Market Overview

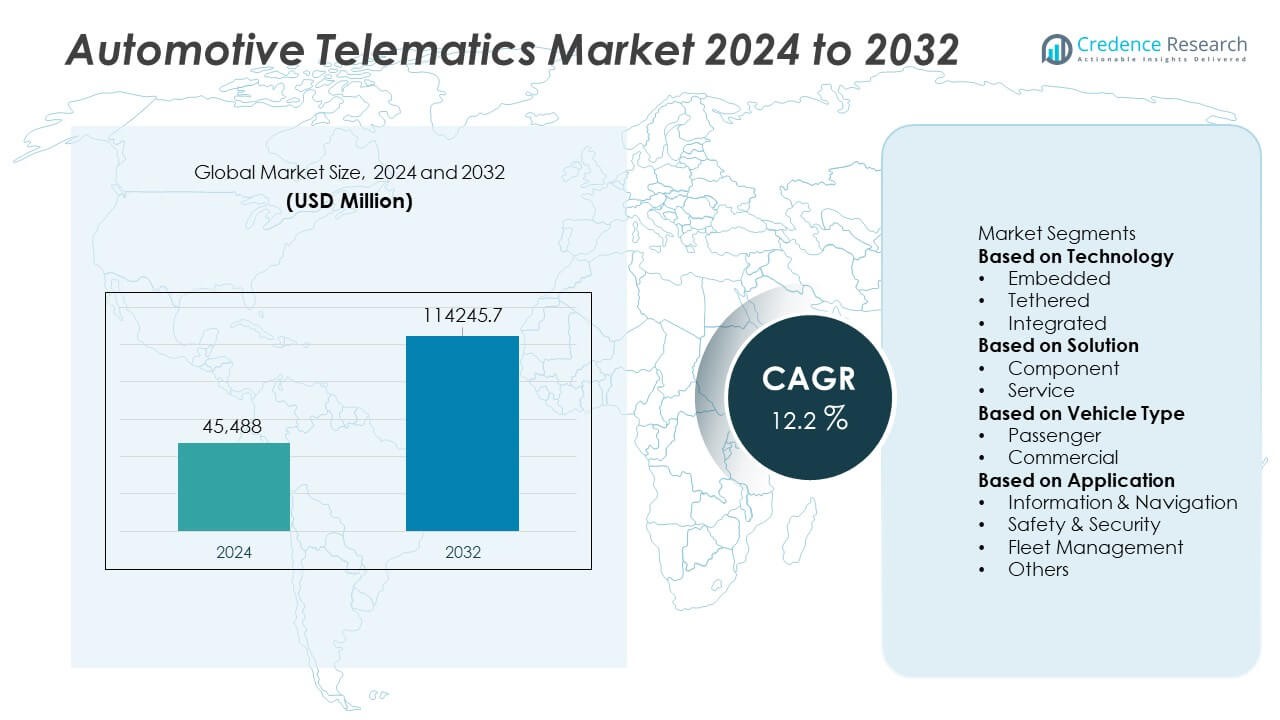

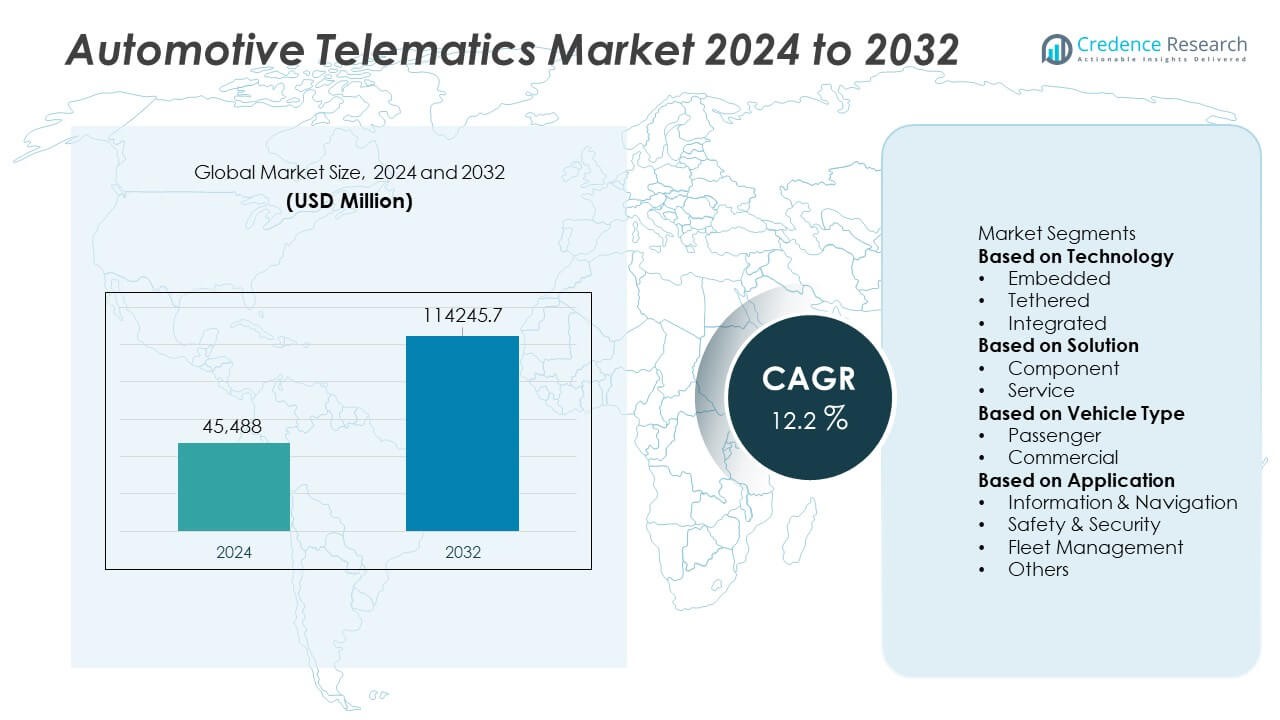

The Automotive Telematics Market size reached USD 45,488 million in 2024 and is expected to grow to USD 114,245.7 million by 2032, registering a CAGR of 12.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Telematics Market Size 2024 |

USD 45,488 Million |

| Automotive Telematics Market, CAGR |

12.2% |

| Automotive Telematics Market Size 2032 |

USD 114,245.7 Million |

The Automotive Telematics market is shaped by key players such as Tata Motors, Mercedes-Benz AG, Nissan Motor Co., Ltd, BMW Motors, Hyundai Motor Company, General Motors Company, Toyota Motor Corporation, AB Volvo, Ford Motor Company, and Volkswagen AG. These companies expand telematics capabilities through embedded platforms, over-the-air updates, and advanced safety services. North America leads the market with a 38% share, driven by strong regulatory support, high connected-vehicle adoption, and widespread fleet digitalization. Europe follows with a 29% share, supported by strict safety mandates and growing demand for connected mobility solutions across both passenger and commercial vehicle segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Telematics market reached USD 45,488 million in 2024 and will grow at a CAGR of 12.2% through 2032.

- Strong market drivers include rising demand for connected safety features and expanding fleet optimization needs across global transport and logistics firms.

- Key trends include wider adoption of embedded telematics, over-the-air updates, and AI-driven predictive maintenance as automakers shift toward software-defined vehicle platforms.

- Competitive analysis shows major players improving digital services while North America leads with a 38% share, followed by Europe at 29%, Asia Pacific at 25%, Latin America at 5%, and Middle East & Africa at 3%.

- Market restraints include cybersecurity risks and high costs, while embedded technology holds a 52% segment share and service-based telematics leads with a 58% share, supporting sustained regional and global growth.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Technology

Embedded telematics leads this segment with a 52% share, supported by strong OEM integration and rising demand for connected safety features. Automakers prefer embedded systems because they offer reliable connectivity, automatic crash response, and real-time diagnostics. Tethered and integrated options grow due to smartphone pairing flexibility, yet they remain secondary because they provide limited data depth. Growing focus on predictive maintenance and remote monitoring strengthens embedded adoption across global markets. Regulations that mandate advanced safety systems also boost demand, keeping embedded technology in a dominant position.

- For instance, BMW has many connected vehicles which are capable of receiving over-the-air (OTA) updates. This system allows for numerous software upgrades which introduce new features, functional improvements, and quality enhancements across the entire fleet.

By Solution

Service-based telematics holds a 58% share, driven by rising adoption of fleet management tools, remote diagnostics, and subscription-based connected services. Automakers and mobility providers invest in cloud platforms that enhance analytics, improve vehicle uptime, and support continuous updates. Component-based offerings remain essential but expand at a slower rate due to their one-time revenue structure. Growth in usage-based insurance, cybersecurity services, and mobility-as-a-service strengthens the leadership of service solutions. Expanding digital ecosystems and value-added offerings further reinforce the dominance of the service segment.

- For instance, General Motors OnStar handles customer interactions that encompass a variety of connected vehicle services. The platform provides features including remote diagnostics requests, automatic crash notifications, and remote vehicle updates, all designed to enhance safety and connectivity for drivers.

By Vehicle Type

Passenger vehicles lead this segment with a 61% share, supported by growing demand for navigation, safety alerts, and connected infotainment features. OEMs integrate telematics as standard in mid-range and premium models, increasing adoption across major markets. Commercial vehicles follow due to fleet digitalization, route optimization needs, and compliance pressures in logistics. Buyers of passenger cars value features such as emergency assistance, stolen-vehicle tracking, and predictive maintenance, which drive higher installation rates. Increasing awareness of connected safety systems continues to strengthen the dominance of passenger vehicles in the telematics market.

Key Growth Drivers

Growing Integration of Connected Safety and Compliance Features

Automotive telematics adoption rises as safety and compliance standards become stricter across major markets. Automakers integrate telematics units to support crash alerts, emergency response, and advanced driver-assistance systems. These features reduce accident risks and improve regulatory compliance for both personal and commercial vehicles. Fleet operators depend on telematics for monitoring driver behavior and meeting reporting norms. As governments enforce stronger safety rules and buyers prioritize protection, demand for embedded and service-based telematics grows steadily across the automotive sector.

- For instance, Mercedes-Benz enhanced its eCall system through the Mercedes me platform, which processed safety-related telematics events. The system supports automatic collision alerts triggered rapidly after impact, working in conjunction with other active safety systems like Active Brake Assist to help prevent or reduce the severity of accidents.

Rising Demand for Fleet Optimization and Predictive Maintenance

Fleet operators adopt telematics platforms to cut operational costs and improve productivity. Real-time data helps monitor engine health, vehicle usage, fuel patterns, and driver performance, supporting quicker maintenance decisions. Predictive maintenance reduces breakdowns and increases vehicle availability, making telematics essential for logistics and transport companies. Route optimization and performance tracking further enhance fleet efficiency. With growth in e-commerce, last-mile delivery, and shared mobility, advanced telematics solutions become central to fleet management strategies.

- For instance, Ford Pro Telematics analyzed vast amounts of vehicle-health data daily across connected commercial fleets. The platform reduced unplanned downtime by enabling numerous predictive maintenance alerts each month.

Expansion of Connected Services and In-Vehicle Digital Features

Consumers expect enhanced digital services in their vehicles, pushing automakers to integrate advanced telematics systems. These platforms support navigation, entertainment, remote access, and personalized vehicle settings. Over-the-air updates and subscription-based offerings create new revenue opportunities for manufacturers. Cloud connectivity and AI-enabled insights improve user experience and strengthen brand loyalty. As digital lifestyles expand, connected services emerge as a major driver, increasing adoption of telematics across both new vehicles and existing fleets.

Key Trends and Opportunities

Shift Toward Over-the-Air Updates and Software-Defined Vehicles

The shift to software-defined vehicles increases reliance on telematics platforms for continuous improvements. Over-the-air updates enhance navigation, safety features, and system performance without requiring physical service visits. Automakers benefit from reduced maintenance load and better customer engagement. These updates also support rapid deployment of new digital features. As software-centric design grows, telematics becomes a foundational technology shaping future vehicle functionality and value creation.

- For instance, Tesla delivered numerous over-the-air software updates annually across its global fleet, fundamentally changing the automotive product lifecycle. A major update improved Autopilot lane-keeping accuracy by processing extensive fleet-learning data, leveraging a vision-based neural net model to enhance performance.

Growing Opportunity in Insurance Telematics and Usage-Based Models

Insurance companies adopt telematics to offer personalized premium plans based on individual driving behavior. Usage-based models grow as customers seek fair pricing and real-time transparency. Data on braking, speed, and mileage helps insurers assess risk more accurately and reduce fraudulent claims. Automakers and telematics providers form partnerships with insurers to expand service offerings. Rising interest in behavioral insurance creates a strong opportunity for telematics expansion in both developed and emerging regions.

- For instance, Progressive Insurance’s Snapshot program recorded driving data from more than 25 billion miles tracked through onboard telematics devices. The platform captured over 200 million hard-braking and rapid-acceleration events to refine driver-risk scoring.

Key Challenges

Concerns Over Data Security and Privacy Risks

The growth of telematics increases exposure to cybersecurity threats, raising concerns among users and regulators. Vehicle systems store sensitive data related to driving patterns, locations, and user identity, making them a target for hackers. Automakers must invest in strong encryption, secure cloud networks, and continuous threat monitoring. Privacy rules also demand clarity on data usage and storage practices. These concerns slow adoption for some buyers and push companies to strengthen cybersecurity frameworks.

High Cost of Advanced Telematics Hardware and Services

The cost of telematics hardware, communication modules, and connected services remains a significant adoption barrier. Advanced systems require high investment in sensors, processors, and software integration. Subscription-based services add ongoing costs for customers and fleet operators. Smaller fleets often delay adoption due to tight budgets. Automakers face pressure to offer affordable yet feature-rich systems. This cost challenge affects adoption in price-sensitive markets and slows the expansion of advanced telematics solutions.

Regional Analysis

North America

North America leads the Automotive Telematics market with a 38% share, driven by strong adoption of connected vehicle technologies and early integration of advanced safety systems. Automakers in the United States and Canada deploy embedded telematics to support compliance, remote diagnostics, and emergency services. Rising demand for fleet management tools and usage-based insurance strengthens market expansion. High smartphone penetration and robust 4G and 5G networks enhance connectivity performance. Strong regulatory focus on safety and emissions monitoring further accelerates adoption across both passenger and commercial vehicle segments, keeping North America in a leading position.

Europe

Europe holds a 29% share of the Automotive Telematics market, supported by strict safety mandates and growing preference for connected services. The EU’s eCall regulation drives widespread adoption of embedded telematics in new vehicles. Automakers focus on digital services, over-the-air updates, and eco-driving solutions to meet sustainability goals. Strong demand for fleet optimization, especially in logistics and cross-border transportation, boosts telematics deployment. Advancements in vehicle-to-everything communication and rising EV adoption further support market growth. Europe’s mature automotive sector and regulatory environment keep the region a major contributor to telematics expansion.

Asia Pacific

Asia Pacific accounts for a 25% share, driven by rapid urbanization, high vehicle production, and expanding connected mobility services. China, Japan, and South Korea lead telematics integration through strong government support and fast 5G deployment. Growing demand for navigation, security alerts, and smart mobility services accelerates adoption in passenger vehicles. Fleet operators in e-commerce, ride-hailing, and logistics also rely on telematics for route optimization and predictive maintenance. Rising consumer interest in digital features and expanding automotive manufacturing capacity position Asia Pacific as one of the fastest-growing regions in the telematics market.

Latin America

Latin America holds a 5% share of the Automotive Telematics market, driven by growing interest in fleet digitalization and theft-recovery solutions. Brazil and Mexico lead adoption due to rising logistics operations and regulatory initiatives supporting vehicle tracking. Telematics services gain traction in insurance, rental fleets, and commercial transportation. Affordable smartphone connectivity and expanding mobility platforms strengthen regional growth. However, economic constraints limit advanced hardware adoption in some countries. Continuous investment in telematics-enabled security and fleet efficiency tools supports steady market expansion across the region.

Middle East and Africa

The Middle East and Africa account for a 3% share, supported by growing deployment of fleet management solutions in logistics, construction, and oil and gas sectors. Countries such as the UAE and Saudi Arabia promote smart mobility and connected vehicle initiatives, encouraging wider use of telematics. Demand rises for tracking, route optimization, and compliance monitoring. Adoption in passenger vehicles grows slowly due to cost barriers and limited local manufacturing. However, expanding digital infrastructure and rising interest in safety and security features promote gradual market growth across the region.

Market Segmentations:

By Technology

- Embedded

- Tethered

- Integrated

By Solution

By Vehicle Type

By Application

- Information & Navigation

- Safety & Security

- Fleet Management

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Telematics market features strong competition among major players including Tata Motors, Mercedes-Benz AG, Nissan Motor Co., Ltd, BMW Motors, Hyundai Motor Company, General Motors Company, Toyota Motor Corporation, AB Volvo, Ford Motor Company, and Volkswagen AG. These companies invest in advanced telematics platforms that support remote diagnostics, safety alerts, navigation, and over-the-air updates. Automakers strengthen their offerings through partnerships with software providers, telecom operators, and cloud service firms. Many leading players focus on embedded telematics to improve reliability and enhance customer experience. Expanding demand for fleet management, predictive maintenance, and connected services drives continuous innovation. Companies also advance cybersecurity features to protect vehicle data and meet rising regulatory expectations. Growing emphasis on digital ecosystems encourages players to develop subscription-based services and AI-driven insights, enhancing long-term customer engagement and market competitiveness.

Key Player Analysis

- Tata Motors

- Mercedes-Benz AG

- Nissan Motor Co., Ltd

- BMW Motors

- Hyundai Motor Company

- General Motors Company

- Toyota Motor Corporation

- AB Volvo

- Ford Motor Company

- Volkswagen AG

Recent Developments

- In August 2025, Mercedes-Benz AG remains among premium brands offering embedded telematics services as standard across models and geographies.

- In August 2025, BMW (BMW Motors) was also cited among premium brands that deliver built-in telematics services by default.

- In January 2024, Tata Motors announced that it had already connected 500,000 (5 lakh) commercial vehicles via its fleet-management platform Fleet Edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Solution, Vehicle Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Telematics adoption will rise as vehicles shift toward software-defined architectures.

- Embedded telematics systems will gain more integration across new passenger and commercial models.

- Over-the-air updates will expand, reducing service visits and improving long-term vehicle performance.

- Predictive maintenance will become standard in fleet operations to reduce downtime.

- Insurance telematics and behavior-based pricing models will attract more consumers.

- AI-driven analytics will enhance real-time decision-making for safety and vehicle health.

- Demand for cybersecurity solutions will grow as data protection becomes a priority.

- 5G connectivity will enable faster data transmission and richer in-vehicle digital services.

- Collaboration between automakers, telecom providers, and software companies will increase.

- Emerging markets will show stronger adoption as digital infrastructure and connected mobility services expand.

Market Segmentation Analysis:

Market Segmentation Analysis: