Market Overview:

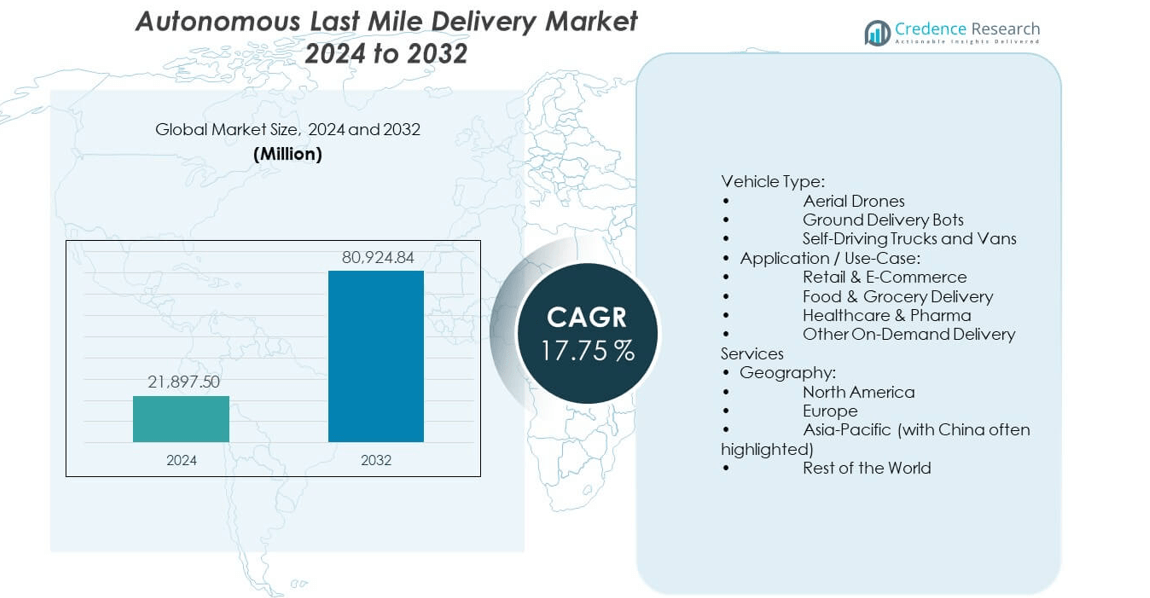

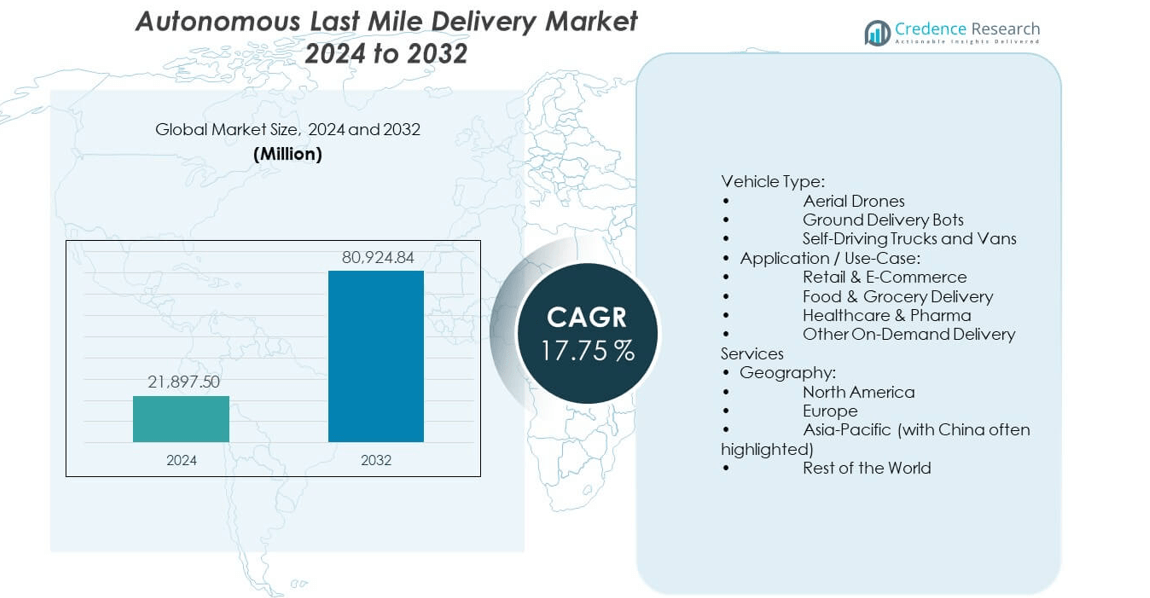

The autonomous last mile delivery market is projected to grow from USD 21,897.5 million in 2024 to USD 80,924.84 million by 2032, with a CAGR of 17.75% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Autonomous Last Mile Delivery Market Size 2024 |

USD 21,897.5 million |

| Autonomous Last Mile Delivery Market , CAGR |

17.75% |

| Autonomous Last Mile Delivery Market Size 2032 |

USD 80,924.84 million |

Rising demand for faster and contact-free deliveries drives major investment across retail, e-commerce, and parcel networks. Companies deploy autonomous robots to reduce delivery time and support efficient order cycles in dense urban zones. Growth in AI-based routing improves trip accuracy and lowers operational strain for high-volume environments. Businesses adopt autonomous fleets to ease labor pressure and maintain delivery reliability. Wider acceptance of unmanned machines in residential and commercial districts enhances system readiness across the supply chain.

North America leads due to strong adoption across e-commerce, well-developed tech ecosystems, and favorable testing rules that support continuous deployment. Europe follows with high emphasis on sustainable delivery models and structured pilot programs across major cities. Asia Pacific emerges quickly as countries expand digital commerce and support mobility innovation through active policy frameworks. The Middle East also gains momentum as smart city programs scale autonomous mobility projects. These zones create strong ground for future expansion across varied delivery environments.

Market Insights:

- The Autonomous last mile delivery market is valued at USD 21,897.5 million in 2024 and is projected to reach USD 80,924.84 million by 2032, advancing at a 75% CAGR driven by rapid adoption across retail and logistics networks.

- North America holds the largest regional share due to strong pilot approvals, advanced robotics ecosystems, and active investment from e-commerce and logistics leaders that support wide deployment.

- Europe maintains the second-largest share supported by structured regulatory frameworks, sustainability-driven mobility programs, and stable adoption of delivery bots and drones across urban corridors.

- Asia-Pacific ranks as the fastest-growing region, driven by high deployment activity in China, Japan, and South Korea, large e-commerce volumes, and active government support within smart-city programs.

- Ground delivery bots lead the vehicle-type segment, and retail & e-commerce dominates the application segment, supported by high parcel frequency and strong demand for quick, contact-free deliveries across dense markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Shift Toward Faster, Low-Touch Delivery Fulfillment Across Dense Urban Zones

The autonomous last mile delivery market gains strength from rapid demand for faster, low-touch fulfillment cycles. Retailers expand automated fleets to reduce strain on traditional courier networks. E-commerce firms push for shorter delivery windows to match rising consumer expectations. Robotics platforms enable steady output during peak traffic hours. AI-based navigation improves path control in narrow city corridors. Companies test new micro-hubs to reduce driver burdens. Urban congestion policies support adoption of compact autonomous units. Continuous demand for faster delivery cycles drives further deployment across major cities.

- For instance, Starship Technologies has completed over 9 million autonomous deliveries across the US and Europe, supported by more than 2,700 active robots. The fleet operates in over 270 locations across seven countries.

Growing Pressure To Reduce Labor Costs and Cover Persistent Driver Shortages in Logistics

Labor scarcity pushes logistics firms to adopt autonomous delivery units across busy routes. Companies face rising wage pressure in high-volume delivery regions. Automated robots maintain steady performance during peak order cycles. Shifting consumer habits demand frequent and small parcel drops. Autonomous units help reduce fleet downtime and maintain delivery accuracy. Digital platforms manage route control with minimal human input. Firms deploy mixed fleets to cover diverse terrain. This improves network resilience during labor-intensive periods.

- For instance, Nuro’s R2 vehicle operates without a steering wheel or pedals and holds a U.S. DOT regulatory exemption that permits fully driverless operation on public roads.

Higher Demand for Safe, Contact-Free Deliveries Across Retail and Healthcare Settings

Contact-free delivery needs rise across sensitive sectors like healthcare and pharma. Autonomous units reduce human interaction during medicine and test-kit transport. Retail chains push adoption to enhance hygiene standards across delivery routes. Robots operate with controlled temperature zones to protect sensitive goods. Vision systems reduce collision risk during curbside handovers. Delivery networks benefit from consistent adherence to safety rules. Healthcare facilities use robots to supply routine items with minimal delay. It strengthens operational reliability in sensitive delivery zones.

Rapid Advancements in Sensing, Mapping, and Navigation Platforms across Robotics Ecosystems

Navigation tools gain precision through stronger LiDAR, radar, and camera systems. High-resolution maps support robots in complex outdoor and indoor zones. Cloud-based analytics improve route selection and traffic handling. Robotics makers focus on low-power sensors to extend unit runtime. Developers integrate safe-mode controls to manage uncertain road conditions. Fleet platforms predict roadway obstacles with better accuracy. Improved autonomy reduces service interruptions. These advances accelerate adoption across varied customer groups.

Market Trends:

Wider Adoption of Hybrid Delivery Models Combining Drones, Sidewalk Robots, and Micro-Hubs

The autonomous last mile delivery market sees faster adoption of hybrid networks. Firms deploy drones for rural drops and robots for urban blocks. Micro-hubs shorten trips by improving node placement across cities. New delivery patterns help reduce road congestion. Companies expand multimodal fleets to support variable terrain. Hybrid setups maintain strong performance during weather-driven delays. Robot-to-drone handoff models gain traction for niche routes. These models push higher automation across fulfillment channels.

- For instance, Wing (Alphabet) has completed more than 500,000 commercial drone deliveries worldwide, with active networks in the US, Australia, Finland, and Ireland.

Rising Integration of AI-Driven Fleet Platforms That Enhance Predictive Routing Behavior

Predictive routing tools gain use to improve delivery timing. AI systems study demand spikes for efficient job assignment. Data platforms detect pathway bottlenecks earlier. Fleet managers gain real-time updates for traffic disruptions. Predictive alerts reduce wasted distance across routes. Cloud dashboards create better job clustering patterns. Companies integrate these tools into autonomous units. These capabilities set new standards for fleet efficiency.

- For instance, UPS Flight Forward holds the FAA Part 135 Standard certification, enabling drone fleets to run predictive route-optimization software under regulated airspace with continuous data feeds.

Growing Use of Secure Delivery Pods and Temperature-Stable Compartments in Commercial Deployments

Secure pods gain interest among retailers handling sensitive parcels. Temperature-stable compartments support pharma and grocery networks. Sensors record compartment conditions during each trip. Retailers demand sealed delivery lockers for doorstep safety. Access codes reduce parcel theft in high-density regions. Robots maintain consistent interior conditions through adaptive cooling. Multi-compartment units help fulfill mixed-category orders. These features raise confidence in automated delivery adoption.

Expansion of Cross-Industry Partnerships Between Retailers, Tech Firms, and Mobility Operators

Retailers collaborate with robotics developers to accelerate testing. Mobility firms integrate mapping systems into commercial robots. Tech companies offer fleet platforms for end-to-end control. Cross-sector pilots cover campus zones, suburbs, and small towns. Partnerships help refine unit safety rules during public trials. Firms share analytics to understand route behavior. Joint ventures support long-term ecosystem growth. These alliances expand adoption across new markets.

Market Challenges Analysis:

Operational and Regulatory Constraints Limiting Large-Scale Rollouts Across Public Delivery Zones

The autonomous last mile delivery market faces strict rules that limit expansion across public roads. Cities enforce safety checks for robots handling pedestrian traffic. Weather patterns disrupt robot movement on open streets. Small units struggle with complex road intersections. Infrastructure gaps reduce robot routing accuracy in older districts. Firms require permits that slow pilot expansion. Technical glitches hinder job completion during peak hours. Such factors delay full-scale commercial deployment across many regions.

Persistent Safety Concerns, Infrastructure Gaps, and Performance Limitations Across Real-World Scenarios

Safety concerns arise when robots navigate unpredictable human movement. Narrow sidewalks reduce maneuvering space for larger units. Limited battery runtime restricts long-route capability. Poor connectivity disrupts remote monitoring tools. Hardware damage increases during high-impact road conditions. Theft or tampering remains a challenge in some zones. Public acceptance varies across regions with limited exposure. These issues raise operational pressure for firms testing advanced delivery units.

Market Opportunities:

Expansion of Scalable Autonomous Delivery Networks Across Retail, Grocery, and Healthcare Sectors

The autonomous last mile delivery market gains strong opportunity through rising interest from retail, grocery, and healthcare networks. Robots help reduce load on conventional fleets during seasonal peaks. Multi-unit deployments support rapid neighborhood coverage. Healthcare chains adopt robots for safe routine deliveries. Grocery retailers use temperature-controlled systems for fresh goods. Urban regions push smart mobility programs that support autonomous trials. Firms explore subscription-based delivery models. These factors open wider growth avenues.

High Potential for Technology Upgrades Through AI, 5G, Edge Computing, and Advanced Robotics

AI platforms improve obstacle detection and trip prediction accuracy. 5G networks strengthen real-time monitoring for fleet managers. Edge computing speeds decision cycles at the robot level. Robotics firms develop rugged units for uneven outdoor zones. Battery upgrades extend unit uptime in dense routes. Cloud-connected dashboards support better job orchestration. Tech partnerships help refine commercial-grade solutions. These upgrades unlock new deployment scenarios across markets.

Market Segmentation Analysis:

Vehicle Type

The autonomous last mile delivery market uses three core vehicle categories that shape adoption patterns. Aerial drones support rapid point-to-point drops in areas with fewer physical barriers and help businesses manage urgent or lightweight payloads. Ground delivery bots hold the largest traction due to strong deployment on sidewalks, campuses, and controlled urban paths. These bots offer predictable routing behavior and operate with stable autonomy levels across indoor-outdoor zones. Self-driving trucks and vans handle heavier loads and support business-to-consumer routes over longer distances. Each vehicle type serves a distinct operational niche and enables firms to match delivery mode with route structure.

- For instance, Amazon Prime Air received FAA approval for beyond-visual-line-of-sight (BVLOS) operations, enabling autonomous drone flights without continuous human observation.

Application / Use-Case

Retail and e-commerce lead adoption due to high parcel frequency and continuous demand for quick doorstep delivery. Food and grocery networks rely on short-distance robotic fleets that maintain controlled handling of perishable items. Healthcare and pharma use autonomous units for safe and consistent delivery of medical supplies and lab samples. Other on-demand services include campus logistics, hospitality, and micro-fulfillment programs that need reliable short-haul automation. Each application segment adopts autonomy to reduce job strain, improve delivery timing, and maintain quality in diverse operating conditions. Firms align use-case selection with route predictability, safety rules, and payload requirements.

- For instance, Ocado uses over 2,000 autonomous robots in its smart fulfillment centers, enabling the system to process more than 50,000 item picks each hour.

Segmentation:

By Vehicle Type:

- Aerial Drones

- Ground Delivery Bots

- Self-Driving Trucks and Vans

By Application / Use-Case:

- Retail & E-Commerce

- Food & Grocery Delivery

- Healthcare & Pharma

- Other On-Demand Delivery Services

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The autonomous last mile delivery market holds its largest share in North America due to strong deployment across retail, logistics, and controlled urban zones. It benefits from rapid pilot approvals, advanced robotics ecosystems, and heavy investment from major technology leaders. Companies expand autonomous fleets across campus areas, suburban communities, and dense city districts. Logistics providers integrate ground bots, drones, and self-driving vans to strengthen high-frequency delivery cycles. Regulatory bodies refine frameworks that support consistent commercial trials. Retailers push fast adoption to improve delivery reliability and reduce human labor strain. These conditions keep North America in the leading position across global markets.

Europe

Europe secures the second-largest share, supported by structured testing rules and strong adoption across major cities. National programs encourage autonomous mobility trials that align with strict safety and sustainability goals. Retail and parcel operators deploy delivery bots in pedestrian zones with stable routing paths. Drone corridors gain recognition in several countries, strengthening air-delivery testing. Companies adopt advanced navigation and mapping tools to meet urban infrastructure needs. Public acceptance grows across regions that experience frequent robotic deliveries. It maintains a solid growth trajectory driven by technology readiness and clear regulatory pathways.

Asia-Pacific

Asia-Pacific emerges as the fastest-growing regional share due to strong deployment activity in China, Japan, South Korea, and expanding Southeast Asian hubs. Governments support trials across smart city programs, industrial parks, and large e-commerce networks. Retail giants integrate ground bots and drones to manage high-order volumes across short-distance routes. Urban expansion creates continuous need for efficient, low-touch delivery systems. Tech firms upgrade autonomy stacks to manage complex road patterns and mixed pedestrian movement. Partnerships between e-commerce platforms and robotics developers accelerate regional scaling. These factors position Asia-Pacific as the strongest expansion zone for long-term autonomous delivery adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alibaba Group

- com, Inc.

- Drone Delivery Canada

- Flytrex

- Starship Technologies

- Marble Robot

- Savioke

- Udelv

- Nuro

- DHL International GmbH

- United Parcel Service of America, Inc. (UPS)

- DPD Group

- Wing Aviation LLC

- Flirtey

- Airbus S.A.S.

- Kiwi Campus (KiwiBot)

- MAVERICK or similar emerging robotics developers

Competitive Analysis:

The autonomous last mile delivery market features strong competition driven by global tech firms, logistics leaders, and robotics innovators. Companies expand autonomous fleets to strengthen delivery networks in urban and suburban routes. It pushes firms to refine sensor systems, routing platforms, and fleet management tools. Retailers partner with robotics developers to accelerate commercial trials across controlled zones. Drone operators gain traction in regions with flexible air-mobility rules. Logistics giants invest in self-driving vans to support heavier payloads. Startups enter with niche models that address campus, hospitality, or micro-hub operations. Continuous product upgrades shape the pace of competition across segments.

Recent Developments:

- In October 2025, Amazon.com introduced several AI-powered delivery innovations including a six-armed robotics system, an agentic AI digital assistant tailored for frontline delivery employees, and smart glasses for delivery drivers aimed at enhancing safety and productivity. Among these advancements, Amazon is finalizing efforts to deploy humanoid robots trained in a specialized “humanoid park” to hitch rides in its Rivian electric delivery vans and autonomously deliver packages directly to customers’ doors, pushing forward its robotic workforce initiative for last-mile deliveries. This marks a significant step towards automating complex delivery routes in urban settings.

- com Logistics, a subsidiary of JD.com Inc., announced in October 2025 its acquisition of JD Group’s local instant delivery service business for approximately US$270 million. This move is aimed at bolstering JD Logistics’ last-mile delivery capabilities by integrating the acquired local delivery subsidiaries. The acquisition complements JD’s existing logistics network, supporting business growth and operational efficiency in the instant and last-mile delivery segment.

- In July 2025, Alibaba Group’s logistics arm Cainiao formed a strategic partnership with STO Express to deploy a fleet of 2,000 autonomous delivery vehicles across China by the end of 2025. This large-scale deployment aims to revolutionize last-mile delivery with AI-driven electric vehicles, enhancing delivery speed, reducing costs, and advancing sustainability goals. The autonomous vehicles are expected to operate in major Chinese cities starting early 2026, positioning Alibaba at the forefront of smart logistics innovation in Asia.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle Type and Application / Use-Case segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of autonomous fleets across retail, food, and healthcare routes.

- Wider approval of pilot programs within dense urban environments.

- Stronger alignment between robotics makers and logistics operators.

- Higher investment in mapping, sensing, and low-power autonomy stacks.

- Growth in multimodal networks using drones, bots, and self-driving vans.

- Increased regulatory clarity supporting commercial deployment stages.

- Rising adoption of temperature-controlled robotic delivery units.

- Faster integration of AI-driven fleet management platforms.

- Broader use of micro-hubs to shorten last-mile trip distances.

- Strong momentum for long-term autonomous delivery ecosystems across regions.