Market Overview:

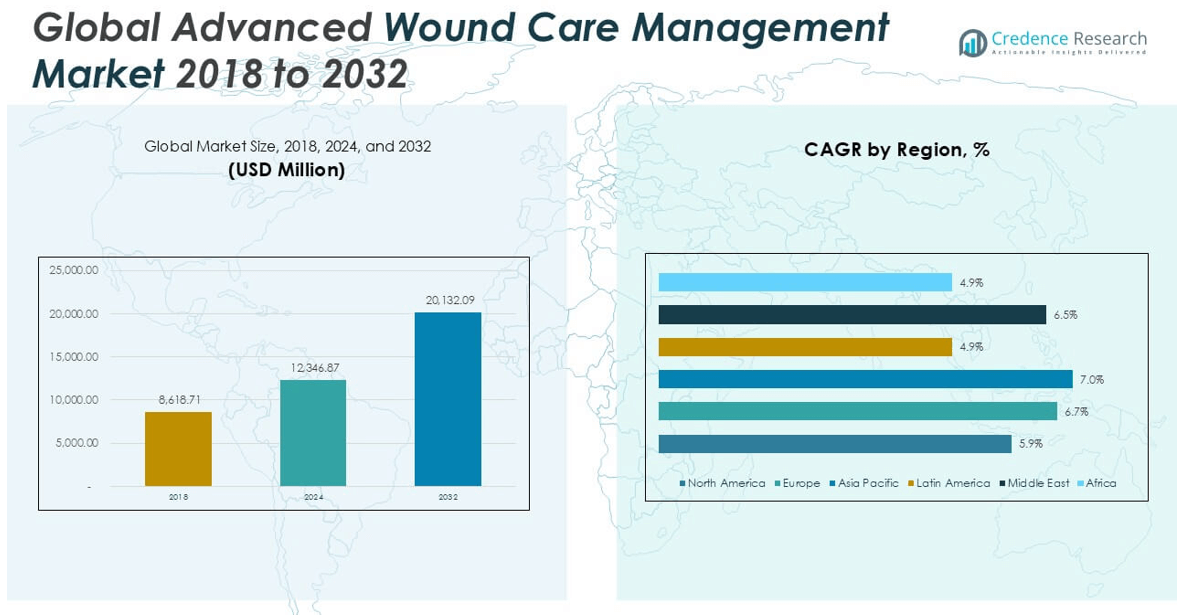

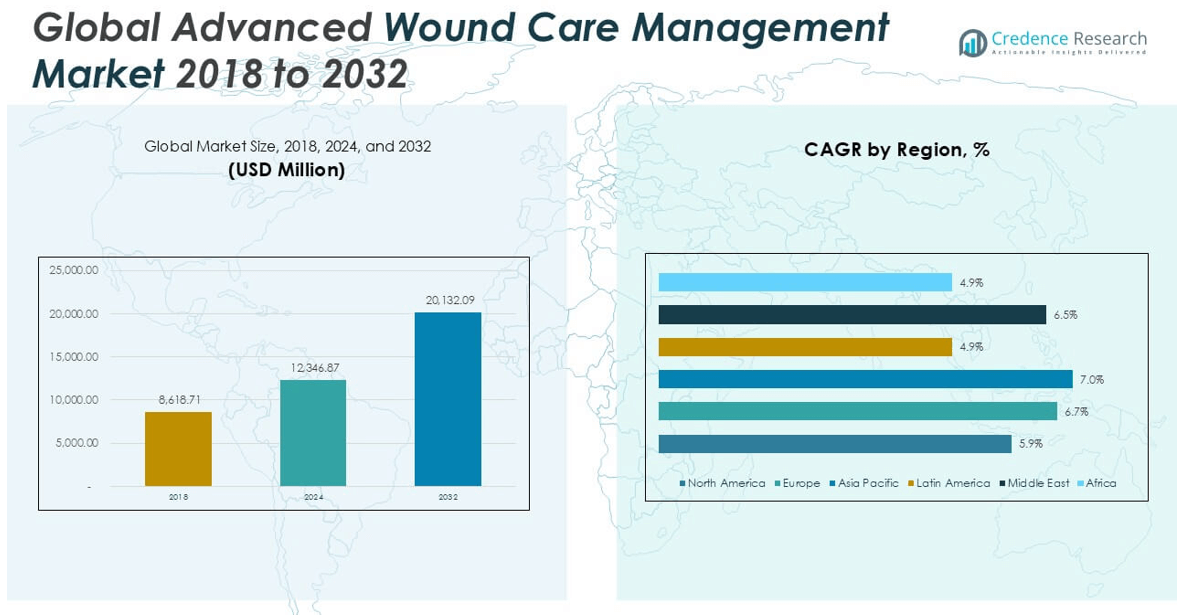

The Advanced Wound Care Management market size was valued at USD 8,618.71 million in 2018, reached USD 12,346.87 million in 2024, and is anticipated to reach USD 20,132.09 million by 2032, growing at a CAGR of 6.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Wound Care Management Market Size 2024 |

USD 12,346.87 million |

| Advanced Wound Care Management Market, CAGR |

6.33% |

| Advanced Wound Care Management Market Size 2032 |

USD 20,132.09 million |

The Advanced Wound Care Management market is led by prominent players such as Acelity L.P. Inc., 3M, Smith & Nephew Plc, Molnlycke Healthcare, Coloplast A/S, Convatec, Inc., and Medline Industries, Inc. These companies maintain a strong global presence through continuous product innovation, strategic acquisitions, and a focus on expanding their advanced wound care portfolios. North America dominates the global market, accounting for 30.9% of the total market share in 2024, driven by advanced healthcare infrastructure, high adoption of innovative wound care solutions, and a growing elderly population. Europe follows closely, supported by strong regulatory standards and increasing chronic wound cases.

Market Insights

- The Advanced Wound Care Management market was valued at USD 12,346.87 million in 2024 and is projected to reach USD 20,132.09 million by 2032, growing at a CAGR of 6.33% during the forecast period.

- Rising cases of chronic wounds, including diabetic foot ulcers and pressure ulcers, along with an aging global population, are key drivers fueling the demand for advanced wound care solutions.

- Growing adoption of bioactive therapies, smart wound dressings, and home-based wound care is reshaping market trends, especially in developed regions with high healthcare spending.

- Leading companies such as 3M, Smith & Nephew, and Molnlycke Healthcare dominate through innovation, acquisitions, and wide product portfolios; however, high product costs and limited awareness in low-income regions remain major restraints.

- North America holds the largest regional market share at 30.9%, followed by Europe at 29.1% and Asia Pacific at 24.5%; the Advanced Wound Dressing segment leads product-wise with the highest share

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

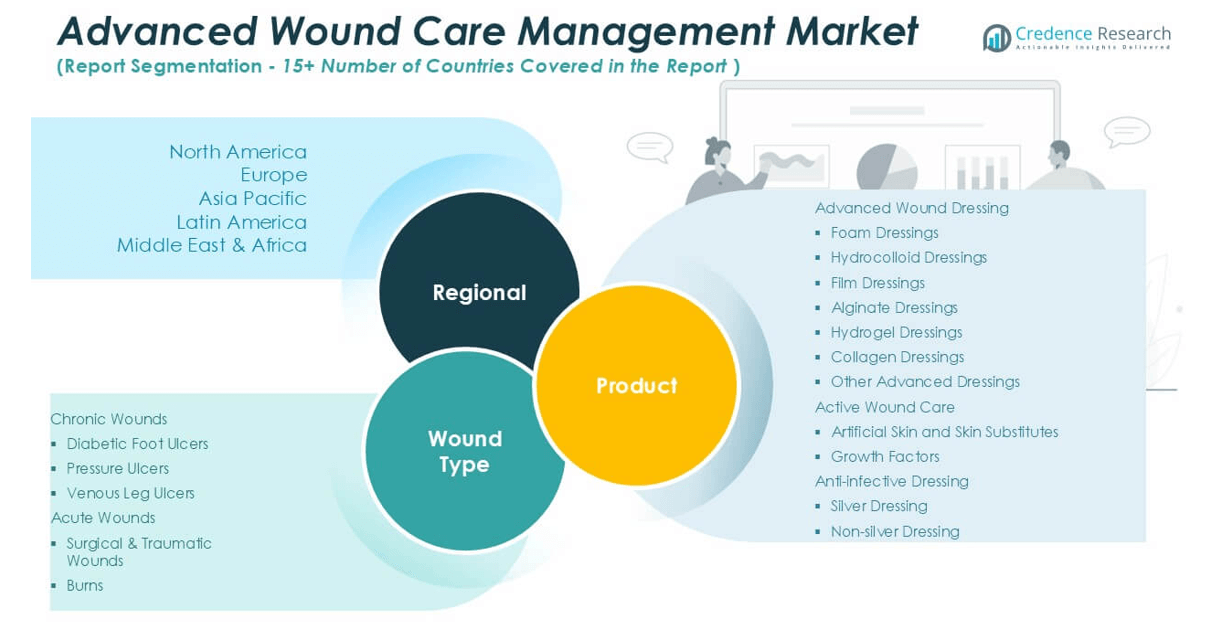

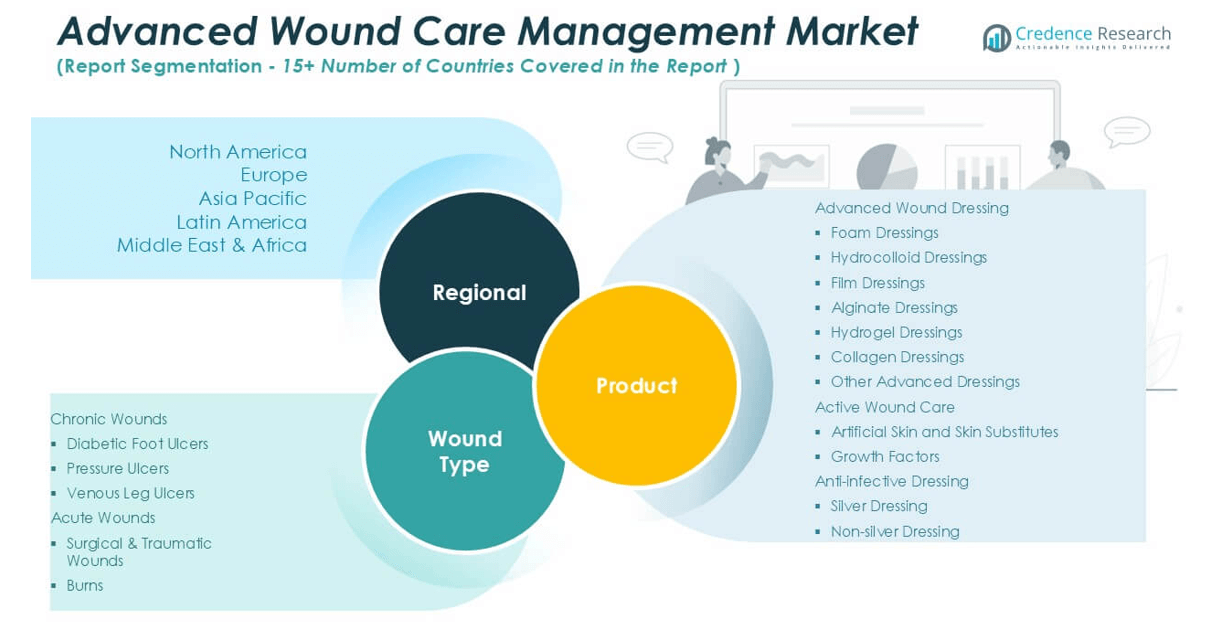

By Product

The Advanced Wound Dressing segment dominates the Advanced Wound Care Management market, accounting for the largest market share due to its widespread use in treating both acute and chronic wounds. Within this category, foam dressings lead the market, driven by their high absorbency, moisture retention, and cost-effectiveness in managing exudative wounds. Hydrocolloid and hydrogel dressings also hold substantial shares, favored for their healing properties and patient comfort. The growing preference for non-invasive treatments and increasing adoption in hospitals and outpatient settings continue to propel the demand for advanced wound dressings globally. The Active Wound Care and Anti-infective Dressing segments are also witnessing steady growth. Active wound care, led by artificial skin and skin substitutes, is gaining momentum due to its application in treating complex and non-healing wounds, particularly among diabetic and elderly patients. The growth factors sub-segment is expanding with rising investments in regenerative medicine.

- For instance, Smith & Nephew’s Allevyn Life foam dressings were used in over 24,000 clinical wound care interventions across 17 countries, demonstrating consistent exudate management in chronic wound settings.

By Wound Type

The Chronic Wounds segment holds the largest share of the Advanced Wound Care Management market, primarily driven by the high incidence of diabetic foot ulcers, pressure ulcers, and venous leg ulcers. Diabetic foot ulcers account for the dominant sub-segment, fueled by the global rise in diabetes prevalence and associated complications. Pressure ulcers also represent a significant portion due to aging populations and long-term hospitalizations. The chronic nature of these wounds and their prolonged healing timelines necessitate advanced wound care solutions, thus contributing substantially to the market’s overall growth. The Acute Wounds segment is expected to grow at a robust pace, supported by increasing surgical procedures and trauma cases worldwide. Surgical and traumatic wounds represent the leading sub-segment within this category, owing to the rapid demand for post-operative wound care in hospitals and ambulatory surgical centers. Burns also contribute to the segment’s expansion, especially in regions with high industrial activity and low workplace safety standards.

- For instance, ConvaTec’s AQUACEL Ag+ dressings were used in over 3,100 burn wound cases in U.S. trauma centers, helping reduce bacterial load and improving healing rates in partial-thickness burns.

Market Overview

Rising Prevalence of Chronic and Lifestyle-Related Diseases

The growing incidence of chronic diseases such as diabetes, obesity, and cardiovascular disorders is a primary driver of the advanced wound care management market. These conditions often lead to chronic wounds like diabetic foot ulcers and pressure ulcers, which require prolonged and specialized care. The increasing aging population further contributes to wound complexity due to reduced skin regeneration capabilities. With chronic wounds posing a significant public health burden, healthcare systems are investing in effective treatment solutions, thereby boosting the demand for advanced wound care products.

- For instance, 3M reported treating over 10 million chronic wound cases globally through its Tegaderm and Silvercel product lines, specifically targeting diabetic foot ulcers and pressure ulcers.

Technological Advancements in Wound Care Products

Rapid technological innovation in wound care materials and delivery systems is accelerating market growth. Developments such as bioactive dressings, nanotechnology-based products, and skin substitutes are offering enhanced healing and infection control capabilities. Products incorporating growth factors, oxygen therapies, and intelligent wound monitoring systems are transforming wound care by reducing healing time and improving patient outcomes. These innovations are increasingly adopted in hospitals and home care settings, driven by clinical evidence of improved efficacy and patient satisfaction, thereby expanding the market potential globally.

- For instance, Mölnlycke’s Mepilex Border Flex dressings demonstrated a 37% reduction in healing time in over 5,800 hospital-treated wound cases, driven by its patented Safetac® technology.

Increasing Surgical Procedures and Traumatic Injuries

The rise in surgical interventions, both elective and emergency, has significantly contributed to the growing demand for advanced wound care solutions. Post-surgical wound management is essential for preventing infections, minimizing complications, and ensuring faster recovery. Additionally, the increasing incidence of accidents, burns, and trauma—particularly in industrial and conflict-prone regions—fuels the need for effective wound care products. The growing number of ambulatory surgical centers and the emphasis on post-operative care standards further reinforce the market’s expansion across both developed and emerging economies.

Key Trends & Opportunities

Shift Toward Home Healthcare and Outpatient Wound Care

There is a notable shift from inpatient to outpatient and home-based wound care services, driven by the rising costs of hospital care and the growing demand for patient convenience. This trend presents a significant opportunity for manufacturers to develop easy-to-use, portable, and cost-effective wound care products. Telemedicine and remote wound monitoring technologies are further enabling this transition. As healthcare systems globally prioritize reducing hospital stays and improving quality of life for patients with chronic wounds, the home care segment is poised for substantial growth.

- For instance, Medline Industries supplied over 6.2 million home-delivered advanced wound care kits in 2023, integrating telehealth-compatible tools for remote nurse-guided dressing changes.

Adoption of Regenerative Medicine and Biologics

The integration of regenerative medicine, including stem cell therapies, tissue-engineered skin substitutes, and biologics, is opening new avenues in wound care management. These therapies enhance tissue repair and accelerate wound healing, especially in complex and non-healing wounds. Increasing research funding and clinical trials focused on bioengineered solutions are fostering innovation in this space. With a rising focus on personalized and targeted treatment approaches, biologic-based wound therapies are emerging as a transformative trend, particularly in the management of chronic wounds.

- For instance, Organogenesis’ Apligraf has been used in more than 1.8 million wound care procedures for venous leg ulcers and diabetic foot ulcers, showing histological integration within 14 days of application in over 85% of cases.

Key Challenges

High Cost of Advanced Wound Care Products

Despite their clinical advantages, the high cost of advanced wound care products remains a major barrier to widespread adoption, particularly in low- and middle-income countries. Many patients and healthcare systems struggle with the affordability of bioengineered dressings, growth factors, and skin substitutes. Limited reimbursement coverage and budget constraints in public healthcare settings often lead to the preference for traditional wound care methods. This pricing disparity hampers market penetration, especially in rural and underdeveloped areas where access to specialized care is already limited.

Limited Awareness and Training Among Healthcare Providers

The effective use of advanced wound care solutions requires specialized knowledge and training. However, in many healthcare settings, especially in developing regions, there is a lack of adequate training for clinicians and caregivers on proper wound assessment and product application. This results in suboptimal treatment outcomes and underutilization of advanced therapies. The absence of standardized treatment protocols and wound care education further compounds this challenge, underscoring the need for ongoing professional development and awareness programs in wound management.

Stringent Regulatory Approvals and Clinical Validation

Bringing advanced wound care products to market involves navigating complex regulatory pathways and extensive clinical validation processes. Regulatory authorities often require rigorous data on product safety, efficacy, and long-term outcomes, which can delay product launches and increase development costs. These barriers are particularly challenging for start-ups and smaller manufacturers. Furthermore, variations in regulatory standards across countries can limit the global scalability of innovative wound care solutions, impeding timely access to life-improving technologies in many regions.

Regional Analysis

North America

North America held the largest share of the Advanced Wound Care Management market in 2024, accounting for approximately 30.9% of the global market. The regional market was valued at USD 2,720.07 million in 2018, rising to USD 3,814.12 million in 2024, and is projected to reach USD 6,039.63 million by 2032, growing at a CAGR of 5.9%. This growth is fueled by advanced healthcare infrastructure, rising surgical procedures, and the high prevalence of chronic wounds, particularly in the aging U.S. population. Strong reimbursement frameworks and early adoption of new technologies further support the region’s dominant position in the market.

Europe

Europe captured a significant share of the global Advanced Wound Care Management market, contributing approximately 29.1% to the total market revenue in 2024. With a market value of USD 2,452.02 million in 2018, it grew to USD 3,588.88 million in 2024, and is expected to reach USD 6,017.48 million by 2032, expanding at a CAGR of 6.7%. The region benefits from a strong presence of key market players, increasing prevalence of diabetic and pressure ulcers, and government-funded wound care programs. Moreover, increased awareness regarding advanced wound treatments and growing demand for cost-effective solutions contribute to sustained market growth.

Asia Pacific

Asia Pacific is emerging as the fastest-growing region in the Advanced Wound Care Management market, with a CAGR of 7.0% and a 2024 market share of 24.5%. The regional market grew from USD 2,031.43 million in 2018 to USD 3,021.28 million in 2024, and is projected to reach USD 5,167.91 million by 2032. This growth is primarily driven by rising healthcare investments, increasing incidence of chronic diseases, and improving access to advanced treatments in countries like China, India, and Japan. The rapid expansion of hospital infrastructure and growing elderly population further support the region’s strong growth trajectory.

Latin America

Latin America accounted for 10.0% of the global market share in 2024, with steady growth driven by improving healthcare services and increasing demand for advanced wound care in urban centers. The market was valued at USD 929.10 million in 2018, reached USD 1,238.39 million in 2024, and is expected to grow to USD 1,817.93 million by 2032, registering a CAGR of 4.9%. Brazil and Mexico are leading contributors to regional growth, supported by rising chronic wound cases, surgical procedures, and gradual improvements in wound care awareness among healthcare professionals and patients.

Middle East

The Middle East Advanced Wound Care Management market demonstrated notable expansion, growing at a CAGR of 6.5% with a 2024 market share of approximately 3.7%. Valued at USD 316.31 million in 2018, the market reached USD 457.89 million in 2024, and is projected to rise to USD 756.97 million by 2032. Growth is driven by increasing healthcare investments, rising incidence of diabetes-related wounds, and the development of private healthcare facilities. Countries such as the UAE and Saudi Arabia are at the forefront, adopting advanced technologies and focusing on enhancing chronic wound care services.

Africa

Africa holds the smallest share of the Advanced Wound Care Management market, contributing about 1.8% in 2024. The market size increased from USD 169.79 million in 2018 to USD 226.30 million in 2024, and is forecasted to reach USD 332.18 million by 2032, growing at a CAGR of 4.9%. Although growth is moderate, it is supported by international health initiatives, improving access to healthcare, and growing awareness of advanced wound care solutions. However, limited infrastructure and affordability challenges continue to restrain broader adoption across rural regions and public healthcare facilities in the continent.

Market Segmentations:

By Product:

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Active Wound Care

- Artificial Skin and Skin Substitutes

- Growth Factors

- Anti-infective Dressing

- Silver Dressing

- Non-silver Dressing

By Wound Type:

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Advanced Wound Care Management market is characterized by the presence of several established players and continuous strategic developments aimed at innovation, market expansion, and portfolio diversification. Key companies such as Acelity L.P. Inc., Convatec, Inc., Coloplast A/S, and Smith & Nephew Plc dominate the market, leveraging strong R&D capabilities and global distribution networks. These players focus on developing advanced dressings, biologics, and negative pressure wound therapy systems to address complex wound types. Strategic collaborations, mergers, and acquisitions—such as 3M’s acquisition of Acelity—are reshaping the competitive dynamics by enhancing technological capabilities and global reach. Moreover, firms are investing in digital health integration and smart wound monitoring solutions to stay ahead in the evolving wound care landscape. The market remains moderately consolidated, with innovation and patient-centric product development serving as key differentiators. As emerging players enter with cost-effective and region-specific solutions, competition is expected to intensify, especially in developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Acelity L.P. Inc.

- Convatec, Inc.

- Coloplast A/S

- Derma Sciences, Inc.

- Integra Lifesciences Corporation

- Medline Industries, Inc.

- Molnlycke Healthcare

- Smith & Nephew Plc

- 3M

Recent Developments

- In May 2025, Smith & Nephew secured a 10-year, $75 million contract with the U.S. Department of Defense for its RENASYS TOUCH Negative Pressure Wound Therapy (NPWT) System. The system is noted for its portability, user-friendly interface, and versatile therapy modes, making it suitable for both military and civilian wound care.

- In April 2025, Smith & Nephew’s advanced wound care portfolio, including products like ALLEVYN Life, PICO sNPWT, and IODOSORB, was emphasized for its continued innovation and investment in digital wound care and biologics.

- In 2025, Mölnlycke Health Care continued its focus on its leading Mepilex and Mepitel dressing ranges, emphasizing Safetac® technology to reduce patient pain during dressing changes. The company also prioritized sustainability and evidence-based improvements in product development. This included expanding their product reach and investing in research and development to enhance their wound care solutions.

- In 2025, 3M continues to hold a strong market position in wound care, largely due to its acquisition of Acelity/KCI. The V.A.C.® Therapy systems, now part of 3M’s portfolio, are still recognized as industry leaders in negative pressure wound therapy. 3M continues to innovate and expand its NPWT offerings to meet evolving clinical needs and improve patient outcomes.

- In October 2024, Convatec advanced the clinical profile of InnovaMatrix AC, the first porcine placental-derived extracellular matrix (ECM) medical device cleared by the FDA for wound management in the US.

Market Concentration & Characteristics

The Advanced Wound Care Management Market exhibits moderate to high market concentration, with a few dominant players accounting for a significant share of global revenue. Key companies such as 3M, Smith & Nephew Plc, Molnlycke Healthcare, Coloplast A/S, and Convatec, Inc. lead the market through extensive product portfolios, strong distribution networks, and continued investments in research and development. It reflects a mature market in developed regions, where demand for advanced dressings, biologics, and negative pressure wound therapy remains strong due to aging populations and rising chronic wound incidence. In emerging markets, growth is driven by increasing healthcare access and a shift toward modern wound care practices. The market features a high degree of product differentiation, with a focus on efficacy, patient comfort, and infection control. Regulatory compliance and clinical validation remain essential for market entry, creating high barriers for new entrants. It continues to evolve through innovation in bioengineered products and smart wound technologies.

Report Coverage

The research report offers an in-depth analysis based on Product, Wound Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to rising cases of chronic wounds, especially among aging populations.

- Demand for bioengineered skin substitutes and regenerative therapies will increase in complex wound treatment.

- Home-based wound care solutions will gain traction with the growth of telehealth and portable technologies.

- Smart wound care products with sensors and real-time monitoring features will see greater adoption.

- Emerging markets in Asia Pacific and Latin America will offer strong growth opportunities due to improving healthcare infrastructure.

- Hospital and outpatient facilities will continue to prioritize advanced dressings for faster patient recovery.

- Reimbursement policies and regulatory support will play a key role in accelerating product adoption.

- Market players will invest more in digital platforms to support wound assessment and remote care.

- Collaborations between healthcare providers and manufacturers will drive innovation and patient-centric solutions.

- Rising awareness about infection prevention will fuel demand for antimicrobial and silver-based dressings.