an estimated 29% market share and stands as the fastest-growing region due to expanding automotive production, infrastructure development, and rapid industrialization across China, India, Japan, and Southeast Asia. The region’s large construction pipeline, rising manufacturing output, and increasing investment in transportation and energy projects drive extensive use of U-bolt clamps in piping systems, machinery, and structural applications. Cost-efficient manufacturing capabilities and growing aftermarket demand further support regional growth. As domestic OEMs scale up operations and enforce stricter quality standards, demand for stainless steel and high-strength clamps continues to rise across APAC markets.

Latin America

Latin America represents roughly 5% of the global market, with growth concentrated in Brazil, Mexico, Argentina, and Chile. Rising automotive assembly operations and expanding construction and energy infrastructure support steady adoption of U-bolt clamps across multiple applications. Industrial modernization projects, particularly in oil and gas and mining, contribute to increased demand for durable clamps with enhanced corrosion and vibration resistance. However, economic volatility and irregular investment cycles limit overall purchasing momentum. Despite these challenges, aftermarket demand for automotive and machinery maintenance provides consistent long-term opportunities for clamp manufacturers and distributors.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for approximately 4% of market share, driven primarily by oil and gas activities, petrochemical expansion, and large-scale infrastructure development across the Gulf Cooperation Council (GCC) nations. Heavy-duty U-bolt clamps are widely used in pipeline networks, HVAC systems, and industrial equipment installations, creating stable demand. Africa’s growing mining sector and urban infrastructure projects also contribute to market expansion. However, limited industrial diversification and fluctuating construction investments restrict faster growth. Increasing adoption of stainless steel clamps in high-temperature and corrosive environments continues to support MEA’s long-term demand trajectory.

Market Segmentations:

By Type

- Aluminized Steel Clamps

- Stainless Steel Clamps

By Application

- Automotive

- Non-Automotive

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the U-bolt clamps market is characterized by a mix of global manufacturers, regional producers, and specialized engineering firms competing on product quality, material innovation, and distribution reach. Leading companies focus on supplying high-strength stainless steel and aluminized steel clamps that meet stringent automotive, industrial, and construction-grade specifications. Many players invest in advanced manufacturing technologies such as automated bending, precision threading, robotic welding, and surface treatment processes to enhance durability and dimensional accuracy. Strategic partnerships with automotive OEMs, industrial contractors, and aftermarket distributors strengthen market positioning. Meanwhile, regional manufacturers emphasize cost competitiveness, serving price-sensitive segments with standard clamp configurations. The growing demand for corrosion-resistant and heavy-duty clamps encourages firms to expand product lines and pursue certification-based differentiation. Intense competition also drives companies to optimize logistics, enhance inventory availability, and offer customized clamps for application-specific requirements. Overall, innovation, consistent performance, and responsive supply chains define competitive success in the market.

Key Player Analysis

- Peterson Spring

- Kale Clamp

- Ideal Clamp

- Yushin Precision Industrial

- BAND-IT

- Togo Seisakusyo

- Oetiker Group

- Rotor Clip

- Norma Group SE

- Clampco

Recent Developments

- In August 2025, Clampco Products, Inc. earned Nadcap certification for its welding processes a step that underlines its commitment to aerospace- and defense-grade clamp manufacturing

- In December 2024, NORMA Group secured a major contract from a U.S. home-appliance manufacturer to supply nearly three million custom metal TORRO clamps annually.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-strength stainless-steel U-bolt clamps will continue rising as industries prioritize longer service life and corrosion resistance.

- Automotive OEMs and aftermarket suppliers will increase adoption of precision-engineered clamps to support evolving exhaust, suspension, and chassis system requirements.

- Industrial infrastructure upgrades in oil and gas, power, HVAC, and construction sectors will drive consistent long-term consumption.

- Manufacturers will expand customization capabilities to deliver application-specific clamp geometries for heavy-duty and high-vibration environments.

- Automation in bending, threading, and welding processes will enhance production efficiency and dimensional accuracy.

- Global distributors will strengthen online platforms, improving market accessibility and aftermarket engagement.

- Growth in emerging economies will accelerate clamp usage across transportation, manufacturing, and pipeline installations.

- Material innovations like advanced coatings and higher-grade alloys will improve performance in chemically aggressive and high-temperature settings.

- Competitive pressure will intensify, pushing suppliers to differentiate through certification, quality control, and engineering support.

- Sustainability initiatives will encourage adoption of recyclable materials and energy-efficient manufacturing methods across the clamp industry.

Market Segmentation Analysis:

Market Segmentation Analysis: