Market Overview

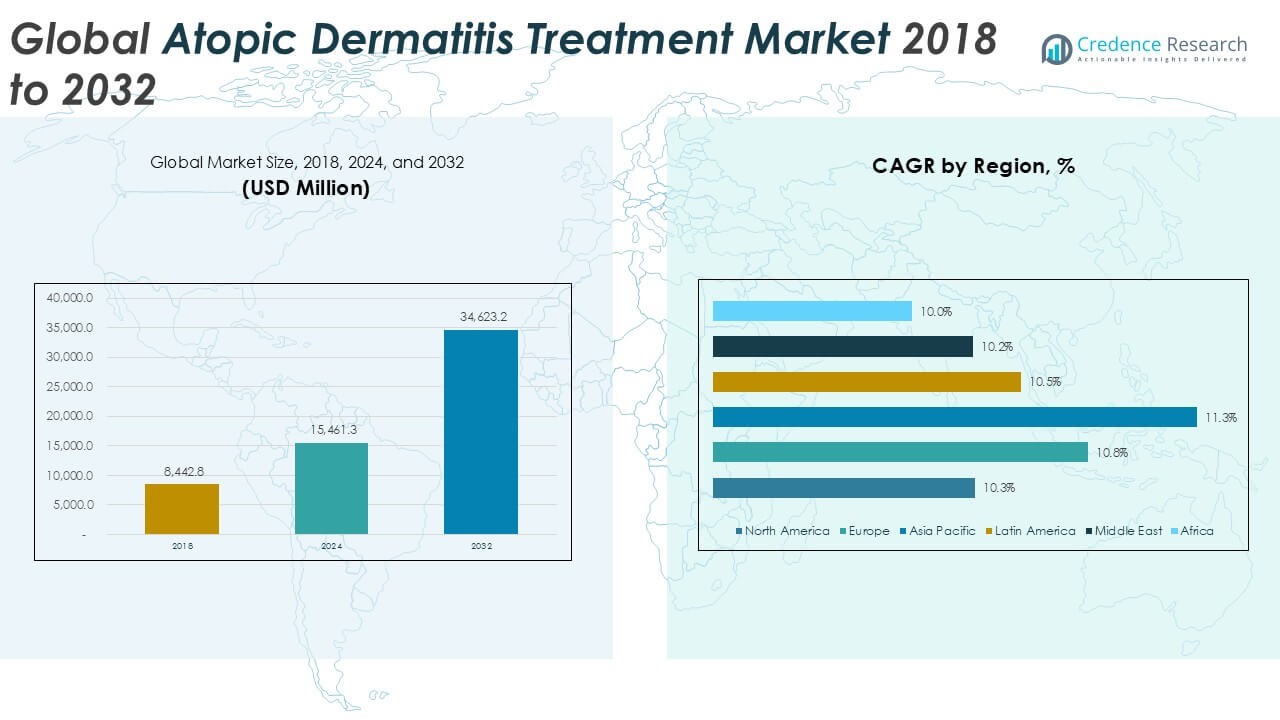

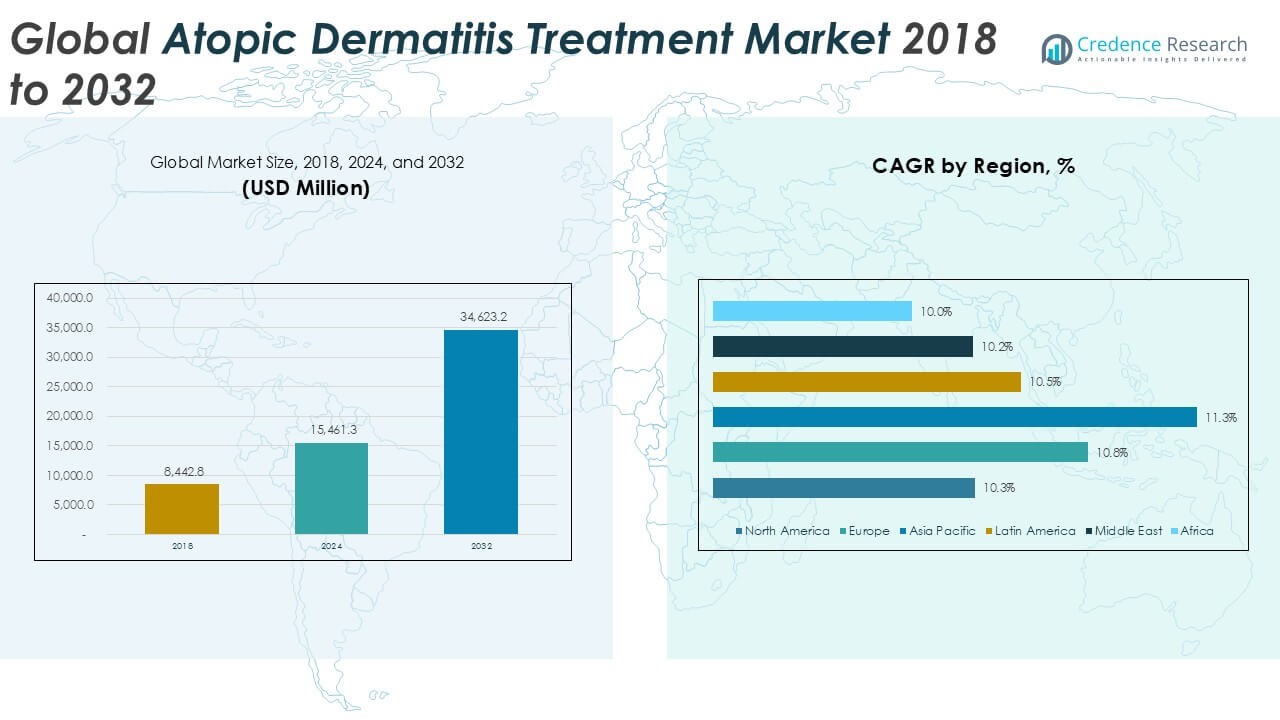

The Global Atopic Dermatitis Treatment Market is projected to grow from USD 15,461.3 million in 2024 to an estimated USD 34,623.2 million by 2032, with a compound annual growth rate (CAGR) of 10.66% from 2025 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Atopic Dermatitis Treatment Market Size 2024 |

USD 15,461.3 Million |

| Atopic Dermatitis Treatment Market, CAGR |

10.66% |

| Atopic Dermatitis Treatment Market Size 2032 |

USD 34,623.2 Million |

Market drivers include the growing incidence of allergic diseases and chronic skin conditions, rising healthcare expenditure, and a surge in demand for innovative topical and systemic therapies. The trend toward personalized medicine and biologic drugs, such as monoclonal antibodies, is gaining momentum, offering promising treatment alternatives with higher efficacy and fewer side effects. Moreover, ongoing clinical trials and regulatory approvals for novel therapies are contributing to a more dynamic and competitive market environment.

Geographically, North America dominates the atopic dermatitis treatment market due to high diagnosis rates, advanced healthcare infrastructure, and strong presence of key pharmaceutical players. Europe follows closely with increased investment in dermatology research. Meanwhile, the Asia Pacific region is expected to witness the fastest growth owing to a rising patient population, improved access to healthcare, and increasing awareness about skin conditions. Key players in the market include Pfizer Inc., Sanofi S.A., LEO Pharma A/S, Regeneron Pharmaceuticals Inc., AbbVie Inc., and Novartis AG.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market is projected to grow from USD 15,461.3 million in 2024 to USD 34,623.2 million by 2032, at a CAGR of 10.66% between 2025 and 2032.

- Increasing global prevalence of atopic dermatitis, particularly among children and the elderly, is a key growth driver.

- Rising demand for targeted therapies and biologics is transforming the treatment landscape and improving patient outcomes.

- High treatment costs and limited access to advanced therapies in developing regions continue to restrain market expansion.

- North America leads the market, driven by advanced healthcare infrastructure and strong presence of major pharmaceutical players.

- Asia Pacific is expected to witness the fastest growth due to increasing healthcare access, awareness, and patient population.

- Ongoing clinical trials, regulatory approvals, and innovations in personalized medicine are creating a dynamic competitive environment.

Market Drivers

Rising Prevalence of Atopic Dermatitis Across All Age Groups Fuels Demand for Treatment Solutions

The increasing number of individuals diagnosed with atopic dermatitis is one of the primary drivers of the Global Atopic Dermatitis Treatment Market. It affects both children and adults, with pediatric cases accounting for a significant share. Growing urbanization, pollution levels, and changes in dietary habits contribute to the rising incidence of skin-related allergies. Healthcare providers are reporting more frequent consultations for chronic skin conditions, prompting pharmaceutical firms to expand treatment options. The need for long-term care and symptom control drives continuous demand for both prescription and over-the-counter medications. It supports consistent market growth across developed and developing regions.

- For instance, the U.S. Centers for Disease Control and Prevention (CDC) reported that approximately 18,000,000 people in the United States were diagnosed with atopic dermatitis in 2024, including both children and adults.

Shift Toward Biologics and Targeted Therapies Enhances Treatment Outcomes

Biologic drugs and targeted therapies are transforming the treatment landscape for atopic dermatitis. These therapies offer greater efficacy and safety compared to traditional corticosteroids and immunosuppressants. Regulatory bodies are approving newer molecules that focus on underlying immune responses, increasing physician adoption rates. Patients benefit from improved disease control and fewer relapses, which strengthens trust in novel therapies. The Global Atopic Dermatitis Treatment Market is witnessing rapid development in monoclonal antibodies and JAK inhibitors, leading to expanded product pipelines. It encourages pharmaceutical companies to invest in clinical research and drug innovation.

- For instance, pharmaceutical industry data from 2024 indicated that over 1,200,000 biologic prescriptions for atopic dermatitis were issued in the United States, reflecting the growing adoption of advanced therapies.

Growing Awareness and Early Diagnosis Drive Market Penetration

Educational campaigns and dermatological awareness programs are contributing to early detection of atopic dermatitis. Consumers are increasingly seeking medical help for skin issues rather than relying on home remedies. Public and private healthcare initiatives promote regular skin checkups, leading to early diagnosis and prompt treatment. Insurance coverage for dermatological consultations and medications improves access to advanced therapies. The Global Atopic Dermatitis Treatment Market benefits from greater patient engagement and timely intervention. It enables healthcare systems to manage disease progression more effectively.

Expanding Healthcare Infrastructure in Emerging Economies Supports Growth

Emerging markets are strengthening their healthcare infrastructure, enabling better diagnosis and treatment of chronic skin conditions. Governments are increasing investment in public health and essential dermatological care. Pharmaceutical companies are expanding distribution networks and launching region-specific products. The Global Atopic Dermatitis Treatment Market gains momentum in Asia Pacific and Latin America due to favorable reimbursement policies and rising disposable income. It creates new opportunities for market entrants and established players. Greater physician access and drug availability enhance treatment adherence and improve outcomes.

Market Trends

Increasing Adoption of Biologic Therapies is Reshaping the Treatment Landscape

Biologic therapies are emerging as a dominant trend in managing moderate to severe atopic dermatitis. These treatments, particularly monoclonal antibodies, target specific immune pathways responsible for inflammation. Physicians prefer biologics for their ability to offer long-term relief with fewer side effects compared to traditional systemic drugs. The Global Atopic Dermatitis Treatment Market is seeing greater investment in biologic drug development and commercialization. It is also benefiting from ongoing clinical trials evaluating the safety and efficacy of next-generation biologics. Market participants are expanding indications and dosing options to reach a broader patient population.

- For instance, in 2024, over 320,000 patients with atopic dermatitis worldwide were treated with dupilumab, the leading biologic therapy, according to company reports and government health registries.

Focus on Personalized and Precision Medicine is Gaining Ground

Tailored therapies based on patient-specific genetic, biomarker, and immune profiles are becoming more common in dermatological care. Physicians are increasingly using diagnostic tools to identify patients most likely to respond to targeted treatments. This shift toward precision medicine supports more effective management of symptoms and reduces the risk of adverse reactions. The Global Atopic Dermatitis Treatment Market is aligning with this trend by promoting personalized care plans and treatment algorithms. It reflects a broader industry movement toward individualized therapy approaches. Companies are investing in research to integrate precision diagnostics with novel treatment pathways.

- For instance, in 2024, more than 150 dermatology clinics in the United States adopted molecular biomarker testing for atopic dermatitis patients to guide therapy selection, as reported by a national dermatology association survey.

Technological Advancements in Drug Delivery Improve Patient Experience

Improved drug delivery systems, including extended-release topicals and needle-free injectables, are enhancing patient adherence and satisfaction. These innovations help reduce application frequency and minimize discomfort during administration. Pharmaceutical firms are developing user-friendly formats that support better compliance across age groups. The Global Atopic Dermatitis Treatment Market is witnessing a surge in innovation aimed at simplifying long-term disease management. It aligns with patient demand for convenience and reduced treatment burden. Companies are focusing on delivery platforms that preserve drug potency and stability.

Growing Use of Digital Health Platforms Enhances Disease Monitoring and Management

Digital health technologies, including mobile apps and teledermatology tools, are gaining traction for managing atopic dermatitis. These platforms support remote consultations, symptom tracking, and personalized treatment reminders. Healthcare providers are leveraging digital tools to enhance patient engagement and improve long-term outcomes. The Global Atopic Dermatitis Treatment Market is integrating digital health solutions to complement conventional therapies. It helps bridge gaps in care, especially in underserved or rural areas. Digital monitoring tools also assist clinicians in tracking treatment effectiveness over time.

Market Challenges

High Treatment Costs and Limited Access to Advanced Therapies Restrict Market Reach

The high cost of advanced therapies, particularly biologics, limits their accessibility for many patients. Insurance coverage often excludes or partially reimburses these treatments, creating financial barriers. In low- and middle-income countries, public healthcare systems lack the resources to support widespread use of expensive medications. The Global Atopic Dermatitis Treatment Market faces challenges in achieving equitable access despite growing demand. It relies heavily on premium-priced drugs, which restrict adoption among cost-sensitive populations. Economic disparities and inadequate reimbursement frameworks continue to hinder market penetration.

- For instance, the annual cost of biologic therapies for atopic dermatitis, such as dupilumab, can range from 10,000 to 30,000 units per patient, making these treatments unaffordable for many individuals without comprehensive insurance or government support

Safety Concerns and Regulatory Hurdles Slow Down New Product Approvals

Safety issues related to long-term use of systemic treatments raise concerns among healthcare providers and patients. Regulatory agencies maintain stringent approval standards for new drug classes, leading to longer development timelines. Clinical trials for atopic dermatitis treatments must demonstrate both sustained efficacy and minimal adverse effects, which increases research complexity. The Global Atopic Dermatitis Treatment Market struggles with delays in regulatory clearance, impacting time-to-market for innovative therapies. It creates uncertainty for pharmaceutical companies planning product launches. Ongoing safety evaluations and evolving clinical guidelines also contribute to limited product turnover.

Market Opportunities

Expanding Patient Base in Emerging Markets Offers Untapped Potential

Emerging economies present strong growth opportunities due to rising awareness, increasing healthcare expenditure, and improved diagnostic capabilities. Countries in Asia Pacific, Latin America, and the Middle East are witnessing a growing number of atopic dermatitis cases, driven by urbanization, pollution, and changing lifestyles. The Global Atopic Dermatitis Treatment Market stands to benefit from the expanding reach of healthcare services and availability of dermatological care in these regions. It creates room for pharmaceutical companies to introduce affordable generics and localized treatment options. Government initiatives to strengthen healthcare infrastructure further support market expansion. Multinational firms are also partnering with local stakeholders to improve distribution and access.

Innovation in Non-Biologic Therapies and Combination Treatments Creates Growth Avenues

There is significant potential in developing new topical therapies, small molecules, and combination treatments that balance efficacy with affordability. Many patients prefer non-biologic options due to lower cost, fewer side effects, and easier administration. The Global Atopic Dermatitis Treatment Market is seeing renewed interest in alternative therapies that target mild to moderate conditions effectively. It opens the door for companies to diversify their portfolios and capture new patient segments. Innovation in delivery mechanisms, such as transdermal patches and sprays, further enhances product value. Strategic R\&D efforts focused on differentiated offerings can lead to competitive advantages and long-term market growth.

Market Segmentation Analysis

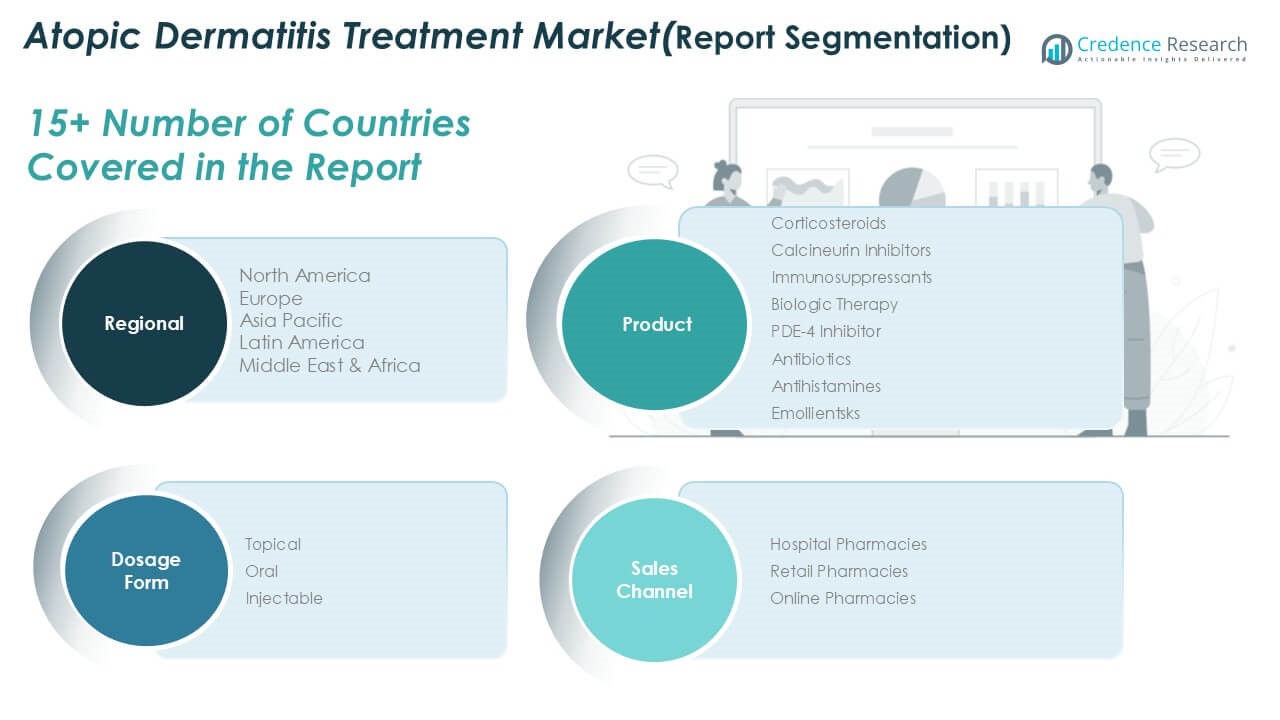

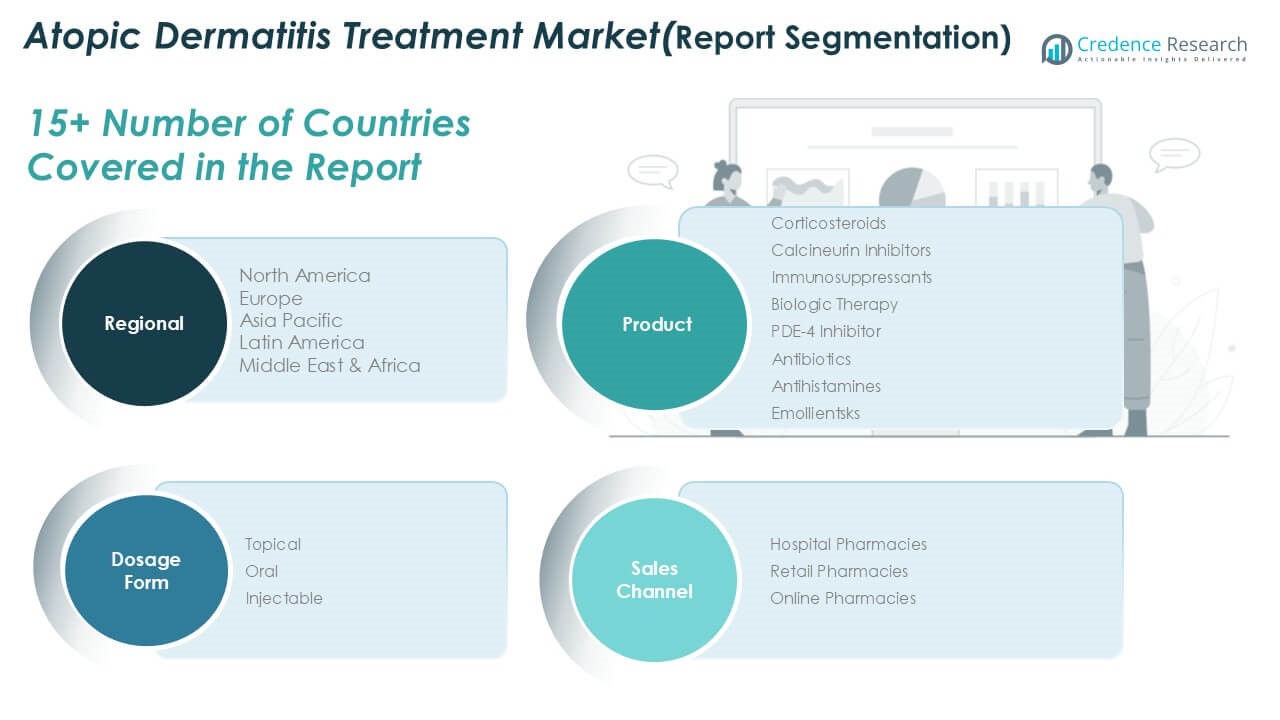

By Drug Class

The Global Atopic Dermatitis Treatment Market is segmented into corticosteroids, calcineurin inhibitors, immunosuppressants, biologic therapy, PDE-4 inhibitors, antibiotics, antihistamines, and emollients. Corticosteroids hold a dominant share due to their widespread use in managing inflammation and flare-ups. Biologic therapies are gaining strong momentum, supported by high efficacy in treating moderate to severe cases. PDE-4 inhibitors and calcineurin inhibitors are increasingly prescribed for patients requiring long-term, steroid-sparing options. Immunosuppressants continue to serve patients unresponsive to first-line treatments. Emollients, antibiotics, and antihistamines complement treatment plans by managing skin hydration, infections, and itch, respectively. The market reflects a balanced adoption of traditional and advanced drug classes.

- For instance, in 2023, over 12 million corticosteroid prescriptions were dispensed in the United States alone for atopic dermatitis treatment, while biologic therapies were administered to approximately 350,000 patients globally.

By Dosage Form

The market is categorized into topical, oral, and injectable dosage forms. Topical formulations lead the segment, driven by patient preference, ease of application, and suitability for mild to moderate conditions. Oral medications follow, particularly for patients with widespread symptoms requiring systemic therapy. Injectable forms, mainly biologics, are rapidly expanding in share due to their effectiveness in controlling severe cases and reducing relapse rates. The market shows a clear shift toward high-efficacy systemic options in parallel with continued reliance on topicals for routine management. It reflects evolving treatment preferences based on disease severity and patient compliance.

- For instance, global sales data indicate that around 45 million units of topical atopic dermatitis treatments were sold in 2023, with injectable biologics accounting for about 1.2 million units sold worldwide.

By Sales Channel

Sales channels in the market include hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies dominate due to their role in dispensing advanced therapies and biologics under medical supervision. Retail pharmacies remain widely used for over-the-counter and prescription topical treatments. Online pharmacies are expanding quickly, driven by growing e-commerce adoption and consumer preference for convenience. The Global Atopic Dermatitis Treatment Market benefits from multi-channel availability, allowing broad access across patient demographics. It supports market growth through both traditional and digital distribution models.

Segments

Based on Drug Class

- Corticosteroids

- Calcineurin Inhibitors

- Immunosuppressants

- Biologic Therapy

- PDE-4 Inhibitor

- Antibiotics

- Antihistamines

- Emollientsks

Based on Dosage Form

Based on Sales Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Atopic Dermatitis Treatment Market

The North America Atopic Dermatitis Treatment Market reached USD 5,231.43 million in 2024 and is projected to grow to USD 11,380.63 million by 2032, registering a CAGR of 10.3%. It accounted for the largest regional share at approximately 33.8% in 2024. The region benefits from high awareness, advanced healthcare infrastructure, and early adoption of biologics for moderate to severe cases. The United States remains the key contributor, with robust R\&D investments and widespread insurance coverage for prescription therapies. Canada also supports growth with national health plans that increase access to topical and systemic treatments. The Fidget Toys Market reflects strong maturity and sustained expansion in North America due to continuous innovation and high diagnosis rates.

Europe Atopic Dermatitis Treatment Market

Europe’s market was valued at USD 4,087.29 million in 2024 and is forecasted to reach USD 9,247.84 million by 2032, growing at a CAGR of 10.8%. It held approximately 26.4% of the global market share in 2024. Countries like Germany, France, and the UK are leading in clinical trials and biologic therapy adoption. Regulatory initiatives and government funding are encouraging pharmaceutical advancements. Healthcare professionals are increasingly prescribing newer therapies, which are being supported by favorable reimbursement models. Europe continues to invest in dermatology training and education, contributing to earlier diagnosis and more consistent treatment.

Asia Pacific Atopic Dermatitis Treatment Market

The Asia Pacific market reached USD 3,389.11 million in 2024 and is estimated to hit USD 7,963.32 million by 2032, with the highest CAGR of 11.3%. It captured approximately 21.9% of the global market in 2024. China, Japan, and India are the key growth markets, driven by increasing urban populations, environmental triggers, and expanding healthcare infrastructure. Government initiatives and private sector partnerships are improving access to dermatological care. Domestic pharmaceutical players are introducing affordable treatment options tailored to local demand. The region presents significant potential due to its large, underserved population.

Latin America Atopic Dermatitis Treatment Market

Latin America’s market stood at USD 1,722.83 million in 2024 and is projected to reach USD 3,808.55 million by 2032, growing at a CAGR of 10.5%. It represented about 11.1% of the global market share in 2024. Brazil and Mexico are leading markets due to rising awareness and expanding insurance coverage for dermatological treatments. Urbanization and increased pollution levels contribute to higher prevalence rates across the region. The pharmaceutical industry is expanding its footprint through local partnerships and generic product launches. Retail pharmacies and online platforms play a growing role in distributing over-the-counter and prescription treatments.

Middle East Atopic Dermatitis Treatment Market

The Middle East market was valued at USD 637.00 million in 2024 and is expected to grow to USD 1,384.93 million by 2032, with a CAGR of 10.2%. It held a market share of approximately 4.1% in 2024. The United Arab Emirates and Saudi Arabia are driving growth with investments in specialty healthcare facilities and medical tourism. Patients in urban centers are gaining better access to dermatology clinics and biologic therapies. Governments are improving healthcare funding, allowing for wider availability of new treatments. Rising awareness and consumer willingness to seek medical intervention support the market’s forward momentum.

Africa Atopic Dermatitis Treatment Market

Africa’s market stood at USD 393.60 million in 2024 and is projected to reach USD 837.88 million by 2032, growing at a CAGR of 10.0%. It contributed roughly 2.5% of the global market share in 2024. South Africa, Nigeria, and Kenya are emerging markets where rising public health initiatives are improving awareness and diagnosis. Government and NGO efforts to provide access to basic dermatological care are expanding treatment options. Local manufacturers are playing a role in increasing availability of topical and generic products. The region remains in early development stages but shows long-term potential through healthcare reform and educational outreach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Sanofi S.A.

- Galderma SA

- Allergan Plc.

- Novartis AG

- Bristol-Myers Squibb Company

- Bayer AG

- Encore Dermatology Inc.

- Eli Lilly & Company

- Leo Pharma

- Pfizer Inc.

Competitive Analysis

The Global Atopic Dermatitis Treatment Market is highly competitive, with key players focusing on innovation, strategic partnerships, and portfolio expansion to strengthen their market position. Leading pharmaceutical companies are prioritizing biologic therapies and targeted treatments to address unmet medical needs in moderate to severe cases. It is marked by active R\&D, regulatory approvals, and a shift toward precision medicine. Companies such as Sanofi, Pfizer, and Eli Lilly hold a competitive edge through their extensive pipelines and global presence. Emerging firms are entering the market with novel formulations and digital solutions. Strategic acquisitions and licensing agreements continue to shape the competitive landscape. Players are investing in market expansion through geographic reach, product accessibility, and collaboration with dermatology specialists.

Recent Developments

- In April 2025, Sanofi and Regeneron indeed presented positive results from their DISCOVER trial, demonstrating Dupixent’s effectiveness in improving atopic dermatitis symptoms, including itch and dyspigmentation, in patients with darker skin tones.

- In June 2025, Galderma presented two-year extension data for Nemluvio at the Revolutionizing Atopic Dermatitis (RAD) conference, demonstrating sustained improvements in symptoms.

Market Concentration and Characteristics

The Global Atopic Dermatitis Treatment Market exhibits moderate to high market concentration, with a few major players controlling a significant share of revenue. It is characterized by strong research pipelines, high entry barriers due to regulatory requirements, and a growing preference for biologic and targeted therapies. Leading companies focus on innovation, strategic collaborations, and expanding access to advanced treatments across key regions. The market shows a clear shift toward personalized medicine, supported by technological advancements and increased patient awareness. Competition centers on efficacy, safety profiles, and pricing strategies, especially in emerging economies. It remains dynamic, with frequent product launches and strong emphasis on chronic disease management.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Dosage Form, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Biologic drugs will remain a major growth driver, offering targeted treatment options for moderate to severe cases. New approvals and extended indications will expand patient access globally.

- Rapid urbanization and improved healthcare infrastructure in Asia Pacific, Latin America, and Africa will boost market penetration. Pharmaceutical companies are expected to strengthen local distribution networks.

- Advances in genetic and biomarker research will enable more individualized treatment approaches. This shift will increase treatment efficacy and patient satisfaction across disease severities.

- Mobile apps, wearable sensors, and telehealth platforms will play a larger role in disease monitoring and adherence. These tools will improve physician-patient interaction and optimize treatment outcomes.

- Future drug development will address the growing pediatric patient base with safer, age-specific formulations. Regulatory bodies will prioritize therapies targeting infants and children.

- Ongoing clinical trials will deliver new mechanisms of action and combination regimens. Breakthrough drugs in biologics and non-steroidal classes will reshape the competitive landscape.

- Demand for preventive skin care, emollients, and barrier creams will increase alongside prescription therapies. Retail and online channels will see rising sales in non-prescription categories.

- Leading players will pursue acquisitions to enhance R\&D capabilities, diversify portfolios, and enter untapped markets. These deals will improve scale and accelerate global reach.

- Future therapies will emphasize long-term symptom control and patient comfort. Drug delivery systems will become more user-friendly, encouraging better compliance.

- Governments and health organizations will invest in education, early diagnosis, and reimbursement reforms. These efforts will strengthen market dynamics and ensure wider treatment accessibility.