Market Overview

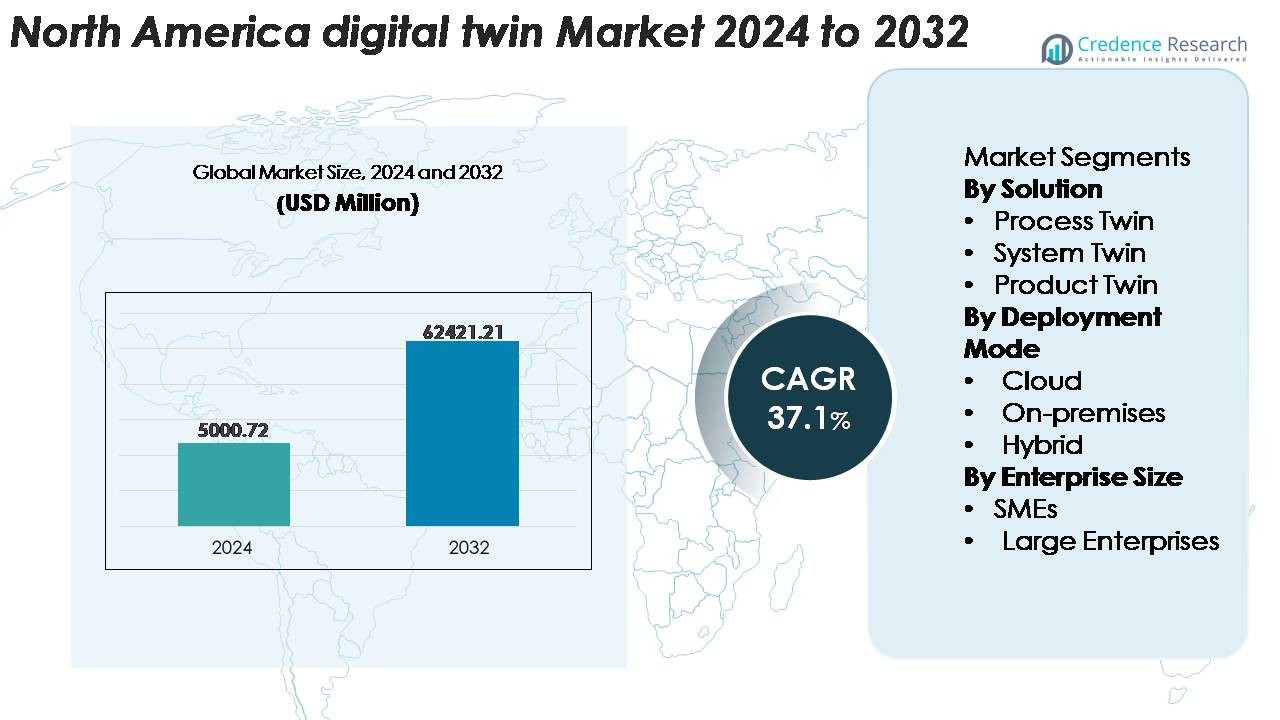

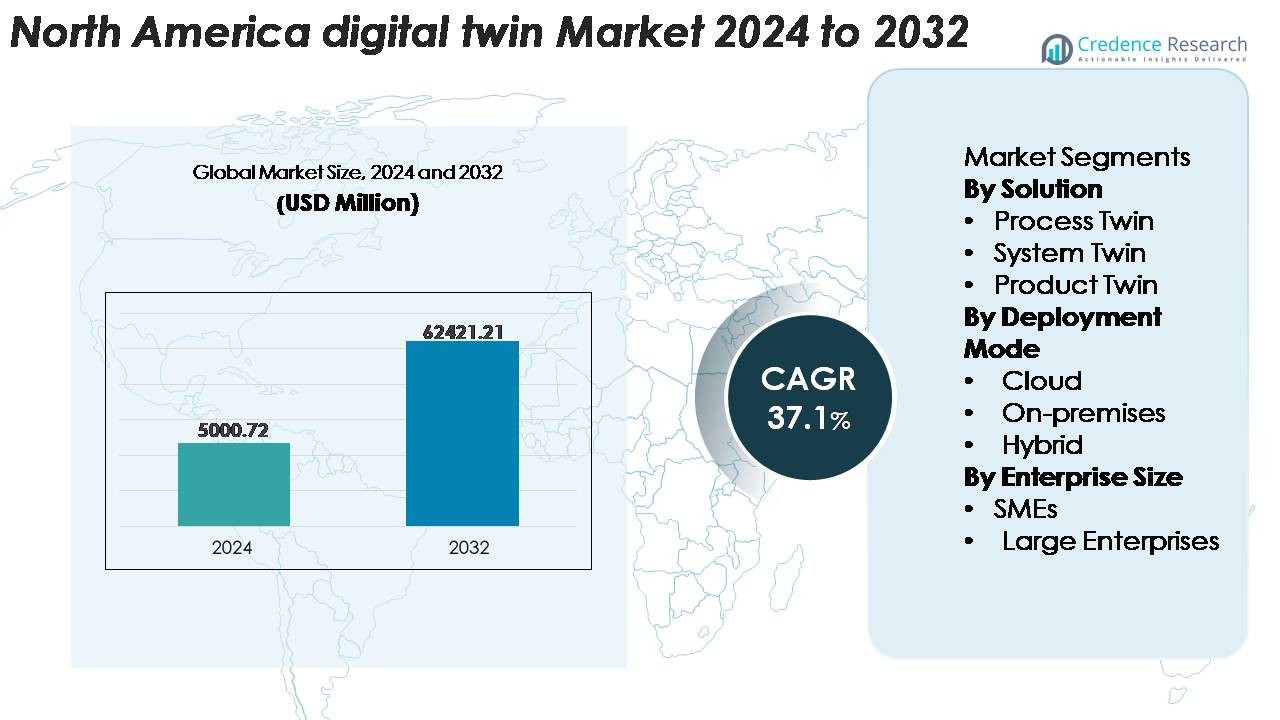

The North America digital twin market was valued at USD 5,000.72 million in 2024 and is projected to reach USD 62,421.21 million by 2032, expanding at a CAGR of 37.1% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America digital twin market Size 2024 |

USD 5,000.72 Million |

| North America digital twin market, CAGR |

37.1% |

| North America digital twin market Size 2032 |

USD 62,421.21 Million |

The North America digital twin market is shaped by leading technology and industrial players such as IBM, Microsoft, PTC, Siemens, General Electric, Oracle, Autodesk, ANSYS, and Dassault Systèmes, each offering advanced simulation, IoT integration, and AI-driven predictive analytics platforms. These companies strengthen their regional presence through cloud-based digital twin suites, real-time operational intelligence tools, and sector-specific engineering solutions. The United States remains the dominant regional market, capturing approximately 82% of the total North American share due to its strong digital transformation ecosystem, extensive industrial automation, and rapid adoption across aerospace, manufacturing, automotive, and energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America digital twin market was valued at USD 5,000.72 million in 2024 and is projected to reach USD 62,421.21 million by 2032, expanding at a 37.1% CAGR during 2025–2032.

- Market growth is driven by rapid industrial digitalization, strong IoT penetration, and rising adoption of AI-enabled predictive maintenance, with Product Twin leading the solution segment at over 45% share due to its extensive use in manufacturing and automotive design cycles.

- Key trends include the integration of AI-driven simulations, expansion of edge-enabled operational twins, and increasing deployment across smart infrastructure and energy systems.

- Competitive intensity is high, with IBM, Microsoft, Siemens, PTC, ANSYS, GE, and Dassault Systèmes shaping the landscape through scalable cloud platforms, real-time analytics, and sector-focused engineering solutions, though high integration costs remain a restraint.

- Regionally, the U.S. dominates with ~82% share, followed by Canada at ~12% and Mexico at ~6%, reflecting varying digital maturity and industrial automation levels across the region.

Market Segmentation Analysis:

By Solution

In the North America digital twin market, Product Twin emerges as the dominant sub-segment, holding the largest share due to its extensive use in asset performance monitoring, predictive maintenance, and lifecycle optimization across manufacturing, automotive, aerospace, and energy sectors. Organizations deploy product-level twins to simulate behavior, improve engineering precision, and reduce physical prototyping cycles. Process Twin solutions continue to gain traction in industries with complex workflows, while System Twin adoption accelerates in utilities and logistics networks. The dominance of Product Twin is driven by high adoption of digitalized product development and increasing integration with IoT and PLM platforms.

- For instance, supports large-scale product-twin deployments through its Teamcenter platform, which manages more than 7 million licensed users worldwide and handles product configurations containing over 150,000 individual components in complex programs such as aerospace assemblies.

By Deployment Mode

The Cloud deployment model accounts for the largest share in North America, propelled by rapid scalability, lower upfront investment, and seamless integration with real-time IoT data streams. Enterprises prefer cloud-based digital twin platforms for remote monitoring, multi-site operations, and continuous analytics across distributed assets. On-premises deployments remain relevant in highly regulated industries such as aerospace, defense, and pharmaceuticals due to strict data-control requirements. Hybrid deployment is expanding as organizations combine local processing for sensitive data with cloud-based analytics for complex simulations. Cloud dominance is driven by accelerated cloud-migration initiatives and high adoption of industrial SaaS ecosystems.

- For instance, Microsoft Azure Digital Twins supports graph-based environments containing millions of digital twin entities and relationships, enabling large industrial customers to simulate entire factories or utility networks in real time.

By Enterprise Size

Large enterprises represent the dominant sub-segment, capturing the highest market share owing to their strong financial capabilities, extensive asset bases, and established digital transformation roadmaps. Major players in manufacturing, energy, automotive, and utilities implement large-scale digital twin programs to optimize operations, enhance predictive maintenance, and reduce system downtime. SMEs are increasing adoption as modular, subscription-based solutions lower entry barriers; however, limited budgets and integration complexities slow their penetration. The leadership of large enterprises is driven by multi-million-dollar investments in IoT infrastructure, real-time analytics platforms, and advanced simulation technologies.

Key Growth Drivers

Rapid Industrial Digitalization and Integration of IoT–Enabled Asset Ecosystems

North America’s rapid shift toward Industry 4.0 significantly accelerates digital twin adoption as enterprises expand IoT-driven monitoring, predictive maintenance, and real-time asset optimization across industrial facilities. Manufacturers, utilities, transportation networks, and energy operators increasingly deploy sensor-rich systems that generate high-frequency telemetry essential for accurate digital twin simulations. The widespread presence of connected equipment and the region’s strong 5G rollout further enhance real-time synchronization between physical assets and digital replicas. Industries leverage these capabilities to boost equipment reliability, extend asset life, reduce operational variability, and streamline engineering cycles. As predictive analytics and condition-based maintenance become standard, digital twins evolve from optional innovation tools to mission-critical operational platforms. This deepening integration between IoT ecosystems and simulation models is a primary driver strengthening market expansion.

- For instance, Siemens’ industrial IoT platform, known as Insights Hub (formerly MindSphere), processes vast amounts of data to enable high-resolution telemetry feeds for digital twin simulations and advanced analytics, supporting industrial operations and optimization.

Strong Adoption Across High-Value Sectors Such as Aerospace, Automotive, and Energy

North America’s leadership in high-value engineering sectors fuels extensive demand for digital-twin-enabled modeling, testing, and lifecycle management. Aerospace and defense organizations utilize twins to simulate propulsion systems, optimize avionics performance, and validate safety-critical components without extensive physical testing. Automotive OEMs deploy digital twins for EV battery diagnostics, thermal simulations, and autonomous vehicle development, reducing costly prototyping cycles. Meanwhile, energy operators rely on plant-level and grid-level twins to monitor turbines, transformers, substations, and offshore assets. These industries handle complex systems with high downtime costs, making digital twins essential for operational continuity and engineering agility. Their sustained investment in advanced simulation platforms, real-time analytics, and edge-cloud integration strengthens digital twin penetration across the region.

- For instance, in aerospace, Rolls-Royce’s digital twin environment monitors more than 13,000 aircraft engines in active service, generating over 70 trillion data points per year for performance modeling and predictive maintenance.

Expansion of Smart Infrastructure, Smart Cities, and Large-Scale Public Digitalization Programs

North America’s increasing investment in smart infrastructure significantly boosts digital twin market growth as governments and municipalities integrate simulation platforms to improve urban planning, resource allocation, and infrastructure resilience. Cities deploy digital twins for traffic management, utilities optimization, flood-risk modeling, and energy-efficiency forecasting. Infrastructure operators use twins to assess structural integrity of bridges, tunnels, rail networks, and public buildings through real-time monitoring systems. Digital twins also support emergency response planning, scenario testing, and environmental modeling. Federal and state-level innovation programs encourage adoption across public infrastructure modernization initiatives, stimulating vendor participation and cross-sector collaboration. As cities expand sensor networks and digital command centers, digital twins become foundational for predictive governance and long-term infrastructure planning, driving sustained regional adoption.

Key Trends & Opportunities

Rising Adoption of AI-Driven Simulation, Autonomous Optimization, and Self-Learning Twins

A key market trend centers on integrating advanced AI and machine-learning engines into digital twin platforms to enable autonomous decision-making and self-optimizing asset behavior. AI-enhanced twins continuously analyze historical, real-time, and predictive datasets to generate automated recommendations, enabling operators to minimize failures, optimize throughput, and improve accuracy of engineering simulations. North American enterprises increasingly invest in AI-powered simulation tools for anomaly detection, automated fault prediction, and real-time process forecasting. This opportunity expands further as machine-learning-enhanced twins evolve into closed-loop systems capable of self-correcting operational deviations. The convergence of AI, next-gen simulation engines, and edge intelligence positions digital twins as strategic intelligence systems rather than purely visual replicas, creating strong adoption momentum across modern industrial environments.

- For instance, BMW Group uses NVIDIA Omniverse–powered AI simulation to operate digital twins across 31 manufacturing plants, enabling factory-scale physics modeling and real-time robotics coordination.

Expansion of Cross-Industry Collaboration and Interoperable Twin Ecosystems

A growing opportunity emerges from the development of interoperable digital twin ecosystems capable of integrating data from multiple domains—manufacturing floors, energy grids, logistics networks, healthcare systems, and smart buildings. North American industries increasingly adopt open architectures, cross-platform APIs, and standardized data models to enable system-level visibility across complex, multi-stakeholder environments. This trend allows enterprises to scale from single-asset twins to multi-plant, multi-fleet, or city-wide operational replicas. Collaboration between cloud providers, simulation vendors, engineering companies, and industrial OEMs strengthens ecosystem synergies. As more organizations demand unified monitoring, shared analytics, and ecosystem-scale decision frameworks, interoperability becomes a powerful growth catalyst, transforming digital twin deployments into large integrated digital infrastructures.

- For instance, Microsoft’s Azure Digital Twins platform supports graph models containing millions of interconnected nodes and relationships, enabling multi-domain synchronization across factories, buildings, and utility networks.

Growth of Edge-Enabled and Real-Time Operational Twins

A major trend shaping the region is the rise of edge-computing-enabled digital twins capable of performing real-time modeling and local decision-making near the physical asset. Industries handling time-sensitive operations such as power distribution, autonomous logistics, heavy manufacturing, and oil & gas benefit from edge-level processing that reduces latency and enhances operational precision. The convergence of edge gateways, industrial networking, and low-latency compute solutions enables organizations to deploy twins closer to the source of data, improving responsiveness and reliability. This trend opens new opportunities for operational twins that support mission-critical processes requiring continuous synchronization and instant analytics.

Key Challenges

High Implementation Costs and Complex Integration with Legacy Infrastructure

Despite strong growth, digital twin adoption in North America faces challenges due to high initial setup costs, complex integration requirements, and the need for substantial digital infrastructure upgrades. Many industrial facilities operate legacy machines, disconnected systems, and outdated SCADA networks that require significant modernization before establishing real-time digital twin environments. Integrating heterogeneous data sources, ensuring compatibility across sensors, software, and simulation systems, and maintaining accurate synchronization demand substantial investment. Smaller enterprises face budget limitations, while large enterprises encounter long deployment cycles and complex multi-site integration. These financial and operational barriers slow scalability, particularly in asset-intensive sectors.

Rising Data Governance, Cybersecurity Risks, and Model Reliability Concerns

Digital twin platforms continuously process vast volumes of operational, engineering, and sensor-generated data, increasing concerns about cybersecurity, data integrity, and compliance. Real-time mirroring of critical infrastructure systems—such as power grids, manufacturing plants, and transportation networks—makes twins potential cyberattack targets. Ensuring data confidentiality, model reliability, and safe bidirectional communication becomes a major challenge. Additionally, inaccurate models or poorly calibrated simulation engines can result in misleading predictions, operational disruptions, or safety risks. Addressing these vulnerabilities requires robust encryption, zero-trust frameworks, continuous validation, and regulatory-compliant data handling, which adds complexity to widespread adoption.

Regional Analysis

United States

The United States dominates the North America digital twin market, accounting for approximately 82% of the regional share, driven by large-scale adoption across manufacturing, automotive, aerospace, energy, and smart infrastructure programs. The country’s strong ecosystem of cloud providers, simulation software vendors, digital engineering firms, and 5G-enabled industrial networks accelerates deployment across industrial value chains. U.S. enterprises lead in integrating AI-powered predictive maintenance, lifecycle management twins, and system-level operational twins. High investments in Industry 4.0 initiatives, federal smart infrastructure programs, and digital transformation across Fortune 500 corporations continue to position the U.S. as the core growth engine within the region.

Canada

Canada holds around 12% of the North America digital twin market, supported by increasing adoption across energy utilities, public infrastructure, mining operations, and advanced manufacturing clusters in Ontario and Quebec. Canadian enterprises leverage digital twins for asset reliability, environmental monitoring, and grid modernization initiatives. Government-backed innovation programs accelerate the use of twins in smart city development, transportation modeling, and carbon-intensive sectors such as oil & gas. Growing collaboration between universities, engineering firms, and industrial operators strengthens research-driven deployment. Although smaller than the U.S. market, Canada is steadily expanding its footprint through targeted digitalization strategies and rising industrial automation investment.

Mexico

Mexico accounts for approximately 6% of the North America digital twin market, with growth concentrated in automotive manufacturing, electronics assembly, and industrial automation hubs along major industrial corridors. The country’s expanding network of nearshoring-driven manufacturing facilities increases demand for digital twins to enhance production efficiency, minimize downtime, and improve quality control. Adoption is further supported by multinational OEMs integrating real-time monitoring and simulation tools across local plants. While digital twin penetration remains in an early stage due to infrastructure limitations, rapid industrial expansion and increasing technological investments position Mexico as a rising growth contributor within the region.

Market Segmentations:

By Solution

- Process Twin

- System Twin

- Product Twin

By Deployment Mode

By Enterprise Size

By Geography

Competitive Landscape

The competitive landscape of the North America digital twin market is defined by a strong presence of global technology leaders, industrial automation providers, and engineering simulation specialists competing to deliver advanced, scalable, and sector-specific digital twin solutions. Key players such as IBM, Microsoft, PTC, Siemens, General Electric, Dassault Systèmes, ANSYS, Oracle, and Autodesk focus on integrating cloud platforms, real-time analytics, and AI-driven modeling to support multi-asset, multi-system, and enterprise-level deployments. These companies invest heavily in expanding partner ecosystems across manufacturing, aerospace, automotive, energy, and smart infrastructure domains to strengthen interoperability and accelerate customer adoption. Strategic initiatives such as platform enhancements, digital engineering collaborations, and acquisition of simulation or IoT-focused startups further intensify competition. Additionally, high-value projects in predictive maintenance, grid modernization, and virtual commissioning attract large enterprise clients, reinforcing market consolidation among established vendors. Despite strong innovation, new entrants offering specialized analytics and edge-twin capabilities continue to diversify the competitive dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft

- Hexagon

- GE Vernova

- Dassault Systèmes

- Amazon Web Services (AWS)

- Siemens

- Rockwell Automation

Recent Developments

- In 2025, GE Vernova also shared a dedicated article discussing digital twin technology and analytics for asset optimization.

- In 2024, Hexagon announced a collaboration with Microsoft to enhance industrial operations via a cloud-native SaaS platform.

Report Coverage

The research report offers an in-depth analysis based on Solution, Deployment mode, Enterprise size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for real-time, AI-driven digital twin models will accelerate as industries prioritize predictive operations and automation.

- Adoption of multi-system and enterprise-scale twins will grow as organizations expand digital transformation across interconnected assets.

- Edge-enabled digital twins will gain traction to support low-latency, mission-critical industrial processes.

- Integration of digital twins with 5G networks will enhance data flow, simulation accuracy, and remote operational visibility.

- Smart city and infrastructure modernization projects will increasingly rely on digital twins for planning, monitoring, and resilience management.

- Collaboration between cloud providers, simulation vendors, and industrial OEMs will deepen to create unified, interoperable platforms.

- Manufacturing, automotive, aerospace, and energy sectors will continue driving the largest deployment volumes.

- Adoption among SMEs will rise as modular, subscription-based digital twin solutions reduce implementation barriers.

- Sustainability initiatives will push industries to use twins for energy optimization and emissions monitoring.

- Regulatory momentum toward digital engineering and infrastructure digitalization will strengthen long-term market expansion.