Market Overview

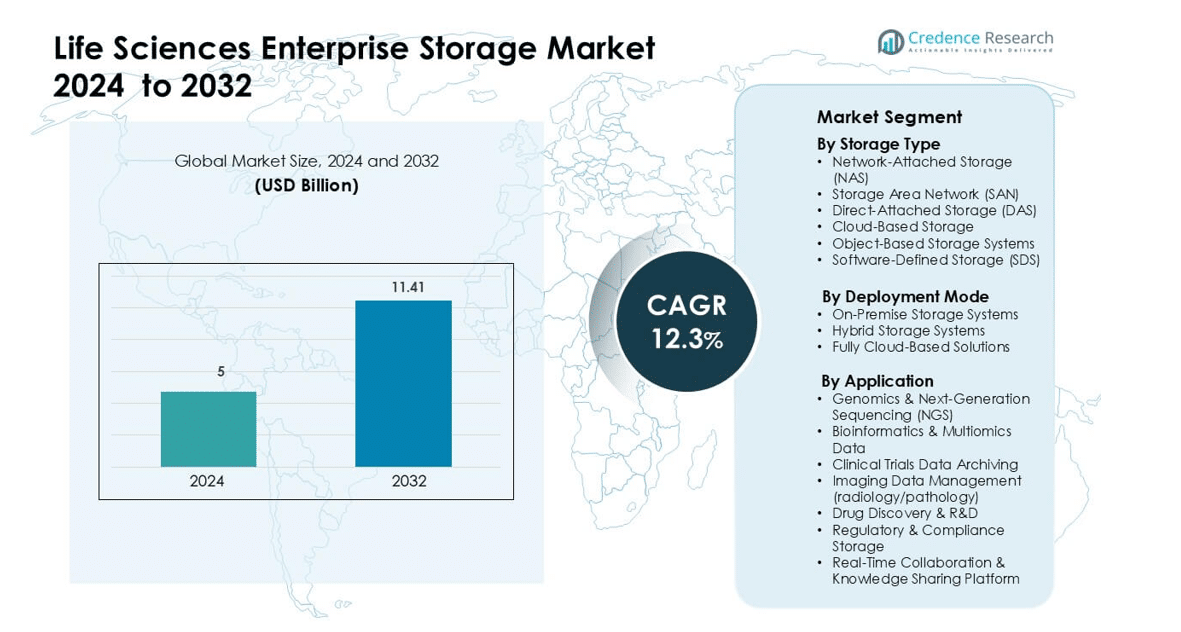

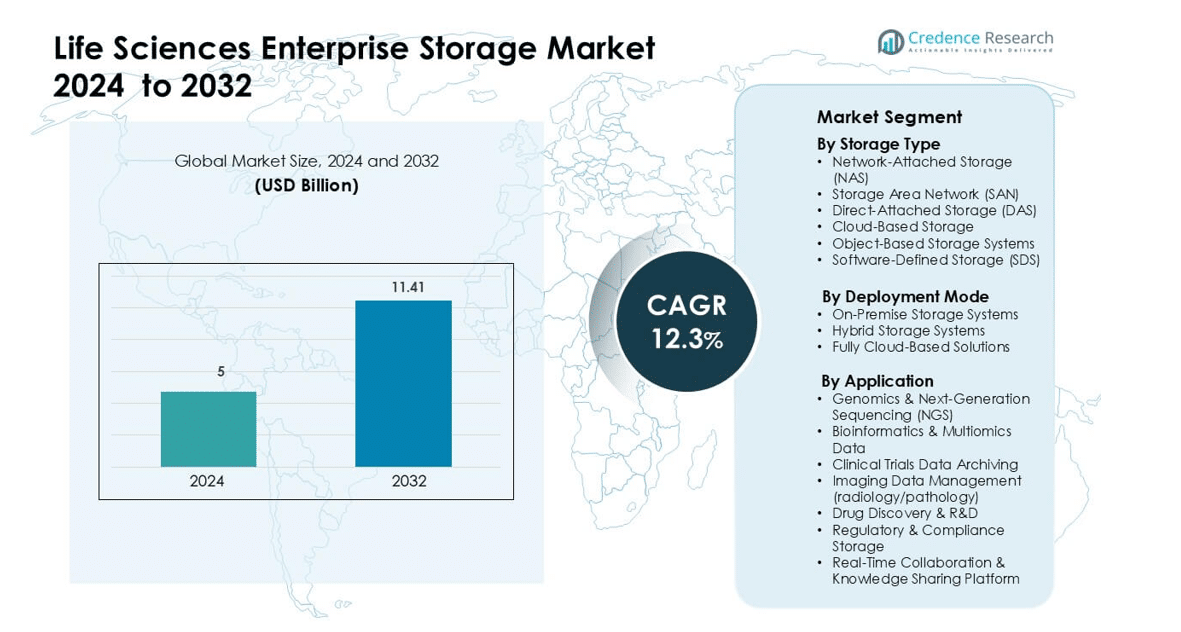

Life Sciences Enterprise Storage Market was valued at USD 5 billion in 2024 and is anticipated to reach USD 11.41 billion by 2032, growing at a CAGR of 12.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Life Sciences Enterprise Storage Market Size 2024 |

USD 5 billion |

| Life Sciences Enterprise Storage Market, CAGR |

12.3% |

| Life Sciences Enterprise Storage Market Size 2032 |

USD 11.41 billion |

The top players in the Life Sciences Enterprise Storage Market include Hitachi Vantara, Microsoft Azure for Genomics & Life Sciences, Pure Storage Inc., NetApp Inc., Seagate Technology, Google Cloud Platform for Biomedical Data Storage, IBM Storage & Cloud Infrastructure, Dell Technologies (EMC Storage), Amazon Web Services for Life Sciences, and Hewlett-Packard Enterprise. These companies compete by delivering scalable, compliant, and high-performance storage platforms tailored for genomics, multiomics, imaging, and clinical research workloads. North America leads the market with a 38% share, driven by strong adoption of hybrid cloud systems, large sequencing centers, and advanced AI-enabled research ecosystems.

Market Insights

- The Life Sciences Enterprise Storage Market was valued at USD 5 billion in 2024 and is projected to reach USD 11.41 billion by 2032, growing at a CAGR of 12.3%.

- Demand rises due to expanding genomics, multiomics, and clinical research programs that generate high-volume datasets, driving stronger adoption of scalable hybrid and cloud-integrated storage systems.

- Trends show rapid movement toward AI-ready architectures, object storage platforms, and automated data-tiering that support real-time analytics, imaging workloads, and distributed collaboration.

- Competition intensifies as AWS, Dell Technologies, HPE, NetApp, IBM, Google Cloud, and Pure Storage strengthen offerings with performance-optimized and compliance-driven solutions; cost and data-security challenges remain key restraints.

- North America leads with 38% share, followed by Europe at 29%, while Asia-Pacific grows fastest at 23%; by segment, Network-Attached Storage holds 32%, and on-premise deployment leads with 44% due to strict regulatory control requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Storage Type

Network-Attached Storage holds the lead with nearly 32% share due to strong scalability and reliable data access across research teams. Many life sciences groups use NAS to support high-volume sequencing data and shared analytics workflows. Demand rises as multiomics programs generate larger datasets each year. Cloud-based storage grows fast as research units adopt elastic capacity for NGS pipelines. Software-Defined Storage also gains traction because labs want hardware-agnostic control. Direct-Attached and Object-Based Storage remain useful for localized workloads where labs handle controlled or instrument-linked data flows.

- For instance, In HPC environments like those managed by West Grid/Alliance, the primary storage for active computational workloads typically consists of parallel file systems such as Lustre or GPFS, which are designed for high-speed, parallel access to large numbers of files.

By Deployment Mode

On-premise systems dominate with about 44% share because labs need strict control over sensitive genomic and clinical data. Many institutes use local infrastructure to meet internal compliance checks and maintain predictable performance for imaging workloads. Hybrid setups expand quickly as firms blend secure local storage with scalable cloud tiers for multiomics analysis. Fully cloud-based deployment sees rising adoption among biotech firms that outsource heavy compute tasks. Growth in hybrid and cloud models accelerates because teams want flexible scaling while meeting regulatory expectations across regions.

- For instance, Kyoto University Center for Genomic Medicine built a hybrid cloud system combining an on‑prem supercomputer, science cloud and public cloud to jointly genotype 11,238 whole‑genome sequences.

By Application

Genomics and NGS lead with close to 29% share as sequencing platforms produce massive raw files that require high-throughput ingestion and rapid retrieval. Labs store terabytes per run, driving strong demand for tiered and high-performance storage. Bioinformatics workflows expand this need due to multiomics integration. Imaging data management also grows as radiology and pathology adopt higher-resolution formats. Drug discovery teams push storage upgrades to handle simulation datasets. Clinical trial archiving rises due to retention mandates, while collaboration platforms gain traction as global research teams share real-time updates.

Key Growth Drivers

Surge in Genomics, Multiomics, and NGS Data Volumes

Life sciences organizations generate unprecedented data volumes from NGS platforms, multiomics studies, and large sequencing cohorts. Each whole-genome run can produce hundreds of gigabytes, pushing research units to expand storage capacity and adopt high-performance data architectures. Growth in population genetics projects, precision medicine programs, and real-time molecular profiling increases the load on storage ecosystems. Research teams require fast retrieval, parallel processing, and highly scalable environments to support analytics workflows. This surge encourages wider adoption of NAS, SAN, cloud tiers, and object storage models. Vendors benefit as institutions replace legacy systems with elastic, automated platforms capable of handling diverse biological datasets.

- For instance, according to the Broad Institute’s Data Sciences Platform, the organization produces nearly 20 terabytes of genomic data every day. This highlights the massive scale of data generation in modern genomics research.

Rising Digitalization in Clinical Trials and Drug Discovery

Digital transformation accelerates across clinical development and discovery pipelines. Modern trials generate structured and unstructured data from ePRO systems, imaging repositories, wearable sensors, and decentralized trial platforms. This shift increases the need for secure, compliant, and long-term archiving solutions. Drug discovery groups also rely on AI-driven modeling, real-time simulations, and molecular screening workflows, which require high-speed storage access and reliable throughput. Organizations move toward tiered storage and hybrid deployments to balance cost, compliance, and performance. Growth in decentralized clinical models further drives storage expansion as sponsors manage distributed datasets across global research sites.

- For instance, the rise of electronic data capture (EDC), wearables, and real-world data (RWD) sources (like electronic health records) has vastly increased the volume and variety of data collected.

Expanding Regulatory Demands and Data Governance Requirements

Life sciences companies face strict regulatory mandates governing data retention, auditability, and traceability. Regulations such as FDA 21 CFR Part 11, GxP, HIPAA, and GDPR require controlled environments for clinical, genomic, and patient-linked data. These rules push organizations to deploy validated on-premise infrastructure, encrypted cloud repositories, and audit-ready storage frameworks. Strong governance practices increase demand for immutable archives, version control, and secure access protocols. As research programs become more digitally interconnected, firms invest in enterprise-grade systems ensuring compliance while supporting high-volume workflows. These pressures make storage modernization a top strategic priority for both pharma and biotech firms.

Key Trend & Opportunity

Rapid Adoption of AI-Driven and Cloud-Integrated Storage Architectures

AI-enabled research and cloud-native workflows reshape storage strategies across the life sciences sector. Machine learning models used in drug discovery, imaging diagnostics, and multiomics analytics require high-bandwidth access to large datasets. This drives adoption of cloud-integrated storage layers, GPU-optimized file systems, and automated data-tiering solutions. Research groups increasingly combine object storage with scalable cloud buckets to optimize cost and performance. Vendors offering AI-ready platforms benefit as enterprises shift from rigid legacy systems to flexible hybrid architectures. The trend presents an opportunity for solutions that support distributed analytics, continuous data ingestion, and cross-platform interoperability.

- For instance, the storage industry is heavily focused on delivering extremely high throughput to eliminate bottlenecks for GPU-intensive AI workloads.

Growth of Real-Time Collaboration and Global Research Ecosystems

Life sciences companies expand global R&D networks, requiring storage systems that support real-time collaboration, multi-site data access, and fast replication. Cloud-connected repositories enable teams in genomics, pathology, and drug design to work on shared datasets without compromising compliance. Collaborative tools and knowledge-sharing platforms grow as multi-disciplinary teams integrate diverse biological data streams. Storage vendors see strong demand for distributed file systems, federated access controls, and low-latency data synchronization. This trend creates opportunities for platforms offering seamless integration with ELNs, LIMS, and computational pipelines across global research hubs.

- For instance, Novartis unified a multi‑cloud platform ingesting 9 terabytes of internal and external data from over 80 sources and cut new analytics‑use‑case setup time from ~10 days to ~3 days to empower its global workforce.

Key Challenge

High Infrastructure Costs and Complex Scalability Requirements

Life sciences organizations face rising costs as they attempt to scale infrastructure for massive datasets. High-performance storage systems, GPU-optimized file servers, and multi-tier architectures require substantial capital expenditure and specialized expertise. Many institutions struggle to manage data growth without increasing operational overhead. Balancing performance, security, and cost efficiency becomes difficult as research programs expand. Cloud migration offers relief, but long-term storage of multi-petabyte datasets can still become expensive. These financial and operational constraints delay modernization efforts and limit adoption for smaller research labs and emerging biotechs.

Data Security, Compliance, and Interoperability Barriers

Managing sensitive genomic, clinical, and patient-linked data requires strict security frameworks. Organizations must comply with complex global regulations while supporting fast data movement across research functions. Ensuring encryption, controlled access, and audit trails becomes increasingly challenging as hybrid and multi-cloud deployments grow. Interoperability gaps between legacy on-premise systems and modern cloud environments create risks of data fragmentation. These issues slow digitalization, extend validation cycles, and increase exposure to cyber threats. Many firms struggle to maintain compliance and security while enabling open, collaborative research workflows.

Regional Analysis

North America

North America leads the Life Sciences Enterprise Storage Market with about 38% share, driven by strong genomics programs, advanced clinical research networks, and high adoption of hybrid cloud systems. Research institutes and biopharma companies invest heavily in scalable, compliant, and high-performance storage for multiomics and real-time analytics. The United States dominates regional demand due to major sequencing centers and extensive AI-enabled drug discovery pipelines. Strict regulatory requirements also support growth of validated on-premise and hybrid architectures. Canada adds momentum through expanding precision medicine initiatives and rising cloud migration across academic research hubs.

Europe

Europe holds nearly 29% share, supported by robust biomedical research, expanding clinical trial activity, and strong adoption of GDPR-aligned data governance frameworks. Countries such as Germany, the U.K., and France drive storage demand through major genomics consortia and advanced healthcare digitization programs. Research groups adopt hybrid deployment models to meet compliance needs while enabling cross-border collaboration. Growth accelerates as European biopharma firms integrate AI-driven analytics into discovery workflows. Academic institutes increase investment in scalable archives to manage rising imaging and multiomics datasets generated through regional precision medicine initiatives.

Asia-Pacific

Asia-Pacific captures around 23% share and stands as the fastest-growing region due to expanding genomic sequencing capacity, rising biotech investments, and digital transformation across healthcare systems. China, Japan, South Korea, and India lead adoption of cloud-integrated storage to support national genomics missions and large-scale population studies. Regional pharma outsourcing also boosts data generation across CROs and research labs. Cloud providers gain traction as enterprises favor flexible, cost-efficient architectures. Growing utilization of AI in drug discovery and medical imaging further increases demand for high-performance, scalable enterprise storage platforms.

Latin America

Latin America accounts for roughly 6% share, with growth led by Brazil, Mexico, and Argentina as these countries expand biomedical research and clinical data infrastructure. Investment in genomics and digital health programs encourages adoption of hybrid and cloud-based storage frameworks. Organizations focus on scalable systems to manage increasing imaging and trial-related datasets. Rising collaboration with global biopharma firms drives modernization of data infrastructure. Limited funding remains a constraint, yet cloud adoption improves accessibility to advanced storage capabilities for research institutions and emerging biotech firms.

Middle East & Africa

The Middle East & Africa region holds close to 4% share, supported by growing healthcare digitization, expanding clinical research hubs, and early-stage adoption of cloud-based data platforms. Countries such as the UAE, Saudi Arabia, and South Africa invest in AI-enabled diagnostics, digital pathology, and genomics labs, which increases demand for secure and compliant storage ecosystems. Hospitals and research centers shift toward hybrid models to balance cost, data sovereignty, and performance. While infrastructure gaps persist in parts of the region, rising government funding in precision health strengthens growth prospects for enterprise storage solutions.

Market Segmentations:

By Storage Type

- Network-Attached Storage (NAS)

- Storage Area Network (SAN)

- Direct-Attached Storage (DAS)

- Cloud-Based Storage

- Object-Based Storage Systems

- Software-Defined Storage (SDS)

By Deployment Mode

- On-Premise Storage Systems

- Hybrid Storage Systems

- Fully Cloud-Based Solutions

By Application

- Genomics & Next-Generation Sequencing (NGS)

- Bioinformatics & Multiomics Data

- Clinical Trials Data Archiving

- Imaging Data Management (radiology/pathology)

- Drug Discovery & R&D

- Regulatory & Compliance Storage

- Real-Time Collaboration & Knowledge Sharing Platform

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Life Sciences Enterprise Storage Market features a mix of global cloud leaders, enterprise storage vendors, and specialized high-performance solution providers. Companies compete by offering scalable architectures that support genomics, multiomics, imaging, and clinical research workloads. Cloud providers strengthen their position with elastic, compliant, and AI-ready storage tiers favored by research groups handling dynamic datasets. Traditional storage vendors focus on enhanced performance, data integrity, and on-premise or hybrid deployments that meet regulatory and security demands. Firms expand capabilities through high-throughput file systems, object storage platforms, and data-governance frameworks. Strategic partnerships with pharma, biotech, and sequencing centers remain central as vendors integrate their systems with LIMS, ELNs, and analytics pipelines. Innovation around automated tiering, encryption, and real-time collaboration tools further intensifies competition across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Vantara

- Microsoft Azure for Genomics & Life Sciences

- Pure Storage Inc.

- NetApp Inc.

- Seagate Technology

- Google Cloud Platform (GCP) for Biomedical Data Storage

- IBM Corporation (Storage & Cloud Infrastructure)

- Dell Technologies (EMC Storage)

- Amazon Web Services (AWS Life Sciences Cloud Storage)

- Hewlett-Packard Enterprise (HPE)

Recent Developments

- In October 2025, NetApp launched its AFX all-flash systems and AI Data Engine. The platform delivers exabyte-scale storage for AI and data-heavy life sciences workloads. NetApp targets unified, disaggregated data infrastructure so research teams can scale hybrid clouds.

- In July 2025, Hexaware Technologies, a global provider of IT services and solutions, and Abluva, an innovator in agentic AI security, collaborated to launch secure AI solutions for the life sciences sector.

- In May 2025, Synology, a Taiwanese corporation that specializes in network-attached storage (NAS) devices, unveiled the PAS series, which has enterprise-grade storage for high-performance and always-on workloads.

Report Coverage

The research report offers an in-depth analysis based on Storage Type, Deployment Mode, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as genomics, multiomics, and imaging programs expand across research ecosystems.

- Hybrid and cloud-integrated storage architectures will gain stronger adoption for scalable data management.

- AI-driven drug discovery and diagnostics will increase the need for high-performance, low-latency storage systems.

- Compliance-ready platforms will grow as regulations tighten for clinical, genomic, and patient-linked data.

- Object storage models will expand due to their ability to handle unstructured scientific datasets.

- Real-time collaboration tools will accelerate adoption of distributed and globally accessible storage frameworks.

- Automation in data-tiering and lifecycle management will improve operational efficiency for research institutions.

- Vendor partnerships with sequencing centers and biopharma firms will deepen to support data-intensive pipelines.

- Edge-based storage for instrument-linked data capture will grow in labs using advanced sequencing and imaging devices.

- Investment in cybersecurity and zero-trust architectures will strengthen as organizations safeguard sensitive biomedical data.