Market Overview

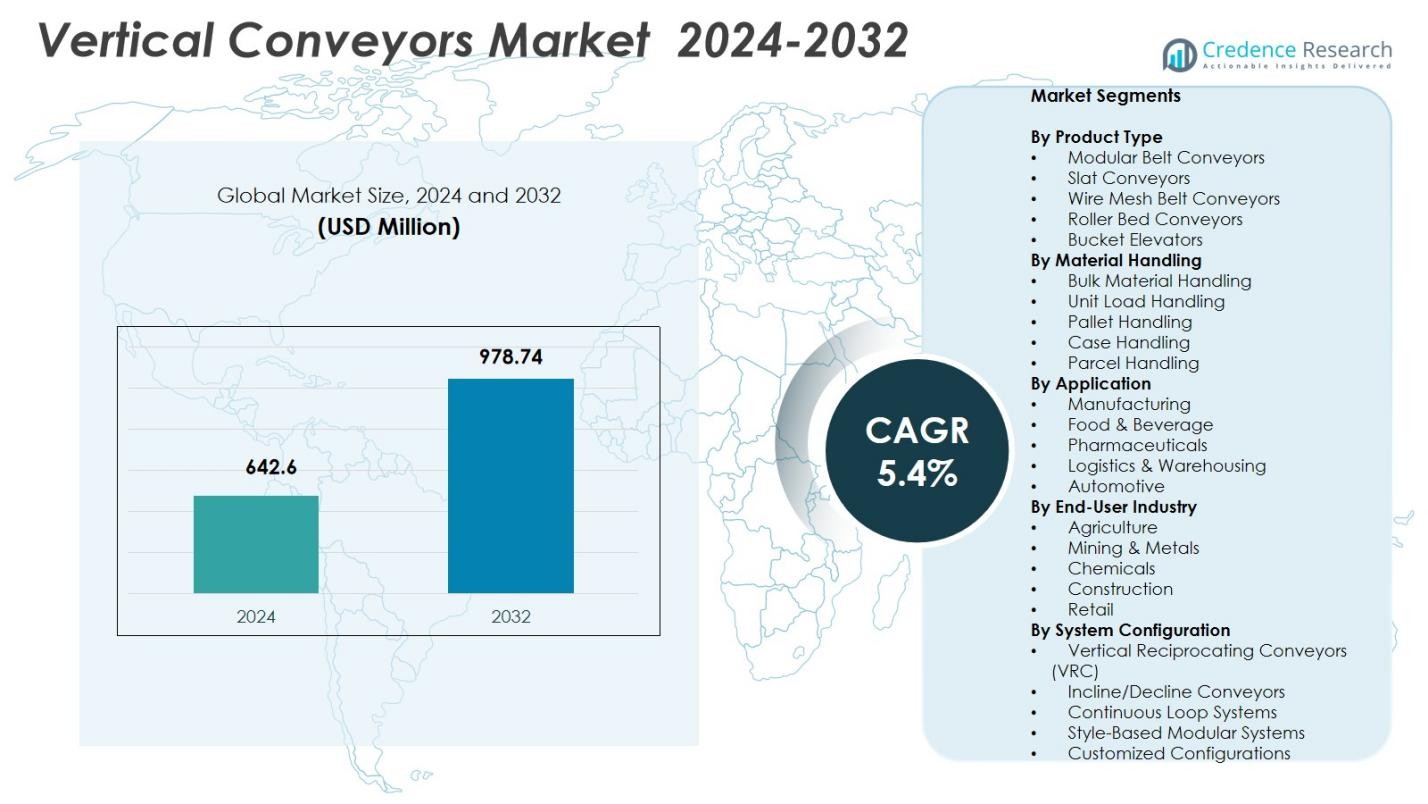

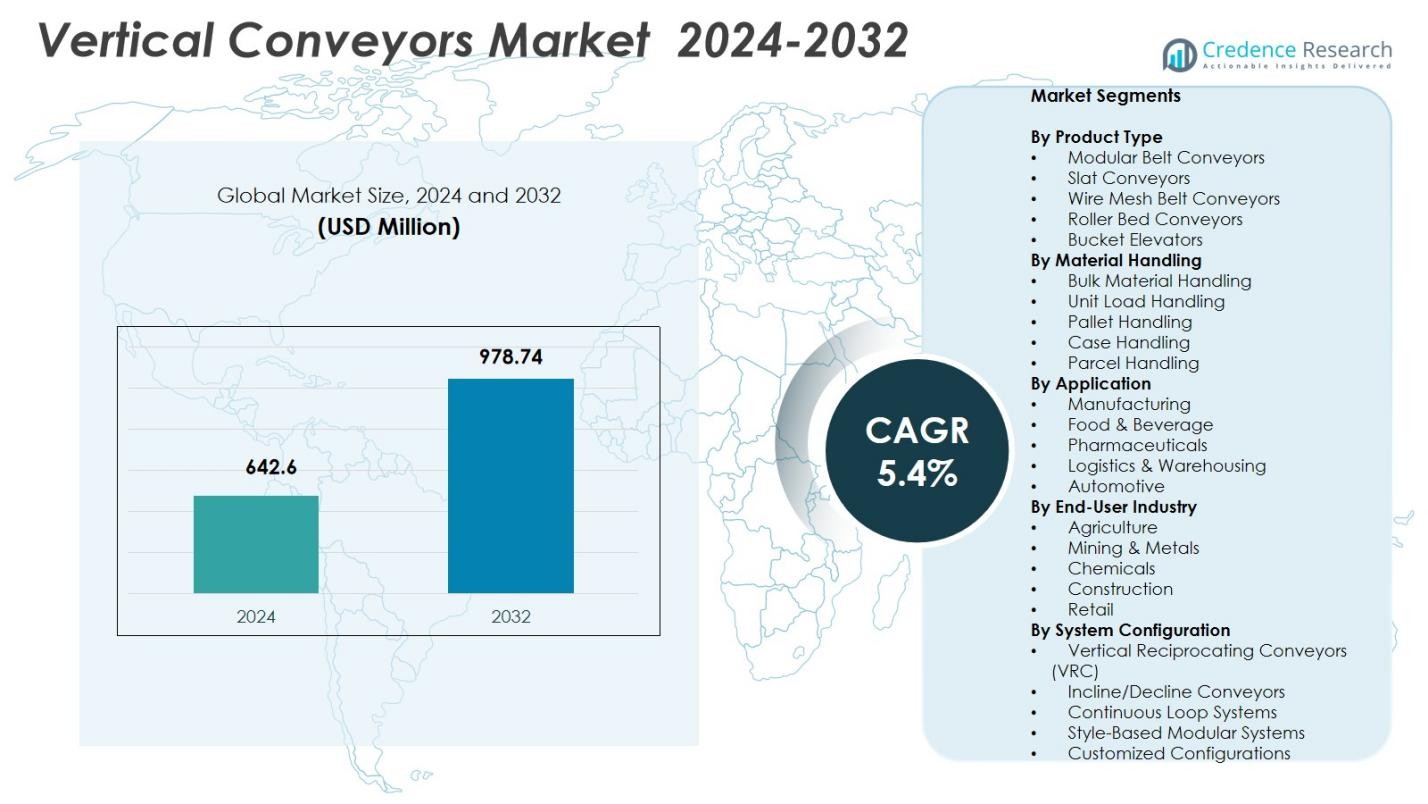

Vertical Conveyors Market size was valued at USD 642.6 Million in 2024 and is anticipated to reach USD 978.74 Million by 2032, growing at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vertical Conveyors Market Size 2024 |

USD 642.6 Million |

| Vertical Conveyors Market, CAGR |

5.4% |

| Vertical Conveyors Market Size 2032 |

USD 978.74 Million |

Vertical Conveyors Market companies such as Aravali Engineers, ARROWHEAD Systems, Bastian Solutions, Belt Technologies, Caddy, Doer, Hywema, Inter System, Invata, and Kardex Mlog maintain strong presence across global markets. Asia‑Pacific emerges as the leading region, capturing a 34.1% share in the global conveyor systems market in 2024. These vendors benefit from Asia‑Pacific’s rapid industrialization, expanding manufacturing base, and accelerating e‑commerce logistics, which drive demand for automated, space‑efficient vertical conveyors. North America and Europe follow, supported by modernization of warehousing infrastructure and growing adoption of smart automation technologies in manufacturing and distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Vertical Conveyors Market was valued at USD 642.6 Million in 2024 and is projected to reach USD 978.74 Million by 2032, growing at a CAGR of 5.4%.

- Rising adoption of automation in warehouses and manufacturing plants is driving demand, with modular belt conveyors holding 34.2% of the product type segment and unit load handling at 41.6%.

- Market trends include integration with smart warehouse and Industry 4.0 systems, expansion of energy-efficient modular designs, and growing use in logistics & warehousing, which accounts for 37.8% of the application segment.

- Key players such as Aravali Engineers, ARROWHEAD Systems, Bastian Solutions, Belt Technologies, Caddy, Doer, Hywema, Inter System, Invata, and Kardex Mlog are investing in technology upgrades, partnerships, and retrofitting solutions to strengthen their presence.

- Regional analysis shows Asia‑Pacific leading with 32.7% share, followed by North America at 28.5%, Europe at 25.3%, Latin America at 7.4%, and Middle East & Africa at 6.1%, reflecting industrialization, e-commerce growth, and automation adoption.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

In the Vertical Conveyors Market, Modular Belt Conveyors dominate the product type segment with a 34.2% market share in 2024. Their high flexibility, ease of integration, and suitability for multi-level material transport drive adoption across industries. Slat Conveyors and Wire Mesh Belt Conveyors follow, serving heavy-duty and temperature-sensitive applications, respectively. The growing demand for efficient, space-saving, and automated material handling solutions in manufacturing and warehousing facilities further accelerates the uptake of modular belt systems. Increased focus on reducing labor costs and optimizing vertical transport operations reinforces their market leadership.

- For instance, Dorner’s 3200 Series modular belt conveyors support loads up to 450 kg and offer enhanced side-flexing designs for vertical and incline applications in manufacturing.

By Material Handling:

Within the material handling segment, Unit Load Handling holds the largest share at 41.6% in 2024, reflecting its versatility in transporting standardized loads such as totes, bins, and cartons. Bulk Material Handling caters to raw material and granular product movement, while Pallet and Case Handling address larger-scale logistics needs. The dominance of unit load systems is driven by rapid automation adoption, rising e-commerce logistics requirements, and the need for consistent, reliable, and efficient vertical transport in warehouses and manufacturing plants. Integration with conveyors, automated storage, and retrieval systems further boosts growth.

- For instance, Siemens AG has developed automated conveyor systems with AI-driven monitoring that optimize bulk material transport by reducing downtime and improving maintenance.

By Application:

Among applications, Logistics & Warehousing accounts for the highest share at 37.8% in 2024, owing to surging e-commerce demand and the need for high-density storage solutions. Manufacturing and Food & Beverage industries follow, leveraging vertical conveyors to optimize workflow, enhance throughput, and reduce manual handling. Pharmaceutical and Automotive sectors utilize these conveyors for precision, hygiene, and heavy-load requirements. The growth in logistics and warehousing is propelled by technological advancements, rising labor costs, and the push for automated material flow, enabling faster order fulfillment, reduced downtime, and improved operational efficiency across supply chains.

Key Growth Drivers

Rising Adoption of Automation in Warehousing and Manufacturing

The growing trend of automation across manufacturing plants and warehouses is a primary driver for the Vertical Conveyors Market. Organizations aim to enhance operational efficiency, reduce labor dependency, and optimize space utilization. Vertical conveyors enable seamless multi-level transport of materials, improving throughput and minimizing downtime. E-commerce growth, coupled with increasing demand for automated storage and retrieval systems, further accelerates adoption. Integration with robotics and warehouse management systems strengthens productivity, positioning vertical conveyors as essential solutions for modern automated material handling operations.

- For instance, UPM Conveyors designed a bespoke vertical conveyor system for a UK-based medical device injection moulding specialist. The system transports components directly from the moulding machine to assembly using a Forbo modular link belt with scooped flights and a variable speed inverter providing 17 minutes of cooling time, streamlining end-of-line processes.

Demand for Space-Efficient Material Handling Solutions

Limited floor space in urban and industrial facilities drives the demand for compact, vertical material transport systems. Vertical conveyors maximize storage density while enabling fast, multi-level movement of goods. Industries including logistics, food & beverage, and pharmaceuticals benefit from these systems due to improved workflow efficiency and reduced operational footprint. The pressure to optimize facility layouts and accommodate growing product volumes reinforces market growth. Companies increasingly adopt vertical conveyors to support high-rise storage, streamline material flow, and maintain consistent productivity in space-constrained environments.

- For instance, Belt Technologies provided PureSteel vacuum conveyors for satellite solar panel production, enabling precise handling in multi-level setups for efficient infrastructure technology assembly.

Technological Advancements in Conveyor Systems

Innovation in conveyor design and materials is enhancing performance, safety, and energy efficiency, fueling market expansion. Features like modular construction, automated load handling, and integration with IoT-enabled monitoring systems allow precise control, predictive maintenance, and reduced operational costs. High durability, energy-saving drives, and compatibility with diverse load types further encourage adoption across industries. Continuous R&D investments by key players ensure improved load capacity, reliability, and customization, making vertical conveyors attractive for companies seeking technologically advanced, scalable, and long-lasting material handling solutions.

Key Trends & Opportunities

Integration with Smart Warehouse and Industry 4.0 Solutions

Vertical conveyors are increasingly being integrated with smart warehouses and Industry 4.0 systems, creating opportunities for real-time monitoring, predictive analytics, and automated load management. Connected systems enhance efficiency, reduce human error, and support seamless coordination between conveyors, robotics, and automated storage systems. The trend of digitalization in logistics and manufacturing opens avenues for retrofitting existing conveyors with sensors and software, enabling data-driven decision-making and optimized material flow. This integration positions vertical conveyors as a critical component of next-generation automated facilities.

- For instance, KAPELOU integrates roller conveyors with vertical lifts, stacker cranes, and shuttle systems to automate horizontal and vertical load movement across multiple warehouse levels.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East offer significant growth potential due to rapid industrialization, increasing e-commerce penetration, and rising demand for modern warehousing infrastructure. Companies are investing in vertical conveyors to enhance storage density, operational efficiency, and supply chain responsiveness. Favorable government policies, growing foreign investments, and expanding manufacturing sectors create opportunities for market players to establish local production facilities and supply chains. These markets are expected to witness accelerated adoption, driving long-term growth in the global vertical conveyors industry.

- For instance, Daifuku opened a new factory in India to meet rising demand from automotive and electronics sectors, supporting smart-factory retrofits in the region.

Key Challenges

High Initial Investment and Implementation Costs

The deployment of vertical conveyor systems requires significant capital investment, including equipment, installation, and integration with existing workflows. Small and medium-sized enterprises often face budget constraints, delaying adoption. Customization, specialized materials, and automation features further increase costs. Companies must evaluate return on investment carefully, balancing operational benefits with upfront expenditures. The high cost of implementation remains a major barrier, particularly for emerging markets and smaller facilities, limiting widespread penetration despite the efficiency and productivity advantages offered by vertical conveyors.

Maintenance and Operational Complexity

Vertical conveyors involve complex mechanical and electronic components, requiring skilled personnel for operation, monitoring, and preventive maintenance. Downtime due to technical faults or inadequate servicing can disrupt workflows, impacting productivity and operational efficiency. Integrating advanced automation and IoT features adds further complexity, demanding continuous training and specialized support. Ensuring consistent reliability, managing component wear, and maintaining safety standards pose ongoing challenges for organizations, potentially restraining market growth unless effective maintenance programs and technical support infrastructure are established.

Regional Analysis

North America

North America leads the Vertical Conveyors Market with a 28.5% share in 2024, driven by advanced manufacturing infrastructure, widespread warehouse automation, and high e-commerce penetration. The region’s strong focus on Industry 4.0 integration and adoption of automated storage and retrieval systems enhances demand for vertical conveyors. Key sectors such as food & beverage, pharmaceuticals, and automotive increasingly rely on space-efficient material handling solutions to optimize productivity and reduce operational costs. Continuous investment in smart warehouse technologies and retrofitting of existing facilities further strengthens market growth across the United States and Canada.

Europe

Europe accounts for 25.3% of the Vertical Conveyors Market in 2024, supported by the presence of established industrial hubs, modern logistics infrastructure, and sustainability-driven operations. Countries like Germany, France, and the UK lead adoption, leveraging vertical conveyors for efficient multi-level material transport in manufacturing, automotive, and warehouse operations. The growing emphasis on reducing labor dependency, increasing throughput, and optimizing floor space drives demand. Government initiatives supporting automation, digitalization, and energy-efficient material handling systems further bolster market growth, making Europe a key region for technologically advanced vertical conveyor solutions.

Asia-Pacific

Asia-Pacific holds the largest share at 32.7% in 2024, fueled by rapid industrialization, expanding e-commerce, and rising logistics infrastructure development in China, India, Japan, and Southeast Asia. Increasing investments in automated warehouses, manufacturing plants, and high-density storage facilities drive vertical conveyor adoption. The growing focus on operational efficiency, labor cost reduction, and supply chain optimization encourages companies to deploy modular and unit load handling systems. Government support for smart factories, coupled with expanding automotive, food & beverage, and pharmaceutical sectors, positions Asia-Pacific as the fastest-growing market for vertical conveyors globally.

Latin America

Latin America captures a 7.4% share of the Vertical Conveyors Market in 2024, driven by rising industrialization and modernization of logistics and warehousing infrastructure in Brazil, Mexico, and Argentina. Growth is supported by increasing adoption of automated storage solutions and vertical transport systems to optimize operational efficiency and reduce labor costs. E-commerce expansion, coupled with the need for streamlined supply chains and multi-level material handling in warehouses and manufacturing units, accelerates demand. Investments in modernizing manufacturing facilities and implementing smart warehouse technologies present growth opportunities for vertical conveyor vendors in the region.

Middle East & Africa

The Middle East & Africa represents a 6.1% share in 2024, supported by ongoing investments in logistics infrastructure, large-scale warehousing projects, and industrial automation in the UAE, Saudi Arabia, and South Africa. Rapid urbanization, rising e-commerce, and a growing focus on efficiency and space optimization drive vertical conveyor adoption. Key sectors such as food & beverage, pharmaceuticals, and manufacturing increasingly rely on automated solutions for multi-level material transport. Government initiatives to promote industrial growth, smart cities, and supply chain modernization further create opportunities for vertical conveyor market expansion across the region.

Market Segmentations:

By Product Type

- Modular Belt Conveyors

- Slat Conveyors

- Wire Mesh Belt Conveyors

- Roller Bed Conveyors

- Bucket Elevators

By Material Handling

- Bulk Material Handling

- Unit Load Handling

- Pallet Handling

- Case Handling

- Parcel Handling

By Application

- Manufacturing

- Food & Beverage

- Pharmaceuticals

- Logistics & Warehousing

- Automotive

By End-User Industry

- Agriculture

- Mining & Metals

- Chemicals

- Construction

- Retail

By System Configuration

- Vertical Reciprocating Conveyors (VRC)

- Incline/Decline Conveyors

- Continuous Loop Systems

- Style-Based Modular Systems

- Customized Configurations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Vertical Conveyors Market includes key players such as Aravali Engineers, ARROWHEAD Systems, Bastian Solutions, Belt Technologies, Caddy, Doer, Hywema, Inter System, Invata, and Kardex Mlog. Market leaders focus on continuous innovation, strategic partnerships, and product portfolio expansion to strengthen their position. Companies are investing in automation technologies, modular designs, and energy-efficient systems to meet growing demand from logistics, manufacturing, and e-commerce sectors. Adoption of smart warehouse integration, predictive maintenance solutions, and customization capabilities allows vendors to differentiate themselves. Regional expansions, collaborations with industrial integrators, and retrofitting solutions for existing facilities further enhance market presence. Intense competition drives pricing strategies, technology upgrades, and service excellence, ensuring continuous improvement in operational efficiency and client satisfaction across diverse industries globally, thereby solidifying long-term growth prospects for top market players.

Key Player Analysis

- Hywema

- Kardex Mlog

- Caddy

- ARROWHEAD Systems

- Bastian Solutions

- Invata

- Aravali Engineers

- Belt Technologies

- Doer

- Inter System

Recent Developments

- In July 2024, Emmepi Group completed the acquisition of Avanti Conveyors, expanding its material-handling and integrated conveyor solutions portfolio.

- In December 2024, RAM Enterprise announced a strategic partnership with Cambelt International to deliver high-incline conveying and material-handling solutions a move that supports enhanced vertical and steep-angle conveyor adoption.

- In September 2024, Bosch Rexroth launched a new belt-conveyor variant under its VarioFlow system the new “VarioFlow belt conveyor,” suited for FMCG and delicate product flows, offering modular belt options in standard widths of 406 mm and 608 mm.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Handling, Application, End User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automation in warehouses and manufacturing will drive demand for vertical conveyors globally.

- Integration with smart warehouse and Industry 4.0 systems will enhance operational efficiency.

- Rising e-commerce and logistics requirements will boost multi-level material handling solutions.

- Modular and energy-efficient conveyor designs will gain increased acceptance across industries.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will witness accelerated adoption.

- Continuous R&D will lead to improved durability, load capacity, and safety features.

- Growing focus on space optimization will encourage vertical conveyor deployment in compact facilities.

- Retrofitting existing facilities with vertical conveyors will create additional growth opportunities.

- Expansion of pharmaceuticals, food & beverage, and automotive sectors will support market growth.

- Strategic partnerships and collaborations among key players will drive technological innovation and market penetration.

Market Segmentation Analysis:

Market Segmentation Analysis: