| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Battery Electric Vehicle Market Size 2024 |

USD 2,58,958.20 Million |

| Battery Electric Vehicle Market, CAGR |

13.27% |

| Battery Electric Vehicle Market Size 2032 |

USD 6,99,800.01 Million |

Market Overview:

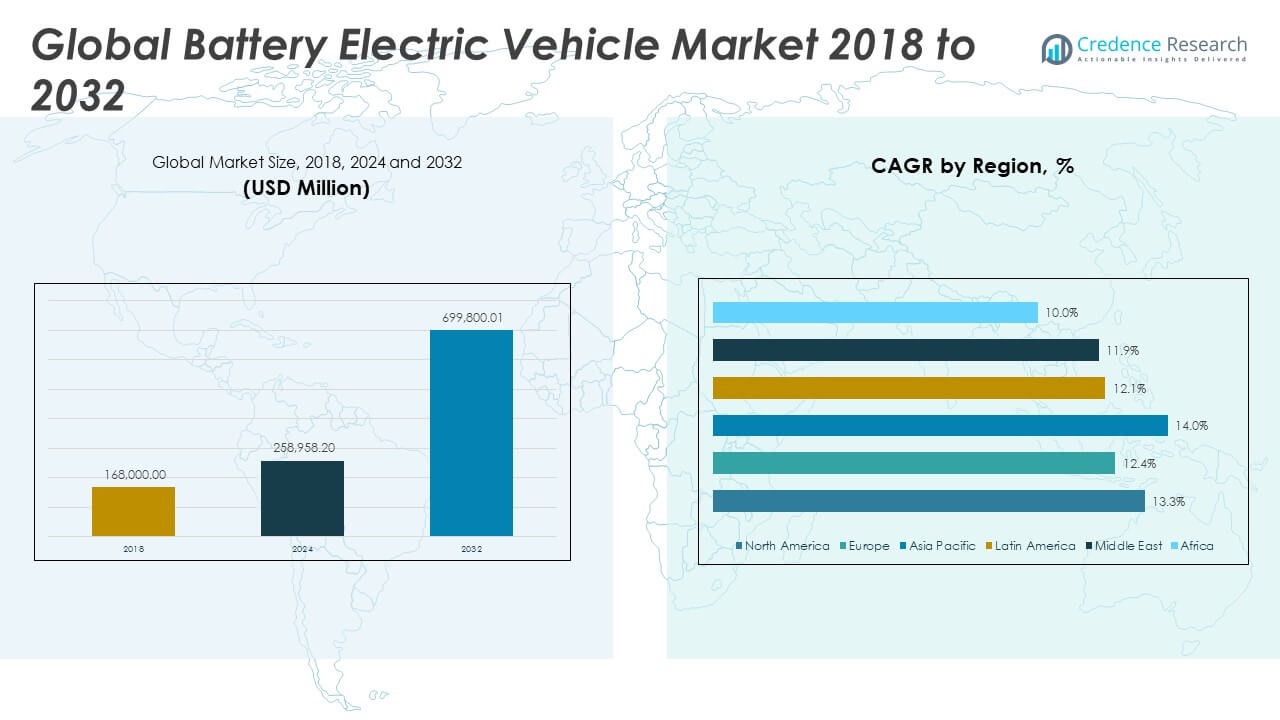

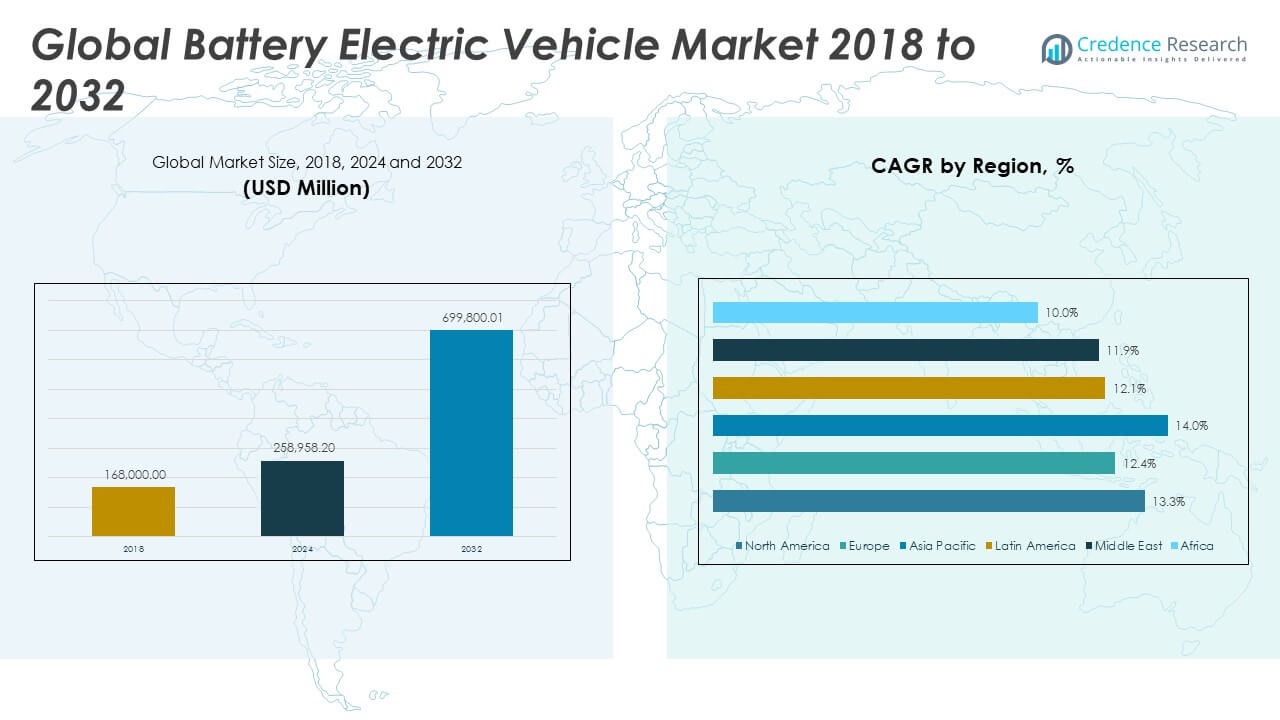

The Battery Electric Vehicle Market size was valued at USD 1,68,000.00 million in 2018 to USD 2,58,958.20 million in 2024 and is anticipated to reach USD 6,99,800.01 million by 2032, at a CAGR of 13.27% during the forecast period.

The Battery Electric Vehicle (BEV) market is being propelled by several key growth drivers. One of the most significant factors is the rapid advancement in battery technologies, particularly improvements in lithium-ion chemistry and the emergence of solid-state batteries. These innovations are helping reduce charging times, extend driving ranges, and lower overall battery costs, making BEVs more accessible and practical for consumers. Government policies across major economies continue to play a crucial role, with initiatives such as subsidies, tax incentives, and zero-emission mandates accelerating BEV adoption. Regulatory pressure to reduce greenhouse gas emissions and combat air pollution is also pushing automakers to shift from internal combustion engines to all-electric drivetrains. Moreover, the expanding network of charging infrastructure and the falling cost of renewable electricity sources are improving the operational feasibility of BEVs. Original equipment manufacturers (OEMs) are investing heavily in dedicated BEV platforms, manufacturing capacity, and vertical integration strategies to meet rising demand.

The Battery Electric Vehicle market exhibits distinct regional dynamics that reflect policy frameworks, infrastructure readiness, and consumer adoption rates. Asia Pacific leads the global market, with China dominating both production and consumption. In 2024, China accounted for more than half of global EV sales, driven by strong government incentives, a robust domestic supply chain, and aggressive fleet electrification policies. Japan and South Korea are also expanding BEV adoption, supported by strong automotive industries and innovation in battery technology. In Europe, the market has grown substantially, supported by stringent CO₂ regulations, investment in charging infrastructure, and increasing consumer demand for sustainable vehicles. Countries such as Germany, the Netherlands, and Norway have made significant progress, although recent reductions in subsidies have slowed momentum in some markets. North America follows closely, with the United States being the primary contributor. Emerging regions such as Latin America, the Middle East, and Africa are in earlier stages of BEV adoption but are beginning to show positive trends due to falling vehicle prices, growing urbanization, and initial government-backed initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Battery Electric Vehicle Market is set to expand significantly, growing from USD 2,58,958.20 million in 2024 to USD 6,99,800.01 million by 2032, at a CAGR of 13.27%.

- Advancements in battery technology, including lithium-ion and solid-state batteries, are enabling longer ranges, faster charging, and lower costs, fueling market growth.

- Strong government incentives, such as subsidies and zero-emission mandates, are accelerating BEV adoption across key global markets.

- Increasing investments in charging infrastructure ranging from ultra-fast public stations to home units are improving accessibility and user convenience.

- Rising awareness of sustainability and the growing shift toward electric corporate fleets are reshaping consumer and business preferences.

- High upfront costs and limited availability of affordable BEVs remain major barriers, especially in developing economies.

- Asia Pacific leads the market, driven by China’s dominance in production and consumption, while Europe and North America follow with expanding policy and infrastructure support.

Market Drivers:

Strong Government Policies and Regulatory Push Accelerate BEV Adoption

The Battery Electric Vehicle Market is experiencing accelerated growth due to robust government support and regulatory mandates. Nations are enforcing stricter emission norms to curb greenhouse gas levels and meet international climate targets, compelling automakers to shift away from internal combustion engines. Incentives such as tax credits, rebates, and reduced registration fees are boosting BEV sales across key markets. Zero-emission vehicle (ZEV) policies, purchase subsidies, and low-emission zones in urban centers are further encouraging consumer adoption. Governments are also investing in public transportation electrification, which positively impacts demand for electric vehicle platforms. These regulatory mechanisms are not only stimulating consumer interest but also pressuring manufacturers to innovate and align product strategies with decarbonization goals.

- For example, the Inflation Reduction Act (IRA) established a long-term extension of the Section 30D tax credit for new light-duty vehicles (up to $7,500 per vehicle), a new $40,000 credit for commercial EVs under Section 45W, and a $4,000 credit for used EVs under Section 25E.

Technological Advancements in Battery Design Improve Vehicle Performance

Advances in battery technologies have significantly enhanced the commercial viability and performance of electric vehicles. Improvements in lithium-ion chemistry, including nickel-manganese-cobalt (NMC) and lithium iron phosphate (LFP), are increasing energy density while lowering production costs. Solid-state battery research is progressing rapidly, promising safer, longer-range vehicles with faster charging times. Automakers are focusing on modular battery designs and scalable platforms that support multiple vehicle models, reducing costs and accelerating production timelines. Thermal management systems and battery management software are also improving, increasing durability and efficiency. It is benefitting from these innovations, as they make electric vehicles more competitive against traditional fuel-based models in terms of range, performance, and cost-effectiveness.

- For example, Toyota has announced it will deploy generation-3 solid-state batteries capable of delivering up to 745 miles of range on a single charge, with a recharge time under 10 minutes; these batteries are scheduled for production as early as 2027.

Expansion of Charging Infrastructure Enhances User Convenience

The rapid development of charging infrastructure is strengthening consumer confidence and removing a major barrier to BEV adoption. Investments in ultra-fast DC charging stations, home charging units, and vehicle-to-grid (V2G) systems are creating a reliable ecosystem that supports long-distance travel and daily commutes. Public-private partnerships and utility-led programs are playing a key role in expanding nationwide charging networks. Charging times are being reduced significantly with advancements in charging technology and battery interface protocols. Smart grid integration and real-time energy optimization tools are also facilitating efficient power usage and load balancing. It benefits from these infrastructure improvements, which are making electric vehicle ownership more practical and appealing across both urban and rural areas.

Rising Consumer Awareness and Corporate Fleet Electrification

Shifting consumer attitudes toward sustainability and cost efficiency are positively influencing the market. Lower total cost of ownership (TCO), reduced maintenance needs, and high fuel savings are making BEVs attractive to individual buyers and businesses alike. Corporations are electrifying their vehicle fleets to meet ESG targets and reduce operational costs, further accelerating market penetration. Consumers are becoming more aware of environmental impacts and seeking alternatives to fossil fuel-powered transportation. Marketing efforts, model variety, and increased affordability are also reshaping public perceptions of electric mobility. The Battery Electric Vehicle Market is gaining traction among early adopters and mainstream buyers, supported by favorable economics and changing lifestyle preferences.

Market Trends:

Emergence of Dedicated BEV Manufacturing Platforms Reshapes Production Strategy

Automakers are shifting from adapting existing internal combustion engine platforms to developing dedicated BEV architectures. These purpose-built platforms allow greater design flexibility, improved weight distribution, and more efficient integration of battery and powertrain systems. Companies such as Tesla, BYD, Volkswagen, and Hyundai are investing in scalable platforms like MEB, E-GMP, and Skateboard architecture to streamline production. These platforms support multiple vehicle sizes and body types, reducing development costs and shortening time-to-market. The Battery Electric Vehicle Market is being redefined by this trend, enabling brands to deliver high-performance vehicles that meet diverse customer expectations. It supports long-term operational efficiencies and product differentiation in a competitive market.

Integration of Vehicle Software and Over-the-Air (OTA) Updates Transforms Ownership Experience

The adoption of digital technologies and software-defined vehicle architectures is becoming a defining trend in the BEV segment. Manufacturers are enabling real-time performance upgrades, diagnostics, and feature enhancements through OTA updates. These capabilities allow continuous vehicle optimization without requiring physical service center visits. Automakers are also launching app-based platforms for remote monitoring, energy usage insights, and vehicle control. It is becoming increasingly interconnected with broader digital ecosystems, aligning with evolving consumer expectations for tech-enabled mobility. The Battery Electric Vehicle Market is evolving beyond traditional hardware-focused models into dynamic, software-centric ecosystems.

- For instance, BYD’s proprietary “BYD OS” represents a unique move toward complete decoupling of software and hardware enabling frequent OTA updates, feature deployment, and reduced maintenance costs across multiple brands using the same platform.

Rise of Second-Life and Recycling Solutions for EV Batteries

Battery lifecycle management is gaining strategic importance as global BEV adoption grows. Companies are exploring second-life applications, where used EV batteries power stationary storage systems, reducing waste and adding value. Circular economy practices are being integrated into business models to recover critical minerals like lithium, nickel, and cobalt through recycling. Firms such as Redwood Materials, Umicore, and Li-Cycle are scaling recycling infrastructure to address end-of-life battery challenges. It reflects a growing emphasis on sustainability and supply chain resilience. The Battery Electric Vehicle Market is adapting to resource constraints and environmental considerations by embracing innovative battery repurposing and recovery solutions.

- For example, Redwood Materials operates the most extensive lithium-ion battery recycling operation in North America, processing over 20 GWh of batteries annually, the equivalent of about 250,000 EVs, and capturing approximately 90% of all lithium-ion batteries recycled in the region.

Growth of Premium and Performance Electric Vehicle Segments

Luxury and performance brands are entering the BEV space with high-end offerings that deliver advanced design, power, and digital integration. Models from Porsche, Lucid Motors, BMW, and Mercedes-Benz are competing on acceleration, range, and cabin technology. These vehicles cater to affluent consumers seeking exclusivity and innovation in electric mobility. The performance BEV segment is also gaining traction in motorsports and enthusiast communities, shifting public perception of EV capabilities. It is benefiting from the aspirational appeal and engineering breakthroughs that these models represent. The Battery Electric Vehicle Market is seeing increased diversification, with premium segments elevating the technological and experiential benchmarks.

Market Challenges Analysis:

High Upfront Costs and Affordability Barriers Limit Mass Market Penetration

Despite falling battery prices and government incentives, high upfront costs remain a significant obstacle for widespread adoption. Entry-level BEVs often carry a premium over comparable internal combustion engine vehicles, which deters budget-conscious consumers. The limited availability of affordable electric models, especially in developing markets, restricts the addressable customer base. Automotive manufacturers face challenges in balancing cost reductions with performance, safety, and feature enhancements. Consumer hesitation is further influenced by concerns over long-term battery degradation and resale value. The Battery Electric Vehicle Market faces persistent affordability challenges that could hinder its growth trajectory in price-sensitive segments.

Charging Infrastructure Gaps and Range Anxiety Undermine Consumer Confidence

Insufficient charging infrastructure continues to constrain BEV adoption across many regions. Urban centers may offer adequate coverage, but rural and suburban areas often lack accessible and reliable charging options. This disparity amplifies range anxiety and limits the perceived practicality of electric vehicles for long-distance or everyday use. Slow charging times at public stations and compatibility issues between networks also impact user satisfaction. Utility grid limitations and permitting delays pose further hurdles to infrastructure expansion. It must overcome these charging ecosystem inefficiencies to ensure a seamless and dependable user experience.

Market Opportunities:

Expansion into Emerging Markets Presents Untapped Growth Potential

The Battery Electric Vehicle Market has significant opportunities in emerging economies where EV adoption remains in early stages. Countries across Southeast Asia, Latin America, and Africa are beginning to implement supportive policies, incentivize clean mobility, and invest in localized manufacturing. Rising urbanization, increasing fuel costs, and growing environmental awareness are pushing governments and consumers toward electric alternatives. Affordable BEV models tailored to local conditions can unlock large volumes in these high-population regions. Local production partnerships and modular assembly units can reduce costs and support job creation. It can achieve meaningful scale by aligning product strategies with regional mobility needs and economic constraints.

Advancements in Energy Storage and Grid Integration Create New Business Models

The evolution of battery technologies and energy storage systems is opening new revenue streams for BEV stakeholders. Vehicle-to-grid (V2G) solutions allow BEVs to function as mobile energy storage units, supporting grid stability and energy arbitrage. Fleet operators and utilities can leverage smart charging platforms to optimize energy use and reduce peak loads. Second-life battery applications for stationary storage add value beyond the initial vehicle lifecycle. It is well-positioned to capitalize on these intersections between mobility and energy. The Battery Electric Vehicle Market stands to benefit from a future where electric vehicles play a central role in distributed energy ecosystems.

Market Segmentation Analysis:

The Battery Electric Vehicle Market is segmented by vehicle type and battery type, each reflecting varied demand dynamics and technological requirements.

By vehicle types, electric cars dominate the market, driven by rising consumer adoption, supportive regulations, and expanding charging infrastructure. Electric buses hold a significant share in public transportation, particularly in urban areas focused on emission reduction. Electric trucks are gaining traction for short-haul logistics, supported by fleet electrification strategies. Electric motorcycles and scooters are popular in densely populated regions, where compact mobility and affordability are priorities. E-bikes are expanding rapidly, fueled by demand for low-cost personal transportation and last-mile delivery.

- For example, BYD has deployed over 80,000 electric buses worldwide (BYD Annual Report 2024), with the K9 model boasting a 324 kWh LFP battery pack and a range of up to 155 miles per charge under typical city conditions.

By battery type, lithium-ion (Li-ion) leads the market due to its high energy density, longer lifecycle, and declining cost. It is widely adopted across all BEV categories, supporting both performance and range requirements. Sealed Lead Acid (SLA) batteries are used in low-power applications, primarily in two-wheelers and e-bikes, where cost sensitivity remains high. Nickel Metal Hydride (NiMH) holds a niche presence but is gradually being phased out due to lower efficiency compared to Li-ion. The Battery Electric Vehicle Market reflects a strong alignment between battery innovation and vehicle electrification needs across segments.

- For example, The Panasonic/Tesla 2170 cylindrical Li-ion cell is a key battery chemistry used in Tesla Model 3 and Model Y vehicles. Cell-level energy density typically reaches around 260 Wh/kg, making it one of the highest-density NCA-format batteries in EVs.

Segmentation:

By Vehicle Type:

- Electric Cars

- Electric Buses

- Electric Trucks

- Electric Motorcycles & Scooters

- E-bikes

By Battery Type:

- Sealed Lead Acid (SLA)

- Lithium-ion (Li-ion)

- Nickel Metal Hydride (NiMH)

By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Battery Electric Vehicle Market size was valued at USD 28,224.00 million in 2018 to USD 42,364.01 million in 2024 and is anticipated to reach USD 114,138.64 million by 2032, at a CAGR of 13.3% during the forecast period. North America holds nearly 16% of the global Battery Electric Vehicle Market, driven by strong policy support, growing infrastructure, and early technology adoption. The United States is the largest contributor in the region, supported by federal investments in EV infrastructure through programs like NEVI and state-level ZEV mandates. Tesla continues to dominate the domestic market, although competition is intensifying with entries from Ford, GM, and Rivian. Canada is following a similar trajectory, with provincial incentives and climate goals accelerating BEV growth. Range anxiety and inconsistent tax credits remain challenges, but rising consumer interest and fleet electrification trends are keeping the market dynamic. It continues to expand with increased OEM production capacity and growing model availability across segments.

Europe

The Europe Battery Electric Vehicle Market size was valued at USD 39,580.80 million in 2018 to USD 58,362.10 million in 2024 and is anticipated to reach USD 147,904.59 million by 2032, at a CAGR of 12.4% during the forecast period. Europe accounts for nearly 22% of the global Battery Electric Vehicle Market, supported by stringent carbon regulations and strong policy frameworks. Leading countries such as Germany, Norway, the Netherlands, and the UK continue to push BEV adoption through financial incentives, tax exemptions, and emission targets. Automakers like Volkswagen, BMW, and Renault are investing heavily in dedicated BEV platforms and local battery production. Charging infrastructure is expanding rapidly across the EU, ensuring convenience and accessibility. Recent subsidy reductions in some countries have impacted short-term sales, but long-term demand remains resilient due to regulatory enforcement and consumer shift toward sustainable mobility. It maintains a leadership position in aligning environmental goals with industry transformation.

Asia Pacific

The Asia Pacific Battery Electric Vehicle Market size was valued at USD 81,816.00 million in 2018 to USD 128,921.25 million in 2024 and is anticipated to reach USD 366,905.71 million by 2032, at a CAGR of 14.0% during the forecast period. Asia Pacific dominates the Battery Electric Vehicle Market with a share of over 50%, led by China’s aggressive push for electrification. China alone contributes nearly two-thirds of global BEV sales, backed by subsidies, charging network expansion, and dominance in battery manufacturing. Automakers like BYD, NIO, and XPeng are innovating at scale and reducing unit costs. Japan and South Korea are advancing through innovations in solid-state battery technology and premium BEV models. India is emerging with ambitious policy initiatives and investment in local manufacturing. It continues to lead global volume growth, supported by vertically integrated supply chains and high domestic demand.

Latin America

The Latin America Battery Electric Vehicle Market size was valued at USD 9,206.40 million in 2018 to USD 14,032.94 million in 2024 and is anticipated to reach USD 34,759.06 million by 2032, at a CAGR of 12.1% during the forecast period. Latin America holds a modest share of approximately 4% in the global Battery Electric Vehicle Market but is witnessing steady momentum. Brazil, Chile, and Mexico are key markets pushing EV adoption through tax incentives, low-emission targets, and public transportation electrification. Infrastructure is still developing, and affordability remains a challenge for large-scale consumer uptake. However, commercial fleet operators are investing in electric vehicles for logistics and ride-hailing services. Government-backed procurement programs and public-private partnerships are playing a crucial role. It has significant room for expansion as policy frameworks evolve and battery prices decline.

Middle East

The Middle East Battery Electric Vehicle Market size was valued at USD 6,535.20 million in 2018 to USD 9,450.29 million in 2024 and is anticipated to reach USD 23,097.25 million by 2032, at a CAGR of 11.9% during the forecast period. The Middle East contributes roughly 3% to the global Battery Electric Vehicle Market, with growing interest in sustainable transportation driven by national visions and environmental goals. The UAE and Saudi Arabia are leading the regional transition through major investments in EV infrastructure and pilot projects. Premium BEVs are gaining traction among high-income consumers, while governments are initiating green mobility mandates. Harsh climate conditions and a preference for combustion engines still pose barriers. Charging infrastructure development and local policy enforcement will determine future growth. It is gradually positioning itself as a regional hub for smart mobility transformation.

Africa

The Africa Battery Electric Vehicle Market size was valued at USD 2,637.60 million in 2018 to USD 5,827.61 million in 2024 and is anticipated to reach USD 12,994.76 million by 2032, at a CAGR of 10.0% during the forecast period. Africa holds a market share of under 2% in the global Battery Electric Vehicle Market but is showing early signs of progress. South Africa, Egypt, and Morocco are emerging as focal points, with pilot programs and import incentives for electric vehicles. Limited charging infrastructure, high vehicle costs, and inconsistent policy support remain major obstacles. International organizations and NGOs are partnering with local governments to introduce electric buses and fleet vehicles. Second-hand BEVs imported from developed markets are gaining popularity in urban centers. It represents a long-term opportunity, contingent on economic development and investment in mobility ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BMW Group

- Volkswagen AG

- Ford Motor Company

- Toyota Motor Corporation

- Hyundai Motor Company

- Nissan Motor Corporation

- Energica Motor Company S.p.A

Competitive Analysis:

The Battery Electric Vehicle Market is highly competitive, led by a mix of established automakers and emerging electric-only manufacturers. Key players include Tesla, BYD, Volkswagen AG, Hyundai Motor Company, BMW Group, and Nissan Motor Corporation. These companies compete on battery efficiency, range, pricing, and digital integration. Startups such as Rivian, Lucid Motors, and XPeng are gaining traction through innovation and niche market targeting. Companies are investing heavily in R&D, battery technology, and dedicated EV platforms to strengthen their market position. Strategic partnerships, vertical integration, and expansion into new geographic markets are common competitive tactics. It continues to evolve with frequent product launches, price realignments, and advancements in autonomous driving and connectivity. Competitive intensity is expected to rise as more manufacturers scale production and governments enforce stricter emissions targets. The Battery Electric Vehicle Market rewards agility, technological leadership, and the ability to align with changing consumer expectations and regulatory landscapes.

Recent Developments:

- In July 2025, VinFast launched bookings for its VF 6 and VF 7 electric SUVs in India. The company began taking orders on July 15, 2025, and secured dealership partnerships with 13 groups to open 32 outlets across 27 cities, with plans to expand to 35 by year’s end.

- In July 2025, Renault’s EV unit Ampere formed a new investment fund with Chinese investors. The alliance, signed on July 10 in Hangzhou, targets technological areas such as batteries, smart driving, and intelligent cockpits to fuel global EV innovation.

- In March 2025, BMW announced the upcoming launch of the BMW iX3, an all-electric SUV based on the brand’s new Vision Neue Klasse X concept. This vehicle is expected to begin production in late 2025 and arrive in global markets, including the U.S., by Q2 2026. The iX3 will feature next-generation battery technology, promising enhanced driving range and rapid charging capabilities, solidifying BMW’s presence in the fast-growing electric SUV segment.

Market Concentration & Characteristics:

The Battery Electric Vehicle Market exhibits moderate to high market concentration, with a few dominant players such as Tesla, BYD, and Volkswagen accounting for a significant share of global sales. It features characteristics of rapid technological advancement, high capital intensity, and strong regulatory influence. Barriers to entry remain substantial due to the need for advanced manufacturing capabilities, supply chain integration, and software development expertise. The market favors vertically integrated firms with control over battery production, vehicle design, and distribution networks. It is defined by fast product cycles, continuous innovation, and evolving consumer preferences. Regional dynamics vary widely, but leading players maintain a global footprint through localized production and strategic alliances. The Battery Electric Vehicle Market continues to attract new entrants, but sustained competitiveness depends on scalability, cost optimization, and alignment with environmental and safety standards.

Report Coverage:

The research report offers an in-depth analysis based on vehicle type and battery type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Global BEV adoption will accelerate with increasing regulatory pressure to reduce vehicle emissions.

- Battery technologies will advance, making electric vehicles more affordable for mainstream consumers.

- Emerging innovations such as solid-state batteries will improve range, safety, and charging efficiency.

- Automakers will introduce a broader range of BEV models to serve entry-level and mid-range segments.

- Integration with energy systems through vehicle-to-grid applications will expand market functionality.

- Autonomous driving capabilities will be more commonly integrated into electric vehicle platforms.

- Charging infrastructure will grow rapidly, emphasizing convenience, speed, and urban-rural coverage.

- Battery reuse and recycling will become a critical focus to enhance circular economy practices.

- Commercial fleets will transition to BEVs to meet sustainability targets and reduce operational costs.

- Strategic collaborations will increase as manufacturers optimize production and secure raw material access.