Market Overview

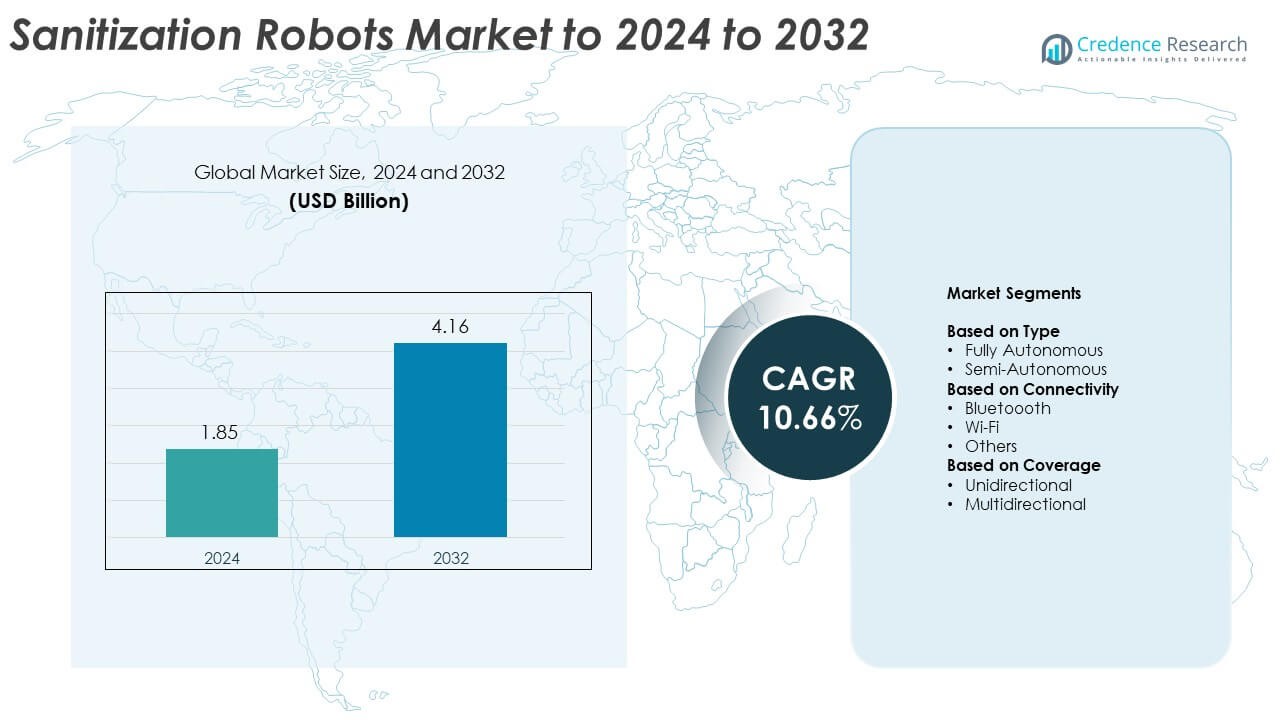

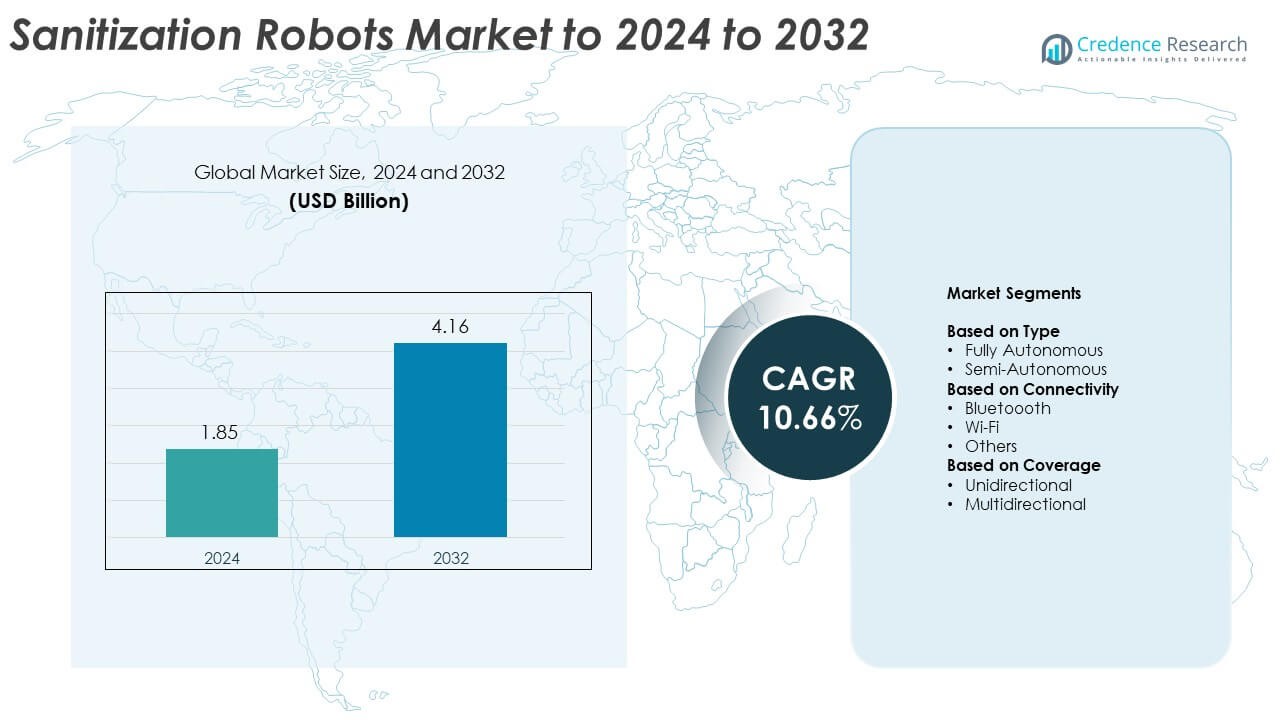

Sanitization Robots Market size was valued at USD 1.85 billion in 2024 and is anticipated to reach USD 4.16 billion by 2032, at a CAGR of 10.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sanitization Robots Market Size 2024 |

USD 1.85 Billion |

| Raised Access Floor Market, CAGR |

10.66% |

| Raised Access Floor Market Size 2032 |

USD 4.16 Billion |

The Sanitization Robots Market features leading participants such as Nevoa Inc., Blue Ocean Robotics (UVD Robots), SMP Robotics Systems Corp., Xenex, ROBOTLAB Inc., Mediland, Tru-D SmartUVC, and Taimi Robotics Technology Co. Ltd, each advancing automated disinfection through UV-C, spray-based, and hybrid technologies. These companies strengthen their position by improving navigation, reducing cycle times, and integrating cloud-enabled monitoring for large facilities. North America leads the market with a 41% share, supported by strong investments in healthcare and commercial automation. Europe follows with 28%, while Asia Pacific holds 23% due to rapid infrastructure expansion and rising hygiene standards.

Market Insights

- The market was valued reached USD 1.85 billion in 2024, and is projected to achieve USD 4.16 billion by 2032 at a CAGR of 10.66%.

• Adoption rises as hospitals, airports, and major commercial sites shift to automated sanitization, with fully autonomous robots holding a 62% share due to high efficiency and reduced labor dependence.

• UV-C and hybrid disinfection systems continue to expand, while connected robots with cloud monitoring and adaptive navigation support next-generation performance improvements.

• Competition strengthens as manufacturers enhance mobility, reduce maintenance needs, and introduce compact, cost-effective models for mid-scale facilities.

• North America holds a 41% regional share, followed by Europe at 28% and Asia Pacific at 23%, driven by strong hygiene mandates and rising automation investments across key industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Fully autonomous systems lead this segment with a 62% share due to strong demand for hands-free disinfection in hospitals, airports, and commercial buildings. Buyers prefer these units because they reduce labor needs, maintain steady cleaning cycles, and lower exposure risks for frontline staff. Semi-autonomous models still gain traction in smaller facilities that need operator involvement for targeted sanitization. Adoption of both types grows as organizations expand infection-control protocols and shift toward predictable, automated hygiene procedures that support consistent surface and air-treatment performance.

- For instance, Xenex reported that its LightStrike robots have completed over 35 million disinfection cycles in healthcare facilities worldwide, by the year 2022

By Connectivity

Wi-Fi-enabled robots dominate with a 58% share because continuous network access supports remote monitoring, fleet coordination, and cloud-based performance tracking. Facilities rely on Wi-Fi systems to schedule routes, receive alerts, and integrate sanitization workflows with broader building-management platforms. Bluetooth models see use in settings that favor quick pairing and short-range control, while other connectivity formats fill specialized roles. Growth in connected robots reflects rising expectations for real-time diagnostics, centralized control, and seamless data flow across large indoor environments.

- For instance, Brain Corp announced its BrainOS-powered fleet logged over 2.3 million hours of autonomous operation in 2023.

By Coverage

Multidirectional coverage leads this category with a 64% share as organizations prioritize robots that disinfect complex layouts, high-touch surfaces, and shadowed zones. These systems deliver wider spray or UV exposure patterns, which strengthen compliance with hygiene standards in healthcare and transportation hubs. Unidirectional units remain practical for corridor-based workflows and linear cleaning paths. Demand for multidirectional designs increases as facilities seek higher pathogen-reduction consistency, improved area penetration, and faster cycle times across crowded or irregular floor plans.

Key Growth Drivers

Key Growth Drivers

Rising Infection-Control Requirements

Healthcare systems, transport hubs, and commercial buildings continue to enforce strict hygiene standards, which drives strong demand for automated sanitization. Organizations adopt robots to reduce manual cleaning pressure, improve consistency, and lower exposure risks for staff. The shift toward continuous disinfection in high-traffic areas strengthens adoption across hospitals, airports, hotels, and industrial sites. This driver remains the most influential as global health policies emphasize prevention, rapid response, and measurable hygiene outcomes supported by robotic systems.

- For instance, Xenex achieved disinfection cycle times as low as 2 minutes for vegetative bacteria using its LightStrike robot, a speed that makes “between-case” cleaning in operating rooms a viable option.

Labor Shortages in Facility Management

Facility operators face staffing gaps and rising labor costs, leading them to integrate robots to maintain sanitation quality. Automated units help meet required cleaning frequencies without relying on large manual teams. This need is especially strong in hospitals, manufacturing plants, and logistics centers where downtime and contamination risks can disrupt workflows. Robots support round-the-clock coverage, reduce task fatigue, and help organizations sustain predictable cleaning cycles. As workforce constraints widen, automation becomes a practical and scalable operational solution.

- For instance, Brain Corp’s floor-scrubbing robots covered 38 billion square feet in 2023 alone.

Shift Toward Smart and Connected Buildings

Modern buildings now emphasize integrated digital systems, which accelerates the adoption of connected sanitization robots. Facilities prefer units that sync with network dashboards, provide performance data, and support automated scheduling. This alignment with smart-building infrastructure helps managers track hygiene levels in real time and optimize cleaning routes. As IoT-driven facilities expand in corporate campuses, malls, and transport hubs, robots become essential tools within broader digital maintenance ecosystems.

Key Trends and Opportunities

Growing Preference for UV-C and Hybrid Disinfection Systems

Demand rises for robots using UV-C light, dry fogging, or combined disinfection methods due to their ability to treat air and surfaces without chemical residue. Hybrid platforms that merge spraying and UV-C expand coverage in sensitive areas such as ICUs, labs, and production lines. This trend creates opportunities for manufacturers to introduce multi-mode robots that offer faster cycles and stronger pathogen reduction. The shift reflects a market move toward rapid, chemical-free, and energy-efficient disinfection technologies.

- For instance, the UVD Robot offers 360° UV-C coverage and fully autonomous navigation capabilities, including LiDAR and 3D cameras for obstacle avoidance.

Expansion Across Non-Healthcare Sectors

Sanitization robots gain traction in retail, hospitality, warehousing, education, and public transport as these industries prioritize visible hygiene. Airports, metro stations, and malls deploy robots to maintain cleanliness during peak footfall. Restaurants, hotels, and office campuses also adopt these solutions to reassure customers and employees. This expansion outside healthcare unlocks sizeable opportunity pools, encouraging vendors to design affordable, user-friendly, and compact models tailored to smaller or segmented environments.

- For instance, the LG CLOi ServeBot (shelf type) can carry a total maximum cargo capacity of 30 kg (66 lbs) across its three shelves (with a maximum of 10 kg per shelf), and offers up to 11 hours of operation during continuous driving on a single charge.

Key Challenges

High Initial Costs and Budget Constraints

Many small and mid-sized organizations face financial barriers that limit robot adoption. High procurement, maintenance, and software-upgrade costs discourage buyers with limited budgets. Facilities often compare robots with manual cleaning costs, making return-on-investment justification difficult for smaller sites. These cost barriers slow adoption in schools, small retail spaces, and regional healthcare centers, where capital expenditure approvals remain strict.

Navigation Limitations in Complex Environments

Robots struggle to operate efficiently in crowded or highly dynamic spaces where furniture changes frequently or foot traffic remains heavy. Navigation issues lead to incomplete coverage, route interruptions, or slowed disinfection cycles. These limitations reduce reliability in environments such as supermarkets, warehouses during peak hours, or compact hospital floors. Vendors must improve sensors, mapping algorithms, and adaptive mobility to ensure consistent performance in complex real-world layouts.

Regional Analysis

North America

North America holds a 41% market share due to strong adoption across hospitals, airports, and commercial facilities that prioritize automated hygiene. The United States drives most deployment as large enterprises and healthcare networks invest in high-performance robots with real-time connectivity features. Canada expands adoption through government-backed infection-control programs and rising demand in public infrastructure. Vendors benefit from well-established robotics ecosystems, higher spending capacity, and strong preference for autonomous systems. Growing integration with building-management platforms further strengthens the region’s leadership across large campuses and transportation hubs.

Europe

Europe accounts for a 28% market share, supported by strict regulatory standards for infection control and growing investment in automated cleaning technologies across healthcare and transportation sectors. Countries such as Germany, the United Kingdom, and France lead adoption through large hospital networks and public-facility upgrades. Demand rises in airports, rail stations, and manufacturing plants that prioritize contact-free sanitization. The region also supports sustainability-focused solutions, encouraging the use of energy-efficient and chemical-free disinfection robots. Increasing reliance on robotics for workforce optimization continues to reinforce Europe’s position in the global market.

Asia Pacific

Asia Pacific captures a 23% market share, driven by rapid urban expansion, growing hospital infrastructure, and heightened hygiene awareness following regional health outbreaks. China, Japan, and South Korea lead technological innovation and deploy robots widely in airports, malls, and corporate campuses. India and Southeast Asian countries experience rising demand as businesses adopt automation to manage crowded environments and reduce labor pressure. The region benefits from strong robotics manufacturing capabilities and competitive pricing, making sanitization systems more accessible. Expanding smart-city projects and large public transport networks further accelerate market penetration.

Latin America

Latin America holds a 5% market share as adoption grows gradually among hospitals, airports, and hospitality facilities seeking consistent disinfection performance. Brazil and Mexico lead the region through increased investment in healthcare modernization and automated cleaning technologies. Budget limitations slow large-scale deployment, but interest increases as organizations recognize the long-term cost efficiency of automated sanitization. Retail chains and logistics centers begin integrating robots to maintain hygiene during peak activity. Gradual digital infrastructure improvements support wider adoption across commercial and public-sector environments.

Middle East and Africa

Middle East and Africa represent a 3% market share, with adoption led by the Gulf countries due to strong investments in healthcare, aviation, and smart-infrastructure development. The UAE and Saudi Arabia integrate sanitization robots into hospitals, airports, and large public venues to support national hygiene and safety initiatives. Africa shows early-stage adoption, mainly in private hospitals and premium hospitality facilities. Limited budgets and slower automation readiness restrict wider uptake, but growing interest in infection-control technologies and new digital projects enhances future potential across both subregions.

Market Segmentations:

By Type

- Fully Autonomous

- Semi-Autonomous

By Connectivity

By Coverage

- Unidirectional

- Multidirectional

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Nevoa Inc., Blue Ocean Robotics (UVD Robots), SMP Robotics Systems Corp., Xenex, ROBOTLAB Inc., Mediland, Tru-D SmartUVC, and Taimi Robotics Technology Co. Ltd operate in a competitive environment defined by rapid innovation, expanding product portfolios, and rising demand for automation-ready hygiene systems. The market features companies that focus on advanced navigation, UV-C disinfection, hybrid fogging technologies, and scalable connectivity solutions to serve hospitals, airports, logistics centers, and public facilities. Vendors compete by improving cycle efficiency, enhancing coverage accuracy, and integrating robots with smart-building platforms for centralized control. Many players strengthen their positions through global distribution networks, strategic partnerships with healthcare groups, and R&D investments aimed at reducing unit size, energy use, and maintenance needs. Competition continues to intensify as new entrants target cost-sensitive buyers with compact and affordable platforms, while established participants push premium models geared toward large institutions seeking high-throughput sanitization performance.

Key Player Analysis

- Nevoa Inc.

- Blue Ocean Robotics (UVD Robots)

- SMP Robotics Systems Corp.

- Xenex

- ROBOTLAB Inc.

- Mediland

- Tru-D SmartUVC

- Taimi Robotics Technology Co. Ltd

Recent Developments

- In 2025, Xenex continued enhancing its LightStrike+ robot that uses a patented pulsed xenon UV system to reduce microbial loads in healthcare environments.

- In 2023, UVD Robots (Blue Ocean Robotics) further integrated its existing autonomous UV-C disinfection robots into a comprehensive, cloud-connected platform, enabling data-driven hygiene insights for customers

- In 2023, Tru-D SmartUVC introduced the new iQ system, enhancing their intelligent UV disinfection robots with a smart layered cleaning approach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Connectivity, Coverage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider deployment across hospitals, airports, malls, and transport hubs.

- Demand will rise for autonomous robots that handle full-cycle disinfection without human support.

- Hybrid UV-C and spray-based models will gain traction for broader surface and air coverage.

- Manufacturers will focus on smaller, low-maintenance units suitable for compact facilities.

- Connectivity features will expand, enabling real-time route updates and centralized monitoring.

- Robots will integrate with smart-building platforms to support automated hygiene scheduling.

- Adoption will grow in retail, hospitality, and education as hygiene standards increase.

- Advances in sensors and navigation systems will improve accuracy in crowded environments.

- Battery efficiency and faster charging will reduce downtime and support continuous operations.

- More vendors will enter the market, driving innovation in cost-effective sanitization solutions.

Key Growth Drivers

Key Growth Drivers